Vinted has crossed €1 billion in annual revenue in 2025, proving that resale marketplaces can be both scalable and highly profitable when built on the right fundamentals. What began as a simple peer-to-peer fashion resale app has evolved into one of Europe’s most dominant recommerce platforms, supported by millions of active users, high transaction frequency, and deeply integrated logistics and payments. Its growth also reflects a broader shift toward sustainable consumption and value-driven shopping behavior.

For founders, Vinted’s model is especially compelling because it removes seller commissions entirely, a major friction point in most marketplaces, while still generating massive revenue. Instead of taxing participation, Vinted monetizes trust through buyer protection fees, convenience via logistics integration, and scale through repeat transactions. This approach accelerates supply growth, attracts casual sellers, and creates strong network effects without hurting liquidity.

Understanding how Vinted makes money helps entrepreneurs design marketplaces that grow fast without discouraging sellers or distorting prices. It demonstrates how revenue can be layered subtly into the transaction flow, how operational efficiency can outperform high commissions, and how long-term value is created by maximizing trust, retention, and transaction volume rather than short-term extraction.

Vinted Revenue Overview – The Big Picture

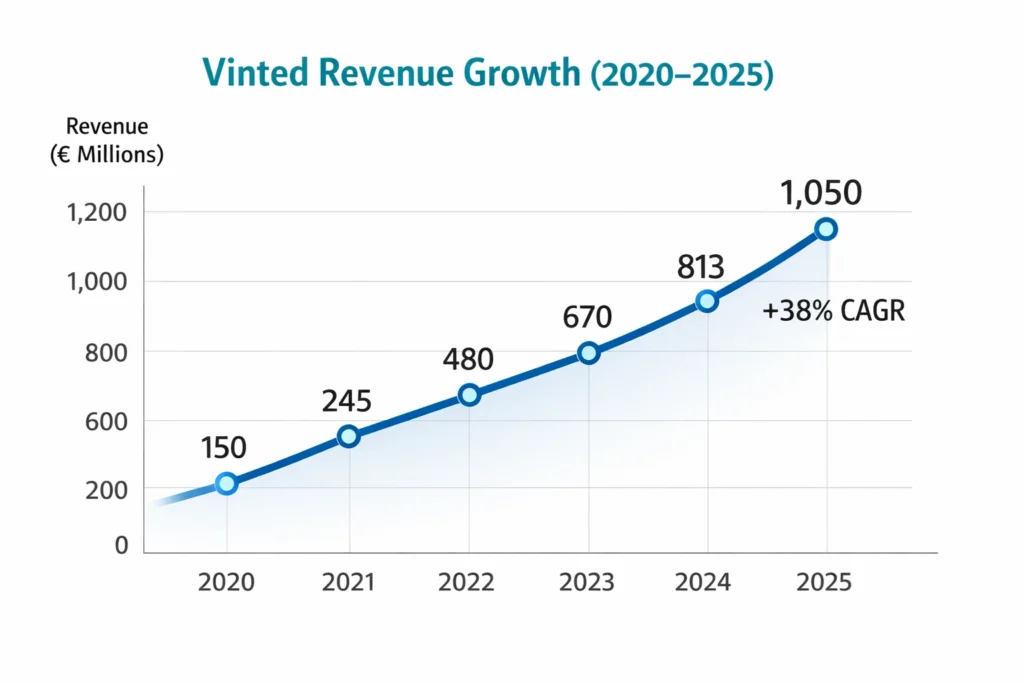

In 2025, Vinted’s estimated revenue exceeds €1 billion, driven by strong transaction volumes across Europe and rapid logistics expansion.

- 2025 Revenue: ~€1.05 billion

- Valuation: ~€8 billion

- YoY Growth: ~38%

- Revenue by region:

- Europe: ~88%

- UK: ~7%

- Other markets & pilots: ~5%

- Profit margins: 18–22% EBITDA

- Competition benchmark: Higher margins than Depop and ThredUp due to zero seller commission and strong logistics leverage

Read More: What is Vinted and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Buyer Protection Fees

This is Vinted’s core monetization engine. Buyers pay a small protection fee per transaction that covers escrow, dispute handling, and refunds. At scale, this fee becomes extremely powerful.

- Share of revenue: ~62%

- Why it works: Buyers perceive safety as essential, not optional.

Revenue Stream #2: Promoted Listings

Sellers can pay to boost item visibility, push listings to the top, or increase impressions.

- Share of revenue: ~17%

- High-margin revenue with minimal operational cost.

Revenue Stream #3: Shipping & Logistics Margins

Through integrated shipping and owned logistics networks, Vinted earns margin on label generation and delivery optimization.

- Share of revenue: ~11%

- Strongly improves unit economics at scale.

Revenue Stream #4: Advertising & Brand Partnerships

Fashion brands, resellers, and sustainability partners advertise directly within the ecosystem.

- Share of revenue: ~6%

Revenue Stream #5: Premium & Optional Services

Includes advanced seller tools, analytics, and early feature access.

- Share of revenue: ~4%

Revenue Streams Breakdown Table

| Revenue Stream | % Share (2025) |

|---|---|

| Buyer protection fees | 62% |

| Promoted listings | 17% |

| Shipping & logistics margin | 11% |

| Advertising & partnerships | 6% |

| Premium services | 4% |

The Fee Structure Explained

Vinted’s genius lies in shifting fees away from sellers while still monetizing every transaction.

User-side fees

Buyers pay a protection fee consisting of a flat component plus a percentage of the order value.

Provider-side fees

Sellers list and sell for free but can opt into paid promotions.

Hidden revenue layers

Shipping optimizations, payment handling, and dispute management create additional revenue layers invisible to most users.

Regional pricing variation

Fees vary slightly by country based on logistics costs, regulations, and local purchasing behavior.

Fee Structure Table

| Fee Type | Buyer | Seller |

|---|---|---|

| Transaction protection fee | Yes | No |

| Listing promotions | Optional | Paid |

| Shipping & handling | Included | Included |

| Advertising | No | Indirect |

| Premium services | Optional | Optional |

How Vinted Maximizes Revenue Per User

Vinted focuses on volume multiplied by retention, not aggressive commissions.

- Segmentation: Different fee sensitivities across regions

- Upselling: Timed promotion prompts for sellers

- Cross-selling: Integrated shipping and wallet services

- Dynamic pricing: Adjusted protection fees by item value

- Retention monetization: Trust increases repeat buyers

- LTV optimization: Power sellers receive nudges for frequent listing

- Psychological pricing: Small fees feel insignificant relative to item savings

Real data shows that repeat buyers generate over 3× lifetime value compared to one-time users.

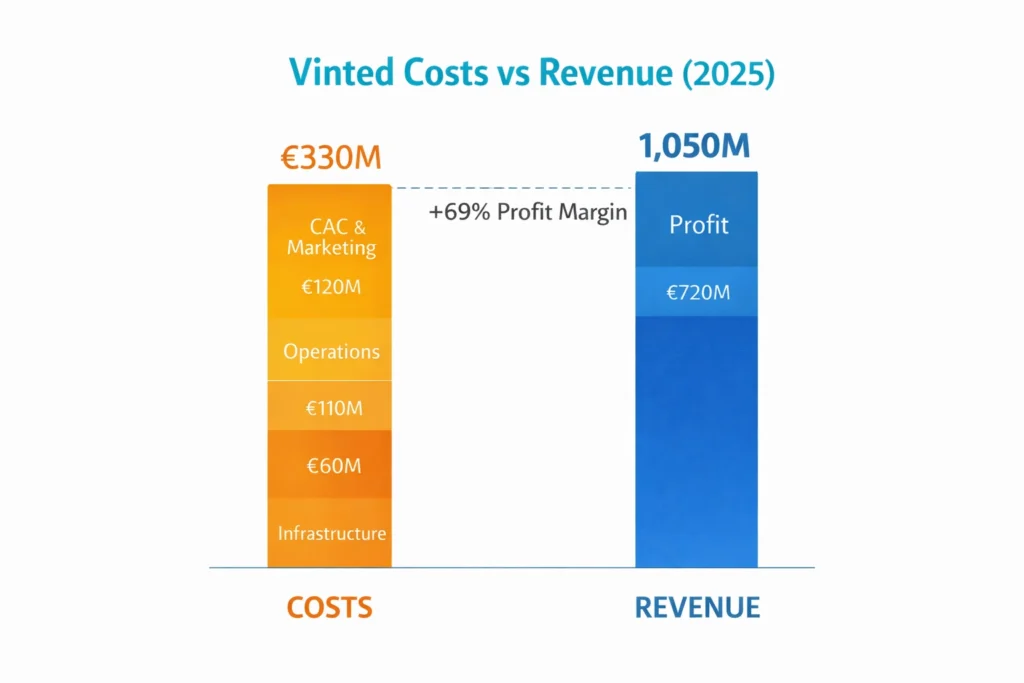

Cost Structure & Profit Margins

Vinted’s profitability is driven by operational leverage.

- Infrastructure: Cloud hosting, payments, marketplace engine

- CAC & marketing: Performance marketing, referrals, influencer loops

- Operations: Customer support, moderation, logistics coordination

- R&D: Logistics automation, AI moderation, fraud detection

- Unit economics: Positive contribution margin after second transaction

- Margin optimization: Logistics scale + automation

- Profitability path: Break-even at regional scale, strong profits post-density

Read More: Best Vinted Clone Scripts 2025 for Fashion Resale Entrepreneurs

Future Revenue Opportunities & Innovations

Looking ahead, Vinted is positioned for further monetization expansion.

- AI-driven pricing recommendations

- Seller subscription tiers

- Cross-border resale automation

- Private resale storefronts for creators

- Circular fashion analytics for brands

Risks: logistics dependency, regulation, resale saturation

Opportunities for founders: niche vertical resale, localized logistics, faster trust systems

Lessons for Entrepreneurs & Your Opportunity

What works: zero seller friction, buyer-paid trust fees

What to replicate: promotions, logistics monetization, repeat usage

Market gaps: category-specific resale, B2B resale, luxury verification

Improvements: faster payouts, AI pricing, creator resale tools

Want to build a platform with Vinted’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Vinted clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch but if you want it, we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Vinted proves that marketplaces don’t need seller commissions to succeed. By prioritizing trust through buyer protection, scale through frictionless selling, and smart fee placement at moments of perceived value, the platform outperforms many traditional commission-based models. This strategy not only attracts more sellers but also increases transaction volume, repeat usage, and long-term marketplace liquidity.

For founders, the lesson is clear: monetize value, not participation. Users are far more willing to pay for safety, convenience, and speed than for simply being allowed to transact. When fees are aligned with outcomes—such as successful delivery or dispute protection—they feel justified, transparent, and sustainable at scale.

The resale economy is still early, and platforms built today can dominate tomorrow by focusing on category depth, operational efficiency, and trust-driven monetization. As sustainability, affordability, and circular commerce continue to grow, founders who apply these principles now have the opportunity to build the next generation of category-defining marketplaces.

FAQs

1. How much does Vinted make per transaction?

Primarily through buyer protection fees and shipping margins.

2. What’s Vinted’s most profitable revenue stream?

Buyer protection fees due to high volume and low marginal cost.

3. How does Vinted’s pricing compare to competitors?

Lower seller friction but higher buyer trust monetization.

4. What percentage does Vinted take from sellers?

Zero commission; sellers pay only for optional promotions.

5. How has Vinted’s revenue model evolved?

From simple fees to logistics-driven and trust-based monetization.

6. Can small platforms use similar models?

Yes, especially in niche or regional resale markets.

7. What’s the minimum scale for profitability?

Profitability typically emerges after strong repeat usage density.

8. How to implement similar revenue models?

Focus on trust fees, promotions, and logistics integration.

9. What are alternatives to Vinted’s model?

Commission-based, subscription-based, or hybrid models.

10. How quickly can similar platforms monetize?

Some platforms generate revenue within weeks of launch if liquidity is achieved.