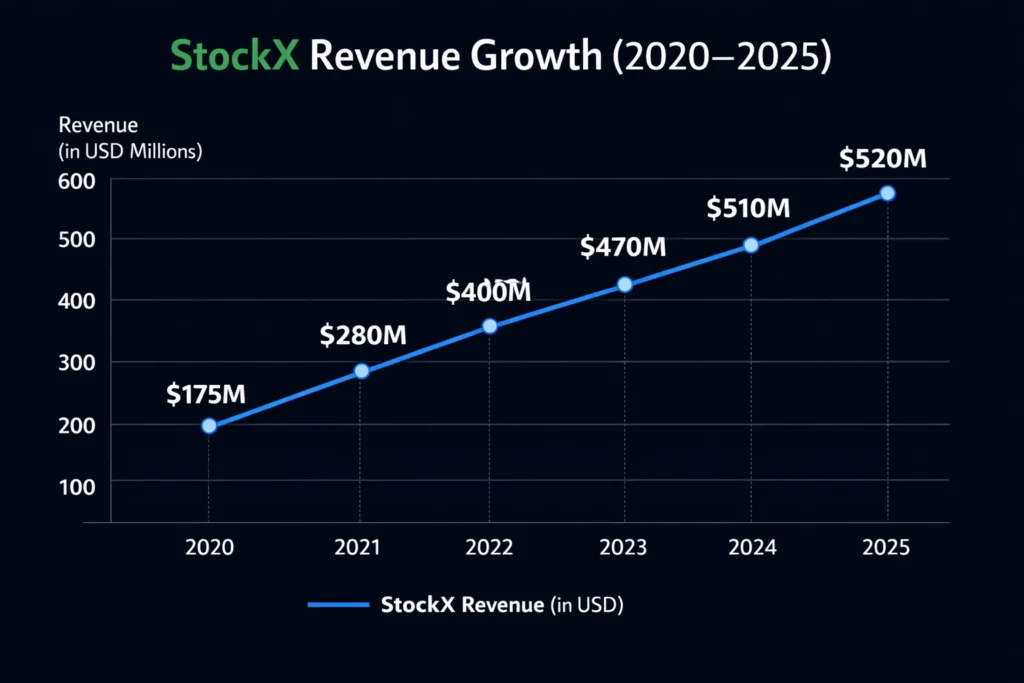

StockX crossed an estimated $520 million in revenue in 2025, turning sneaker reselling into a data-driven financial marketplace. By introducing live bid-ask pricing, historical price charts, and real-time demand signals, StockX transformed sneakers from lifestyle products into tradeable assets with measurable market value.

What began as a simple sneaker exchange now operates like a commodities trading platform for culture-driven assets. Products such as sneakers, streetwear, watches, and collectibles are priced dynamically based on supply, demand, and volatility—mirroring stock-market mechanics rather than traditional eCommerce pricing models.

For founders building marketplaces, StockX offers one of the most disciplined monetization blueprints in resale commerce. Its layered revenue approach—combining transaction fees, authentication services, seller tiers, and data monetization—demonstrates how trust, transparency, and pricing intelligence can drive scalable and defensible marketplace profits.

StockX Revenue Overview – The Big Picture

- 2025 Revenue: ~$520 million (estimated, private company disclosures)

- Valuation: ~$3.8 billion (latest secondary market estimates)

- YoY Growth: ~11% (slower but profitable-focused growth)

- Revenue by Region:

- North America: 58%

- Europe: 21%

- Asia-Pacific: 17%

- Others: 4%

- Gross Profit Margins: 32–35%

- Primary Competitors: GOAT, eBay Authenticity Guarantee, Grailed

Read More: What is StockX and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Transaction Fees

StockX charges sellers a transaction fee on every completed sale.

- Seller Fee: 8%–12% (tier-based)

- Revenue Share: ~48% of total revenue

- 2025 Impact: ~$250M

Revenue Stream #2: Payment Processing Fees

Buyers pay an additional processing fee.

- Fee: ~3% of transaction value

- Revenue Share: ~18%

- 2025 Impact: ~$94M

Revenue Stream #3: Authentication Services

Every item is physically verified by StockX facilities.

- Built into transaction pricing

- Drives trust-based pricing premiums

- Revenue Share: ~15%

Revenue Stream #4: Seller Program Subscriptions

High-volume sellers receive reduced fees in exchange for monthly commitments.

- Revenue Share: ~10%

Revenue Stream #5: Data & Market Insights

Enterprise pricing data licensed to brands and institutional partners.

- Revenue Share: ~9%

Revenue streams percentage breakdown

| Revenue Stream | How it makes money | Typical pricing / fee | Estimated % Share (2025) |

|---|---|---|---|

| 1) Seller Transaction Fees | Commission charged to sellers per completed sale | 8%–12% (tier-based) | 48% |

| 2) Buyer Processing Fees | Fee charged to buyers at checkout | ~3% of order value | 18% |

| 3) Authentication & Verification | Built-in service margin via verification operations | Included in service layer | 15% |

| 4) Seller Programs / Subscriptions | Benefits for high-volume sellers (fee reductions, tools, faster payout options) | Monthly program / tier benefits | 10% |

| 5) Data & Market Insights | Trend/pricing insights sold to brands/partners (analytics-driven revenue) | Enterprise/partner agreements | 9% |

| Total | 100% |

The Fee Structure Explained

User-Side Fees

- Buyer processing fee (≈3%)

- Shipping & duties (region-dependent)

Provider-Side Fees

- Seller transaction fee (8%–12%)

- Payout processing fee

Hidden Revenue Layers

- FX conversion margins

- Premium shipping options

- Storage & delayed payout charges

Regional Pricing Variation

- Asia-Pacific fees ~2% higher due to logistics

- EU VAT embedded into final pricing

Complete fee structure by user type

| User Type | Fee Category | What it’s for | How it’s charged | Typical Range / Notes |

|---|---|---|---|---|

| Buyer | Buyer Processing Fee | Payment handling + platform service layer | % of item price | ~3% (varies by market and order size) |

| Buyer | Shipping Fee | Delivery from authentication center to buyer | Flat / tiered by region | Depends on country, speed, and carrier |

| Buyer | Duties & Taxes (International) | Import/VAT/GST in cross-border orders | Added at checkout or on delivery (region rules) | Higher in EU/UK/APAC; varies by item category |

| Buyer | Currency Conversion (FX spread) | Conversion for non-USD currencies | Embedded margin | Small spread depending on currency + payment method |

| Buyer | Optional: Express Shipping / Speed Upgrades | Faster delivery options where available | Add-on | Premium pricing varies by lane/region |

| Seller | Seller Transaction Fee | Core platform commission | % of sale price | 8%–12% (tier-based, can improve with volume) |

| Seller | Seller Payment / Payout Fee | Processing seller payout to bank | Flat or % (varies) | Market-dependent; often reduced for top sellers |

| Seller | Shipping to StockX (Inbound) | Seller ships item to authentication center | Usually seller-paid label / region-based | Cost varies by country and service level |

| Seller | Account / Tier Program Adjustments | Volume tiers, incentives, benefits | Impacts fee rate | Higher volume can reduce transaction fee % |

| Seller | Failed Authentication / Non-Compliance Penalties | Deterrent against fakes/mismatch/condition issues | Flat penalty or chargebacks | Charged when item fails verification or violates rules |

| Seller | Returns/Exception Handling Costs | Dispute resolution, rerouting, relisting | Case-by-case | Varies based on issue type and region |

| Enterprise / Brand Partner | Data & Market Insight Licensing | Aggregated pricing + trend analytics | Contract / subscription | Enterprise pricing (varies by scope) |

| Enterprise / Brand Partner | Promotions / Campaign Partnerships | Visibility boosts and co-marketing | Contract-based | Sponsored placements, bundles, seasonal promos |

| Enterprise / Brand Partner | Operational Integrations | Bulk workflows, managed programs | Contract-based | May include service fees depending on integration depth |

How StockX Maximizes Revenue Per User

- Segmentation: Casual sellers vs power sellers

- Upselling: Faster payouts, premium shipping

- Cross-Selling: Multi-category resale (electronics, luxury bags)

- Dynamic Pricing: Live bid/ask pricing increases velocity

- Retention Monetization: Fee discounts tied to volume

- LTV Optimization: Repeat traders generate 6.2x LTV

- Psychological Pricing: Market charts trigger FOMO-based bids

Real data shows sellers with over 50 transactions annually spend 42% more per year on platform services.

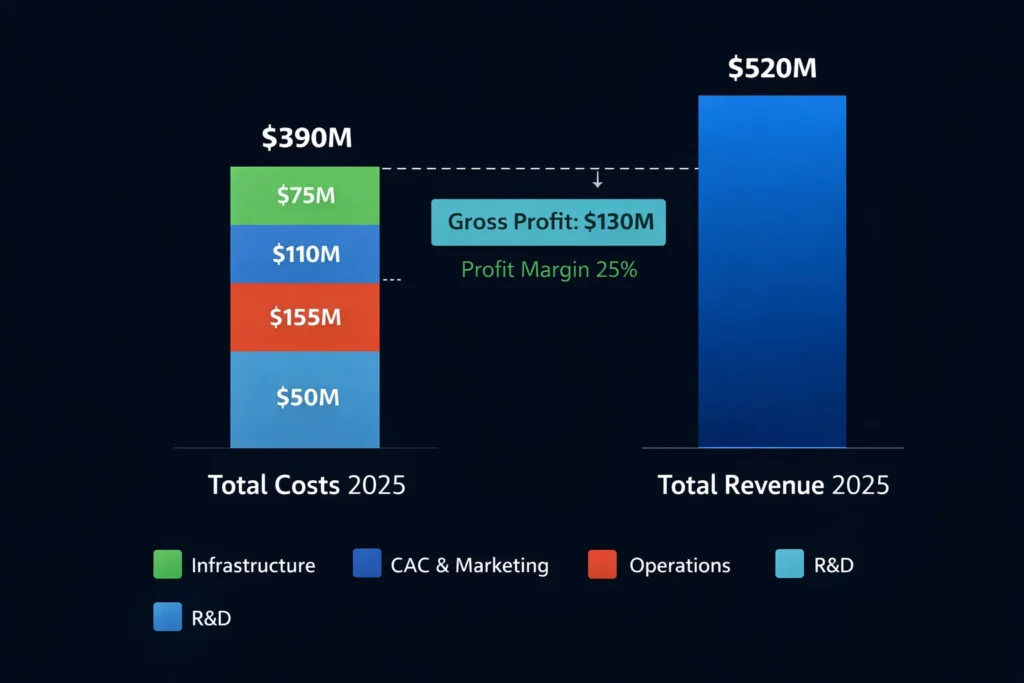

Cost Structure & Profit Margins

Infrastructure Costs

- Authentication centers

- Warehousing & logistics tech

- Cloud marketplace infrastructure

Customer Acquisition & Marketing

- Influencer campaigns

- Referral incentives

- CAC stabilized at ~$38 per active seller

Operations

- Quality control

- Customer dispute handling

R&D

- Pricing algorithms

- Fraud detection systems

Unit Economics

- Avg order value: $310

- Gross margin per order: ~$98

Profitability Path

StockX reached operational profitability in core markets by late 2024.

Read More: Best StockX Clone Script 2025: Sneaker & Collectibles Marketplace

Future Revenue Opportunities & Innovations

- AI-driven price prediction subscriptions

- Brand-direct resale partnerships

- White-label authentication APIs

- Expansion into watches & collectibles

- Web3 asset verification

Risks:

- Margin pressure from eBay

- Brand-owned resale platforms

Opportunities for Founders:

Niche resale markets remain under-monetized outside footwear.

Lessons for Entrepreneurs & Your Opportunity

What works is trust-first monetization.

What to replicate is transaction-based revenue layered with services.

Market gaps exist in regional resale, B2B liquidation, and vertical-specific authentication.

Want to build a platform with StockX’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our StockX clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

StockX proves marketplaces win when pricing is transparent, data-backed, and publicly visible. By exposing real transaction prices, bid-ask spreads, and historical trends, StockX removes information asymmetry—building trust, accelerating purchase decisions, and increasing transaction velocity.

Its real innovation lies in turning culture into a financial instrument. Sneakers, streetwear, and collectibles behave like assets with volatility, liquidity, and speculative demand, allowing StockX to monetize not just transactions, but market behavior, analytics, and price discovery itself.

For founders, resale is no longer a side hustle—it’s infrastructure. Modern resale platforms function as financial ecosystems that require authentication, pricing intelligence, logistics, and scalable monetization layers, making them long-term digital assets rather than short-term trend businesses.

FAQs

1. How much does StockX make per transaction?

Around $95–$100 in combined fees and margins per order.

2. What’s StockX’s most profitable revenue stream?

Seller transaction fees.

3. How does StockX’s pricing compare to competitors?

Slightly higher than GOAT, but justified through authentication.

4. What percentage does StockX take from sellers?

Between 8% and 12%, depending on seller tier.

5. How has StockX’s revenue model evolved?

From flat fees to tiered, data-backed monetization.

6. Can small platforms use similar models?

Yes, especially in niche resale categories.

7. What’s the minimum scale for profitability?

Roughly 20,000 monthly transactions.

8. How to implement similar revenue models?

Start with transaction fees, then layer services.

9. What are alternatives to StockX’s model?

Subscription-first or brand-owned resale platforms.

10. How quickly can similar platforms monetize?

Many businesses begin generating revenue soon after launch.