Imagine a bank that doesn’t charge hidden fees, doesn’t make you wait for payday, and helps you save automatically — all from your smartphone. That’s the promise of Chime, one of America’s most popular neobanks redefining personal finance in 2025.

Founded in 2013 by Chris Britt and Ryan King, Chime started with a simple idea: traditional banks profit from fees; Chime profits when its users succeed financially. Today, it offers checking and savings accounts, instant money transfers, credit-building tools, and early direct deposits — all managed through a sleek, mobile-first experience.

As of 2025, Chime serves over 20 million users across the U.S., processing billions in transactions monthly. It’s known for fee-free banking, instant payment notifications, and AI-driven financial tools that empower users to manage money effortlessly.

By the end of this guide, you’ll understand what Chime is, how it works, how it earns revenue, and how you can build a Chime-like neobank app using Miracuves’ fintech clone technology — enabling entrepreneurs to enter the booming digital banking market in record time.

What is Chime?

Chime is a mobile-based neobank that offers everyday banking services like checking, savings, and credit building — without the traditional fees or paperwork associated with legacy banks. It’s not a bank itself but partners with FDIC-insured institutions such as The Bancorp Bank and Stride Bank to provide financial services securely.

The main problem Chime solves is banking accessibility. Many people in the U.S. face overdraft fees, delayed payments, or minimum balance requirements. Chime eliminates those barriers by offering a fully digital experience with no hidden charges, no overdraft penalties, and faster access to funds through early direct deposits.

Its target users include individuals seeking simple, affordable, and transparent banking — especially younger generations, freelancers, and gig economy workers who rely on real-time payments.

As of 2025, Chime has grown into one of the top digital banks in the U.S. with more than 20 million users and an estimated valuation exceeding $25 billion. Its success comes from user-first design, fast money movement, and smart financial automation that encourages savings and better money habits.

How Does Chime Work?

Chime functions as a fully digital financial platform — replacing traditional bank branches and paperwork with an intuitive app that manages checking, savings, and spending in real time. Its operations revolve around speed, simplicity, and user empowerment.

For Users

1. Account Setup

Users download the Chime app, sign up with their basic information, and get a spending account paired with a free Visa debit card. No credit checks or minimum deposits are required.

2. Direct Deposit & Early Pay

When users set up direct deposit, Chime releases their paychecks up to two days earlier than traditional banks by immediately crediting incoming funds once received from the employer.

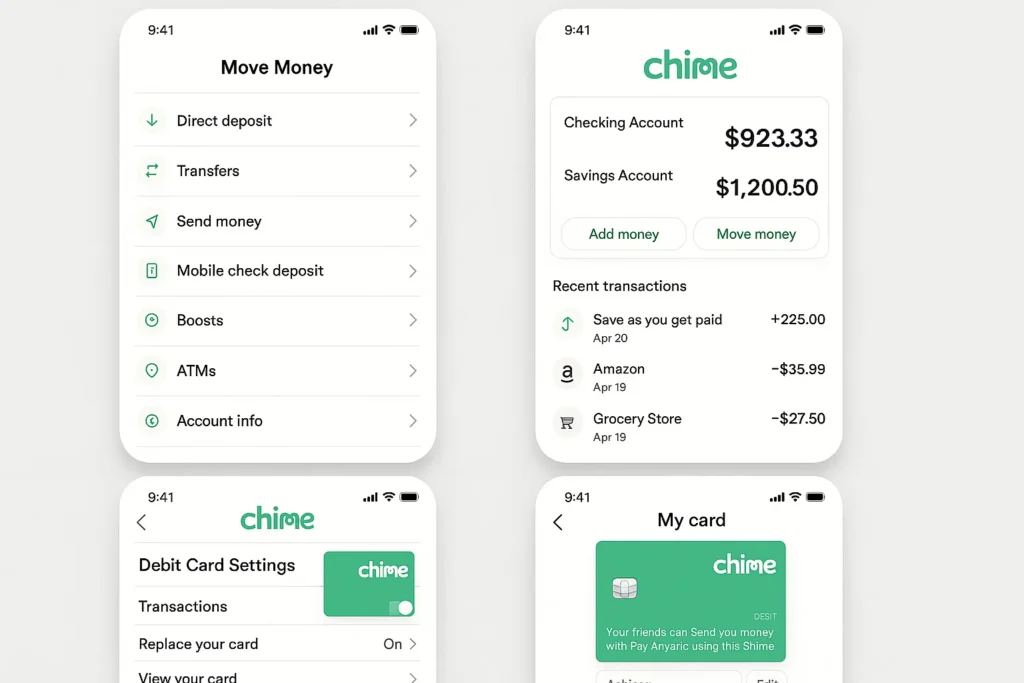

3. Spending & Transfers

The Chime debit card allows purchases anywhere Visa is accepted, and users can send or receive money instantly via Chime’s “Pay Anyone” feature — even if the recipient doesn’t use Chime.

4. Savings Automation

Chime’s savings account offers automatic round-up savings. Every time a user makes a purchase, the transaction is rounded up to the nearest dollar, and the difference is transferred to their savings account.

5. Credit Builder Card

Users can apply for Chime’s Credit Builder Visa card, a secured credit line that helps improve credit scores without the risk of interest or debt. All payments are reported to major credit bureaus automatically.

Example

A user with a $1,000 paycheck deposited through Chime gets access to funds on Wednesday instead of Friday. Purchases made throughout the week are tracked and rounded up to savings automatically. The user’s credit activity is updated in real time, improving financial health effortlessly.

Technical Overview

Chime operates as a fintech company that partners with FDIC-insured banks to provide the backend infrastructure. Transactions are processed through secure APIs and real-time payment rails. The platform integrates AI for fraud monitoring, spending insights, and transaction categorization.

Its architecture focuses on scalability, with cloud-based servers ensuring high uptime and real-time synchronization across millions of accounts.

Read More :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Chime’s Business Model Explained

Chime’s business model is built on providing free, accessible banking while earning revenue from backend financial partnerships and interchange fees. Instead of charging users with traditional banking fees, Chime makes money when its users spend and engage with the platform.

1. Interchange Fees

Every time a user makes a purchase using their Chime Visa debit or credit builder card, Chime earns a small percentage (usually around 1.5%–2%) from Visa’s interchange network. This is the primary revenue source and scales with user spending volume.

2. Bank Partnerships

Chime collaborates with FDIC-insured banks like The Bancorp Bank and Stride Bank. These banks hold customer deposits and share a portion of the interest or processing fees with Chime in exchange for customer acquisition and digital infrastructure management.

3. Credit Builder Program

Through its Credit Builder Visa card, Chime earns from interest on security deposits and affiliate partnerships with financial service providers. It positions itself as a responsible alternative to high-interest credit products.

4. Savings and Lending Partnerships

Chime partners with lending institutions to offer users low-risk, small-scale loan products and high-yield savings options. These partnerships generate commissions and service fees while maintaining transparency for users.

5. Premium and Optional Services

Though the basic platform is free, Chime offers optional premium services such as instant external transfers, priority support, and advanced financial analytics for small monthly fees.

6. Scale and User Engagement

As of 2025, Chime has more than 20 million active users and processes billions in card volume each month. The company’s focus on financial inclusion and fee-free banking has made it one of the most profitable neobanks in the U.S., even without traditional lending revenue streams.

Read Also :- Business Model For Digital Banking

Key Features That Make Chime Successful

Chime’s success comes from designing financial tools around user empowerment rather than profit from fees. Its seamless interface, transparency, and automation make it one of the most trusted neobanking apps in the U.S.

1. Fee-Free Banking

Chime eliminates overdraft fees, minimum balance requirements, and monthly maintenance charges. Users can manage money freely without worrying about hidden costs — a major draw compared to traditional banks.

2. Early Direct Deposit

One of Chime’s most loved features is early paycheck access. By crediting deposits as soon as payment files arrive, users get paid up to two days earlier than they would with a conventional bank.

3. SpotMe (Fee-Free Overdraft)

Chime allows users to overdraw up to $200 on debit card purchases without fees. The feature automatically adjusts repayment from future deposits, making overdrafts more manageable.

4. Credit Builder Card

The Credit Builder Visa card helps users build or improve their credit scores. It reports payments to all major credit bureaus and doesn’t require a credit check or charge interest.

5. Automated Savings

Every transaction can be rounded up to the nearest dollar, with the spare change automatically transferred to the user’s savings account. This encourages passive saving without conscious effort.

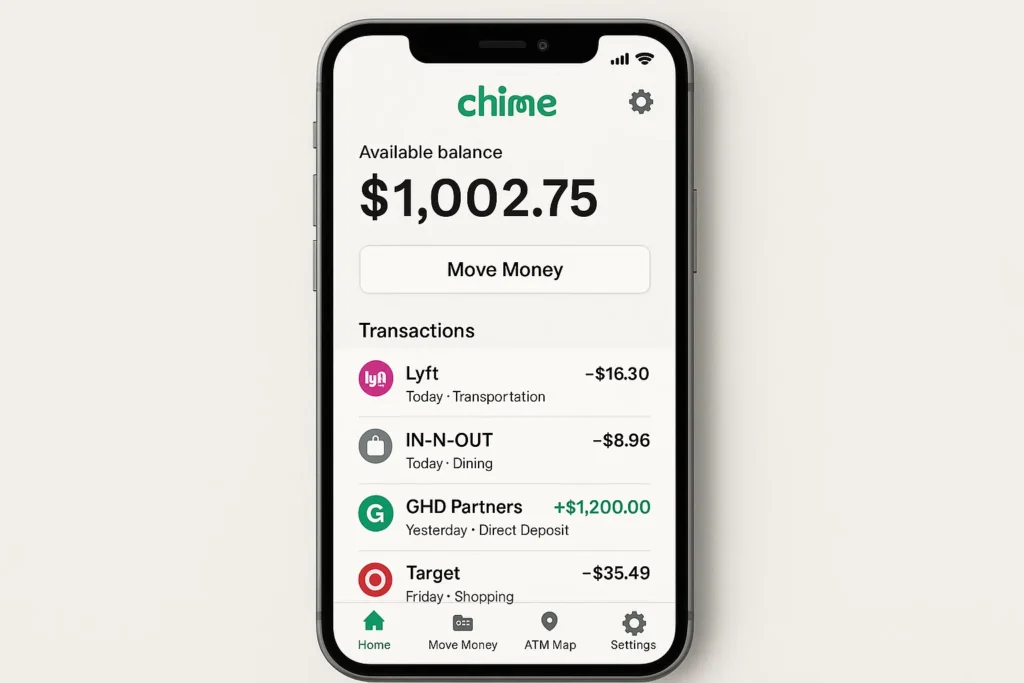

6. Real-Time Notifications

Every deposit, withdrawal, or purchase triggers an instant notification, giving users complete transparency and control over their money.

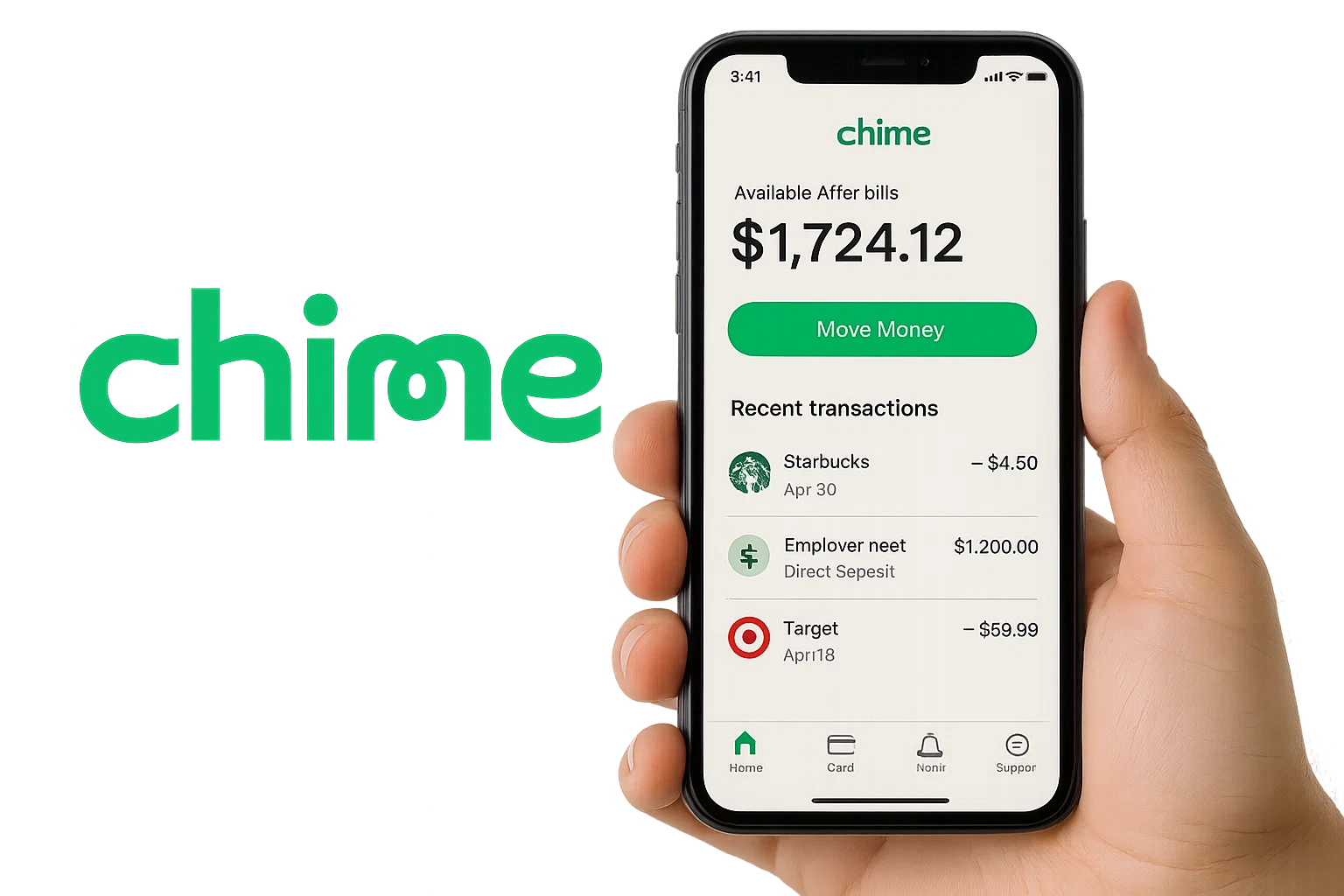

7. Mobile-First Experience

The Chime app is designed for simplicity and ease of navigation. With just a few taps, users can pay bills, transfer funds, and check balances instantly.

8. Security and Fraud Protection

Chime provides account alerts, biometric logins, instant card blocking, and AI-driven fraud monitoring to safeguard user funds and data.

9. Financial Insights and Automation

Chime uses AI to categorize spending, offer budgeting tips, and provide personalized recommendations to help users manage money better.

10. Seamless Integrations

Chime connects with major payment apps like Cash App, Venmo, and PayPal for smooth fund transfers and external wallet use.

2025 Updates:

Chime introduced AI-powered savings goals, crypto-compatible deposits, and expanded SpotMe coverage for larger overdrafts. It also enhanced fraud prevention algorithms for faster detection and real-time recovery.

Also Read :- How to Start a Digital Banking App Business in 2025

The Technology Behind Chime

Chime’s technological foundation focuses on security, scalability, and real-time banking operations. Instead of maintaining its own banking infrastructure, Chime partners with licensed banks while managing the entire digital ecosystem through APIs, cloud computing, and automation.

Tech Stack Overview

Chime’s backend is built using Python, Go, and Java for reliability and concurrency. It leverages AWS (Amazon Web Services) for cloud hosting and Kubernetes for container orchestration. For database management, it uses PostgreSQL and MongoDB to store financial data efficiently and securely.

On the frontend, the Chime mobile app is developed with React Native for a unified iOS and Android experience, ensuring smooth performance and faster updates.

Real-Time Processing

Chime uses API integrations with its partner banks and payment networks to process transactions instantly. Each deposit, transfer, or purchase is reflected in real time through webhooks and event-driven architecture.

Security and Compliance

Chime employs TLS 1.3 encryption, biometric authentication, and AI-based transaction monitoring to ensure every account and transaction remains secure. It complies with FDIC insurance, PCI DSS, and U.S. financial regulatory standards.

Scalability and Reliability

By using a microservices-based architecture, Chime can handle millions of concurrent transactions without performance drops. This setup allows it to deploy updates frequently while minimizing downtime.

AI and Machine Learning

AI models at Chime analyze spending behavior to detect fraud, automate savings recommendations, and identify credit improvement opportunities for users. Machine learning also powers personalized insights that help users save more and avoid unnecessary spending.

API Ecosystem and Integrations

Chime integrates seamlessly with external financial apps such as Plaid, Venmo, Cash App, and Zelle. Its open API framework ensures compatibility with payment systems and banking APIs used by partners and fintech developers.

Data Analytics and Insights

The app’s analytics engine uses tools like Snowflake and Apache Kafka to process large datasets in real time, generating insights on customer behavior, credit risk, and platform performance.

Chime’s strong technology backbone allows it to deliver banking experiences that feel instant, personal, and secure — proving that modern fintech can outperform legacy banking infrastructure on every level.

Chime’s Impact and Market Opportunity

Chime has played a major role in reshaping how Americans think about banking. By removing traditional barriers like overdraft fees, minimum balances, and branch visits, it has turned digital banking into a lifestyle rather than a service.

Industry Disruption

Before Chime, traditional banks relied heavily on fees and strict lending criteria. Chime’s approach — combining zero fees, automation, and user empowerment — disrupted this model. It proved that a bank could succeed by aligning its business growth with customer financial health.

This disruption forced legacy banks and credit unions to adopt similar digital-first strategies, including early pay access, mobile-first account management, and transparent fee structures.

Market Statistics and Growth

As of 2025, Chime has surpassed 20 million users and processes over $200 billion in annual transaction volume. It holds a strong market share in the neobank segment, competing with brands like SoFi, Varo, and Revolut.

The global neobanking market is valued at $130 billion in 2025 and projected to grow at CAGR 22% through 2030 — driven by users shifting away from legacy financial systems.

User Demographics and Behavior

Most Chime users are Millennials and Gen Z customers aged between 18–40, who prefer digital experiences over physical branches. Many are freelancers, gig workers, and early-career professionals who rely on Chime’s real-time payments and flexible credit options.

Geographic Presence

Chime primarily operates in the United States but plans to expand into Canada and select Latin American markets. It partners with Visa and major U.S. banks for card issuance and global transaction processing.

Future Projections

By 2030, Chime aims to evolve into a full-service digital bank offering investment tools, crypto support, and AI-based wealth management. With its existing infrastructure and user loyalty, it’s well-positioned to dominate the next phase of digital banking evolution.

Opportunities for Entrepreneurs

The success of Chime highlights a growing global opportunity for digital-first neobanks. Entrepreneurs can build platforms targeting underserved regions or specific demographics — such as students, freelancers, or small business owners.

With Chime Clone Script, you can launch a neobank-style platform that includes mobile banking, instant transfers, savings automation, and credit-building tools — all delivered and fully customizable to local regulations.

Building Your Own Chime-Like Platform

Chime’s success shows how focusing on customer trust, technology, and transparency can redefine banking for a digital-first world. Entrepreneurs now have the opportunity to create similar platforms that bring modern banking to new markets or underserved audiences.

Why Businesses Want Chime Clones

The appeal of a Chime-like platform lies in its accessibility and flexibility. Businesses and fintech startups can build neobanks that offer:

- Instant account creation with KYC automation

- No hidden fees or minimum balances

- Early access to paychecks

- Built-in savings automation and financial analytics

- Credit-building tools for users with limited history

A Chime clone empowers startups to launch a mobile-first banking experience without needing to secure a full banking license — instead, they can partner with regulated institutions, just like Chime.

Key Considerations for Development

If you plan to build a Chime-style digital bank, prioritize:

- Regulatory Compliance: Partner with FDIC- or equivalent-insured banks to ensure user fund protection.

- Security Infrastructure: Include encryption, biometric login, and fraud monitoring.

- Automation: Enable automatic savings, instant pay, and recurring transfers.

- User Experience: Keep the interface simple, clean, and mobile-optimized.

- Credit Tools: Offer secured cards or spending insights to help users build healthy credit habits.

- Scalability: Use a cloud-based, API-driven architecture for high performance and easy integration.

Cost Factors & Pricing Breakdown

Chime-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Neobank (MVP Money App) | Digital account creation, eKYC onboarding, basic spending account/wallet, transaction history, simple P2P transfers, bill payments, basic alerts & notifications, admin panel for user & limits management, web dashboard with mobile-responsive experience | $90,000 |

| 2. Mid-Level Chime-Style Money Platform | Full checking-style account features, paycheck/direct deposit flows, basic overdraft-style features, richer transaction categorisation, budgeting & insights, card management hooks, integrations with payment rails/banks, stronger security & audit logs, full web + Android/iOS apps | $160,000 |

| 3. Advanced Chime-Level Digital Banking App | Multi-account setup, advanced card controls & spending limits, early paycheck-style features, fee logic, rewards/cashback hooks, partner integrations (banks, payment providers, fintech tools), advanced risk & fraud monitoring, regulatory/compliance workflows, scalable cloud-native architecture | $260,000+ |

Chime-Style Mobile Banking App Development

The prices above reflect the global market cost of developing a Chime-like digital banking and money management platform — typically ranging from $90,000 to over $260,000, with a delivery timeline of around 4–12 months depending on the mix of banking features, card & payment integrations, risk and compliance requirements, and long-term scalability goals.

Miracuves Pricing for a Chime-Like Custom Platform

Miracuves Price: Starts at $15,999

This starting price is positioned for a feature-rich, JS-based Chime-style money app that can include digital onboarding and eKYC, spending account/wallet, money transfers, bill payments, transaction categorisation, budgeting views, notifications, and modern web + mobile apps—while still leaving room to extend into advanced card controls, early paycheck-style features, rewards, and partner integrations as your product evolves.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational digital banking ecosystem ready for launch and future expansion.

Delivery Timeline for a Chime-Like Platform with Miracuves

For a Chime-style, JS-based custom build, the typical delivery timeline with Miracuves is approximately 30–90 days, depending on:

- The mix of banking features you plan to offer (spending accounts, overdraft-style features, rewards, etc.)

- Number and complexity of integrations (banks/NBFCs, payment gateways, KYC/AML providers, card issuers, bureaus)

- Depth of analytics, dashboards, and compliance/reporting workflows

- Scope of mobile apps, branding requirements, and long-term scalability expectations

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include

- Instant digital onboarding and verification

- Fee-free transactions and overdraft protection

- Savings automation with round-ups and goals

- Credit builder or secured card system

- Instant payment and money transfer modules

- Smart AI-based spending insights

- Admin and user dashboards with full analytics

Read More :- How to Market a Digital Banking App Successfully After Launch

Conclusion

Chime represents more than a digital banking app — it’s a movement toward fair, transparent, and customer-focused finance. By removing unnecessary fees, simplifying credit access, and empowering users to save automatically, Chime has set a new benchmark for how modern banking should feel in 2025.

Its success stems from understanding that people want control, simplicity, and trust — not complicated bank products or hidden charges. With its mobile-first design, early paydays, and AI-driven savings tools, Chime proves that financial technology can serve people better than traditional banks ever did.

For entrepreneurs, Chime’s rise is a roadmap to building meaningful fintech solutions that combine technology and empathy. The demand for accessible digital banking is only growing, especially in emerging markets where users still face high fees or limited financial options.

A well-executed idea can become a scalable business with the right support — and Miracuves can help you make it a reality.

FAQs :-

How does Chime make money?

Chime earns revenue primarily through interchange fees — a small percentage paid by merchants whenever users make purchases using their Chime debit or credit builder cards. It also generates income through banking partnerships and optional premium services.

Is Chime a real bank?

Chime is a neobank, not a traditional bank. It partners with FDIC-insured banks such as The Bancorp Bank and Stride Bank to provide checking, savings, and credit services securely.

How much does Chime charge in fees?

Chime has no monthly fees, no overdraft charges, and no minimum balance requirements. Most services, including account setup, deposits, and transfers, are completely free.

How does Chime’s early direct deposit work?

When an employer sends a paycheck file, Chime credits the user’s account immediately — up to two days earlier than traditional banks. This feature has made Chime especially popular among gig workers and hourly employees.

What is Chime SpotMe?

SpotMe is Chime’s fee-free overdraft service, allowing users to overdraw up to $200 on debit purchases without penalties. The overdraft is automatically adjusted with the next deposit.

Is Chime safe and secure?

Yes. Chime uses bank-level encryption, real-time transaction alerts, two-factor authentication, and AI-based fraud monitoring to ensure user safety. All deposits are FDIC-insured up to $250,000.

Can I build an app like Chime?

Yes. With Chime Clone Script, you can develop a secure, customizable neobank platform featuring instant deposits, savings automation, and credit-building modules — launched .

What makes Chime different from traditional banks?

Unlike traditional banks that rely on fees and minimum balances, Chime focuses on accessibility and automation — providing a modern, app-based experience without extra costs.

How many users does Chime have?

As of 2025, Chime serves over 20 million users and processes more than $200 billion in annual transaction volume.

How can I create a Chime-like neobank app?

Partner with Miracuves to build your own digital banking solution. Their Chime Clone Solution includes onboarding, instant transfers, AI-driven savings tools, and full customization — ready to launch .

Related Articles :-