Revolut Clone

Set Up Your Own Digital Banking & FinTech Platform

Offer secure multi-currency accounts, instant payments, crypto trading, virtual cards, and advanced financial tools for seamless money management.

Go Live in 3 Days with 60 Days Tech SupportComplete Source CodesComplete RebrandingComplete WhitelabelingApp Publishing SupportFree 1 Year Updates

Next-Gen Banking at Your Fingertips

Enable users to send, spend, save, and invest with an all-in-one digital finance solution.

In today’s ever-evolving digital world, financial technology or “Fintech” plays an integral role. Companies worldwide are continuously seeking innovative solutions that can provide them with a competitive advantage. One such solution is a professionally developed Revolut Clone, which can offer a range of benefits to businesses looking to streamline their international transactions.

- Cost-Effective: A Revolut Clone can offer businesses a cost-effective way to conduct international transactions by eliminating the need for traditional banks and their high fees. This can result in significant cost savings over time.

- Speedy Transactions: With the Revolut Clone, transactions can be completed quickly, often within a matter of seconds or minutes, as opposed to the days or weeks it may take with traditional banks.

- Enhanced Security: A professionally developed Revolut Clone typically comes with advanced security features, including encryption and secure data storage, to ensure that sensitive financial information is protected from unauthorized access.

- Scalability: The Revolut Clone can be customized to meet the specific needs of any business, regardless of its size or industry. This means that as a company grows, its financial technology can grow with it.

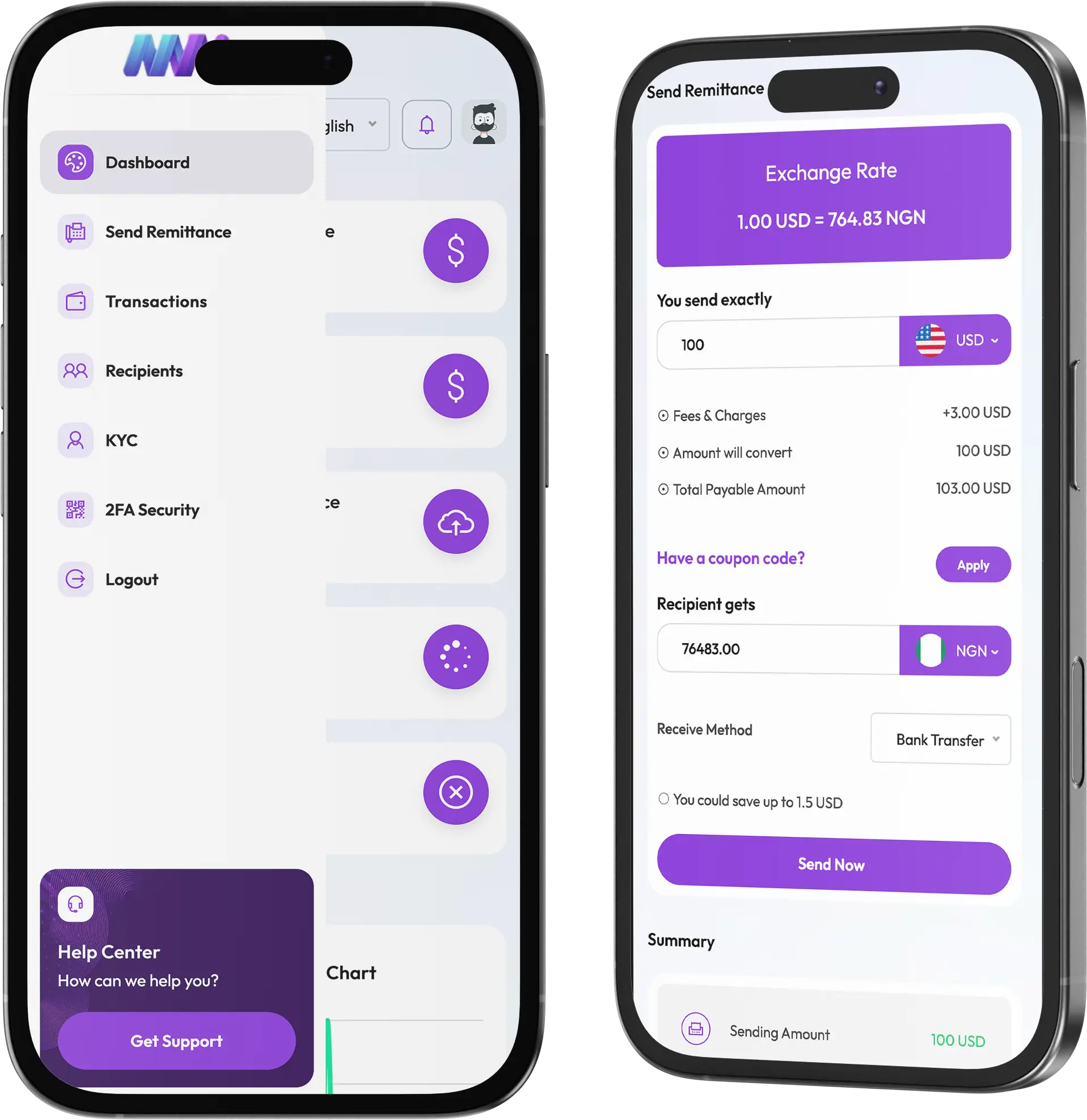

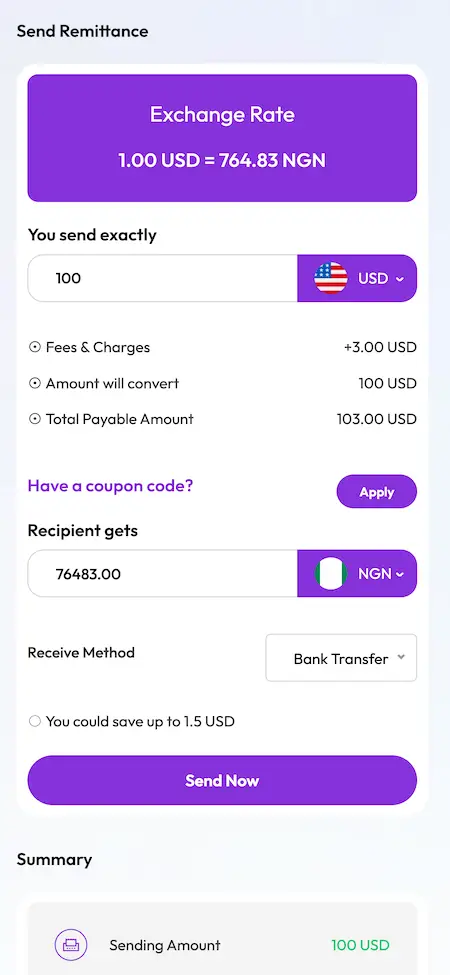

Real-time Exchange Rates

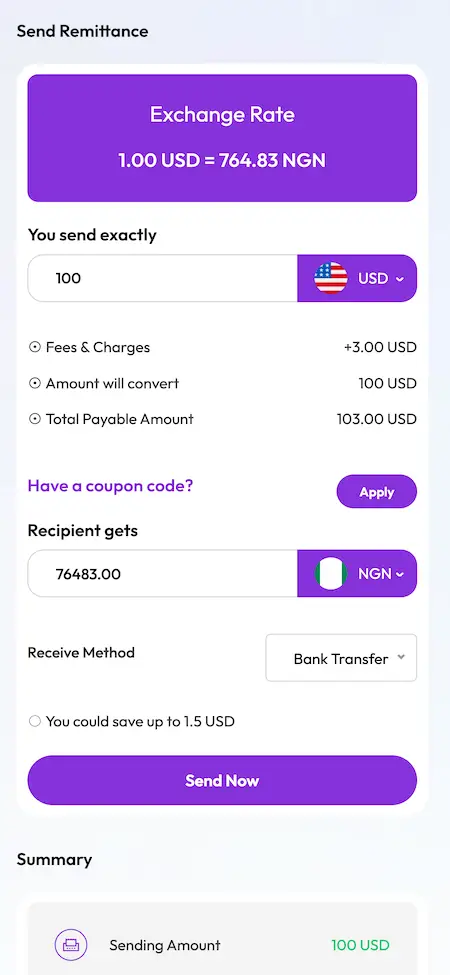

his feature enables users to make currency exchanges at the current exchange rate, which can be more favorable than the rates offered by traditional banks.

Instant Transfers

Users can transfer money instantly to other Revolut Clone users across the globe, even on weekends and holidays, which is not possible with traditional bank transfers.

Multi-Currency Wallet

A Revolut Clone typically allows users to hold multiple currencies in a single wallet. This not only simplifies international transactions but also provides flexibility in managing different currencies.

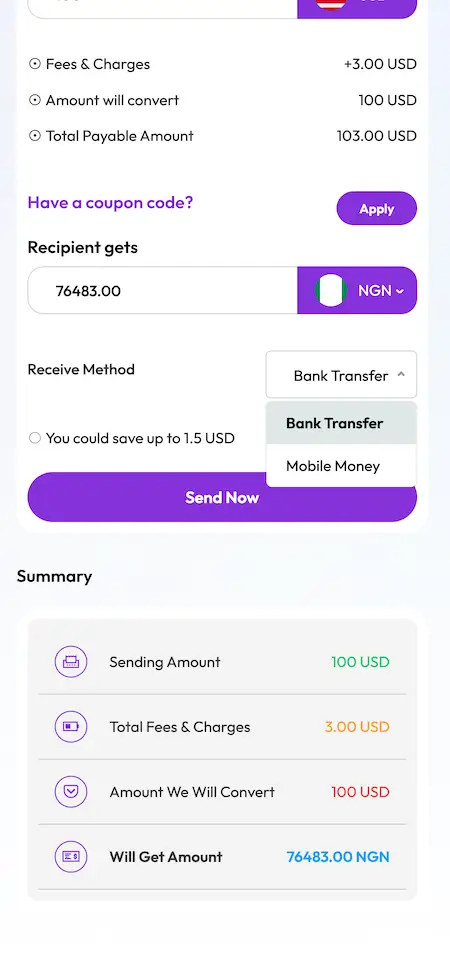

Transparent Fees

A Revolut Clone platform often displays upfront fees for international transactions, ensuring transparency and enabling users to make informed decisions about their money transfers.

Key Features of Revolut Money Transfer App Clone

Cutting-edge Features

that drive

Revolut Clone

The Revolut Clone, a cutting-edge financial technology solution, stands out for its real-time exchange rates, multi-currency wallet, and instant international transfers. Its transparent fee structure, advanced security protocols, and cost-effective nature set it apart from traditional banking. This scalable solution caters to businesses of all sizes and needs, providing a comprehensive global financial management tool.

Real-Time Exchange Rates

Enables instant currency conversions at the current rate.

Multi-Currency Wallet

Stores various currencies in a single digital wallet.

Instant International Transfers

Facilitates immediate cross-border transactions.

Transparent Fee Structure

Displays upfront fees for clear transaction understanding.

Advanced Security Protocols

Utilizes encryption and secure storage for data protection.

Cost-Effective Solution

Avoids traditional banking fees for monetary savings.

Scalability

Adapts to businesses of all sizes and needs for global operations.

Comprehensive Features Across Web, App, and Admin

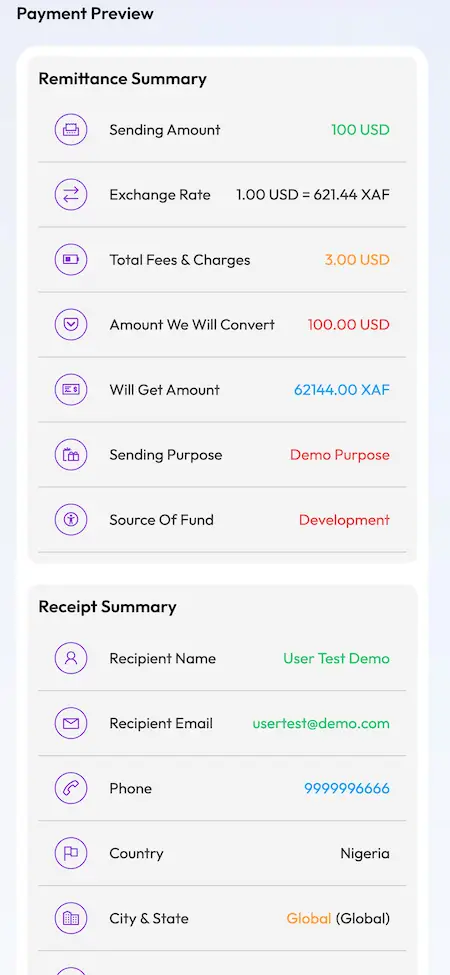

Secure International Transfers: Users can securely transfer funds internationally, leveraging Revolut’s robust encryption and authentication measures to ensure safe transactions.

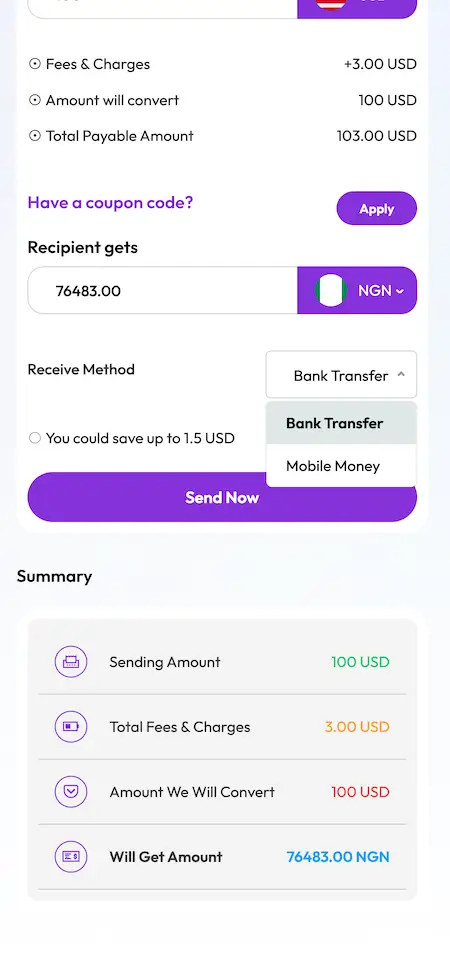

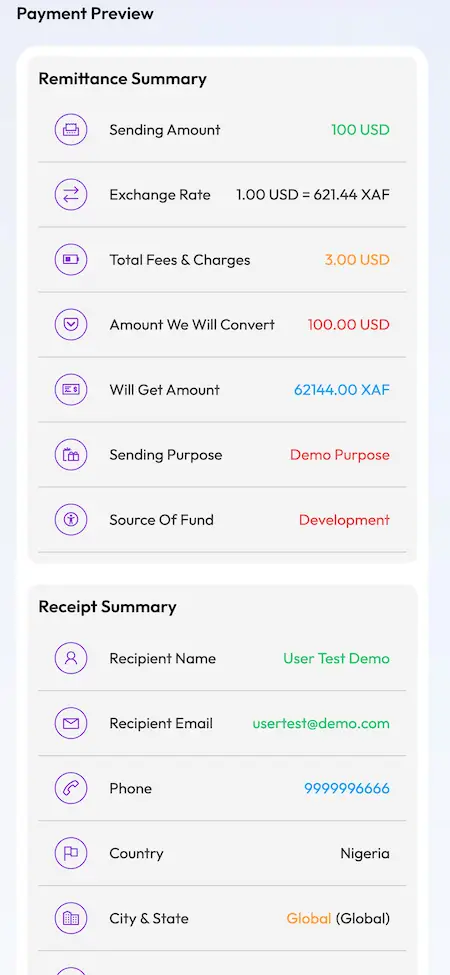

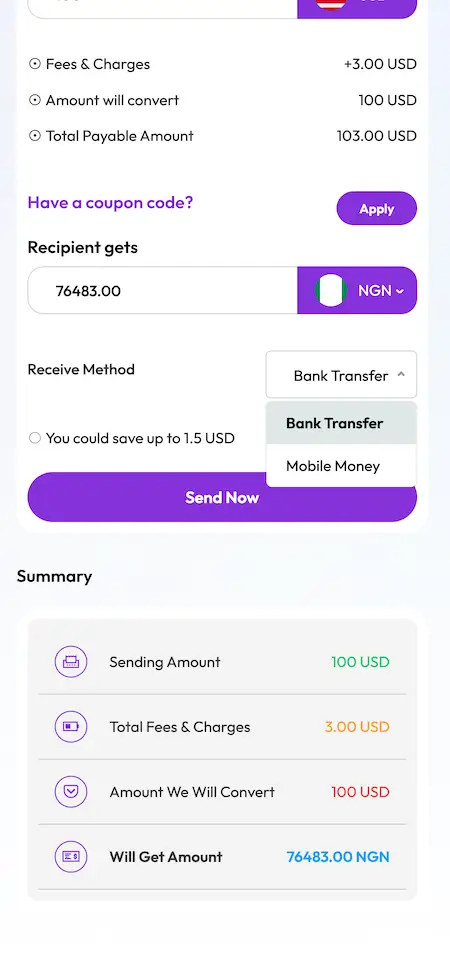

Transparent Fees: Clear and transparent fee structures empower users to understand the costs associated with their transfers upfront, avoiding hidden charges and surprises.

Real-Time Exchange Rates: Access to real-time exchange rates enables users to make informed decisions, ensuring they get the best value for their money when sending or receiving international payments.

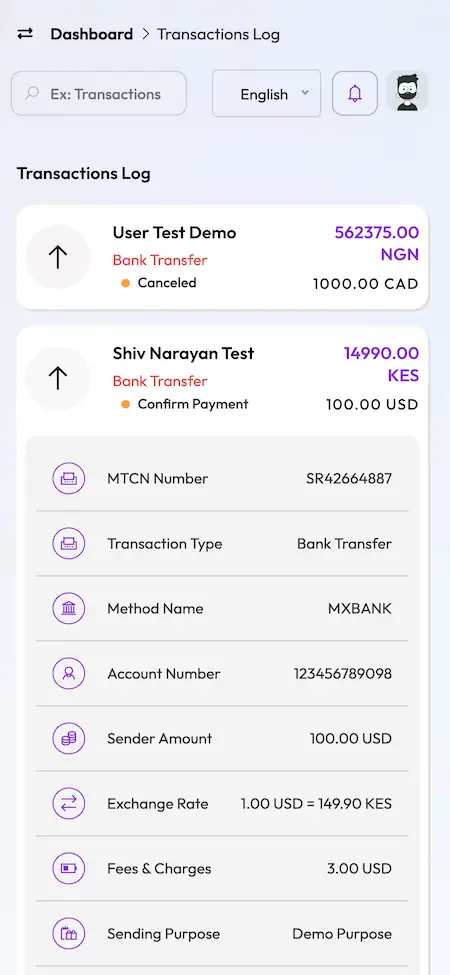

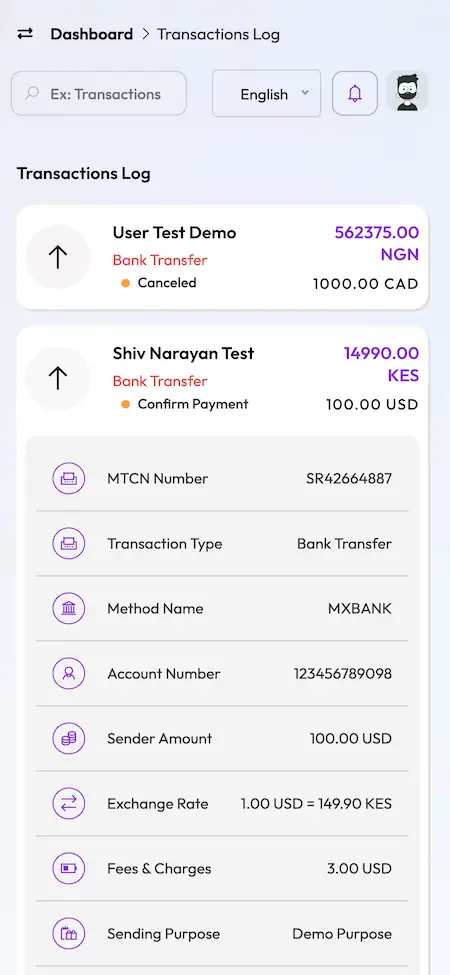

Transaction Tracking: Users can track the status of their transfers in real-time, receiving updates on processing, completion, and delivery, providing peace of mind and transparency throughout the process.

Multi-Currency Support: The platform supports a wide range of currencies, allowing users to send and receive payments in their preferred currency, eliminating the need for costly currency conversions.

User-Friendly Interface: A intuitive and user-friendly interface guides users through the transfer process seamlessly, making it easy for both novice and experienced users to navigate and complete transactions effortlessly.

Transaction Management: Admins have full control over transactions, with tools to monitor, review, and manage transfers, ensuring compliance with regulatory requirements and internal policies.

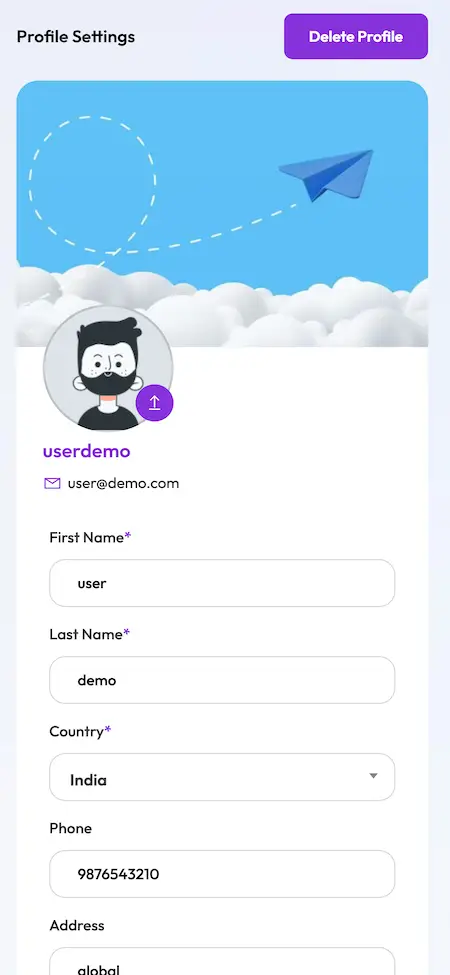

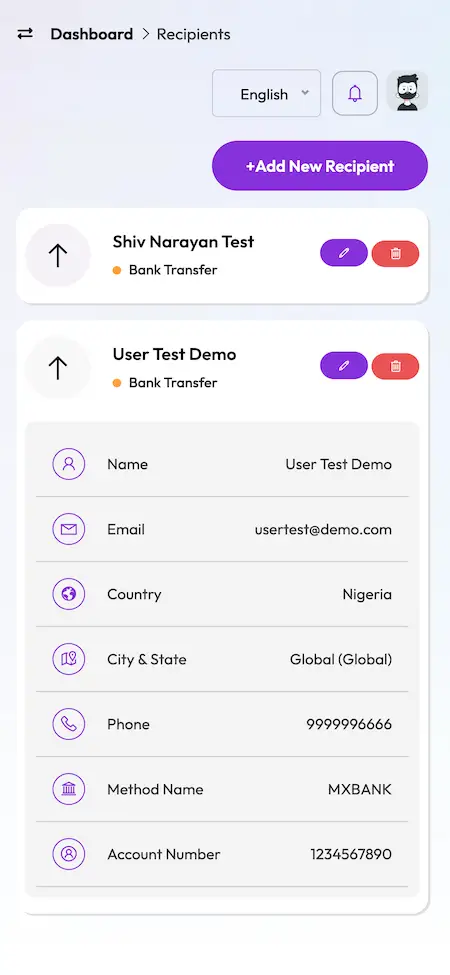

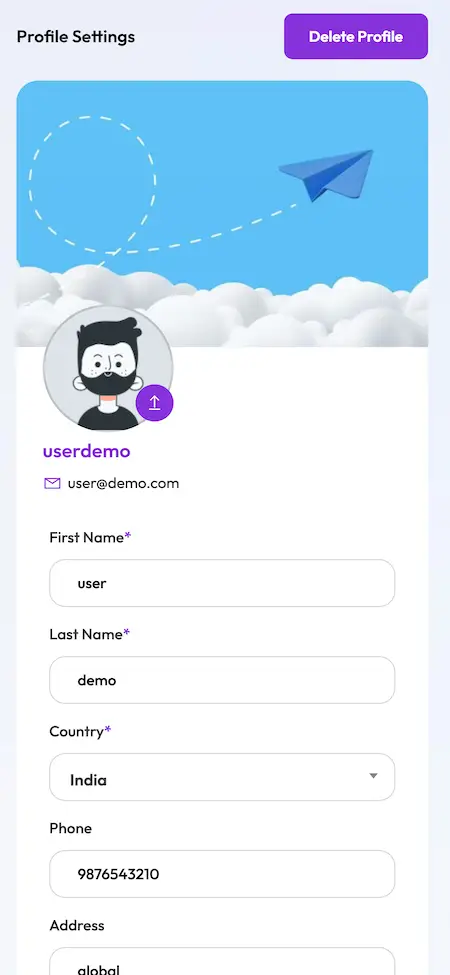

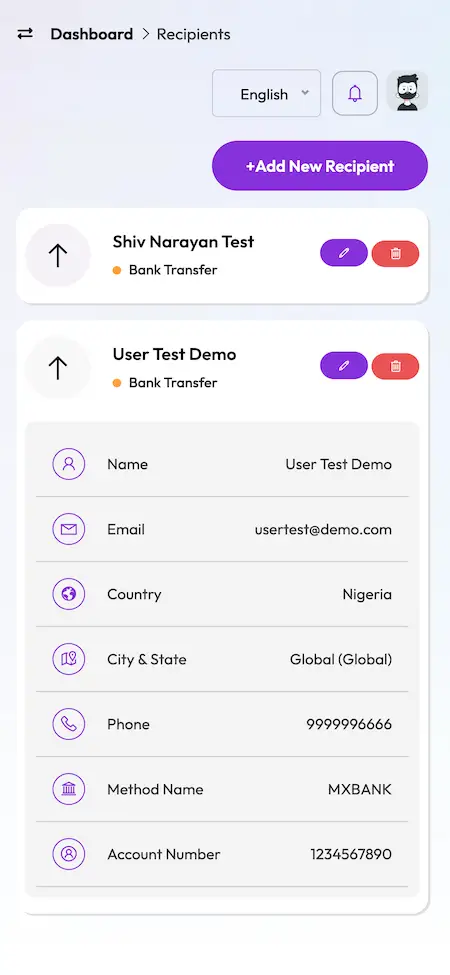

User Management: The admin panel provides capabilities for managing user accounts, including verification, approval, and account suspension, maintaining the integrity and security of the platform.

Fee Management: Admins can set and adjust fee structures, enabling flexibility in pricing strategies while ensuring competitiveness and sustainability in the market.

Compliance and Risk Management: Comprehensive compliance and risk management tools help admins detect and mitigate fraudulent activities, ensuring the security and trustworthiness of the platform for all users.

Analytics and Reporting: Analytics dashboards offer insights into transaction volumes, revenue streams, user demographics, and other key metrics, enabling informed decision-making and strategic planning.

Customer Support: Admins can provide assistance and support to users, addressing inquiries, resolving disputes, and handling issues promptly and efficiently, fostering trust and loyalty among users.

- On-the-Go Transfers: Users can initiate and manage international transfers conveniently from their mobile devices, offering flexibility and accessibility wherever they are.

- Biometric Authentication: Secure biometric authentication methods such as fingerprint or face recognition enhance the security of the mobile app, ensuring only authorized users can access their accounts and initiate transactions.

- Push Notifications: Real-time push notifications keep users informed about the status of their transfers, alerting them to important updates and ensuring timely action when needed.

- In-App Support: Integrated support features within the mobile app enable users to access help resources, contact customer support, and receive assistance directly from their smartphones, providing a seamless and efficient support experience.

- Currency Converter: A built-in currency converter tool allows users to quickly check exchange rates and convert currencies, helping them make informed decisions when sending or receiving international payments.

- Offline Mode: Offline functionality enables users to access certain features of the mobile app even without an internet connection, providing uninterrupted access to essential functions such as viewing transaction history or accessing help resources.

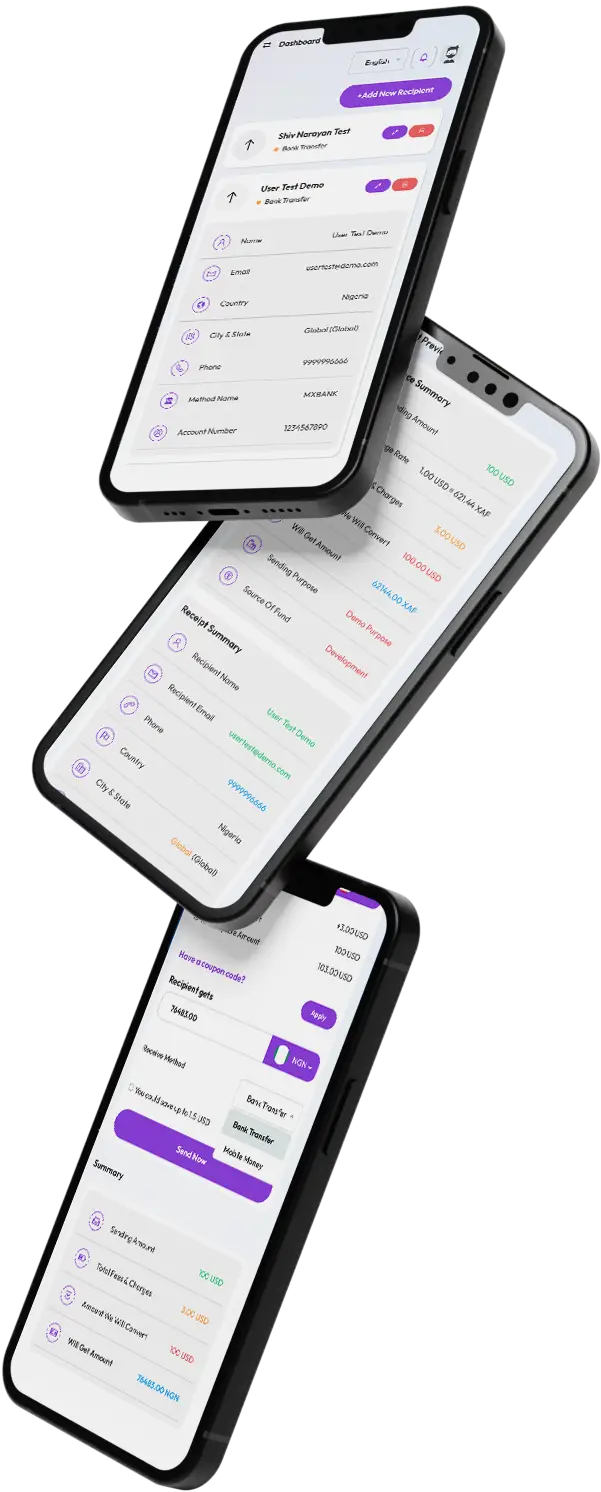

User Flow of our Revolut Clone

Sign Up/Login

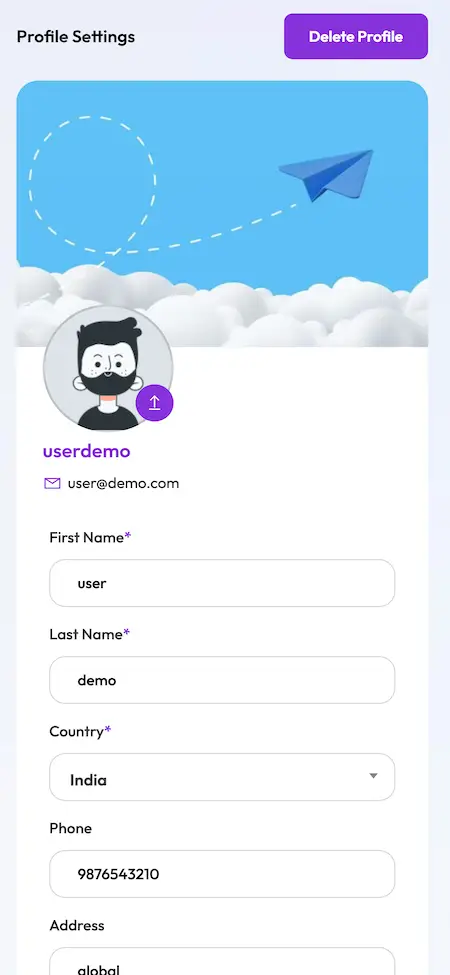

Users create an account or log in to their existing account on the Revolut clone platform.

Initiate Transfer

Users select the currency and amount they want to transfer, as well as the recipient's details.

Choose Transfer Method

Users choose between bank transfer, debit/credit card payment, or alternative payment methods available.

Confirm Transaction Details

Users review and confirm the transaction details, including fees and exchange rates.

Provide Payment Information

Users input payment details such as bank account information or card details for processing the transfer.

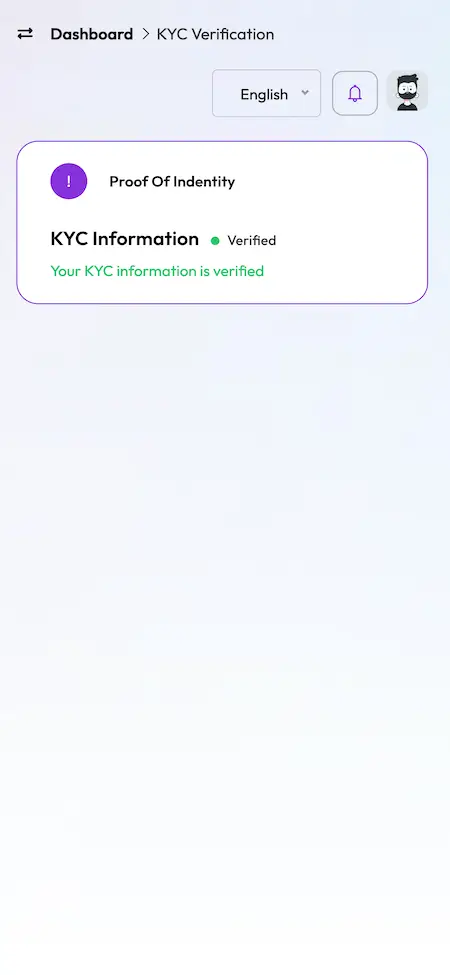

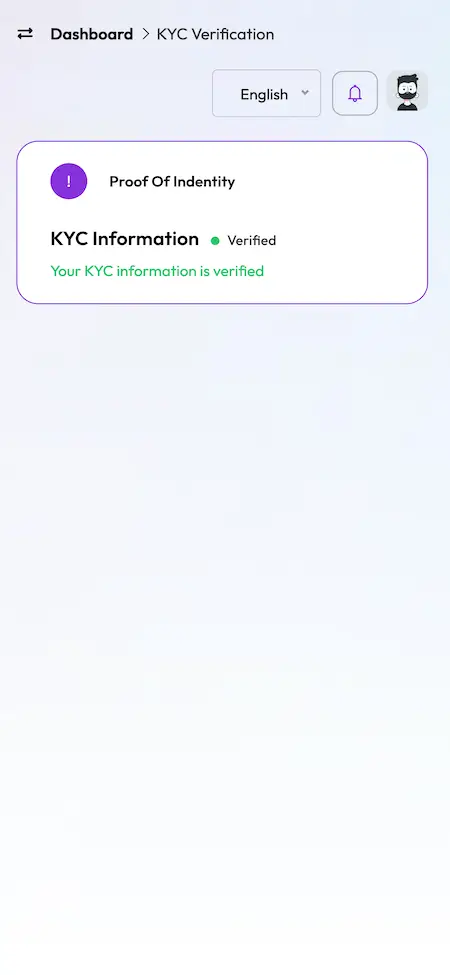

Verify Identity

Users may need to verify their identity through additional security measures such as two-factor authentication or identity verification documents.

Track Transfer Status

Users can track the status of their transfer in real-time, including processing, completion, or any issues that may arise.

Confirmation and Receipt

Users receive confirmation of the successful transfer and a receipt detailing the transaction for their records.

Benefits and Seamless Implementation

Ready

Pre-built and readily available, reducing development time and enabling quick implementation.

Now

Immediate access to modern technologies, enabling businesses to stay current and competitive.

Set

Configured to suit specific needs, minimizing the need for extensive customization before deployment.

In

Customization to suit own needs is essential for everyone and we do it all for you.

Go

Once deployed, can be quickly integrated into existing systems, enabling seamless adoption.

Time

Readymade Approach saves you a deal of time and gives you edge with early launch.

Demo Video in Action

Access Demo

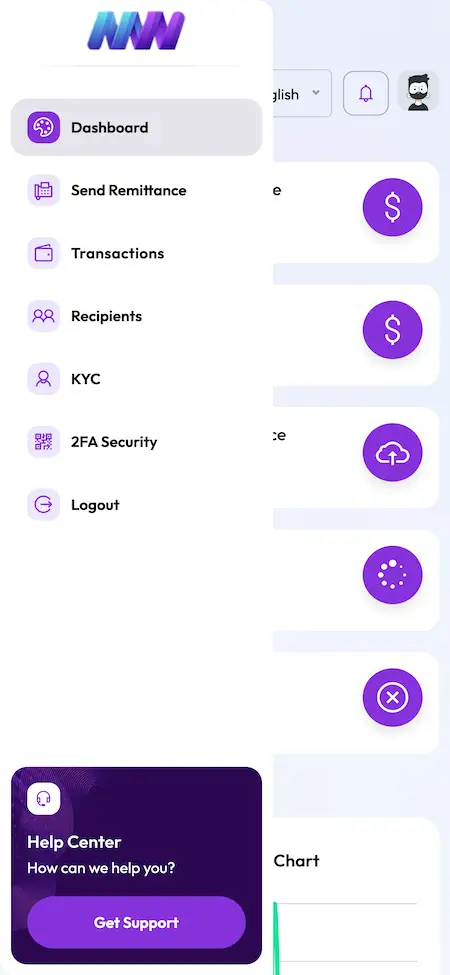

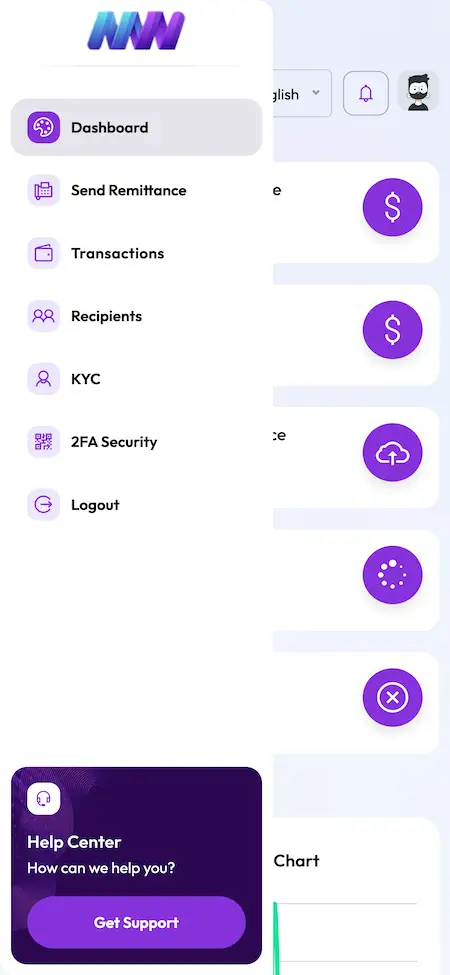

Admin Panels

Explore the admin panels of the solution

Technology Stack

Web & Admin

PHP with Bootstrap Framework | NodeJS | MySQL & MongoDB

Android Apps

Flutter Full Components Apps with Latest Dependencies

iOS App

Flutter Full Components Apps with Latest Dependencies

3rd Party API

Google Maps, Twilio, Firebase, Pay Api, Translate & MTR.

Deliverables - What You'll Get

Admin Panels

Explore the admin panels of the solution

Free Deployment

We do complete rebranding of your web and apps with your logo, icons & color scheme and deploy them.

Source & Project Codes

We provide you with complete source codes with no encryption so you can work on them as per your custom needs.

Apps Publishing

We take care of publishing your apps in both the stores on your developer accounts and get them approved.

Support Timeline

We include 60 Days of tech bug support and 1 year of products if any in terms of SDK or API at no extra cost.

Addons Available

Implement an invoice generation tool that enables users to create and send professional invoices directly from the platform, streamlining the billing process for freelancers, businesses, and service providers.

Provide API integration capabilities to allow businesses to seamlessly integrate the Revolut clone platform with their existing systems, ERP software, or e-commerce platforms, enabling seamless data exchange and automation of payment processes.

Client Testimonials & Reviews

See how individuals & companies like yours used Miracuves app platform to help them achieve their business goals using IT Solutions & Services

Why Choose Miracuves

Fully Customizable

Miracuves provides customization services to ensure that our clients get the exact features & flows they need for their specific needs.

Complimentary Tech Support

At Miracuves we ensure that all your support needs are met in time and with discretion to ensure no downtime.

Free Bug Support

Miracuves provides complimentary bug support timeline to clients to ensure that the platform runs smoothly and without any issues.

Complete Source Code

Miracuves ensures you get complete usage ownership of the Revolut clone by offering you the complete source code.

Custom development requires a high budget but our ready-made clone script comes with ample features and free rebranding service at a budget price.

Waiting is boring, that is why we bring you this ready-to-launch clone script which is completely customizable as per your needs.

We have vast experience in developing cryptocurrency-based applications to make your deployment capable enough to boost your crypto trading business.

We know the seriousness of security in the current times of data breach. That is why we have already verified our clone script with rigorous security testing.

Our dedication to providing a comprehensive solution, we’ve also optimized the script for enhanced speed, ensuring that users experience swift and efficient performance.

Combining al the key points we come to the stage of efficient functioning solution which delivers the right purpose and functions for everyone.

Why Our Premium Revolut Clone Script Over Custom Development?

Cost Effective

Custom development requires time and budget with our ready-made Revolut clone script get all features and rebranding service at a pocket friendly price.

Time to Market

Our ready-to-launch Revolut clone script is completely customizable as per your needs and is constantly updated to meet market standards.

Expertise

Having vast experience in developing Cross border accoutns and payments apps to provide, Revolut clone capable enough to boost your online remittance business.

Security

We know the seriousness of security in money transfer apps like Revolut. That is why we do QAT & various Code Assesments on the Revolut clone script to keep data safe.

Insights For Cross Border Platform Entrepreneurs

- Concept

- Feature

- Capabilites

- Inclusions

- Marketability

- Revenue

- Prospects

A Revolut-like platform is a cutting-edge fintech solution designed to provide users with a digital banking experience, multi-currency accounts, international payments, and advanced financial tools. It caters to individuals, freelancers, and businesses looking for a fast, cost-effective, and secure alternative to traditional banking.

Multi-Currency Digital Wallets for holding and managing funds globally.

Seamless International Transfers with competitive exchange rates.

Cryptocurrency Trading & Investment Features for modern finance users.

Advanced Budgeting & Financial Analytics Tools for better money management.

Integrated Debit Cards with Virtual & Physical Options for worldwide payments.

Regulatory Compliance & Strong Security Measures for safe transactions.

Instant P2P Money Transfers & Bill Payments for user convenience.

Subscription-Based Banking Features offering premium financial services.

Personal & Business Banking Accounts tailored for different financial needs.

AI-Powered Fraud Detection & AML Compliance to enhance security.

A versatile fintech platform like Revolut transforms digital banking with smart, user-centric financial solutions. Launch your Revolut Clone with a user-friendly interface, offering seamless financial services for global transactions. Empower users with a secure, feature-rich digital banking experience.

A Revolut-style banking app comes with numerous innovative features:

Multi-Currency Accounts allowing users to store, convert, and transact in different currencies.

Instant & Scheduled Money Transfers with international banking support.

Live Currency Exchange & Forex Trading at interbank rates.

Cryptocurrency Support for seamless crypto buying, selling, and holding.

AI-Based Expense Tracking & Budgeting Tools for better financial planning.

Virtual & Physical Debit Cards with enhanced security features.

Subscription-Based Premium Services like cashback, insurance, and exclusive benefits.

Stock & ETF Trading Capabilities for integrated investments.

Business Banking Solutions with invoicing, expense management, and team accounts.

QR Code & NFC Payments for contactless transactions.

A feature-packed neobanking solution ensures financial efficiency, flexibility, and security.

A Revolut-like fintech platform is designed to:

Handle Multi-Currency Transactions with Real-Time Conversion for global users.

Process Instant Cross-Border Money Transfers with minimal fees.

Offer Crypto & Stock Trading Features for diversified investment options.

Provide AI-Driven Financial Insights & Automated Budgeting for smarter money management.

Enable Integration with Apple Pay, Google Pay, & Contactless Payment Methods.

Support Business Accounts with Payroll, Tax Compliance & Financial Tools.

Ensure High-Level Security through KYC, AML, & Fraud Detection.

Scale into Banking-as-a-Service (BaaS) & Embedded Finance Models.

Facilitate Open-Banking API Integrations for extended fintech services.

Comply with International Financial Regulations for seamless operations.

A powerful Revolut-like platform provides all-in-one banking, trading, and financial management capabilities.

A Revolut-style digital banking script includes:

Multi-Currency Wallet System & Currency Exchange APIs for seamless transactions.

Crypto & Stock Trading Modules for investment flexibility.

AI-Powered Fraud Prevention & Compliance Tools for financial security.

Personalized Banking Dashboard & Mobile Apps for better user experience.

Physical & Virtual Card Issuance System for easy transactions.

Subscription-Based Banking Features for premium financial services.

P2P Payment & Bill Splitting Functionalities for enhanced social payments.

Business Banking & Payroll Management Tools for corporate users.

Secure Payment Gateway & Bank Integrations for financial compatibility.

24/7 AI Chatbot & Customer Support System for seamless assistance.

A ready-to-deploy fintech platform provides comprehensive digital banking capabilities.

The demand for digital banking platforms is driven by:

The Shift Towards Cashless & Digital-First Banking.

Growing Demand for Multi-Currency Accounts & Cross-Border Payments.

Rise of Cryptocurrency Trading & Decentralized Finance (DeFi).

Increased Adoption of AI & Automation in Financial Management.

Growth of Neobanking & Challenger Banks Targeting Millennials & Businesses.

Expansion of Contactless & Mobile Payment Solutions.

Integration of Embedded Finance & Open-Banking Features.

Demand for Subscription-Based Premium Banking Services.

Regulatory Push for Transparent & Compliant Fintech Solutions.

Emerging Market Interest in Low-Cost Banking Alternatives.

A next-gen Revolut-like platform addresses modern banking needs for individuals and businesses.

A Revolut-style fintech platform generates revenue through:

Subscription-Based Premium Banking Plans for exclusive features.

Transaction Fees on Currency Exchanges & Cross-Border Transfers.

Commission-Based Earnings from Stock & Crypto Trading.

Interchange Fees from Virtual & Physical Card Transactions.

Forex Margin Revenue from Multi-Currency Conversions.

BaaS & API Monetization for Third-Party Integrations.

Business Banking & Payroll Services Fees.

Affiliate Partnerships & Referral Commissions for Financial Products.

Embedded Finance Services such as Insurance & Loan Offerings.

Premium Support & Consultation Services for Enterprise Clients.

A diverse fintech revenue model ensures long-term profitability and scalability.

The future of digital banking platforms is driven by:

Expansion of AI-Powered Financial Management & Automated Savings Plans.

Integration of DeFi & Smart Contracts for Blockchain-Based Banking.

Growth of Central Bank Digital Currencies (CBDCs) & Crypto Transactions.

Voice-Activated & Biometric Authentication for Banking Security.

Development of 5G & IoT-Enabled Financial Services.

Emergence of Personalized Financial Assistants using AI.

Regulatory Advancements Enabling More Global Banking Partnerships.

Increased Adoption of Sustainable & Green Banking Solutions.

Rise of Metaverse-Based Digital Banking & Virtual Branches.

AI-Based Investment & Wealth Management Features.

A futuristic Revolut-like solution brings next-level innovation to digital banking and fintech ecosystems.

Our Development Process for Revolut Clone App

Requirements Gathering

We start by understanding your requirement in regards to purpose, goals and future targets. Following the same we start customizing our Revolut Clone script to match to your specific needs.

Design

Our next step is the designing part where our skilled designers will understand your creative needs and will work with you closely to get the idea in ui/ux design ready to implement.

Development

At this stage, Miracuves start the rebranding process as we offer a ready-to-launch Revolut Clone App. Here we do setup, configurations and required modifications as agreed.

Testing

We use a rigorous testing process to ensure that the Revolut clone is completely free of bugs and meets all of your requirements before it is deployed on your requested servers.

Deployment

Once the quality team passes us the green signal we will proceed to the deployment process, ensuring your Revolut clone is smoothly deployed and runs as you have wanted.

Support & Maintainence

We offer 60 days of free support and maintenance services including technical support, and bug support to ensure that your Revolut clone continues to meet your business goals.

Check Out Our Full Range of App Clone Solutions

Check Out Other Solutions Offered By Miracuves

Miracuves offers a comprehensive suite of ready-to-deploy solutions tailored for seamless functionality across various industries. Designed with user-friendliness at their core, our products enhance efficiency and simplify processes, ensuring a hassle-free experience for all your business needs

Frequently Asked Questions & Release Log

Users can register through a simple online form, providing basic personal information (name, email, phone number) and verifying their identity via email or SMS. Some businesses may require additional KYC (Know Your Customer) documentation for compliance.

--[ADDED] System Maintenance Mode

--[ADDED] Currency Layer API for Automatic Exchange Rate

--[ADDED] PayStack Payment gateway

--[ADDED] Two new languages (French, Hindi)

--[UPDATED] Strowallet Webhook

--[UPDATED] Gradle, Dart, Flutter and Package versions

--[UPDATED] Documentation --[ADDED] Transaction Type Cash Pickup

--[ADDED] Agent Part as an addon

--[UPDATED] Re-Brand

--[UPDATED] Gradle, Dart, Flutter and Package versions

--[UPDATED] Documentation --[UPDATED] Installer

--[UPDATED] Gradle, Dart, Flutter and Package versions

--[UPDATED] Documentation --[ADDED] New User Bonus

--[ADDED] Bank Method for both automatic and manual

--[ADDED] Google 2FA for admin

--[UPDATED] GDPR Cookie

--[UPDATED] Flutter and Dart version

--[UPDATED] Documentation--[UPDATED] language keys

--[UPDATED] Flutter and Dart version--[ADDED] Automatic Bank Transfer

--[ADDED] Automatic Bank list load based on receiver country

--[ADDED] Pagadito Payment Gateway

--[ADDED] Remittance Search

--[UPDATED] Razorpay Payment Gateway

--[UPDATED] Basic settings user register

--[UPDATED] Flutter and Dart version

--[UPDATED] Documentation