Taobao is one of the most powerful eCommerce ecosystems in the world, and its revenue engine remains one of the most studied models by founders. With Alibaba’s commerce division surpassing $24 billion+ in 2025 revenue, Taobao continues to set global standards in marketplace monetization.

Understanding how Taobao makes money is essential because the platform blends marketplace economics, ad-based monetization, data intelligence, and fintech into one aggressive growth engine. If you’re building an eCommerce marketplace, learning from Taobao’s revenue model will give you a major strategic advantage.

This breakdown will show how Taobao earns, scales, and monetizes its massive user base in 2025.

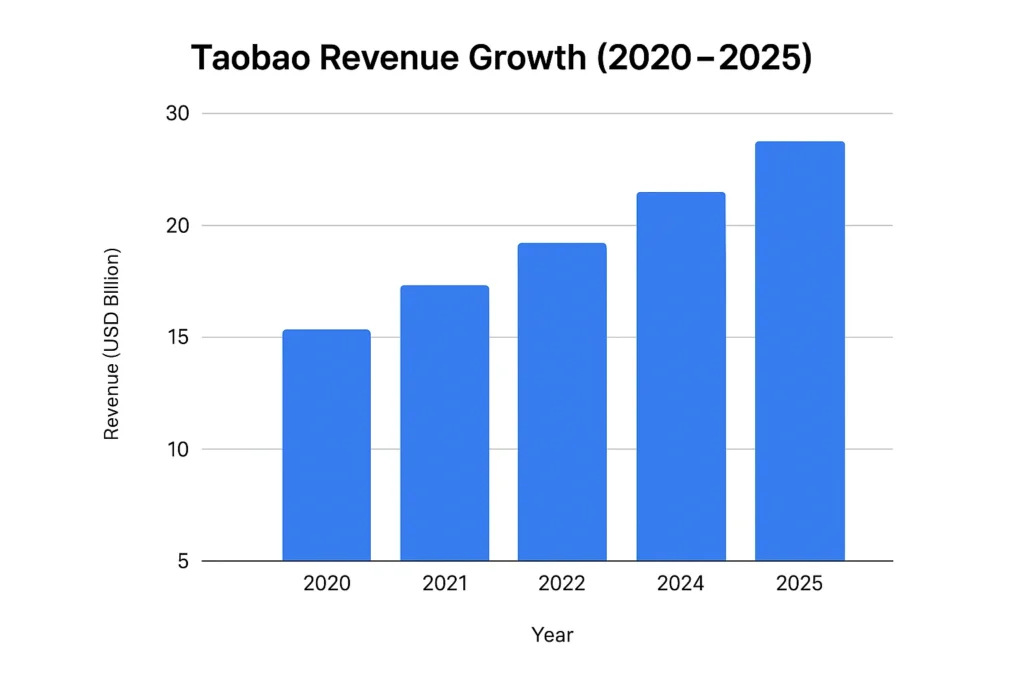

Taobao Revenue Overview – The Big Picture

2025 Revenue

Taobao (part of Alibaba’s China Commerce division) contributed to an estimated $24–26 billion in 2025 marketplace-driven revenues.

Valuation

Part of Alibaba Group, which maintains a $190B–$210B market cap in 2025.

YoY Growth

~4.2% YoY growth driven by stronger merchant services, ads, and localized retail models.

Revenue by Region

- China Mainland: ~94%

- Hong Kong + Taiwan: ~3%

- Global Users: ~3% (expanding through AliExpress synergies)

Profit Margins

Estimated blended margins: 32–38%, strengthened by ad monetization and logistics optimization.

Competition Benchmark

Taobao’s closest competitors:

- Pinduoduo / Temu – highly aggressive price-led commerce

- JD.com – quality + fulfillment-led model

- Douyin/TikTok Shop – social commerce disruption

Primary Revenue Streams Deep Dive

1. Advertising & Sponsored Listings (42–48%)

Taobao’s largest revenue source.

Merchants pay for:

- Keyword ads

- Display placements

- Landing-page promotion slots

- Bidding-based ad visibility

High-margin revenue because ads scale with merchant competition.

2. Commission on Transactions (18–22%)

Taobao traditionally operates with low commissions, but:

- Fashion: 2–5%

- Electronics: 1–3%

- Luxury and specialized categories: 5–10%

Commission revenue rose sharply due to cross-category expansion.

3. Merchant Services (10–14%)

Taobao charges merchants for:

- Store setup services

- Operational tools

- CRM solutions

- Payment settlement features

- Live commerce hosting tools

4. Payment Fees — Alipay Ecosystem (12–16%)

Every transaction runs through Alipay, generating:

- Wallet fees

- Escrow fees

- Merchant payment processing fees

- Cross-border settlement revenue

5. Logistics, Fulfillment & Value-added Services (6–10%)

Provided through Cainiao + Taobao partners:

- Delivery

- Warehousing

- Return handling

- Packaging

- Fast-ship premium services

Revenue Streams Percentage Breakdown

| Revenue Stream | 2025 Share |

|---|---|

| Advertising & Sponsored Listings | 42–48% |

| Commissions | 18–22% |

| Merchant Services | 10–14% |

| Alipay Payment Revenue | 12–16% |

| Logistics & Value-added Services | 6–10% |

The Fee Structure Explained

User-Side Fees

- No signup fee

- Delivery charges (vary by seller)

- Premium fast delivery options

- Cross-border transaction fees

Provider-Side (Merchant) Fees

- Commission (1–10%)

- Ad bidding

- Store tools subscription

- Payment gateway charges

- Logistics service fees

Hidden Revenue Layers

- Data-backed recommendation boosting

- Priority indexing fees

- Live-commerce monetization

- Influencer–merchant partnership fees

Regional Pricing Variations

- Mainland China: lowest advertisement CPC

- Hong Kong: higher logistics cost

- Cross-border: higher gateway fees

Complete Fee Structure by User Type

| Fee Type | User Pays | Merchant Pays |

|---|---|---|

| Commission | No | Yes |

| Ads | No | Yes |

| Payment Fees | Minimal | Yes |

| Logistics | Yes | Yes |

| Store Tools | No | Subscription |

| Premium Visibility | No | Yes |

How Taobao Maximizes Revenue Per User

Segmentation

AI-based segmentation identifies:

- Deal hunters

- Luxury shoppers

- Live commerce fans

- Frequent repeat customers

Upselling

- Bundled offers

- Recommended accessories

- Brand store upsells

Cross-selling

- Payment-linked offers via Alipay

- Logistics upgrades

- Lifestyle subscription options

Dynamic Pricing

Taobao’s merchant ecosystem uses real-time competitive pricing tools.

Retention Monetization

- Loyalty points

- Exclusive coupons

- Daily check-in gamification

LTV Optimization

Data from Alipay + browsing behavior increases personalization depth.

Psychological Pricing

Flash sales, 9.9 pricing, countdown timers, and scarcity triggers.

Real Data Example

Users exposed to live commerce sessions show 18–25% higher AOV compared to standard buyers.

Cost Structure & Profit Margins

Infrastructure

Servers, cloud services, AI models, content moderation.

Customer Acquisition Cost (CAC)

Lower than global competitors due to Taobao’s ecosystem effect. Estimated CAC: $2–$4 per active user.

Operations

Merchant onboarding, quality checks, dispute resolution.

R&D

AI search models, recommendation engines, live commerce technology.

Unit Economics

High because logistics is handled by external sellers and partners.

Margin Optimization

- Automation of seller support

- Outsourced delivery networks

- Self-learning recommendation engines

Profitability Path

2025 margins strengthened due to:

- Ad competition

- Payment processing expansion

- Live-stream commerce growth

Future Revenue Opportunities & Innovations

New Streams

- AI-driven stores

- Influencer-shop integrations

- Microseller toolkits

AI/ML Monetization

- Behavior prediction selling

- Dynamic modeling for merchant bidding

- Automated visual search shopping

Market Expansion

- Southeast Asia

- Global cross-border sellers

Predicted Trends (2025–2027)

- Social commerce dominance

- More hybrid offline–online experiences

- Fintech becoming the largest revenue engine

Risks & Threats

- Regulatory pressure

- Competitive price wars

- TikTok/Douyin commerce boom

Opportunities for New Founders

- Niche commerce models

- Creator-led stores

- Region-specific marketplace micro-models

Lessons for Entrepreneurs & Your Opportunity

What Works

- Multi-layer revenue stacking

- Zero-commission entry to attract merchants

- Large-scale ad monetization

What to Replicate

- Low-friction seller onboarding

- Payment + marketplace synergy

- AI-driven personalization

Market Gaps

- Regional niche stores

- Specialty product marketplaces

- B2B supplier marketplaces

Improvements Founders Can Use

- Transparent commission models

- Vertical-focused logistics

- Built-in influencer commerce tools

Want to build a platform with Taobao’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Taobao clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Taobao’s revenue model is a masterclass in multi-stream monetization. It proves that platforms grow faster when ads, payments, logistics, and personalization work together. For founders, Taobao is a reminder that the marketplace game is not about low commission alone — it’s about building an ecosystem.

In 2025, live commerce and AI-driven recommendations continue to define Taobao’s success. These same elements can be replicated in new regional or niche marketplaces with the right strategy and technology.

If you aim to build a scalable eCommerce platform, Taobao’s revenue model offers a roadmap that blends data, ads, payments, and seller competition into sustainable profits.

FAQs

1. How much does Taobao make per transaction?

Typically 1–10% depending on category and merchant ad spend.

2. What’s Taobao’s most profitable revenue stream?

Advertising and sponsored listings (42–48%).

3. How does Taobao’s pricing compare to competitors?

Lower commissions than JD.com and Pinduoduo, but higher ad competition.

4. What percentage does Taobao take from providers?

1–10% commission plus optional ad fees and service tools.

5. How has Taobao’s revenue model evolved?

Shifted from pure marketplace commissions to ad-first monetization + live commerce.

6. Can small platforms use similar models?

Yes — especially ad-led and service-led monetization layers.

7. What’s the minimum scale for profitability?

Usually 500K–1M monthly active users depending on CAC and ad penetration.

8. How to implement similar revenue models?

Use layered monetization: commissions + ads + payment fees + logistics.

9. What are alternatives to Taobao’s model?

Subscription commerce, curated marketplaces, hyperlocal commerce platforms.

10. How quickly can similar platforms monetize?

With strong merchant competition, revenue can begin in 15–45 days.