Imagine buying something you really want today — clothes, electronics, beauty products — and paying for it later in small, interest-free installments. No credit card needed, no hidden fees, no long bank forms. That convenience is exactly why Afterpay became one of Australia’s most loved Buy Now, Pay Later (BNPL) apps.

Founded in Sydney in 2014, Afterpay changed retail shopping forever by allowing users to split purchases into four equal payments spread over six weeks. Its simple rules, strong merchant network, and instant approvals made it a global BNPL leader across Australia, New Zealand, the U.S., Canada, and the U.K.

By 2025, Afterpay continues to dominate the BNPL industry with millions of active customers, thousands of partner brands, and smooth in-store + online checkout options.

By the end of this article, you’ll understand what Afterpay is, how it works, how it makes money, and how you can build your own Afterpay-like BNPL platform with Miracuves.

What is Afterpay? The Simple Explanation

Afterpay is an Australian buy now, pay later (BNPL) service that lets customers purchase products instantly and pay for them over four interest-free installments. It removes the need for credit checks or traditional loans, making it one of the most accessible short-term financing solutions for online and in-store shopping.

The core problem Afterpay solves is payment flexibility. Many customers want to buy essential or desired products but prefer spreading payments over weeks rather than paying the full amount upfront. Afterpay provides this flexibility while charging no interest — as long as payments are made on time.

Its primary users are young adults, online shoppers, and budget-conscious consumers who prefer manageable installments. Businesses use Afterpay to increase conversion rates, reduce abandoned carts, and boost order values.

As of 2025, Afterpay is available in Australia, the U.S., the U.K., Canada, and New Zealand, with millions of active users. It is one of the pioneers of the global BNPL revolution, now integrated with thousands of retail brands and e-commerce stores worldwide.

Afterpay became successful because of its simplicity, zero-interest model, user protections, and strong merchant partnerships that made it a trusted name in flexible payments.

How Afterpay Works – Step-by-Step Breakdown

Afterpay operates on a simple Buy Now, Pay Later (BNPL) model, allowing shoppers to split purchases into four equal, interest-free payments. It benefits both customers and online/offline merchants through frictionless checkout and increased conversions.

For Users (Shoppers)

1. Account Creation

Users sign up using their mobile number and verify their identity with basic details. No credit score is required for initial approval, and eligibility is based on spending behavior and repayment history.

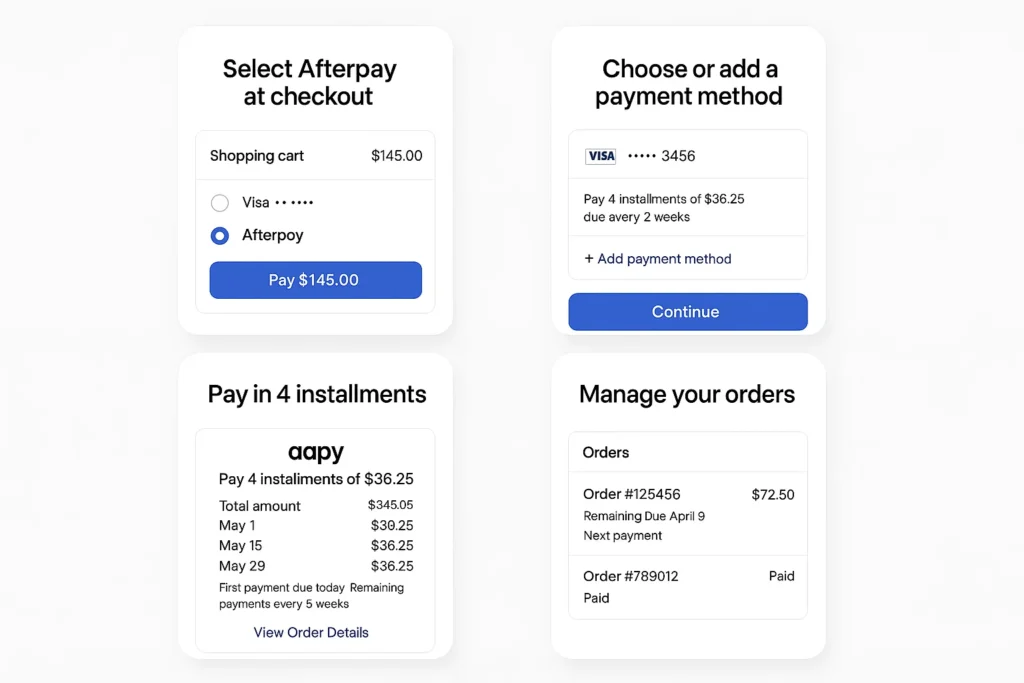

2. Shopping Online or In-Store

Users select Afterpay at checkout (online) or use the Afterpay Card / barcode (in-store) to complete purchases instantly.

3. Payment Schedule

The total purchase value is split into 4 equal payments:

- 1st payment: Paid at checkout

- Remaining 3 payments: Automatically charged every two weeks

No interest is charged as long as payments are made on time.

4. Spending Limits

Afterpay assigns dynamic spending limits based on the user’s payment history, purchase size, and account activity. Responsible usage increases the limit gradually.

5. App Features

Users can:

- Track installments

- Manage due dates

- Receive reminders

- Access curated shopping deals

- Freeze accounts in case of missed payments

For Merchants (Retailers)

1. Integration

Merchants integrate Afterpay through APIs, plugins, or POS systems. Once connected, customers can choose Afterpay as a checkout method.

2. Instant Payments

Afterpay pays merchants the full transaction amount upfront (minus fees), reducing risk and improving cash flows.

3. Customer Acquisition

Afterpay brings new customers to merchants through its marketplace-style app showcasing partnered brands.

4. Increased Conversions

BNPL options help reduce cart abandonment and boost average order value.

Technical Overview (Simple)

Afterpay uses a secure BNPL engine connected to card networks, merchant systems, and internal risk models.

Key components:

- Cloud-based architecture for scaling

- API-based merchant integrations

- Automated risk scoring using ML

- Real-time payment authorization

- Secure tokenization for card storage

The app provides a seamless checkout experience with automated installment processing.

Afterpay’s Business Model Explained

Afterpay operates on a Buy Now, Pay Later (BNPL) model that allows users to split payments into four interest-free installments. Instead of charging customers interest, Afterpay earns primarily from merchants who pay fees for offering the service. Its simple, customer-friendly model has helped it scale across Australia, the U.S., the UK, and other major markets.

1. Merchant Fees (Primary Revenue Source)

Merchants pay Afterpay a fee for every transaction completed through the platform.

This includes:

- A fixed fee per transaction

- A variable fee (usually between 3%–6%)

Merchants accept these fees because Afterpay significantly increases conversion rates, average order values, and customer loyalty.

2. Late Fees (Minor Revenue Source)

While customers aren’t charged interest, Afterpay earns late fees when users miss installment deadlines.

These fees are capped and represent a small portion of total revenue, as Afterpay encourages timely payments.

3. Interchange Fees

In regions where Afterpay offers a virtual card or in-store payments, it earns a portion of interchange fees from the transaction.

4. Brand Partnerships

Afterpay partners with major brands to run promotions, drive traffic during sales, and feature merchants in the Afterpay marketplace.

These partnerships generate additional marketing and referral revenue.

5. Afterpay Ads & Marketplace Listings

Retailers can promote their products inside the Afterpay app for increased visibility.

This creates a growing advertising revenue stream similar to other modern fintech marketplaces.

6. Data Insights for Merchants

Afterpay also monetizes aggregated consumer insights, helping retailers understand spending patterns and optimize campaigns.

Market Growth

By 2025, Afterpay continues to be one of the most influential BNPL providers globally, processing billions in annual payments with strong expansion in both online and in-store channels.

Read Also :- Most Profitable Digital Banking & Fintech Apps to Launch in 2025

Key Features That Make Afterpay Successful

Afterpay became one of the world’s most popular Buy Now, Pay Later (BNPL) platforms because it focuses on simplicity, transparency, and customer-friendly repayment structures. Here are the features that drive its success:

1. Zero-Interest Installments

Users can split purchases into four equal payments over six weeks without paying interest. This makes Afterpay appealing to young shoppers who want flexible budgeting without credit card debt.

2. Instant Approval

Afterpay performs a quick eligibility check and approves most users instantly without requiring a hard credit inquiry. This speed and convenience help reduce checkout friction.

3. No Traditional Credit Checks

Afterpay doesn’t rely on traditional credit scores for approval, making it accessible to users who lack strong credit histories. This is a major reason for its popularity among millennials and Gen Z.

4. In-App Shopping Directory

The Afterpay app lists thousands of partner brands across fashion, beauty, electronics, travel, and home goods. Users can browse deals and shop directly through the app, increasing conversions.

5. Automatic Payments

Payments are automatically deducted from the user’s linked card or account on scheduled due dates. This minimizes missed installments and improves repayment reliability.

6. Spending Limits

Afterpay sets dynamic spending limits based on user behavior. Responsible borrowers receive higher limits over time — improving loyalty while reducing risk.

7. Late Fee Caps

Afterpay charges small late fees, but they’re capped to ensure customers don’t fall into debt spirals. This consumer-friendly approach boosts brand trust.

8. Merchant Integration

For merchants, Afterpay offers easy integration through:

- APIs

- E-commerce plugins (Shopify, WooCommerce, Magento)

- Point-of-sale integrations for in-store purchases

This helps sellers offer BNPL at checkout with minimal complexity.

9. High Conversion Rates

Retailers benefit from:

- Increased average order value

- Higher checkout completion rates

- More returning customers

This is a key reason thousands of brands adopt Afterpay.

10. Global Availability & Cross-Border Shopping

Afterpay supports international shopping across the U.S., Australia, New Zealand, Canada, and the UK through its Clearpay brand. Users can shop globally with a unified experience.

2025 Updates:

Afterpay introduced:

- Instant refunds for returns

- AI-based spending insights

- BNPL for travel bookings

- Real-time budgeting dashboards

- Improved fraud detection algorithms

The Technology Behind Afterpay

Afterpay’s “Buy Now, Pay Later” model works smoothly because of the strong technology stack behind it. The platform is built to approve transactions instantly, assess user risk in real time, and manage repayments across millions of customers worldwide — all with minimal friction.

Tech Stack Overview (Simplified)

Afterpay’s systems use a mix of modern technologies designed for high availability and low-latency transactions:

- Backend: Java, Go, Kotlin, Node.js

- Frontend: React + React Native

- Databases: PostgreSQL, DynamoDB, Redis

- Cloud Hosting: AWS for scalability, redundancy, and global server distribution

- APIs: REST and GraphQL APIs for merchant integrations

- Messaging & Streaming: Kafka for real-time event processing

This setup supports millions of BNPL approvals and repayments every day.

Real-Time Risk Scoring

Afterpay doesn’t run traditional credit checks. Instead, it uses real-time behavioral algorithms to evaluate user eligibility by analyzing:

- Purchase amount

- Previous repayment patterns

- Frequency of transactions

- Account age and activity

This makes approvals fast — usually in a few seconds.

Data Handling & Privacy

Afterpay securely stores user and transaction data using:

- Tokenization

- AES-256 encryption

- PCI DSS compliance for payment handling

- Regional data storage per country mandates

It also uses multi-factor authentication and fraud-detection models to protect user accounts.

Scalability Approach

As a global platform, Afterpay uses microservices and auto-scaling cloud environments to handle peak shopping seasons such as Black Friday. Each service (payments, approvals, refunds, notifications) scales independently.

Mobile App vs Web

- The mobile app focuses on user payments, installments, and shopping features.

- The web platform provides deeper analytics and management tools for merchants.

Both sync through unified APIs so customers can switch devices effortlessly.

Merchant & API Integrations

Afterpay integrates with thousands of retailers using:

- Shopify, WooCommerce, Magento plugins

- Custom API integrations

- Merchant dashboards for settlement and reporting

Brands can add Afterpay into their checkout in minutes, which accelerates adoption.

Why This Tech Matters

- Instant approvals increase conversion rates

- Automated repayments reduce missed installments

- Global architecture supports millions of users

- Low-latency risk analysis makes BNPL feel seamless

- Easy integrations boost merchant partnerships

Afterpay’s technical foundation is the reason its BNPL experience feels smooth, fast, and trustworthy.

Afterpay’s Impact & Market Opportunity

Afterpay has reshaped how consumers shop across Australia, the U.S., the U.K., and Europe by making Buy Now, Pay Later (BNPL) a mainstream payment method. Its influence extends beyond finance — it has transformed retail, eCommerce, consumer psychology, and brand loyalty.

Industry Disruption

Before Afterpay, installment payments were complicated, credit-based, and interest-heavy. Afterpay changed this by offering:

- Instant approval

- Zero interest

- Transparent payments

- A simple 4-installment model

This model removed friction from online shopping and helped merchants significantly increase conversions, especially among younger shoppers. Traditional credit cards and banks were pushed to innovate or launch their own BNPL services because of Afterpay’s rise.

Market Statistics & Growth

By 2025:

- Afterpay serves over 20 million global users

- Processes billions in GMV annually

- Partners with over 140,000 merchants worldwide

- Continues to grow under Block, Inc. (its parent company)

- BNPL is projected to exceed $1 trillion in annual transaction volume globally by 2030

The growth of BNPL is being driven by online shopping trends, inflation-conscious consumers, and retailers wanting higher conversion rates.

User Demographics & Behavior

Afterpay’s core audience includes:

- Gen Z and Millennials

- Online shoppers who avoid credit cards

- Budget-conscious buyers

- Fashion, beauty, electronics, and lifestyle consumers

These users value flexible, interest-free payments and tend to choose stores that offer BNPL options.

Geographic Presence

Afterpay is headquartered in Australia, but its largest user base is in:

- United States

- Australia & New Zealand

- United Kingdom

- Canada

- Select European markets

Its global expansion accelerated rapidly after being acquired by Block, Inc.

Future Projections

By 2030, Afterpay aims to:

- Expand into offline retail and point-of-sale ecosystems

- Introduce loyalty programs integrated across Block’s network

- Add subscription payments and recurring billing

- Integrate deeper within the Cash App financial ecosystem

- Offer BNPL-as-a-Service for banks and global fintech partners

Opportunities for Entrepreneurs

The BNPL boom is still in its early stages. There is high demand for:

- Region-specific BNPL apps

- Niche BNPL solutions for travel, healthcare, education, or luxury shopping

- Merchant-focused BNPL plugins and APIs

- BNPL wallet + credit hybrid platforms

With Afterpay Clone Script, entrepreneurs can launch a fully functioning BNPL platform, complete with:

- Merchant dashboard

- User app

- Instant approval engine

- Repayment scheduling

- Late fee automation

- KYC/AML verification

- Real-time analytics

This massive BNPL demand means there is significant room for new players — especially in emerging markets.

Read Also :- Top UI/UX Mistakes in Digital Banking & Fintech Apps

Building Your Own Afterpay-Like Platform

Afterpay’s explosive success proves one thing clearly: Buy Now, Pay Later (BNPL) is no longer just a trend — it’s a global shift in how people shop and manage short-term payments. If you’re aiming to create a modern fintech product that boosts merchant sales and gives customers flexible payment power, an Afterpay-style BNPL platform is one of the strongest opportunities in 2025.

Why Businesses Want Afterpay Clones

A BNPL solution like Afterpay offers several strategic advantages:

- Helps merchants increase conversion, average order value, and repeat purchases

- Attracts younger shoppers who avoid credit cards

- Builds customer loyalty through interest-free installments

- Offers an alternative credit model with instant approvals

- Creates a high-retention ecosystem for both merchants and users

- Generates strong recurring revenue through merchant fees

BNPL usage worldwide is expected to exceed $700+ billion by 2030, and there’s plenty of room for localized, niche, or industry-focused platforms.

Key Considerations for Development

To build a strong and compliant BNPL platform, focus on:

- Risk assessment models for credit approvals

- Merchant onboarding tools with APIs and plugins

- Instant user verification using KYC, PAN/Aadhaar (India), SSN (USA), etc.

- Secure payment gateway integration

- Automated installment tracking & reminders

- Transaction-level credit scoring

- Zero-downtime architecture for checkout integrations

- Compliance with lending and consumer finance laws in your region

Cost Factors & Pricing Breakdown

Afterpay-Like BNPL App Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic BNPL MVP | User onboarding, KYC, basic “buy now, pay later” checkout, simple repayment schedules, order history, merchant panel, standard admin panel | $35,000 |

| 2. Mid-Level BNPL Platform | Multi-merchant support, flexible instalment plans, payment gateway integrations, improved risk checks, notifications, dashboards, mobile-ready frontends | $80,000 |

| 3. Advanced Afterpay-Level BNPL Platform | Advanced risk and credit-scoring engine, multi-country support, complex repayment logic, deep merchant integrations, dispute handling, rich analytics, web + apps | $200,000+ |

Afterpay-Style Buy Now, Pay Later Platform Development

The prices above reflect the global market cost of developing an Afterpay-like buy now, pay later (BNPL) platform — typically ranging from $35,000 to over $200,000, with a delivery timeline of 4–10 months depending on payment gateway integrations, risk and credit-scoring complexity, regulatory requirements, scalability needs, and merchant ecosystem depth.

Miracuves Pricing for an Afterpay-Like Custom Platform

Miracuves Price: Starts at $14,999

This is positioned for a feature-rich, Afterpay-style BNPL platform (user onboarding and KYC, BNPL checkout flows, repayment schedules, order and transaction histories, merchant tools, and mobile apps), with room to extend into more advanced risk engines, multi-country compliance, and deeper merchant/partner integrations as your business scales.

Note: This includes full non-encrypted source code (complete ownership), complete deployment support, backend & API setup, admin panel configuration, and assistance with publishing on the Google Play Store and Apple App Store—ensuring you receive a fully operational BNPL ecosystem ready for launch and future expansion.

Delivery Timeline for an Afterpay-Like Platform with Miracuves

For an Afterpay-style, JS-based custom build, the typical delivery timeline with Miracuves is 30–90 days, depending on:

- Scope and complexity of BNPL and repayment features

- Number of payment gateways, merchants, and external services to integrate

- Depth of risk-scoring, fraud detection, and compliance workflows

- Required dashboards, reporting tools, and analytics for merchants and admins

Tech Stack

We preferably will be using JavaScript for building the entire solution (Node.js / Nest.js / Next.js for the web backend + frontend) and Flutter / React Native for mobile apps, considering speed, scalability, and the benefit of one codebase serving multiple platforms. Other technology stacks can be discussed and arranged upon request during the consultation phase.

Other technology stacks can be discussed and arranged when you request a consultation, based on your internal team preferences, compliance needs, or infrastructure choices.

Read More :- Read the complete guide on fintech app development costs

Conclusion

Afterpay transformed the way people shop by making budgeting easier, interest-free, and more consumer-friendly. It removed the fear of large upfront payments and replaced it with simple, predictable installments. This shift didn’t just attract millions of users — it reshaped global retail, helping brands increase sales while giving customers more control over their spending.

In 2025, Afterpay remains one of the strongest Buy Now, Pay Later platforms worldwide, especially in Australia, the U.S., and Europe. Its ability to blend seamless checkout experiences, risk-management technology, and user-centric design sets the standard for modern BNPL services.

For entrepreneurs and businesses, Afterpay’s model represents a massive opportunity. Consumers increasingly prefer flexible payment options, and merchants rely on BNPL to drive conversions and customer loyalty. A platform that mirrors Afterpay’s simplicity, transparency, and instant decisioning can thrive in almost any market.

Afterpay shows that financial innovation doesn’t need to be complicated — it just needs to make life easier. Your next fintech breakthrough can begin today with the right technology and a vision to empower modern shoppers.

FAQs :-

How does Afterpay make money?

Afterpay earns primarily from merchant fees. Businesses pay a percentage (usually 4%–6%) plus a small fixed fee for each Afterpay transaction. A smaller portion comes from late fees charged to users who miss payments.

Is Afterpay safe to use?

Yes. Afterpay uses encrypted transactions, secure authentication, and strict risk controls. It never shares full card details with merchants, and spending limits adjust based on user behavior.

Does Afterpay charge interest?

No. Afterpay is interest-free for users. The only possible cost is a late fee if payments are missed.

Is Afterpay available worldwide?

Afterpay operates in Australia, New Zealand, the United States, Canada, and the UK. Acceptance depends on regional merchants.

How much can I spend with Afterpay?

Spending limits vary by user and increase over time based on repayment history, account age, and transaction behavior.

What happens if I miss a payment?

Afterpay charges a late fee and may temporarily block new purchases until the overdue amount is cleared.

Does Afterpay affect credit score?

In most regions, Afterpay does not report repayments to credit bureaus. However, repeated defaults may impact your ability to use the service.

How do refunds work with Afterpay?

If a merchant approves a refund, Afterpay immediately adjusts the remaining installment amounts or returns funds to the original payment method.

Can businesses integrate Afterpay easily?

Yes. Merchants can add Afterpay via plugins (Shopify, WooCommerce, BigCommerce) or through API integration.

Can I build an app like Afterpay?

Yes. With Miracuves, you can launch a fully functional BNPL platform — including installment payments, merchant dashboards, risk engines, and automated repayment flows.

Related Articles :-