From a simple card reader to a global commerce operating system, Square proved that small businesses want payments, POS, analytics, and growth tools in one place. In 2025, that insight matters more than ever. With global digital payments expected to cross $14T and SMBs demanding unified tools, entrepreneurs who understand the Square clone model can launch faster and win niche markets before incumbents react. The opportunity is clear: merchants want reliability, speed, and insight without complexity.

A modern Square clone Script combines ultra-fast transactions, cloud POS, real-time analytics, and embedded financial services into a single platform. For founders, this means recurring revenue, high retention, and expansion paths into lending, payroll, and subscriptions. Miracuves helps entrepreneurs capture this opportunity with production-ready Square clone architectures designed for performance, compliance, and rapid scale.

What Makes a Great Square Clone?

A great Square clone in 2025 is not just a payment processor. It is a commerce operating system that removes friction for merchants while giving founders scalable revenue levers. Entrepreneurs often fail when they copy surface-level features instead of rebuilding the deep infrastructure that powers speed, trust, and flexibility. The strongest Square-style platforms succeed because they feel instant, reliable, and intelligent at every interaction—from checkout to analytics to payouts.

At its core, a modern Square clone must deliver payment speed under 300ms, 99.9% uptime, and seamless experiences across in-store, online, and mobile channels. Merchants expect their POS, inventory, customer data, and payouts to sync in real time without manual work. This requires cloud-native architecture, event-driven processing, and strong API layers that can scale during peak transaction volumes without latency spikes.

In 2025, differentiation also comes from intelligence. AI-driven insights that forecast inventory, suggest pricing, and detect fraud are no longer optional. Blockchain-backed transaction logs are increasingly adopted for transparency, reconciliation, and dispute reduction. Cross-platform consistency—web POS, tablet POS, mobile POS—must feel identical, fast, and intuitive.

What Defines a Great Square Clone in 2025

- Ultra-fast payment processing with sub-300ms response times

- Unified POS ecosystem for in-store, online, and mobile sales

- Scalable cloud infrastructure supporting millions of transactions daily

- Built-in analytics and reporting for real-time business decisions

- Multiple monetization layers including transaction fees, subscriptions, and add-on services

Must-Have Modern Capabilities

- AI automation for sales forecasting, fraud detection, and merchant insights

- Blockchain transparency for tamper-proof transaction records and audits

- Cross-platform integration across POS hardware, mobile apps, and web dashboards

- API-first architecture enabling third-party tools, marketplaces, and extensions

Modern Square Clone Comparison

| Capability | Basic Clone | Advanced Clone | Enterprise-Grade Clone |

|---|---|---|---|

| Transaction Speed | 500–700ms | 300–400ms | Under 300ms |

| Uptime SLA | 99.5% | 99.8% | 99.9%+ |

| AI Analytics | Limited | Standard insights | Predictive & prescriptive AI |

| Blockchain Logs | Not included | Optional | Built-in |

| Scalability | Local markets | Multi-region | Global-ready |

Essential Features Every Square Clone Must Have

A Square clone only becomes powerful when every user type is thoughtfully engineered. Founders often underestimate how different the needs of merchants, admins, and service operators are. In 2025, successful platforms win by balancing simplicity on the surface with deep control under the hood. Each layer must work independently yet sync perfectly in real time.

On the user side, merchants expect speed and clarity. Payments should feel instant, dashboards should explain performance without training, and everyday tasks like refunds or inventory updates should take seconds, not minutes. Retention in this segment depends heavily on convenience and trust.

On the admin side, founders need visibility and automation. A Square-style business scales only when compliance, payouts, disputes, and merchant onboarding are system-driven instead of manual. Admins should be able to control pricing rules, transaction limits, risk flags, and regional settings from a single panel.

The service and operator layer—covering POS devices, mobile apps, and merchant staff—demands real-time accuracy. Earnings dashboards, transaction history, and AI-driven recommendations help merchants optimize revenue while staying loyal to the platform.

Core Functional Layers Explained

User Side (Merchants)

- Fast checkout experience across POS, mobile, and online

- Real-time sales and inventory tracking

- Customer profiles and purchase history for retention campaigns

- Automated payouts and refunds with transparent timelines

Admin Panel (Platform Owner)

- Centralized merchant management and KYC workflows

- Advanced analytics dashboards for GMV, churn, and revenue

- Automated fraud detection and risk scoring

- Compliance tools for taxes, regional rules, and audits

Service / Operator Side

- Live transaction monitoring across devices

- Earnings and settlement dashboards

- AI recommendations for pricing, upsells, and stock planning

- Offline-to-online sync for uninterrupted sales

Advanced 2025 Features That Drive Differentiation

- AI-based personalization suggesting products, bundles, and offers

- AR-assisted onboarding for POS setup and merchant training

- Blockchain verification for immutable transaction records

- Smart notifications for anomalies, chargebacks, and demand spikes

Technical Architecture Requirements

A production-ready Square clone must be built on microservices architecture, supported by auto-scaling cloud infrastructure. Load balancers handle peak traffic, while encrypted APIs secure payment data end-to-end. Third-party integrations—payment gateways, tax engines, accounting tools—must be modular to allow fast expansion without core rewrites.

Feature Tier Comparison

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| POS & Payments | ✔ | ✔ | ✔ |

| Inventory Management | Basic | Advanced | AI-driven |

| Analytics | Standard reports | Custom dashboards | Predictive insights |

| Blockchain Logs | ✖ | Optional | Included |

| Scalability | Single region | Multi-region | Global scale |

Miracuves implements these features through pre-tested Square clone scripts designed for reliability, speed, and future upgrades. Every module is optimized for performance while remaining flexible enough for customization as your platform grows.

Read More : What is Square App and How Does It Work?

Cost Factors & Pricing Breakdown

Square-Like POS & Merchant Payments Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic POS & Payments MVP | Merchant onboarding, POS dashboard, card payments, transaction history, basic reports, and admin panel. | $75,000 |

| 2. Mid-Level Merchant Payments Platform | Web + mobile POS, inventory tracking, invoices, refunds, multi-store support, notifications, and analytics dashboards. | $190,000 |

| 3. Advanced Square-Level Platform | Unified POS + online payments, subscriptions, payroll hooks, merchant analytics, fraud detection, compliance automation, and enterprise scalability. | $360,000+ |

These figures represent the typical global investment required to build an all-in-one merchant payments and POS ecosystem similar to Square.

Miracuves Pricing for a Square-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete merchant payments and POS foundation with seller onboarding, payment processing, POS workflows, transaction management, reporting tools, and a powerful admin backend — built for scalable retail and service businesses.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded Square-style platform with complete ownership.

Launch Your Square-Style POS & Payments Platform — Contact Us Today

Delivery Timeline for a Square-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- POS & hardware integration depth

- Number of merchants & locations

- Payment methods & regions

- Compliance & security requirements

- Branding & UI/UX customization

- Reporting and admin controls

Tech Stack

Built using a JS-based architecture, ideal for POS systems and merchant payment platforms requiring real-time transactions, scalable APIs, and high availability.

Customization & White-Label Option

Building a Square-style merchant payments and point-of-sale (POS) platform isn’t just about accepting payments — it’s about creating an all-in-one commerce ecosystem that combines in-store POS, online payments, inventory management, analytics, and business tools. A platform inspired by Square must seamlessly connect physical and digital commerce while remaining simple for merchants and scalable for growth.

Miracuves delivers a fully white-label Square-style solution that allows deep customization across payment flows, POS interfaces, merchant dashboards, and backend commerce operations. Whether you are targeting small retailers, restaurants, service businesses, or multi-location merchants, the platform can be tailored to your business model and market focus.

Why Customization Matters

Merchants expect flexibility across both online and offline sales. Customization ensures your platform adapts to different industries, transaction types, hardware setups, and regional compliance needs—without locking businesses into rigid workflows.

What You Can Customize

Complete UI/UX Personalization

Customize POS screens, merchant dashboards, admin panels, reports, typography, color schemes, and mobile-first layouts to reflect your brand identity.

POS & In-Store Workflows

Configure checkout flows, item catalogs, modifiers, tipping options, discounts, receipts, refunds, and offline payment handling.

Online Payments & Checkout

Enable hosted checkout pages, payment links, invoices, QR-based payments, and ecommerce integrations.

Inventory & Order Management

Set up inventory syncing across locations, SKU tracking, stock alerts, order routing, and sales reconciliation.

Merchant & Business Tools

Merchant onboarding, role-based access, staff management, permissions, multi-location support, and operational analytics.

Payments & Payouts

Configure transaction processing, settlement schedules, fee structures, refunds, chargebacks, and payout management.

Hardware & Device Integration

Support POS terminals, card readers, mobile devices, barcode scanners, printers, and other peripheral hardware.

Backend & Integrations

Integrate accounting systems, CRM tools, loyalty programs, marketing platforms, analytics tools, and third-party commerce APIs.

Monetization & Revenue Models

Transaction fees, subscription plans, premium business tools, hardware revenue models, and value-added services.

How Miracuves Handles Customization

Miracuves follows a structured customization approach built for omnichannel commerce platforms.

- Requirement Understanding

Analysis of your target merchants, industries, and sales channels. - Planning & Breakdowns

Customization tasks are organized into modular components for smooth execution. - Design & Development

UI/UX enhancements, POS logic, and payment workflows are implemented according to your roadmap. - Testing & Quality Assurance

Payment accuracy checks, hardware compatibility testing, performance validation, and security reviews. - Deployment

Your fully white-labeled POS and payments platform goes live with complete branding and operational configuration.

Real Examples from the Miracuves Portfolio

Miracuves has powered 600+ successful fintech and commerce deployments, including:

- POS systems for retail and hospitality businesses

- Omnichannel payment platforms combining in-store and online sales

- Merchant dashboards with real-time analytics and reporting

- White-label commerce platforms integrating hardware and software

These real-world deployments demonstrate how customization transforms a Square-style platform into a scalable, merchant-friendly, and omnichannel commerce solution.

Launch Strategy & Market Entry

Launching a Square-style platform is not just a technical milestone; it is a market-entry decision that defines how fast you gain traction and how defensible your position becomes. In 2025, founders who win are those who treat launch as a structured rollout, not a single release date.

Before going live, every Square clone must pass through a disciplined pre-launch phase. Payments, compliance, and data accuracy leave no room for assumptions. A single failure at checkout can permanently damage merchant trust.

Pre-Launch Checklist for Founders

- End-to-end testing of payments, refunds, and settlements

- PCI-DSS compliance and regional tax validation

- Load testing for peak transaction volumes

- App store readiness and merchant onboarding flows

- Marketing assets, demos, and pricing plans finalized

Regional Market Entry Strategies

Different regions demand different approaches. In Asia, adoption accelerates through QR payments and mobile-first POS. In MENA, trust, compliance, and local payment gateways matter most. Europe emphasizes data protection and tax transparency, while the U.S. rewards feature depth and ecosystem integrations. Successful founders localize payment methods, language, pricing, and compliance from day one.

User Acquisition Frameworks That Work in 2025

Growth is driven by repeatable systems, not one-off campaigns. High-performing Square-style platforms combine multiple channels to reduce acquisition cost and increase lifetime value.

- Influencer-led merchant education and demos

- Referral loops rewarding merchants for onboarding peers

- Retention funnels using analytics-driven insights and offers

Proven Monetization Models

- Transaction-based fees per payment

- Monthly or annual POS subscriptions

- Premium analytics and reporting add-ons

- Embedded financial services and integrations

How Miracuves Supports Your Launch

Miracuves provides end-to-end launch support, from server deployment and security hardening to merchant onboarding playbooks. Founders also receive a 90-day growth roadmap, helping them move from launch to traction with clarity and confidence.

Why Choose Miracuves for Your Square Clone

A Square-style platform looks simple in screenshots, but the real difficulty shows up when real merchants start processing real money at real volume. Payments, POS sync, refunds, settlements, chargebacks, and compliance create a system where small mistakes become expensive fast. This is where the right technology partner decides whether your product becomes a trusted platform or a constant firefight.

Miracuves is built for founders who want speed without shortcuts. Instead of experimenting with untested builds, you launch on production-ready frameworks designed for reliability, scalability, and fast iteration.

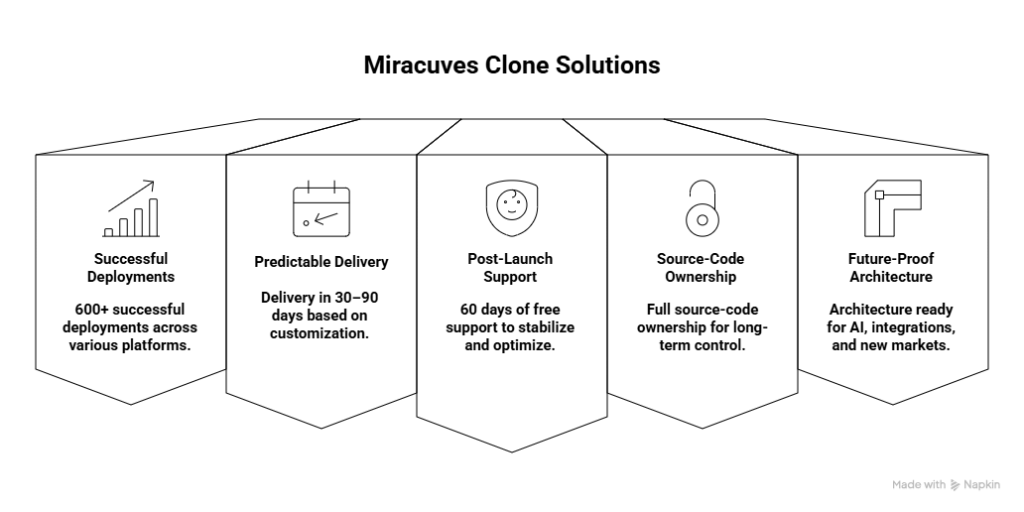

What You Get with Miracuves Clone Solutions

- 600+ successful deployments across marketplaces, ecommerce, and transaction-heavy platforms

- Predictable delivery in 30–90 days based on customization scope

- 60 days of free post-launch support to stabilize and optimize after go-live

- Full source-code ownership so you control your product long term

- Future-proof architecture ready for AI modules, integrations, and new markets

What This Means for a Square Clone Founder

When your platform can handle transactions smoothly, merchants trust you. When dashboards are clear, they stay. When settlements are transparent, disputes drop. And when the admin system is automated, your business scales without adding overhead. Miracuves focuses on building that full loop so your Square clone is not just launched, but built to grow into a category leader in your niche.

Short Success Transformations

- A regional retail startup moved from manual billing to a unified POS and payment system, cutting checkout time and boosting repeat purchases through built-in customer profiles.

- A service-based merchant network adopted a Square-style mobile POS flow, enabling on-the-go payments and automated payouts that improved merchant retention.

- A niche commerce platform launched with subscription plans plus transaction fees, creating predictable revenue and faster reinvestment into growth.

Final Thought

Square did not grow by chasing every merchant. It grew by deeply understanding how businesses accept payments, manage sales, and make decisions in real time. For entrepreneurs in 2025, the lesson is clear: success comes from mastering the business logic behind the platform, not just copying features.

A well-built Square clone gives founders a shortcut to this proven model. When combined with the right execution partner, it allows you to launch faster, validate markets sooner, and scale with confidence. Instead of spending months solving infrastructure problems, you focus on merchant acquisition, product refinement, and revenue growth.

Miracuves empowers founders to turn this advantage into reality. By combining enterprise-grade clone technology with flexible customization and expert guidance, entrepreneurs can build payment and POS platforms that feel reliable from day one and remain competitive as markets evolve.

Ready to launch your Square clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Square clone?

Depending on features and customization, deployment typically happens within 30–90 days, ensuring stability and compliance without rushing critical systems.

What’s included in the Miracuves clone package?

You get a complete Square-style ecosystem including POS, payments, admin dashboard, merchant apps, analytics, and deployment support.

Can I get full source-code access?

Yes. Miracuves provides 100% source-code ownership, giving you full control over future upgrades and integrations.

How does Miracuves ensure scalability?

The architecture is cloud-native and microservices-based, designed to handle high transaction volumes with 99.9% uptime and auto-scaling support.

Does Miracuves assist with app store approval?

Yes. The team guides you through app store compliance, submission standards, and approval best practices.

Is post-launch maintenance included?

Miracuves offers 60 days of free post-launch support covering performance tuning, fixes, and optimizations.

Can Miracuves integrate custom payment gateways?

Absolutely. Custom and regional payment gateways can be integrated based on your target market needs.

What’s the upgrade and update policy?

Your platform can be upgraded modularly without disrupting live operations, ensuring smooth feature expansion.

How does white-labeling work?

Your Square clone is delivered under your brand with custom UI, domain, and app identity, with no Miracuves branding visible.

What kind of ongoing support can I expect?

Beyond launch, Miracuves offers optional long-term support plans covering maintenance, scaling, and feature evolution.

Related Articles

- Best Neobank Clone Scripts in 2025: Features & Pricing Compared

- Best Binance Clone Scripts in 2025: Features & Pricing Compared

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Revolut Clone Scripts in 2025: Features & Pricing Compared

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform

- Best Square Clone Scripts 2025: Build a Scalable POS & Payment Ecosystem Faster