Picture this: instead of paying for car insurance based on your age, ZIP code, or credit score, your price is mostly based on how you actually drive. You download an app, drive for a few weeks, and the app quietly measures your braking, speed and focus to offer a personalized rate. That’s the core promise of Root Insurance.

Root Insurance is a U.S.-based, app-first auto insurer that uses smartphone telematics to price policies primarily on real driving behavior, not just traditional risk factors. It launched in the mid-2010s with a mission to make car insurance fairer and more data-driven. Over the years, Root has grown into a leading usage-based insurance (UBI) player, and by 2025 it is active in around 35 U.S. auto markets, from California and Florida to Texas and New York.

The company has seen significant premium growth, with gross premiums written rising from about $600 million in 2022 to over $1.3 billion in 2024, reflecting strong traction in telematics-driven auto insurance. At the same time, the broader usage-based auto insurance market is booming globally, projected to reach well over $200 billion by 2030, which gives Root a strong tailwind.

By the end of this guide, you’ll clearly understand what Root Insurance is, how its app and telematics-based pricing work, how it makes money, the technology behind it, and why many founders are now exploring Root-style insurance platforms that can be built and launched with the help of Miracuves.

What Is Root Insurance? The Simple Explanation

Root Insurance is a U.S.-based auto insurance company that uses smartphone telematics to determine how much you pay. Instead of relying mainly on traditional factors like age, ZIP code, or credit score, Root measures how you actually drive through its mobile app. Your braking, speed, distraction level, and smoothness behind the wheel all influence your personalized rate.

The Core Problem Root Solves

Traditional insurance pricing often feels unfair because it groups people into broad categories. Root solves this by rewarding good driving habits with lower premiums and offering a much more transparent, data-driven alternative.

Target Users

Root primarily serves:

• Safe drivers who want fair pricing based on behavior

• Younger drivers who don’t benefit from traditional scoring models

• Tech-savvy users comfortable with app-based insurance

• Drivers looking for cheaper, flexible, usage-based (UBI) plans

Market Position in 2025

By 2025, Root is recognized as one of the leading app-first auto insurers using behavioral telematics. The company’s customer base has grown in states where usage-based pricing is popular, and its mobile-first model keeps acquiring younger drivers attracted to fairer, tech-driven insurance.

Why It Became Successful

Root succeeded because it built insurance around how people actually live today—through their phones. Fast quotes, app-based claims, and personalized pricing create a simple, modern experience compared to the complex, paperwork-heavy world of traditional insurers.

How Root Insurance Works — Step-by-Step Breakdown

For Drivers (Users)

Signup & App Setup

A driver downloads the Root app and provides basic details—vehicle info, location, and license details. The app immediately begins a test-drive period, typically a few weeks, to understand how the user drives.

Driving Behavior Tracking

Root uses smartphone sensors (accelerometer, GPS, gyroscope) to measure:

- Braking smoothness

- Speed consistency

- Cornering

- Phone distraction

- Time of day you drive

- Road types

This data helps Root understand whether someone is a safe or risky driver.

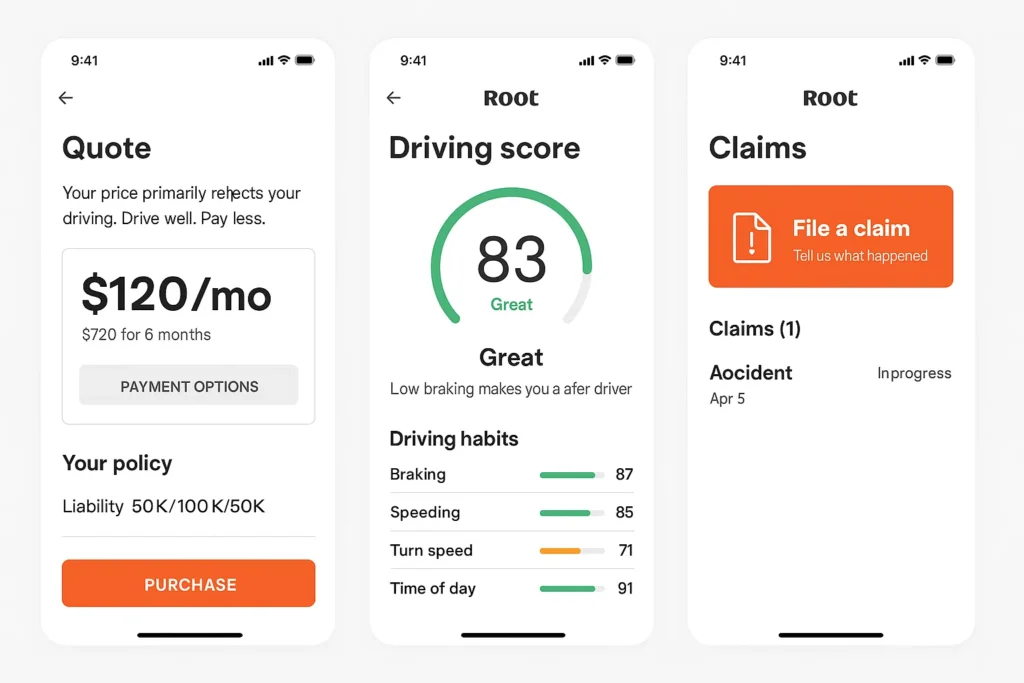

Personalized Quote

After the test-drive, the app generates a custom insurance rate based primarily on the user’s actual driving behavior. Safer drivers get noticeably lower premiums.

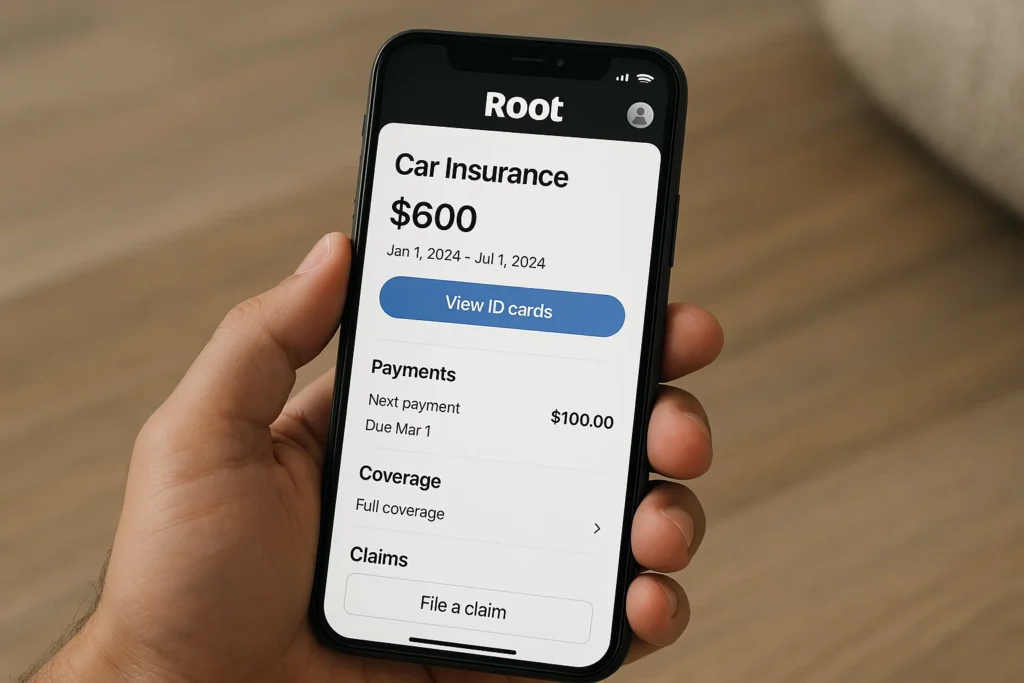

Policy Management

Once the user accepts a quote, everything is managed inside the app:

- ID cards

- Payments

- Roadside assistance

- Adjustments and renewals

Filing Claims

Users can file claims directly from the app by uploading photos, answering guided questions, and tracking claim progress. The digital-first experience removes delays and manual paperwork.

Example User Journey

A new driver installs the app, completes a two-week driving evaluation, receives a lower-than-expected quote (because they drive safely), and manages their entire policy through the app without calling an agent.

For Service Providers (Repair Shops, Towing)

Onboarding

Service providers integrate into Root’s partner network after basic credentialing and compliance checks.

Operation

They handle repairs, towing, or inspections requested by Root when a customer files a claim. Updates, documentation, and billing are shared digitally through integrated tools.

Earnings

Providers are paid service fees or agreed rates depending on the task performed—repair, towing, inspection, etc.

Technical Overview (Simplified)

Root’s system works through a combination of telematics, mobile technology, and data science:

- Smartphone sensors capture real-world driving behavior.

- AI models evaluate driving risk and generate personalized pricing.

- Cloud-based systems handle policies, payments, and claims.

- APIs connect Root with roadside partners, repair shops, and verification systems.

- App notifications keep users updated on claims, billing, and driving score progress.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Root Insurance’s Business Model Explained

How Root Insurance Makes Money

Root operates as a full-stack auto insurer, generating revenue primarily through:

- Policy Premiums: Monthly or annual payments from insured drivers.

- Underwriting Profit: The difference between collected premiums and claims paid out.

- Investment Income: Earnings from investing premium reserves (standard insurer model).

- Fees & Ancillary Services: Roadside assistance, optional add-ons, and administrative fees.

Root’s edge comes from using telematics and AI to predict risk more accurately, ideally increasing underwriting margins over time.

Pricing Structure

Root prices policies based mostly on:

- Driving behavior (the biggest factor)

- Vehicle type

- Location and state regulations

- Coverage level selected

- Additional risk factors (age, mileage, credit score in some states)

Because Root emphasizes fairness in pricing, drivers who complete the test-drive and demonstrate safe habits often see significantly lower premiums compared to traditional models.

Commission / Fee Breakdown

Root does not take a commission from service providers. Instead, its revenue comes directly from policy premiums. Provider payouts—repairs, towing, inspections—are part of Root’s claim expenses.

Market Size and Growth

The U.S. auto insurance market is massive, exceeding $300 billion annually. Usage-based insurance (UBI), which Root helped popularize, is one of the fastest-growing segments thanks to:

- Smartphone adoption

- Demand for fair pricing

- Telematics advancements

- Younger drivers preferring app-based insurance

UBI adoption is expected to grow sharply from 2025 onward as insurers increasingly rely on real-time behavioral data.

Profit Margin Insights

Root’s long-term success depends on:

- Lowering claim costs through better driver selection

- Using telematics to reduce risk exposure

- Increasing renewal rates for safe drivers

- Reducing administrative overhead via app automation

Revenue Model Breakdown

| Revenue Stream | Description | Who Pays | Nature |

|---|---|---|---|

| Premium Revenue | Auto insurance premiums collected | Drivers | Recurring |

| Underwriting Profit | Premiums minus claims | Drivers indirectly | Risk-based |

| Investment Income | Returns from capital reserves | Internal | Financial |

| Ancillary Services | Roadside assistance, add-ons | Drivers | Optional |

Key Features That Make Root Insurance Successful

Usage-Based, App-First Experience

Root is built around the smartphone. From quote to claim, almost everything happens inside the app. This lets users:

- Get quotes without calling agents

- View ID cards digitally

- Manage payments and coverage

- File claims with photos and guided steps

A smooth, app-first flow is a big reason Root appeals to younger, tech-savvy drivers.

Telematics-Driven Pricing

Instead of relying mostly on demographics, Root uses driving behavior as a primary pricing input. The app tracks things like:

- Hard braking and rapid acceleration

- Speed vs road limits

- Time of day you drive

- Phone distraction patterns

Safer behavior = better scores = potentially lower premiums. This “fair pricing” concept is a core differentiator.

Test-Drive Period

New users typically go through a driving evaluation period before getting their final quote. This creates:

- A clear link between how you drive and what you pay

- A chance for Root to filter out very risky drivers

- More accurate premiums compared to static questionnaires

Simple Policy Management

Within the app, drivers can:

- Adjust coverages and limits

- Add or remove vehicles

- Update personal details

- Access proof of insurance instantly

This reduces support calls and gives users more control.

Fast, Guided Claims

Root’s claims flow is designed to be straightforward and mobile-native:

- Users answer guided questions

- Upload photos and details from the scene

- Track claim progress step by step

This makes a stressful moment (an accident) feel more manageable and transparent.

Integrated Roadside Assistance

Many Root policies include or offer roadside services such as towing, jump starts, or lockout help. These services are triggered and tracked from within the app, adding extra convenience.

Driver Insights and Feedback

Because Root collects driving data, it can provide feedback on driving habits. Even simple insights (“You’re braking hard often” or “You frequently drive late at night”) help users understand risk and potentially improve behavior over time.

Transparent, Modern Brand Positioning

Root markets itself as a fair, tech-driven alternative to traditional insurers. Clear messaging, clean UI, and straightforward communication reinforce that positioning and help differentiate it in a crowded market.

2024–2025 Enhancements (Conceptual)

Across the telematics space, ongoing improvements include:

- Better detection of phone distraction

- Smarter fraud and crash detection algorithms

- More personalized offers and discounts for safe driving

Root leverages these trends to keep refining pricing accuracy and user experience.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

The Technology Behind Root Insurance

Tech Stack Overview (Simplified)

Root runs on a mobile-first, cloud-based architecture designed to process large amounts of sensor data and convert it into meaningful risk insights. Core components include:

- A smartphone app that collects telematics data

- Backend systems running on scalable cloud infrastructure

- Machine learning models that analyze driving behavior

- Secure databases for policies, claims, and risk profiles

The technology stack is engineered to handle millions of driving events per user while delivering fast, accurate pricing.

How Real-Time Driving Data Works

Root uses the smartphone’s built-in sensors to measure:

- Acceleration

- Hard braking

- Cornering forces

- GPS-derived speed

- Time-of-day driving patterns

- Phone interactions (e.g., distraction)

This data is sent to the backend, where algorithms interpret the risk level. Because everything happens through a phone, no additional hardware is required — making adoption much easier.

Data Handling and Privacy

As an insurer collecting sensitive behavioral information, Root places emphasis on:

- Encrypted transmission of all telematics data

- Secure storage of driving and claims information

- Strict access controls and compliance with U.S. insurance regulations

- Clear user permissions for what data is collected and how it’s used

Transparency about data helps build trust with users who may be cautious about telematics.

Scalability Approach

Root’s infrastructure scales horizontally so it can process thousands of driving sessions at once. During growth spikes — like expansion into new states — the system can handle increased load without performance drops. Microservices let Root scale specific components (rating engine, telematics processing, claims automation) independently.

Mobile App vs Web Platform

- Mobile App: The core experience — quotes, driving test, telematics, claims, payments, ID cards.

- Web Platform: Useful for browsing coverage details, managing account information, and supporting multi-device access.

Root prioritizes mobile because that’s where telematics data is collected.

API Integrations

Root integrates with:

- Third-party verification tools (driver license, vehicle data)

- Repair shops and roadside assistance partners

- Regulatory reporting systems

- Payment gateways

- Fraud and claims-validation services

These APIs ensure Root’s insurance workflows are fast, automated, and compliant.

Why This Tech Matters

Root is not just an insurance company — it’s a tech company that writes insurance. The technology:

- Lowers administrative costs

- Filters out high-risk drivers early

- Improves pricing accuracy

- Enables fast, digital claims

- Makes the customer experience smoother than traditional insurance

For entrepreneurs, Root shows how powerful app-first telematics can be when building modern, usage-based insurance platforms.

Root Insurance’s Impact & Market Opportunity

Industry Disruption

Root has reshaped how Americans think about auto insurance by shifting from demographic-based pricing to behavior-based pricing. Instead of judging drivers by age or credit score alone, Root evaluates real driving behavior — something traditional insurers only partially adopted. This push toward fairness and transparency has accelerated the adoption of telematics across the entire insurance industry.

Market Statistics & Growth

The U.S. auto insurance market exceeds $300 billion per year, and usage-based insurance (UBI) continues to grow rapidly as smartphone adoption increases. Younger drivers — a demographic traditionally charged high premiums — are especially receptive to Root’s model.

In 2025, more insurers are integrating telematics, but Root remains one of the strongest pure-play, app-first UBI models.

User Demographics & Behavior

Root primarily attracts:

- Safe drivers who want lower premiums

- Younger users who prefer app-based services

- Tech-savvy customers comfortable sharing driving data

- Drivers looking for flexible coverage options

These users appreciate transparency, easy onboarding, and app-managed policies.

Geographic Presence

Root operates across many U.S. states, expanding strategically where telematics regulations support fair-pricing initiatives. The company continues to grow in states with dense urban areas where safe driving discounts appeal to large populations.

Future Projections

Telematics-based insurance is expected to grow significantly due to:

- Advancements in smartphone sensors

- AI-driven risk models

- Real-time driving insights

- Personalized pricing

- Rising consumer demand for app-based services

The next wave of innovation will involve deeper integration with EVs, smart cars, and in-car systems.

Opportunities for Entrepreneurs

There is a huge opportunity for founders to create niche Root-style insurance platforms—such as:

- Regional UBI insurers

- Usage-based commercial vehicle plans

- Insurance tied to EV usage

- Teen-driver or senior-focused telematics solutions

- Ride-hailing or delivery-driver insurance

This massive success is why many entrepreneurs now want to create Root-like platforms that combine telematics, AI-driven pricing, and instant app-based policy management.

Building Your Own Root Insurance–Like Platform

Why Businesses Want Root-Style Insurance Platforms

Root Insurance proved that drivers love fair, behavior-based pricing instead of being judged mainly by age, ZIP code, or credit score. A Root-style platform:

- Rewards safe drivers with better prices

- Attracts younger, app-first users

- Uses real driving data instead of assumptions

- Feels modern, transparent, and fully digital

For founders and insurers, this model is attractive because it can improve risk selection, reduce claim ratios over time, and build a strong brand around fairness and technology.

Key Considerations Before You Start Development

Before building a Root-like solution, you should be clear about:

- Target segment: private cars, commercial vehicles, fleets, delivery drivers, ride-hailing, teens, or regional focus

- Geography and regulations: usage-based insurance rules, data privacy, telematics consent

- Business role: full licensed insurer, MGA (managing general agent), or pure tech provider partnering with existing insurers

- Data strategy: what driving behaviors you’ll measure and how they’ll affect pricing

- Claims and partner network: repair shops, towing, inspection partners, fraud tools

Your product, tech stack, and legal setup will all depend on these decisions.

Cost Factors & Pricing Breakdown

Root Insurance-Like App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| Basic Digital Auto Insurance MVP | Core web/app for selling a limited set of auto insurance policies, user registration & login, quote & buy journey, basic driver and vehicle profile, policy management, simple claims FNOL (first notice of loss) form, standard admin panel, basic reports | $90,000 |

| Mid-Level Usage-Based Auto Insurance Platform | Multiple product options, improved pricing engine, driver profile enrichment, policy and endorsements management, telematics/drive data ingestion via SDK or device (using your providers), claims status tracking, notifications & reminders, analytics dashboard, polished mobile-first UX (web + apps) | $170,000 |

| Advanced Root Insurance-Level Insurtech Ecosystem | Full telematics-driven rating, advanced risk & pricing engine, multi-state/multi-region compliance logic, complex claims workflows, integrations with core insurance and data providers, fraud & anomaly signals, customer engagement tools, rich analytics, cloud-native, highly scalable architecture | $280,000+ |

Root Insurance-Style Digital Auto Insurance Platform Development

The prices above reflect the global market cost of developing a Root Insurance–like digital auto insurance platform — typically ranging from $90,000 to over $280,000, with a delivery timeline of around 4–12 months for a full, from-scratch build. This usually includes quote & bind journeys, telematics/driver data handling, policy administration, claims workflows, integrations with insurance back-office systems and data providers, compliance considerations, and extensive testing for real-world policy and claims operations.

Miracuves Pricing for a Root Insurance-Like Custom Platform

Miracuves Price: Starts at $15,999

This is positioned for a feature-rich, JS-based Root Insurance–style digital auto insurance and telematics platform that covers online quote & purchase journeys, driver and vehicle profiles, basic-to-intermediate risk and pricing logic (via your insurance stack), telematics/drive data ingestion (through your chosen SDKs/devices), digital claims submission and tracking, notifications, analytics, an insurer/admin console, and modern web + mobile interfaces. From this foundation, the platform can be scaled into deeper risk scoring, more advanced telematics models, additional product lines, and multi-state or multi-country compliance as your insurtech business grows.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational digital auto insurance ecosystem ready for launch and future expansion.

Delivery Timeline for a Root Insurance-Like Platform with Miracuves

For a Root Insurance–style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of auto insurance product coverage and rating/underwriting rules

- Number and complexity of integrations (core insurance systems, telematics providers, KYC/ID verification, payment gateways, data providers, etc.)

- Complexity of claims workflows, risk/fraud checks, and regulatory reporting

- Scope of web portal, mobile apps, branding requirements, and long-term scalability targets

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js/Nest.js/Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms.

Other technology stacks can be discussed and arranged upon request when you contact our team, ensuring they align with your internal preferences, compliance needs, and infrastructure choices.

Essential Features to Include in a Root-Like Platform

To be competitive, your Root-style app should offer at least:

- App-based onboarding and quote flow

- Driving test / telematics evaluation period

- Behavior-based scoring and dynamic pricing logic

- Full policy management in the app (ID cards, payments, renewals)

- In-app claims filing with photo/video upload

- Integrated roadside assistance workflows

- Driver behavior insights and coaching

- Admin dashboard for underwriting, claims, and customer support

Later, you can add more advanced features such as:

- Gamified safe-driving rewards

- Real-time crash detection and instant outreach

- Customized plans for EVs, fleets, or ride-hailing drivers

Read More :- Read the complete guide on fintech app development costs

Conclusion

Root Insurance shows how combining telematics, AI-driven pricing, and a clean mobile-first experience can disrupt an entire industry. By focusing on fairness and real-world behavior, Root created an insurance model that feels modern, transparent, and aligned with how people actually drive. For entrepreneurs, it proves there’s enormous opportunity in building niche, data-driven insurance platforms that put users at the center of the experience.

FAQs :-

How does Root Insurance make money?

Root earns revenue from auto insurance premiums, underwriting profit (the difference between premiums collected and claims paid), optional add-on services, and income generated from investing premium reserves.

Is Root Insurance available in my country?

Root operates only in the United States and is available in selected states where telematics-based insurance models are approved by regulators.

How much does Root Insurance charge users?

Pricing varies widely by driving behavior, coverage selected, location, and vehicle type. Safe drivers typically receive lower rates after completing the test-drive telematics evaluation.

What’s the commission for service providers?

Service providers such as repair shops or towing partners do not pay commissions. They are paid directly by Root for services rendered during the claims process.

How does Root Insurance ensure safety and privacy?

Root uses encrypted telematics data transmission, secure storage, strict access controls, and adheres to insurance and data privacy regulations. Users must consent to telematics tracking before participating.

Can I build something similar to Root Insurance?

Yes. Many entrepreneurs are now launching usage-based insurance platforms, telematics scoring engines, and behavior-based pricing apps. Pre-built templates and clone solutions help accelerate development.

What makes Root Insurance different from competitors?

Root relies heavily on smartphone-based telematics for pricing, offering a fairer model that rewards safe drivers. Its mobile-first approach, digital claims, and transparency set it apart from traditional insurers.

How many users does Root Insurance have?

Root serves hundreds of thousands of policyholders across multiple U.S. states and continues to grow in markets where telematics adoption is high.

What technology does Root Insurance use?

Root uses smartphone sensors, AI-driven risk models, cloud infrastructure, microservices, APIs for claims and underwriting partners, and advanced telematics scoring systems.

How can I create an app like Root Insurance?

You can build it from scratch or use a pre-built insurance platform. Miracuves helps entrepreneurs launch Root-style telematics and behavior-based insurance apps in 30-90 days with full customization, claims modules, and scoring systems included.