Rakuten, founded in Japan in 1997 by Hiroshi Mikitani, started as an e-commerce marketplace before expanding into a global cashback and rewards ecosystem. The company’s U.S. arm (formerly Ebates) became the foundation of Rakuten’s international cashback empire after its acquisition in 2014.

Fast-forward to 2025, Rakuten now partners with over 3,500 retailers worldwide—including giants like Walmart, Amazon, Macy’s, and Sephora—offering users cashback on purchases, travel, and even food delivery. The platform has over 20 million active users globally, rewarding billions in cashback every year.

Rakuten isn’t just a cashback app—it’s a loyalty powerhouse transforming how consumers interact with brands.

What is Rakuten? The Simple Explanation

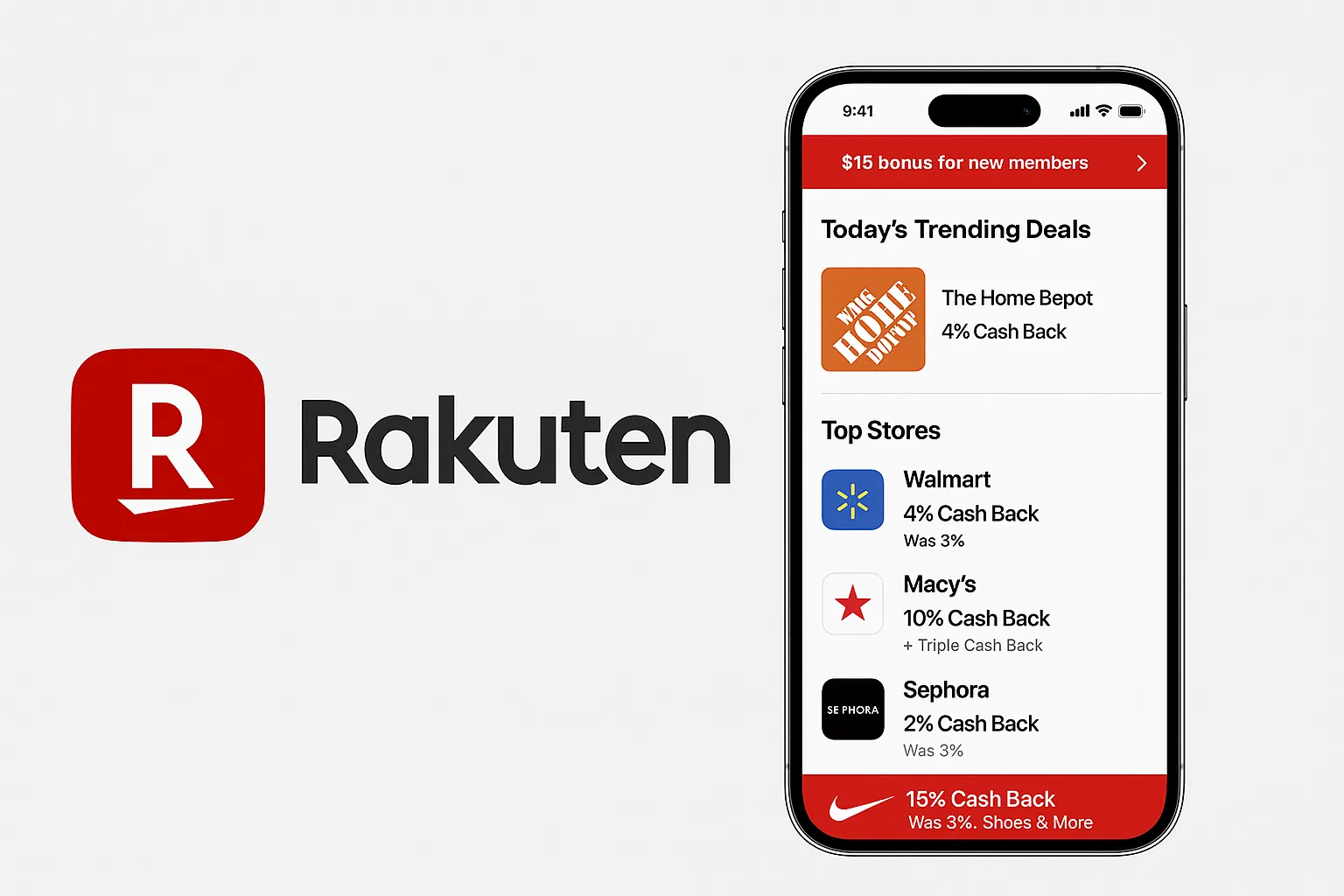

Rakuten is a cashback and rewards app that gives users a percentage of their money back every time they shop online or in-store through its partner retailers. Instead of earning traditional loyalty points, Rakuten lets you earn real cash — which you can withdraw directly to your PayPal or bank account.

The app solves a common problem: most people shop online without realizing they could be saving money on every purchase. Rakuten bridges that gap by rewarding customers for something they’re already doing — shopping.

Its target audience includes online shoppers, frequent travelers, and bargain hunters looking to save on everything from groceries to luxury fashion. Businesses also benefit by driving more sales through Rakuten’s affiliate partnerships.

As of 2025, Rakuten’s cashback network spans 3,500+ partner stores and serves over 20 million active users globally. It has distributed more than $3.5 billion in cashback rewards, maintaining its status as one of the top loyalty platforms in the world.

Rakuten became successful because it aligned incentives — shoppers save, and retailers gain new customers. Its simple, frictionless model turned cashback into a global shopping habit.

How Does Rakuten Work? Step-by-Step Breakdown

Rakuten’s magic lies in its simple but smart system — connecting shoppers, retailers, and rewards seamlessly. Here’s how it all works:

For Users (Shoppers)

- Sign Up or Log In

Users can create a free account via the Rakuten app or website. Once logged in, they browse partner stores or use the in-app browser extension. - Shop Through Rakuten

Instead of going directly to a retailer’s website, users access it through Rakuten’s portal. This allows Rakuten to track purchases and apply cashback automatically. - Earn Cashback

When a purchase is completed, Rakuten earns a commission from the retailer and shares a portion of that commission with the shopper — typically 1% to 15%, depending on the store or promotion. - Get Paid

Every quarter, Rakuten sends users their accumulated cashback as PayPal deposits or “Big Fat Checks.” It’s real money — not points — and users love that transparency.

Example:

You buy $100 worth of products from Nike via Rakuten. Nike pays Rakuten a 10% referral fee ($10), and Rakuten gives you $5 as cashback — simple and rewarding.

For Service Providers & Retailers

- Onboarding Process

Retailers join Rakuten’s affiliate program to attract customers and increase conversions. - How They Operate

Each sale made through Rakuten’s referral links is tracked using cookies or APIs. Retailers pay a small commission to Rakuten for driving traffic and confirmed purchases. - Earnings/Commission Structure

Rakuten takes a percentage of this commission and gives the rest to users.

- Typical structure:

- Retailer → Rakuten: 10% commission

- Rakuten → User: 5% cashback

- Rakuten keeps: 5%

- Typical structure:

This win-win ecosystem fuels both brand loyalty and retailer growth.

Technical Overview (Simple Terms)

Rakuten’s platform operates like a smart affiliate engine.

- When you click a Rakuten link, a tracking ID tags your purchase.

- When you buy, Rakuten’s system confirms the transaction via API integration with the retailer.

- Cashback is credited automatically to your Rakuten wallet.

Key Technologies Used:

- AI-driven recommendations for personalized deals

- Cloud-based tracking for real-time purchase validation

- Data analytics engines to optimize cashback rates and retailer performance

- Secure payment APIs for PayPal and direct deposits

Rakuten’s Business Model Explained

Rakuten’s business model is a perfect example of affiliate marketing at scale, powered by data, loyalty, and trust. It brings together shoppers, retailers, and advertisers in a symbiotic ecosystem where everyone wins — users earn cashback, retailers gain customers, and Rakuten earns commissions for facilitating those sales.

How Rakuten Makes Money

Rakuten earns revenue through affiliate commissions, advertising, and business partnerships.

Here’s how it works:

- Affiliate Commission Model (Core Revenue Stream)

When users make purchases through Rakuten links, retailers pay Rakuten a referral commission, typically between 4–10% of the sale value.

Rakuten then shares a portion (usually 50–70%) of this commission with the shopper as cashback.

Example:

- User buys $200 from Sephora via Rakuten.

- Sephora pays Rakuten 10% ($20).

- Rakuten gives $12 cashback to the user and keeps $8 as profit.

- Retail Advertising & Promotions

Retailers can pay Rakuten for premium visibility — such as banner placements, featured listings, or sponsored deals. This drives more clicks and conversions during seasonal campaigns. - Rakuten Card & Financial Services

Rakuten also monetizes through its own ecosystem — offering Rakuten credit cards, mobile payments, and fintech integrations. Users earn extra cashback when paying with Rakuten’s payment products. - Data & Analytics Services

With millions of transactions processed daily, Rakuten provides consumer behavior insights to partner retailers, helping them optimize campaigns and pricing strategies.

Pricing Structure for Retailers

Rakuten’s affiliate partnerships typically include:

- Base Commission Rate: 1–15% of each sale

- Performance Bonuses: Higher rates for high-volume or exclusive partnerships

- Advertising Add-ons: Custom campaigns for featured placements

Retailers only pay when a verified sale occurs — making Rakuten a low-risk, high-reward marketing channel.

Market Size & Growth Stats (2025 Update)

- Global cashback market size (2025): $145+ billion

- Rakuten user base: 20+ million active users across the U.S., Japan, and Europe

- Annual cashback payouts: Over $3.5 billion distributed to shoppers

- Average user earnings: $150–$200/year in cashback

- Top partners: Walmart, Nike, Amazon, Expedia, Macy’s, and Sephora

Rakuten’s loyalty-driven model has kept its user base growing at 12–15% annually, even in competitive markets.

Profit Margins Insights

Rakuten’s affiliate model allows high scalability with minimal overhead, yielding:

- Gross margins: ~45–55%

- Net margins: 10–15% after cashback payouts

- Top growth segments: Fintech, travel bookings, and mobile cashback

By blending cashback with advertising and payments, Rakuten has diversified revenue streams beyond traditional e-commerce — ensuring long-term sustainability.

| Revenue Source | Description | % of Total Revenue (2025) |

| Affiliate Commissions | Core cashback partnerships | 55% |

| Retail Advertising | Sponsored listings & promos | 20% |

| Rakuten Financial Services | Cards, payments, fintech | 15% |

| Data Analytics | Retail insights & analytics | 10% |

Rakuten’s business success lies in aligning user value with corporate growth — every dollar earned by Rakuten represents real savings for its users, creating a sustainable feedback loop of loyalty and trust.

Key Features That Make Rakuten Successful

Rakuten’s success in 2025 isn’t accidental — it’s the result of powerful features that combine simplicity, rewards, and technology to deliver an unmatched shopping experience. Let’s break down what makes this app so effective and widely loved.

1. Cashback on Every Purchase

The cornerstone of Rakuten’s appeal — users earn cashback when shopping from any of 3,500+ partner stores. The cashback percentages vary from 1% to 15%, turning daily shopping into consistent savings.

2. Browser Extension (Rakuten Button)

A brilliant innovation that detects cashback offers automatically when users visit an eligible site. It removes friction — you don’t need to open the Rakuten app; the extension activates cashback instantly.

3. In-Store Cashback

Beyond online shopping, Rakuten also rewards in-store purchases. By linking a debit or credit card to Rakuten, users can earn cashback at partnered physical stores and restaurants.

4. Seasonal Double Cashback Events

Rakuten runs limited-time promotions offering double or even triple cashback during sales seasons like Black Friday, Cyber Monday, and holidays — driving user excitement and retention.

5. Referral & Loyalty Program

Users earn bonuses for referring friends (e.g., $30 per successful referral in 2025). This viral growth mechanic helped Rakuten surpass 20 million global users.

6. Rakuten Travel & Entertainment Offers

Rakuten has expanded into flights, hotels, car rentals, and experiences. It’s now a one-stop platform for cashback on travel bookings, rivaling platforms like Expedia and Booking.com.

7. AI-Powered Deal Recommendations

Using machine learning, Rakuten personalizes offers based on user behavior, location, and past purchases — ensuring every shopper sees relevant deals.

8. Rakuten Wallet Integration

Users can track, redeem, and transfer cashback through Rakuten Wallet, which supports PayPal payouts and direct bank transfers for seamless financial flow.

9. Rakuten Gift Cards & Coupons

The app includes exclusive discount codes and vouchers from partnered brands, further increasing user savings and engagement.

10. Multi-Device Synchronization

A unified experience across web, iOS, Android, and browser extensions, ensuring users never miss cashback opportunities regardless of where they shop.

2025 Updates & AI Integrations

Rakuten has upgraded its platform with cutting-edge technologies in 2025:

- AI Chat Assistant: Helps users find the best deals, answer questions, and recommend stores in real time.

- Predictive Cashback Insights: AI predicts potential savings across categories, encouraging smarter purchases.

- Voice Activation (via Siri & Alexa): Users can now ask “What’s my cashback balance?” or “Find me stores offering cashback on electronics.”

- Rakuten+ for Premium Members: A subscription tier offering higher cashback rates and early access to limited-time promotions.

These innovations have positioned Rakuten as both a shopping assistant and a financial companion, not just a rewards app.

What Sets Rakuten Apart from Competitors

| Feature | Rakuten | Competitors (e.g., Honey, Ibotta) |

| Cashback on 3,500+ brands | ✅ Yes | ⚠️ Limited |

| Automatic browser tracking | ✅ Yes | ⚠️ Requires manual activation |

| Travel & entertainment rewards | ✅ Included | ❌ Not available |

| AI & voice integration | ✅ 2025 rollout | ⚠️ Basic personalization |

| Direct PayPal & bank payouts | ✅ Yes | ✅ Yes |

| Global presence | 🌍 20+ countries | 🇺🇸 Mostly US-based |

Rakuten’s multi-dimensional platform — spanning e-commerce, travel, and fintech — gives it a long-term edge in the loyalty market.

The Technology Behind Rakuten

Rakuten may look like a simple cashback app on the surface, but under the hood, it’s a powerful technology ecosystem that seamlessly integrates AI, cloud infrastructure, and secure payment systems. Let’s break down how it works behind the scenes — in plain language.

Tech Stack Overview (Simplified)

Rakuten’s platform operates across multiple services — e-commerce, payments, advertising, and analytics. Its modern architecture allows millions of users to shop, track cashback, and redeem rewards in real time.

| Layer | Technologies Used (Simplified) | Purpose |

| Frontend | React.js, Next.js, Swift (iOS), Kotlin (Android) | Smooth, responsive user interfaces across web & mobile |

| Backend | Node.js, Java Spring Boot | Processes cashback calculations, transactions, and API requests |

| Database | PostgreSQL, MongoDB | Stores user data, cashback logs, and retailer integrations |

| Cloud Infrastructure | AWS, Google Cloud | Ensures global scalability and uptime |

| Payments & Wallet | PayPal APIs, Stripe, Rakuten Wallet | Handles payouts, card linking, and in-store cashback |

| AI & Analytics | TensorFlow, Python, BigQuery | Personalizes deals, detects fraud, and forecasts user behavior |

This combination ensures Rakuten can process millions of transactions per day with 99.9% uptime.

Real-Time Features Explained

Rakuten’s real-time cashback system uses affiliate tracking and event-based architecture:

- When a user clicks a retailer link, Rakuten attaches a unique tracking ID.

- The retailer confirms the sale via API callback.

- Rakuten verifies and credits cashback instantly to the user’s account.

This real-time system minimizes delays and provides instant satisfaction — a key reason users keep coming back.

Data Handling & Privacy

Rakuten treats data as a valuable asset — with strict compliance to GDPR, CCPA, and global data protection laws.

- End-to-End Encryption: All transaction data is encrypted at rest and in transit.

- Anonymized Analytics: User identities are masked in Rakuten’s AI models.

- Fraud Detection: Machine learning flags suspicious activities like fake referrals or duplicate transactions.

With over 20 million users worldwide, trust and transparency remain Rakuten’s biggest technological priorities.

Scalability Approach

Rakuten’s cloud-based infrastructure is built for global growth. Using microservices and containerization (Docker, Kubernetes), the company can deploy updates and add new retailers without downtime.

This modular approach allows Rakuten to easily scale across markets like Japan, the U.S., and Europe while maintaining localized pricing, currencies, and languages.

Mobile App vs. Web Platform

Both the Rakuten app and web portal share the same backend, ensuring consistent cashback synchronization across devices.

- Mobile App (iOS/Android): Push notifications for deals, card-linked offers, and quick payouts.

- Web Extension: Auto-activates cashback when visiting eligible sites.

Users can start shopping on their phone and finish checkout on desktop — Rakuten tracks it all seamlessly.

API Integrations

Rakuten connects with thousands of global retailers through affiliate network APIs and SDKs. These integrations handle:

- Real-time sale verification

- Cashback rate synchronization

- Store-specific promo updates

- Secure payment routing

For developers, Rakuten even provides APIs to integrate cashback features into third-party apps or fintech products — expanding its ecosystem.

Why This Tech Matters for Business

Rakuten’s tech backbone delivers three major business advantages:

- Speed: Real-time tracking builds user trust and retention.

- Scalability: Modular systems allow fast international expansion.

- Security: Encrypted data handling ensures brand reliability.

By combining AI with cloud-based agility, Rakuten has built one of the most efficient loyalty platforms in the world — capable of handling billions in cashback transactions annually.

Rakuten’s Impact & Market Opportunity

Rakuten’s success story goes far beyond cashback — it’s about transforming global shopping behavior. The brand has reshaped how millions of people interact with e-commerce platforms, pushing the entire retail industry toward data-driven loyalty ecosystems.

Let’s explore Rakuten’s market impact, growth trajectory, and opportunities for entrepreneurs in 2025.

Industry Disruption Caused by Rakuten

Rakuten pioneered the concept of “cashback as customer retention” — a system where savings are not just incentives but experiences. Instead of competing on discounts like Amazon or coupon apps, Rakuten focuses on long-term loyalty through rewards.

Its model disrupted traditional affiliate marketing by:

- Turning affiliate commissions into direct user incentives.

- Creating an ecosystem where retailers gain repeat buyers instead of one-time shoppers.

- Integrating AI-driven personalization to tailor deals uniquely for each user.

Rakuten’s success inspired a wave of similar models globally, from TopCashback in the UK to CashKaro in India — all echoing its blueprint.

Market Statistics and Growth (2025 Snapshot)

| Metric | Rakuten (2025) | Industry Benchmark |

| Active Users | 20+ million | 12 million (avg competitors) |

| Partner Retailers | 3,500+ | 2,000 avg |

| Cashback Paid Out | $3.5+ billion | $1.8 billion avg |

| Global Market Share | ~25% | N/A |

| Annual Revenue | $2.4 billion+ | — |

Rakuten dominates 25% of the global cashback and rewards market, making it the undisputed leader.

Its consistent reinvestment in AI, fintech, and advertising has allowed it to expand beyond cashback — into Rakuten Pay, Rakuten Bank, and Rakuten Travel, forming a full-circle loyalty and financial ecosystem.

User Demographics & Behavior

Rakuten’s user base spans a wide age range, but millennials and Gen Z dominate the platform.

- Age Groups: 25–44 years form 60% of users.

- Gender Split: 55% female, 45% male.

- Shopping Categories: Fashion, electronics, travel, and groceries are top-performing sectors.

- Average Cashback Per User: $150–200 annually.

Interestingly, over 70% of Rakuten’s users say they choose stores based on cashback rates — proving the emotional pull of saving while shopping.

Geographic Presence

Rakuten operates in more than 20 countries, with major markets including:

- Japan (HQ) — Its strongest and oldest market.

- United States — Acquired Ebates to dominate North America.

- Europe — Growing rapidly in the UK, Germany, and France.

- Southeast Asia — New focus markets for travel and e-commerce integration.

In 2025, Rakuten also began testing localized cashback programs in the Middle East and India, targeting the rapidly growing digital shopping populations.

Future Projections

Analysts predict the cashback and rewards industry will surpass $190 billion by 2030, with Rakuten expected to retain a strong market lead. Key growth factors include:

- Expansion into AI-powered loyalty experiences.

- Integration with crypto wallets for tokenized cashback.

- Partnerships with super apps and fintech startups.

- Increasing demand for privacy-first, non-intrusive advertising.

By 2030, Rakuten could easily serve 50+ million active users, especially as mobile commerce continues to surge globally.

Opportunities for Entrepreneurs

Rakuten’s rise has opened a new frontier for startups — cashback and loyalty app development. Businesses across retail, fintech, and e-commerce now aim to build Rakuten-like platforms to capitalize on the rewards economy.

Entrepreneurs can replicate Rakuten’s success by:

- Launching niche cashback platforms (e.g., groceries, travel, gaming).

- Integrating AI-driven personalization for better engagement.

- Adding multi-vendor support and digital wallets for instant redemption.

- Building transparent affiliate partnerships with measurable ROI.

This leads perfectly into the next section — how to build your own Rakuten-like platform using Miracuves’ ready-made technology.

Transition

Rakuten’s global dominance proves one thing: reward-based loyalty apps are the future of digital commerce.

Its growth story continues to inspire entrepreneurs who want to tap into this billion-dollar industry with customized cashback and rewards platforms.

Building Your Own Rakuten-Like Platform

Rakuten’s success shows how a simple idea — giving back a portion of spending — can become a multi-billion-dollar business when paired with the right technology. If you’re an entrepreneur or business owner looking to enter this booming cashback market, here’s how you can build your own Rakuten-like platform in 2025.

Why Businesses Want Rakuten Clones

Cashback apps aren’t just about saving money — they build trust, retention, and long-term customer loyalty.

Brands and startups want to create their own Rakuten-style platforms because:

- Consumer demand for rewards is skyrocketing.

70% of shoppers prefer stores offering cashback or points. - Affiliate revenue is booming.

The global affiliate marketing market is projected to exceed $22 billion by 2026. - Loyalty drives retention.

Cashback-based platforms increase repeat purchases by up to 40%.

By launching a Rakuten-like app, businesses can tap into both consumer loyalty and merchant partnerships, earning steady commissions while rewarding users.

Key Considerations for Development

To build a successful cashback platform, you’ll need to focus on these essentials:

- Affiliate Network Integration

Connect to global or regional affiliate networks (like CJ, Awin, or ShareASale) to automatically fetch offers and track transactions. - Real-Time Cashback Tracking

Build an API-based system that records every sale, validates it with the retailer, and updates user wallets instantly. - Wallet & Payout System

Integrate payment gateways for direct deposits, PayPal transfers, or gift card redemptions. - AI Recommendation Engine

Use machine learning to suggest relevant stores, deals, or seasonal promotions to users. - Cross-Platform Accessibility

Offer a web version, mobile app, and browser extension for seamless user experiences. - Scalability & Data Security

Deploy using cloud-based architecture (AWS, GCP, or Azure) for global reach with encrypted user data handling.

Cost Factors & Pricing Breakdown

Building a Rakuten-style cashback and rewards marketplace from scratch requires affiliate integrations, merchant dashboards, user wallets, cashback calculation logic, and real-time tracking. Below is the global benchmark for development cost.

Rakuten-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

| Basic Cashback MVP | Merchant list, basic affiliate link routing, simple wallet, user profile | $50,000 |

| Mid-Level Cashback System | Affiliate API integrations, reward engine, merchant onboarding, withdrawal module, mobile apps | $90,000 |

| Advanced Cashback Platform (Rakuten-scale) | Global affiliate APIs, advanced cashback routing, coupon engine, multi-language, analytics, high concurrency backend, native mobile apps | $150,000+ |

Rakuten-Style Store Development

These amounts reflect the global market cost of building a Rakuten-style affiliate + cashback platform from scratch, generally requiring 6–12 months of development depending on integrations and scale.

Miracuves Rakuten-Style Cashback Platform Pricing

Miracuves Price: Starts at $13,999

This delivers a feature-rich cashback and rewards ecosystem with merchant onboarding, affiliate link tracking, user wallets, cashback workflows, coupon management, and mobile apps—built on a modern, scalable architecture.

Note: This includes full non-encrypted source code, complete deployment support, backend setup, admin panel configuration, and publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational ecosystem ready for launch and future expansion.

Delivery Timeline for Rakuten-Style Platform

Miracuves development timeline including setup, configuration, admin deployments, API integrations, and platform handover in approximately 30–90 days, depending on customization and additional functional layers requested. This ensures a stable, market-ready system with predictable delivery and no hidden engineering delays

Tech Stack

We preferably will be using JavaScript for the entire platform (Node.js, Next.js, PostgreSQL) and Flutter/React Native for mobile apps to ensure performance, scalability, and easier multi-platform deployment.

Essential Features to Include

Your Rakuten-like platform should include:

- User registration & profile management

- Retailer onboarding panel

- Cashback calculation & history

- Affiliate tracking & API integration

- Wallet system for cashback payouts

- Push notifications for offers

- Referral & bonus system

- Real-time analytics dashboard

- Admin control panel

These ensure your platform functions efficiently and keeps both shoppers and retailers engaged.

Build Your Own Cashback App Like Rakuten Turn your business idea into a thriving cashback platform. Contact Us to get a personalized quote today!

Conclusion

Rakuten’s story is a masterclass in how technology, trust, and timing can transform a simple idea — cashback on purchases — into a multi-billion-dollar ecosystem. By rewarding shoppers and empowering retailers, Rakuten has built one of the most powerful loyalty networks in the digital world.

In 2025, as consumers demand personalized, transparent, and value-driven experiences, Rakuten continues to lead the cashback revolution. Its combination of AI recommendations, real-time tracking, and global partnerships makes it far more than just a cashback app — it’s a smart financial companion that helps users shop better and save effortlessly.

FAQs

Q:1 How does Rakuten make money?

Rakuten earns revenue primarily through affiliate commissions from partner retailers. When a shopper buys something through Rakuten, the retailer pays Rakuten a commission, and Rakuten shares part of it with the user as cashback.

Q:2 Is Rakuten available in my country?

Yes. As of 2025, Rakuten operates in 20+ countries, including the United States, Japan, the UK, Canada, France, and India, with expansion plans for Southeast Asia and the Middle East.

Q:3 How much does Rakuten charge users?

Rakuten is completely free to use. Users don’t pay any subscription or transaction fees — they earn cashback directly from Rakuten’s partner stores.

Q:4 What’s the commission for service providers or retailers?

Retailers typically pay 5–15% commission on verified sales made via Rakuten links. A portion of this is shared with shoppers as cashback, and the rest is Rakuten’s profit margin.

Q:5 How does Rakuten ensure safety and privacy?

Rakuten uses encrypted data processing, GDPR-compliant privacy policies, and AI-driven fraud detection to protect users’ data and transactions.

Q:6 Can I build something similar to Rakuten?

Absolutely. With Miracuves’ Rakuten Clone Script, you can build a cashback and rewards app with real-time tracking, wallet integration, and multi-store partnerships.

Q:7 What makes Rakuten different from competitors?

Rakuten’s global reach, real cashback system, AI-driven deal personalization, and multi-industry partnerships (shopping, travel, entertainment) make it more versatile than typical coupon or discount apps.

Q:8 How many users does Rakuten have?

Rakuten has 20+ million active users worldwide and has distributed over $3.5 billion in cashback rewards to date.

Q:9 What technology does Rakuten use?

Rakuten’s tech stack includes React.js, Node.js, AWS Cloud, TensorFlow, and PayPal API integrations, ensuring speed, scalability, and data security.

Q:10 How can I create an app like Rakuten?

You can create your own Rakuten-like cashback app using Miracuves’ ready-made Rakuten Clone Solution, featuring real-time tracking, wallet integration, and affiliate APIs

Related Articles: