In 2026, Tokopedia contributes to over $2.1 billion in annual platform revenue, making it one of Southeast Asia’s most powerful marketplace engines. This scale is driven by mass SME onboarding, high-frequency consumer purchases, and strong category diversification across electronics, fashion, groceries, and digital goods. Its ability to monetize transactions without heavy inventory risk keeps margins resilient even during market fluctuations.

Tokopedia isn’t just an online marketplace—it’s a multi-layered monetization machine built on millions of active SMEs, repeat buyers, and embedded services. Beyond transaction commissions, the platform generates significant income from seller advertising, logistics integrations, digital products, and financial services, allowing it to earn revenue at multiple points in a single user journey.

For founders, understanding Tokopedia’s revenue model reveals how marketplaces scale profitably in emerging markets by prioritizing seller success, low entry barriers, and optional paid growth tools. The model proves that sustainable marketplace revenue comes from ecosystem design, not aggressive fee extraction, making it highly replicable for region-focused or vertical-specific platforms.

Tokopedia Revenue Overview – The Big Picture

Tokopedia operates as a multi-sided marketplace under the GoTo ecosystem, monetizing sellers, buyers, and brands simultaneously.

2025 Snapshot

- Estimated 2025 Revenue: ~$2.1–2.3 billion

- Valuation (GoTo ecosystem share): ~$18–20 billion

- YoY Revenue Growth: ~14% (2024–2025)

- Primary Markets: Indonesia (≈90%), Southeast Asia cross-border

- Average Gross Margin: 22–26%

- Profitability Status: Contribution-margin positive, group-level EBITDA improving

Revenue by Region

- Indonesia: ~90%

- Cross-border sellers (China, SEA): ~7%

- Digital services & others: ~3%

Competition Benchmark

- Shopee: Higher GMV, lower margins

- Lazada: Higher logistics cost

- Tokopedia: Strong SME monetization + ads efficiency

Read More: What is Tokopedia and How Does It Work?

Primary Revenue Streams – Deep Dive

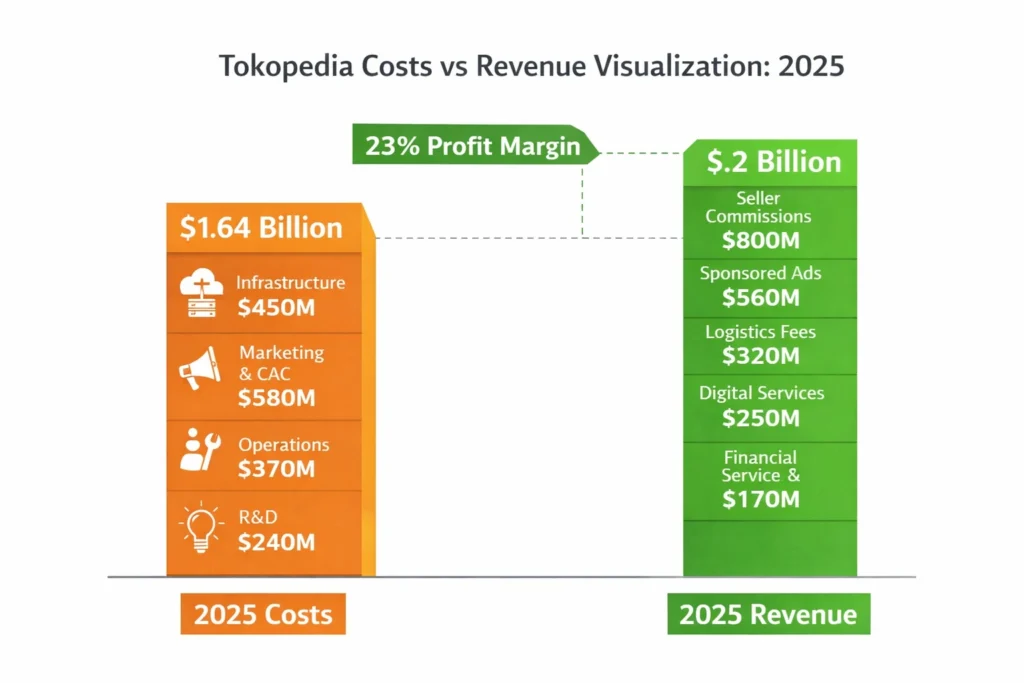

Revenue Stream #1: Seller Commissions

Tokopedia charges sellers a commission per successful transaction depending on category.

- Commission Rate: 1%–6%

- Revenue Share: ~38%

- 2025 Contribution: ~$800M+

- Higher-margin categories include electronics, fashion, and digital goods.

Revenue Stream #2: Sponsored Ads & Product Boosting

Sellers pay to boost product visibility within search and category listings.

Revenue Stream #3: Logistics & Fulfillment Fees

Tokopedia earns margins through integrated logistics partnerships and fulfillment services.

- Revenue Share: ~15%

- 2025 Contribution: ~$320M

- Includes warehousing, same-day delivery, and seller shipping tools.

Revenue Stream #4: Digital Products & Services

Includes mobile top-ups, utility payments, tickets, subscriptions, and digital vouchers.

- Revenue Share: ~12%

- 2025 Contribution: ~$250M

- Low CAC, high repeat usage.

Revenue Stream #5: Financial & Merchant Services

Includes seller loans, BNPL partnerships, payment facilitation, and wallet integrations.

- Revenue Share: ~8%

- 2025 Contribution: ~$170M

- High LTV, strong retention driver.

Revenue Streams Breakdown

| Revenue Stream | % Share |

|---|---|

| Seller Commissions | 38% |

| Sponsored Ads | 27% |

| Logistics & Fulfillment | 15% |

| Digital Products | 12% |

| Financial Services | 8% |

The Fee Structure Explained

Tokopedia’s strength lies in layered, flexible fees rather than heavy upfront charges.

User-Side Fees

- Free browsing & signup

- Delivery fees (variable)

- Convenience fees on digital services

Provider-Side Fees

- Transaction commission

- Ad spend (optional but competitive)

- Fulfillment service fees

Hidden Revenue Layers

- Float income on wallets

- Merchant financing partnerships

- Data-driven ad optimization margins

Regional Pricing

- Lower commissions for new sellers

- Category-based fee variation

Fee Structure Table

| User Type | Fee Type | Typical Range |

|---|---|---|

| Buyers | Service & delivery | 1–4% |

| Sellers | Commission | 1–6% |

| Sellers | Ads | CPC/CPM |

| Merchants | Fulfillment | Per order |

| Partners | Financial services | Revenue share |

How Tokopedia Maximizes Revenue Per User

Tokopedia focuses on lifetime value, not one-time transactions.

- Segmentation: Power sellers vs casual sellers

- Upselling: Premium seller tools & ads

- Cross-selling: Logistics + payments + ads

- Dynamic Pricing: Category-based commission tuning

- Retention Monetization: Wallet credits & subscriptions

- Psychological Pricing: Low commissions, visible ROI ads

Real Example (2025):

Top 20% sellers contribute nearly 65% of ad revenue, proving the power of seller-focused monetization.

Cost Structure & Profit Margins

Tokopedia’s margins improve as scale increases.

Cost Breakdown

- Infrastructure & Cloud: ~22%

- Marketing & CAC: ~28%

- Operations & Support: ~18%

- R&D & Product: ~12%

Unit Economics

- Average order contribution margin: 18–24%

- Ads & financial services offset logistics costs

Profitability Path

- Ads + fintech → margin expansion

- Logistics → efficiency over scale

Read More: Best Tokopedia Clone Scripts 2025 | A Multi-Vendor Marketplace

Future Revenue Opportunities & Innovations

New Revenue Streams

- AI-powered seller ads

- Cross-border seller enablement

- Subscription-based seller tiers

AI/ML Monetization

- Smart pricing recommendations

- Conversion-optimized ad bidding

Market Expansion

- Tier-2 & Tier-3 cities

- Regional ASEAN sellers

2025–2027 Trends

- Ads-first marketplaces

- Embedded finance growth

- Faster fulfillment expectations

Risks

- Price wars

- Logistics inflation

- Regulatory fintech pressure

Opportunities for Founders

- Vertical marketplaces

- SME-focused platforms

- Regional-first commerce apps

Lessons for Entrepreneurs & Your Opportunity

What Works

- Multi-layer monetization

- Seller-first growth strategy

- Ads as profit engine

What to Replicate

- Low entry barrier + optional upsells

- Integrated payments & logistics

Market Gaps

- Niche vertical marketplaces

- Local-language commerce platforms

Founder Improvements

- Faster seller onboarding

- AI-driven pricing tools

Want to build a platform with Tokopedia’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Tokopedia clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Tokopedia proves that marketplaces don’t win by charging more—they win by charging smarter. Instead of relying on high commissions, it uses low base fees combined with optional, performance-driven monetization such as sponsored listings, logistics services, and financial tools, ensuring sellers only pay more as they grow.

Its success comes from carefully balancing seller growth, buyer trust, and layered monetization. Tokopedia invests in seller education, reliable fulfillment, and transparent pricing, while monetizing through ads, value-added services, and repeat usage, creating a system where growth for one side of the marketplace fuels revenue across the entire platform.

For founders, this model shows how sustainable revenue emerges from ecosystem thinking rather than short-term extraction. By designing platforms that help sellers succeed first and monetizing through optional enhancements, entrepreneurs can build long-lasting marketplaces with higher retention, healthier margins, and compounding network effects.

FAQs

1. How much does Tokopedia make per transaction?

Typically 1–6% in commission, plus optional ad and logistics margins.

2. What’s Tokopedia’s most profitable revenue stream?

Sponsored ads and merchant services.

3. How does Tokopedia’s pricing compare to competitors?

Lower base commissions but higher optional monetization.

4. What percentage does Tokopedia take from providers?

On average, 3–5% per transaction.

5. How has Tokopedia’s revenue model evolved?

From pure commissions to ads-first monetization.

6. Can small platforms use similar models?

Yes, especially niche or regional marketplaces.

7. What’s the minimum scale for profitability?

Typically 50K–100K monthly active buyers.

8. How to implement similar revenue models?

Start with commissions, then layer ads and services.

9. What are alternatives to Tokopedia’s model?

Subscription-led or inventory-based commerce.

10. How quickly can similar platforms monetize?

With the right setup, within the first 30–90 days.