Let’s be honest—traditional banking is about as exciting as reading the terms and conditions on a toaster. Enter Revolut, the digital bank that made money sexy. With its slick UI, borderless banking, and cult-like user base, it didn’t just build a fintech app—it built a movement. And if you’re dreaming of launching your own Revolut clone, it’s time to take notes on how they marketed their way into wallets across the world.

Here’s the twist: According to TechCrunch, Revolut didn’t rely on a massive ad spend from day one. Instead, it went rogue referrals, virality, memes, and magnetic positioning. It knew its audience (digital nomads, crypto-curious users, and fee-haters), and spoke their language with attitude, not bank-speak.

In this blog, we’ll decode Revolut’s marketing strategy, highlight what made it work, and show how you can build and promote your own digital banking app. And if you need a powerhouse team to help bring it to life, Miracuves has your back.

Why Revolut’s Marketing Works: The Core Playbook

1. Speak Like a Rebel, Not a Banker

While legacy banks talk about “financial empowerment” and “secure solutions,” Revolut said things like:

“Stop getting ripped off by your bank.”

“Freeze your card with a tap. Like magic. But real.”

This casual, borderline cheeky tone turned Gen Z and Millennials into fans. The message? Banking doesn’t have to suck.

Tip: Your marketing copy should feel like a DM, not a boardroom memo. Use humor, empathy, and punchy phrasing.

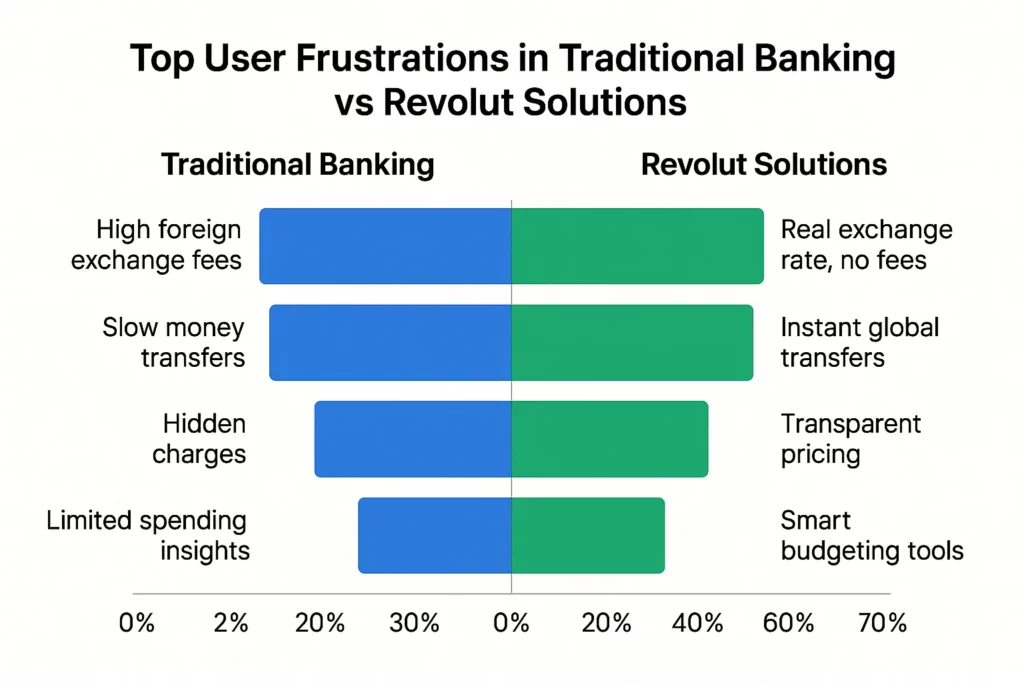

2. Target Pain Points Ruthlessly

Revolut’s early success came from solving real pains:

- Foreign exchange fees? Gone.

- ATM withdrawal limits? Transparent.

- International money transfers? Fast and cheap.

- Crypto & commodities? Right inside the app.

What to do: Your app doesn’t need 100 features. Focus on 3 key pain points and market them hard.

Acquisition Strategy: Growth Loops, Not Just Ads

1. Viral Referral Engine

Revolut’s invite-a-friend program was simple:

Refer a friend → they sign up → you both get rewarded.

Sometimes it was cash, sometimes it was premium access—but always limited-time and high-pressure.

How to clone it:

- Keep it frictionless (1-tap invite link)

- Use scarcity language (“Only 2 invites left!”)

- Layer in badges and streaks

2. Waitlist & Exclusivity Tactics

At launch, Revolut used a waitlist model that gamified onboarding. The more people you referred, the higher you moved up the list. Users felt cool getting early access.

Apply this to your launch:

- Create an invite-only beta phase

- Give influencers early access

- Reward waitlist leaders with perks

Content, Social, and Community: The Power Trio

1. Twitter with Teeth, TikTok with Humor

Revolut’s Twitter is packed with sarcastic memes, real-time product updates, and casual threads. Its TikTok presence? Quick finance explainers, crypto tutorials, and “relatable money struggles.”

What you can do:

- Build your brand voice on platforms your users live on

- Use native formats (don’t repost Instagram on TikTok)

- Educate through humor

2. User Education = Loyalty

Finance is intimidating. Revolut tackled this by creating simple blogs, in-app explainers, and notifications that teach users how to use new features, manage spending, and track goals.

Growth tip: Make users smarter, not just loyal.

B2B & Partnership Strategy

1. Brand Collabs & Fintech Integrations

Revolut partnered with:

- Apple Pay & Google Pay early on

- Crypto networks for on-ramp access

- Travel companies for bundled benefits

Your play: Partner with lifestyle apps, coworking spaces, and budgeting tools that resonate with your user base.

2. Banking-as-a-Service (BaaS) and API Plays

Revolut expanded into business banking, offering multi-currency accounts and expense management to startups and freelancers—while marketing it with startup vibes, not enterprise stiffness.

Your angle: Tap into the solopreneur + SME economy with sleek UX and freelancer-friendly features.

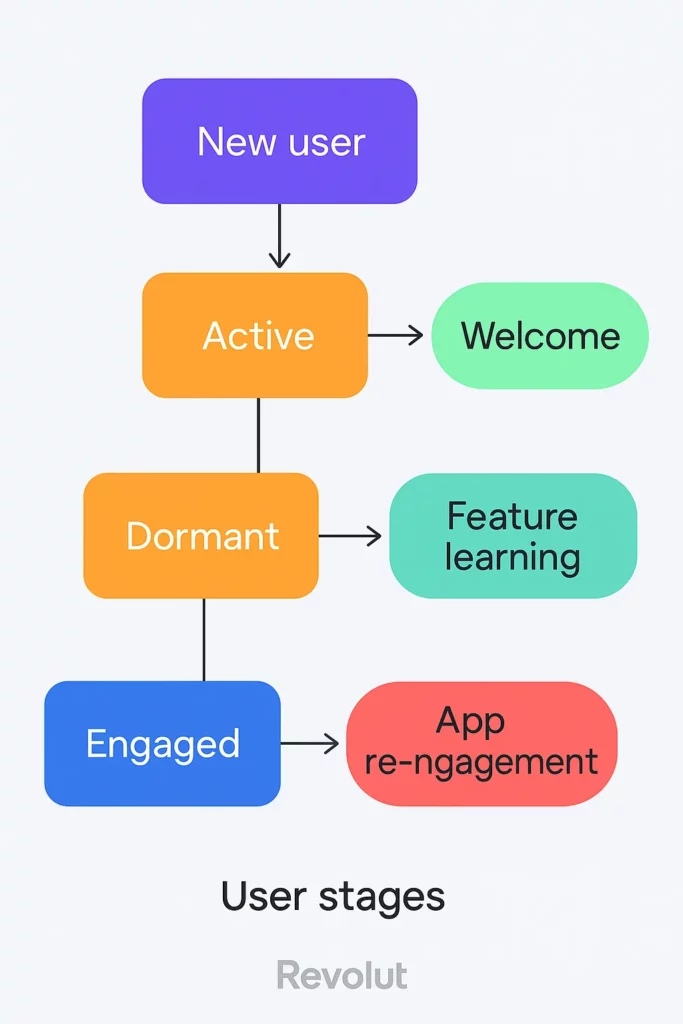

Retention Marketing: Stickiness That Scales & Features

1. Gamified UX + Progression

Revolut turns mundane finance into dopamine hits:

- Spending insights + smart budgeting

- Savings challenges + vaults

- Tiered premium plans (Metal, Premium, etc.)

Users stick because it feels like progress.

2. Push Notifications That Aren’t Annoying

Their alerts are timely, contextual, and often funny.

Examples:

- “You’re crushing your budget this month”

- “You just spent €45 at Starbucks. That’s… a lot of lattes.”

Clone-worthy tactic: Use behavior-based triggers instead of sending generic push blasts.

Learn More: Top Revolut App Features Explained | Fintech Clone Guide

Conclusion

Revolut like platform didn’t win just because it was faster or cheaper. It won because it felt different—more like Spotify or Netflix than a financial institution. It made money management cool, fast, and shareable.

If you want to replicate that kind of success, build more than just an app—build a voice, a community, and a story. And when you’re ready to launch, scale, and dominate?

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What made Revolut grow so fast?

Revolut nailed product-market fit early, layered on viral referral loops, and built a powerful brand voice that connected with digital-first users.

Is Revolut’s strategy replicable for small startups?

Yes! You can adapt its tactics—like referral rewards, waitlist gamification, and pain-point marketing—at any scale.

Do I need a huge budget to market like Revolut?

Not at all. Start scrappy: build social presence, partner smart, and use growth loops over paid ads in the early stage.

What features should I promote first in my fintech app?

Highlight what solves the biggest pain: zero fees, fast transfers, in-app crypto, or budgeting tools.

How do I make my app stand out in a crowded fintech space?

Craft a bold, relatable voice. Build trust fast. Offer niche features that traditional banks ignore.

Can Miracuves help me build a Revolut-style app?

Absolutely! We specialize in building and customizing high-performance fintech app clones with the right tech and growth potential.