Zalando’s €12+ billion revenue milestone in 2026 shows that fashion marketplaces become truly scalable when they diversify beyond basic product sales. Instead of relying only on retail margins, Zalando combines direct sales with marketplace commissions, logistics services, and advertising revenue to create multiple income layers.

For founders, this model demonstrates how integrating retail, third-party sellers, fulfillment, and brand marketing into one ecosystem increases resilience and profitability. Each participant—buyers, sellers, and brands—contributes to revenue in different ways.

By studying Zalando’s approach, entrepreneurs can learn how to monetize not just transactions, but also user behavior, logistics infrastructure, and brand partnerships, leading to stronger long-term growth.

Zalando Revenue Overview – The Big Picture

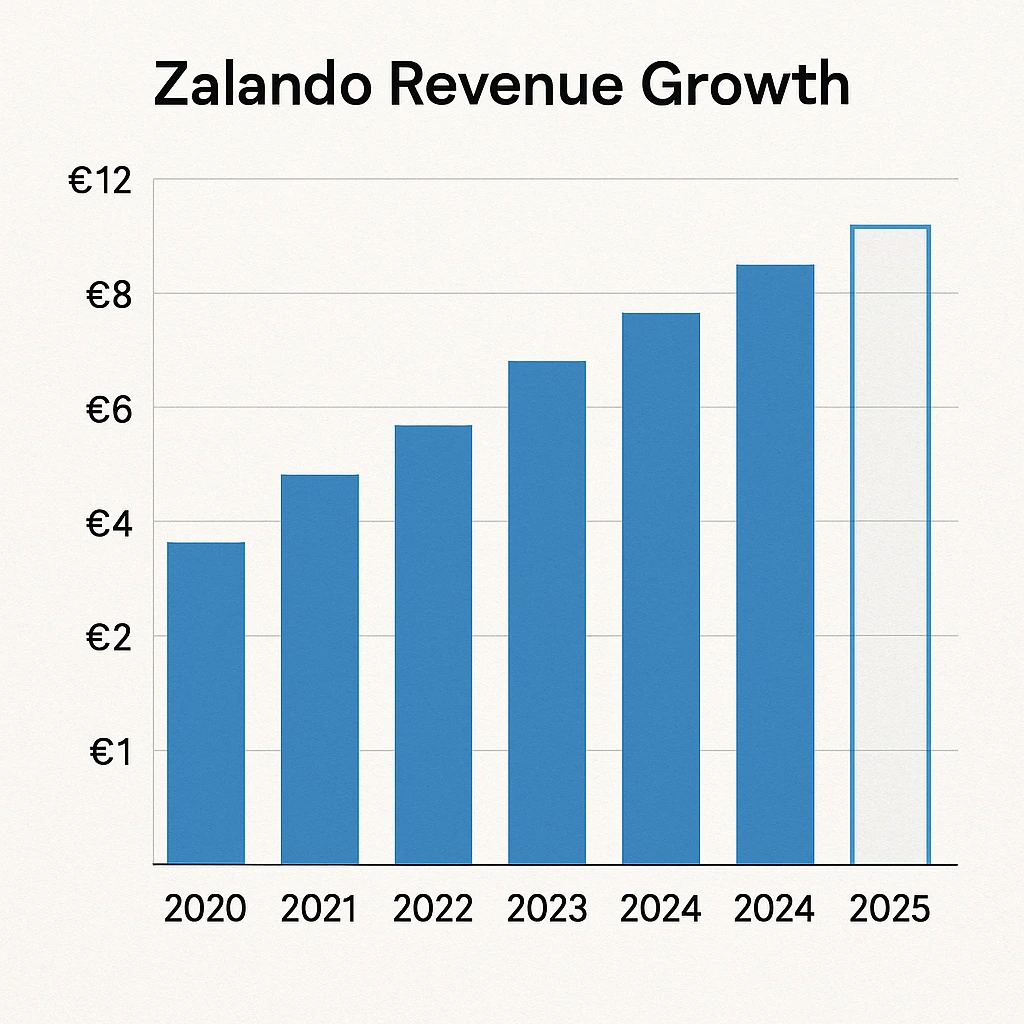

Zalando’s estimated 2026 revenue stands between €12.1 and €12.4 billion, driven by its dominance across European fashion e-commerce markets.

- Valuation: Estimated €20+ billion based on public market capitalization trends

- Year-over-Year Growth: 4%–9% growth driven by platform services and B2B expansion

- Revenue by Region:

- Germany, Austria, Switzerland: ~40%

- Western Europe: ~35%

- Nordics & Eastern Europe: ~25%

- Profit Margins: Adjusted EBIT margin around 4.5%–5%

- Competition Benchmark: Competes with ASOS, Farfetch, Amazon Fashion, Shein (EU), and regional marketplaces

Read More: What is Zalando and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Direct Retail Sales

Zalando purchases inventory directly from brands and sells to consumers, earning gross margins on every sale. This model provides pricing control and predictable revenue.

- Share of revenue: ~45%

- Margin driven by private labels and exclusive brand deals

Revenue Stream #2: Marketplace Commissions

Third-party brands sell on Zalando’s platform and pay commissions per sale.

- Share of revenue: ~25%

- Commission range: 5%–25% depending on category and volume

Revenue Stream #3: Fulfillment Services (ZFS)

Brands pay Zalando to store, pack, ship, and return products using Zalando’s logistics infrastructure.

- Share of revenue: ~10%

- High retention, recurring B2B revenue

Revenue Stream #4: Advertising & Brand Marketing

Brands pay for sponsored listings, product boosts, and brand visibility across Zalando’s app and website.

- Share of revenue: ~12%

- One of the highest-margin revenue streams

Revenue Stream #5: Subscriptions & Value-Added Services

Premium memberships and analytics services increase customer lifetime value.

- Share of revenue: ~8%

Revenue Streams Percentage Breakdown

| Revenue Stream | Share |

|---|---|

| Direct Sales | 45% |

| Marketplace Commissions | 25% |

| Fulfillment Services | 10% |

| Advertising | 12% |

| Subscriptions & Other | 8% |

The Fee Structure Explained

User-Side Fees

- No platform joining fees

- Product pricing only

- Optional premium memberships for faster delivery and exclusive benefits

Provider-Side Fees

- Sales commissions on every order

- Fulfillment and warehousing fees

- Advertising and promotion fees

Hidden Revenue Layers

- Sponsored placements

- Priority search ranking

- Data insights and brand analytics

Regional Pricing Variation

Fees vary by country based on logistics costs, competition, and return rates.

Complete Fee Structure by User Type

| User Type | Fee Type | Description |

|---|---|---|

| Consumers | Product price | No platform fees |

| Brands | Sales commission | Percentage per sale |

| Brands | Fulfillment fees | Storage, packing, shipping |

| Brands | Advertising | CPC / placement based |

| Consumers | Subscription | Optional premium services |

How Zalando Maximizes Revenue Per User

Zalando focuses heavily on increasing revenue per customer rather than just acquiring new users.

- Segmentation: High-value customers receive exclusive deals

- Upselling: Style bundles and premium brands

- Cross-selling: Beauty, sportswear, accessories

- Dynamic Pricing: Flash sales and demand-based discounts

- Retention Monetization: Loyalty programs and fast delivery perks

- LTV Optimization: Personalized recommendations and AI styling

- Psychological Pricing: Limited-time offers and anchor pricing

These strategies consistently improve average order value and repeat purchase rates.

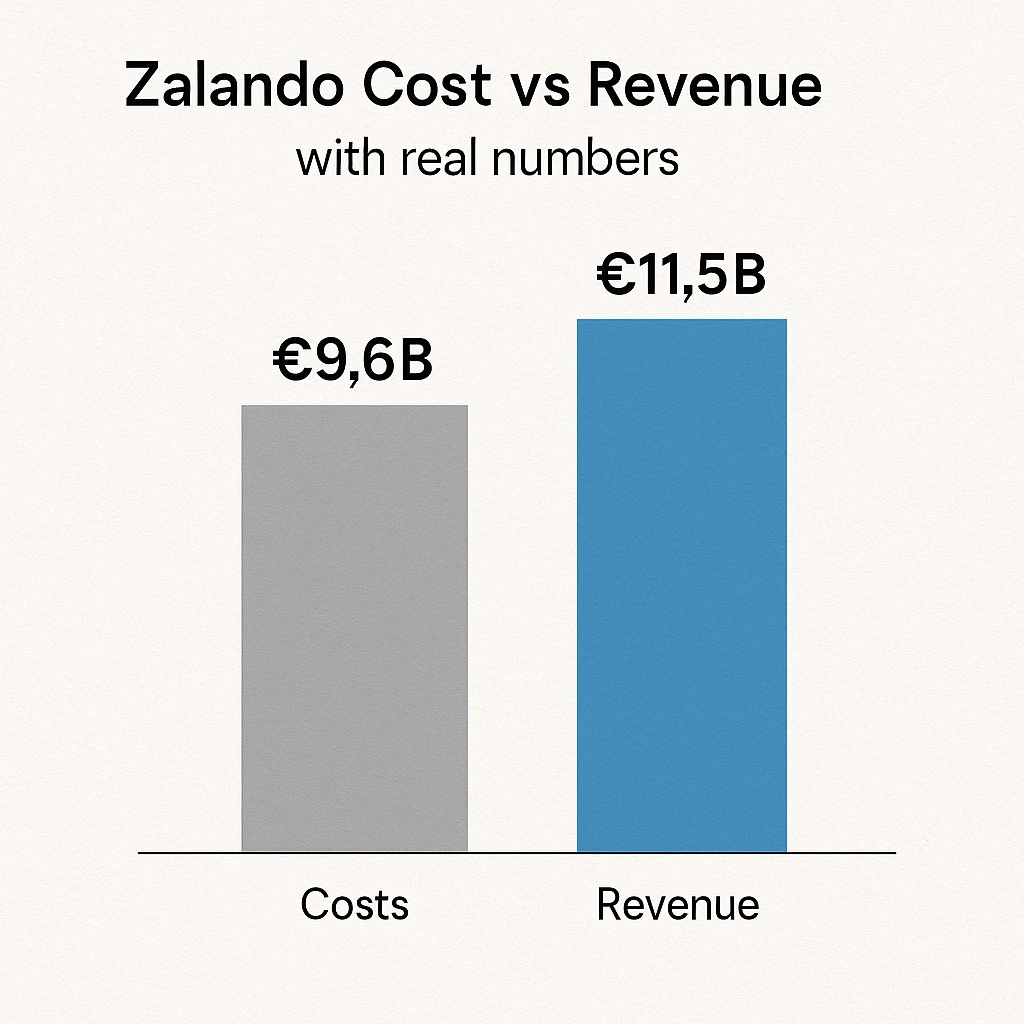

Cost Structure & Profit Margins

Infrastructure Costs

Warehouses, automation systems, returns handling, and cloud infrastructure.

Customer Acquisition & Marketing

Performance marketing, influencer partnerships, brand campaigns.

Operations

Customer support, returns management, fraud prevention.

R&D

AI personalization, recommendation engines, logistics optimization.

Unit Economics

- High upfront logistics cost

- Strong margin expansion through ads and services

Profitability Path

Zalando improves margins by shifting revenue toward advertising and fulfillment services.

Read More: Best Zalando Clone Script 2025 | Build an eCommerce Marketplace

Future Revenue Opportunities & Innovations

- Expansion of B2B logistics services

- AI-powered personal shopping subscriptions

- Data-driven brand insights monetization

- Expansion into new European and emerging markets

- Private label brand scaling

Risks:

- Rising return rates

- Fast-fashion competition

- Logistics cost inflation

Opportunities for Founders:

- Vertical fashion marketplaces

- Regional niche platforms

- Hybrid marketplace + fulfillment models

Lessons for Entrepreneurs & Your Opportunity

What Works

- Multiple revenue streams

- Platform + services approach

- Strong logistics backbone

What to Replicate

- Marketplace commissions

- Advertising monetization

- Fulfillment-as-a-service

Market Gaps

- Local fashion brands

- Sustainable fashion platforms

- Creator-led commerce

Founder Improvements

- Faster go-to-market

- Niche targeting

- Leaner logistics partnerships

Want to build a platform with Zalando’s proven revenue model?

Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Zalando-style marketplace solutions come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Zalando clearly demonstrates that long-term success in fashion marketplaces comes from monetizing beyond product sales. The highest margins are generated through services, data-driven insights, logistics capabilities, and brand enablement tools.

For founders working with Miracuves, the takeaway is simple: build platforms that unlock revenue at every layer of the ecosystem. With the right marketplace architecture and built-in monetization models, scalable and profitable growth becomes achievable from day one.

FAQs

1. How much does Zalando make per transaction?

It earns through product margins, commissions, and service fees per order.

2. What’s Zalando’s most profitable revenue stream?

Advertising and brand services deliver the highest margins.

3. How does Zalando’s pricing compare to competitors?

It stays competitive while monetizing through backend services.

4. What percentage does Zalando take from providers?

Typically between 5% and 25% depending on category.

5. How has Zalando’s revenue model evolved?

It shifted from retail-only to a platform-plus-services model.

6. Can small platforms use similar models?

Yes, especially niche or regional marketplaces.

7. What’s the minimum scale for profitability?

Thousands of monthly transactions with service monetization.

8. How to implement similar revenue models?

Combine marketplace fees, ads, and fulfillment services.

9. What are alternatives to Zalando’s model?

Subscription-only commerce or creator-led marketplaces.

10. How quickly can similar platforms monetize?

With the right setup, monetization can begin within weeks of launch.