In today’s fast-paced financial world, having a reliable, feature-rich trading app is crucial for investors. Platforms like E*TRADE have revolutionized how we interact with the stock market, giving users the power to trade, manage investments, and monitor market trends right from their smartphones. With millions of users relying on these apps, the demand for custom-built trading platforms continues to grow.

Building an app like E*TRADE offers immense potential, not only for financial institutions but also for entrepreneurs looking to tap into the lucrative world of online trading. However, creating a platform that balances functionality, user experience, and security is no small feat. From enabling real-time trades to ensuring regulatory compliance, there are many complex steps involved in this journey.

This guide will walk you through the entire step-by-step process of building an app like E*TRADE, helping you understand the technical requirements, design principles, and monetization strategies necessary to develop a successful trading app. Whether you’re an entrepreneur or a business owner, by the end of this article, you’ll be equipped with the knowledge to bring your app idea to life in a rapidly growing market.

What is E*TRADE and What Does It Do?

E*TRADE is one of the most well-known online trading platforms in the financial industry, allowing users to trade stocks, options, bonds, mutual funds, and more with ease. It has empowered everyday investors by providing access to advanced trading tools that were once exclusive to institutional traders. Users can manage portfolios, execute trades in real-time, and access a wealth of financial data and market insights, all from one intuitive app.

The app provides a variety of services, including investment education, professional portfolio management, and in-depth research reports. With user-friendly interfaces, real-time quotes, and secure transactions, E*TRADE has attracted millions of users who trust the platform for managing their investments. It caters to both beginners and seasoned traders, offering everything from basic tools to advanced trading strategies.

Key Features of E*TRADE:

- Real-time trading: Instant access to stock prices and execution of trades in seconds.

- Portfolio management: Users can track their assets, monitor performance, and adjust their investments on the go.

- Research and insights: E*TRADE offers financial data, market news, and analysis to help users make informed decisions.

- Customizable dashboards: Traders can set up personalized views to track their preferred stocks or market trends.

- Educational tools: The app also provides educational content for novice investors, helping them understand how to trade and manage risks.

E*TRADE’s success lies in its ability to blend advanced trading features with a seamless user experience, making it a popular choice for anyone looking to trade online.

Why Build an App Like E*TRADE?

Building an app like E*TRADE presents a unique opportunity in the ever-expanding fintech landscape. The demand for online trading platforms is surging as more people seek to take control of their investments and grow their wealth. With a growing number of millennials and Gen Z entering the stock market, the potential user base is vast and increasingly tech-savvy.

Creating a trading app not only addresses this rising interest but also offers the chance to introduce innovative features that enhance user experience. For example, integrating advanced analytics, AI-driven recommendations, and personalized alerts can set your app apart from existing platforms. Furthermore, the appeal of a user-friendly interface and educational resources can attract novice investors, making trading accessible to everyone.

Moreover, the financial services industry is witnessing a shift toward mobile solutions. Users are looking for convenience, allowing them to trade on-the-go while accessing real-time market data. By capitalizing on this trend, your app can become a trusted partner for users navigating their investment journeys.

Finally, with the right monetization strategy—such as offering premium features, educational content, or subscription services—you can create a sustainable revenue model. In summary, building an app like E*TRADE not only positions you to tap into a lucrative market but also enables you to empower users in their financial endeavors.

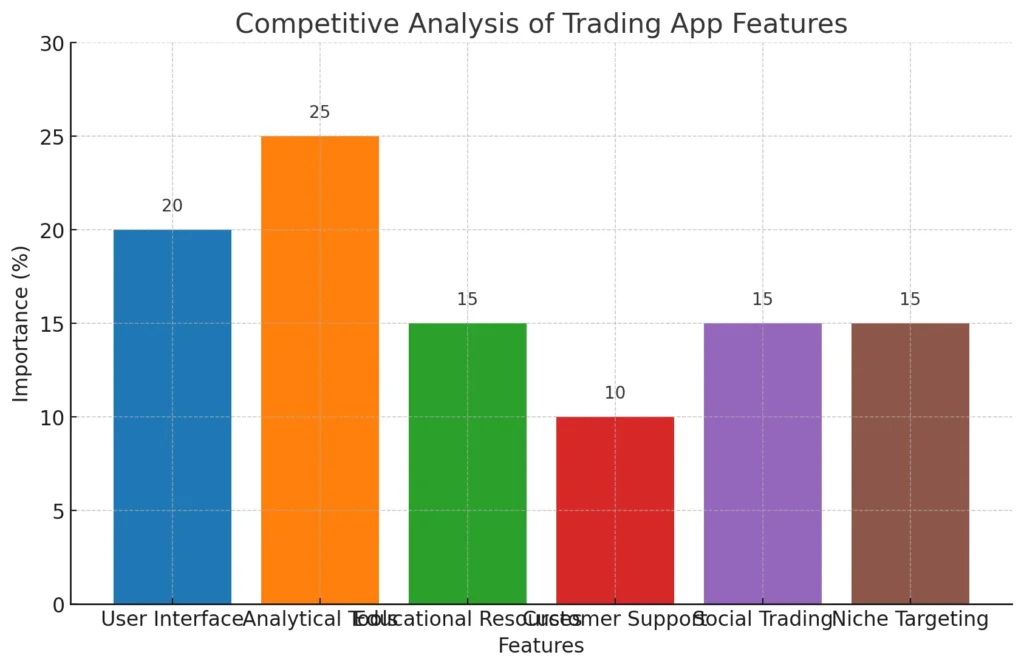

How to Differentiate Your App from Competitors

In a crowded marketplace filled with trading apps, standing out is crucial for success. To differentiate your app like E*TRADE, you need to focus on unique selling points (USPs) that cater to the specific needs of your target audience. Here are some strategies to consider:

- User-Centric Design: An intuitive and visually appealing user interface can significantly enhance the user experience. Invest in thoughtful design that makes navigation seamless. Features like customizable dashboards allow users to tailor their trading experience to their preferences.

- Advanced Analytical Tools: Providing advanced tools such as real-time data analytics, trend analysis, and AI-powered trading suggestions can attract experienced traders. Features that help users understand market trends and make informed decisions will set your app apart.

- Educational Resources: Offering a wealth of educational content, from beginner tutorials to advanced trading strategies, can make your app a go-to resource for investors. Consider incorporating webinars, video tutorials, and interactive quizzes to engage users and help them learn.

- Social Trading Features: Introducing social trading options can foster a community among users. Allowing them to follow and replicate the trades of successful investors can enhance user engagement and trust in your platform.

- Robust Customer Support: Exceptional customer service can make a significant difference. Providing multiple support channels—such as chat, email, and phone—ensures that users can get help whenever they need it, building loyalty and trust.

- Niche Targeting: Consider focusing on underserved markets, such as specific demographics (e.g., young investors) or investment strategies (e.g., socially responsible investing). Tailoring your app’s features to meet the needs of these niches can give you a competitive edge.

Market Size, Growth, and Business Model

| Revenue Model | Description | Advantages | Drawbacks |

|---|---|---|---|

| Commission-Based | Charging users a fee per trade executed. | – Direct revenue per transaction. – Incentivizes higher trading volume. | – May deter users who prefer low-cost options. |

| Subscription-Based | Charging a monthly fee for premium features or services. | – Predictable revenue stream. – Encourages user loyalty. | – Users may resist paying upfront without proven value. |

| Freemium Model | Offering a basic version for free with optional paid features. | – Attracts a large user base. – Monetizes through upselling. | – Conversion from free to paid can be low. |

| Advertising | Incorporating ads or sponsored content in the app. | – Additional revenue without direct charges to users. – Can be highly scalable. | – May disrupt user experience. – Dependence on third-party advertisers. |

| Partnerships/Sponsorships | Collaborating with financial institutions for sponsored services or content. | – Increased credibility. – Potential for shared marketing costs. | – Reliance on third-party partnerships can be risky. |

| Data Monetization | Selling aggregated user data (with consent) for market research. | – Revenue from valuable insights. – Minimal impact on user experience. | – Privacy concerns; requires strict adherence to regulations. |

The financial technology sector, particularly mobile trading apps, is experiencing explosive growth. As of 2023, the global online trading market is valued at approximately $10 billion and is expected to grow at a compound annual growth rate (CAGR) of over 15% in the coming years. This surge is driven by increasing smartphone penetration, a tech-savvy younger population, and a growing interest in personal finance and investment opportunities.

Investors today are looking for platforms that provide convenience, real-time data, and seamless trading experiences. The rise of mobile trading apps reflects a shift in consumer behavior, where individuals prefer managing their investments on-the-go. The demand for user-friendly interfaces, advanced trading tools, and educational resources makes this an ideal time to enter the market.

When it comes to the business model, there are several avenues to explore. Commission-based models allow you to charge users a fee per trade, while subscription models offer premium features or enhanced services for a monthly fee. Another strategy is to incorporate advertising within the app or partner with financial institutions to provide sponsored content. Diversifying revenue streams can enhance your app’s financial viability.

To capitalize on this growth, your app must not only meet current market needs but also anticipate future trends. With a focus on user engagement, personalized features, and a robust marketing strategy, your trading app can thrive in this competitive landscape.

Key Features of an E*TRADE-Like App

To successfully build an app like E*TRADE, it’s essential to incorporate key features that not only attract users but also enhance their trading experience. Here’s a breakdown of the must-have features for your trading app:

- User-Friendly Interface: A clean, intuitive design allows users to navigate the app effortlessly. Simplified menus and easy access to essential functions can significantly enhance user satisfaction.

- Account Management: Users should be able to create and manage their accounts seamlessly. Features like account balance tracking, transaction history, and easy deposit/withdrawal processes are crucial.

- Real-Time Market Data: Providing real-time quotes, charts, and market news helps users make informed trading decisions. Incorporating customizable watchlists allows users to track their favorite stocks efficiently.

- Trading Tools: Advanced tools like technical analysis charts, indicators, and pattern recognition features can help traders analyze market trends and make data-driven decisions.

- Secure Transactions: Ensuring robust security measures, such as two-factor authentication and end-to-end encryption, builds user trust. Security is paramount in financial applications to protect sensitive data.

- Educational Resources: Including tutorials, webinars, and articles can empower users, especially beginners. Knowledgeable users are more likely to engage actively with your platform.

- Customer Support: Offering multiple support channels—live chat, email, and phone—ensures that users can get help whenever they need it. Responsive customer service can enhance user loyalty.

- Push Notifications: Timely alerts for market changes, price movements, or news updates keep users engaged and informed, allowing them to act quickly on opportunities.

By incorporating these features into your app, you can create a comprehensive trading platform that meets the diverse needs of investors and traders. The right combination of functionality, security, and education will not only attract users but also encourage them to stay and trade actively.

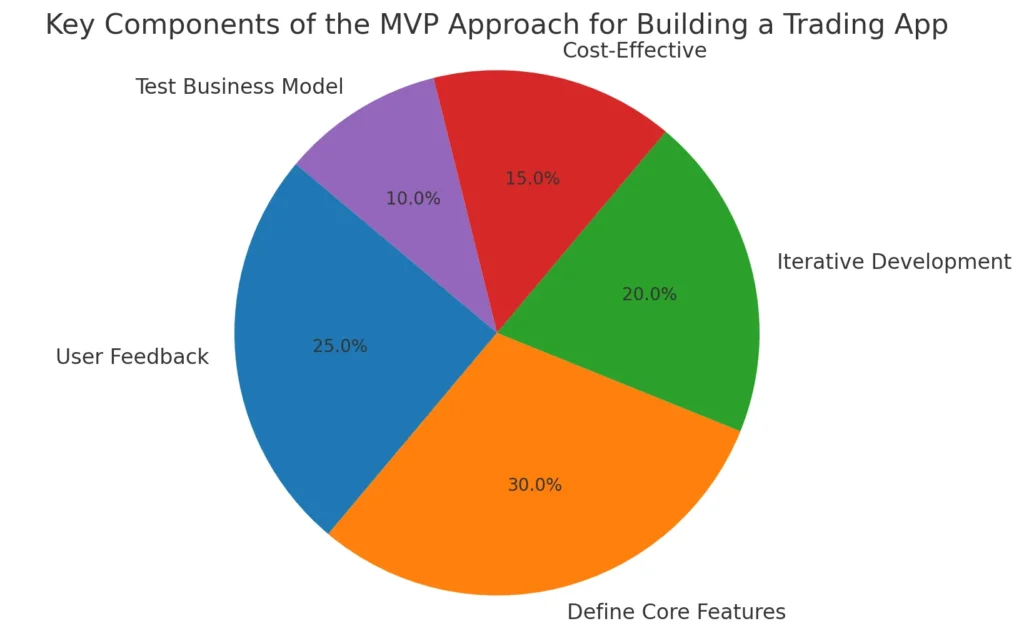

Minimum Viable Product (MVP) Approach

When embarking on the journey to build an app like E*TRADE, adopting a Minimum Viable Product (MVP) approach is crucial. This strategy focuses on developing a basic version of your app that includes only the essential features necessary to meet the needs of early adopters. By launching an MVP, you can gather valuable user feedback and validate your concept before investing further resources into development.

- Define Core Features: Start by identifying the must-have features that will attract your target users. For a trading app, these might include account creation, basic trading functionality, real-time market data, and secure transactions. Focus on delivering a smooth user experience with these features.

- User Feedback: Once your MVP is launched, actively seek feedback from users. Understand their pain points, preferences, and suggestions for improvement. This real-world input is invaluable for refining your app and ensuring it meets user expectations.

- Iterative Development: Use the insights gathered from user feedback to make informed decisions about future updates. Prioritize adding features that enhance user engagement and address any identified issues. This iterative approach not only improves the app but also demonstrates your commitment to user satisfaction.

- Cost-Effective: Developing an MVP allows you to enter the market quickly and cost-effectively. By focusing on essential features, you minimize development costs while still providing value to your users. This can lead to faster market entry and the opportunity to start generating revenue sooner.

- Test Your Business Model: The MVP phase is also an excellent time to test your monetization strategies. Whether you choose a commission-based model, subscription fees, or in-app purchases, monitoring user interactions with these features can guide you in refining your approach.

By following the MVP approach, you can mitigate risks, optimize your app based on user feedback, and ensure that your trading platform is well-equipped to compete in the dynamic fintech landscape. It’s a strategic pathway that not only focuses on delivering immediate value but also lays a solid foundation for future growth.

Technical Requirements

| Component | Description | Advantages | Use Cases |

|---|---|---|---|

| Frontend Technologies | Frameworks for user interface development (e.g., React Native, Flutter). | – Cross-platform capabilities. – Faster development with a single codebase. | Building responsive and interactive mobile interfaces. |

| Backend Technologies | Server-side logic and database interactions (e.g., Node.js, Python). | – Handles real-time data efficiently. – Easy integration with databases. | Processing trades, managing user accounts, and handling transactions. |

| APIs | Third-party services for market data and payment processing (e.g., Alpha Vantage, Stripe). | – Provides real-time stock quotes. – Secure handling of financial transactions. | Fetching market data and processing user payments. |

| Database Solutions | Storage solutions for user data and transaction records (e.g., PostgreSQL, MongoDB). | – Efficient data retrieval and management. – Scalability for growing user bases. | Storing user profiles, transaction history, and account balances. |

| Security Measures | Protocols to protect user data and transactions (e.g., SSL, 2FA). | – Builds user trust. – Prevents unauthorized access and data breaches. | Ensuring secure logins and protecting sensitive financial information. |

| Cloud Services | Platforms for app hosting and scalability (e.g., AWS, Google Cloud). | – Scalable resources to handle traffic spikes. – Reliable data storage and analytics tools. | Hosting the application, managing user data, and scaling with user growth. |

Building an app like E*TRADE involves a comprehensive understanding of the technical requirements necessary for successful development. This section outlines the essential technologies and components needed to create a robust trading platform.

- Frontend Technologies: The frontend is what users interact with, so it’s crucial to choose frameworks that enable responsive and dynamic designs. React Native and Flutter are popular choices for building cross-platform apps, allowing you to develop for both iOS and Android with a single codebase. This not only reduces development time but also ensures a consistent user experience across devices.

- Backend Technologies: The backend handles the logic, database interactions, and server-side operations. Node.js is a great option due to its non-blocking architecture, making it suitable for real-time applications like trading platforms. Alternatively, Python is also favored for its simplicity and extensive libraries, particularly in data analysis and financial modeling.

- APIs: Integrating third-party APIs is crucial for functionalities such as market data access and transaction processing. Financial data APIs (like Alpha Vantage or IEX Cloud) provide real-time stock quotes and historical data. Payment processing APIs (such as Stripe or PayPal) are essential for handling user transactions securely.

- Database Solutions: Choosing the right database is vital for managing user data and transaction records. PostgreSQL and MongoDB are popular options. PostgreSQL is great for structured data and complex queries, while MongoDB’s NoSQL structure allows for greater flexibility, especially for unstructured data.

- Security Measures: Given the sensitive nature of financial transactions, implementing robust security measures is non-negotiable. This includes end-to-end encryption for data transfer, secure socket layer (SSL) certificates, and two-factor authentication (2FA) to protect user accounts.

- Cloud Services: Utilizing cloud platforms like Amazon Web Services (AWS) or Google Cloud ensures scalability and reliability. These services can handle increasing traffic as your user base grows and offer tools for data storage, analytics, and application deployment.

By carefully selecting the right technologies and implementing strong security measures, you can build a trading app that not only functions efficiently but also prioritizes user trust and satisfaction. This technical foundation will be critical as you scale your application and enhance its features in response to user feedback.

Design and User Interface (UI/UX)

Creating a successful trading app like E*TRADE goes beyond just functionality; a great design and user interface (UI) are crucial to enhancing the overall user experience (UX). An intuitive and visually appealing design can significantly impact how users interact with your app, influencing their satisfaction and retention. Here are key elements to focus on:

- Simplicity and Clarity: The primary goal of your app’s design should be to make it easy for users to navigate and execute trades. A clean layout with straightforward menus helps users find what they need without confusion. Limit the number of options on each screen to avoid overwhelming users.

- Responsive Design: With users accessing trading apps from various devices, responsive design is essential. Ensure your app looks and functions well on smartphones, tablets, and desktops. Utilizing frameworks like Bootstrap can help create a fluid design that adapts to different screen sizes.

- Visual Hierarchy: Organize information in a way that guides users through the app effortlessly. Use size, color, and positioning to highlight key actions, such as “Buy” or “Sell” buttons. Important information should stand out to make trading decisions easier.

- Color Scheme and Branding: Choose a color palette that aligns with your brand identity while also being visually appealing. Colors can evoke emotions and influence behavior, so select hues that instill trust and professionalism, such as blues and greens commonly associated with finance.

- Interactive Elements: Incorporate interactive features such as charts, graphs, and sliders that allow users to visualize data easily. Dynamic elements not only make the app more engaging but also help users make informed decisions based on real-time data.

- User Feedback Mechanisms: Integrate features that provide instant feedback on user actions. For example, animations when a trade is executed or confirmations when an account is updated can enhance user satisfaction and instill confidence in the app’s functionality.

- Accessibility: Ensure your app is accessible to all users, including those with disabilities. Features like voice commands, adjustable text sizes, and high-contrast modes can make your app more inclusive.

By prioritizing these design principles, you can create an engaging UI/UX that resonates with users. A well-designed trading app not only enhances user experience but also fosters loyalty and encourages active participation in trading activities.

Development Process

| Stage | Description | Key Activities | Goals |

|---|---|---|---|

| 1. Idea Validation | Confirm the demand for your app concept. | – Conduct market research. – Surveys and focus groups. – Analyze competitors. | Ensure there’s a market need for your app. |

| 2. Wireframing & Prototyping | Create visual layouts to outline the app’s design. | – Develop wireframes. – Use tools like Figma or Sketch. – Build interactive prototypes. | Visualize user journeys and refine designs. |

| 3. Backend Development | Set up the server-side infrastructure. | – Configure databases and servers. – Write APIs for data handling. | Create a robust backend for processing trades and managing data. |

| 4. Frontend Development | Develop the user interface that users will interact with. | – Build the UI using frameworks like React Native. – Ensure responsiveness and accessibility. | Provide an intuitive and engaging user experience. |

| 5. Integration of APIs | Incorporate necessary third-party services. | – Integrate market data and payment processing APIs. – Test API functionality. | Enhance app capabilities and ensure real-time data flow. |

| 6. Testing | Validate app performance and user experience. | – Conduct unit and integration testing. – Perform user acceptance testing (UAT). | Identify and fix bugs; ensure usability. |

| 7. Deployment | Launch the app for users to access. | – Deploy on cloud platforms (e.g., AWS, Google Cloud). – Implement security protocols. | Successfully launch the app with robust security. |

| 8. Post-Launch Support | Monitor performance and implement updates. | – Collect user feedback. – Release regular updates and fixes. | Maintain user satisfaction and app relevance. |

Building an app like E*TRADE involves a structured development process that ensures each aspect of the application is carefully crafted and thoroughly tested. Here’s a step-by-step overview of the development journey:

- Idea Validation: Before diving into development, it’s essential to validate your app concept. Conduct market research to understand user needs, preferences, and pain points. Surveys and focus groups can provide valuable insights into what potential users seek in a trading app. This step will help you refine your idea and ensure there’s demand for your app.

- Wireframing and Prototyping: Once the idea is validated, create wireframes to outline the app’s layout and functionality. This visual representation helps you map out user journeys and interactions. Tools like Figma or Sketch can assist in building prototypes that simulate user experience. Prototyping allows for quick iterations based on feedback, ensuring the design meets user expectations before moving into development.

- Backend and Frontend Development: With wireframes in hand, it’s time to start coding. The backend development involves setting up servers, databases, and APIs. This is where all the behind-the-scenes magic happens—processing trades, managing user data, and ensuring security. For the frontend, focus on creating an intuitive user interface that aligns with your designs. Use frameworks like React Native for mobile apps to build a seamless experience across platforms.

- Integration of APIs: Incorporate third-party APIs for real-time market data, payment processing, and any other necessary features. Ensure these integrations are smooth and secure to maintain user trust. Testing these integrations is crucial to ensure they function correctly and enhance the app’s capabilities.

- Testing: Rigorous testing is vital to ensure your app is reliable and user-friendly. Conduct various tests, including unit testing, integration testing, and user acceptance testing (UAT). Involve real users during the UAT phase to gather feedback and identify any issues before the official launch.

- Deployment: Once testing is complete and any bugs are fixed, it’s time to deploy the app. Choose a suitable cloud platform like AWS or Google Cloud for hosting. Ensure that all necessary security protocols are in place to protect user data during and after deployment.

- Post-Launch Support and Updates: After the app goes live, monitor its performance and user feedback closely. Be prepared to address any issues that arise and provide timely updates. Continuous improvement based on user feedback will help maintain engagement and satisfaction.

By following this structured development process, you can build a robust and user-friendly trading app that meets the needs of modern investors. Each stage is crucial to ensuring that your app not only functions well but also provides a seamless and engaging user experience.

Cost Estimation and Timeframe

| Cost Component | Description | Estimated Cost Range |

|---|---|---|

| Feature Development | Cost of implementing core and advanced features. | $20,000 – $100,000+ |

| Design and UX | Investment in user interface and user experience design. | $10,000 – $30,000 |

| Backend Infrastructure | Setting up servers and integrating APIs. | $15,000 – $40,000 |

| Development Team | Hourly rates for developers, designers, and project managers. | $30 – $200 per hour |

| Basic MVP Development | Estimated timeframe for a Minimum Viable Product. | 3 to 6 months |

| Full-Scale App Development | Timeframe for a complete app with advanced features. | 6 to 12 months |

| Ongoing Costs | Monthly expenses for server, maintenance, and support. | $1,000 – $5,000 per month |

Estimating the cost and timeframe for building a trading app like E*TRADE is essential for planning and budgeting. Various factors can influence both, including the complexity of features, the technology stack, and the development team’s location. Here’s a breakdown of key considerations:

- Development Costs:

- Feature Complexity: The more features you include, the higher the cost. Basic functionalities such as account creation and trading execution may range from $20,000 to $50,000. However, adding advanced features like real-time analytics or social trading functionalities can push costs upwards of $100,000 or more.

- Design and UX: Investing in a good user interface and experience is crucial for user retention. A well-designed app can add an additional $10,000 to $30,000 to your budget.

- Backend Infrastructure: Setting up secure servers and integrating APIs can also add significant costs, generally estimated between $15,000 to $40,000.

- Team Composition: The size and expertise of your development team can greatly influence costs. Hiring experienced developers, UI/UX designers, and project managers in North America or Western Europe can be more expensive (ranging from $100 to $200 per hour). In contrast, hiring a team in Eastern Europe or Asia may range from $30 to $70 per hour.

- Timeframe for Development:

- Basic MVP: If you are developing a Minimum Viable Product (MVP) with essential features, expect a timeframe of about 3 to 6 months.

- Full-Scale App: For a complete app with advanced features, the development may take 6 to 12 months or longer, depending on the complexity.

- Ongoing Costs: Remember to budget for ongoing expenses after the app launch. This includes server costs, maintenance, updates, and customer support, which can range from $1,000 to $5,000 per month.

By understanding these cost components and the estimated timeframe, you can better prepare for the financial and logistical aspects of building your trading app. Proper budgeting will not only help in allocating resources efficiently but also in setting realistic expectations for project completion.

Create a powerful trading platform!

From real-time alerts and charting tools to multifunctional

portfolio tracking, we can help you develop an app

that empowers users to trade smarter.

Monetization Strategies

Monetizing your trading app like E*TRADE is crucial for achieving profitability and ensuring long-term sustainability. Here are some effective strategies to consider:

- Commission-Based Model: This traditional model involves charging users a fee for each trade they execute. While it provides a direct revenue stream, consider offering competitive rates to attract users. For instance, some platforms offer zero-commission trades to entice new customers, relying instead on volume to drive revenue.

- Subscription Fees: Implementing a subscription model allows you to charge users a recurring fee for premium features, advanced tools, or exclusive content. This could include in-depth market analysis, personalized investment advice, or enhanced trading tools. By providing significant value, you can justify the subscription cost and foster user loyalty.

- Freemium Model: Offer a basic version of your app for free while charging for premium features. This model allows users to experience your app without any upfront cost, encouraging them to upgrade as they recognize the value of advanced features. This approach can significantly expand your user base.

- In-App Purchases: Allow users to purchase additional features or tools directly within the app. For instance, users could pay for premium charts, additional data analytics, or specific trading indicators. This can be a lucrative way to enhance user experience while generating extra revenue.

- Advertising: Once your app has a substantial user base, consider incorporating advertisements. Partnering with financial institutions for sponsored content can also provide revenue without directly charging your users. However, be mindful of the user experience; intrusive ads can lead to dissatisfaction.

- Partnerships and Affiliations: Collaborate with financial services or educational platforms to offer their services through your app. You could earn a referral fee for every user that signs up for these services, providing a win-win situation for both parties.

- Data Monetization: If appropriate, you could aggregate anonymized user data to sell insights to market research firms or financial institutions. However, ensure that you comply with data privacy regulations and maintain user trust.

By exploring these monetization strategies, you can create a diverse revenue stream that enhances the financial viability of your trading app. The key is to balance profitability with user satisfaction, ensuring that your users see value in what they pay for while also maintaining a competitive edge in the market.

Launching and Marketing the App

Once your app is developed, successfully launching and marketing it are critical steps that will determine how well it performs in a competitive market. Here’s a step-by-step guide to ensure a smooth launch and effective marketing strategy:

- Pre-Launch Preparation: Before you officially launch your app, build anticipation by creating a pre-launch campaign. This could include teaser videos, early access invitations, and building a landing page that explains your app’s features and benefits. Collect email addresses from interested users so you can notify them when the app is live.

- App Store Optimization (ASO): Just as SEO is crucial for websites, ASO is essential for your app’s visibility in app stores. Optimize your app title, description, and keywords to ensure it appears in relevant searches. Use high-quality screenshots and engaging promotional videos to showcase your app’s functionality.

- Leverage Social Media and Influencers: Use social media platforms like Instagram, Twitter, LinkedIn, and YouTube to promote your app. Collaborate with financial influencers or bloggers to review your app and share their experiences with their audience. This can build credibility and drive downloads.

- Content Marketing: Create educational content that addresses common pain points for your target users. For instance, blog posts, webinars, and video tutorials about trading strategies, how to use your app, or tips for new investors can attract potential users who are searching for valuable insights.

- Referral Programs: Encourage word-of-mouth marketing by offering referral incentives to existing users. When users invite friends or family to download the app, reward them with free access to premium features, discounted trades, or other perks. This approach can quickly expand your user base.

- Paid Advertising: Consider using paid ads on Google, Facebook, or financial websites to drive traffic to your app. Targeted advertising ensures that your marketing budget is spent on reaching users who are most likely to download and use your app. Pay-per-click (PPC) campaigns can also help you measure performance and optimize your ads for better results.

- Partnerships: Collaborate with financial institutions or educational platforms to co-promote your app. For instance, if a financial website features your app as a recommended trading platform, it can drive significant traffic and downloads.

- Launch Event: If possible, host a virtual or in-person launch event to create buzz around your app’s release. You can invite industry experts, influencers, and early adopters to test the app, share their experiences, and promote it to their networks.

By following these steps, you’ll increase your app’s visibility and ensure a successful launch. Consistent marketing efforts, coupled with valuable features and a user-friendly experience, will help your trading app gain traction and grow steadily.

Legal and Regulatory Considerations

When developing a trading app like E*TRADE, it’s vital to ensure compliance with legal and regulatory frameworks. Financial apps are subject to strict regulations due to the sensitive nature of the transactions they facilitate and the handling of personal user data. Here’s a breakdown of key legal aspects you must address:

- Licensing and Compliance: To legally offer trading services, you’ll need to obtain the appropriate licenses from financial regulatory bodies in the countries where you operate. In the U.S., for example, the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) regulate brokerage firms. In Europe, MiFID II applies, while ASIC oversees trading platforms in Australia. Ensure your app complies with the relevant laws and acquire any necessary approvals before launch.

- Data Privacy Laws: Your app will handle sensitive user information such as personal details, financial data, and transaction history. It’s critical to comply with data protection laws like General Data Protection Regulation (GDPR) in Europe and California Consumer Privacy Act (CCPA) in the U.S. Implement robust privacy policies, and ensure that users understand how their data is collected, used, and protected.

- Know Your Customer (KYC) and Anti-Money Laundering (AML) Regulations: To prevent fraud and illegal activity, your app must include KYC protocols to verify user identities during the onboarding process. This may involve collecting proof of identity, address verification, and financial background checks. Additionally, adhere to AML regulations to detect and report suspicious transactions to the appropriate authorities.

- Payment Compliance: If your app processes payments, you’ll need to comply with Payment Card Industry Data Security Standard (PCI DSS) to protect cardholder data and ensure secure payment transactions. Additionally, ensure your payment gateway integrations are secure and comply with local regulations for financial transactions.

- Terms and Conditions & User Agreements: Draft clear terms and conditions, privacy policies, and user agreements to protect both your business and your users. These documents should outline the app’s use, responsibilities, data handling, and legal liabilities. It’s advisable to work with legal professionals to ensure these agreements are legally sound and in full compliance with regional laws.

- Intellectual Property Protection: Protect your app’s brand, code, and design through copyrights, trademarks, and patents, if applicable. Registering these rights helps safeguard your app from unauthorized use or replication by competitors.

- Cybersecurity Measures: Ensure that your app complies with cybersecurity regulations and employs state-of-the-art security measures to protect against cyberattacks. This includes using encryption, firewalls, and multi-factor authentication (MFA) to secure sensitive financial and personal data.

By addressing these legal and regulatory considerations, you can build a trusted trading app that adheres to the highest standards of security and compliance. It’s essential to work with legal experts who specialize in fintech to ensure all your bases are covered, both locally and internationally.

Also Read :- Build Your Own Crypto Exchange: A Guide to Creating an App Like Coinbase

Future Growth

Building an app like E*TRADE is just the beginning—sustaining its success and scaling for future growth is a critical part of the journey. As the fintech market continues to evolve, so too must your app. Here are key strategies for ensuring your app remains competitive and well-positioned for long-term growth:

- User Growth and Retention: To scale effectively, focus on acquiring new users while retaining existing ones. Invest in user engagement through personalized features like custom dashboards, tailored notifications, and exclusive content. Regularly update the app with new features or improvements to keep users excited and engaged. Offering loyalty programs or discounts on premium services can also help increase user retention.

- Global Expansion: Expanding your app to new markets can significantly increase your user base. This might involve adapting the app to support multiple languages, currencies, and comply with international regulations. For example, launching in Europe would require compliance with MiFID II regulations, while expanding into Asia might require different KYC/AML protocols. Conduct market research in your target regions to identify potential barriers to entry and opportunities for growth.

- Introduce New Features: Keep your app competitive by continuously evolving its features based on user feedback and emerging market trends. For instance, consider incorporating AI-driven trading tools, robo-advisors, or social trading features. These advanced tools can provide users with personalized insights and help them make smarter investment decisions.

- Scalability of Infrastructure: As your user base grows, so will the demand on your infrastructure. Ensure that your app is hosted on a scalable cloud platform, like AWS or Google Cloud, that can handle increased traffic without compromising performance. This also includes strengthening your backend systems to support more complex transactions and higher volumes of user data.

- Data Analytics for Business Insights: Use data analytics to gain insights into user behavior, market trends, and app performance. By analyzing user interactions, you can refine your strategies for product updates, marketing campaigns, and customer service. Data-driven decisions will help optimize your app’s features and overall user experience.

- Partnerships and Integrations: Partnering with financial institutions, educational platforms, or fintech services can provide added value for your users. For example, offering integrated financial advisory services or exclusive investment content can attract more users and position your app as a comprehensive investment solution.

- Adapt to Regulatory Changes: The regulatory environment is constantly changing, especially in fintech. Ensure your app is always compliant with the latest regulations, and be prepared to adjust your services in response to new laws. Proactively staying ahead of legal changes will prevent disruptions and help you maintain user trust.

By focusing on these strategies, your app can achieve sustained growth and adapt to the fast-paced changes in the fintech world. Prioritizing innovation, infrastructure scalability, and regulatory compliance will ensure that your app remains competitive and continues to thrive in an ever-evolving market.

Also Read :- How to Build a Cryptocurrency App like Gemini from Scratch

Why Trust Miracuves Solutions for Your Next Project?

| Key Factor | Description | Benefits |

|---|---|---|

| Proven Expertise | Extensive experience in fintech app development. | Ensures your app meets technical, regulatory, and market standards. |

| Tailored Solutions | Customized services based on specific business and market needs. | Delivers a unique app that aligns with your goals and user expectations. |

| End-to-End Support | Full-cycle development services from ideation to post-launch maintenance. | Guarantees a smooth, efficient development process with ongoing support. |

| Strong Focus on Security | Implements robust security measures, including encryption and audits. | Protects sensitive user data and ensures compliance with regulations. |

| Innovative Features | Integration of cutting-edge technologies like AI and blockchain. | Provides a competitive edge with advanced functionality and future-ready features. |

| Scalability and Future-Proofing | Scalable app architectures and modular designs for future growth. | Ensures your app can grow with your business and adapt to market changes. |

Choosing the right partner for developing a trading app like E*TRADE is crucial to ensure success. Miracuves Solutions stands out as an industry leader in providing customized and innovative app development services. Here’s why you should trust Miracuves Solutions for your next project:

- Proven Expertise: With years of experience in building financial technology (fintech) solutions, Miracuves Solutions understands the complexities of creating robust, secure, and scalable trading platforms. Our team of expert developers and financial specialists knows how to build apps that meet both technical and regulatory standards.

- Tailored Solutions: At Miracuves Solutions, we don’t believe in a one-size-fits-all approach. We tailor our solutions to meet the specific needs of your business and target audience. Whether you’re looking to develop an MVP or a fully-featured trading app, we offer a range of development services that can be customized to your unique goals.

- End-to-End Support: From ideation and development to launch and post-launch support, we provide full-cycle services. Our team works with you at every step, ensuring a smooth and efficient development process. We also offer ongoing maintenance and updates to ensure your app stays up to date and continues to perform well.

- Strong Focus on Security: Security is a top priority when dealing with financial data. Miracuves Solutions employs industry-leading practices such as encryption, two-factor authentication, and regular security audits to safeguard sensitive user information and ensure compliance with data protection regulations.

- Innovative Features: We are committed to helping our clients stay ahead of the curve by integrating cutting-edge technologies like artificial intelligence (AI) for trading recommendations, blockchain for secure transactions, and advanced analytics for data-driven insights. These innovations not only make your app more attractive but also ensure it stands out in a competitive market.

- Scalability and Future-Proofing: Miracuves Solutions builds apps that grow with your business. We design scalable architectures that can handle increasing traffic and transactions as your user base expands. Our team ensures your app is ready for future growth by integrating modular features and supporting global expansion plans.

By partnering with Miracuves Solutions, you are choosing a reliable and innovative development team that will bring your trading app vision to life. We pride ourselves on delivering high-quality solutions that exceed client expectations and help businesses thrive in the fast-paced world of fintech.

Also Read :- Creating a Stock Trading App Like Zerodha: A Step-by-Step Tutorial

Conclusion

Building a trading app like E*TRADE is an ambitious yet rewarding venture that requires careful planning, cutting-edge technology, and a deep understanding of the fintech market. By focusing on essential features, user experience, and robust security measures, you can create an app that appeals to a wide range of investors and traders.

Through each phase of development—from validating your idea to scaling for future growth—you have the opportunity to create a platform that empowers users and meets their financial needs. Prioritizing features like real-time data, advanced trading tools, and seamless account management ensures a positive user experience and long-term success.

By partnering with experienced development teams like Miracuves Solution, you can ensure that your app is built to the highest standards, with a focus on innovation, security, and scalability. With the right strategy, your trading app can carve out its space in the competitive fintech market and continue to grow for years to come.

If you’re ready to turn your idea into reality, now is the perfect time to start your journey toward creating a world-class trading app.

Ready to launch your own E-Trade platform?

Our pre-built E-Trade app solutions include real-time market data, trade execution, portfolio management, and customizable trading features—all designed for scalability and security.

FAQs

How long does it take to build a trading app like E*TRADE?

Developing a basic version can take between 3 to 6 months, while a fully-featured app may take 6 to 12 months or more, depending on complexity.

What are the key features of a successful trading app?

Essential features include real-time market data, secure transactions, intuitive user interfaces, advanced trading tools, and educational resources for users.

How much does it cost to develop a trading app?

Development costs can range from $50,000 to $200,000, depending on the complexity of the features, team size, and region of development.

What are the regulatory requirements for a trading app?

Your app must comply with local and international regulations, such as KYC (Know Your Customer), AML (Anti-Money Laundering), and data privacy laws like GDPR or CCPA.

How can I monetize a trading app?

Common monetization strategies include commission-based models, subscription fees, in-app purchases, advertising, and partnerships with financial institutions.