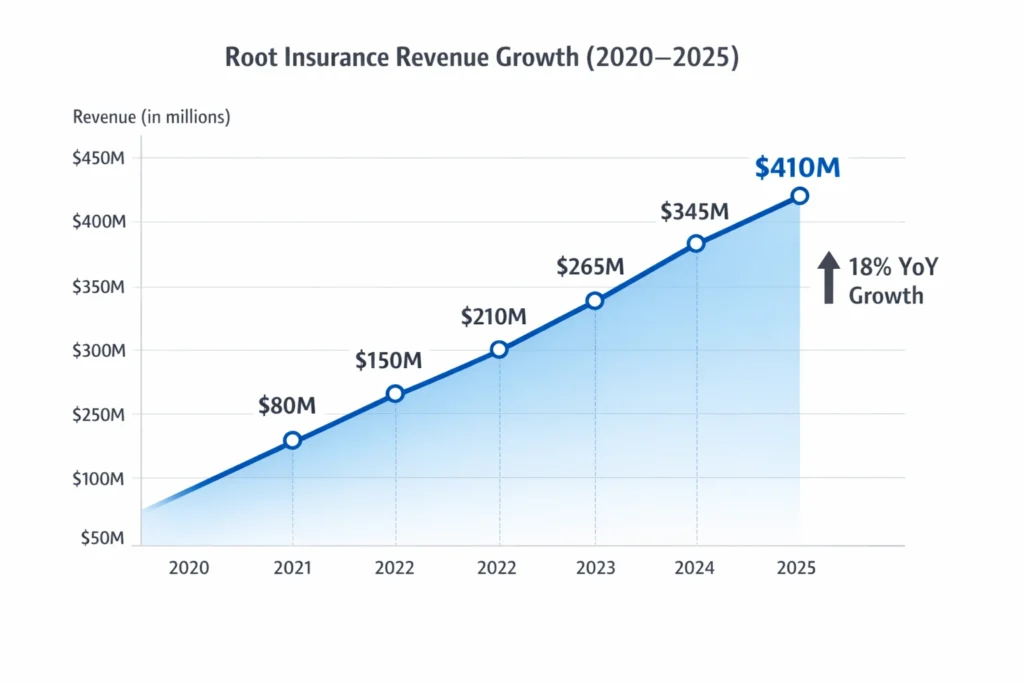

Root Insurance reached an estimated $410 million in revenue in 2025, proving that AI-driven auto insurance can compete with legacy giants that have dominated the industry for decades. By replacing traditional underwriting with smartphone-based driving data, Root changed how risk is priced and how trust is built with modern drivers.

For entrepreneurs, Root Insurance is more than an insurance company. It represents a data-first business model where technology, behavioral analytics, and personalized pricing converge into a scalable financial platform. This approach opens new doors for startups looking to disrupt regulated industries using automation and real-time intelligence.

What makes Root especially valuable to study is how it transforms raw user behavior into recurring revenue streams. Instead of selling a one-time service, Root builds long-term financial relationships, increasing customer lifetime value while reducing fraud, risk exposure, and acquisition costs through smarter targeting and segmentation.

Founders who understand this model gain insight into how to build AI-powered financial platforms that monetize trust, transparency, and personalization at scale.

Root Insurance Revenue Overview – The Big Picture

2025 Revenue: ~$410 million

Valuation: ~$1.2 billion (private market estimates after restructuring and capital raises)

YoY Growth: ~18% (driven by underwriting optimization and policy retention improvements)

Revenue by Region:

- United States: ~95%

- International Markets: ~5% (pilot programs and reinsurance-backed expansions)

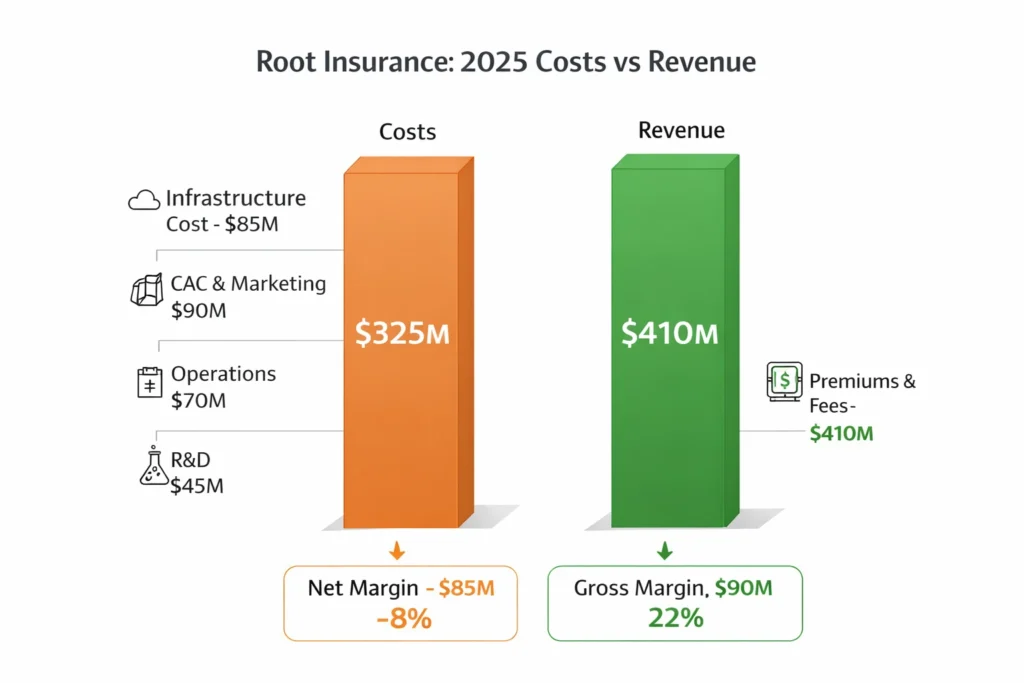

Profit Margins:

- Gross Margin: ~22%

- Net Margin: -8% (moving toward breakeven through automation and CAC reduction)

Competition Benchmark:

- Progressive: ~$62B revenue

- GEICO (Berkshire Hathaway): ~$41B revenue

- Lemonade: ~$480M revenue

- Root Insurance: ~$410M revenue

Root positions itself between tech-first insurers like Lemonade and traditional giants like Progressive by focusing on driver behavior intelligence rather than demographic-based pricing.

Primary Revenue Streams Deep Dive

Revenue Stream #1: Auto Insurance Premiums (72%)

This is Root’s core business. Customers install the Root app, complete a driving test, and receive personalized pricing based on real driving behavior. Premiums are billed monthly or annually.

2025 Data:

- Average Monthly Premium: $115

- Annual Revenue Contribution: ~$295 million

Revenue Stream #2: Home Insurance Policies (12%)

Root expanded into homeowners insurance to increase wallet share per customer. Bundling auto and home policies improves retention and lifetime value.

2025 Data:

- Average Annual Home Policy: $1,350

- Revenue Contribution: ~$49 million

Revenue Stream #3: Fees & Policy Services (7%)

Includes late fees, reinstatement charges, and policy modifications. These are small per user but massive at scale.

2025 Data:

- Average Fee Per User Per Year: $18

- Revenue Contribution: ~$29 million

Revenue Stream #4: Reinsurance Partnerships (5%)

Root transfers part of its underwriting risk to reinsurers while earning structured returns through shared policy pools.

2025 Data:

- Revenue Contribution: ~$20 million

Revenue Stream #5: Data & Risk Intelligence (4%)

Aggregated, anonymized driving insights are licensed to automotive safety researchers and insurance risk platforms.

2025 Data:

- Revenue Contribution: ~$16 million

Revenue streams percentage breakdown

| Revenue Stream | % Share | Annual Revenue (2025) |

|---|---|---|

| Auto Premiums | 72% | $295M |

| Home Insurance | 12% | $49M |

| Fees & Services | 7% | $29M |

| Reinsurance | 5% | $20M |

| Data Intelligence | 4% | $16M |

The Fee Structure Explained

User-Side Fees:

- Monthly/Annual Premium Payments

- Late Payment Fees ($10–$25)

- Policy Cancellation & Reinstatement Fees

Provider-Side Fees:

- Reinsurance Risk Transfer Fees

- Claims Processing Platform Fees

Hidden Revenue Layers:

- Interest on held premium balances

- Referral commissions from bundled home insurance partners

Regional Pricing Variation:

- Urban Drivers: 15–30% higher premiums

- Rural Drivers: Lower premiums due to reduced risk exposure

Complete fee structure by user type

| User Type | Fees Paid | Revenue Impact |

|---|---|---|

| Drivers | Premiums, late fees, reinstatement | High |

| Homeowners | Annual policy fees | Medium |

| Partners | Risk-sharing & platform fees | Medium |

| Data Clients | Analytics licensing | Low |

How Root Insurance Maximizes Revenue Per User

Segmentation:

Drivers are grouped by risk score, driving habits, and geographic profile.

Upselling:

Auto-only users are encouraged to bundle home insurance.

Cross-Selling:

Partner offers for roadside assistance and safety services.

Dynamic Pricing:

Rates adjust based on driving behavior and claims history.

Retention Monetization:

Long-term users receive loyalty discounts that reduce churn.

LTV Optimization:

- Average Customer Lifetime: 4.2 years

- Estimated LTV: $4,800 per user

Psychological Pricing:

Transparent “safe driver” discounts motivate behavior that lowers claims and increases margins.

Real Data Example:

Drivers who maintain a top 25% safety score generate 38% higher lifetime revenue than average users.

Cost Structure & Profit Margins

Infrastructure Cost:

- Cloud systems, telematics data processing, AI modeling

- ~$85 million annually

CAC & Marketing:

- App installs, referral bonuses, ad campaigns

- ~$90 million annually

Operations:

- Claims handling, customer support, compliance teams

- ~$70 million annually

R&D:

- AI underwriting models, fraud detection systems

- ~$45 million annually

Unit Economics:

- Average CAC: $310

- Average Annual Revenue Per User: $1,380

Margin Optimization:

Improved risk scoring reduces claim payouts by ~12% YoY.

Profitability Path:

Automation and AI-driven underwriting aim to push Root toward sustained profitability by 2027.

Read More: Best Root Insurance Clone Script 2026 – Telematics Insurance App

Future Revenue Opportunities & Innovations

New Streams:

- Commercial fleet insurance

- Usage-based insurance for gig drivers

AI/ML-Based Monetization:

- Predictive risk APIs for insurers and auto manufacturers

Market Expansions:

- Latin America and Southeast Asia pilots

Predicted Trends 2025–2027:

- Embedded insurance in vehicle apps

- Real-time pricing based on live driving data

Risks & Threats:

- Regulatory changes

- Rising claim severity due to EV repair costs

Opportunities for New Founders:

Niche insurance platforms for delivery drivers, EV owners, and remote workers.

Lessons for Entrepreneurs & Your Opportunity

What Works:

- AI-driven personalization

- Transparent pricing models

- Strong mobile-first experience

What to Replicate:

- Behavior-based monetization

- Subscription-style recurring revenue

- Automated risk scoring

Market Gaps:

- SME insurance platforms

- Cross-border digital insurance

Improvements Founders Can Use:

- Faster claims automation

- Blockchain-based policy validation

CTA

Want to build a platform with Root Insurance’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Root Insurance clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Root Insurance proves that financial platforms no longer have to rely on legacy systems, paperwork-heavy processes, and slow underwriting cycles. By turning smartphones into real-time risk engines, Root shows how modern businesses can transform everyday behavior into structured, scalable revenue.

For founders, the real takeaway is not insurance itself, but the framework of monetization through intelligence, automation, and personalization. Any industry that depends on trust, risk, or compliance can be rebuilt using this same data-first model.

As markets move toward embedded finance, AI-powered underwriting, and real-time pricing, platforms inspired by Root’s approach will define the next generation of fintech, insurtech, and digital risk management businesses.

FAQs

1. How much does Root Insurance make per transaction?

On average, Root earns about $115 per user per month in premium revenue.

2. What’s Root Insurance’s most profitable revenue stream?

Auto insurance premiums generate the highest margin and volume.

3. How does Root Insurance’s pricing compare to competitors?

Safe drivers often pay 20–30% less than traditional insurers.

4. What percentage does Root Insurance take from providers?

Root retains around 70–75% of premiums after reinsurance costs.

5. How has Root Insurance’s revenue model evolved?

It expanded from auto-only to bundled home and data monetization.

6. Can small platforms use similar models?

Yes, especially in niche insurance and subscription-based risk platforms.

7. What’s the minimum scale for profitability?

Around 250,000 active policyholders based on current unit economics.

8. How to implement similar revenue models?

Start with behavioral data collection, dynamic pricing, and subscription billing.

9. What are alternatives to Root Insurance’s model?

Flat-fee insurance platforms and broker-based commission models.

10. How quickly can similar platforms monetize?

With automation and partnerships, platforms can begin generating revenue within 30–60 days of launch.