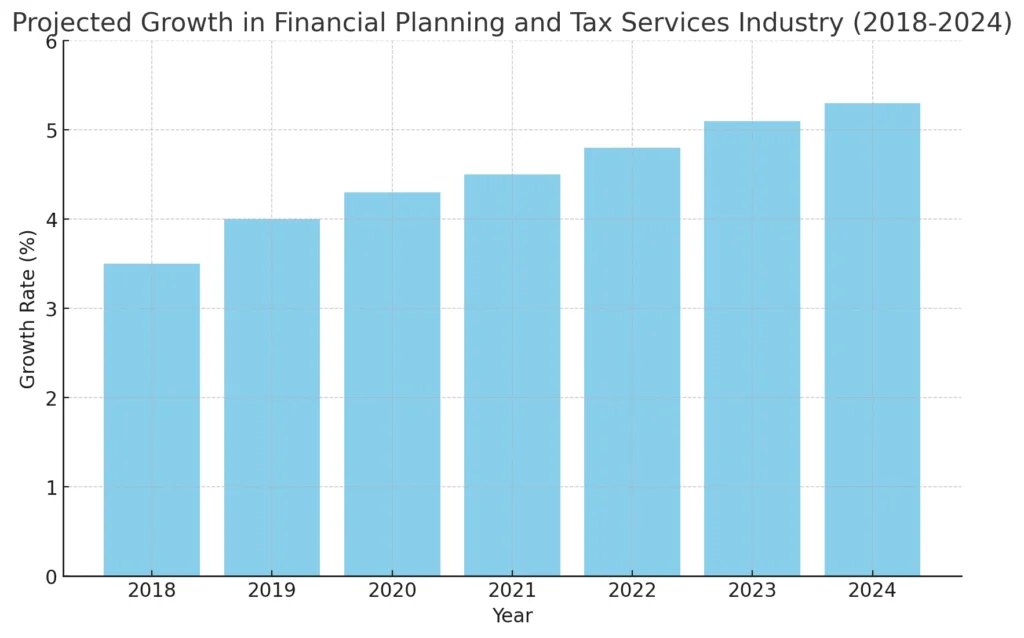

The financial planning and tax preparation industry has become a cornerstone of personal and business financial stability, offering a range of opportunities for startups looking to make an impact in a growing market. With the rising complexity of tax regulations, increased personal wealth management needs, and heightened focus on financial literacy, this sector is seeing robust demand from both individuals and businesses seeking expert guidance. Entrepreneurs venturing into this industry can take advantage of various business models, from tech-driven tax solutions to niche financial advisory services.

For those considering a startup in financial planning or tax services, understanding the potential for growth and the industry’s latest trends is crucial and can also check Ideas for IT Consulting Business Startups. Not only is this market expanding, but it also holds opportunities to innovate, leveraging new technologies and adapting to evolving client demands. In the sections that follow, we’ll dive into top startup ideas that cover a range of budgets, services, and target audiences, ensuring there’s a fit for entrepreneurs at all levels of experience.

Why Choose Financial Planning and Tax Preparation?

The financial planning and tax preparation industry is more than just numbers; it’s about helping individuals and businesses achieve financial clarity, security, and growth. In today’s economy, with constant changes in tax laws, shifts in financial markets, and an increasing emphasis on financial independence, demand for reliable financial planning and tax services is on the rise. Miracuves, with its tech-driven approach and customized financial solutions, is enabling clients—from young professionals to established businesses—to navigate this evolving landscape with confidence. This industry attracts a diverse client base, from those seeking investment advice to businesses needing tax solutions that align with complex regulations.

For startups, entering this industry offers unique advantages. First, financial services are essential across all demographics, ensuring a steady client flow regardless of economic cycles. Second, advancements in technology, like AI-driven tax software and digital advisory platforms, have made it easier than ever to start a business that operates efficiently while delivering top-notch client services. Moreover, financial planning and tax services are often recession-resistant, as people and businesses prioritize these needs even in challenging times.

For those with financial expertise—or simply a passion for helping others navigate their financial lives—this industry provides a fulfilling career path. Not only is there room for growth, but with careful planning, startups in this sector can build long-term relationships with clients who trust them to manage and safeguard their assets.

Read more : – What is a Neobank App and How Does It Work?

Current Trends and Future Opportunities in Financial Planning and Tax Preparation

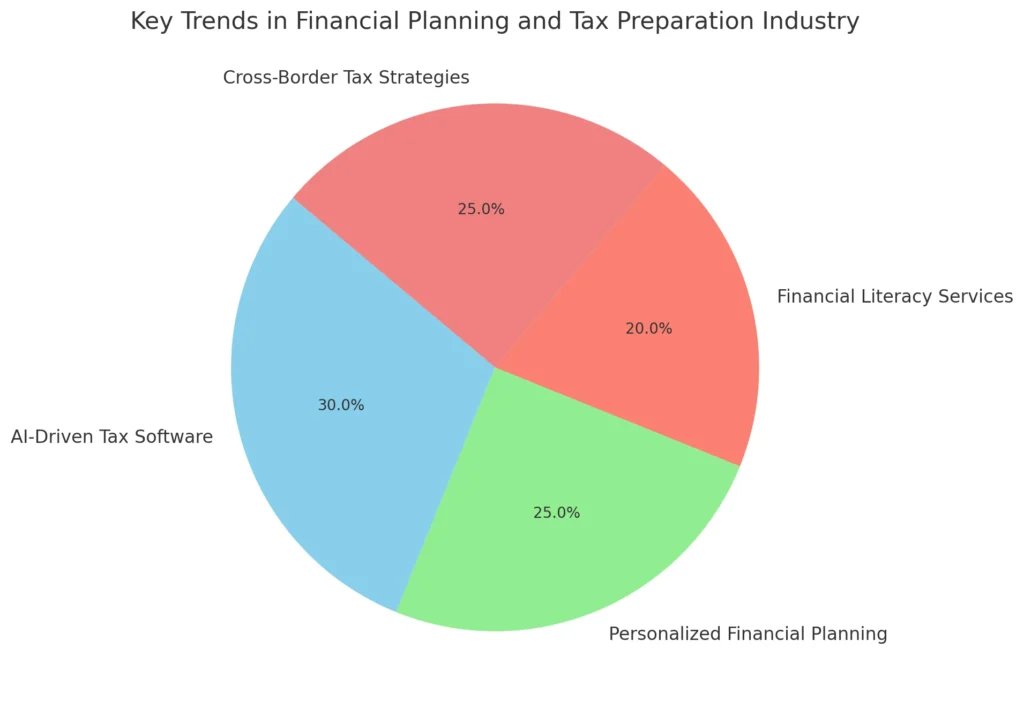

The financial planning and tax preparation industry is rapidly evolving, driven by technological advances and changing client expectations. One of the most significant trends is the adoption of digital tools. From AI-powered tax preparation software that minimizes errors to robo-advisors that provide automated financial guidance, technology has transformed how services are delivered. This trend is especially appealing to startups, as it reduces operational costs and allows for more scalable, efficient service delivery.

In addition to technology, the demand for personalized financial planning is reshaping the industry. Today’s clients are looking for tailored advice that takes into account their unique financial goals, life stages, and values. For example, younger clients might prioritize wealth-building strategies, while retirees focus on asset protection. This shift towards personalized financial planning offers startups a valuable opportunity to specialize and stand out in the market.

Another emerging trend is the focus on financial literacy and education. With economic uncertainty affecting many people, clients increasingly seek professionals who not only manage their finances but also educate them about making informed financial decisions. Startups that incorporate financial education into their services can foster trust and long-term client relationships, creating a loyal customer base.

Lastly, as more businesses operate globally, there is a growing demand for international tax and financial planning expertise. Startups that offer guidance on cross-border tax strategies and compliance can cater to this niche, giving them a competitive edge in the industry.

One of the most significant trends is the adoption of digital tools, from AI-powered tax preparation software that minimizes errors to robo-advisors that provide automated financial guidance.

Top 10 Ideas for Financial Planning and Tax Preparation Business Startups

Starting a business in financial planning or tax preparation offers endless possibilities, especially in an era where personalized service and financial literacy are highly valued. Below are ten innovative ideas that cater to diverse needs in the market, each with unique startup requirements, target audiences, and potential profitability.

| Business Idea | Target Market | Estimated Startup Costs | Potential Profitability |

|---|---|---|---|

| Virtual Tax Preparation Service | Busy professionals, remote workers | Low to Moderate | High |

| Personalized Financial Advisory for Millennials | Young professionals, first-time investors | Moderate | High |

| AI-Powered Tax Filing App | Tech-savvy individuals, self-employed | High | Very High |

| Retirement Planning Service for Baby Boomers | Individuals aged 55+ nearing retirement | Moderate | High |

| Cross-Border Tax Consultancy | Expats, international business owners | High | Very High |

| Freelance Bookkeeping and Tax Services for SMBs | Small businesses, freelancers | Low | Moderate |

| Financial Literacy Workshops and Coaching | Schools, community groups, young adults | Low | Moderate |

| Estate and Trust Planning Services | High-net-worth individuals, families | Moderate to High | High |

| Student Loan Advisory Services | Recent graduates, students | Low | Moderate |

| Investment Advisory with Socially Responsible Focus | Environmentally-conscious investors | Moderate | High |

1. Virtual Tax Preparation Service

- Offer online tax preparation for individuals and small businesses, accessible through video calls and secure file-sharing tools.

- Target Market: Busy professionals, remote workers.

- Estimated Startup Costs: Low to moderate.

2. Personalized Financial Advisory for Millennials

- Focus on wealth-building strategies for millennials, including budgeting, investment planning, and retirement saving.

- Target Market: Young professionals and first-time investors.

- Estimated Startup Costs: Moderate.

3. AI-Powered Tax Filing App

- Develop a user-friendly app that uses AI to streamline tax filings, catching deductions and reducing errors.

- Target Market: Tech-savvy individuals and self-employed workers.

- Estimated Startup Costs: High due to technology investment.

4. Retirement Planning Service for Baby Boomers

- Specialize in retirement income planning, social security optimization, and long-term care insurance.

- Target Market: Individuals aged 55+ nearing retirement.

- Estimated Startup Costs: Moderate.

5. Cross-Border Tax Consultancy

- Provide specialized tax planning for clients with international assets or expatriates managing taxes across borders.

- Target Market: Expats, international business owners.

- Estimated Startup Costs: High due to required expertise.

6. Freelance Bookkeeping and Tax Services for Small Businesses

- Offer flexible bookkeeping and tax preparation tailored to small businesses, especially freelancers and startups.

- Target Market: Small businesses, freelancers.

- Estimated Startup Costs: Low.

7. Financial Literacy Workshops and Coaching

- Conduct workshops on budgeting, debt management, and financial planning, both online and in-person.

- Target Market: Schools, community groups, and young adults.

- Estimated Startup Costs: Low.

8. Estate and Trust Planning Services

- Assist families and individuals with estate planning, wills, and trusts for wealth preservation.

- Target Market: High-net-worth individuals and families.

- Estimated Startup Costs: Moderate to high.

9. Student Loan Advisory Services

- Provide guidance on managing and repaying student loans, refinancing options, and budgeting strategies.

- Target Market: Recent graduates and students.

- Estimated Startup Costs: Low.

10. Investment Advisory with Socially Responsible Focus

- Focus on advising clients interested in socially responsible investing (SRI) and environmentally sustainable funds.

- Target Market: Environmentally-conscious investors.

- Estimated Startup Costs: Moderate.

Read more : – Top 10 Ideas for Tax Preparation and Filing Business Startups

Real-World Examples

Successful financial planning and tax preparation startups prove that innovative ideas, combined with strategic planning, can lead to high client satisfaction and sustainable growth. These real-world examples show how businesses in this industry have carved their niche, even in competitive markets.

One example is a virtual tax preparation service that leveraged technology to provide remote assistance during tax season. By utilizing secure file-sharing platforms and video consultations, this business expanded its client base beyond its local area, serving clients nationwide. This model reduced overhead costs, allowing the startup to offer competitive pricing while maintaining quality service.

Another inspiring case is a financial literacy workshop provider targeting young adults. This business found success by partnering with educational institutions and community centers to run engaging, practical workshops on budgeting, saving, and investment basics. Through consistent outreach and positive word-of-mouth, this startup grew from a local initiative to a regional leader in financial education, filling a vital gap in young people’s financial knowledge.

A third notable example is a cross-border tax consultancy that addressed the complex needs of expatriates and international businesses. This startup’s founder, having personal experience with international taxation, built a specialized service focusing on U.S. expats and foreign business owners. By offering insights into tax compliance across jurisdictions, this company gained a loyal client base among those with unique international tax requirements.

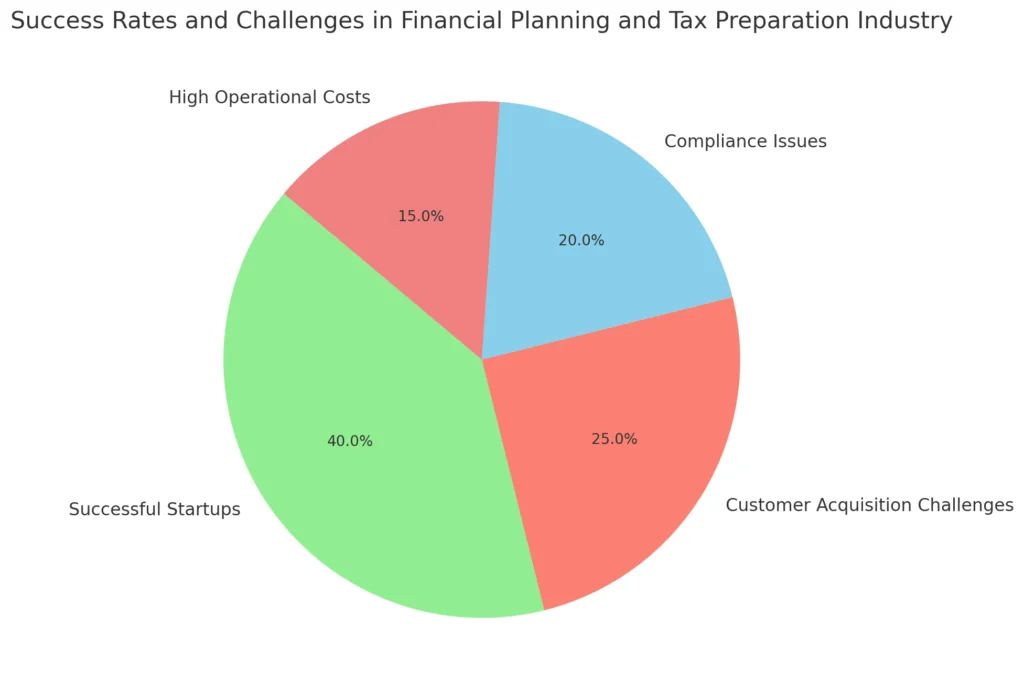

Mistakes to Avoid When Starting a Business in Financial Planning and Tax Preparation

Entering the financial planning and tax preparation industry offers exciting potential, but like any startup journey, it comes with challenges. Many businesses stumble not because of lack of expertise but due to common missteps that could be easily avoided with the right foresight.

One major mistake is underestimating compliance requirements. Financial services are heavily regulated, and staying up-to-date with compliance standards, licensing, and certifications is essential. Failure to prioritize compliance can lead to costly penalties or, worse, damage to your reputation. Startups should invest in proper training and ongoing education to remain aligned with evolving regulations.

Another frequent pitfall is inadequate customer service. In a field where clients rely on you for crucial financial guidance, trust is everything. Startups that neglect the client experience may struggle to retain customers. Building trust through clear communication, prompt responses, and transparent processes can distinguish a new business from its competitors.

Overlooking technology investments is another common issue. While it may be tempting to save on tech costs early on, this can limit efficiency and scalability. Tools that streamline operations, such as secure document management, tax software, and financial analysis platforms, are invaluable in this industry. Embracing technology from the beginning can give startups a competitive edge and support sustainable growth.

Lastly, many startups try to cater to a broad audience, spreading themselves too thin. Instead, narrowing down to a specific niche, like small business tax preparation or retirement planning, allows for more targeted marketing and a loyal client base. Starting with a focused service, then expanding as demand grows, is often a more sustainable approach.

Financial services are heavily regulated, and staying up-to-date with compliance standards, licensing, and certifications is essential.

| Common Mistake | Preventive Measure |

|---|---|

| Underestimating compliance requirements | Invest in training and ongoing education on regulations. |

| Inadequate customer service | Build trust through clear communication and prompt responses. |

| Overlooking technology investments | Use essential tools like tax software and secure document management. |

| Trying to cater to a broad audience | Focus on a specific niche to target marketing effectively. |

Why Trust Miracuves Solutions for Your Next Project?

Choosing the right partner for your financial planning or tax preparation project is a critical step towards business success. Miracuves Solutions stands out in the industry as a leader in providing effective, ready-made solutions tailored specifically to meet the needs of startups and established businesses alike. With a commitment to innovation, affordability, and client satisfaction, Miracuves Solutions offers a streamlined approach to developing customized solutions that align perfectly with your business goals.

One of the most compelling reasons to trust Miracuves Solutions is its proven track record in delivering high-quality products at a fraction of the global cost. Where others might take months to complete an application or a business tool, Miracuves Solutions accomplishes the same with remarkable speed and precision, cutting both time and cost without compromising quality. This means startups can launch faster, scale efficiently, and enter the market with confidence.

In addition to cost efficiency, Miracuves Solutions brings a unique understanding of client needs and industry requirements. Their expert team takes a hands-on approach to every project, ensuring that each solution is not only user-friendly and functional but also compliant with industry standards. This attention to detail and commitment to client success make Miracuves Solutions a reliable partner for businesses seeking to make a lasting impact.

Read more : –Top 10 Ideas for Insurance Advisory Business Startups in 2025

Conclusion

Starting a financial planning or Ideas for Tax Preparation and Filing Business Startups is an excellent opportunity to make a real difference in people’s financial lives while building a profitable, sustainable business. This industry offers a range of niches, from virtual tax services to investment advisory, allowing entrepreneurs to select a path that aligns with their skills, interests, and market demands. With the right idea, proper planning, and a focus on client satisfaction, there is significant potential for success in this field.

For those ready to take the leap, the journey involves choosing the best business model, understanding startup costs, and preparing to meet industry standards. As we’ve outlined, each step of building a financial planning or tax preparation startup is a chance to make a meaningful impact. With careful consideration of market needs and an eye on future trends, your business can grow and adapt, becoming a trusted partner in your clients’ financial journeys.

Ready to get started? Contact us today and let Miracuves help you shape your financial success.

FAQs

What qualifications do I need to start a financial planning or tax preparation business?

Having relevant certifications, like CPA for tax preparation or CFP for financial planning, is beneficial. However, certain niches may not require formal certifications, allowing you to start with basic training and experience.

How much does it typically cost to start a financial planning or tax preparation business?

Startup costs vary based on the type of business. A virtual tax service might have lower startup costs, while an AI-driven app could require a higher initial investment.

Can I start a financial planning business online?

Yes, many financial planning and tax services can be offered remotely. Virtual consultations, secure document sharing, and cloud-based tools make it feasible to run these businesses entirely online.

What are the main challenges in starting this type of business?

Common challenges include staying compliant with regulations, gaining client trust, and managing operational costs. Investing in the right technology and focusing on customer service can help address these challenges.

Is the financial planning and tax preparation industry profitable?

Yes, with rising demand for personalized financial services, this industry holds great profit potential, especially for niche markets and those offering specialized services.

Related Articles:

- Top 10 Ideas for Starting a Mobile Notary Services Business

- Wise App Marketing Strategy: Disrupting Finance, One Transparent Transfer at a Time

- Build Your Own Taxi Service App Like LeCab: Everything You Need to Know

- The Future of Decentralized Finance (DeFi) Apps: Trends to Watch in 2025 and Beyond

- How to Build an App Like Banking Solution – A Developer’s Guide from Scratch