Shein has transformed fast fashion into a data-powered global commerce engine, combining real-time consumer insights, agile manufacturing, and vertically integrated supply chains to launch thousands of new styles at unprecedented speed.

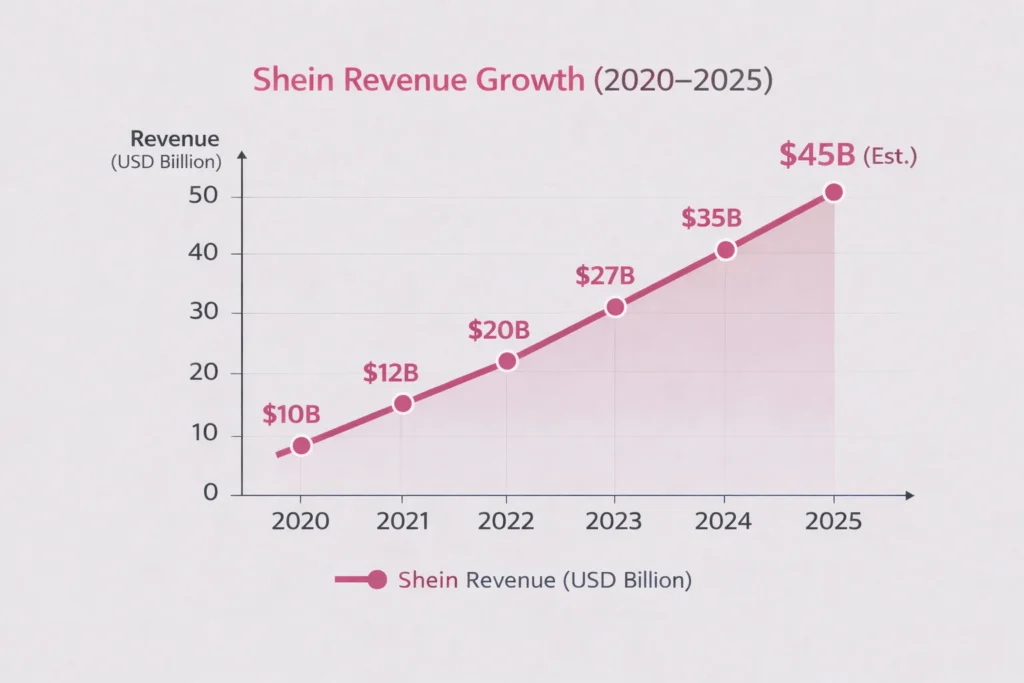

By 2025, it ranks among the world’s highest-revenue fashion platforms, outperforming traditional retailers through ultra-competitive pricing, short production cycles, global reach, and algorithmic demand forecasting that minimizes inventory risk.

For founders, Shein’s revenue model demonstrates how technology-driven decision-making can reshape manufacturing, optimize inventory, accelerate go-to-market timelines, and unlock scalable monetization in fashion and eCommerce platforms.

Shein Revenue Overview – The Big Picture

Shein operates as a direct-to-consumer fast fashion giant, blending private-label manufacturing with marketplace-style monetization.

2025 Business Snapshot (Estimated):

- 2025 Revenue: ~$45–47 billion

- Valuation: ~$60–65 billion

- YoY Growth: ~12–15%

- Primary Markets: US, Europe, Middle East, Southeast Asia

- Profit Margins: ~7–10%

- Average Order Value: $35–55

- Key Competitors: Zara, H&M, Temu, Amazon Fashion

Read More: What is SHEIN and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Direct Product Sales (Private Label)

Shein earns the majority of its revenue by selling its own branded products.

- Revenue Share: ~68%

- Pricing: $3–$30 per item

- Key Advantage: No middlemen, ultra-low production cycles

- 2025 Insight: AI demand prediction reduced unsold inventory by ~30%

Revenue Stream #2: Marketplace Seller Commissions

Shein allows selected third-party sellers to list products.

- Commission Range: 10–20%

- Revenue Share: ~12%

- Low Risk: Inventory owned by sellers

Revenue Stream #3: Shipping & Handling Fees

Customers pay for express or international shipping.

- Revenue Share: ~8%

- Pricing: $0–$8 per order

- Free Shipping: Above minimum order threshold

Revenue Stream #4: Advertising & Sponsored Listings

Brands and sellers pay for visibility.

- Revenue Share: ~7%

- High Margin: Minimal operational cost

- Formats: Sponsored products, homepage banners

Revenue Stream #5: Data & Brand Collaborations

Shein monetizes fashion trend data and influencer partnerships.

- Revenue Share: ~5%

- Used by: Designers, brands, marketing agencies

Revenue Streams Percentage Breakdown – Shein Clone

| Revenue Stream | Description | % of Total Revenue (2025) |

|---|---|---|

| Direct Product Sales (Private Label) | Shein-owned fast-fashion items | 68% |

| Marketplace Seller Commissions | Fees from third-party sellers | 12% |

| Shipping & Handling Fees | Delivery & logistics charges | 8% |

| Advertising & Sponsored Listings | Paid visibility & promotions | 7% |

| Data & Brand Collaborations | Trend insights & partnerships | 5% |

| Total | 100% |

The Fee Structure Explained

Shein’s fee system is simple for users but layered behind the scenes.

Customer-Side Fees

- Product price

- Shipping & express delivery fees

- Import & handling charges

- Optional priority delivery

Seller-Side Fees

- Commission on sales

- Advertising spend

- Promotional campaign participation

Hidden Revenue Layers

- Supplier-negotiated manufacturing margins

- Logistics cost arbitrage

- Dynamic pricing by region

Complete Fee Structure by User Type – Shein Clone

| User Type | Fee Category | What It Covers | Typical Pricing (2025) | When It Applies |

|---|---|---|---|---|

| Customer | Product Price | Apparel & accessories | $3–$30 per item | Every purchase |

| Customer | Shipping Fee | Standard delivery | $0–$5 | Free above threshold |

| Customer | Express Shipping | Faster delivery | $3–$8 | Optional |

| Customer | Import / Handling Fee | Cross-border logistics | $1–$6 | International orders |

| Seller | Sales Commission | Platform fee on sales | 10–20% | Per transaction |

| Seller | Sponsored Listings | Paid product visibility | CPC / Fixed | Optional |

| Seller | Campaign Participation | Discounts & promos | Variable | Seasonal events |

How Shein Maximizes Revenue Per User

Shein focuses on volume + frequency, not high margins per item.

- Hyper-personalized product feeds

- Flash sales and countdown pricing

- Cross-selling accessories

- Dynamic regional pricing

- Influencer-driven urgency

- Gamified rewards and coupons

- High-repeat purchase behavior

Example:

A frequent buyer placing 2–3 orders per month generates over 4× lifetime value compared to seasonal shoppers.

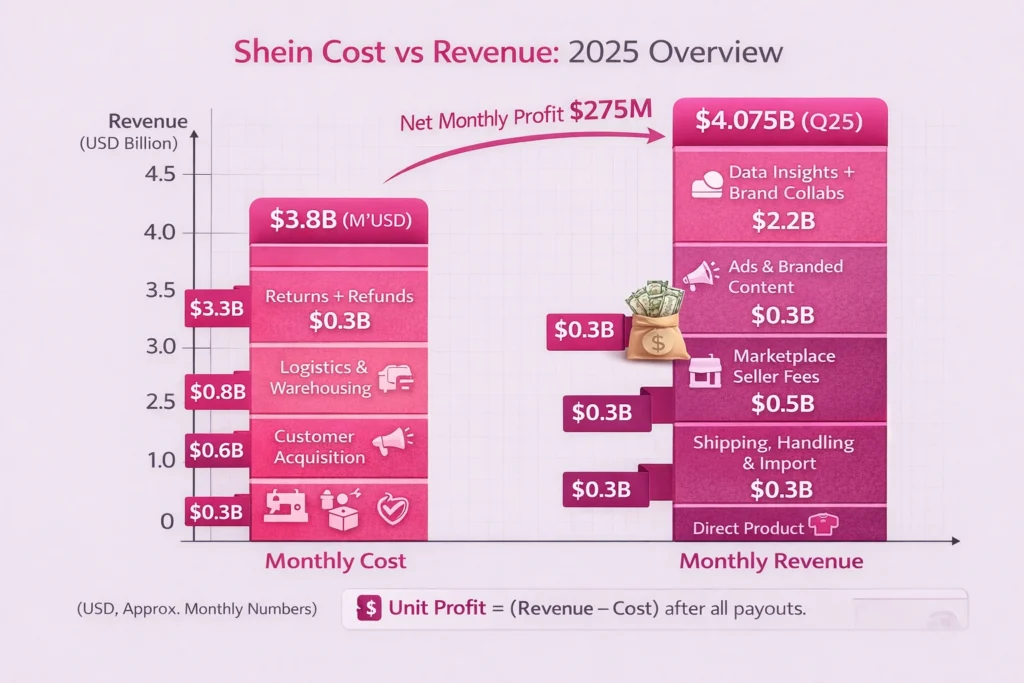

Cost Structure & Profit Margins

Key Cost Components

- Manufacturing & supplier payments

- Global logistics & warehousing

- Customer acquisition via social ads

- Technology & AI systems

- Returns and refunds

Unit Economics

- Low production batches reduce waste

- Break-even reached at massive scale

Profitability Path

- Increased private-label margins

- Reduced return rates

- Higher ad revenue share

Read More: Best Shein Clone Scripts 2025 – Launch a Fashion eCommerce App

Future Revenue Opportunities & Innovations

New Monetization Paths

- Creator-designed collections

- AI-generated fashion lines

- B2B wholesale fashion

AI & ML Monetization

- Predictive design creation

- Demand-based manufacturing

Expansion Opportunities

- Tier-2 cities globally

- Emerging markets

Risks

- Regulatory pressure

- Sustainability concerns

- Fast-fashion backlash

Founder Opportunities

- Ethical fast fashion niches

- Region-focused fashion marketplaces

Lessons for Entrepreneurs & Your Opportunity

What Works

- Data-driven manufacturing

- Vertical integration

- Ultra-fast supply chains

What to Replicate

- Trend-to-product speed

- Low inventory risk

- AI-driven demand forecasting

Market Gaps

- Sustainable fashion

- Local designer platforms

Want to build a platform with Shein’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Shein-style fashion marketplace scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Shein proves that modern fashion success is driven by data, analytics, and rapid execution rather than design intuition alone, enabling brands to respond to consumer behavior in near real time.

Its greatest competitive edge lies in predicting demand before trends peak, reducing overproduction, lowering inventory risk, and aligning supply tightly with actual customer intent.

For founders, the takeaway is clear: platforms that prioritize speed, data intelligence, and operational agility will consistently outperform traditional, slower-moving fashion models.

FAQs

1. How much does Shein make per transaction?

Roughly $8–15 after costs on an average order.

2. What’s Shein’s most profitable revenue stream?

Direct private-label product sales.

3. How does Shein’s pricing compare to competitors?

Significantly lower due to vertical integration.

4. What percentage does Shein take from sellers?

Around 10–20%.

5. How has Shein’s revenue model evolved?

From fast fashion to AI-driven production.

6. Can small platforms use similar models?

Yes, at a regional scale.

7. What’s the minimum scale for profitability?

Tens of thousands of monthly orders.

8. How to implement similar revenue models?

Use demand forecasting + private labels.

9. What are alternatives to Shein’s model?

Marketplace-only or sustainable fashion platforms.

10. How quickly can similar platforms monetize?

Within weeks if supplier onboarding is strong.