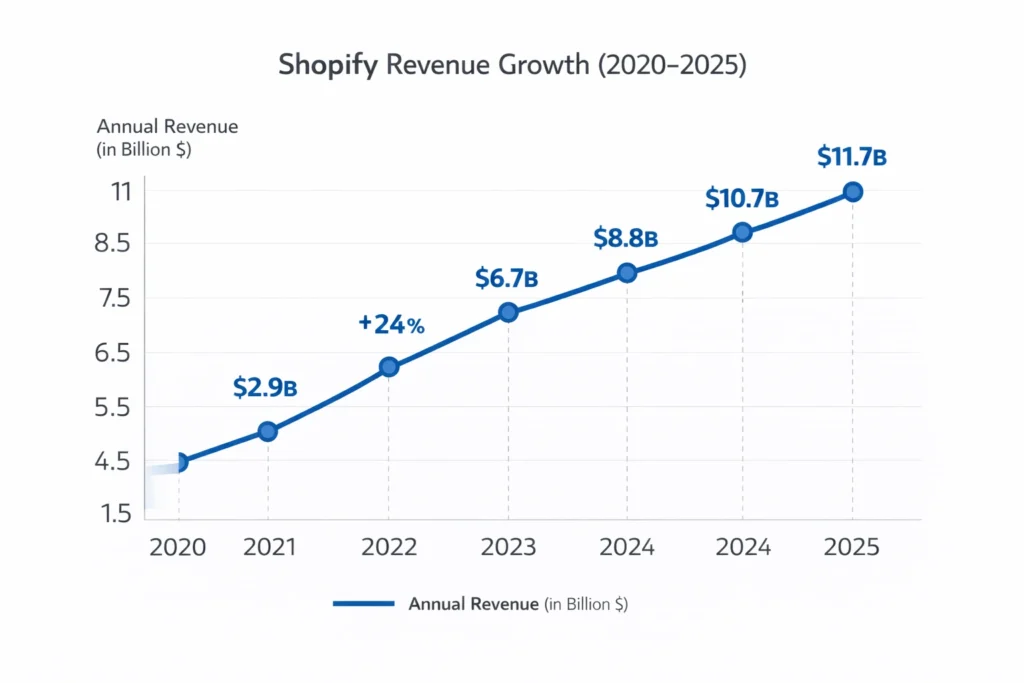

In 2025, Shopify is operating at an estimated $10.7 billion in annual revenue, proving that commerce infrastructure can be more powerful than selling products themselves.

What makes Shopify remarkable is not just subscriptions—but how it monetizes every layer of a merchant’s journey, from store creation to payments, shipping, marketing, and ecosystem expansion.

For founders, Shopify’s model is a blueprint for building a high-margin, recurring, and compounding platform business rather than a traditional e-commerce store.

Shopify Revenue Overview – The Big Picture

Shopify operates as a commerce operating system powering millions of merchants globally.

2025 Snapshot

- 2025 Revenue: ~$10.7 billion

- Valuation: ~$80–90 billion range

- YoY Growth: ~20%

- Profit Margins: 22–28% blended

Revenue by Region

- North America: ~55%

- Europe: ~25%

- Asia-Pacific: ~15%

- Rest of World: ~5%

Competition Benchmark

- Higher ARPU than pure SaaS competitors

- Stronger margins than logistics-heavy platforms

- Superior ecosystem monetization compared to storefront-only tools

Read More: What is Shopify and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Subscription Plans

How it works: Merchants pay monthly fees for access to the platform.

Revenue Share: ~29%

Pricing: Tiered plans from entry-level to enterprise

2025 Insight: Enterprise subscriptions now contribute a growing share of predictable revenue.

Revenue Stream #2: Shopify Payments (Transaction Fees)

How it works: Shopify takes a percentage of every transaction processed.

Revenue Share: ~38%

Pricing: ~2%–3% per transaction

2025 Insight: Payments have become Shopify’s single largest revenue engine.

Revenue Stream #3: Merchant Services

How it works: Shipping, capital advances, POS hardware, tax tools.

Revenue Share: ~18%

2025 Insight: Embedded services improve merchant retention and lifetime value.

Revenue Stream #4: App & Theme Ecosystem

How it works: Revenue share from third-party apps and themes.

Revenue Share: ~9%

2025 Insight: App ecosystem acts as a growth multiplier without Shopify building everything.

Revenue Stream #5: Shopify Plus & Enterprise Services

How it works: High-value contracts with large brands.

Revenue Share: ~6%

2025 Insight: Fewer merchants, but significantly higher ARPU.

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share (2025) |

|---|---|

| Payments & Transaction Fees | 38% |

| Subscriptions | 29% |

| Merchant Services | 18% |

| App & Theme Ecosystem | 9% |

| Enterprise Services | 6% |

The Fee Structure Explained

Shopify monetizes primarily on the merchant side, but with layered fees.

User-Side Fees

- Monthly subscription fees

- Transaction processing fees

- Shipping and fulfillment margins

- Capital financing fees

Provider-Side Fees

- App developer revenue share

- Theme marketplace commissions

Hidden Revenue Layers

- Payment float income

- Foreign exchange conversion margins

- Advanced analytics upsells

Regional Pricing Variation

- Higher subscription tiers in North America

- Payment-driven monetization in emerging markets

- Enterprise customization in Europe

Complete Fee Structure by User Type

| User Type | Fee Type | Typical Range |

|---|---|---|

| Small Merchants | Subscription + payments | Monthly + 2–3% |

| Growing Brands | Subscription + services | Mid-tier plans |

| Enterprise Brands | Custom contracts | High ARPU |

| App Developers | Revenue share | ~20–30% |

| Logistics Partners | Commission | Variable |

How Shopify Maximizes Revenue Per User

Shopify focuses on merchant success first, then monetizes that success.

- Segmentation: SMBs, D2C brands, enterprises

- Upselling: Payments, shipping, POS, analytics

- Cross-selling: Capital, marketing tools, fulfillment

- Dynamic Pricing: Volume-based incentives

- Retention Monetization: High switching costs

- LTV Optimization: Merchants using payments + apps generate ~2.5× LTV

- Psychological Pricing: Tier anchoring encourages upgrades

- Real Data Example: Merchants using 4+ Shopify services generate significantly higher ARPU.

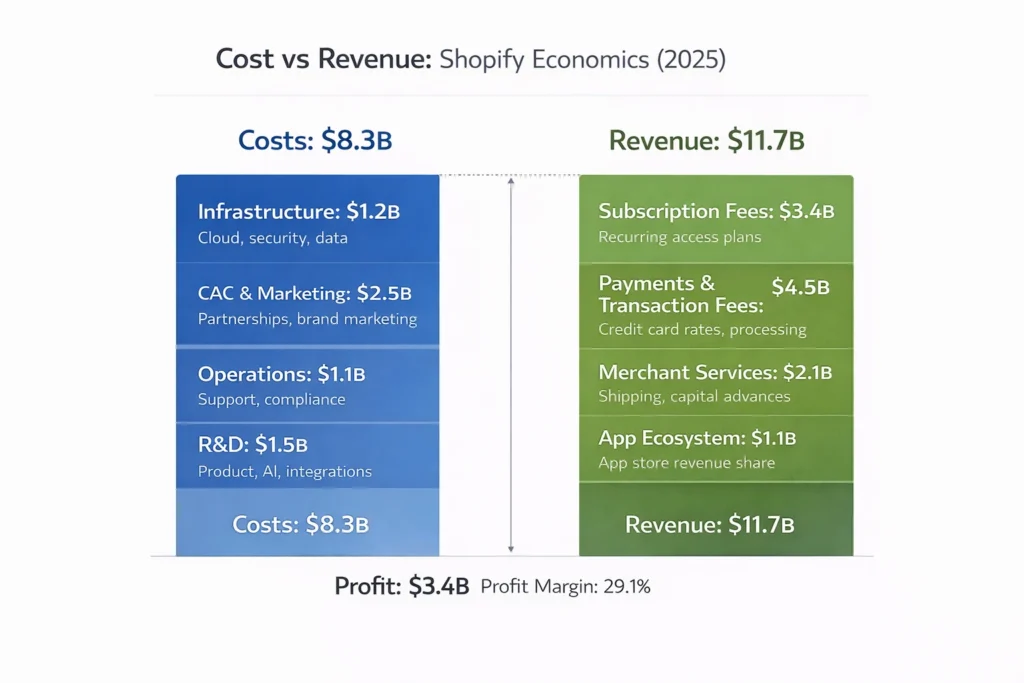

Cost Structure & Profit Margins

Shopify balances high-margin software with operational services.

Cost Breakdown

- Infrastructure: Cloud, security, data (~15%)

- CAC & Marketing: Partnerships, brand marketing (~22%)

- Operations: Support, compliance (~13%)

- R&D: Product, AI, integrations (~14%)

Unit Economics

- SaaS gross margin: 80%+

- Payments & services margin: 25–35%

Profitability Path

- Payments volume unlocks scale economics

- Automation improves margins year-over-year

Read More: Best Shopify Clone Scripts 2025 | Launch eCommerce SaaS Platform

Future Revenue Opportunities & Innovations

New Streams

- Embedded lending & financial products

- AI-powered conversion optimization

- Global fulfillment expansion

AI/ML Monetization

- Predictive sales analytics

- Automated marketing optimization

- AI storefront personalization

Market Expansion

- Cross-border commerce

- B2B commerce infrastructure

- Creator-led commerce

Predicted Trends (2025–2027)

- Commerce OS consolidation

- Payments-first monetization

- Fewer tools, deeper platforms

Risks & Threats

- Payments margin compression

- Platform dependency backlash

- Regulatory pressure

Opportunities for New Founders

- Vertical-specific Shopify-style platforms

- Regional commerce operating systems

- AI-native commerce tools

Lessons for Entrepreneurs & Your Opportunity

What Works

- Revenue aligned with customer success

- Multi-layer monetization

- Strong ecosystem leverage

What to Replicate

- Subscription + transaction hybrid

- Platform extensibility

- Embedded financial services

Market Gaps

- Affordable enterprise-grade tools for SMBs

- Faster global onboarding

- AI-first commerce stacks

Want to build a platform with Shopify’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Shopify clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Shopify didn’t win by selling stores—it won by becoming commerce infrastructure.

Instead of competing on storefront features alone, Shopify embedded itself into every operational layer of online businesses, including payments, fulfillment, analytics, and financial services. This positioning transformed Shopify from a tool into a platform that merchants depend on daily, creating strong switching costs and long-term platform loyalty.

Its revenue model compounds as merchants grow, making it resilient and scalable.As merchants scale their sales volume, Shopify earns more through transaction fees, premium services, and ecosystem participation—without proportionally increasing its costs. This alignment between merchant success and platform revenue allows Shopify to grow even during market slowdowns, making its business model structurally durable.

FAQs

1. How much does Shopify make per transaction?

Typically around 2–3% depending on payment volume.

2. What’s Shopify’s most profitable revenue stream?

Subscription fees and enterprise plans carry the highest margins.

3. How does Shopify’s pricing compare to competitors?

It’s higher long-term but delivers more integrated value.

4. What percentage does Shopify take from merchants?

Primarily through transaction fees and app revenue shares.

5. How has Shopify’s revenue model evolved?

From SaaS-only to payments-first platform monetization.

6. Can small platforms use similar models?

Yes, by combining subscriptions with transaction fees.

7. What’s the minimum scale for profitability?

Usually a few thousand active merchants.

8. How to implement similar revenue models?

Start with subscriptions, then layer payments and services.

9. What are alternatives to Shopify’s model?

Marketplace-only or logistics-first platforms.

10. How quickly can similar platforms monetize?

Many begin generating revenue within the first 30–60 days.