Cryptocurrency is rapidly transforming the global financial landscape, and at the forefront of this revolution are crypto exchanges like Binance. Binance, in particular, has set the standard for seamless and secure crypto trading, amassing millions of users worldwide. With the growing adoption of digital currencies, building a crypto exchange platform presents an unparalleled business opportunity.

If you’ve ever considered starting a crypto exchange like Binance, you’re in the right place. This comprehensive guide will walk you through the entire process, from understanding the basic framework of cryptocurrency exchange development to implementing essential security protocols and complying with global regulations. With the right strategy, you can create a Binance clone that not only rivals top exchanges but also stands out in today’s competitive market.

In the following sections, we’ll delve into the core components of building a cryptocurrency exchange platform, ensuring you’re equipped with practical knowledge and actionable steps to launch your own crypto trading platform successfully.

Understanding the Basics of Cryptocurrency Exchange Development

What is a Crypto Exchange?

A cryptocurrency exchange is a platform that allows users to buy, sell, and trade digital assets like Bitcoin, Ethereum, and other cryptocurrencies. These platforms operate in two primary forms: centralized exchanges (CEXs) and decentralized exchanges (DEXs). Centralized exchanges, such as Binance, act as intermediaries between buyers and sellers, ensuring liquidity and security. On the other hand, decentralized exchanges enable peer-to-peer trading without intermediaries, offering more privacy and control to users but with higher risk.

For anyone entering the space, choosing the right exchange model is crucial. Centralized exchanges typically provide greater ease of use, liquidity, and customer support, while decentralized exchanges align more with the crypto community’s ethos of decentralization.

Binance Clone: What Is It and Why You Should Consider It?

A Binance clone refers to a ready-made cryptocurrency exchange software that mimics the core functionalities of the Binance platform. It allows entrepreneurs and businesses to launch their crypto exchange in a significantly shorter time frame, with less development cost compared to building one from scratch. By using a white-label exchange solution, you can customize the platform to suit your brand and operational needs while leveraging proven exchange features like advanced trading systems, multi-currency wallets, and high-security protocols.

The primary benefit of choosing a Binance clone is that it provides a cost-effective and scalable solution, enabling you to quickly enter the market and attract users. With the flexibility to customize the platform, businesses can focus on features that resonate with their target audience, giving them a competitive edge in the ever-growing crypto space.

Market Demand and Opportunities in Crypto Trading

The global cryptocurrency market has witnessed exponential growth, with the total market capitalization reaching over $2 trillion in recent years. The number of active crypto traders is also skyrocketing, creating a massive demand for crypto trading platforms that are fast, secure, and user-friendly. Binance, for instance, handles billions of dollars in daily trading volume, showcasing the immense profitability of this sector.

Building a crypto exchange like Binance allows you to tap into this fast-growing market and cater to a wide user base, including retail traders, institutional investors, and even blockchain developers. Whether you choose to focus on a decentralized exchange or a centralized platform, the opportunities for growth and revenue are immense, especially as digital assets continue to gain mainstream acceptance.

Steps to Build a Cryptocurrency Exchange Like Binance

Planning and Market Research

Before diving into development, comprehensive market research is essential. Start by analyzing your target market and identifying the needs of potential users. Are you targeting retail investors, institutional traders, or a niche community of blockchain enthusiasts? Understanding your target audience helps you define the scope of your exchange, from the types of cryptocurrencies to be supported to the level of trading sophistication required.

Next, study the competition. Analyze the strengths and weaknesses of existing exchanges like Binance, Coinbase, and Kraken. Determine which features are most valued by users, such as high-frequency trading systems, user-friendly interfaces, and secure crypto wallets. Armed with this knowledge, you can create a business plan that outlines the platform’s structure, features, and long-term goals, ensuring your exchange stands out from the crowd.

Choosing the Right Development Model

When it comes to cryptocurrency exchange development, businesses can choose between two primary development models: building from scratch or using a white-label exchange solution.

- Building from Scratch: This option gives you complete control over the platform’s features, design, and security architecture. However, it requires significant time, resources, and expertise. It involves custom-coding the backend infrastructure, integrating essential features such as P2P trading platforms, and ensuring blockchain integration for secure and transparent transactions.

- White-Label Exchange Solution: For a quicker and more cost-effective launch, a white-label Binance clone is a popular choice. These pre-built solutions come equipped with essential features like multi-currency wallets, API integration for crypto exchange, and liquidity management. White-label solutions allow customization of the interface and functionality, giving your platform a unique identity while leveraging proven technology.

Core Features for Crypto Exchange

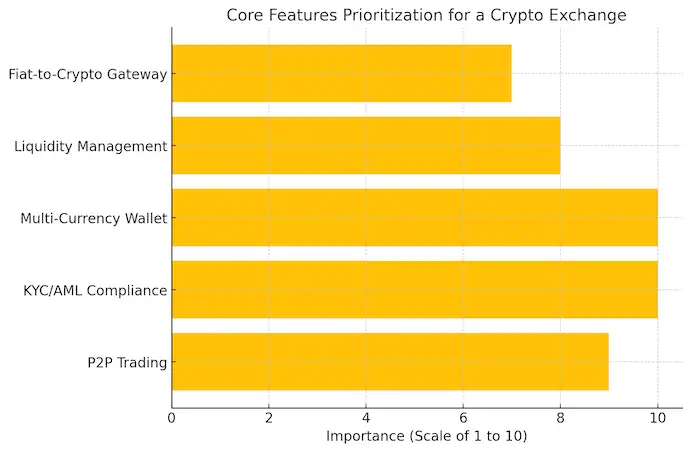

The success of a crypto trading platform depends on its features. Here’s a breakdown of the essential components your exchange must have to compete with platforms like Binance:

- P2P Trading Platform: Allows users to trade directly with each other without intermediaries, increasing privacy and reducing fees.

- KYC/AML Compliance: To comply with international regulations, integrating a robust Know Your Customer (KYC) and Anti-Money Laundering (AML) system is essential. This protects the platform from fraudulent activities while building trust with users.

- Multi-Currency Wallet: Support for multiple cryptocurrencies is a must. Your exchange should provide users with secure crypto wallets that allow easy deposits, withdrawals, and storage of various digital assets.

- API Integration: Implementing API integration for crypto exchange allows your platform to connect with external services like payment processors and trading bots, enhancing functionality and user experience.

- Liquidity Management: Liquidity is critical for ensuring smooth trading on your platform. Implement systems that manage liquidity efficiently, such as connecting to liquidity providers or enabling users to act as market makers.

- Fiat-to-Crypto Gateway: Enabling fiat-to-crypto transactions (e.g., USD to Bitcoin) will significantly broaden your exchange’s user base. By offering a simple fiat-to-crypto gateway, you attract novice traders who need a bridge between traditional and digital currencies.

| Feature | Description | Importance |

|---|---|---|

| P2P Trading Platform | Enables peer-to-peer transactions without intermediaries. | High |

| Multi-Currency Wallet | Supports storing and transacting with multiple cryptocurrencies. | Critical |

| KYC/AML Compliance | Ensures legal compliance with global anti-fraud measures. | Critical |

| API Integration for Crypto | Allows external services and tools to connect to the platform. | High |

| Liquidity Management | Ensures sufficient liquidity to execute trades quickly. | High |

| Fiat-to-Crypto Gateway | Allows users to convert fiat currencies into cryptocurrencies. | Medium |

Security Measures and Exchange Protocols

In the world of cryptocurrency, security is paramount. Without robust security features, your exchange is vulnerable to hacking and theft, which can destroy your platform’s reputation. Here are the essential security measures every exchange should implement:

- Two-Factor Authentication (2FA): A critical layer of security, two-factor authentication ensures that users must verify their identity through multiple channels before accessing their accounts or making transactions.

- Exchange Security Protocols: Use state-of-the-art security protocols to protect the platform from Distributed Denial of Service (DDoS) attacks, phishing, and other threats. Advanced encryption, multi-signature wallets, and hardware security modules (HSMs) can help safeguard user assets.

- Smart Contracts for Exchanges: For decentralized platforms, integrating smart contracts ensures that trades are executed automatically when specific conditions are met. This eliminates the need for third-party intermediaries, making transactions more transparent and secure.

By focusing on a secure, scalable, and user-friendly platform, you can build a crypto exchange that attracts traders and maintains their trust in the long term.

Technical Requirements for Building a Crypto Exchange Like Binance

Building a cryptocurrency exchange involves a range of complex technical requirements to ensure the platform is secure, scalable, and user-friendly. Below are the key technical components and requirements necessary for a successful crypto exchange development:

1. Trading Engine

The trading engine is the core component of your exchange. It handles the execution of buy and sell orders, matches trades, and manages the order book. A reliable trading engine should support various order types, such as market orders, limit orders, and stop orders, while maintaining high efficiency even during high-volume trading periods.

- Key Features: Order matching, price determination, trade execution

- Technical Considerations: Low-latency processing, support for high-frequency trading

2. User Interface (UI) and User Experience (UX)

A well-designed UI/UX is crucial for user engagement. Your platform should be intuitive, easy to navigate, and responsive across devices (desktop, mobile, and tablet). The interface should include features like real-time price charts, order book displays, and a seamless trading experience.

- Key Features: Intuitive dashboards, responsive design, user-friendly navigation

- Technical Considerations: Front-end development using React, Angular, or Vue.js, optimized for speed and performance

3. Blockchain Integration

Blockchain integration is essential for verifying and processing crypto transactions on the platform. The integration allows for secure and transparent trading, fund transfers, and the management of crypto assets. Supporting multiple blockchains ensures that users can trade various cryptocurrencies securely.

- Key Features: Secure transaction verification, decentralized ledger, asset management

- Technical Considerations: API integration with popular blockchains (Bitcoin, Ethereum, Binance Smart Chain, etc.), handling node synchronization

4. Secure Crypto Wallet

Your exchange must offer multi-currency wallets for storing different cryptocurrencies. This includes both hot wallets for quick access to funds and cold wallets for securely storing large amounts offline. The wallet infrastructure must include encryption and multi-signature functionality to ensure the highest level of security.

- Key Features: Multi-currency support, hot and cold wallets, multi-signature

- Technical Considerations: Wallet encryption, secure key management, hardware security modules (HSMs)

5. KYC/AML Compliance

Compliance with KYC/AML regulations is a technical requirement for most jurisdictions. Implementing KYC requires integrating systems that can verify user identities through government-issued IDs and other documents. AML protocols help monitor suspicious trading activity and prevent fraud.

- Key Features: User identity verification, anti-money laundering tracking, risk management

- Technical Considerations: Third-party integration for KYC services (e.g., Onfido, Jumio), automated AML monitoring tools

6. API Integration

APIs are essential for connecting your platform to external services and tools such as payment gateways, liquidity providers, and third-party applications (like trading bots). A well-documented API integration allows developers to build on your platform, enhancing user functionality.

- Key Features: Integration with payment processors, liquidity management systems, trading bots

- Technical Considerations: RESTful or WebSocket APIs, API security using OAuth or API keys

7. Security Infrastructure

Security is paramount for any crypto exchange. Beyond basic security measures like two-factor authentication (2FA), your platform must include encryption protocols, DDoS protection, firewall configurations, and secure coding practices to prevent breaches. Additionally, regular security audits should be scheduled to identify vulnerabilities.

- Key Features: Two-factor authentication, multi-signature transactions, encryption

- Technical Considerations: SSL encryption, regular security audits, compliance with data privacy regulations (e.g., GDPR)

8. Liquidity Management System

A well-functioning exchange must have sufficient liquidity to ensure users can execute trades without significant price slippage. You can integrate liquidity from external providers or allow users to act as liquidity providers using a liquidity management system.

- Key Features: Efficient order matching, minimal slippage, external liquidity integration

- Technical Considerations: Connection to liquidity pools or external market makers, automated market-making algorithms

9. Admin and Management Console

An efficient admin console allows the management team to oversee operations, approve listings, monitor trading activity, and manage users. This tool also provides insights into platform performance, security alerts, and regulatory compliance.

- Key Features: User management, trading activity monitoring, reporting tools

- Technical Considerations: Role-based access control, real-time dashboards, integration with compliance tools

10. High-Frequency Trading Systems

For advanced traders, offering support for high-frequency trading (HFT) systems can provide an edge. HFT systems require low-latency networks and optimized order execution to facilitate large volumes of trades at lightning speed.

- Key Features: Fast order execution, algorithmic trading, low-latency processing

- Technical Considerations: Co-located servers, low-latency networking, optimized algorithms for market arbitrage

Final Thoughts on Technical Requirements

Successfully launching a crypto exchange like Binance requires a meticulous focus on technical aspects, from the architecture of the trading engine to blockchain integration and security protocols. By ensuring that these technical components are robust and scalable, you can create a platform that is not only functional but also secure and trusted by users. A strong technical foundation also sets your exchange up for future enhancements and growth as the crypto industry evolves.

Worried about high development costs for your crypto app?

Start Your Crypto App with Low Costs ! We offer cost-effective

solutions without compromising quality.

Cost of Developing a Crypto Exchange Like Binance

Factors Affecting the Cost

The cost of developing a crypto exchange like Binance depends on several factors, ranging from the scope of features to the security protocols you plan to implement. Here are the key components that influence the overall budget:

- Development Approach: Choosing between building the exchange from scratch or using a white-label exchange solution has a significant impact on the cost. Developing from scratch requires a custom development team, longer timelines, and higher upfront costs, whereas white-label solutions reduce development time and expenses.

- Platform Features: The more advanced the features, the higher the cost. Essential features such as P2P trading, multi-currency wallets, and liquidity management require substantial development work. Additionally, integration of fiat-to-crypto gateways, high-frequency trading systems, and API integration adds to the complexity and cost.

- Security Requirements: Robust exchange security protocols like two-factor authentication, multi-signature wallets, and DDoS protection are critical but can be expensive to implement. A strong focus on security will increase costs, but it’s essential for building trust and protecting user funds.

- Regulatory Compliance: Ensuring your exchange complies with KYC/AML regulations across different regions will also impact costs. You’ll need to integrate automated KYC solutions and constantly update them to stay compliant with changing laws.

- UI/UX Design: A user-friendly interface with intuitive navigation is essential for attracting users. Custom design elements, branding, and personalized features require additional investment, but they help differentiate your platform from competitors.

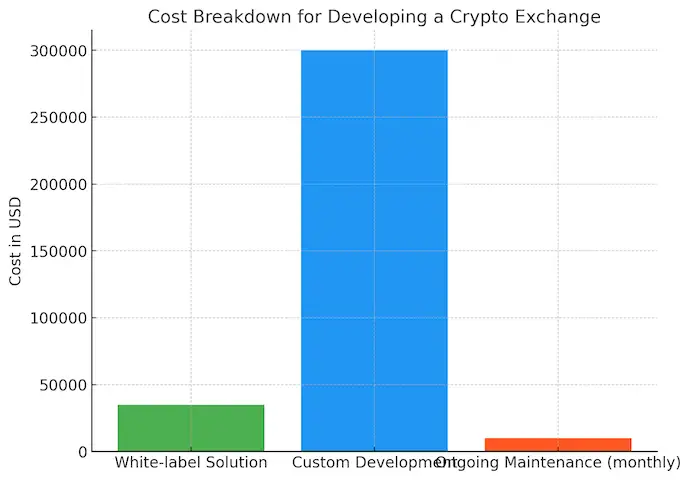

| Development Option | Estimated Cost | Features Included | Time to Market |

|---|---|---|---|

| White-Label Binance Clone | $20,000 – $50,000 | Core features (trading engine, multi-currency wallet, security, API integration) | 1-2 months |

| Custom Development | $100,000 – $500,000+ | Full customization, advanced features (liquidity management, smart contracts) | 6-12 months |

| Ongoing Maintenance (monthly) | $5,000 – $20,000 | Security audits, feature updates, legal compliance | Continuous |

Estimating Development Costs

The cost to develop a cryptocurrency exchange app like Binance can vary widely based on the factors mentioned above. Here’s a rough estimate:

- White-Label Solution: A basic white-label Binance clone with standard features can range from $20,000 to $50,000. This is the most cost-effective option for businesses looking to launch quickly.

- Custom Development: For a fully customized crypto exchange platform, expect to spend anywhere from $100,000 to $500,000 or more. This approach gives you complete control over the features, design, and security protocols, but it requires a significant investment of time and resources.

- Ongoing Costs: Keep in mind the additional expenses related to server hosting, security audits, software maintenance, and legal fees, which can add $5,000 to $20,000 per month.

Ongoing Costs (Maintenance, Upgrades, Support)

Running a cryptocurrency exchange requires continuous attention even after launch. Here are the primary ongoing costs you need to account for:

- Security Audits: Regular security audits are critical to safeguarding your exchange from evolving cyber threats. Depending on the scope of the audit, this can cost $10,000 to $50,000 annually.

- Maintenance and Updates: To stay competitive, you will need to continuously add new features and update the platform. This involves regular software updates, bug fixes, and user support services, which can cost $5,000 to $15,000 per month.

- Compliance Costs: As regulations around cryptocurrencies evolve, you’ll need to ensure your platform remains compliant. This might involve hiring legal advisors or updating KYC/AML protocols, which could add significant ongoing costs.

By planning for these factors and allocating a sufficient budget, you can ensure the long-term success and scalability of your crypto trading platform.

Third-Party Integrations for Crypto Exchanges

Integrating third-party services into your crypto exchange platform can greatly enhance its functionality, improve user experience, and offer a competitive edge. These integrations allow you to provide seamless trading experiences, streamline processes, and ensure your platform remains up to date with market demands.

Payment Gateway Integration

To facilitate smooth transactions between fiat currencies and cryptocurrencies, implementing a fiat-to-crypto gateway is essential. Third-party payment processors like Stripe, Simplex, or MoonPay can help you provide secure, real-time transactions for users looking to buy or sell cryptocurrencies using traditional currencies. These gateways ensure that your users can easily move between fiat and crypto without leaving the platform, making it more user-friendly.

KYC/AML Compliance Integration

Complying with KYC/AML regulations is crucial for the legitimacy of any crypto exchange. Automating this process through third-party KYC/AML services such as Jumio, Onfido, or Shufti Pro ensures a smooth verification process for users. These services help verify user identities quickly, protecting your platform from fraudulent activities and ensuring compliance with global regulations.

Liquidity Providers

Liquidity is the lifeblood of any exchange, and partnering with external liquidity providers ensures that your platform offers smooth trading without delays. Providers like Binance Liquidity Swap or Bitfinex can be integrated to maintain high liquidity, allowing traders to execute large transactions without impacting the market price. This not only boosts trading volume but also enhances the reputation of your exchange among serious traders.

Trading Bots and Algorithmic Trading Tools

Many professional traders use trading bots and algorithmic trading tools to automate their strategies. Integrating with popular services like 3Commas, Cryptohopper, or Shrimpy allows users to connect their accounts and automate trades based on predefined strategies. This feature can attract advanced traders to your platform, increasing user retention and trading volumes.

API Integration for External Tools

Offering API integration allows third-party developers to connect their tools or applications to your platform. This opens up a range of possibilities, from custom analytics tools to external wallet integration. APIs also enable your platform to integrate with other services, such as tax reporting tools or portfolio management software, enhancing user experience and keeping your exchange competitive.

Two-Factor Authentication (2FA) Services

For enhanced security, integrating third-party two-factor authentication (2FA) services like Google Authenticator or Authy is critical. These services add an extra layer of security by requiring users to verify their identity through multiple steps before gaining access to their accounts or making transactions. This integration can drastically reduce the risk of unauthorized access and cyber attacks.

SMS and Email Notifications

Keeping users informed about their trades, account activities, and market movements is crucial for engagement. Integrating third-party services like Twilio or SendGrid for SMS and email notifications can help you automate alerts, ensuring users stay updated in real-time. This improves user experience and boosts confidence in your platform’s responsiveness.

By integrating these third-party services, you can significantly enhance the performance, security, and usability of your crypto exchange platform. These partnerships allow you to offer robust features without having to build everything in-house, ensuring that your platform remains competitive, secure, and user-friendly.

Legal Compliance and Regulations

Importance of KYC and AML Compliance

One of the most critical aspects of running a crypto exchange is ensuring compliance with international regulations, specifically around KYC (Know Your Customer) and AML (Anti-Money Laundering). These protocols are not only necessary for legal reasons but also build trust with users and financial institutions.

KYC compliance requires your exchange to verify the identity of users before they can trade, helping to prevent illegal activities such as money laundering and fraud. This often involves collecting personal information, government-issued ID scans, and proof of address from your users. In many jurisdictions, this is a mandatory step before allowing users to trade or withdraw funds.

AML protocols go a step further by monitoring transactions for suspicious activity. For example, if a user is making unusually large trades or frequent transfers to multiple accounts, the platform is required to flag these actions and possibly report them to financial authorities. Implementing strong KYC/AML measures protects your exchange from potential legal issues and ensures that your platform is safe for legitimate users.

Failing to comply with KYC/AML regulations can lead to heavy fines or even force the shutdown of your platform. Therefore, integrating automated KYC/AML solutions is crucial for the long-term sustainability of your crypto exchange.

Read More “Best Crypto Solutions to Start“

Navigating International Regulatory Frameworks

Cryptocurrency exchanges are subject to a wide variety of regulatory requirements depending on the region in which they operate. Some countries, like the United States, have strict regulations in place, while others, like Malta, offer more crypto-friendly environments. Therefore, you need to choose your operational jurisdiction carefully.

- United States: In the U.S., crypto exchanges must register with FinCEN (Financial Crimes Enforcement Network) and comply with strict KYC/AML laws. Exchanges are also required to report suspicious activities and comply with the Bank Secrecy Act (BSA).

- European Union: In the EU, exchanges must comply with the 5th Anti-Money Laundering Directive (5AMLD), which mandates KYC for all crypto service providers and applies stringent reporting requirements for suspicious transactions.

- Asia: Countries like Japan and Singapore have also implemented comprehensive crypto regulations, requiring exchanges to adhere to strict KYC/AML standards, register with local financial authorities, and follow guidelines on cybersecurity and data privacy.

- Crypto-Friendly Jurisdictions: Some regions, such as Malta, Estonia, and the Cayman Islands, offer more lenient regulatory frameworks, making them attractive for startups. However, even in these jurisdictions, KYC/AML compliance remains essential to avoid becoming a hub for illegal activities.

When planning to launch a crypto trading platform, you must carefully study the legal requirements of your target market. Consulting with legal experts familiar with cryptocurrency regulations will help ensure that your exchange is fully compliant with both local and international laws.

Additionally, it’s essential to stay updated on regulatory changes, as the crypto landscape is continually evolving. Many countries are currently in the process of drafting new laws that could impact the way exchanges operate, particularly around taxation, privacy, and anti-money laundering efforts.

By prioritizing regulatory compliance, you can build a reputable exchange that instills confidence in users and partners, ensuring long-term success in a rapidly changing market.

Advanced Features and Enhancements

Blockchain Integration and Smart Contracts

The foundation of any cryptocurrency exchange lies in its underlying blockchain technology. Integrating blockchain ensures transparency, security, and efficiency in transactions. The decentralized nature of blockchain allows for instant and tamper-proof recording of trades, which is crucial for maintaining user trust and system integrity.

One advanced feature that modern exchanges are adopting is the use of smart contracts. These self-executing contracts automatically enforce the terms of an agreement once pre-defined conditions are met, eliminating the need for intermediaries. This is especially useful for decentralized exchanges (DEXs) where trust between trading parties is a major concern.

By leveraging blockchain integration and smart contracts, you can automate processes such as trade execution, fee calculations, and user verification, making your platform more efficient and secure. These features also help minimize human error, reduce fraud, and enhance the user experience by offering transparency in transactions.

High-Frequency Trading Systems and Liquidity Management

High-frequency trading (HFT) has become a dominant force in the financial markets, including cryptocurrency exchanges. HFT systems enable traders to execute a large number of orders at extremely fast speeds, often profiting from minor price discrepancies across different markets. Implementing a high-frequency trading system can attract advanced traders to your platform, increasing trading volumes and liquidity.

However, for HFT systems to function optimally, your platform needs robust liquidity management mechanisms in place. Liquidity refers to the availability of assets that can be quickly traded without affecting the market price. Without sufficient liquidity, trades can be delayed or executed at unfavorable prices, leading to a poor user experience.

To ensure high liquidity, exchanges often rely on external liquidity providers, partnerships with market makers, or even pooling liquidity from other exchanges. Offering features like automated market makers (AMMs) or allowing users to act as liquidity providers can significantly boost the overall liquidity on your platform.

Advanced liquidity management tools, coupled with HFT systems, can greatly enhance the trading experience on your platform, making it more attractive to both retail and institutional traders.

Enhancing User Security with Advanced Protocols

Security is one of the top concerns for any crypto trading platform, as cyber-attacks and fraud are prevalent in the cryptocurrency industry. To build trust with your users and ensure long-term platform stability, you must implement cutting-edge security protocols.

One of the most crucial security features is two-factor authentication (2FA), which requires users to verify their identity using multiple methods (such as SMS or app-based authentication) before gaining access to their accounts. This extra layer of security helps protect against unauthorized access, even if a user’s password is compromised.

In addition to 2FA, your platform should adopt the following security measures:

- Cold Storage: Store the majority of user funds in offline wallets, or cold storage, which are inaccessible to hackers.

- Multi-Signature Wallets: Require multiple private keys to authorize a transaction, preventing single points of failure.

- DDoS Protection: Implement Distributed Denial of Service (DDoS) protection to safeguard your exchange from attacks that could overload and crash your servers.

- Encryption Protocols: Use end-to-end encryption for all communications and transactions on your platform to prevent data breaches and ensure user privacy.

By integrating advanced security features like two-factor authentication, multi-signature wallets, and DDoS protection, you create a robust defense system that protects both your platform and your users’ assets. Prioritizing security in every aspect of the exchange is key to building a trustworthy reputation in the competitive crypto market.

Business Model and Revenue Streams for Crypto Exchanges

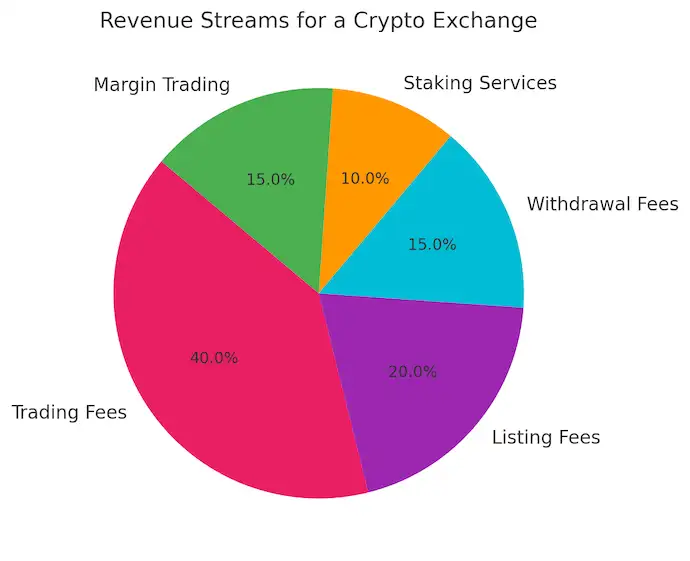

Revenue Models for Crypto Exchanges

A well-thought-out business model is essential for the long-term sustainability and profitability of any crypto exchange. While building a platform like Binance can be a significant investment, the potential revenue streams are equally promising. Below are some of the primary revenue models employed by successful exchanges:

- Trading Fees: The most common revenue stream for crypto exchanges is charging fees on trades executed by users. These fees can be a percentage of the trade’s value or a flat fee per transaction. By implementing tiered fees—offering discounts for high-volume traders—you can encourage greater activity on your platform while generating substantial revenue.

- Listing Fees: Exchanges often charge cryptocurrency projects a fee to list their tokens on the platform. New and emerging tokens are willing to pay for access to a broad user base, making listing fees a lucrative revenue stream for exchanges. However, it’s essential to maintain strict vetting processes to ensure that only legitimate and high-quality tokens are listed.

- Withdrawal Fees: Charging users a small fee when they withdraw their assets (either in crypto or fiat) can add up over time, especially as trading volumes increase. While it’s important to keep these fees competitive, they are a steady source of income that doesn’t directly impact trading activity.

- Staking and Lending Services: Many exchanges now offer staking and lending services as an additional revenue stream. Staking allows users to earn rewards by locking up their assets, while lending allows users to loan their crypto in exchange for interest. The exchange typically takes a percentage of the rewards or interest, generating passive income while providing value-added services to users.

- Margin Trading and Leverage: Offering margin trading allows users to borrow funds to trade larger positions, amplifying their potential profits (and losses). Exchanges charge interest on the borrowed funds, creating a consistent revenue stream. This feature appeals to more experienced traders looking for higher-risk, higher-reward strategies.

- Premium Services: Exchanges can offer premium features such as advanced charting tools, access to exclusive token sales, or lower fees for premium accounts. These services can be offered via subscription models, providing a recurring revenue stream while enhancing the user experience.

| Revenue Stream | Description | Potential Profitability |

|---|---|---|

| Trading Fees | Charge a percentage or flat fee for each trade executed. | High |

| Listing Fees | Charge projects to list their tokens on the platform. | High |

| Withdrawal Fees | Fees applied when users withdraw crypto or fiat from the platform. | Medium |

| Staking and Lending Services | Generate income through staking rewards or loan interest. | Medium |

| Margin Trading | Offer leveraged trading and charge interest on borrowed funds. | High |

Monetizing a Binance Clone Effectively

Building a successful Binance clone involves not only replicating its features but also implementing a robust monetization strategy. To effectively monetize your platform, it’s essential to balance generating revenue with creating value for your users. Here’s how you can maximize profits while maintaining user satisfaction:

- Offer Competitive Trading Fees: While trading fees are a significant revenue source, keeping them too high can drive users to competing platforms. To remain competitive, consider offering volume-based discounts, fee reductions for using native tokens, or loyalty programs to encourage repeat usage. Binance, for example, uses its native token BNB to offer discounts on trading fees, a model you could replicate for your exchange.

- Expand to New Markets: As the global adoption of cryptocurrency grows, expanding into emerging markets with fewer competitors can provide new opportunities for growth. Consider offering localized versions of your platform, supporting regional fiat currencies, and tailoring services to the specific needs of different regions.

- Diversify Your Services: Beyond trading, offering features like P2P trading, staking, crypto loans, and fiat-to-crypto gateways can attract a broader user base. By providing these additional services, you can increase engagement and transaction volume on your platform, generating more revenue across different streams.

- Leverage High-Volume Traders: Implement features that appeal to institutional traders, such as high-frequency trading systems and advanced API integrations. By catering to high-volume and professional traders, you can significantly increase the platform’s trading volume and revenue from fees.

- Implement Affiliate Programs: Offering an affiliate or referral program is another effective way to grow your user base while incentivizing existing users to bring new traders onto the platform. Affiliates earn commissions based on the trading activity of users they refer, providing a scalable growth strategy.

By implementing a diversified monetization strategy, you can ensure that your crypto exchange generates consistent and scalable revenue. Keep in mind that user trust and satisfaction should always come first—ensuring transparent fees, excellent customer support, and a secure platform will help foster long-term user loyalty.

Conclusion

Building a cryptocurrency exchange like Binance offers an immense opportunity to tap into the rapidly growing digital asset market. However, success in this competitive space requires a well-planned approach that combines advanced technology, robust security protocols, and user-centric features. By choosing the right development model, integrating essential features like multi-currency wallets, P2P trading, and API integration, and ensuring strong compliance with KYC/AML regulations, your platform can stand out in the market.

Additionally, focusing on advanced features such as blockchain integration, smart contracts, and high-frequency trading systems will not only attract traders but also enhance the overall user experience. Monetizing your platform through a mix of trading fees, listing fees, staking services, and premium offerings will ensure sustainable revenue growth.

As the demand for secure, scalable, and user-friendly crypto trading platforms continues to rise, building your own exchange like Binance could be your gateway to success in the digital financial world. Armed with the knowledge from this guide, you’re now better equipped to take the next step toward creating your own cryptocurrency exchange.

To take your cryptocurrency exchange development to the next level, partner with Miracuves, your trusted technology solution provider. With our cutting-edge Binance clone solutions and a team of seasoned blockchain experts, we offer you the fastest, most secure, and scalable way to launch your very own crypto trading platform. Whether you’re looking for white-label exchange solutions or custom development, we’ve got you covered with features like multi-currency wallets, API integration, P2P trading platforms, and more.

Start your crypto journey today! Get in touch with Miracuves for a free consultation and turn your vision into a reality.

Have an innovative crypto app idea?

Discuss Your Crypto App Idea with Experts ! Let’s discuss your vision with our team of experts. We’ll help you refine the concept and build the perfect app.

FAQs

What is a Binance Clone, and how does it work?

A Binance clone is a white-label crypto exchange software that replicates the core functionalities of Binance. It allows businesses to launch a custom crypto trading platform quickly by using pre-built features like multi-currency wallets, API integration, and trading engines.

How much does it cost to develop a cryptocurrency exchange like Binance?

You can launch a Binance-like cryptocurrency exchange in just 3–6 days using Miracuves’ ready-made Binance Clone — a fully secure, scalable, and pre-tested platform available for $3,299, ensuring rapid deployment without the delays of traditional development timelines.

What are the essential features for a successful crypto exchange?

Key features include P2P trading platforms, multi-currency wallets, KYC/AML compliance, liquidity management, API integration, and fiat-to-crypto gateways to ensure seamless and secure trading experiences.

Is it legal to start a cryptocurrency exchange?

Yes, it is legal, but regulations vary by country. It’s important to comply with KYC/AML laws and register with appropriate regulatory bodies, such as FinCEN in the U.S. or 5AMLD in the EU, to avoid legal issues.

How long does it take to build a crypto exchange like Binance?

You can launch a Binance-like crypto exchange within just 3–6 days using Miracuves’ ready-made Binance Clone — a fully tested, scalable, and secure platform designed for rapid go-to-market deployment without long development delays.

What are the best ways to generate revenue from a crypto exchange?

Revenue can be generated through trading fees, listing fees, withdrawal fees, and services like staking or margin trading. Offering premium features and subscription services can also drive additional revenue.

Empower your crypto ventures with Miracuves – designed for scalability, security, and seamless transactions:

- BSCpad Clone Like Platform – A launchpad platform on Binance Smart Chain, designed to help new crypto projects raise funds and gain community support.

- Pinksale Clone Like Platform – A decentralized launchpad platform for crypto projects to conduct token sales and grow their community.

- MEXC Clone Like Platform – A high-performance crypto exchange platform offering spot, futures, and margin trading with a focus on low fees and fast execution.

- Paxful Clone Like Platform – A peer-to-peer crypto trading platform enabling users to buy and sell crypto securely and directly with each other.

- LocalBitcoins Clone Like Platform – A peer-to-peer Bitcoin trading platform that allows users to buy and sell Bitcoin directly, ensuring privacy and security in transactions.

- Rarible Clone Like Platform – An NFT marketplace platform allowing users to create, buy, sell, and trade unique digital assets, providing a seamless NFT trading experience.