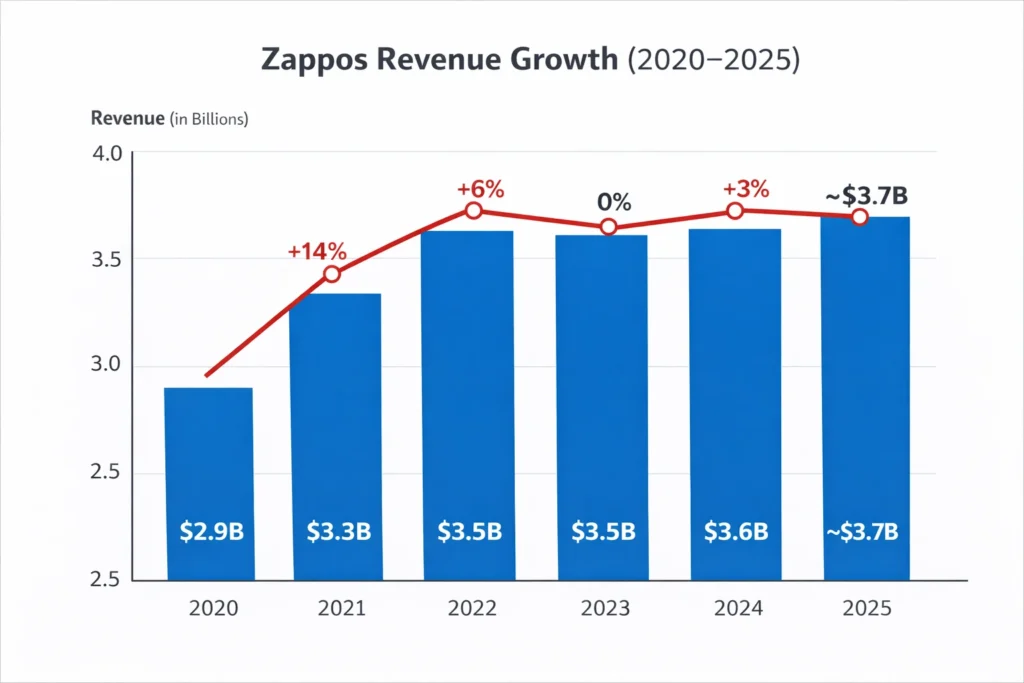

Zappos closed 2025 with approximately $3.7 billion in revenue, maintaining its position as one of the most profitable footwear-focused eCommerce brands globally. This performance highlights strong repeat purchase behavior, deep customer trust, and the effectiveness of focusing on a single core category rather than spreading across unrelated verticals.

Unlike pure marketplaces, Zappos built scale through inventory ownership, customer obsession, and lifetime value optimization. By controlling inventory, Zappos ensures consistent product quality and availability, while its legendary customer service and free returns strategy significantly increase repeat buying and long-term customer value.

For founders, Zappos is a masterclass in how service-driven eCommerce can outperform price-led competition. It demonstrates that investing in experience, retention, and brand loyalty can create defensible advantages and sustainable profitability, even in markets crowded with discount-focused competitors.

Zappos Revenue Overview – The Big Picture

- 2025 Revenue: ~$3.7B

- Valuation (internal estimate): ~$10–12B (Amazon subsidiary benchmark)

- YoY Growth: ~6%

- Revenue by Region:

- United States: ~92%

- International: ~8%

- Average Gross Margin: ~34–36%

- Competition Benchmark: Nike DTC, Foot Locker, Amazon Fashion

Read More: What is Zappos and How Does It Work?

Primary Revenue Streams Deep Dive

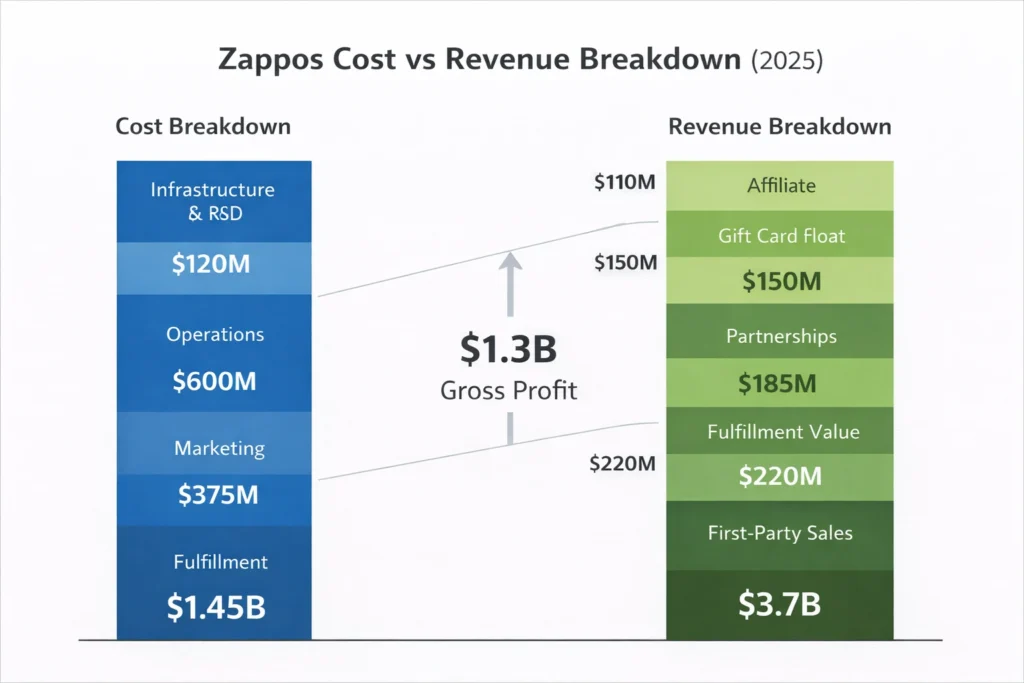

Revenue Stream #1: Direct Product Sales

Zappos primarily sells footwear and apparel through a direct-to-consumer model.

- Pricing: MSRP-driven with seasonal discounts

- Revenue share: ~82%

- Strong margin control due to owned inventory

Revenue Stream #2: Premium Fulfillment & Shipping

Fast shipping and free returns are embedded into pricing.

- Revenue share: ~6%

- Higher AOV offsets logistics cost

Revenue Stream #3: Brand Partnerships & Exclusives

Limited editions and exclusive brand collaborations.

- Revenue share: ~5%

- Improves conversion and retention

Revenue Stream #4: Gift Cards & Store Credit Float

Unused balances and delayed redemptions generate float income.

- Revenue share: ~4%

Revenue Stream #5: Affiliate & Cross-Brand Sales

Traffic monetization via Amazon ecosystem integrations.

- Revenue share: ~3%

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share |

|---|---|

| Direct Product Sales | 82% |

| Fulfillment & Shipping Value | 6% |

| Brand Partnerships & Exclusives | 5% |

| Gift Cards & Store Credit Float | 4% |

| Affiliate & Cross-Brand Sales | 3% |

The Fee Structure Explained

- Customer-side pricing:

- Product price includes shipping & returns

- Premium products priced 12–18% higher than average retail

- Supplier-side economics:

- Wholesale pricing contracts

- Volume-based procurement discounts

- Hidden revenue layers:

- Breakage from gift cards

- Data-driven assortment optimization

- Regional pricing variation:

- Minor price differences due to tax and logistics

Complete Fee Structure by User Type

| User Type | Fee Type | Typical Range |

|---|---|---|

| Buyer | Product Price Markup | 25–40% GM |

| Buyer | Express Delivery | Bundled |

| Brand | Wholesale Discount | 30–55% |

| Platform | Gift Card Breakage | 2–4% revenue |

How Zappos Maximizes Revenue Per User

Zappos focuses heavily on lifetime customer value, not single transactions.

- Segmentation: Repeat buyers vs first-time buyers

- Upselling: Premium materials and branded collections

- Cross-selling: Accessories bundled with footwear

- Dynamic pricing: Seasonal demand-based adjustments

- Retention monetization: Loyalty-driven reorders

- LTV optimization: Repeat customers spend ~3× more

- Psychological pricing: Free returns reduce purchase friction

- Real data example: Over 60% of revenue comes from repeat buyers

Cost Structure & Profit Margins

- Infrastructure: Warehousing, ERP, cloud platforms

- CAC & marketing: ~9–11% of revenue

- Operations: Fulfillment, returns, customer service

- R&D: Personalization, logistics optimization

- Unit economics: Profitable by second purchase

- Margin optimization: Scale-driven procurement savings

- Profitability path: High-margin loyalty flywheel

Read More: Best Zappos Clone Scripts 2025: Footwear Marketplace

Future Revenue Opportunities & Innovations

- AI-driven size and fit recommendations

- Subscription footwear essentials

- Private-label brand expansion

- B2B corporate footwear programs

- Trends (2025–2027): Faster delivery, predictive buying

- Risks: Inventory exposure, fashion volatility

- Opportunities: Vertical footwear marketplaces

Lessons for Entrepreneurs & Your Opportunity

What works

- Customer experience as a growth engine

- Inventory-led margin control

What to replicate

- Free returns baked into pricing

- Loyalty-first monetization

Market gaps

- Regional footwear specialists

- Sustainable footwear platforms

Founder improvements

- Faster fulfillment tech

- AI-based demand forecasting

Want to build a platform with Zappos’ proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Zappos-style clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, andif you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Zappos proves that exceptional service can be a revenue strategy, not just a cost center. By prioritizing fast shipping, hassle-free returns, and responsive customer support, the company reduces purchase friction and builds trust that directly translates into higher conversion rates and repeat sales.

Its model shows how customer loyalty compounds margins over time. As repeat buyers return with lower acquisition costs and higher average order values, profitability improves naturally, allowing Zappos to reinvest in service quality without sacrificing margins.

For founders, this approach serves as a clear roadmap to sustainable eCommerce profitability. It highlights how long-term thinking, customer-first design, and retention-focused monetization can create resilient businesses that grow steadily even in competitive markets.

FAQs

1. How much does Zappos make per transaction?

Around 30–35% gross margin per order.

2. What’s Zappos’ most profitable revenue stream?

Repeat direct product sales.

3. How does Zappos’ pricing compare to competitors?

Slightly higher, offset by free shipping and returns.

4. What percentage margin does Zappos earn?

Roughly 34–36% gross margin.

5. How has Zappos’ revenue model evolved?

From discount retail to loyalty-led DTC.

6. Can small platforms use similar models?

Yes, especially in niche categories.

7. What’s the minimum scale for profitability?

After consistent repeat purchases.

8. How to implement similar revenue models?

Bundle service costs into pricing.

9. What are alternatives to Zappos’ model?

Marketplace or subscription footwear models.

10. How quickly can similar platforms monetize?

Many start generating revenue within the first month.