What started as a simple idea to help beginners invest spare change has turned Stash into one of the most recognized micro-investing platforms in the world, managing billions in assets and serving millions of users globally. By 2026, investment apps like Stash are no longer just tools for trading they are education-driven wealth platforms powered by automation behavioral finance and AI-guided decisions.

For entrepreneurs, understanding the Stash clone model is critical. The global investment app market surpassed $180 billion in 2025, driven by retail investors Gen Z participation and the rise of fractional investing. Users now expect low-barrier entry automated portfolios and personalized financial guidance. With Stash Clone Development, founders can tap into this growing demand by launching platforms focused on beginner investors niche communities or regional markets. Miracuves helps entrepreneurs transform this proven investment model into scalable revenue-ready products using the Best Stash Clone Script 2026, built for compliance performance and long-term growth.

What Makes a Great Stash Clone?

A successful Stash Clone in 2026 is not just about enabling users to invest it is about lowering psychological and financial barriers to wealth creation. Entrepreneurs entering the investment app space must focus on simplicity trust and education while maintaining enterprise-grade performance and regulatory readiness. A great Stash Clone Development strategy blends micro-investing logic intuitive UX and automated guidance into one seamless experience. Users expect instant onboarding transparent fees and real-time portfolio insights across all devices.

Performance and reliability play a critical role in investor trust. Modern Stash-style platforms operate with average response times under 300ms maintain 99.9 percent uptime and support real-time trade execution without delays. Security is equally essential with end-to-end encryption multi-factor authentication and compliance-ready audit trails becoming baseline expectations. At Miracuves every Stash Clone Script is engineered with cloud-native scalability ensuring smooth performance during high trading volumes and market volatility.

Key Elements That Define a Great Stash Clone in 2026

• Simple micro-investing and fractional share support

• AI-driven portfolio recommendations and risk profiling

• Educational content integrated directly into the investing flow

• Bank-grade security and regulatory compliance readiness

• Cross-platform access across mobile and web

• Flexible monetization through subscriptions and advisory fees

Must-Have 2026 Technologies in Stash Clone Development

AI Automation personalizes investment portfolios based on user goals risk tolerance and spending behavior. Blockchain-backed transaction logging enhances transparency and trust. Cross-platform frameworks ensure consistent experience across iOS Android and web while reducing long-term maintenance costs.

Comparison Table: Modern Stash Clones vs Traditional Investing Apps

| Feature Area | Traditional Investing Apps | Modern Stash Clone by Miracuves |

|---|---|---|

| Investment Access | Full-share trading | Fractional and micro-investing |

| User Guidance | Limited | AI-based recommendations |

| Performance | Variable | Under 300ms response time |

| Security | Standard encryption | Bank-grade security layers |

| Scalability | Limited | Cloud-native auto scaling |

| Monetization | Trading fees | Subscription and advisory models |

Essential Features Every Stash Clone Must Have

A modern Stash Clone in 2026 must be designed as a complete investment ecosystem rather than a basic trading app. Entrepreneurs who succeed in this space focus on structured feature layers that serve users operators and system intelligence equally well. Effective Stash Clone Development balances ease of use education and automation while maintaining compliance scalability and security. Miracuves structures every Stash clone with modular feature layers so platforms can grow without reengineering the core system.

User Experience Layer

The user side of a Stash Clone should feel welcoming especially for first-time investors. Simple onboarding guided investment flows and educational nudges help users gain confidence quickly. Micro-investing logic fractional shares and automated portfolio balancing make investing accessible without overwhelming complexity. In 2026 investment apps that combine education with action see significantly higher engagement and long-term retention.

Key User Features

• Fractional investing and recurring investments

• AI-based goal setting and risk assessment

• Educational content embedded into the investment journey

• Real-time portfolio tracking and performance insights

• Smart alerts for market changes and portfolio rebalancing

Admin Panel and Business Control Layer

For founders and operators the admin dashboard acts as the strategic control center. It must provide complete visibility into user behavior investment patterns revenue streams and compliance status. Miracuves builds admin systems that allow entrepreneurs to automate operations and make data-driven decisions without manual overhead.

Admin Capabilities

• User and subscription management

• Investment performance and revenue analytics

• Automated compliance and reporting tools

• Content and education module control

• Risk monitoring and fraud prevention

Investment Engine and Intelligence Layer

This layer powers the core investing logic and differentiates a professional Stash Clone from basic apps. AI-driven recommendations automated diversification and real-time data processing ensure users receive personalized investment guidance. Blockchain-based verification can be added to enhance transparency and trust especially in regulated markets.

Advanced 2026 Features

• AI-powered portfolio recommendations

• Automated diversification and rebalancing

• Blockchain-backed transaction verification

• Multi-currency and regional compliance logic

• API integrations with brokers banks and market data providers

Technical Architecture Requirements

A production-ready Stash Clone must support high transaction volumes maintain consistent performance and meet strict security standards. Miracuves uses cloud-native microservices architecture load balancing encrypted APIs and scalable databases to ensure sub-300ms response times and 99.9 percent uptime even during market volatility.

Feature Comparison Table: Stash Clone Editions

| Feature Scope | Basic | Professional | Enterprise |

|---|---|---|---|

| Investment Options | Limited assets | Diversified portfolios | Advanced asset classes |

| AI Guidance | Basic suggestions | Smart recommendations | Predictive intelligence |

| Admin Analytics | Standard reports | Advanced dashboards | Real-time insights |

| Security Layer | Standard encryption | Enhanced security | Compliance + blockchain |

| Customization | Minimal | Moderate | Full white-label |

Miracuves integrates all these features into its Best Stash Clone Script 2026, ensuring entrepreneurs can launch quickly customize confidently and scale sustainably without rebuilding their platform as the business grows.

Cost Factors & Pricing Breakdown

Stash-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Micro-Investing MVP | User onboarding, profile & risk assessment, manual investment flows, portfolio view, basic admin dashboard | $35,000 – $50,000 |

| 2. Mid-Level Investing Platform | Automated investing rules, recurring investments, fractional shares logic, financial education modules, notifications & analytics | $80,000 – $130,000 |

| 3. Advanced Stash-Level Platform | Robo-advisory logic, compliance & KYC flows, portfolio rebalancing, insights engine, high-availability & security | $160,000+ |

Stash-Style Micro-Investing Platform Development

The above estimates reflect the global market cost of building a micro-investing and financial education platform like Stash.

Such platforms require regulated workflows, secure financial data handling, automation logic, and compliance-ready architecture, typically resulting in 6–12 months of development with a specialized fintech team.

Miracuves Pricing for a Stash-Like Custom Platform

Miracuves Price: Starts at $15,999

This pricing is positioned for a feature-rich, scalable micro-investing ecosystem, including user onboarding, investment logic, portfolio dashboards, education modules, admin controls, and mobile-ready apps—delivered at a fraction of global development costs.

Note:

This includes full non-encrypted source code (complete ownership), end-to-end deployment support, backend & API setup, admin panel configuration, and publishing support for the Google Play Store and Apple App Store—ensuring you receive a fully operational investing platform ready for launch and long-term growth.

Planning to build a Stash-style investing app with full ownership and enterprise-grade foundations? Book a consultation today to get a clear, step-by-step roadmap tailored to your fintech vision.

Delivery Timeline for a Stash-Like Platform with Miracuves

For a Stash-style, JavaScript-based custom build, the typical delivery timeline is 30–90 days, depending on:

- Investment logic & automation complexity

- Compliance, KYC, and verification requirements

- Portfolio analytics & reporting depth

- Security and data-privacy considerations

- UI/UX customization level

Tech Stack

We preferably use JavaScript for building the entire solution—leveraging Node.js / Next.js for backend & frontend, PostgreSQL for secure financial data handling, and Flutter or React Native for mobile apps.

This ensures high performance, scalability, and a single unified codebase across platforms.

Alternative tech stacks or compliance-driven customizations can be discussed during the consultation phase

Customization & White-Label Options

Building a Stash-style investing platform requires more than basic stock trading. Users expect simple investing, automated portfolios, education, and guidance that helps beginners build wealth confidently. The platform must combine easy onboarding, fractional investing, financial education, and secure brokerage infrastructure.

A fully white-label Stash-style solution can be customized to match your brand, target audience, regulatory environment, and monetization strategy—whether you’re launching a beginner investing app, a fintech super-app feature, or a bank-branded wealth product.

Why Customization Matters

Stash-style platforms focus on accessibility, trust, and long-term engagement. Businesses typically need:

- Beginner-friendly investing flows with low entry barriers

- Fractional shares and recurring investment support

- Guided portfolio building and thematic investing

- Educational content tied directly to user actions

- Automated deposits and recurring contributions

- Clear performance and progress tracking

- Strong compliance and investor protection controls

- Admin tools for customer support and reporting

Customization ensures the investing experience feels approachable, educational, and aligned with user confidence levels.

What You Can Customize

UI/UX & Branding

Custom onboarding, dashboards, portfolio views, educational prompts, and visual design aligned with your brand tone.

Investment Products & Portfolios

Fractional stocks, ETFs, curated themes, risk-based portfolios, and long-term investment options.

Automation & Recurring Investing

Auto-invest rules, round-ups, scheduled deposits, and portfolio rebalancing logic.

Education & Guidance

In-app lessons, explainers, nudges, quizzes, and contextual financial education.

Performance & Insights

Portfolio performance, dividends, milestones, and goal-based progress views.

Security & Compliance Layer

KYC, AML, suitability checks, disclosures, audit logs, and regulatory reporting.

Backend Integrations

Brokerage APIs, payment processors, identity providers, analytics, and notification services.

Monetization Add-Ons

Subscription tiers, premium portfolios, advisory tools, and value-added investing features.

How We Handle Customization

- Requirement Analysis

Define investor profiles, regions, regulatory requirements, and feature scope. - Sprint Planning

Structure development from MVP investing flows to advanced automation and education. - Design & Development

Build onboarding, investing logic, automation engines, education modules, and admin tools. - Testing & QA

Validate trade execution, compliance flows, edge cases, and system performance. - Deployment

Launch a fully branded investing platform with user apps, admin dashboards, analytics, and support systems.

Real Examples for a Stash-Style Platform

- Beginner-friendly investing and wealth-building apps

- Bank-branded micro-investing platforms

- Fintech super-apps offering guided investing

- Employer-sponsored investing and savings tools

- Subscription-based investment education platforms

Launch Strategy & Market Entry for a Stash Clone

Launching a Stash Clone in 2026 is about much more than publishing an app. The difference between slow adoption and rapid growth often comes down to how well the launch is planned and executed. Entrepreneurs who treat launch as a structured growth phase rather than a single event typically see measurable traction within 30 to 90 days. Miracuves supports founders with both technology and strategic guidance to ensure a confident market entry.

Pre-Launch Readiness Checklist

Before going live the platform must be tested for performance security and compliance. App store requirements privacy policies and financial disclosures need to be aligned with regional regulations. Marketing assets onboarding tutorials and support workflows should be ready to guide first-time investors smoothly.

Essential Pre-Launch Actions

• End-to-end functional and security testing

• Compliance readiness including KYC and AML flows

• App Store and Play Store submission setup

• Server and cloud infrastructure optimization

• Marketing and onboarding content preparation

Regional Market Entry Strategies

Different regions require different approaches to investing platforms. In Asia mobile-first design low entry barriers and education-led onboarding drive adoption. In MENA localization trust signals and regulatory compliance are critical. European markets emphasize data protection while U.S. users expect advanced analytics and diversified asset access. Miracuves builds Stash Clone Scripts with regional adaptability so founders can expand without rebuilding the platform.

User Acquisition Frameworks That Work in 2026

Education-driven content marketing remains one of the strongest acquisition channels for investing apps. Influencer partnerships referral rewards and community-based growth loops help build trust quickly. Apps that integrate referral incentives directly into the investment journey often see faster organic growth than paid advertising alone.

Monetization Models Proven for Stash Clones

Subscription-based plans continue to dominate with monthly and annual tiers. Freemium access with premium advisory features works well for beginner investors. Additional revenue streams include managed portfolios educational courses and B2B partnerships with financial institutions.

Miracuves End-to-End Launch Support

Miracuves assists founders with server deployment compliance alignment app store approvals and post-launch monitoring. Each client receives a structured 30 to 90 days growth roadmap covering acquisition retention and monetization optimization. This allows entrepreneurs to focus on scaling their investment business while Miracuves handles the technical foundation.

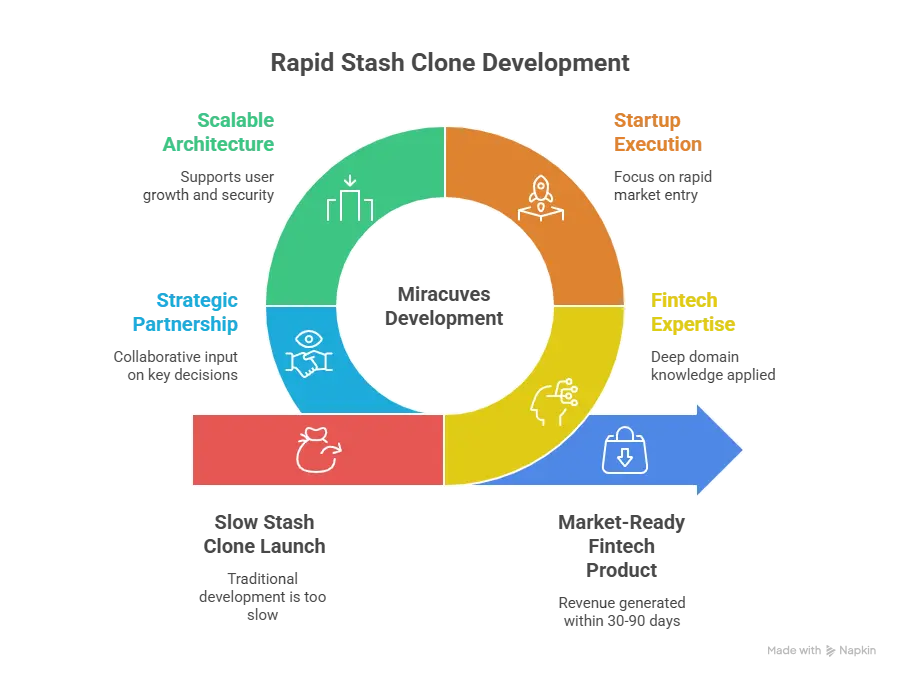

Why Choose Miracuves for Your Stash Clone

Choosing the right development partner is one of the most critical decisions when launching a Stash Clone. In 2026 the investment app market is highly competitive and speed trust and execution matter more than ever. Miracuves stands out because it goes beyond delivering code it delivers market-ready fintech products designed to scale and generate revenue within 30 to 90 days.

Miracuves combines deep fintech domain expertise with startup-focused execution. Every Stash Clone Development project is built on a future-ready architecture that supports rapid user growth advanced security and evolving regulatory needs. This approach has helped entrepreneurs move from concept to live investment platform faster and more confidently than traditional development routes.

What Makes Miracuves a Trusted Partner for Entrepreneurs

• 600+ successful deployments across fintech SaaS and investment platforms

• Rapid delivery cycles built for faster market entry

• Free 60 days post-launch support to ensure stability and performance

• Complete source-code ownership with no licensing lock-ins

• Scalable and secure architecture designed for long-term growth

Entrepreneurs working with Miracuves often see early momentum because the platform is engineered with monetization retention and compliance in mind. One startup launched a customized Stash Clone focused on beginner investors and reached strong subscription traction within 30 to 90 days using AI-driven portfolio guidance and referral-based growth. Another founder built a region-specific micro-investing platform for SMEs and achieved operational breakeven in the first quarter after launch.

Miracuves believes in partnership rather than one-time delivery. Founders receive strategic input on feature prioritization pricing models and scaling decisions throughout the journey. This collaborative approach ensures your Stash Clone evolves with market demands stays compliant and remains competitive as the investment landscape changes.

Final Thought

Building a successful Stash Clone in 2026 is about more than replicating an investment app interface it is about understanding how modern users learn invest and build confidence over time. Stash’s business logic proves that micro-investing education and automation can unlock massive adoption when executed correctly. Entrepreneurs who grasp this logic gain a powerful foundation to build trust-driven fintech products that serve beginners and long-term investors alike.

With Miracuves Clone Solutions founders can turn this proven investment model into a scalable market-ready platform without the usual complexity and delays of fintech development. By combining smart investment architecture AI-powered personalization and compliance-ready infrastructure Miracuves enables entrepreneurs to launch faster adapt to user needs and achieve meaningful growth within 30 to 90 days.

Ready to launch your Stash clone? Get a free consultation and a detailed project roadmap from Miracuves trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Stash clone

Miracuves delivers a market-ready Stash Clone built for scalability security and growth, with founders typically seeing real user adoption and revenue traction within 30 to 90 days depending on customization and launch strategy.

What’s included in the Miracuves Stash clone package

The package includes micro-investing logic fractional share support AI-driven portfolio guidance admin dashboards user management subscription systems secure APIs and deployment assistance.

Do I get full source-code ownership

Yes Miracuves provides complete source-code ownership allowing full control customization and future expansion without restrictions.

How does Miracuves ensure scalability

Miracuves uses cloud-native microservices auto-scaling infrastructure optimized databases and load balancing to maintain consistent performance during high trading volumes.

Does Miracuves support compliance and app store approval

Yes Miracuves assists with KYC AML readiness regulatory alignment and App Store and Play Store submission support.

Is post-launch support included

Yes every project includes 60 days of free post-launch support covering performance optimization bug fixes and monitoring.

Can custom payment and brokerage APIs be integrated

Miracuves supports integration with custom payment gateways brokerage APIs and market data providers based on regional requirements.

What is the upgrade and update policy

The platform supports modular upgrades allowing new features security updates and performance enhancements without disrupting live users.

How does white-labeling work

White-labeling removes all Miracuves branding enabling you to launch your Stash Clone under your own brand name domain and app store identity.

What ongoing support can I expect

After the initial support period Miracuves offers flexible maintenance and growth plans including updates scaling security audits and feature evolution.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best YNAB Clone Scripts 2026 Build a Smarter Budgeting App with Proven Financial Logic

- Best Tipalti Clone Scripts 2026 – Build a Global Payables Automation Platform with Miracuves

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Lemonade Clone Scripts 2026 to Launch a Digital Insurance Startup Faster

- Best GoFundMe Clone Scripts 2026 for Fundraising Startups and Social Impact Platforms

- Best Mint Clone Scripts 2026 : Build a Modern Budgeting App Like Mint for 2026 Founders