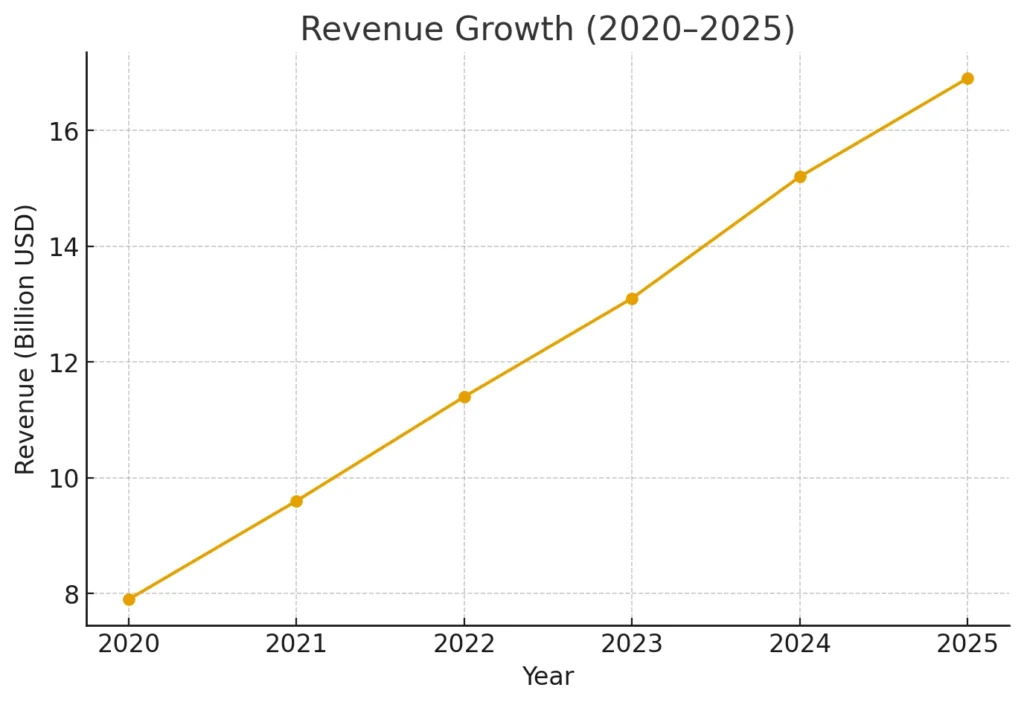

Spotify crossed $16.9 billion in annual revenue in 2025, proving that music streaming remains one of the most powerful and scalable digital business models of our time. What makes Spotify’s model so impressive isn’t just its massive user base—but the way it monetizes every layer of the listening experience through subscriptions, ads, creator tools, and intelligent personalization.

For entrepreneurs, understanding how Spotify structures its revenue engine is critical. This model demonstrates how a digital platform can turn engagement, data, and content distribution into predictable recurring revenue. By studying Spotify’s approach, founders can build high-growth streaming platforms that replicate the same monetization strengths—while innovating in niche markets where demand is exploding.

Spotify Clone Revenue Overview – The Big Picture

Valuation (2025): ~$40B

Annual Revenue (2025): $16.9B

YoY Growth: ~11%

Revenue by Region:

- Europe: 30%

- North America: 29%

- Latin America: 22%

- Asia-Pacific & Others: 19%

Profit Margin: Spotify turned repeat quarterly profits in 2025 with ~5–7% net margin, driven by subscription growth and reduced licensing costs.

Market Position:

Spotify leads global streaming with ~33% share, ahead of Apple Music (~15%) and Amazon Music (~13%).

Primary Revenue Streams Deep Dive

1. Premium Subscriptions (64% of total revenue)

Spotify’s main income source.

How it works: Monthly/annual subscription fees unlock ad-free listening, offline mode, and better audio quality.

2025 Pricing: $10.99–$16.99 depending on plan

2025 Contribution: ~$10.8B globally

Example: Family plans greatly improve retention and LTV.

2. Advertising Revenue (13%)

Free-tier users hear ads between songs.

Ad Formats: Audio ads, video ads, sponsored playlists, display ads

2025 Contribution: ~$2.2B

Why it works: Massive user base → high CPM rates.

3. Creator Monetization & Marketplace Tools (10%)

Spotify sells tools & services to artists:

- Promotion features

- Analytics tools

- Paid placements

- Merch integration fees

2025 Contribution: ~$1.6B

4. Podcast Monetization (10%)

Through:

- Podcast ads

- Subscription podcasts

- Spotify’s AI ad marketplace

2025 Contribution: ~$1.7B

Podcasts have much lower licensing costs, increasing margin.

5. Licensing, Partnerships & Enterprise Deals (3%)

B2B revenue from partnerships with:

- Telcos

- OEMs

- Education institutes

2025 Contribution: ~$500M

Read More: Business Model of Spotify – How It Earns in 2025

Revenue Share Table

| Revenue Stream | % Share | 2025 Contribution |

|---|---|---|

| Premium Subscriptions | 64% | $10.8B |

| Advertising | 13% | $2.2B |

| Creator Marketplace | 10% | $1.6B |

| Podcasts | 10% | $1.7B |

| Partnerships | 3% | $0.5B |

The Fee Structure Explained

User-Side Fees

- Monthly subscription fees

- Premium plan differential pricing

- Regional pricing adjustments

Provider-Side Fees

- Revenue-sharing with artists

- Commission on promotional placements

- Fees on creator tools and podcast monetization

Hidden Revenue Layers

- AI ad targeting

- Behavioral analytics licensing

- Algorithmic playlist sponsorships

Regional Pricing

Lower-income markets get discounted plans to maximize adoption.

Fee Structure Table

| User Type | Fees Charged | Notes |

|---|---|---|

| Free Users | Ads served | CPM/CPC model |

| Premium Users | Monthly fees | Tier-based |

| Artists | Commission on tools | Marketplace revenue |

| Podcasters | Ad revenue share | Lower cost base |

| Partners | Licensing fees | White-label deals |

How Spotify Clone Maximizes Revenue Per User

Segmentation

Tailored plans: student, individual, duo, family.

Upselling

AI-driven prompts push users to premium.

Cross-selling

Merch, concert tickets, exclusive releases.

Dynamic Pricing

Regional & time-based pricing increases conversion.

Retention Monetization

Longer playlists & algorithmic personalization keep users streaming more.

LTV Optimization

Predictive analytics to minimize churn.

Psychological Pricing

$9.99 pricing sweet spot for emotional purchase.

Real Example

A user costing $1.70/month in licensing can generate $9.99 subscription revenue → ~83% gross margin on subscription before royalties.

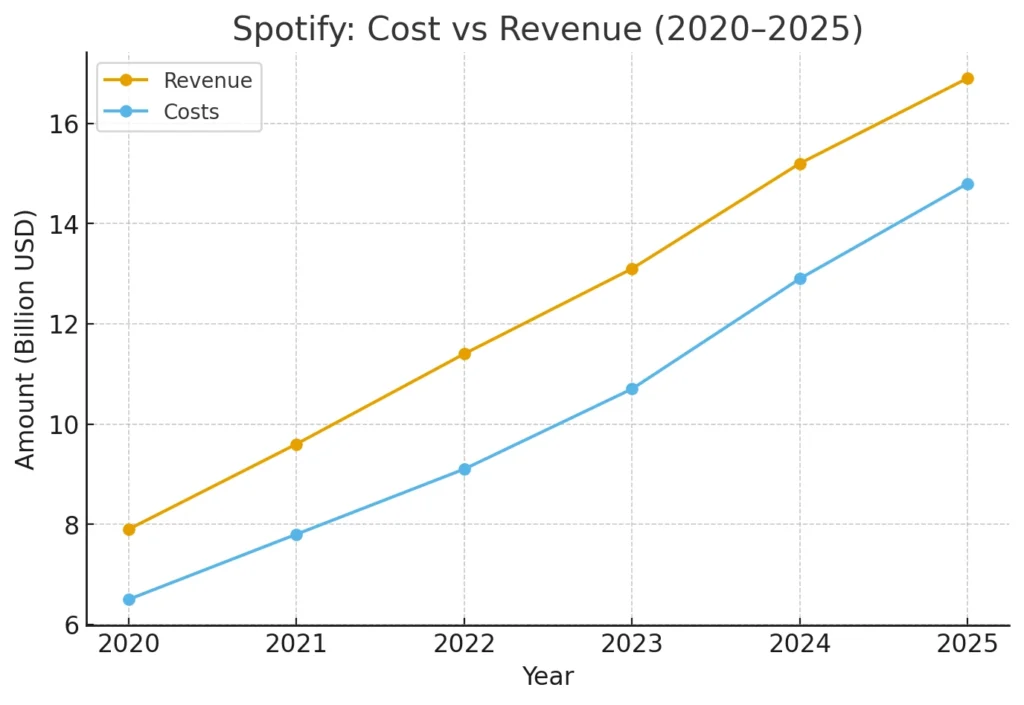

Cost Structure & Profit Margins

Tech Infrastructure

Servers, CDN, transcoding, AI personalization

Annual cost: ~$3B

Marketing / CAC

Aggressive partnerships, influencer campaigns

Cost: ~$2.4B

Operations

Royalties, staff, direct costs

Cost: ~$9B (biggest expense)

R&D

Innovation, AI music recommendation

Cost: ~$1.5B

Unit Economics

- CAC: $8–$12

- Payback: 4–6 months

Profitability Path

Subscription growth + reduced royalty burden → higher margins.

Margin Optimization

- AI-driven ad placements

- Reduced dependency on licensed catalog

- More original podcast content

Future Revenue Opportunities & Innovations

New Revenue Streams

- AI-generated playlist subscriptions

- Artist premium dashboards

- Fan-to-artist micro-payments

AI/ML Monetization

AI-based music recommendations boost retention and engagement.

Expansion Markets

Massive growth expected in India, Africa, Southeast Asia.

Emerging Features (2025–2027)

- Auto-curated mood playlists

- Voice personalization

- Real-time fan interaction tools

Threats/Risks

- Rising artist royalty demands

- Competition from YouTube Music & TikTok Sounds

- Increasing licensing costs

Opportunities for New Players

A Spotify Clone can build niche streaming models (regional, genre-specific, AI-personalized).

Lessons for Entrepreneurs & Your Opportunity

What Works

Subscription-first, ads-second approach.

What to Replicate

Engagement loops built around personalization.

Market Gaps

Localized content, language-based streaming, and bundled ecosystem products.

Model Improvements

- Better creator payouts

- Transparent dashboards

- Hybrid subscription + micro-payment systems

Want to build a platform with Spotify’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our Spotify Clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch.

If you want it in advanced language scripting, Miracuves will provide that also.

Get a free consultation to map out your revenue strategy.

Final Thought

Spotify’s billion-dollar model proves how valuable a streaming platform can become when monetization, personalization, and retention work together. With Miracuves, entrepreneurs can replicate these winning strategies through a fully optimized Spotify Clone built for scale. Our ready-to-launch solutions integrate subscription billing, ad engines, creator monetization, and AI-powered recommendations—giving your platform the same revenue strengths as the industry leader.

FAQs

1. How much does a Spotify Clone make per transaction?

It earns 10–35% depending on subscription or creator marketplace fees.

2. What’s the most profitable revenue stream?

Premium subscriptions.

3. How does pricing compare to competitors?

Similar to Apple Music and Amazon, but more flexible globally.

4. What percentage does it take from providers?

Usually 10–30% depending on tools and promotions.

5. How has the model evolved?

Shift toward podcasts, creator tools, and AI-driven ads.

6. Can small platforms use similar models?

Yes—subscription + ads work even for niche apps.

7. What’s the minimum scale for profitability?

~100k–300k monthly active users depending on licensing costs.

8. How to implement similar revenue models?

Use modular monetization: ads, subscriptions, marketplace fees.

9. What are alternatives?

Freemium model, pay-per-download, micro-transactions.

10. How quickly can similar platforms monetize?

With the right model—within 30–60 days.