In just a few years, Shopee evolved from a regional startup into Southeast Asia’s most dominant e-commerce platform, competing head-to-head with global giants like Lazada and Amazon. Backed by Sea Group, Shopee leveraged mobile-first commerce, aggressive localization, and a data-driven marketplace strategy to scale across more than 10 countries — serving hundreds of millions of users.

What makes Shopee especially relevant in 2025 is not just its scale,but how deliberately the Business Model of Shopee is engineered— balancing subsidies, seller enablement, logistics control, fintech integration, and advertising monetization. For founders exploring marketplace apps, multi-vendor platforms, or super-app commerce models, Shopee offers a masterclass in execution under competitive and margin-pressured conditions.

At Miracuves, we study platforms like Shopee closely because they demonstrate how technology architecture, monetization layers, and growth mechanics must evolve together to build sustainable digital ecosystems — especially in high-growth but complex markets.

How the Shopee Business Model Works

Shopee operates on a hybrid marketplace business model designed specifically for mobile-first, price-sensitive markets in Southeast Asia and Latin America. At its core, Shopee connects millions of buyers and sellers through a digital marketplace while progressively integrating logistics, payments, advertising, and cross-border commerce into a unified platform ecosystem.

Rather than maximizing margins early, Shopee prioritized liquidity, trust, and frequency, knowing that once demand and supply density are achieved, monetization layers can scale efficiently.

Core Business Model Framework

Type of Model

- Multi-vendor marketplace (B2C + C2C)

- Hybrid platform with embedded logistics and fintech

- Advertising-supported commerce ecosystem

Value Proposition

- For Buyers:

- Low prices, frequent discounts, flash sales

- Seamless mobile shopping experience

- Integrated payments and buyer protection

- For Sellers:

- Easy onboarding and low entry barriers

- Access to massive consumer demand

- Built-in logistics, marketing tools, and analytics

- For Partners (Logistics, Brands, Payment Providers):

- High transaction volumes

- API-driven integrations

- Long-term recurring commercial relationships

Key Stakeholders

- Buyers (demand side)

- Individual sellers and enterprise brands (supply side)

- Shopee Logistics Service (SLS) partners

- SeaMoney (payments, wallets, credit)

- Advertisers and brand partners

Evolution of the Model

Shopee’s business model did not remain static:

- Early Stage: Heavy subsidies, free shipping, zero commissions

- Growth Phase: Introduction of seller commissions and ads

- Maturity (2024–2025):

- Logistics monetization

- Fintech-driven revenue (wallets, BNPL)

- Higher-margin advertising products

This phased evolution allowed Shopee to optimize unit economics without killing growth, a critical lesson for marketplace founders.

Why Shopee’s Model Works in 2025

- Mobile commerce dominance in Southeast Asia

- High price elasticity among consumers

- Fragmented retail ecosystems needing aggregation

- Strong network effects between sellers and buyers

- Deep localization across languages, payment methods, and logistics

Shopee succeeds because it is not just a marketplace, but a commerce operating system for emerging economies.

Read more : What Is Shopee and How Does It Work?

Target Market & Customer Segmentation Strategy

Shopee’s growth engine is powered by precise market segmentation and hyper-local execution. Instead of targeting a single “average shopper,” Shopee built a platform that adapts to multiple buyer and seller personas across income levels, geographies, and digital maturity.

This segmentation-first strategy allowed Shopee to scale rapidly while maintaining high engagement and retention.

Primary Customer Segments

1. Value-Driven Consumers (Core Segment)

- Price-sensitive, mobile-first users

- Heavy users of flash sales, vouchers, and free shipping

- Strong engagement during campaigns (9.9, 11.11, 12.12)

- High repeat purchase frequency

2. Convenience Seekers

- Urban users prioritizing speed, ease, and reliability

- More likely to use Shopee Mall and branded stores

- Higher average order value (AOV)

3. Micro & SME Sellers

- Home-based sellers and small merchants

- Limited technical knowledge

- Depend on Shopee for traffic, logistics, and payments

4. Enterprise Brands & Official Stores

- FMCG, electronics, fashion brands

- Focus on visibility, trust, and scale

- Heavy users of Shopee Ads and analytics tools

Customer Journey Mapping

Discovery

- App store visibility

- Influencer marketing and social commerce

- Festival-driven campaigns and flash sales

Conversion

- Discounts, vouchers, gamification (coins, spin-to-win)

- Buyer protection and escrow-based payments

Retention

- Loyalty programs and daily check-ins

- Personalized recommendations using behavioral data

- Push notifications tied to browsing history

Acquisition Channels & LTV Optimization

- Paid digital marketing during mega sales

- Seller-driven promotions subsidized by Shopee

- In-app gamification increasing session frequency

- Cross-promotion with SeaMoney wallet products

Shopee maximizes lifetime value by increasing order frequency before increasing margins, a strategic sequencing many marketplaces fail to execute.

Market Positioning & Competitive Edge

Shopee positions itself as:

- The most accessible marketplace for mass consumers

- A seller-first platform with low friction

- A mobile-native brand, not a desktop-first retailer

Its differentiation lies in local relevance + platform scale, allowing Shopee to outperform competitors even with thinner margins.

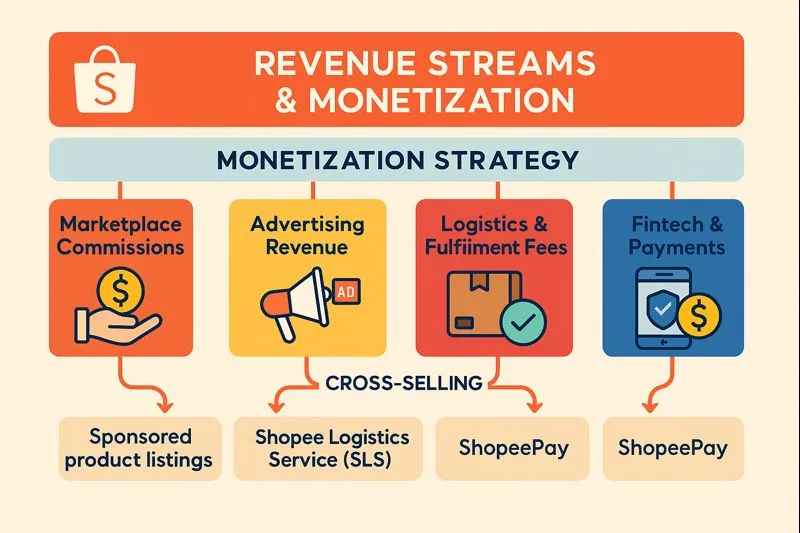

Revenue Streams and Monetization Design

Once Shopee achieved strong buyer–seller liquidity, its business model unlocked multiple, interconnected monetization layers. Unlike traditional e-commerce platforms that rely heavily on commissions alone, Shopee engineered a portfolio-style revenue architecture that balances transaction income, advertising, logistics, and fintech services.

This diversification is critical in 2025, where margins in e-commerce remain tight but data-driven monetization is expanding.

Primary Revenue Stream: Marketplace Commissions

Mechanism

- Sellers pay a commission on every successful transaction

- Rates vary by category and seller type (C2C, B2C, Shopee Mall)

- Enterprise brands pay higher but receive premium placement and trust signals

Pricing Model

- Category-based commission percentages

- Additional fixed service fees in select markets

Revenue Contribution

- One of the largest and most stable revenue streams

- Scales directly with GMV growth and seller density

Growth Trajectory

- Gradual commission increases as seller dependence rises

- Shift toward higher-margin branded stores

Secondary Revenue Streams

1. Advertising Revenue (High-Margin Engine)

- Sponsored product listings

- Keyword bidding (search ads)

- Display and discovery ads within the app

- Brand takeovers during mega-sale events

Advertising has become Shopee’s fastest-growing and highest-margin revenue stream by 2025.

2. Logistics & Fulfilment Fees

- Shopee Logistics Service (SLS)

- Cross-border shipping services

- Value-added logistics (priority shipping, warehousing)

3. Fintech & Payments (SeaMoney)

- Transaction fees from ShopeePay

- Buy Now, Pay Later (BNPL) services

- Merchant lending and credit scoring

4. Value-Added Seller Services

- Analytics and performance insights

- Marketing tools and automation

- Seller subscription programs in select markets

Monetization Strategy: How It All Connects

Shopee’s monetization design is intentionally layered:

- Commissions monetize transactions

- Ads monetize attention

- Logistics monetizes fulfillment complexity

- Fintech monetizes trust and financial access

Cross-selling is built into the platform:

- Sellers using ads sell more → higher commissions

- Sellers using SLS get faster delivery → higher buyer retention

- ShopeePay users convert better → higher GMV

The psychology behind Shopee’s pricing relies on low upfront friction with gradual monetization, ensuring sellers grow before they pay more.

Operational Model & Key Activities

Behind Shopee’s consumer-facing simplicity lies a highly orchestrated operational machine. Its ability to run massive sale events, handle cross-border logistics, and support millions of sellers depends on tight coordination between technology, operations, and local execution.

Shopee’s operational model is designed for scale under volatility — price wars, traffic spikes, regulatory changes, and supply fluctuations.

Core Operations

- Platform & Technology Management

- Mobile-first app development

- Recommendation algorithms and search optimization

- Fraud detection, trust & safety systems

- Seller Enablement & Quality Control

- Onboarding and training programs

- Seller performance scoring

- Dispute resolution and buyer protection

- Logistics & Fulfilment Coordination

- Shopee Logistics Service (SLS) orchestration

- Cross-border order routing

- Last-mile delivery partnerships

- Customer Support & Trust

- In-app dispute management

- Refund and escrow systems

- Multilingual support teams

Resource Allocation Strategy

Shopee’s spending priorities reflect its growth stage and market dynamics:

- Technology & Product:

Heavy investment in cloud infrastructure, data analytics, and personalization engines - Marketing & Growth:

Large budgets allocated to mega campaigns and brand partnerships - Operations & Logistics:

Regional warehousing, delivery subsidies, and logistics optimization - Human Capital:

Local market teams for compliance, partnerships, and seller relations

By 2025, Shopee has shifted from aggressive burn to operational efficiency, optimizing subsidy spend while maintaining volume growth.

Regional Execution Model

- Centralized product and platform strategy

- Decentralized country teams for:

- Pricing

- Campaign design

- Regulatory compliance

- Local partnerships

This hybrid structure allows Shopee to move fast without losing local relevance — a critical advantage in fragmented emerging markets.

Strategic Partnerships & Ecosystem Development

Shopee’s competitive strength is amplified through strategic partnerships that extend its capabilities beyond core marketplace functions. Rather than building everything in-house, Shopee adopts an ecosystem-first philosophy — integrating best-in-class partners while keeping platform control centralized.

This approach allows Shopee to scale faster, reduce operational risk, and deepen network effects.

Partnership Philosophy

Shopee views partners as growth multipliers, not just vendors. Every alliance is evaluated on its ability to:

- Increase transaction volume

- Improve user trust and experience

- Lower operational friction

- Strengthen long-term platform defensibility

Key Partnership Categories

1. Technology & API Partners

- Cloud infrastructure providers

- AI and data analytics vendors

- Security and fraud-prevention platforms

These partnerships support scalability, reliability, and compliance at massive traffic volumes.

2. Payment & Fintech Alliances

- Local banks and card networks

- Wallet integrations and BNPL providers

- Regulatory-compliant payment processors

Through SeaMoney, Shopee also acts as a fintech partner to its own ecosystem.

3. Logistics & Fulfilment Partners

- Last-mile delivery companies

- Cross-border logistics firms

- Regional warehousing providers

This enables Shopee to maintain delivery SLAs without owning physical assets.

4. Marketing & Distribution Partners

- Influencers and creator networks

- Media platforms and telcos

- Brand collaboration partners for mega campaigns

5. Regulatory & Expansion Alliances

- Government trade agencies

- Local compliance consultants

- Market-entry facilitators

Ecosystem Strategy Insights

Shopee’s ecosystem design creates self-reinforcing network effects:

- More sellers → more products → more buyers

- More buyers → better ad ROI → higher seller spend

- More transactions → better credit models → fintech expansion

Partnerships are also monetized:

- Revenue sharing with logistics partners

- Advertising co-investments with brands

- Financial service margins via SeaMoney

Over time, these alliances form competitive moats that are difficult for new entrants to replicate.

Growth Strategy & Scaling Mechanisms

Shopee’s rise was not driven by a single growth hack, but by a stacked growth engine where acquisition, engagement, and monetization reinforced each other. The company optimized for speed, frequency, and habit formation, especially in mobile-first markets.

By 2025, Shopee’s focus has shifted from pure expansion to defensive scaling and profitability discipline.

Core Growth Engines

1. Organic Virality & Referral Loops

- Buyer-to-buyer sharing during flash sales

- Social proof via ratings, reviews, and live commerce

- Seller-driven promotions amplifying reach

2. Paid Marketing & Campaign-Led Growth

- Massive investment in 9.9, 11.11, 12.12 events

- Celebrity endorsements and influencer marketing

- Aggressive app-install and re-engagement campaigns

3. Product-Led Growth

- Gamification mechanics (coins, daily rewards)

- Live streaming and social commerce features

- Shopee Mall for premium brand trust

4. Geographic Expansion Playbook

- Enter price-sensitive, high-mobile-penetration markets

- Localize payments, logistics, language, and content

- Scale demand before optimizing margins

Scaling Challenges & How Shopee Solved Them

Operational Complexity

- Challenge: Managing millions of sellers across regions

- Solution: Automation, seller scoring, and tiered support systems

Infrastructure Stress

- Challenge: Traffic spikes during mega-sale

- Solution: Cloud-native architecture and load balancing

Regulatory Barriers

- Challenge: Payments, data, and cross-border compliance

- Solution: Local partnerships and country-specific operations

Unit Economics Pressure

- Challenge: High subsidy burn

- Solution: Gradual monetization and ad revenue expansion

Shopee’s key insight: Scale first, then optimize — but only if your platform architecture can support it.

Read more : Best Shopee Clone Script 2025 – Build Your Multi-Vendor Marketplace Fast

Competitive Strategy & Market Defense

Shopee operates in one of the most competitive digital commerce landscapes globally. Its survival and dominance are the result of deliberate market defense strategies designed to lock in users, sellers, and partners while continuously raising the bar for competitors.

Rather than competing on price alone, Shopee competes on ecosystem depth and execution speed.

Core Competitive Advantages

Network Effects

- More sellers increase assortment and price competition

- More buyers improve seller ROI and ad effectiveness

- Data density improves recommendations and conversion rates

High Switching Costs

- Sellers depend on Shopee for traffic, ads, logistics, and payments

- Buyers accumulate trust, wallets, coins, and purchase history

Brand Equity & Trust

- Strong association with affordability and reliability

- Buyer protection and escrow systems build confidence

- Shopee Mall establishes brand authenticity

Technology & Data Advantage

- AI-driven search and personalization

- Fraud detection and trust scoring

- Real-time pricing and promotion optimization

Market Defense Tactics

Handling New Entrants

- Rapid feature replication when needed

- Subsidy bursts during competitive threats

- Exclusive brand and seller partnerships

Pricing & Promotion Strategy

- Data-driven discounting rather than blanket subsidies

- Seller co-funded promotions to reduce burn

Strategic Acquisitions & Alliances

- Strengthening fintech and logistics capabilities

- Partnering rather than competing with local champions

Shopee’s defense strategy focuses on making competition economically unattractive rather than merely outspending rivals.

Lessons for Entrepreneurs & Implementation

Shopee’s journey offers clear, hard-earned lessons for founders building marketplaces, on-demand platforms, or super-app ecosystems. Its success was not accidental — it was engineered through disciplined sequencing, local execution, and long-term platform thinking.

Key Factors Behind Shopee’s Success

- Ruthless focus on mobile-first user experience

- Prioritizing liquidity before monetization

- Deep localization across markets

- Building infrastructure (logistics, payments) alongside the marketplace

- Using data as a strategic asset, not just analytics

Replicable Principles for Startups

- Start with one core transaction loop, then layer monetization

- Reduce friction for sellers before increasing fees

- Treat logistics and payments as growth enablers, not cost centers

- Design for habit formation, not one-time transactions

Common Mistakes to Avoid

- Monetizing too early before network effects mature

- Expanding geographically without operational readiness

- Over-subsidizing without a clear path to unit economics

- Ignoring seller tooling and education

Adapting Shopee’s Model to Local or Niche Markets

Shopee’s playbook can be adapted for:

- Regional B2B marketplaces

- Vertical-specific commerce (fashion, grocery, logistics)

- Services marketplaces with escrow and trust layers

Key adaptation strategies:

- Focus on one region or niche first

- Customize payments and compliance

- Build partnerships instead of owning assets

At Miracuves, we help founders shortcut this journey by delivering ready-to-scale marketplace platforms with proven business logic, allowing entrepreneurs to launch in days instead of months.

Ready to implement Shopee’s proven business model for your market?

Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps. Get your free business model consultation today.

Conclusion :

Shopee’s business model proves that scale is not the result of capital alone, but of strategic sequencing and operational discipline. By focusing first on liquidity, trust, and habit formation, Shopee created a marketplace that could later support complex monetization layers without collapsing under its own weight.

In a world where many platforms chase growth at any cost, Shopee demonstrates that execution in emerging markets requires patience, localization, and infrastructure-first thinking. Its success reinforces a powerful lesson for founders in 2025: the strongest platforms are not those that monetize fastest, but those that design systems capable of monetizing sustainably over time.

As platform economies continue to evolve, Shopee stands as a reminder that innovation plus execution — not just ideas — create defensible digital ecosystems.

FAQs:

What type of business model does Shopee use?

Shopee uses a hybrid multi-vendor marketplace business model that combines C2C and B2C commerce with integrated logistics, payments, and advertising.

How does Shopee’s business model create value?

Shopee creates value by aggregating fragmented sellers, offering buyers low prices and trust protection, and enabling seamless transactions through logistics and fintech integration.

What are Shopee’s key success factors?

Its key success factors include mobile-first design, deep localization, strong network effects, aggressive growth sequencing, and diversified monetization layers.

How scalable is Shopee’s business model?

Shopee’s model is highly scalable because it is asset-light, cloud-native, and supported by partnerships rather than owned infrastructure.

What are the biggest challenges in Shopee’s model?

Key challenges include thin margins, high competition, subsidy management, logistics complexity, and regulatory compliance across multiple countries.

How can entrepreneurs adapt Shopee’s model to their region?

Founders should localize payments, logistics, and regulations, start with a focused niche, and scale only after achieving strong supply-demand liquidity.

What resources and timeframe are needed to launch a Shopee-style platform?

A functional marketplace MVP can be launched in 30 – 90 days with the right technology stack, while full ecosystem maturity typically takes 12–24 months.

What are alternatives to Shopee’s business model?

Alternatives include vertical marketplaces, inventory-led e-commerce, subscription commerce, or B2B marketplaces with SaaS monetization.

How has Shopee’s business model evolved over time?

Shopee evolved from a subsidy-heavy growth platform to a balanced, monetized ecosystem integrating ads, logistics, and fintech for sustainable revenue.

Related Article :