From powering global brands like Uber and Spotify to enabling billions in digital transactions, Adyen went from a Netherlands startup to a $25B+ valuation fintech leader with a single promise: unified payments across every channel. In 2025, this model isn’t just an innovation — it’s the benchmark for global commerce.

Today, entrepreneurs don’t need to build a payment gateway from scratch. With the Best Adyen Clone Script 2025, founders can launch a compliant, scalable, multi-currency payment system that handles real-world complexity: settlements, chargebacks, PoS integrations, cross-border regulations, and instant payouts.

If you are planning to enter the financial technology space in 2025, understanding the Adyen clone framework is non-negotiable. The global digital payments market is projected to cross $14.7T by 2027, with payment gateways capturing the highest profit share. That means there’s room for niche platforms — regional, industry-specific, or verticalized solutions — to grow fast.

This is where Miracuves comes in. With proven infrastructure, white-label delivery cycles, and compliance-ready architecture, Miracuves helps founders launch payment platforms that feel premium on day one — not experimental.

What Makes a Great Adyen Clone in 2025?

A great Adyen clone in 2025 is not just a payment gateway; it is a performance engine built for high-volume transactions, multi-currency processing, AI-driven fraud control, and real-time settlement workflows. Entrepreneurs entering fintech today need more than a UI—they need a platform engineered for trust, uptime, and compliance. A strong Adyen-style platform must handle thousands of concurrent transactions, maintain sub-300ms response times, and provide a frictionless payment experience across web, app, PoS, and cross-border markets without failure. Scalability, security layers, regulatory readiness, and future-proof integrations differentiate a real payment solution from a basic script. That is what investors and users look for in 2025.

Key Qualities of a High-Performing Adyen Clone

• Unified payments across web, app, and PoS systems

• Multi-currency & cross-border support with instant FX conversions

• AI-driven fraud prevention + automated risk scoring

• Under 300ms response time for real-time transaction experience

• 99.9% uptime architecture with load-balanced server distribution

• PCI-DSS & KYC/AML-ready compliance frameworks

• Plug-and-play API layer for banks, merchants, and payout partners

• Smart settlement engine with payouts, reversals, and dispute automation

Modern Tech Expectations in 2025

AI automation for KYC and fraud checks;Blockchain-based transparency for settlements;One-click integration for billing systems;Cross-platform SDKs for iOS, Android, and Web;Dynamic routing for failed or risky transactions;PoS hardware API compatibility for retail merchants

Differentiators of Modern Adyen Clones

| Criteria | Old Payment Gateway | Modern Adyen Clone (2025) |

|---|---|---|

| Performance | 700-1200ms latency | <300ms real-time processing |

| Uptime | 97% average | 99.9% uptime SLA |

| Compliance | Basic SSL | PCI-DSS + KYC/AML + Tokenization |

| Scale | Regional capacity | Global multi-currency scaling |

| Revenue Model | Static fees only | Dynamic + subscription + FX margin + PoS |

| Integrations | Limited APIs | Ecosystem-ready API stack |

| Fraud Control | Manual review | AI automation + anomaly detection |

Essential Features Every Adyen Clone Must Have

A successful Adyen clone must operate like a financial ecosystem, not a simple payment app. In 2025, users expect instant approvals, seamless cross-border transactions, and a unified experience across app, web, and PoS. On the backend, founders need transparency, control, dispute handling, analytics, and automation that reduces operational load. A well-built Adyen clone balances performance, compliance, and monetization from day one. This is where Miracuves focuses its engineering — building a foundation that scales without rewriting the core system later.

Core Functional Layers

User Side (Customer Experience & Retention) Seamless onboarding with KYC checks;Instant payments, refunds, and chargebacks;Multi-currency wallet and balance overview;Card, UPI, bank transfer, and crypto acceptance;One-tap saved payment methods with tokenization

Merchant / Vendor Side Real-time transaction history and settlement report;Automated invoice & tax calculations;Chargeback management with status flow;API keys for integration into stores and SaaS systems;Fee structure & payout schedule control

Admin Panel Control Hub Centralized merchant onboarding;AI-based fraud monitoring and suspicious pattern alerts;Dispute resolution tracking;Dynamic fee configuration for region or merchant tier;Financial reporting + demand forecasting

Service Provider / Aggregator Integrations PoS hardware sync;Third-party bank & PSP integrations;Currency routing and FX conversion engine;High-failure attempt routing for fallback processing

Advanced Features for 2025 and Beyond

AI fraud scoring engine;Blockchain proof-of-transaction ledger;AR-based onboarding tutorials for merchants;Smart retry engine for declined transactions;Real-time compliance alerts;Predictive settlement forecasting;Deep analytics with LTV + revenue intelligence dashboards

Technical Architecture Requirements

Performance: Load-balanced architecture, sub-300ms request time

Scalability: Horizontal scaling for traffic bursts

Security: PCI-DSS compliance, tokenization, 256-bit encryption, WAF protection

Integrations: ERP/CRM/SaaS connectors, banking rails, PoS terminals

APIs: REST, Webhooks, GraphQL, SDKs for iOS/Android/Web

Hosting: AWS / GCP / Azure ready with 99.9% uptime

Feature Plans Breakdown

| Features | Basic | Professional | Enterprise |

|---|---|---|---|

| Payment Processing | ✔ | ✔ | ✔ |

| Multi-Currency Support | ✖ | ✔ | ✔ |

| AI Fraud Detection | ✖ | ✖ | ✔ |

| Blockchain Ledger | ✖ | ✖ | ✔ |

| PoS Hardware Support | ✖ | ✔ | ✔ |

| API Integrations | Basic | Advanced | Full Banking Stack |

| Scalability Range | Low | Medium | High-Volume Global |

Miracuves implements every tier with production-ready systems, enabling founders to scale from MVP to enterprise without rebuilding the platform.

Cost Factors & Pricing Breakdown

Adyen-Like Enterprise Payment Infrastructure — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Enterprise Payments MVP | Merchant onboarding, core card payment processing, transaction lifecycle management, settlement basics, and a simple admin panel. | $80,000 |

| 2. Mid-Level Omnichannel Payments Platform | Web dashboards, multi-currency support, online + in-store payments, smart routing, refunds, webhooks, notifications, and analytics dashboards. | $200,000 |

| 3. Advanced Adyen-Level Platform | Unified commerce (online + POS), global acquiring logic, tokenization, smart retries, advanced risk engine, compliance automation, reporting, and enterprise-grade scalability. | $380,000+ |

These figures represent the typical global investment required to build a unified, enterprise-grade payment infrastructure similar to Adyen, designed for high-volume merchants and international commerce.

Miracuves Pricing for an Adyen-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete enterprise payment foundation with merchant onboarding, secure payment APIs, omnichannel transaction handling, refund and settlement workflows, webhook infrastructure, risk-ready architecture, and a powerful admin dashboard — built for long-term scalability and global operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded Adyen-style payments platform under your own ownership.

Launch Your Adyen-Style Enterprise Payments Platform — Contact Us Today

Delivery Timeline for an Adyen-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Number of payment methods and regions

- Online, in-store, and omnichannel logic

- Compliance and security requirements

- API, webhook, and routing complexity

- Branding and UI/UX customization

- Reporting and admin control depth

Tech Stack

Built using a JS-based architecture, ideal for enterprise payment platforms that require API-first design, high availability, scalable microservices, secure transaction processing, and real-time payment handling.

Customization & White-Label Option

Building an Adyen-style enterprise payment infrastructure isn’t just about charging cards — it’s about operating a unified global payments platform that connects online, in-store, marketplace, and subscription payments under one architecture. A platform inspired by Adyen must support real-time processing, multi-currency routing, compliance layers, PCI-safe tokenization, and enterprise-grade availability.

Miracuves delivers a fully white-label Adyen-style solution that can be adapted to payment gateways, SaaS billing systems, marketplace payouts, or retail POS environments. Whether you serve startups, SMEs, or international enterprises, the platform is engineered for scale, flexibility, and operational confidence.

Why Customization Matters

Enterprise merchants demand:

- Consistent uptime under heavy volume

- Routing control for card networks and regions

- APIs that don’t lock them into rigid workflows

- Compliance without disrupting conversion

- Real-time operational visibility

Customization ensures your platform fits different industries, regions, and merchant needs — not the other way around.

What You Can Customize

1. UI/UX & Merchant Experience

- Custom merchant dashboards and onboarding flows

- White-label admin, reporting, and payout screens

- Multi-brand support for agencies, aggregators, and PSPs

2. Payment Routing & Transaction Logic

- Authorization flows, retries, partial refunds, chargebacks

- Gateway routing rules by card type, region, processor, or success rates

- Smart failover routing for uptime continuity

3. Marketplace & Payout Layers

- Split payments for sellers & vendors

- Multi-party payouts & escrow-style settlement

- API-controlled seller onboarding & KYC checks

4. Subscription & Billing Models

- Metered billing, recurring plans, proration

- Invoice automation & tax-aware checkout

- SaaS, membership, and usage-based pricing support

5. Compliance, Security & Risk Control

- AML, KYC/KYB onboarding pipelines

- Tokenization, PCI-safe storage, fraud rules

- Audit logs, dispute workflows, compliance reporting

6. Global Payments & Localization

- Multi-currency wallets and FX rate logic

- Regional payment flows & settlement intervals

- Localized checkouts for different markets

7. Developer Ecosystem Enablement

- APIs, SDKs, sandbox, webhook inspector

- Versioned API docs & testing console

- Integration templates for ecommerce & SaaS platforms

How Miracuves Handles Customization

- Requirement Understanding – Industry, compliance region, volumes, risk appetite

- Architecture & Planning – Modular breakdown: payments core, routing, API layer

- Design & Development – Merchant UX, card logic, payout flows, POS or web layers

- Testing & QA – Load testing, security validation, integration test harness

- Deployment – White-label rollout with domains, dashboards, and API provisioning

Real Examples from Miracuves Deployments

Miracuves has successfully delivered:

- Payment & payout engines for marketplaces

- Subscription billing for SaaS & membership platforms

- Card routing systems for regional payment providers

- Merchant onboarding stacks with KYC/KYB automation

These prove how customization transforms an Adyen-style vision into a scalable financial infrastructure product.

Launch Strategy & Market Entry for an Adyen-Style Payment Gateway in 2025

Launching the Best Adyen Clone Script 2025 is not just a tech milestone, it is a go-to-market race. A powerful payment platform without a clear launch strategy becomes just another app in the store. Smart founders treat launch as a structured playbook: validate flows, harden security, localize for regions, and activate user acquisition frameworks from day one. Miracuves helps you think like this from the very first planning call so you are not just “going live” but actually entering the market with confidence and clarity.

Pre-Launch Checklist for Your Adyen Clone

• Functional QA across web, app, and API endpoints

• Stress testing for concurrent transactions and peak loads

• KYC/AML workflow verification for each region you target

• PCI-DSS alignment and secure key management verification

• Merchant onboarding journeys tested end-to-end

• Settlement flows (T+1, T+2, instant payouts) verified with test data

• App Store and Play Store listing preparation with compliant copy

• Incident, logging, and monitoring systems configured before go-live

Regional Entry Strategies (Asia, MENA, Europe, U.S.)

Asia (India, SEA regions): Focus on UPI/bank transfers, card + wallet mix, language localization, and partnerships with local banks and PSPs. Competition is high but the volume is massive, ideal for niche segments like SaaS, eCommerce or subscription billing.

MENA: Emphasize Sharia-compliant flows, Arabic/English support, and strong KYC/AML processes. Target marketplaces, government payments, and SME ecosystems.

Europe: GDPR, PSD2, SCA, and data residency compliance are critical. Position your Adyen clone as a transparent, regulation-friendly solution for SaaS, marketplaces, and subscription-first businesses.

U.S.: Focus on PoS + online unification, chargeback handling, dispute flows, and integration with accounting/ERP tools. Align with industries like retail, hospitality, and recurring billing actors.

User Acquisition & Growth Frameworks

• Launch with a merchant-first strategy: onboard anchor clients in your niche (SaaS, eCommerce, D2C, B2B) before going mass-market

• Run influencer and founder-led campaigns on LinkedIn, X, and niche fintech communities

• Offer zero or reduced fees for first 3–6 months for early merchants to lock in volume

• Build referral loops: merchants get discounts or bonus features when they bring other businesses

• Launch educational content funnels: webinars, case studies, benchmarks comparing you to legacy gateways

Monetization Models Proven in 2025

• Per-transaction fee (percentage + fixed)

• Tiered subscription plans for merchants (Basic, Professional, Enterprise)

• FX spread for cross-border and multi-currency transactions

• White-label SaaS plans for agencies, banks, or fintech startups

• Premium analytics, risk dashboards, and API priority access as add-ons

When combined, these models turn your Adyen clone into a recurring revenue engine rather than a flat-fee tool.

How Miracuves Supports Your Launch End-to-End

Miracuves doesn’t stop at delivering an Adyen-style script. The team helps you move from code to customers with a structured launch framework:

• Architecture planning, server setup, and cloud configuration for 99.9% uptime

• End-to-end deployment in staging and production environments

• Support with App Store, Play Store, and web deployment readiness

• Guidance on regional compliance basics (GDPR, PCI-DSS structuring, KYC/AML workflows)

• A practical first 90-day growth roadmap tailored to your niche and geography

With delivery cycles structured around 30–90 days depending on customization, Miracuves Clone Solutions ensure that entrepreneurs launch fast, learn fast, and scale with confidence instead of rebuilding from scratch.

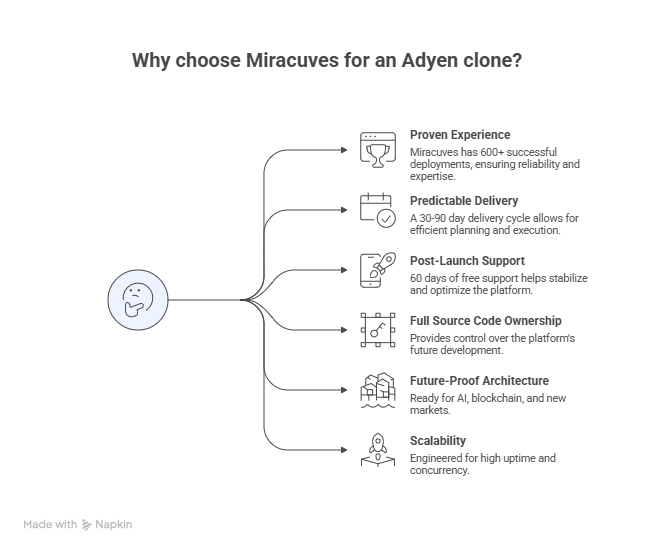

Why Choose Miracuves for Your Adyen Clone

When you are building a payment platform that needs to move real money for real businesses, “just getting an app built” is not enough. You need a technology partner who understands what happens after launch: fraud spikes, traffic bursts, regulatory changes, merchant churn, and the pressure of keeping uptime close to perfect. This is exactly where Miracuves Clone Solutions stands apart for entrepreneurs who want an Adyen-style gateway without gambling on untested code.Instead of starting from zero, you build on battle-tested payment architectures that have already handled high transaction volumes, complex settlements, and multi-region deployments. With 600+ successful deployments across fintech, marketplaces, SaaS, and high-volume transactional platforms, Miracuves brings execution experience that goes beyond theory and pitch decks. You are not buying a script; you are partnering with a delivery engine that understands speed, risk, and scale.

Miracuves Core Strengths for Adyen-Style Platforms

• 600+ successful deployments across payments, marketplaces, and transaction-heavy apps

• Predictable 30–90 day delivery cycle depending on customization and region

• Free 60 days of post-launch support to stabilize, optimize, and refine after go-live

• Full source-code ownership, so you always control roadmap and vendor decisions

• Future-proof architecture ready for AI modules, blockchain transparency, and new markets

• Scalability-first mindset, engineered for 99.9% uptime and high-concurrency handling

Short Success Story 1: From Idea to Regional Payment Player

A founder targeting mid-sized ecommerce brands in Asia approached Miracuves with nothing more than a concept: a unified gateway focused on subscription-first businesses. Using the Miracuves Adyen-style clone base, the platform went live in under 60 days, onboarded its first 40 merchants in 3 months, and hit six-figure annual recurring revenue within the first year by combining transaction fees with tiered subscription plans. What could have taken 12–18 months from scratch turned into a 30–90 day execution window.

Short Success Story 2: Offline + Online Retail Unification

A retail-focused startup wanted to unify PoS payments and online checkouts under a single brand for U.S. and EU merchants. Miracuves delivered a customized Adyen clone with PoS hardware integration, multi-currency settlements, and automated dispute flows. Within months, their early adopters reported smoother reconciliation, lower chargeback confusion, and higher merchant satisfaction because everything lived in one dashboard. The startup used this operational stability to raise funding on the back of real traction, not just a prototype.

Short Success Story 3: Niche Payment Gateway for MENA

Another founder used Miracuves to launch a MENA-focused payment platform aligned with local business needs, dual-language support, and stricter KYC compliance. Because the core clone architecture was already optimized for compliance and scalability, most of the effort went into localization and merchant experience. The result: a differentiated gateway built on trusted rails, live in weeks instead of years.

With Miracuves, your Adyen clone isn’t just a “similar app.” It becomes a payment infrastructure tailored to your market, branded as your own, and engineered to compete from day one.

Final Thought

Launching a payment platform like Adyen is not just about having a product — it is about understanding the business logic, revenue architecture, compliance layers, and scaling strategy behind it. When founders combine that insight with a ready, customizable, and future-proof technical base, the journey becomes faster, cheaper, and significantly less risky. This is the advantage of using the Best Adyen Clone Scripts 2025: you skip the years of trial-and-error and begin where serious companies start — with a system built for uptime, trust, and merchant confidence.

Miracuves gives entrepreneurs the foundation to move with speed: production-ready frameworks, 30–90 day delivery cycles, full source-code ownership, and the depth to evolve into a regional or global payment infrastructure. Whether you are targeting a niche market, a regional expansion, or a cross-border segment with unmet demand, the opportunity is real — and it is growing. The fintech wave is not slowing down; it is shifting toward founders who can execute faster and smarter. Partnering with Miracuves is how you join that group.

Ready to launch your Adyen clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs — Adyen Clone Development

How quickly can Miracuves deploy my Adyen clone?

Miracuves delivers a functional Adyen-style payment gateway within 30–90 days depending on customization and regional compliance needs.

What’s included in the Miracuves Adyen clone package?

A full merchant dashboard, user wallet, admin panel, PoS sync options, payout engine, fraud monitoring, and multi-currency payment support.

Can I get full source-code access?

Yes. Miracuves provides 100% source-code ownership to ensure long-term independence and scalability.

How does Miracuves ensure scalability?

Through 99.9% uptime architecture, high-concurrency handling, load balancers, and horizontal scaling ready for global traffic expansion.

Does Miracuves assist with app store approval?

Absolutely. The team helps with App Store, Play Store, and PWA/web deployment approvals, ensuring everything is launch-ready.

Is post-launch maintenance included?

Yes. Miracuves provides 60 days of free post-launch support for monitoring, optimization, and stability enhancements.

Can Miracuves integrate custom payment gateways and banks?

Yes. Custom bank rails, PSPs, crypto payments, and region-specific payment flows can be integrated based on your business model.

What’s the upgrade/update policy?

Future upgrades and feature expansions are supported through flexible engagement models depending on market growth.

How does white-labeling work?

Your brand replaces all Miracuves references — app UI, web portals, email templates, and payment receipts become fully branded as your company.

What kind of ongoing support can I expect?

Continuous technical support, security updates, scaling assistance, analytics improvements, and optional dedicated team models as you grow.

Related Articles

- Best Square Clone Scripts 2025: Build a Scalable POS & Payment Ecosystem Faster

- Best Binance Clone Scripts in 2025: Features & Pricing Compared

- Best Wise Clone Scripts in 2025: Features & Pricing Compared

- Best Revolut Clone Scripts in 2025: Features & Pricing Compared

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform