Imagine you’re a startup founder trying to track stock, options, SAFEs, and investor ownership—using spreadsheets that are confusing, error-prone, and impossible to scale. Equity management becomes stressful and risky as your company grows and you add more stakeholders.

Carta solves this exact problem by providing a digital equity management platform that helps companies track cap tables, issue electronic stock and options, model dilution, manage valuations, and maintain compliance—all in one place. Instead of messy spreadsheets and manual calculations, Carta offers a centralized, secure, and audit-ready system.

Founded to bring transparency and automation to startup ownership management, Carta has become the go-to tool for startups, venture funds, and private companies that need accurate, scalable, and compliant equity workflows.

By the end of this guide, you’ll understand what Carta is, how it works step by step, its business model, the technology behind it, and why many entrepreneurs and early-stage founders want to build platforms with similar structured equity and cap table capabilities—with Miracuves ready to help you launch your idea.

What Is Carta? The Simple Explanation

Carta is a digital equity management and ownership platform that helps companies, investors, and employees manage shares, options, and ownership records in one secure system. In simple terms, it replaces spreadsheets with a reliable source of truth for who owns what in a company.

The Core Problem Carta Solves

As startups grow, equity becomes complex—founders, employees, angels, VCs, SAFEs, ESOPs, and multiple funding rounds all affect ownership. Managing this manually leads to errors, compliance risks, and confusion. Carta solves this by automating cap tables, equity issuance, valuations, and reporting.

Target Users and Use Cases

Carta is widely used by:

• Startups managing founder equity and ESOPs

• Scaleups preparing for fundraising or exits

• Employees tracking stock options and vesting

• Venture capital firms managing fund ownership

• Finance and legal teams handling compliance

Current Market Position

Carta is the category leader in cap table and equity management for startups and private companies in the U.S. It’s deeply embedded in the venture ecosystem and is commonly recommended by VCs, lawyers, and startup accelerators.

Why It Became Successful

Carta succeeded because it turned one of the most sensitive and complex startup processes—equity ownership—into a structured, transparent, and trustworthy digital workflow. Its focus on accuracy, compliance, and ecosystem trust made it a default choice for founders and investors.

How Carta Works — Step-by-Step Breakdown

For Companies (Founders & Finance Teams)

Account Setup

A company signs up on Carta and sets up its corporate profile. Founders enter basic company details such as incorporation type, jurisdiction, share classes, and initial ownership structure. Existing cap tables from spreadsheets can be imported and validated.

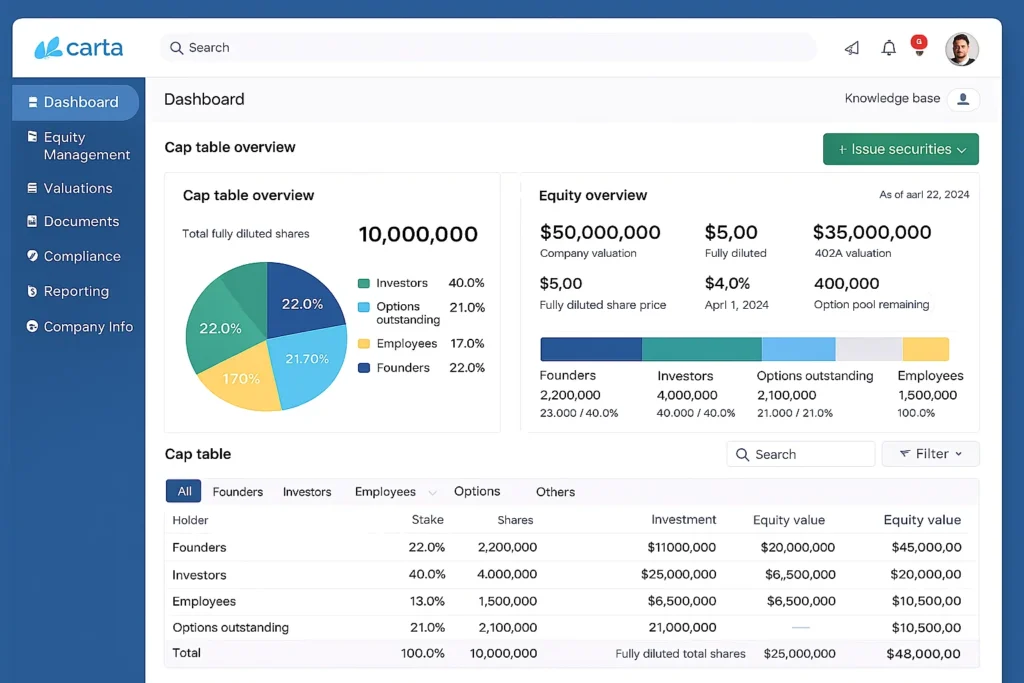

Cap Table Creation & Management

Carta creates a live digital cap table showing:

- Founder shares

- Investor ownership

- Option pools (ESOPs)

- SAFEs and convertible notes

- Fully diluted ownership

Any new issuance or transaction automatically updates the cap table in real time.

Issuing Shares & Options

Companies can issue equity digitally by:

- Granting employee stock options

- Issuing new shares to investors

- Managing vesting schedules and cliffs

Employees receive electronic equity grants and can view their ownership directly in their own Carta accounts.

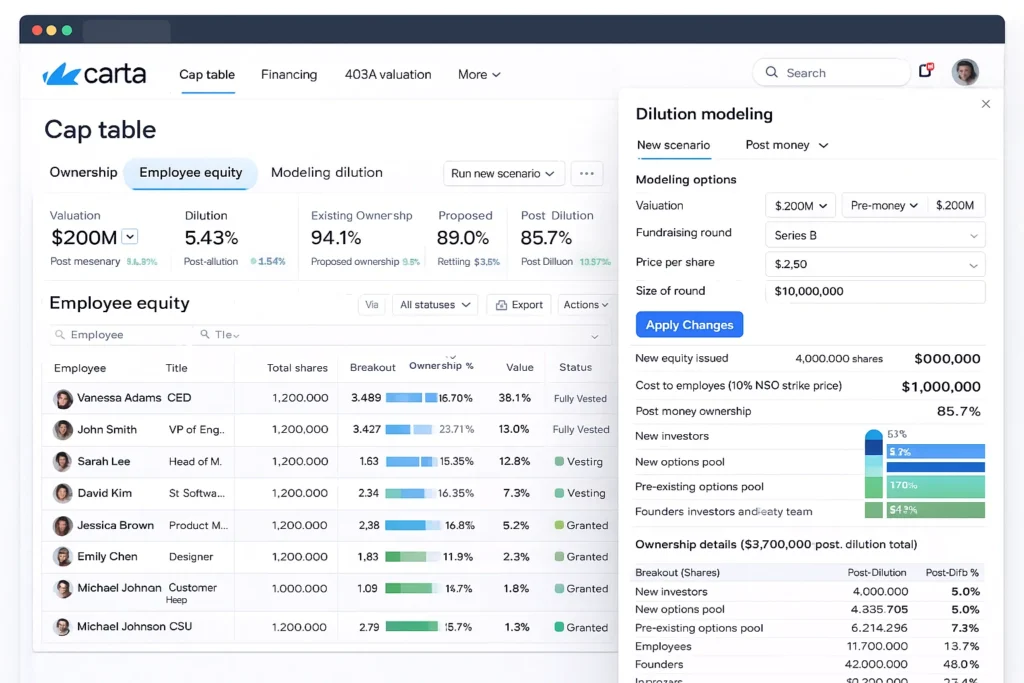

Fundraising & Dilution Modeling

Before a funding round, founders can use Carta to:

- Model dilution scenarios

- Simulate different investment terms

- Understand post-money ownership

This helps founders make informed decisions before negotiating with investors.

Valuations & Compliance

Carta supports:

- 409A valuations (for option pricing)

- Audit-ready reports

- Compliance documentation

This removes reliance on manual processes and external spreadsheets for regulatory needs.

For Employees (Equity Holders)

Equity Visibility

Employees log into Carta to:

- View granted options or shares

- Track vesting progress

- Understand exercise costs and potential value

This transparency helps employees better understand their compensation.

Exercising Options

When eligible, employees can digitally exercise options through Carta, with records updated instantly for both the employee and the company.

For Investors & Funds

Portfolio Management

Investors and VC funds use Carta to:

- Track ownership across multiple startups

- Monitor valuations and dilution

- Generate portfolio reports

This creates a shared system of record between companies and investors.

Technical Overview (Simplified)

Carta operates through:

- A centralized equity ledger as the single source of truth

- Secure user roles for founders, employees, and investors

- Automated calculations for dilution, vesting, and ownership

- Document storage for agreements and compliance records

- Reporting tools for audits, fundraising, and governance

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Carta’s Business Model Explained

How Carta Makes Money

Carta operates on a SaaS subscription model with additional service-based revenue. Instead of charging per transaction, it offers tiered plans depending on company size, complexity, and use cases. Its main revenue streams include:

- Company subscriptions for cap table and equity management

- Valuation services (such as 409A valuations)

- Fund administration services for venture capital and private equity firms

- Advanced compliance and reporting tools for larger organizations

This model aligns well with long-term company growth, as customers typically stay on the platform for years.

Pricing Structure

Carta’s pricing varies based on:

- Number of stakeholders (employees, investors)

- Complexity of equity structures

- Required compliance and reporting features

- Whether the customer is a startup, scaleup, or investment fund

Early-stage startups usually pay a lower annual subscription, while larger companies and VC funds pay more for advanced features and services.

Commission / Fee Breakdown

Carta generally does not take commissions on equity value. Instead:

- Companies pay fixed subscription fees

- Valuation services are billed separately

- Fund administration is priced as a managed service

This avoids conflicts of interest and keeps pricing predictable.

Market Size and Growth

The private markets ecosystem—startups, venture funds, and private equity—continues to expand. As more companies stay private longer, the need for accurate equity tracking, compliance, and transparency grows. This makes equity management software a large and growing B2B SaaS opportunity.

Profit Margin Insights

Carta benefits from:

- High customer retention due to data lock-in

- Recurring annual revenue

- Low churn once equity data is fully onboarded

- Strong expansion revenue as companies grow and add features

Revenue Model Breakdown

| Revenue Stream | Description | Who Pays | Nature |

|---|---|---|---|

| Subscriptions | Equity & cap table management plans | Companies | Recurring |

| Valuation Services | 409A and related valuations | Companies | Service-based |

| Fund Administration | Portfolio & fund management tools | VC / PE firms | Contract-based |

| Advanced Compliance | Audit & reporting tools | Larger enterprises | Add-on |

Key Features That Make Carta Successful

Centralized Cap Table Management

Carta provides a single, always-up-to-date cap table that replaces spreadsheets. Founders, finance teams, and investors can clearly see ownership, dilution, and equity structure at any time.

Digital Equity Issuance

Companies can issue shares and stock options electronically. Grant letters, vesting schedules, and acceptance are all handled digitally, reducing paperwork and errors.

Employee Equity Visibility

Employees get their own dashboards where they can:

- View granted options or shares

- Track vesting progress

- Understand exercise prices and timelines

This transparency improves trust and helps employees better value their compensation.

Dilution & Fundraising Modeling

Carta allows founders to model funding rounds before they happen. They can test different scenarios, see post-money ownership, and understand how new investments affect existing stakeholders.

409A Valuations & Compliance

Carta offers built-in valuation services and compliance reporting. This helps companies stay aligned with regulatory requirements and avoids last-minute valuation stress.

Investor & VC Portfolio Tools

Investors use Carta to track ownership across multiple companies, monitor portfolio performance, and generate reports—creating a shared system of record between startups and funds.

Audit-Ready Reporting

Carta generates structured, audit-ready reports for legal, finance, and governance needs. This is critical during fundraising, M&A discussions, or financial audits.

Role-Based Access Control

Different users see different views. Founders, employees, investors, and administrators each get access only to what they need, improving security and clarity.

Document Management

Equity agreements, option plans, valuation reports, and legal documents are stored centrally, making them easy to access when needed.

Scales With Company Growth

Carta grows with a company—from a small startup with a few founders to a large private company with thousands of employees and complex equity structures.

The Technology Behind Carta

Tech Stack Overview (Simplified)

Carta is built as a secure, cloud-based B2B SaaS platform designed to handle highly sensitive ownership and financial data. The focus of its technology is accuracy, auditability, and trust rather than consumer-style speed or trading features.

At a high level, Carta uses:

- Web-based applications for companies, employees, and investors

- A centralized equity ledger that acts as the single source of truth

- Cloud infrastructure for scalability and reliability

- Secure data storage with strong access controls

Centralized Equity Ledger

At the heart of Carta is a structured equity ledger. Every action—issuing shares, granting options, exercising equity, or raising funds—updates this ledger automatically. This ensures:

- No manual recalculations

- No version conflicts

- Consistent ownership data across all stakeholders

This ledger-driven design is what allows Carta to replace spreadsheets entirely.

Real-Time Calculations & Modeling

Carta’s system continuously recalculates:

- Fully diluted ownership

- Vesting progress

- Option pool availability

- Dilution impact from new rounds

When founders model a funding round or employees exercise options, the platform instantly reflects the outcome across the cap table.

Data Handling, Privacy, and Security

Because equity data is extremely sensitive, Carta uses strong security practices, including:

- Encryption for data at rest and in transit

- Role-based access control (RBAC)

- Secure authentication and session management

- Detailed audit logs of changes and actions

This makes the platform suitable for legal, financial, and regulatory scrutiny.

Scalability Approach

Carta supports companies at every stage—from a handful of shareholders to thousands of equity holders. Its backend is designed to scale smoothly as:

- Employee count increases

- Funding rounds multiply

- Investor relationships grow more complex

Modular services allow new features (fund admin, valuations, reporting) to scale independently without affecting core cap table performance.

Web Platform vs User Dashboards

- Company dashboards: Used by founders and finance teams for issuing equity, modeling rounds, and generating reports.

- Employee dashboards: Focused on clarity—vesting timelines, option values, and exercise actions.

- Investor dashboards: Portfolio-level views across multiple companies.

Each dashboard pulls from the same underlying data, ensuring consistency.

Integrations & Ecosystem

Carta integrates with parts of the startup ecosystem, such as:

- Law firms and incorporation workflows

- Payroll and HR systems (for equity grants)

- Financial and reporting tools

- Valuation and compliance services

These integrations reduce duplicate data entry and align equity data with other business systems.

Why This Technology Matters

Carta’s technology replaces guesswork with certainty. For founders, it reduces legal and financial risk. For employees, it brings clarity to compensation. For investors, it ensures accurate portfolio tracking.

For entrepreneurs, Carta shows how trust-first, data-accurate platforms can dominate complex B2B workflows where mistakes are expensive and confidence matters most.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Carta’s Impact & Market Opportunity

Industry Disruption

Before Carta, equity management was fragmented across spreadsheets, email threads, and legal documents. This created errors, mistrust, and compliance risk—especially during fundraising or exits. Carta standardized equity management by creating a single digital source of truth, fundamentally changing how startups, employees, and investors interact with ownership data.

By normalizing transparent cap tables and digital equity issuance, Carta raised the bar for governance and professionalism in the private markets ecosystem.

Market Statistics & Growth

As more companies stay private longer, equity structures have become more complex. Startups now go through multiple funding rounds, secondary transactions, and employee liquidity events—all of which increase the need for accurate, always-on equity systems. This trend has expanded demand for equity management, fund administration, and valuation services.

Carta sits at the intersection of startups, venture capital, and private equity, serving a growing market that values compliance, transparency, and automation.

User Demographics & Behavior

Carta’s core users include:

- Early-stage founders managing initial ownership and ESOPs

- Scaleups preparing for large funding rounds or acquisitions

- Employees tracking vesting and exercising options

- VC and PE firms managing multi-company portfolios

These users rely on Carta continuously, not occasionally—especially during hiring, fundraising, audits, and exits.

Geographic Presence

Carta is primarily focused on the U.S. private markets, where equity complexity and regulatory requirements are high. However, its influence extends globally through U.S.-incorporated startups with international teams and investors.

Future Projections

The future of equity management is moving toward:

- Greater transparency for employees and investors

- Deeper automation of compliance and reporting

- Integrated secondary liquidity tools

- Broader private market infrastructure beyond cap tables

Carta’s platform is well-positioned to expand alongside these trends as equity becomes a core operational system rather than a back-office task.

Opportunities for Entrepreneurs

There is growing opportunity to build Carta-like platforms for specific niches, such as:

- Regional startup ecosystems

- Employee-first equity education platforms

- Private market reporting tools

- Founder-focused governance and compliance software

- Vertical-specific equity management solutions

This massive success is why many entrepreneurs want to build structured, trust-driven platforms inspired by Carta’s approach to ownership and transparency.

Building Your Own Carta-Like Platform

Why Businesses Want Carta-Style Equity Platforms

Carta proves that equity management is not just a legal necessity—it’s core business infrastructure. Founders, investors, and employees all want clarity, accuracy, and trust around ownership. A Carta-style platform is attractive because it:

- Eliminates spreadsheet risk and manual errors

- Creates a single source of truth for ownership

- Reduces legal and compliance friction

- Builds long-term customer lock-in

- Scales naturally as companies grow

For founders, equity is emotional and high-stakes. Platforms that handle it well become indispensable.

Key Considerations Before You Start Development

Before building a Carta-like solution, you need to define:

- Target users: early-stage startups, scaleups, VC funds, employees, or a niche subset

- Jurisdiction focus: corporate law, tax rules, and compliance vary by country

- Equity instruments to support: shares, options, SAFEs, convertibles, RSUs

- Compliance scope: reporting, audits, valuations, governance needs

- Data accuracy and auditability standards

- Role-based access and permission levels

These decisions determine product complexity and regulatory exposure.

Cost Factors & Pricing Breakdown

Carta-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Cap Table & Equity MVP | Core web platform for startups to maintain a simple cap table, founders/investors share tracking, basic funding rounds, option grants, vesting schedules (time-based), basic reports (ownership %, fully diluted view), standard admin panel | $70,000 |

| Mid-Level Equity Management Platform | Multi-entity support, detailed round modelling, option pool management, advanced vesting rules, digital certificates, stakeholder portals (employees/investors), document storage, basic scenario modelling, notifications & reminders, analytics dashboard, polished web + mobile-ready experience | $150,000 |

| Advanced Carta-Level Equity OS & Governance Ecosystem | Full-scale equity operating system with complex securities support (SAFEs, convertibles, RSUs, performance vesting), waterfall & exit modelling, board & governance workflows, 409A/valuation integrations (via partners), audit-grade reporting, multi-jurisdiction support, cloud-native scalable architecture | $260,000+ |

Carta-Style Equity Management Platform Development

The prices above reflect the global market cost of developing a Carta-like cap table, equity management, and governance platform — typically ranging from $70,000 to over $260,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually includes secure ownership data modelling, cap table logic, stakeholder portals, workflow and notification systems, integrations with legal/valuation partners, and the infrastructure needed for compliance-ready reporting.

Miracuves Pricing for a Carta-Like Custom Platform

Miracuves Price: Starts at $15,999

This is positioned for a feature-rich, JS-based Carta-style equity management platform that covers structured cap tables, funding rounds, option and grant management, core vesting rules, stakeholder access (founders, employees, investors), key reports (ownership %, dilution views), notifications, and a modern admin dashboard plus web/mobile interfaces. From this foundation, the solution can be extended into deeper scenario modelling (waterfalls, exits), advanced governance workflows, valuation and legal partner integrations, and multi-jurisdiction support as your equity stack and portfolio of companies grow.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational equity management ecosystem ready for launch and future expansion.

Delivery Timeline for a Carta-Like Platform with Miracuves

For a Carta-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of cap table features (security types, vesting rules, scenarios, reporting)

- Number and complexity of external integrations (valuation providers, legal tools, identity/KYC, e-signature, etc.)

- Complexity of stakeholder portals, governance workflows, and audit/reporting requirements

- Scope of web portal, mobile apps, branding, and long-term scalability and compliance goals

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include

A strong Carta-like MVP should offer:

- Digital cap table management

- Equity issuance and vesting logic

- Employee equity dashboards

- Dilution and fundraising modeling

- Document storage and reporting

- Role-based access control

- Secure authentication and audit trails

- Admin tools for compliance and support

Advanced features you can add later:

- Valuation workflows

- Fund administration modules

- Secondary transaction tracking

- Payroll/HR integrations

- Cross-border equity support

Read More :- Read the complete guide on fintech app development costs

Conclusion

Carta transformed one of the most complex and high-risk startup processes—equity management—into a structured, transparent, and trustworthy digital system. By replacing spreadsheets with a single source of truth, it gave founders confidence, employees clarity, and investors reliable data at every stage of a company’s journey.

For entrepreneurs, Carta is proof that solving painful, compliance-heavy problems with precision and trust can create long-lasting platforms. When software becomes critical business infrastructure, it doesn’t just support growth—it becomes impossible to replace.

FAQs :-

How does Carta make money?

Carta earns revenue through subscription plans for companies, valuation services (such as 409A valuations), and fund administration services for venture capital and private equity firms. It does not take a commission on equity value.

Who uses Carta?

Carta is used by startups, scaleups, private companies, employees, venture capital firms, and private equity funds to manage equity ownership, cap tables, and compliance.

Is Carta only for startups?

No. While Carta is popular with startups, it’s also used by growing private companies, late-stage firms, and investment funds that need accurate equity and portfolio management.

Can employees see their equity on Carta?

Yes. Employees get individual dashboards where they can view stock options, vesting schedules, exercise prices, and ownership details, improving transparency around compensation.

Does Carta handle valuations and compliance?

Yes. Carta provides 409A valuations, audit-ready reports, and compliance documentation to help companies meet legal and regulatory requirements.

Is Carta secure?

Yes. Carta uses encryption, role-based access control, secure authentication, and audit logs to protect highly sensitive ownership and financial data.

Does Carta replace lawyers or accountants?

No. Carta complements legal and finance teams by automating calculations, record-keeping, and reporting, reducing manual work and errors while professionals handle advice and approvals.

Can investors use Carta to track portfolios?

Yes. Venture capital and private equity firms use Carta to track ownership across multiple companies, monitor dilution, and generate portfolio-level reports.

Is Carta available outside the USA?

Carta is primarily focused on the U.S. private markets, but it’s widely used by U.S.-incorporated companies with international teams and investors.

Can I build a platform like Carta?

Yes. Equity management platforms can be built for specific regions, company stages, or niche use cases. The key is accuracy, compliance, and trust.

How can Miracuves help build a Carta-like platform?

Miracuves helps founders launch Carta-style equity and cap table management platforms in 30-90 days, with secure data models, equity logic engines, role-based access, and full customization—ready to scale with your target market.