In early 2025, X (formerly Twitter) reported nearly $1.14 billion in quarterly income, signaling a strong comeback after major restructuring. The platform’s shift toward paid services, creator monetization, and data-driven revenue has created one of the most diversified social platform business models in the industry.

For entrepreneurs building an X Clone, understanding these revenue pillars is crucial. The X model blends advertising, premium subscriptions, data licensing, AI features, creator payouts, and upcoming financial tools — all of which can be replicated through Miracuves’ ready-made clone solutions.

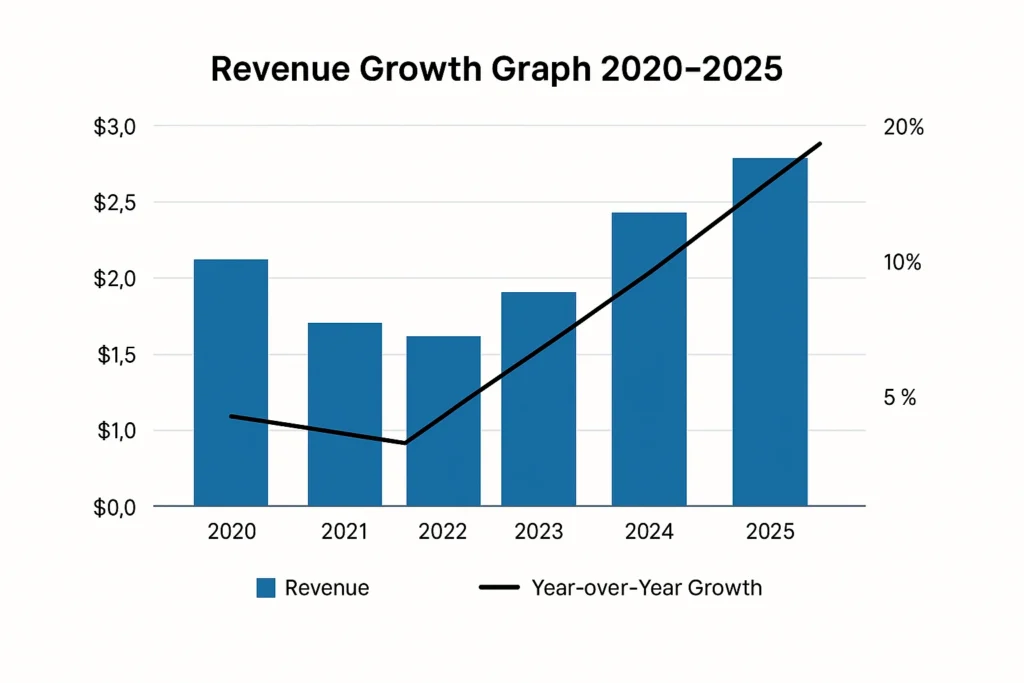

X Revenue Overview – The Big Picture

Current revenue: ~$2.5 billion (2024 actual)

Projected 2025 growth: ~16–18% increase

Valuation trend: Stabilizing after operational restructuring

Global revenue distribution:

- USA: ~52%

- Global markets: ~48%

Profit margins: X is moving toward 20–25% operational margins after streamlining staff, infrastructure, and moderation costs.

Competitive position: Despite new entrants like Threads and Bluesky, X remains the global hub for real-time content, breaking news, political discourse, influencer engagement, and creator monetization.

Read More: X App Explained: How the New Twitter Experience Works

Primary Revenue Streams Deep Dive

Revenue Stream #1: Advertising (Promoted Posts, Trends & Video Ads)

How it works: Brands pay to boost posts, run video ads, or sponsor trending topics, shown to targeted audiences.

Share of total revenue: ~65%

Pricing: CPM ($6–$9), CPC ($0.50–$3), Trend Sponsorship ($100K+/day)

Growth trend: Expected advertising rebound of 17% YoY in 2025

Real example: U.S. ad revenue alone expected to reach $1.3B in 2025

Revenue Stream #2: X Premium (Subscription Model)

How it works: Users pay monthly for premium features: verification, reduced ads, priority ranking, editing posts, extended video uploads.

Share of revenue: ~15%

Pricing: $8–$16/month

Growth trend: Strongest growing revenue category due to creator incentives.

Revenue Stream #3: Data Licensing & API Access

How it works: Businesses, researchers, AI firms, and analysts buy access to real-time and historical data.

Share of revenue: ~12%

Pricing: $100 to $5,000+/month

Growth trend: Surge due to AI model training and market sentiment tracking.

Revenue Stream #4: Creator Monetization (Revenue Share & Long-Form Content)

How it works: X shares ad revenue with creators posting high-engagement, long-form content.

X earns money by: Ad placement, subscription shares, and increased platform retention.

Share of revenue: ~5% (indirect)

Trend: Creator payouts fuel higher platform engagement.

Revenue Stream #5: Payments & Commerce (Future Expansion)

How it works: In-app payments, tipping, subscriptions, and upcoming financial tools.

Share of revenue: <3%

Future potential: Very high — X aims to move toward a “super app” model similar to WeChat.

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share | Est. 2025 Value ($B) |

|---|---|---|

| Advertising | 65% | 1.6 |

| X Premium | 15% | 0.38 |

| Data Licensing | 12% | 0.30 |

| Creator Monetization | 5% | 0.12 |

| Payments & Commerce | 3% | 0.07 |

| Total | 100% | ~2.5B |

The Fee Structure Explained

User-Side Fees

- X Premium: $8–$16/month

- API Access: $100–$5,000+/month

- Transaction charges: ~3–5% for payments/tips

Provider/Advertiser Fees

- Promoted Post CPC: $0.50–$3

- CPM Rates: $6–$9

- Trend Sponsorship: $100K+

Hidden Revenue Drivers

- Priority ranking algorithm boosts

- Reduced ads for premium

- Long-form video monetization

Regional Pricing Differences

- U.S. and U.K.: Highest ad bids

- India & Brazil: High engagement, lower CPM

Complete Fee Structure by User Type

| User Type | Fee Type | Avg. Rate | Frequency |

|---|---|---|---|

| Premium User | Subscription | $8–$16 | Monthly |

| Developer | API Access | $100–$5,000 | Monthly |

| Advertiser | Promoted Ads | $0.50–$3 CPC | Campaign |

| Advertiser | Trend Sponsorship | $100K+ | Daily |

| Creator | Transaction Fee | 3–5% | Per tip/payment |

How X Maximizes Revenue Per User

- User segmentation: Free, Premium, Creator, Advertiser

- Upsells: Priority posts, Premium tiers, advanced analytics

- Dynamic pricing: AI-driven bidding + ad relevance

- Cross-selling: Premium + Creator monetization bundles

- Retention monetization: Exclusive content, long-form video, DM controls

- Psychological pricing: Sub-$10 subscription improves conversion

- Lifetime value optimization: Personalized ads + subscription stacking

Cost Structure & Profit Margins

Major cost categories:

- Cloud servers & infrastructure: ~25%

- R&D and engineering: ~30%

- Marketing & acquisition: ~15%

- Moderation & operations: ~10%

- Creator payouts: ~10%

- Miscellaneous: ~10%

Unit economics:

ARPU ~ $5–$6/month

Operating margins improving toward 25%

Future Revenue Opportunities & Innovations

- AI-driven ad personalization

- In-app video monetization (live + long-form)

- Creator subscription layers

- Integrated payments, wallets, micro-commerce

- Verified business accounts with premium tools

- Global expansion into emerging markets

- Threats: Regulations, trust issues, competition from new platforms

Lessons for Entrepreneurs & Your Opportunity

What entrepreneurs can learn:

- Multi-stream monetization is the future

- Subscriptions stabilize income

- Data licensing is extremely profitable

- Creator monetization boosts retention

- AI-based pricing increases ad revenue

Your Opportunity with Miracuves

Want to build a platform with X’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our X Clone scripts come with flexible revenue streams you can customize. Many clients start generating revenue within 30 days of launch. Get a free consultation to plan your monetization strategy.

Final Thought

X’s 2025 revenue model proves one thing: platforms thrive when they combine ads, subscriptions, creators, and data. If you build an X Clone with the right monetization blueprint, your platform can scale fast with multiple income channels.

For founders, the future is in layered revenue: ad engines that learn, subscription perks that stick, creator tools that attract talent, and data insights that sharpen decisions. When these pieces click, growth becomes a steady rhythm instead of a guessing game.

With a Miracuves X Clone powering your launch, you skip the heavy lifting and step directly into a revenue-ready system. You get a platform built for modern engagement, fast scaling, and long-term monetization. In a space where speed and strategy decide who leads, this gives your platform the kind of head start that actually matters.

FAQs

1. How much does X make per transaction?

About 3–5% on payments and tips.

2. What’s X’s most profitable revenue stream?

Advertising still contributes more than 60% of revenue.

3. How does X’s pricing compare to competitors?

Subscription rates ($8–$16) are lower than LinkedIn Premium and close to Reddit Gold, offering strong value — and with Miracuves, you can build a similar subscription-driven platform starting at just $2899.

4. What percentage does X take from creators?

Typically 3–5% on payments, while ad-revenue share varies.

5. How has X’s revenue model evolved?

Shifted from ad-heavy to a multi-stream model with subscriptions and data sales.

6. Can small social platforms use similar models?

Yes — multi-stream monetization works even at lower user counts.

7. What’s the minimum scale for profitability?

Around 5–10 million active users.

8. How to implement similar revenue models?

Start with ads + premium features + creator payments.

9. What are alternatives to X’s model?

Community-based monetization (Reddit), subscription-first models (Substack).

10. How fast can an X Clone monetize?

With Miracuves, many platforms begin monetizing in just 3–9 days with guaranteed delivery, thanks to the ready-to-launch framework and built-in revenue features.