In 2015, getting a cab meant tapping a button and waiting five minutes. Today? You’re lucky if the fare doesn’t spike mid-click or the driver doesn’t cancel twice. We’ve gone from convenience to chaos — and that, dear founder, is where you come in.

Startup founders, creators, and digital rebels are rethinking the entire rideshare model. And they’re not wrong. Between sky-high commissions, driver dissatisfaction, and algorithmic unpredictability, the big players have lost the plot. What was once a disruptive market now feels… disrupted itself.

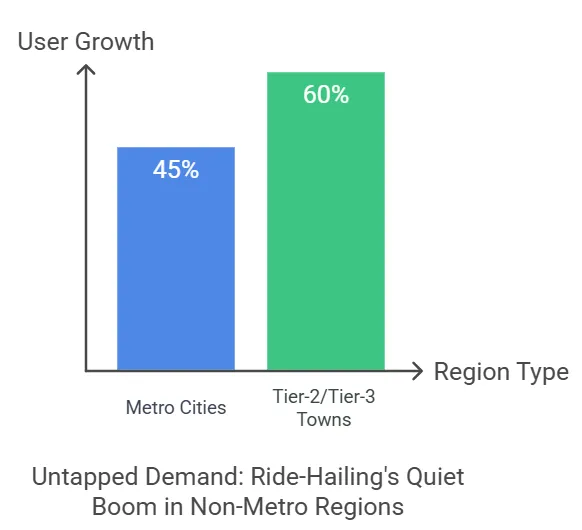

But here’s the kicker: demand hasn’t disappeared. In fact, it’s ballooning across tier-2 cities, niche communities, and use cases traditional platforms can’t (or won’t) serve. If there was ever a moment for next-gen rideshare startups to steal the spotlight, it’s now. And at Miracuves, we’re seeing a sharp uptick in founders ready to do just that.

The Ride-Hailing Market Is Still Booming — Just Not Where You Think

Saturation ≠ Stagnation

Yes, the Ubers and Lyfts of the world dominate urban hubs. But that dominance has also blinded them to underserved areas. Think semi-urban India, suburban Africa, or Latin American towns. These markets have smartphones, internet, and riders — but no reliable ride-hailing infrastructure.

Micro-Mobility Is Exploding

Electric bikes, tuk-tuks, bike taxis, community carpools — these aren’t fringe experiments anymore. They’re valid business models with hyperlocal appeal. And none of these are served efficiently by monolithic apps trying to be all things to all people.

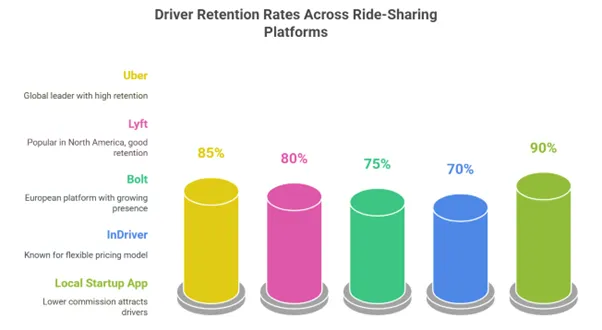

Drivers Want Alternatives

The driver exodus from mainstream platforms is real. With shrinking margins and opaque incentive systems, many are ready to switch — if you offer better pay, transparency, and support.

The Broken Economics of Big Rideshare Apps

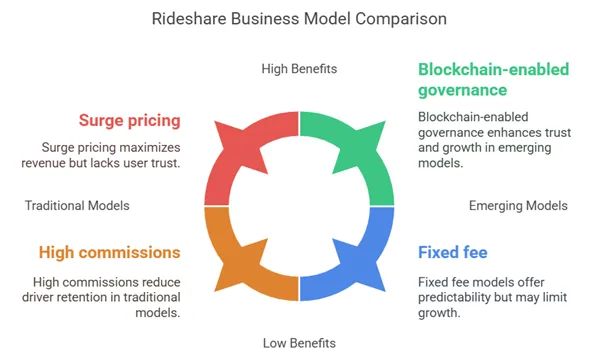

Commissions Kill Trust

Traditional rideshare platforms charge 25–40% commissions. That’s a lot — especially for drivers fueling, maintaining, and often financing their own cars. High take rates lead to:

- Reduced driver morale

- Higher rider fares

- Lower retention on both sides

In contrast, startups using fixed subscriptions, zero-commission models, or blockchain-enabled transparency are winning favor.

The Algorithm Is the Villain

Ever wondered why a ride costs $7 one minute and $19 the next? So do your users. The so-called “smart pricing” systems have alienated both riders and drivers. Surge pricing, trip batching, and driver prioritization all create confusion — not loyalty.

New Business Models That Actually Work

1. Subscription-Based Ride Apps

Flat fees for riders, predictable income for drivers. Great for daily commuters.

- Example: InDriver’s negotiation model + flat transaction fee.

- Bonus: No need to build AI-powered pricing engines.

2. P2P Carpooling for Communities

Think office routes, gated societies, or college towns. Trust-based, low-CAC, and scalable.

- Monetization? Premium matching, ad revenue, and group subscriptions.

3. Decentralized Rideshare with Blockchain

Token-based rewards, DAO governance, smart contract payments — the works.

- Emerging examples: Arcade City, Drife (India).

- Still early, but gaining momentum among crypto-native users.

What Riders Really Want in 2025

Transparency Over Tricks

Riders want to know what they’re paying for — and why. This includes:

- Fixed pricing

- Upfront driver info

- Ratings with context

Speed + Simplicity

The fastest booking wins. Period. Complex onboarding or multi-step flows? Users bounce.

Hyperlocal Relevance

Support for regional languages, payment wallets (UPI, Paytm, M-Pesa), and local routes is no longer optional.

Tech That Makes It All Possible (Yes, Even Without a Huge Budget)

Low-Code/No-Code Stacks

Founders can now launch MVPs without writing a line of code. Miracuves’ rideshare clone kits are built exactly for this — fast, flexible, and fully customizable.

Cloud-Native Backends

Scale on-demand with platforms like AWS, GCP, or DigitalOcean. Focus on product-market fit first.

Embedded Finance & Wallets

Integrate tipping, loyalty points, and split payments with API-first providers like Razorpay, Stripe, and Flutterwave.

Mistakes to Avoid (Because You Don’t Have Time to Learn the Hard Way)

- Overbuilding too early: Focus on core rideshare functionality. You don’t need gamification on Day 1.

- Ignoring driver UX: A bad driver app = no retention = no rides.

- Burning cash on user acquisition: Leverage community, referrals, and local influencers first.

- Forgetting customer support: One support horror story = 100 lost users.

Conclusion

If you’re a startup founder eyeing the next big disruption, rideshare still offers a goldmine. But it’s not about copying Uber — it’s about outthinking them.

Target niches. Build trust. Keep it simple. Use tech that scales without breaking the bank. And if you’re wondering where to even start…

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1. What makes the current market favorable for rideshare startups?

Legacy apps are losing trust while underserved markets grow. Niche, local, and transparent models are in demand.

2. How much does it cost to build a rideshare app in 2025?

Thanks to white-label clones and no-code stacks, MVPs can launch under $10k. Scaling costs vary by features and region.

3. What features should a rideshare MVP include?

Driver/rider registration, real-time GPS, payment gateway, trip history, ratings, and support chat. Everything else can wait.

4. Can rideshare work in low-income or rural areas?

Yes — if pricing is simple, onboarding is fast, and the model fits local transport norms (like tuk-tuks, bike taxis).

5. Are token-based rideshare apps actually viable?

Early days, but promising. Especially in communities familiar with crypto or needing governance transparency.