Imagine opening an app where your money grows automatically — no manual trades, no confusing charts, no panic about what to invest in. You simply deposit funds, and the app builds, manages, and rebalances your portfolio using smart automation. That’s the experience Wealthfront created.

Launched in 2008 in California, Wealthfront quickly became one of the most trusted robo-advisors in the United States. Its mission is simple: help people grow their wealth through automated investing, high-yield saving, personalized financial planning, and long-term smart strategies backed by real data.

In 2025, Wealthfront remains a top choice for hands-off investors, combining low fees, algorithm-driven portfolios, tax optimization, and an easy mobile banking experience.

By the end of this guide, you’ll understand exactly what Wealthfront is, how it works, how it earns money, which features make it popular, and how you can build a Wealthfront-like automated investing platform .

What is Wealthfront?

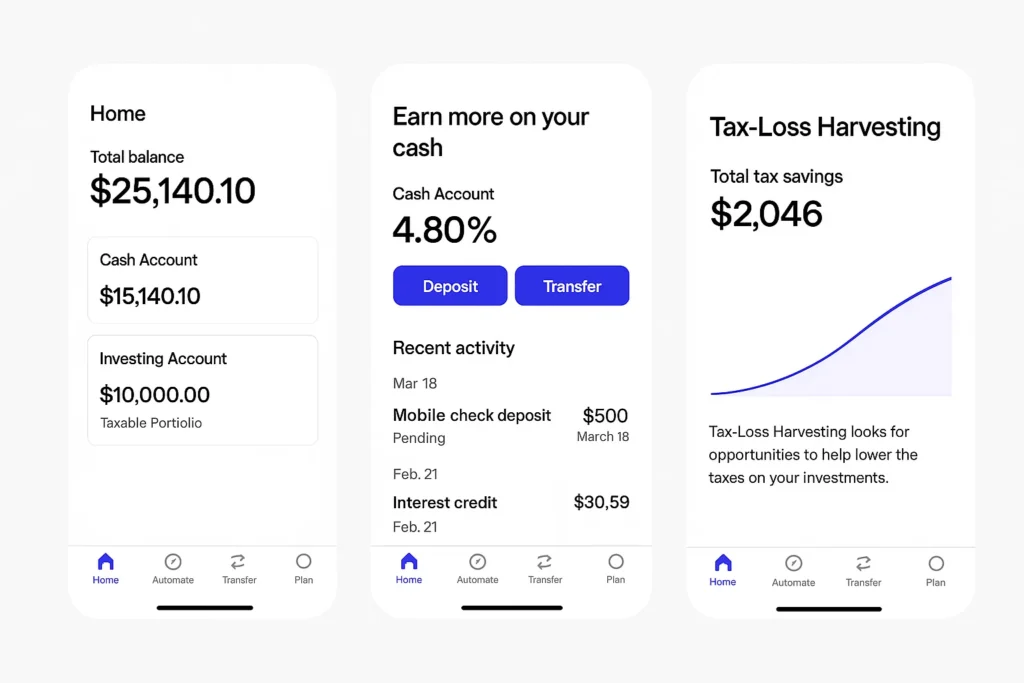

Wealthfront is a U.S.-based robo-advisor and automated wealth management platform that helps users invest, save, and plan their finances without manual decision-making. Instead of choosing stocks or timing the market, users simply deposit money, and Wealthfront’s algorithms build and manage a diversified portfolio designed for long-term growth.

The main problem Wealthfront solves is complexity. Most people don’t know how to invest, how to rebalance portfolios, or how to minimize taxes. Wealthfront handles all of it automatically using proven investment strategies and modern portfolio theory.

Its target users include young professionals, long-term investors, tech-savvy users, and anyone who wants to grow wealth passively without learning advanced investment strategies.

As of 2025, Wealthfront manages billions in assets for hundreds of thousands of clients. Its success comes from low fees, transparency, automation, smart tax tools, and a clean interface that makes long-term investing effortless.

How Does Wealthfront Work? Step-by-Step Breakdown

Wealthfront works as a fully automated investing and financial planning platform. Users deposit money, choose goals, and Wealthfront’s algorithms handle everything from portfolio construction to rebalancing and tax optimization. It’s designed for long-term, hands-off investing.

For Users

1. Account Creation

Users sign up via the app or website, complete identity verification, and answer a short questionnaire about risk tolerance and financial goals. Wealthfront then recommends a personalized portfolio.

2. Funding the Account

Users can fund their account through bank transfer, recurring deposits, or paycheck routing. Wealthfront also offers high-yield cash accounts for savings.

3. Automated Investing

Once money lands, Wealthfront invests it into a diversified mix of:

- U.S. stocks

- Foreign stocks

- Emerging markets

- Bonds

- Real estate

- Natural resources

- Dividend-focused ETFs

The exact mix depends on user risk level.

4. Automatic Rebalancing

Wealthfront monitors every portfolio daily. If allocations drift from the intended percentages, it adjusts positions automatically to keep the portfolio balanced.

5. Tax-Loss Harvesting

Wealthfront is known for its tax optimization tools. When certain investments drop in value, Wealthfront sells and replaces them with similar alternatives to capture tax benefits — without changing long-term strategy.

6. Smart Savings & Cash Account

The Wealthfront Cash Account offers a high APY, automatic bill payments, paycheck routing, and fast transfers to investment portfolios.

7. Financial Planning Tools

Users can:

- Plan retirement

- Project home down payments

- Create saving timelines

- Model future net worth

The tools run in real time using user data.

For High-Net-Worth Users

Wealthfront offers:

- Stock-level tax-loss harvesting (for larger accounts)

- Advanced portfolios (crypto trusts, factor investing, and more)

Technical Overview (Simplified)

Wealthfront relies on:

- Cloud-native infrastructure for scalability

- Automated portfolio management algorithms

- Real-time financial modelling systems

- Secure API connections with banking and brokerage partners

- Encrypted data and compliance with U.S. financial regulations

Its automation engine runs investment decisions and adjustments continuously without human intervention.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Key Features That Make Wealthfront Successful

Wealthfront’s popularity comes from being simple, automated, long-term focused, and trustworthy. Its tools help users grow wealth without needing deep investment knowledge.

1. Automated Portfolios

Wealthfront builds diversified portfolios using ETFs across stocks, bonds, real estate, and commodities. Users don’t pick stocks manually — everything is algorithm-driven.

2. Tax-Loss Harvesting

One of Wealthfront’s strongest features.

The system automatically identifies tax-saving opportunities daily and adjusts portfolios without changing long-term strategy.

3. Automated Rebalancing

Wealthfront monitors portfolios constantly and rebalances them whenever allocations drift, keeping risk and reward aligned.

4. Cash Account with High APY

Wealthfront Cash provides:

- High interest

- Easy bill pay

- Automatic routing of paychecks

- Fast transfers to investment accounts

5. Smart Saving Tools

Users can create short-term goals such as vacation savings, home planning, or emergency funds.

6. Financial Planning & Future Projections

Wealthfront’s planning tools simulate retirement timelines, home affordability, college planning, and net worth growth.

7. No-Human-Advisor Model

Unlike hybrid robo-advisors, Wealthfront is fully digital.

Automation replaces human involvement, lowering costs and increasing consistency.

8. Stock-Level Tax-Loss Harvesting

For larger accounts, the system applies individual stock harvesting for higher tax efficiency.

9. Investing Themes & Advanced Portfolios

Users can customize portfolios with add-ons like:

- Crypto trusts

- Clean energy ETFs

- Dividend-focused investments

10. Clean and Simple Interface

Wealthfront’s mobile and web design is aimed at beginners but powerful enough for advanced users.

2025 Updates

Wealthfront added:

- AI-powered financial guidance

- Enhanced personalization within portfolios

- Upgraded savings automation and paycheck routing

- Expanded high-yield cash partner banks

The Technology Behind Wealthfront

Wealthfront runs on a fully automated, cloud-based system designed to manage portfolios, rebalance assets, detect tax-saving opportunities, and deliver financial planning — all without human involvement. Its technology focuses on accuracy, low cost, and real-time optimization.

Tech Stack Overview (Simplified)

Wealthfront uses a modern tech stack built for reliability and automation, including:

- AWS for scalable cloud hosting

- Python, Java, and Go for backend portfolio engines

- React for web dashboards

- Kubernetes for application scaling

- PostgreSQL and Redis for fast, secure data storage

This setup helps the platform run thousands of small automated actions simultaneously across user portfolios.

Automation Engine

Wealthfront’s core strength is its automation system, which performs:

- Portfolio construction

- Daily portfolio monitoring

- Automatic rebalancing

- Tax-loss harvesting

- Smart deposit routing

- Long-term financial planning calculations

These operations run 24/7 and adjust instantly to market shifts.

Security and Compliance

As a regulated U.S. investment advisor, Wealthfront meets strict financial and data security rules. Its security stack includes:

- End-to-end encrypted communication

- Multi-factor authentication

- Secure bank integrations via encrypted APIs

- Automated compliance checks

- Continuous fraud monitoring

Customer assets are held with trusted partners and protected under U.S. securities laws.

Financial Modeling & AI

Wealthfront uses advanced modeling tools to support:

- Long-term growth projections

- Home planning and retirement timelines

- Risk scoring

- Personalized investment adjustments

AI and machine learning help refine user inputs, detect anomalies, and optimize tax-saving opportunities.

Real-Time Data Infrastructure

The platform consumes real-time market data to keep portfolios aligned with the user’s risk profile. It also updates dashboards instantly whenever assets are bought, sold, or rebalanced.

API Integrations

Wealthfront connects with:

- Banks for cash accounts

- Brokerage partners for ETF execution

- Market data providers

- Planning tools for financial projections

These integrations allow the platform to operate as a complete automated wealth system.

Scalability

A microservices architecture enables Wealthfront to scale individual components — investing, cash management, tax harvesting — independently. This ensures smooth performance during market volatility or heavy trading periods.

Wealthfront’s technology makes it one of the most advanced robo-advisors in the U.S., capable of managing millions of decisions per day with precision and consistency.

Also Read :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Wealthfront’s Impact and Market Opportunity

Wealthfront has reshaped the investing world by showing that long-term wealth building can be automated, affordable, and stress-free. Instead of relying on costly advisors or complex trading platforms, users get a data-driven system that manages their money smarter than most individuals could manually.

Industry Disruption

Before Wealthfront, investing meant:

- High advisory fees

- Manual stock picking

- Limited tax optimization

- Lack of easy tools for financial planning

Wealthfront eliminated these barriers with automated investing, advanced tax strategies, and a clean, beginner-friendly interface. This pushed traditional wealth managers to modernize and adopt automation.

Market Statistics and Growth

As of 2025:

- Wealthfront manages billions in assets

- Robo-advisors are expected to surpass $3 trillion globally by 2030

- Younger investors increasingly prefer automated, low-fee platforms

- Automated tax strategies are becoming standard across fintech

Wealthfront remains one of the leading platforms in the U.S. robo-advisor space.

User Demographics and Behavior

Most Wealthfront users are:

- Young professionals

- Tech-savvy individuals

- Long-term investors

- People with no time for active trading

- Users focused on tax-efficient wealth growth

Wealthfront appeals to those who prefer “set it and forget it” investing.

Geographic Presence

Wealthfront operates primarily in the United States, offering both automated investing and high-yield cash accounts nationwide.

Future Projections

By 2030, Wealthfront plans to:

- Expand advanced investment themes

- Introduce deeper AI-driven financial coaching

- Add more portfolio customization

- Offer new high-yield banking tools

- Broaden its planning and home-buying products

Opportunities for Entrepreneurs

Wealthfront’s success highlights demand for:

- Automated investing platforms

- Tax-efficient wealth management

- AI-driven financial planning

- High-yield cash and saving ecosystems

- Beginner-friendly investment tools

Entrepreneurs can build niche robo-advisors focusing on areas like ESG investing, youth investing, micro-investing, or regional wealth platforms.

With Wealthfront Clone Script, founders can launch a complete robo-advisor — automated portfolios, tax-loss harvesting, smart savings, financial planning .

Building Your Own Wealthfront-Like Platform

Wealthfront proves that people want investing to be simple, automated, and tax-efficient. A platform that handles everything — from portfolio creation to rebalancing to planning — attracts long-term investors who prefer a hands-off approach. This creates a huge opportunity for entrepreneurs worldwide.

Why Businesses Want Wealthfront Clones

A Wealthfront-style platform allows companies to offer:

- Fully automated investing

- Diversified ETF-based portfolios

- Tax-loss harvesting

- Smart rebalancing

- High-yield savings accounts

- Goal-based financial planning

- Long-term wealth dashboards

- Automated deposit routing

- AI-driven financial insights

This all-in-one model ensures strong retention and recurring revenue.

Key Considerations for Development

To build a platform similar to Wealthfront, you need:

- Registered investment advisor licensing (U.S. or regional equivalent)

- Secure banking integrations

- Automated portfolio generation algorithms

- Market data connections

- KYC/AML onboarding systems

- Tax management engines

- Scalable cloud backend

- Strong encryption and user authentication

- Clean UI/UX focused on simplicity

Cost Factors & Pricing Breakdown

Wealthfront-Like Robo-Advisory App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Robo-Advisory MVP | User onboarding, KYC, basic goal-based investing, simple portfolios, deposits/withdrawals, transaction history, standard admin panel | $35,000 |

| 2. Mid-Level Robo-Advisory Platform | Risk profiling, automated rebalancing, richer goal tracking, bank/card integrations, enhanced KYC/AML, performance analytics dashboard, mobile-ready frontends | $80,000 |

| 3. Advanced Wealthfront-Level Platform | Tax-optimised strategies, multi-account support, premium tiers, advanced analytics & reporting, deeper brokerage/data APIs, multi-region support, web + native apps | $200,000+ |

Wealthfront-Style Robo-Advisory Platform Development

The prices above reflect the global market cost of developing a Wealthfront-like online investment and robo-advisory platform — typically ranging from $35,000 to over $200,000, with a delivery timeline of 4–10 months depending on compliance scope, brokerage/data integrations, scalability requirements, and automation depth.

Miracuves Pricing for a Wealthfront-Like Custom Platform

Miracuves Price: Starts at $14,999

This is positioned for a feature-rich, Wealthfront-style robo-advisory platform (investor onboarding and KYC, goal-based investing, basic robo-advisor automation, portfolio and performance views, transaction history, and mobile apps), with room to extend into more advanced tax optimisation, premium tiers, and deeper analytics as your wealth-tech business scales.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational robo-advisory ecosystem ready for launch and future expansion.

Delivery Timeline for a Wealthfront-Like Platform with Miracuves

For a Wealthfront-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Depth of portfolio automation and goal/risk logic

- Number of bank/payment and market data integrations

- Complexity of KYC/AML and compliance workflows

- Required dashboards, reporting tools, and premium feature set

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js / Nest.js / Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms. Other technology stacks can be discussed and arranged upon request during the consultation phase.

Other technology stacks can be discussed and arranged when you request a consultation, based on your internal team preferences, compliance needs, or infrastructure choices.—while still maintaining Miracuves’ standards for security, performance, and long-term maintainability in financial applications.

Essential Features to Include

- Personalized risk assessment

- Automated ETF portfolios

- Rebalancing engine

- Tax-loss harvesting algorithms

- Goal-based planning

- Smart savings routing

- Cash management with high APY

- Robo-advisory analytics

- Financial projections and calculators

- Simple dashboards for all user types

Read More :- Read the complete guide on fintech app development costs

Conclusion

Wealthfront reshaped investing by proving that automation, discipline, and smart tax strategies can outperform emotional, manual decision-making for most people. By simplifying long-term investing and offering tools that were once available only to wealthy clients, Wealthfront made financial growth accessible to millions.

In 2025, Wealthfront continues to be one of the most trusted robo-advisors in the U.S., supported by its low fees, tax-efficient portfolios, intelligent savings tools, and clean design. For users who want long-term, stress-free investing, it remains one of the top choices.

For entrepreneurs, Wealthfront offers a clear blueprint: people want simple, automated, and goal-focused wealth platforms. There is huge demand for localized robo-advisors, thematic investment platforms, ESG-focused tools, and savings-driven financial ecosystems.

A well-executed idea can become a scalable business with the right support — and Miracuves can help you make it a reality.

Your robo-advisor idea can become a reality faster than you think.

FAQs :-

How does Wealthfront make money?

Wealthfront earns revenue through a 0.25% annual advisory fee on investment accounts, interest spreads from its cash account partner banks, and small revenue from stock lending and ETF partnerships.

Is Wealthfront safe to use?

Yes. Wealthfront is a registered investment advisor in the U.S. and uses bank-level encryption, secure API integrations, and strict compliance processes. Investment accounts are protected by SIPC coverage up to $500,000.

Does Wealthfront charge trading fees?

No. Wealthfront does not charge trading commissions. The only ongoing fee for investing accounts is the flat 0.25% advisory fee.

Is Wealthfront available worldwide?

No. Wealthfront currently operates only in the United States.

Does Wealthfront offer retirement accounts?

Yes. Wealthfront supports traditional IRAs, Roth IRAs, and SEP IRAs, all with automated investing and rebalancing.

What makes Wealthfront different from Betterment or other robo-advisors?

Wealthfront stands out for its daily tax-loss harvesting, stock-level harvesting for large accounts, high-yield cash account, and advanced financial planning tools.

How many users does Wealthfront have?

Wealthfront manages billions of dollars in assets for hundreds of thousands of users as of 2025.

Does Wealthfront support crypto investing?

Wealthfront allows indirect crypto exposure via crypto-based trusts and ETFs, depending on regulatory updates.

Can beginners use Wealthfront easily?

Yes. Wealthfront is designed for people who want fully automated, hands-off investing with minimal decision-making.

Can I build a platform like Wealthfront?

Yes. With Wealthfront Clone Script, you can build a complete robo-advisor with automated portfolios, tax-loss harvesting, planning tools, and cash account features .

Related Articles :-