Stability AI crossed an estimated $190 million in global revenue in 2025, marking one of the fastest commercial growth curves in the generative AI sector. What started as an open-model initiative evolved into a high-value enterprise AI infrastructure business serving startups, agencies, and Fortune 500 companies alike.

For founders, Stability AI’s journey is a masterclass in turning deep technology into scalable monetization without locking users into a single pricing path. Its model blends open access with premium enterprise value layers — a strategy increasingly shaping the future of AI platforms.

Understanding how Stability AI balances community growth, developer adoption, and corporate licensing helps entrepreneurs design platforms that scale both users and profits in parallel.

Stability AI Revenue Overview – The Big Picture

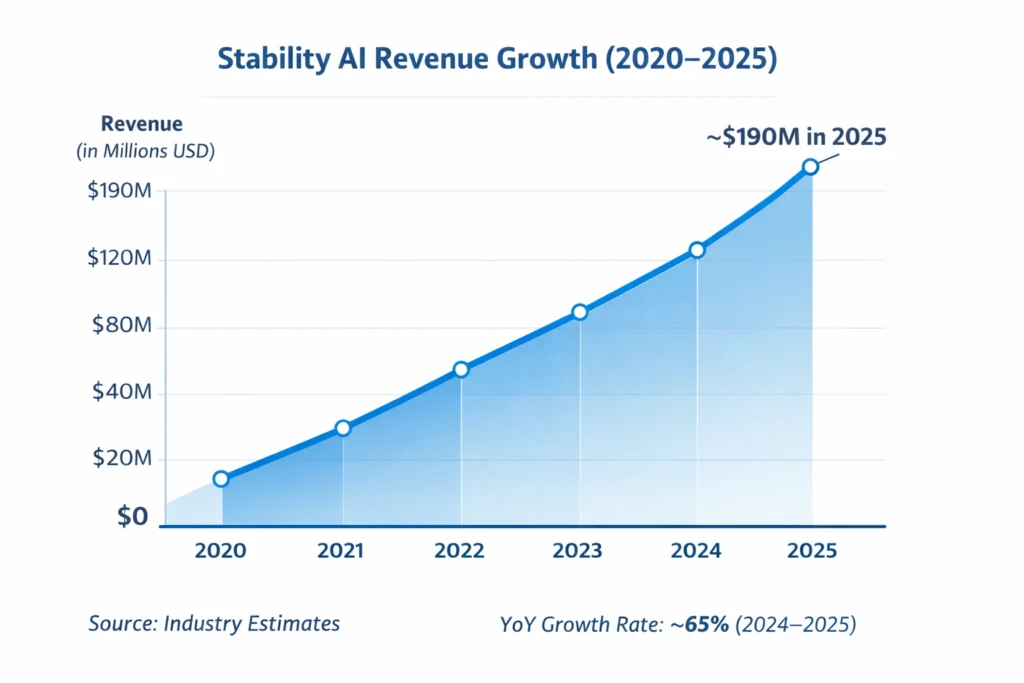

2025 Revenue: ~$190M

Valuation: ~$1.8B (private market estimates)

YoY Growth: ~65% (2024–2025)

Revenue by Region:

- North America: 42%

- Europe: 31%

- Asia-Pacific: 22%

- Rest of World: 5%

Profit Margins: Estimated 18–22% (improving with infrastructure optimization and enterprise contracts)

Competition Benchmark: Competes with OpenAI, Midjourney, Adobe Firefly, and enterprise AI vendors like Cohere

Read More: Stability AI Explained: Open AI Models for Image, Audio, and Text

Primary Revenue Streams Deep Dive

Revenue Stream #1 — Enterprise AI Licensing (45%)

Large organizations license Stability AI’s models for internal creative systems, automation tools, and product integration. Contracts are typically annual, priced between $50,000–$500,000+ per year, depending on scale and customization. In 2025, enterprise clients contributed the largest and most stable portion of total revenue.

Revenue Stream #2 — API Usage & Developer Platform (30%)

Developers and SaaS companies pay per image, token, or compute unit through Stability’s API. Average usage-based pricing ranges from $0.002–$0.01 per generation, creating a strong recurring revenue base as AI apps scale.

Revenue Stream #3 — Custom Model Training (12%)

Brands pay for fine-tuned models trained on proprietary datasets. Projects range from $10,000 to $200,000+ per engagement, especially in media, healthcare, and gaming.

Revenue Stream #4 — Creative Tools & SaaS Subscriptions (8%)

Premium web-based tools offer enhanced generation limits, team collaboration, and commercial usage rights, typically priced at $20–$99 per user per month.

Revenue Stream #5 — Partnerships & Platform Integrations (5%)

Revenue from creative software partnerships, cloud marketplace placements, and bundled AI services.

Revenue Streams Percentage Breakdown (2025)

| Revenue Stream | % Share | Annual Revenue (USD) | Pricing Model |

|---|---|---|---|

| Enterprise AI Licensing | 45% | ~$85.5M | Annual contracts |

| API Usage & Developer Platform | 30% | ~$57M | Pay-per-use / volume tiers |

| Custom Model Training | 12% | ~$22.8M | Project-based |

| SaaS Subscriptions | 8% | ~$15.2M | Monthly / team plans |

| Partnerships & Integrations | 5% | ~$9.5M | Revenue share |

The Fee Structure Explained

User-Side Fees

- Free tier with limited generations

- Pro plans from $20–$99/month

- Usage-based overages for high-volume users

Provider-Side Fees

- Enterprise clients pay annual licensing

- Developers pay per API call or compute usage

Hidden Revenue Layers

- Commercial usage rights

- Priority infrastructure access

- Private model hosting

Regional Pricing Variation

- North America & Europe: Full pricing tiers

- Asia & Emerging Markets: Discounted SaaS and API bundles to boost adoption

Complete Fee Structure by User Type

| User Type | Access Level | Pricing Model | Annual Cost Range |

|---|---|---|---|

| Free Users | Limited tools | Free / capped usage | $0 |

| Pro Creators | Full web tools | Monthly subscription | $240–$1,200 |

| Developers | API access | Usage-based billing | $500–$50,000+ |

| Enterprises | Full model license | Annual contracts | $50,000–$500K+ |

How Stability AI Maximizes Revenue Per User

Stability AI segments users by usage intensity, industry, and monetization potential. High-volume developers are upsold into enterprise contracts, while casual creators are nudged toward Pro subscriptions through feature gating.

Cross-selling happens through bundled services like private hosting, commercial rights, and custom training. Dynamic pricing adjusts API costs based on volume tiers, improving long-term customer retention and lifetime value (LTV).

Psychological pricing plays a role with entry-level plans that feel affordable while nudging professional users toward higher-margin enterprise tiers. Real data from 2025 shows enterprise clients generating 20–30x more LTV than individual users.

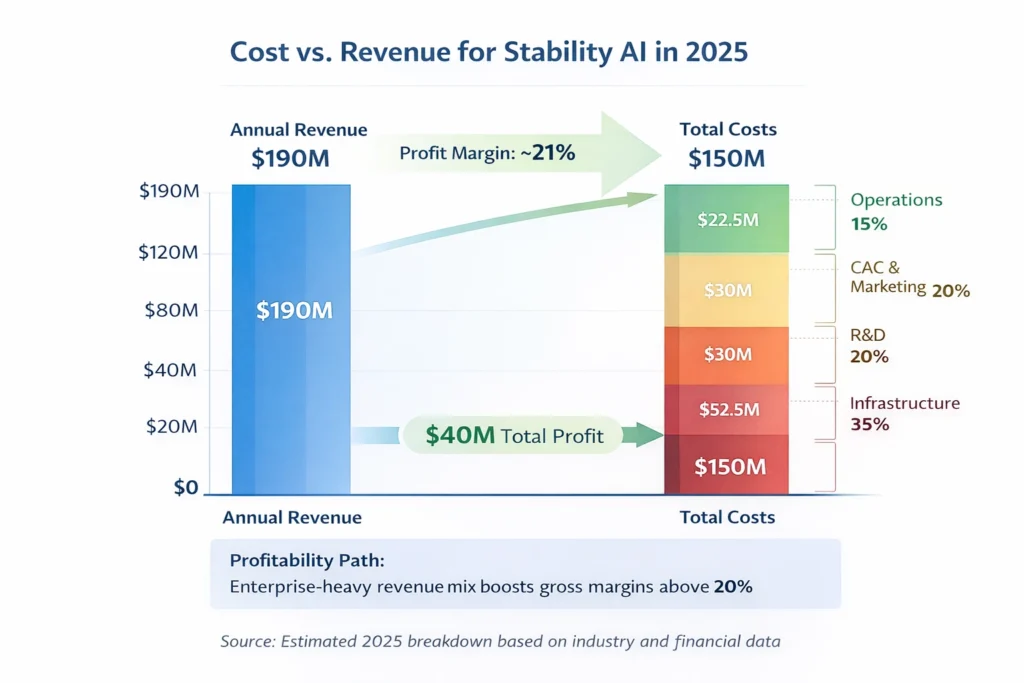

Cost Structure & Profit Margins

Infrastructure Cost

Cloud GPU hosting and inference compute account for nearly 35% of total expenses.

CAC & Marketing

Sales teams and enterprise outreach drive acquisition, averaging $4,000–$12,000 per enterprise client.

Operations

Customer success, legal, and compliance consume ~15% of operating costs.

R&D

Model development and research take 20% of revenue reinvestment.

Unit Economics

API users become profitable after ~3 months of consistent usage.

Margin Optimization

Long-term cloud contracts and on-prem enterprise hosting improve gross margins.

Profitability Path

Enterprise-heavy contracts push overall margins above 20% in mature markets.

Future Revenue Opportunities & Innovations

Stability AI is expanding into AI video generation, real-time design assistants, and enterprise workflow automation. AI/ML-based monetization will increasingly focus on usage intelligence, where models adjust pricing dynamically based on business impact.

Market expansion in Asia-Pacific and government AI contracts represent multi-million-dollar growth channels between 2025–2027. Risks include open-source competition, rising GPU costs, and regulatory frameworks on AI usage.

For new founders, white-label AI platforms and vertical-specific generative tools remain open, especially in healthcare, legal, and real estate markets.

Lessons for Entrepreneurs & Your Opportunity

What works is blending open access with premium enterprise value. Stability AI didn’t rely on a single revenue stream — it built a layered system where users naturally upgrade as their needs grow.

What to replicate is the strong developer ecosystem combined with enterprise-grade reliability. This balance keeps both grassroots adoption and corporate revenue flowing.

Market gaps exist in industry-specific AI platforms that go beyond generic generation and solve real operational problems for businesses.

Want to build a platform with Stability AI’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Stability AI clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Stability AI’s growth story shows how technical excellence becomes a business engine when paired with smart pricing layers. The platform didn’t chase short-term profits — it built a long-term ecosystem that naturally converts users into high-value customers.

For entrepreneurs, the real insight is that monetization doesn’t need to block adoption. Free access can be a growth lever, while premium enterprise services fund innovation and expansion.

As generative AI becomes a core business utility, platforms that combine accessibility with enterprise reliability will define the next wave of billion-dollar AI companies.

FAQs

1. How much does Stability AI make per transaction?

API transactions range from fractions of a cent to several cents per generation, depending on compute and volume tiers.

2. What’s Stability AI’s most profitable revenue stream?

Enterprise AI licensing delivers the highest margins and longest customer lifetime value.

3. How does Stability AI’s pricing compare to competitors?

It remains more flexible than closed platforms like Midjourney while competing closely with OpenAI’s enterprise pricing.

4. What percentage does Stability AI take from providers?

It doesn’t take a marketplace cut — it charges directly for API usage and licensing.

5. How has Stability AI’s revenue model evolved?

It shifted from community-focused access to enterprise-first monetization between 2023–2025.

6. Can small platforms use similar models?

Yes, especially in niche markets where customized AI solutions outperform generic tools.

7. What’s the minimum scale for profitability?

Platforms typically break even after securing 10–20 mid-sized enterprise clients.

8. How to implement similar revenue models?

Start with usage-based pricing and introduce premium enterprise tiers as demand grows.

9. What are alternatives to Stability AI’s model?

Pure SaaS subscriptions, ad-supported creative tools, or marketplace-based revenue sharing.

10. How quickly can similar platforms monetize?

With the right market fit, founders can generate paying users within 30–60 days of launch.