In the early 2000s, while global e-commerce giants chased warehouse dominance, Rakuten chose a radically different path. It built an ecosystem-first marketplace powered by merchants, customer-centric shopping, and its iconic loyalty currency — Rakuten Points.

By 2025, this vision evolved into a $11.8B multi-vertical empire spanning commerce, fintech, telecom, travel, entertainment, and advertising. At the center of it all sits the Business Model of Rakuten, designed to reward, retain, and constantly re-engage users.

Today, over 70% of Japan’s population earns or redeems Rakuten Points monthly, proving how a loyalty-driven ecosystem can outperform traditional marketplaces and offer game-changing lessons for entrepreneurs.

How the Rakuten Business Model Works

Rakuten operates on one of the most sophisticated multi-ecosystem business models in the world — blending marketplace commerce, fintech, telecom, loyalty, and digital ads into a unified customer experience.

At its core, Rakuten is built on a Hybrid Ecosystem Model:

- Marketplace Model (Rakuten Ichiba)

- Subscription & Membership Model (Rakuten Mobile, Rakuten TV, Rakuten Viki)

- Fintech Model (Rakuten Pay, Rakuten Bank, Rakuten Card)

- Loyalty & Cashback Model (Rakuten Points, Rakuten Rewards)

- Advertising Model (Rakuten Marketing)

Each vertical works independently but becomes more powerful when users adopt multiple services — a flywheel effect unique to Rakuten.

Business Model Overview

Rakuten’s model revolves around three core pillars:

1. Marketplace-First Approach

Rakuten Ichiba doesn’t own inventory.

It is a pure marketplace, allowing merchants full control over:

- branding

- pricing

- storefront design

- customer relationships

This is radically different from Amazon’s tightly controlled seller experience.

2. Ecosystem Lock-In via Rakuten Points

Everything Rakuten does — e-commerce, banking, credit cards, mobile services — flows back to Rakuten Points, the most successful loyalty currency in Japan.

This creates:

- higher repeat purchases

- lower churn

- multi-service adoption

strong psychological switching costs

3. Fintech + Telecom Integration

Rakuten operates Japan’s first new major mobile carrier in over a decade.

Mobile usage → generates points → increases e-commerce spending → boosts fintech adoption → leads to more data → strengthens the entire ecosystem.

No other e-commerce company globally has this breadth of vertical control.

Evolution of Rakuten’s Model

- 2000–2010: Marketplace focus + points integration

- 2010–2015: Expansion into fintech (credit cards, banking, e-payments)

- 2015–2020: Global services + advertising + travel + entertainment

- 2020–2025: Telecom launch → full ecosystem unification → super-app behavior

Today, Rakuten functions almost like a Japan-centric super app, but through distributed services rather than one monolithic application.

Why It Works in 2025

- Consumers prefer ecosystems over standalone apps

- Loyalty programs drive 3–5x higher retention

- Fintech-integrated marketplaces grow faster due to embedded finance

- Rising digital payments increase Rakuten Pay adoption

- Telecom bundling increases lifetime value

- First-party data gives Rakuten a competitive edge in ads & personalization

This eco-fused model creates a self-reinforcing flywheel few competitors can replicate.

Read more : What is Rakuten and How Does It Work?

Target Market & Customer Segmentation Strategy

Rakuten’s customer strategy is one of the strongest in the global digital ecosystem space. Unlike Amazon or Walmart, which rely heavily on logistics dominance, Rakuten wins through relationship-driven loyalty, multi-service engagement, and deep customer data integration.

Target Market Overview

Rakuten’s ecosystem serves millions of users across multiple verticals. In 2025, its target market is defined by behavior, not just demographics — prioritizing users who value convenience, rewards, and digital-first experiences

Primary Customer Segments

1. Everyday Shoppers (Core E-Commerce Users)

Demographics: 20–55 years, urban/suburban Japan, value convenience

Behavior:

- Regular online shoppers

- High sensitivity to rewards and cashback

- Tend to compare prices across sellers

Needs: - Trusted merchants

- Easy returns

- Loyalty-driven benefits

2. Financial Services Users (Fintech Adopters)

Demographics: Young professionals, credit-savvy users

Behavior:

- Use Rakuten Card as their main credit card

- Rely on Rakuten Bank for everyday transactions

- Actively earn and convert Rakuten Points

Needs: - Competitive interest rates

- Reward multipliers

- Digital-first banking

3. Rakuten Mobile Subscribers

Demographics: Millennials, tech-savvy users, families

Behavior:

- Mobile subscribers attracted by low-cost unlimited plans

- Earn bonus Rakuten Points

Needs: - Affordable telecom packages

- Seamless digital service management

4. Entertainment Users (Rakuten Viki, Rakuten TV)

Demographics: Global audience aged 18–45

Behavior:

- Enjoy Asian dramas, sports, global entertainment

- Subscription-driven

Needs: - Affordable streaming

- Multi-device access

- Exclusive content

Secondary Segments

5. Merchants & Sellers

Behavior:

- Prefer marketplace with flexible storefront control

- Seek marketing support and analytics

Needs: - Traffic from ecosystem

- Transparent fees

- Branding freedom

6. Loyalty & Cashback Hunters

These users join Rakuten because of the Rakuten Points multiplier effect.

Behavior:

- Multi-service adoption to maximize rewards

- High LTV (Lifetime Value)

Needs: - Frequent deals

- Transparent reward structure

Read more : Best Rakuten Clone Scripts 2025 – Launch Your Own Global E-Commerce Ecosystem

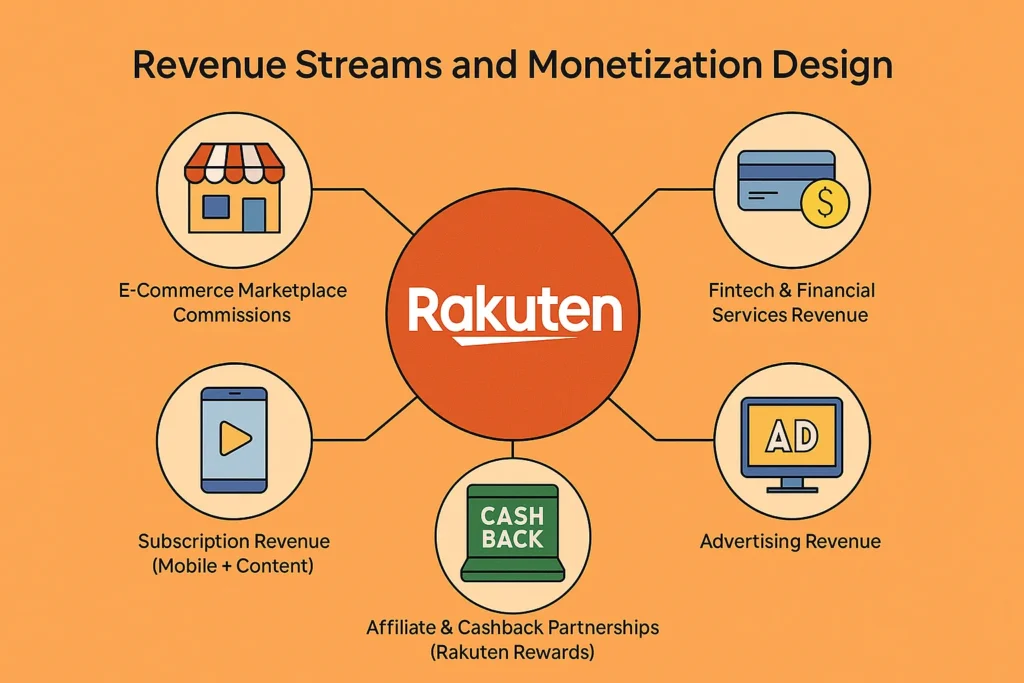

Revenue Streams and Monetization Design

Rakuten’s revenue engine is one of the most diversified among global digital platforms. Unlike Amazon, which relies heavily on e-commerce logistics and AWS, Rakuten earns from commerce, fintech, telecom, advertising, travel, content, and—most importantly—loyalty-driven transactions.

By 2025, this multi-vertical structure allows Rakuten to maintain recurring revenue, reduce risk exposure, and maximize customer lifetime value (LTV).

How Rakuten Makes Money

Rakuten’s revenue model is built on five major pillars:

- E-Commerce Marketplace Commissions

- Fintech & Financial Services Revenue

- Subscription Revenue (Mobile + Content)

- Advertising Revenue

- Affiliate & Cashback Partnerships (Rakuten Rewards)

Together, they form an ecosystem where each revenue stream strengthens the others — creating a self-reinforcing monetization flywheel.

1. Primary Revenue Stream — Marketplace Commissions (Rakuten Ichiba)

Rakuten Ichiba remains the largest revenue contributor.

Mechanism:

Merchants pay Rakuten a commission for selling on Ichiba.

Pricing Model (2025):

- 6–15% commission depending on category

- Monthly store fee: ¥50,000 (≈ $330)

- Optional ad packages for boosting visibility

% of Total Revenue: ~40–45%

Growth Drivers (2024–2025):

- Boost in customer spending due to mobile + credit card reward multipliers

- Expansion in cross-border e-commerce

- Merchant onboarding campaigns in fashion, electronics, FMCG

This revenue stream is stable, predictable, and benefits directly from the Rakuten Points flywheel.

2. Secondary Revenue Stream — Fintech (Rakuten Bank, Rakuten Pay, Rakuten Card)

Rakuten is now as much a fintech powerhouse as an e-commerce company.

Rakuten Card (Credit Card)

- Japan’s No.1 credit card issuer by transaction volume

- Generates revenue via interchange fees, interest, and membership upgrades

- Users earn extra Rakuten Points → drives more marketplace spending

Revenue Contribution: ~20–22%

Rakuten Bank

- Profit from interest spreads, digital banking fees, and loans

- Seamless integration with Rakuten Pay, Ichiba, and Mobile

Rakuten Pay (Digital Payments)

- Merchant fees from online/offline payments

- Key driver for Rakuten’s offline expansion

Why it matters:

Fintech revenue is recurring, high-margin, and increases customer retention dramatically.

3. Subscription Revenue — Telecom + Digital Content

Rakuten Mobile

- Full telecom carrier with aggressively priced unlimited data plans

- Monthly ARPU: ~¥2,800–¥3,000 (2025 estimate)

- High adoption due to loyalty rewards

- Major customer lock-in driver

Revenue Contribution: ~15–18%

Rakuten TV, Rakuten Viki

- Subscription and pay-per-view revenue

- Global audience, especially for Korean and Asian content

- Additional revenue from ads

4. Advertising & Marketing Solutions

Rakuten Marketing is Japan’s and Asia’s leading data-driven advertising network.

Revenue Mechanisms:

- Sponsored listings in Rakuten Ichiba

- Display, video, and native ads

- Rakuten Data Solutions (first-party data targeting)

- Affiliate advertising revenue (global Rakuten Rewards program)

Revenue Contribution: ~10–12%

Why It Matters:

Rakuten has unparalleled consumer behavior data across:

- e-commerce

- credit card spending

- banking

- telecom usage

- streaming consumption

Advertisers pay a premium for such rich, multi-vertical targeting.

The Integrated Monetization Strategy

Rakuten’s genius lies in how its revenue streams reinforce each other.

Example Flywheel:

- A customer uses Rakuten Card → earns Points

- Points are redeemed on Rakuten Ichiba → boosts GMV

- Shopping triggers more Rakuten Pay transactions → more fees

- Customer subscribes to Rakuten Mobile for bonus rewards → increases LTV

- Mobile data drives insights → enhances Rakuten Marketing ads → increases advertiser revenue

Operational Model & Key Activities

Rakuten’s operational engine is one of the most complex and efficient in Asia. The company runs multiple verticals simultaneously—e-commerce, fintech, telecom, advertising, travel, content—and keeps them all unified through technology, rewards, and data.

Below is how this massive machine functions daily.

Core Operational Framework

Rakuten operates through a centralized ecosystem strategy known as Rakuten Economic Zone — an interconnected digital universe where consumer activity across one service boosts activity in others.

This is powered by four operational pillars:

- Technology Infrastructure

- Merchant & Market Operations

- Fintech & Telecom Management

- Customer Lifecycle + Loyalty Engine

1. Technology Infrastructure

Rakuten is fundamentally a technology-first company.

Its operational backbone includes:

Platform Management

- Overseeing Rakuten Ichiba (marketplace platform)

- Maintaining uptime, server scaling, and security

- Continuous UI/UX optimization across services

Data Infrastructure

- Centralized customer data platform (CDP)

- Behavioral analytics across 70+ ecosystem touchpoints

- Real-time fraud detection algorithms for fintech

AI & Automation

- Recommendation engines

- Dynamic pricing systems

- Merchant performance dashboards

- Automated ad targeting (Rakuten Marketing)

- Chatbots for support across 20+ verticals

Cloud & Network Operations

- Rakuten Mobile uses a fully virtualized cloud-native network, the first of its kind globally

- Reduces operational cost and increases scalability

2. Marketplace Operations (Rakuten Ichiba)

Merchant Onboarding & Support

- Dedicated merchant success teams

- Store creation tools and marketing playbooks

- Category-specific support for fashion, electronics, groceries, beauty, etc.

Quality Control & Compliance

- Seller performance monitoring

- Customer feedback loops

- Fraud prevention and dispute handling

Logistics Partnerships

Rakuten doesn’t run Amazon-style warehouses.

Instead, it operates a distributed logistics model through:

- Third-party logistics providers

- Merchant-managed shipping

- Rakuten’s own fulfillment support (Rakuten Super Logistics)

- Smart last-mile integrations

This makes the operation light-weight yet scalable.

3. Fintech & Telecom Operations

Rakuten Card & Rakuten Bank Operations

- Credit scoring algorithms

- Loan management systems

- Risk & compliance monitoring

- Fraud detection

- Partner integrations with offline merchants and POS systems

Rakuten Pay Operations

- Payment settlement infrastructure

- QR code and NFC payment support

- Offline merchant acquisition

- Instant cashback disbursement operations

Rakuten Mobile Operations

- Network optimization (5G rollout, signal quality, bandwidth allocation)

- Customer support

- eSIM & digital activation

- Device bundling programs

Rakuten Mobile is strategically important because it drives consistent monthly revenue and loyalty lock-in.

4. Customer Lifecycle Management

Acquisition

- Points campaigns

- Merchant promotions

- Influencer-led marketing

- Mobile contract bundles

Engagement

- Rakuten Points boosters

- Cross-service recommendations

- Personalized dashboards

- Subscription upsells

Retention

- Points expiry reminders

- Exclusive member benefits

- Seasonal shopping festivals

- Co-branded offers with financial partners

The loyalty system reduces CAC (Customer Acquisition Cost) by 40–60%, making Rakuten far more efficient than typical e-commerce competitors.

Strategic Partnerships & Ecosystem Development

Rakuten’s rise into a multi-vertical digital super-ecosystem didn’t happen through organic efforts alone.

Its expansion across e-commerce, fintech, telecom, travel, entertainment, and advertising is built on deep strategic alliances that accelerate growth, reduce operational risk, and strengthen customer loyalty.

Rakuten understands one core truth of platform economics:

Ecosystems win, not standalone apps.

Rakuten’s Partnership Philosophy

Rakuten positions itself as a collaborative ecosystem builder rather than a closed competitor.

Its philosophy is built on:

- Mutual value creation

- Data-driven integrations

- Reward-based collaboration

- Merchant empowerment over platform control

- Long-term ecosystem expansion

This approach allowed Rakuten to grow faster and more cost-efficiently than most global marketplace giants

Key Categories of Partnerships

1. Technology & API Partners

Rakuten strengthens its platform capabilities through integrations with:

- Cloud providers

- Payment gateways

- Security & identity verification tools

- Data analytics APIs

- AI & machine learning vendors

Impact:

- Lower tech overhead

- Faster innovation cycles

- Reduced time-to-market

- More personalized customer experience

2. Payment & Fintech Partners

Even though Rakuten has its own financial services, it still collaborates with:

- Visa, Mastercard, American Express

- POS providers

- Offline merchants adopting Rakuten Pay

- Banks offering co-branded reward campaigns

Impact:

- Expands acceptance of Rakuten Card

- Boosts Rakuten Pay usage offline

- Increases Points circulation across Japan

- Enables cross-border payment capability

3. Logistics & Delivery Partners

Rakuten does not operate fulfillment centers at Amazon’s scale.

Instead, it partners with:

- Yamato Transport

- Japan Post

- Regional delivery companies

- Merchant-managed logistics providers

Impact:

- Lower operational overhead

- Nationwide coverage

- Faster delivery for priority sellers

- Scalable fulfilment without large inventory risk

4. Telecom & Device Partners

Rakuten Mobile works closely with:

- Handset manufacturers (Samsung, Xiaomi, Sharp)

- Infrastructure vendors

- 5G technology partners

- eSIM technology providers

Impact:

- Cost reduction in mobile network deployment

- Better device bundles for customers

- Increased mobile subscriber retention

Growth Strategy & Scaling Mechanisms

Rakuten’s growth engine is a masterclass in ecosystem scaling.

Instead of relying on a single vertical (like Amazon = commerce, Google = ads, Netflix = content), Rakuten scales through multi-directional growth — where expanding one service boosts the usage of every other service.

This creates a powerful “Economic Zone” effect:

More users → more points → more spending → more merchants → more partners → more data → more revenue.

1. Organic Virality & Referral Flywheels

Rakuten’s loyalty program is its biggest driver of word-of-mouth growth.

Growth Levers:

- Points for sign-up

- Points for referring friends

- Points for first purchase

- Higher multipliers for cross-service use

- Seasonal “Super Points” festivals

Rakuten Points create a viral loop where users want to invite friends to earn more — fueling rapid organic expansion without heavy marketing spend.

2. Paid Marketing & Ecosystem-Level Acquisition

Rakuten invests in cross-vertical paid acquisition, which is more efficient than single-app campaigns.

Examples:

- Mobile ads that promote banking signup

- Banking rewards that drive marketplace shopping

- Marketplace ads that promote Rakuten Mobile bundles

- Travel deals tied into Rakuten Card usage

Because the same user participates in multiple services, CAC (Customer Acquisition Cost) becomes extremely low over time.

3. New Product Lines & Vertical Expansion

Rakuten continuously launches and expands new business lines:

- Rakuten Mobile (telecom)

- Rakuten Pay (payments)

- Rakuten Bank (digital banking)

- Rakuten Viki & TV (content streaming)

- Rakuten Rewards (global cashback network)

- Rakuten Travel (OTAs)

- Rakuten Securities (investment platform)

Each vertical expands Rakuten’s share of the customer’s life and increases average LTV dramatically.

4. Geographic Expansion Strategy

Rakuten uses a targeted international expansion model, not a mass rollout.

Key international markets:

- USA (Rakuten Rewards, Rakuten Viki)

- Asia-Pacific (travel, content)

- Latin America (content & games)

- Europe (selected fintech services + content licensing)

Rakuten scales only where:

- consumer behavior aligns

- content rights are accessible

- reward models resonate

- regulations are favorable

This avoids unnecessary burn and ensures sustainable scaling.

5. Loyalty Engine as a Growth Multiplier

Rakuten Points are the centerpiece of its scaling strategy.

How Points Supercharge Growth:

- Boost transaction frequency

- Increase retention

- Encourage multi-service adoption

- Convert telecom users into ecommerce buyers

- Reduce churn dramatically

Points transform Rakuten from “just another marketplace” into an economic lifestyle ecosystem.

6. Telecom Rollout & Infrastructure Innovation

Rakuten Mobile represents a long-term growth engine by:

- Generating recurring monthly subscription revenue

- Increasing points distribution

- Locking consumers into long-term contracts

- Lowering network costs with cloud-native infrastructure (world’s first)

- Leveraging data from mobile to improve ads, shopping, and banking personalization

This integration gives Rakuten a massive scaling advantage no global competitor can replicate easily.

Competitive Strategy & Market Defense

Rakuten operates in a hyper-competitive landscape — battling giants like Amazon, PayPay Mall, Mercari, SoftBank, and global fintech challengers. Yet, despite the pressure, Rakuten continues to hold one of Japan’s strongest digital market positions in 2025.

Its defensive strength doesn’t come from logistics or low pricing alone — it comes from ecosystem depth, customer loyalty, fintech penetration, and telecom integration.

Let’s break down how Rakuten stays competitive and protects its market share.

Rakuten’s Core Competitive Advantages

1. The Most Powerful Loyalty Engine in Japan

Rakuten Points create a psychological and financial switching barrier.

Why this is a big moat:

- Over 70% of Japanese consumers earn/use points monthly

- Points multipliers make Rakuten cheaper than Amazon

- Rewards apply across every vertical: shopping, banking, mobile, travel, entertainment

- Hard for competitors to replicate due to ecosystem complexit

This loyalty system alone boosts repeat purchase rates 3–5x higher than typical marketplaces.

2. Merchant-First Marketplace (Unlike Amazon)

Unique strengths of the Rakuten marketplace model:

- Merchants have full storefront control

- Sellers can build their own brand identity

- No forced logistics provider (unlike Amazon FBA)

- Merchant-level CRM + analytics provided natively

This attracts a higher number of merchants who don’t want to be commoditized by Amazon.

3. Ecosystem Bundling that Competitors Cannot Match

Amazon has Prime.

Rakuten has an entire economic ecosystem:

- Rakuten Card

- Rakuten Pay

- Rakuten Mobile

- Rakuten Bank

- Rakuten Travel

- Rakuten Viki

- Rakuten Marketplace

Each product increases the value of the other — a defensive shield that makes switching extremely costly

4. Cross-Industry Data Advantage

Rakuten has an unparalleled first-party data moat:

- E-commerce purchase patterns

- Credit card transaction data

- Banking behavior

- Telecom usage

- Travel and entertainment preferences

This data powers:

- hyper-personalized recommendations

- high-CTR advertising

- improved credit scoring

- churn prediction

- dynamic reward boosters

Competitors with single verticals cannot match this depth.

5. Telecom Integration as a Long-Term Defense

Rakuten Mobile is not just a telco — it is a high-frequency touchpoint.

Daily mobile usage → more data → more opportunities to drive customers back to Rakuten’s ecosystem.

No other e-commerce company besides Reliance Jio (India) has successfully merged telecom + e-commerce + fintech at this scale.

Rakuten-Like Marketplace platform – Pricing & Timeline

| Development Level | Inclusions | Estimated Market Price (USD) |

| MVP (Basic Marketplace) | Multi-vendor setup, merchant onboarding, product catalog, checkout, basic cashback module, order management | $60,000 |

| Mid-Level Marketplace | All MVP features + advanced cashback engine, coupon system, loyalty points, analytics dashboard, seller payout automation, improved UI/UX | $120,000 |

| Advanced Marketplace (Full-Level) | All mid-level features + full Rakuten-style ecosystem: affiliate engine, reward network, ads module, mobile apps (iOS + Android), AI recommendations, advanced fraud checks | $200,000 + |

This is the estimated global market price and timeline for building a Rakuten-style solution from scratch.

Rakuten-Like Marketplace platform Development

A Rakuten-style platform combines a multi-vendor marketplace, powerful cashback and loyalty engine, and affiliate + ads ecosystem to drive repeat purchases and higher customer lifetime value. Building such an ecosystem from scratch usually requires a large team, long timelines, and significant investment.

Typical global market cost for building a Rakuten-like multi-vendor cashback marketplace ranges from $60,000 to $200,000 with a delivery timeline of 6–12 months

Miracuves’s Rakuten-Like Marketplace Platform – Pricing

Miracuves focuses on delivering a Rakuten-inspired marketplace, cashback, and loyalty ecosystem at a far more accessible entry cost compared to the typical global market.

Miracuves Price: Starts at $15,999

The platform is optimised for multi-vendor commerce with built-in support for loyalty points, cashback, coupons, affiliate tracking, and ad placements, all running on enterprise-grade scalability, performance, and security baked into the core architecture. It is designed to be fully brandable and customisable to your specific country, niche, or loyalty model, ensuring the experience feels native to your market and aligned with your brand.

Note: This includes full non-encrypted source code, complete deployment support, backend setup, admin panel configuration, and publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational ecosystem ready for launch and future expansion.

Delivery Timeline for Rakuten-Like Marketplace

Miracuves development timeline including setup, configuration, admin deployments, API integrations, and platform handover in approximately 30–90 days, depending on customization and additional functional layers requested. This ensures a stable, market-ready system with predictable delivery and no hidden engineering delays.

Tech Stack

We preferably will be using JavaScript for building the entire solution and Flutter / React Native for mobile apps, considering speed, scalability, and maintaining one codebase across platforms. Other tech stacks can be discussed and arranged upon request.

Contact us to discuss the best-fit setup for your project.

Conclusion :

You don’t win by being the cheapest — you win by being the most interconnected.

From a small Japanese marketplace to a global multi-vertical ecosystem, Rakuten succeeded because it mastered the art of value stacking.

Every new service — marketplace, card, bank, mobile, travel, entertainment — didn’t just add revenue; it added reinforcing power to the entire network.

In a world where apps are fighting for user attention, Rakuten built something different:

A system where customers want to stay, because leaving means losing far more value than they would gain elsewhere.

This is the future of platform economies in 2025 and beyond:

- Ecosystems over standalone apps

- Loyalty over discounts

- Data over guesswork

- Collaboration over competition

- Integration over fragmentation

Entrepreneurs who understand these principles won’t just build apps —

they’ll build economic zones, where merchants, partners, and customers grow together.

And with Miracuves providing the backbone — ready-made modules, fintech integrations, ecosystem-ready architecture — founders today can build what Rakuten built in decades… in under a week.

FAQs :

1. What type of business model does Rakuten use?

Rakuten uses a hybrid multi-ecosystem business model blending marketplace commerce, fintech, telecom, loyalty rewards, and digital content.

Its core monetization engine is the Rakuten Points loyalty system, which connects every service inside the ecosystem.

2. How does Rakuten’s business model create value?

Rakuten creates value by empowering merchants with branded storefronts, rewarding consumers through Rakuten Points, and giving partners access to Japan’s strongest loyalty network. This multi-sided model drives network effects, higher retention, and consistent cross-service engagement.

3. What are Rakuten’s key success factors?

Rakuten wins through its powerful loyalty ecosystem, merchant-first marketplace, fintech leadership, telecom integration, and AI-driven personalization. Strategic partnerships across travel, content, and payments further strengthen its ecosystem advantage.

4. How scalable is Rakuten’s business model?

Rakuten is highly scalable due to its asset-light marketplace, fintech integrations, and loyalty-driven user growth. Its cloud-native telecom network lowers operational costs and supports rapid nationwide expansion.

5. What are the biggest challenges in Rakuten’s model?

Rakuten faces challenges like heavy telecom investment, strong competition from Amazon and Mercari, multi-vertical operational complexity, strict financial regulations, and slower global adoption.

6. How can entrepreneurs adapt Rakuten’s model to their region?

Start with a marketplace + loyalty system, then add payments, cashback, travel, and subscription bundles. Focus on lightweight operations and grow through strategic partnerships to replicate Rakuten’s ecosystem advantage.

7. What are the alternatives to Rakuten’s model?

Alternatives include Amazon’s inventory model, PayPay Mall’s discount-led approach, MercadoLibre’s fintech-first ecosystem, Jio’s telecom-driven strategy, and Shopee’s cashback-heavy marketplace. Each differs, but none match Rakuten’s loyalty-centric design.

8. How has Rakuten’s model evolved over time?

Rakuten evolved from a pure marketplace to a loyalty-powered platform, then expanded into fintech, travel, content, global rewards, and finally telecom — forming a fully unified digital ecosystem by 2025.

Related Article :