Remember the first time you tried swapping tokens on a decentralized exchange? Uniswap clone that stomach-fluttering mix of “Is my wallet connected?” and “Who needs a middleman anyway?” is now the default vibe for crypto founders. In 2025, Uniswap sits at the heart of that feeling—an AMM legend that turned boiler-room trading floors into code and community. For entrepreneurs eyeing a DeFi play, the natural next question is, “Do we reinvent the wheel or ride the Uniswap wave?”

Spoiler: custom-building a decentralized exchange (DEX) is not just smart-contract wizardry and celebratory pizza. You’re talking endless audits, liquidity-bootstrapping drama, and regs that change faster than a meme coin’s price. Meanwhile, clone scripts have matured from clunky knock-offs to polished, audited kickstarts that let you launch in weeks—without kissing goodbye to product-market fit. That’s why more founders are short-listing clone solutions even before they sketch their tokenomics.

Today we’ll unpack exactly why startups keep choosing Miracuves’ Uniswap over rolling their own DEX from scratch—covering economics, tech firepower, security, and yes, the future-proof factor. By the end, you’ll know if cloning is a cheat code or a cop-out (hint: it’s the former). Ready? Let’s dive in and see how Miracuves quietly powers half the launches you saw trending on Crypto Twitter last week.

Why the “Clone vs Custom” Debate Even Exists

Building a DEX is like baking sourdough: the recipe looks simple—until you’ve killed your third starter. Uniswap popularized the Automated Market Maker (AMM) model, open-sourcing its solidity contracts so anyone could fork the code. Great in theory, but practice exposes rough edges:

- Liquidity gravity: Without network effects, your shiny custom DEX is a ghost town.

- Security overhead: Every new line of bespoke code is potential attack surface.

- Regulatory whiplash: Jurisdictions love moving goalposts, and compliance-as-code is harder than it sounds.

Read more : What is Uniswap App and How Does It Work?

1. Speed to Market: “Weeks, Not Quarters”

Launching late is kryptonite in crypto. Uniswap While you’re still writing custom router logic, competitors are announcing airdrops. Miracuves’ Uniswap ships with:

- Pre-audited smart-contracts (v3-style concentrated-liquidity pools).

- Plug-and-play liquidity mining modules.

- Frontend templates optimized for mobile (because yes, most of your users swap on their phones).

Result? Typical clients go from idea to mainnet in 21 days—a fraction of the 4–6 months teams report when coding from scratch.

2. Cost Maths: The Million-Dollar-Mistake You Skip

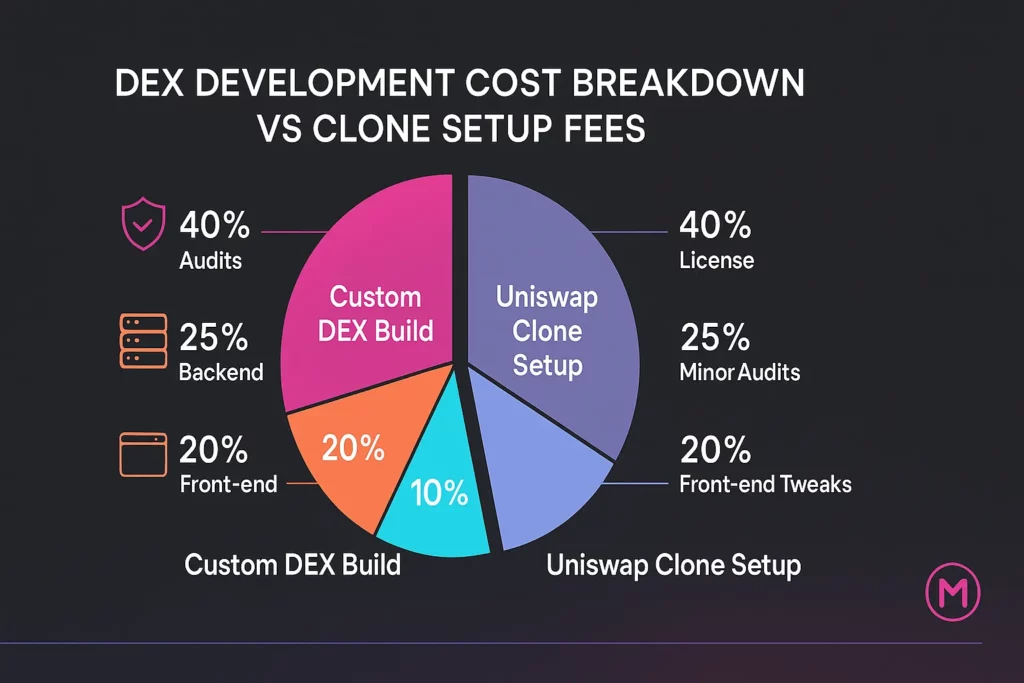

Audit fees alone can run upwards of $150k per version bump. Add senior solidity dev salaries (~$180k/yr), liquidity seeding, bug-bounties, and marketing, and custom builds often cross the $1.2 million mark before the first swap. Miracuves’ clone package comes in at a high-five-figure entry point, audits included. Uniswap Clone That delta directly improves your runway and lets you spend on user incentives instead of reinventing core AMM math.

According to TechCrunch, Uniswap Labs secured a massive $165 million in Series B funding, highlighting the growing investor confidence in decentralized exchange infrastructure.

3. Security by Proven Battle-Testing

In DeFi, trust is audited code. Miracuves’ clone inherits publicly-scrutinized Uniswap logic, then layers additional checks:

- Re-entrancy guards & flash-loan attack mitigations baked in.

- Continuous integration with MythX & Slither for every minor release.

- Bug-bounty matching program where Miracuves tops up rewards 1:1.

Story time: A client forked the codebase to experiment with a fee toggle, skipped our merge-request checklist, Uniswap Clone and almost introduced a rounding bug that could drain fees. The automated test suite flagged it in under two minutes—saving a potential $600k exploit and their brand reputation.

4. Liquidity Hacking: Built-in Incentive Rails

Launching a DEX is useless without pools that matter. Miracuves includes:

- Liquidity Mining SDK—set APRs, cliffs, and vesting with YAML.

- Cross-chain bridge adapters (Base, Polygon, BSC) so you can bootstrap TVL from multiple ecosystems.

- Referral reward contracts that auto-track wallet-to-wallet invites.

Founders typically report hitting $10 million Uniswap Clone Total Value Locked (TVL) in month one—enough to hit leaderboards on aggregator dashboards and attract organic traders.

5. Compliance “Out of the Box” (Yes, Really)

From KYC hooks to transaction-limit flags, our clone’s modular middleware helps you toggle region-specific compliance features without boilerplate rewrites. When regulators drop new guidance (remember the SEC’s April 2024 Wells notice to Uniswap Labs?), Miracuves pushes patch updates you can merge in minutes—no downtime, no mad sprint.

6. Community & Extensibility

Holonym alert: The DEX isn’t an island—wallets, explorers, bots, and market-making scripts form its ecosystem. Miracuves exposes GraphQL endpoints so trading-bot builders (meronym: algos) and analytics dashboards (meronym: charts) can integrate fast. Plus, our dev Discord of 7k builders means you’ll find collaborators, not crickets, when you need to tweak fee tiers or roll out L2 support.

7. Future-Proofing & Upgrade Path

Crypto slang evolves: today it’s “restaking,” tomorrow it’s “intent-based swaps.” Miracuves tracks upstream Uniswap improvements and EIP proposals, Uniswap Clone so you’re never stuck on legacy logic.Hypernym moment: Think of your DEX as part of the broader financial-services stack running on smartphones—Miracuves ensures the stack doesn’t crumble when gas fees or user expectations shift.

Conclusion :

cloning Uniswap with Miracuves isn’t corner-cutting—it’s smart capital allocation. You get security, speed, and scalability while focusing on what actually differentiates your brand: community, incentives, and tokenomics.

Emerging trend to watch? Cross-chain intent layers that route orders across multiple AMMs automatically. Miracuves is already prototyping adapters, so expect an upgrade drop soon.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1. Will investors frown on a clone script?

Not if you articulate the value-add. VCs fund ROI, not lines of code. Proving traction fast often outweighs custom engineering vanity.

2. Can I customize fee tiers and token lists?

Absolutely. The clone ships with a modular fee manager and whitelists you can tweak via config—no core-contract edits.

3. What chains does the Miracuves clone support?

Ethereum mainnet by default, plus adapters for Base, Polygon, BNB Chain, and any EVM-compatible L2.

4. How do upgrades work after launch?

Miracuves uses proxy patterns. You keep ownership; we supply audited new logic contracts you can point to when ready.

5. What about governance?

You can fork UNI’s token model or plug in your own DAO module. Snapshot integration is two clicks away.

6. Is liquidity migration from Uniswap possible?

Yes—our “liquidity teleporter” script lets LPs move positions in a single MetaMask transaction, minimizing friction.

Related Articles :