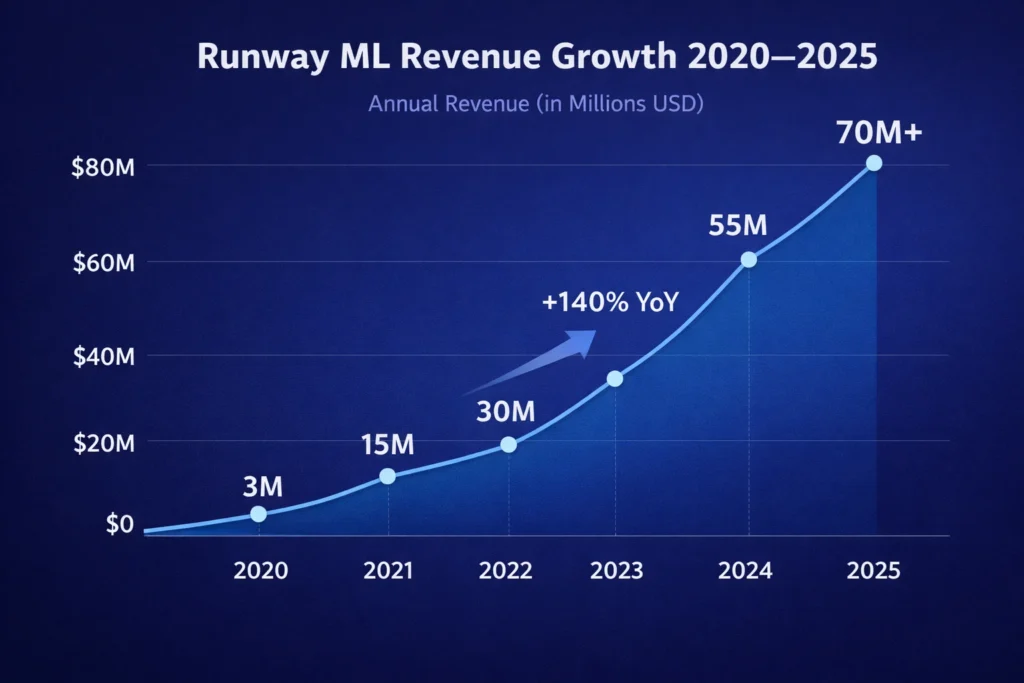

Runway ML crossed an estimated $70+ million in annualized revenue in 2025, positioning itself as one of the most commercially successful creative AI platforms in the world.

For entrepreneurs, this isn’t just about AI-generated video — it’s a real-world case study in how advanced technology becomes a predictable, scalable SaaS revenue engine.

Why founders should analyze this model:

- Shows how freemium funnels convert creators into long-term subscribers

- Demonstrates how enterprise deals stabilize revenue during rapid user growth

- Highlights how API monetization unlocks platform-level scale

- Proves that creative tools can achieve high-margin SaaS economics

Runway ML Revenue Overview – The Big Picture

Runway ML operates at the intersection of AI video generation, creative tooling, and enterprise content production, competing with Pika Labs, Adobe Firefly Video, and Synthesia.

2025 Financial Snapshot (Estimated, industry-reported):

- 2025 Revenue: ~$70–80 million ARR

- Valuation: ~$600 million (post-funding and SaaS multiple estimates)

- YoY Growth: ~140% (2024–2025 driven by Gen-3 model adoption and enterprise rollout)

- Revenue by Region:

- North America: 45%

- Europe: 30%

- Asia-Pacific: 18%

- Rest of World: 7%

- Profit Margins: 25–35% gross margin (after GPU and cloud inference costs)

- Competition Benchmark:

- Pika Labs: ~$85M ARR

- Synthesia: ~$100M ARR

- Adobe Firefly: Bundled enterprise SaaS revenue model

Read More: Runway ML Explained: How AI Creates and Edits Video Step by Step

Primary Revenue Streams Deep Dive

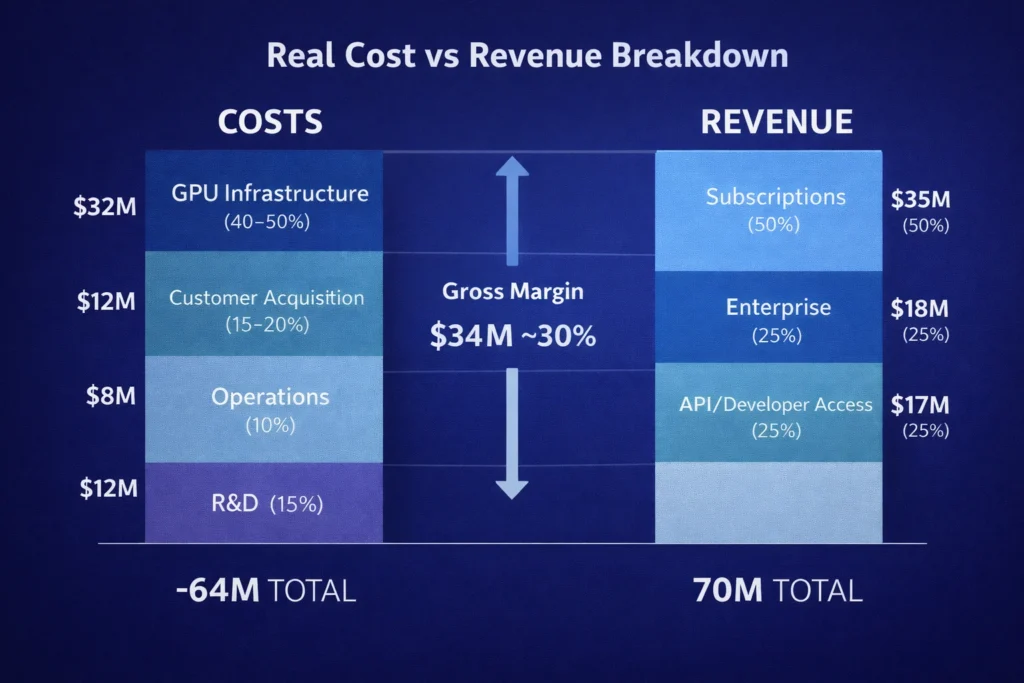

Revenue Stream #1 — Subscription Plans (50%)

Runway ML’s core revenue comes from monthly and annual SaaS plans for creators and production teams.

- Pricing: $12–$60/month per user

- How it works: Generation credits, Gen-3 access, HD exports, priority compute, project storage

- 2025 Data: ~150,000+ paying subscribers globally

- Why it works: High switching costs once creators build workflows inside the platform

Revenue Stream #2 — Enterprise & Studio Licensing (25%)

- Pricing: $3,000–$30,000 per year per organization

- Includes: Custom models, team dashboards, SLA, bulk rendering, brand governance

- High-margin channel with predictable renewals

Revenue Stream #3 — Credit-Based Rendering (10%)

- Pay-per-video and pay-per-export system

- Power users often exceed plan limits, driving incremental revenue

Revenue Stream #4 — API & Platform Integrations (8%)

- Charges per generation call

- Used by SaaS platforms embedding AI video tools into their products

Revenue Stream #5 — Training & White-Label Solutions (7%)

- Custom AI models for studios, agencies, and brands

- Setup fees plus annual maintenance contracts

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share (2025) | Monetization Model | Growth Rate |

|---|---|---|---|

| Subscriptions | 50% | Monthly SaaS plans | High |

| Enterprise Licensing | 25% | Annual contracts | Very High |

| Credit-Based Usage | 10% | Pay-per-render | Medium |

| API Access | 8% | Per-call pricing | High |

| White-Label AI Models | 7% | Setup + support | Medium |

The Fee Structure Explained

User-Side Fees

- Monthly and annual subscriptions

- Additional rendering credits

- HD and commercial-use exports

- Team collaboration add-ons

Provider-Side Fees

- Enterprise onboarding fees

- Custom AI deployment fees

- API integration and scaling fees

Hidden Revenue Layers

- Faster compute queues

- Storage expansion

- Brand watermark removal

- Priority support

Regional Pricing Variation

- US & Europe: Full-price tiers

- Asia & LATAM: 20–40% discounted pricing

Complete Fee Structure by User Type

| User Type | Pricing Model | Average Monthly Spend | Monetization Layer |

|---|---|---|---|

| Casual Creators | Freemium → Basic | $12–$20 | Credits + exports |

| Pro Creators | Pro Subscription | $30–$60 | Priority + HD output |

| Businesses | Enterprise License | $250–$2,500/month | API + SLA + governance |

| Developers | API Usage | $0.03–$0.18/render | Volume-based billing |

How Runway ML Maximizes Revenue Per User

Runway ML focuses on long-term creative dependency rather than one-time usage.

- Segmentation: Hobbyists, professionals, studios, and SaaS partners

- Upselling: Faster compute, 4K exports, team workspaces

- Cross-Selling: API access + enterprise analytics

- Dynamic Pricing: Higher tiers for production teams and agencies

- Retention Monetization: Annual billing discounts to lock in users

- Psychological Pricing: “Studio-grade” branding for premium tiers

- Real Data Example:

- Free → paid conversion: ~9–13%

- Enterprise renewal rate: ~92% annually

Cost Structure & Profit Margins

Major Cost Drivers

- Infrastructure: GPU compute and storage (40–50% of revenue)

- Customer Acquisition: Influencer marketing, paid ads (15–20%)

- Operations: Support, compliance, moderation (10%)

- R&D: Model training and optimization (15%)

Unit Economics

- Average Revenue Per User (ARPU): ~$32/month

- Cost Per User: ~$16/month

- Gross Margin: ~50% on SaaS users

Profitability Path

- Enterprise licensing offsets free-tier compute costs

- API margins improve with scale

- AI model optimization reduces inference expenses over time

Future Revenue Opportunities & Innovations

New Streams

- AI video marketplaces

- Revenue-sharing creator ecosystems

- Real-time AI ad generation tools

AI/ML-Based Monetization

- Industry-specific AI models (education, gaming, real estate, e-commerce)

- Branded AI video assistants for enterprises

Market Expansion

- Creator economy in India and LATAM

- B2B SaaS integrations for marketing platforms

Predicted Trends 2025–2027

- Automated ad campaign generation

- Real-time generative video for live platforms

- AI-powered content personalization

Risks & Threats

- GPU pricing volatility

- Open-source generative video models

- Regulatory restrictions on AI-generated media

Opportunities for New Founders

- Localized AI video platforms

- SME-focused creative SaaS tools

- Vertical-specific AI content engines

Lessons for Entrepreneurs & Your Opportunity

What Works

- Subscription-first monetization

- Enterprise contract layering

- Usage-based pricing expansion

What to Replicate

- Credit systems for power users

- API monetization for platform scale

- Team and studio licensing models

Market Gaps

- Affordable AI video tools for SMEs

- Regional-language AI content platforms

- Industry-specific video generators

Want to build a platform with Runway ML’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Runway ML clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too

Final Thought

Runway ML shows how creative AI can evolve into a predictable, enterprise-ready SaaS business.

For founders, the real lesson is how subscriptions, credits, and API access combine to build durable and scalable revenue streams.

The next opportunity lies in specialized, localized, and industry-focused AI video platforms that solve real business problems.

FAQs

1. How much does Runway ML make per transaction?

It typically earns between $0.03 and $0.18 per render for API and credit-based users.

2. What’s Runway ML’s most profitable revenue stream?

Enterprise licensing due to high annual contract values and low churn.

3. How does Runway ML’s pricing compare to competitors?

It’s generally priced above Pika Labs’ entry tiers but below enterprise-focused platforms like Synthesia.

4. What percentage does Runway ML take from providers?

It doesn’t operate a marketplace model and monetizes directly through SaaS pricing.

5. How has Runway ML’s revenue model evolved?

It expanded from creator subscriptions into enterprise licensing and API-based growth.

6. Can small platforms use similar models?

Yes, especially freemium plus credit-based monetization systems.

7. What’s the minimum scale for profitability?

Roughly 12,000–20,000 paying users depending on GPU and marketing costs.

8. How to implement similar revenue models?

Start with subscriptions, layer credits, and add API and enterprise plans.

9. What are alternatives to Runway ML’s model?

Ad-supported platforms, one-time licensing, and revenue-sharing marketplaces.

10. How quickly can similar platforms monetize?

With a ready-built system, founders often begin monetizing within 30–60 days.