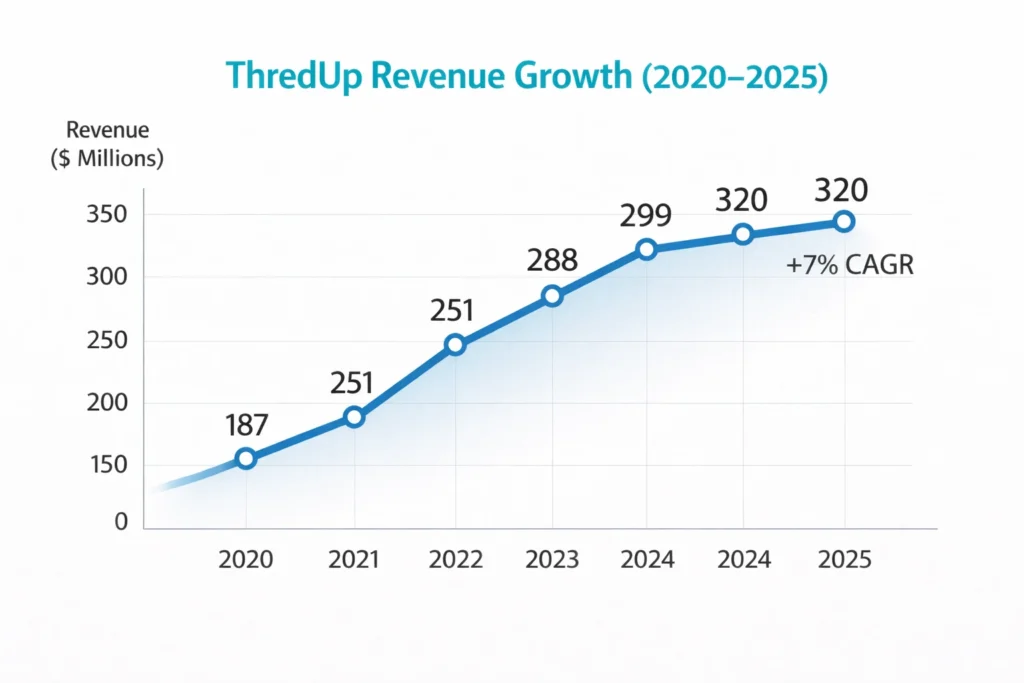

ThredUp has emerged as one of the world’s largest online resale platforms, generating approximately $320 million in revenue in 2025 by turning second-hand fashion into a logistics-driven, high-volume commerce engine. Its scale is powered by centralized warehouses, advanced sorting systems, and consistent inventory flow, allowing ThredUp to operate more like a traditional e-commerce retailer than a typical resale marketplace.

Unlike peer-to-peer resale apps, ThredUp runs a managed resale model, where the platform controls pricing, quality checks, fulfillment, and last-mile delivery. Sellers simply send in items, while ThredUp handles the entire resale lifecycle. This reduces seller effort, standardizes buyer experience, and enables stronger pricing discipline and inventory optimization across categories.

For founders, ThredUp’s model is a masterclass in combining supply aggregation, automation, and data-driven pricing to unlock profitability in recommerce. It demonstrates how operational control can improve margins, how automation lowers unit costs at scale, and how convenience-driven value propositions can justify platform fees while still delivering a frictionless experience for both buyers and sellers.

ThredUp Revenue Overview – The Big Picture

In 2025, ThredUp’s revenue stabilizes around $320M, driven by operational optimization and higher-margin resale services.

- 2025 Revenue: ~$320M

- Valuation: ~$1.3B

- YoY Growth: ~7%

- Revenue by region:

- United States: ~92%

- International & partnerships: ~8%

- Profit margins: 6–10% EBITDA (improving trend)

- Competition benchmark: Higher operational control than Vinted and Depop, but lower margins due to logistics intensity

Read More: What is ThredUp and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Consignment Commissions

ThredUp takes a commission from sellers based on item category, brand value, and sale price. This is its largest revenue driver.

- Share of revenue: ~55%

- Why it works: Centralized pricing and inventory control maximize sell-through.

Revenue Stream #2: Clean-Out Kits & Processing Fees

Sellers pay for expedited processing or premium clean-out services.

- Share of revenue: ~15%

- Strong contribution margin due to automation.

Revenue Stream #3: Brand Resale Partnerships

Retailers use ThredUp’s resale-as-a-service infrastructure to run branded resale programs.

- Share of revenue: ~14%

- High strategic value and recurring contracts.

Revenue Stream #4: Shipping & Handling Margins

Shipping fees and operational efficiencies generate incremental margins.

- Share of revenue: ~10%

Revenue Stream #5: Premium Seller Services

Includes faster payouts, analytics, and priority listing.

- Share of revenue: ~6%

Revenue Streams Breakdown Table

| Revenue Stream | % Share (2025) |

|---|---|

| Consignment commissions | 55% |

| Clean-out & processing fees | 15% |

| Brand resale partnerships | 14% |

| Shipping & handling margins | 10% |

| Premium seller services | 6% |

The Fee Structure Explained

ThredUp’s monetization is seller-centric and logistics-driven.

User-side fees

Buyers pay shipping fees and sometimes handling charges depending on order size.

Provider-side fees

Sellers earn a payout after ThredUp deducts commissions and processing costs.

Hidden revenue layers

Automated pricing algorithms, inventory bundling, and logistics density increase margins.

Regional pricing variation

Fees vary by brand category and warehouse location.

Fee Structure Table

| Fee Type | Buyer | Seller |

|---|---|---|

| Item commission | No | Yes |

| Processing / clean-out fee | No | Optional |

| Shipping & handling | Yes | Indirect |

| Brand resale services | No | Contract-based |

| Premium services | Optional | Optional |

How ThredUp Maximizes Revenue Per User

ThredUp optimizes revenue through scale, data, and automation.

- Segmentation: Brand-tiered commission logic

- Upselling: Clean-out kits and priority processing

- Cross-selling: Brand resale programs

- Dynamic pricing: AI-driven item valuation

- Retention monetization: Loyalty credits for repeat buyers

- LTV optimization: Bulk inventory intake increases per-seller value

- Psychological pricing: Sellers accept lower payouts in exchange for convenience

Real data shows automated pricing improves sell-through rates by 30%+ compared to manual listing.

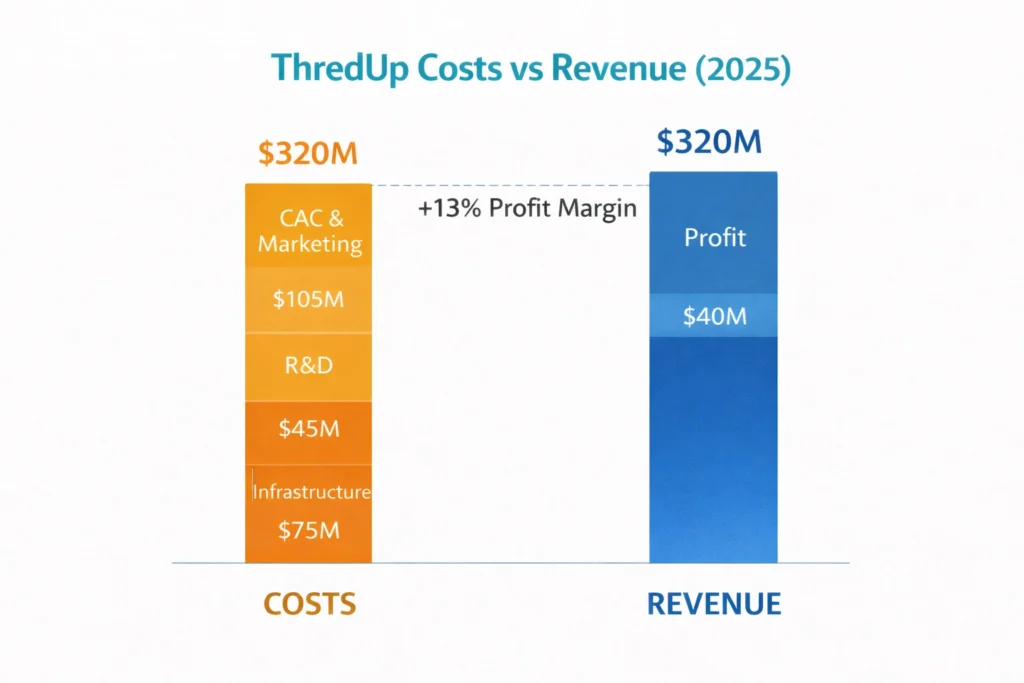

Cost Structure & Profit Margins

ThredUp’s profitability depends on operational efficiency.

- Infrastructure: Warehouses, automation systems, cloud platforms

- CAC & marketing: Paid acquisition and brand partnerships

- Operations: Sorting, quality control, fulfillment

- R&D: Pricing algorithms, robotics, demand forecasting

- Unit economics: Positive contribution margin at warehouse density

- Margin optimization: Automation and brand partnerships

- Profitability path: Sustainable margins achieved after logistics scale

Read More: Best ThredUp Clone Scripts 2025 for High-Growth Resale Startups

Future Revenue Opportunities & Innovations

ThredUp’s next growth phase focuses on margin expansion.

- AI-based resale pricing engines

- White-label resale platforms for brands

- International warehouse expansion

- Subscription-based seller plans

- Circular economy analytics for retailers

Risks: inventory holding cost, fashion demand volatility

Opportunities for founders: vertical resale, asset-light resale models, hybrid P2P + managed resale

Lessons for Entrepreneurs & Your Opportunity

What works: centralized control and automation

What to replicate: resale-as-a-service for brands

Market gaps: niche category resale, regional resale hubs

Improvements: faster seller payouts, localized fulfillment

Want to build a platform with ThredUp’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our ThredUp clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

ThredUp shows that resale can scale like traditional e-commerce when logistics, pricing, and inventory flow are controlled centrally. By owning the operational layer—warehousing, sorting, pricing algorithms, and fulfillment—the platform achieves predictability, consistency, and efficiency that peer-to-peer models often struggle to reach. This centralized approach enables better demand forecasting, faster fulfillment, and improved customer trust at scale.

For founders, the key insight is that convenience itself is a monetizable product, often more powerful than commissions. Sellers are willing to accept lower payouts in exchange for zero effort, while buyers pay for reliability, quality assurance, and fast delivery. When convenience is baked into the core experience, fees feel justified and repeat usage increases naturally.

Managed resale platforms are still early in their adoption curve, leaving significant room for focused, profitable entrants. Vertical-specific resale, regional logistics hubs, and AI-driven pricing models remain underexplored opportunities. Founders who build operational excellence early can create defensible businesses that scale sustainably as recommerce demand continues to rise.

FAQs

1. How much does ThredUp make per transaction?

It earns through commissions, processing fees, and shipping margins.

2. What’s ThredUp’s most profitable revenue stream?

Consignment commissions at scale.

3. How does ThredUp’s pricing compare to competitors?

Lower seller effort but higher operational involvement.

4. What percentage does ThredUp take from sellers?

Variable commissions based on brand and item value.

5. How has ThredUp’s revenue model evolved?

From resale marketplace to resale-as-a-service.

6. Can small platforms use similar models?

Yes, with niche categories or regional focus.

7. What’s the minimum scale for profitability?

Warehouse density and automation are critical.

8. How to implement similar revenue models?

Combine logistics control with dynamic pricing.

9. What are alternatives to ThredUp’s model?

Peer-to-peer resale or hybrid resale systems.

10. How quickly can similar platforms monetize?

Revenue can begin within weeks once inventory flow is active.