The rise of decentralized finance (DeFi) didn’t just give us a new way to swap tokens—it gave birth to entirely new economies. And if PancakeSwap brought food-themed finance to the Binance Smart Chain, SushiSwap spiced things up on Ethereum. With its community-driven model, liquidity incentives, and governance features, SushiSwap quickly became more than just a clone of Uniswap—it became a DeFi powerhouse. In 2025, building a SushiSwap-like platform isn’t just doable, it’s smart business. All you need is the right SushiSwap Clone Scripts to launch your own decentralized exchange with minimal fuss and maximum scalability.

This blog unpacks the best SushiSwap Clone scripts of the year. We’ll dive into what features to look for, compare pricing, and help you understand how to monetize from day one. Whether you’re launching on Ethereum, Arbitrum, or any EVM-compatible chain, this guide is your shortcut to going live with confidence.

And if you’re wondering whether clone scripts are secure or scalable—the answer depends on the team behind them. That’s where trusted developers like Miracuves come into play.

What Is a SushiSwap Clone Script?

A SushiSwap Clone Script is a prebuilt decentralized exchange (DEX) script designed to replicate the essential features of SushiSwap. That includes token swaps, automated market making (AMM), staking, yield farming, and community governance tools. These scripts are typically written in Solidity for Ethereum Virtual Machine (EVM)-compatible chains and packaged with a front end and admin layer for easy customization.

By launching with a clone script, you get the power of DeFi without reinventing the wheel. You can create your own liquidity pools, issue rewards in a native token, and even plug into existing liquidity through aggregators.

Read More : What is Sushiswap App and How Does It Work?

Features That Matter in 2025

SushiSwap evolved quickly—from a basic Uniswap fork to a full DeFi ecosystem with staking, lending, and governance. Here’s what your clone script should support today:

Core Features

- Token swapping using AMM logic

- Liquidity pool creation with LP token issuance

- Yield farming with variable APY settings

- Single-sided staking and dual-farm support

- Wallet integrations (MetaMask, WalletConnect, Trust Wallet)

Extended Modules

- Governance module (vote on emissions, rewards)

- Launchpad/IDO capabilities

- NFT marketplace or artist token drops

- Cross-chain bridges for DeFi expansion

Admin & Security Features

- Swap fee and protocol fee configuration

- Liquidity pair management

- Blacklisting controls and permissioned pools (for regulated markets)

- Smart contract audits or support for third-party verifications

- Multisig wallet setup for admin actions

Read More : The Future of Decentralized Finance (DeFi) Apps: Trends to Watch in 2025 and Beyond

Best SushiSwap Clone Scripts in 2025: Compared

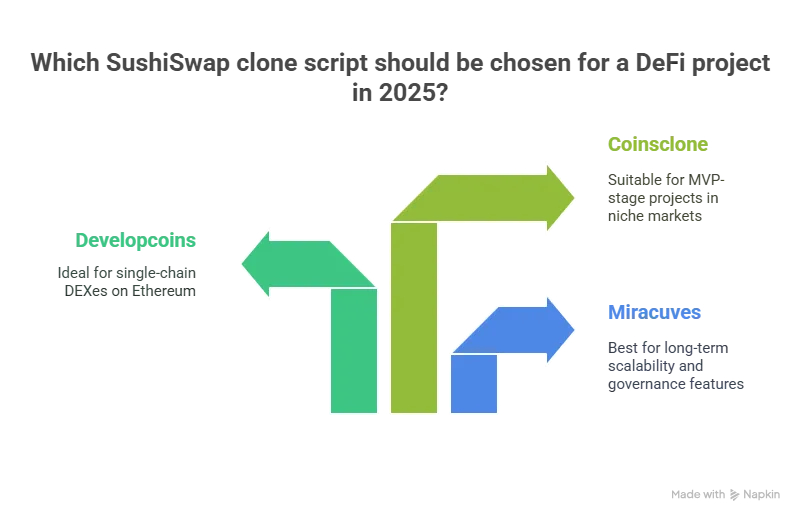

1. Miracuves SushiSwap Clone

Best for: Builders looking for long-term DeFi scalability with governance tools

Features: AMM engine, multi-token swaps, staking farms, DAO-ready modules, LP token analytics, custom token builder, multichain deployment support

Why it stands out: Includes built-in governance layer, audited smart contracts, and token vesting tools for project launches

2. Developcoins SushiSwap Clone

Best for: Startups launching single-chain DEXes on Ethereum

Features: Basic swap, pool creation, liquidity staking

Drawbacks: Limited support for governance and no native IDO tools

3. Coinsclone SushiSwap Clone

Best for: MVP-stage projects in niche markets

Features: Simple UI, farming, liquidity lock

Limitations: No multichain readiness or DAO module

Read More : Reasons startup choose our Sushiswap clone over custom development

Cost Factors & Pricing Breakdown

SushiSwap-Like Decentralized Exchange Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic DEX MVP | Wallet connect, token swap UI, basic liquidity pools, transaction history, and simple monitoring/admin setup. | $50,000 |

| 2. Mid-Level DeFi Trading Platform | Web UI/UX, AMM swap engine, LP dashboards, slippage controls, multi-token support, analytics, and explorer integrations. | $120,000 |

| 3. Advanced SushiSwap-Level Platform | Multi-chain deployment, staking & rewards, farming modules, advanced analytics, security hardening, and enterprise-grade scalability. | $240,000+ |

These figures reflect the typical global investment required to build a production-grade decentralized exchange similar to SushiSwap, including smart contracts, frontend, and blockchain integrations.

Miracuves Pricing for a SushiSwap-Like Platform

Miracuves Price: Starts at $15,999

This package includes wallet integration, token swap workflows, liquidity pool management, staking/farming modules, smart contract deployment, frontend interface, analytics setup, and a unified admin environment — designed for scalable DeFi operations.

Note:

Includes full source code, smart contract setup, frontend & backend integration, admin configuration, API connections, and deployment assistance — enabling you to launch a fully branded SushiSwap-style DEX with full ownership.

Launch Your SushiSwap-Style Decentralized Exchange — Contact Us Today

Delivery Timeline for a SushiSwap-Like Platform with Miracuves

The typical delivery timeframe is 30–90 days, depending on:

- Blockchains and token standards supported

- AMM, farming, and staking complexity

- Governance or reward mechanisms

- UI/UX customization and branding

- Security audits and performance optimization

- Third-party integrations and analytics needs

Tech Stack

Built using a JS-based architecture, ideal for DeFi platforms requiring wallet connectivity, real-time blockchain interactions, modular smart contract integrations, and scalable frontends.

Ways to Monetize Your SushiSwap Clone

The beauty of a decentralized exchange is that it doesn’t just run on autopilot—it earns on autopilot too. Here’s how clone-based DEXs generate revenue:

- Swap fees: Standard 0.3% per transaction with optional fee sharing

- Farming pools: Users stake to earn native tokens; emission rates can be monetized or sold

- Staking rewards: Charge tokens to list in staking pools with rewards

- IDO/launchpad hosting: Offer token sale events and take a cut

- Premium pool listings: Charge projects to create verified liquidity pools

- Governance token trading: Your native token can also be listed, swapped, and staked

With the right mix of utility and incentives, your tokenomics can become a powerful growth engine.

Smart Questions to Ask Before Buying a Clone Script

Before you jump in, here are questions every founder should ask the provider:

- Is the AMM logic forked from the latest SushiSwap or written independently?

- Are the smart contracts audited and upgradable?

- Does the admin panel allow control over liquidity and fees?

- Can the codebase be extended to add NFTs, lending, or bridges?

- Will the script support future governance proposals via DAO?

Skipping these questions often leads to expensive rebuilds. Make sure your script is both feature-rich and future-proof.

Founder’s Story: “SushiSphere” Brings DeFi to Local Tokens

In late 2024, a Malaysian startup launched SushiSphere—a localized DEX for Southeast Asian tokens. Using Miracuves’ SushiSwap Clone, they integrated regional wallets, built a gamified staking program, and even added community voting for upcoming tokens. Within 90 days, they hit $1M in liquidity and processed over 8,000 transactions. Their custom launchpad has since hosted 3 IDOs, raising over $100K each.

That’s what happens when you pair the right vision with the right script.

Read More : Reasons startup choose our Sushiswap clone over custom development

Final Thoughts

SushiSwap changed the game by proving that DEXs could be more than just clones—they could evolve into full ecosystems. In 2025, launching your own DEX doesn’t require a massive dev team or millions in funding. It just requires the right clone script that’s secure, customizable, and geared for growth. From token swaps to staking farms, governance to launchpads, SushiSwap Clone Scripts offer a fast track to building your own DeFi brand.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Still have questions about SushiSwap Clone scripts? Let’s clear them up.

Can I modify the clone script to suit my tokenomics?

Yes. Leading clone scripts allow full customization of emission rates, APYs, and swap fees via smart contract parameters.

Is the clone script compatible with other chains?

Many clone scripts, including those from Miracuves, support multichain deployment including Ethereum, BSC, and Arbitrum.

How long does it take to launch a SushiSwap Clone?

You can go live in as little as 30-90 days, depending on branding, token setup, and liquidity planning.

Do I need a governance token?

Not necessarily, but having one adds long-term value, community engagement, and opens the door to DAO integration.

How do I attract liquidity providers?

Offer high APYs for early farmers, run community campaigns, and provide staking incentives in your native token.

Is a SushiSwap Clone suitable for an NFT platform?

With some customization, yes. Many scripts now include NFT marketplaces or extensions that integrate with the core liquidity model.

Related Articles