So, there you are—scrolling through your phone at 1 a.m., reading yet another headline about someone turning a $50 crypto trade into a Lambo. You’re intrigued. You’ve got ambition, a business idea, maybe even a Telegram group of fellow crypto-curious friends. But there’s a snag: navigating the world of crypto exchanges can feel like trying to open a bank account on Mars.

Enter Ramitano—a platform that’s been quietly turning everyday folks into crypto traders, one peer-to-peer transaction at a time.

For entrepreneurs and startup founders hunting for the next “aha!” moment or app idea, Ramitano is more than just an app. It’s a blueprint for decentralized exchange made simple. And if you’re thinking, “Could I launch my own Ramitano-style app?”—well, that’s where Miracuves jumps in with cape and keyboard.

What is the Ramitano App?

The Basics: P2P Trading for the People

Ramitano is a peer-to-peer (P2P) cryptocurrency trading app that allows users to buy and sell crypto directly with each other. Think of it as Craigslist meets Coinbase—but with fewer spammy ads and more blockchain.

The app connects buyers and sellers, holds funds in escrow, and releases the crypto only when both parties confirm the deal. No middlemen. No unnecessary fees. Just pure person-to-person trading with a safety net.

Key Features of Ramitano (And Why Users Love It)

Multi-Crypto Support

From Bitcoin and Ethereum to Tether and Litecoin, Ramitano isn’t just a Bitcoin exchange—it’s a full crypto buffet. This flexibility opens doors for seasoned investors and newbies alike.

Escrow-Based Security

Ramitano’s escrow system holds the crypto until both buyer and seller confirm the transaction. This trust mechanism is the secret sauce that keeps fraud at bay.

Local Currency Transactions

Unlike global-only platforms, Ramitano allows trades in local fiat currencies. Whether it’s NGN, VND, or MYR—users can cash in and out with ease.

In-App Wallet

The built-in crypto wallet makes it easy for users to store, send, and receive funds—all without ever leaving the app.

Community & Forums

Not just a trading app—Ramitano builds community. Users can post questions, share tips, and report suspicious behavior within the platform.

How Ramitano Works (Under the Hood)

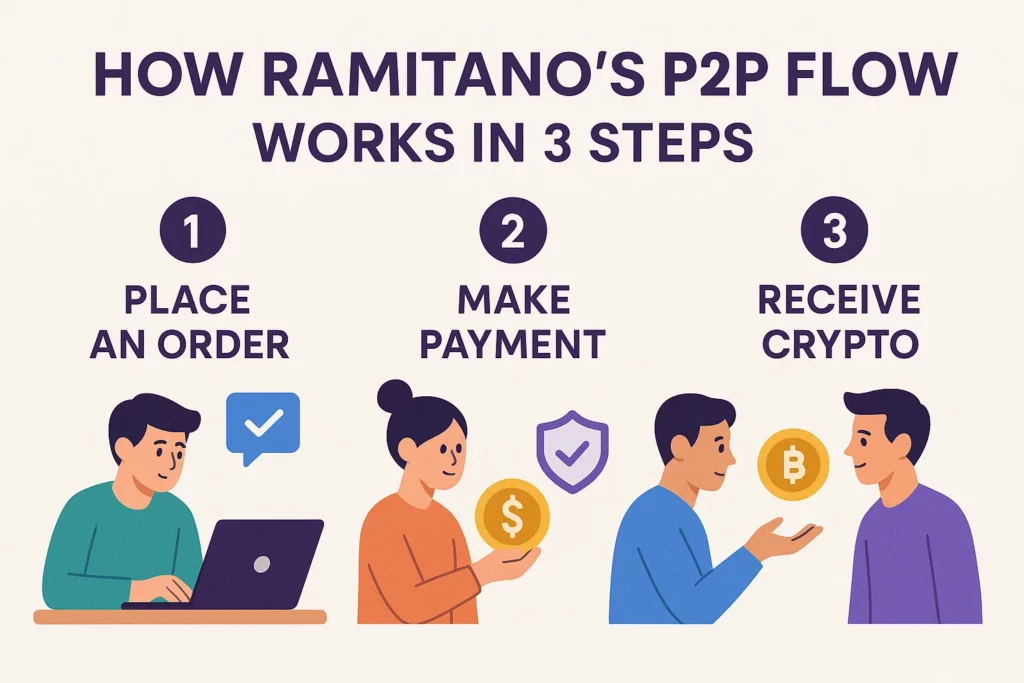

Step-by-Step User Flow

- Sign Up & KYC – Users create an account and verify their identity.

- Browse Offers – Buy or sell orders are listed by real users.

- Initiate Trade – Select an offer and begin trade via in-app chat.

- Escrow Activation – Crypto is temporarily held by Ramitano.

- Payment & Confirmation – Fiat payment happens via bank or mobile transfer.

- Crypto Release – Once confirmed, the crypto is released to the buyer.

That’s it. No confusing wallets. No 10-step blockchain gymnastics. Just straight-up value exchange.

Also Read :-How Much Does It Cost to Build a Peer-to-Peer Cryptocurrency Marketplace in 2025

Why Ramitano’s Model Works for Startups

The genius of Ramitano lies in its low-overhead, high-engagement model. Instead of operating as a centralized exchange with all the regulatory headaches, it functions more like a crypto marketplace.

Key Business Model Drivers

- Transaction Fees – A small percentage from each completed trade.

- Premium Listings – Featured buy/sell ads on top of listings.

- In-App Wallet Charges – For withdrawals or faster transfers.

It’s monetization 101—with crypto flavor.

And guess what? You can absolutely build your own version.

Want to Build a Ramitano Clone? Here’s What You’ll Need

Core Components

- User Onboarding with KYC

- Multi-Currency Wallet Integration

- Escrow Smart Contracts

- Trade Engine & Order Matching

- Chat & Dispute Resolution System

- Admin Dashboard & Analytics

And let’s not forget a seamless UX—because let’s face it, no one wants to trade crypto on a clunky, slow-loading app in 2025.

Read More :-Best Ramitano Clone Scripts in 2025: Features & Pricing Compared

Monetization Models for Your Ramitano-Like App

Why just build an app when you can build a business?

Multiple Revenue Streams

- Trading Fees – Percentage cuts per transaction.

- Withdrawal/Deposit Charges – Optional, adjustable by admin.

- Ad Placement – Offer paid listing boosts.

- Affiliate Program – Grow organically by rewarding referrals.

- Premium KYC Tiers – Unlock more trading power with higher verification.

The beauty of the P2P model is that it’s scalable and requires less operational overhead than centralized alternatives.

Real-Life Use Cases of Ramitano

Entrepreneurs in Emerging Markets

In countries like Nigeria, Malaysia, and Vietnam, Ramitano became a go-to alternative when traditional banking failed to meet modern digital needs.

Side-Hustlers & Traders

Freelancers and digital nomads often use it to convert payments into local currency without waiting days or losing to poor exchange rates.

Micro Investors

Those dipping their toes into crypto appreciate Ramitano’s low entry barrier—no massive upfront investment needed.

What’s Next for Ramitano-Style Apps?

The world is shifting toward decentralized finance (DeFi), and P2P models like Ramitano’s are poised to thrive. Expect integrations with NFT marketplaces, DeFi lending, and even cross-chain trading in the near future.

Whether you’re a startup founder or an investor eyeing your next app play, the timing has never been better.

Read More :-Reasons startup choose our Ramitano clone over custom development

Conclusion

Ramitano isn’t just another crypto app—it’s a living case study of how peer-to-peer trust can fuel financial freedom. From intuitive design to strong security layers, it’s the kind of platform that makes you think: “I could build something like this…”

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Is Ramitano a decentralized exchange?

Not fully. While it’s peer-to-peer, Ramitano still acts as an intermediary for security and escrow purposes.

Can I use Ramitano without completing KYC?

Some features may be accessible without full KYC, but trading typically requires verification to prevent fraud.

How does escrow work in Ramitano?

Ramitano temporarily holds the seller’s crypto until the buyer confirms payment, ensuring both sides play fair.

What fees does Ramitano charge?

Fees vary by transaction type and crypto. Usually, it ranges from 0.5% to 1%.

Can I integrate a Ramitano clone into my existing fintech platform?

Absolutely. A custom clone can be designed to plug into existing ecosystems like e-wallets, investment apps, or remittance solutions.

How long does it take to develop a Ramitano clone?

With the right tech partner (hey, that’s us!), you could launch a working MVP in as little as 4–6 weeks.