From a small fintech experiment in 2008 to managing $45B+ in assets, Betterment changed how everyday people invest. Its rise wasn’t luck—it was timing, technology, and trust. And in 2026, demand for robo-advisory platforms is stronger than ever. The global wealth-tech market is projected to cross $20.5B by 2026, driven by automated investing, AI-based risk profiling, and low-cost portfolio strategies.

For entrepreneurs, building a Betterment Clone Script is no longer optional—it’s one of the fastest-growing fintech opportunities. A Betterment Clone gives startups the foundation to launch their own automated investment app, equipped with personalised portfolio management, AI insights, tax-efficient strategies, and modern wealth-building tools that customers expect today.

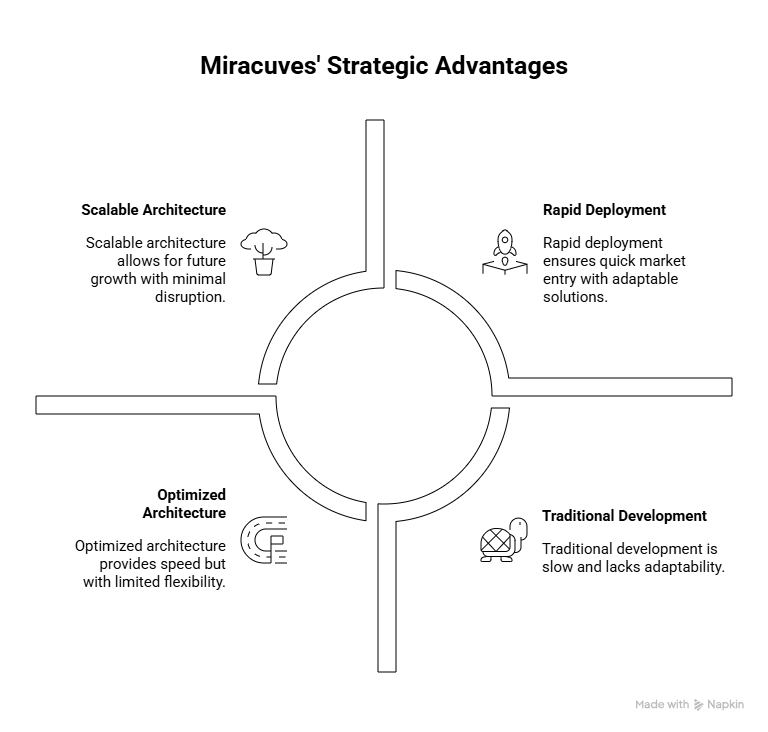

Miracuves helps founders skip the guesswork and build production-ready robo-advisory platforms with speed, accuracy, and future-proof technology.

What Makes a Great Betterment Clone Script ?

Building a successful robo-advisory platform in 2026 requires far more than copying features. A great Betterment Clone must combine speed, accuracy, automation, and trust—the same pillars that made Betterment a global leader in digital investing. Entrepreneurs need a clone system capable of handling real-time market data, automated portfolio balancing, AI-driven insights, and secure transactions while keeping the user experience effortless and intuitive.

A high-quality Betterment Clone must be built for performance at scale. Users expect instant calculations, seamless transactions, and transparent reporting. That means an average response time under 300ms, 99.9% uptime, and an architecture ready to handle thousands of simultaneous trades without lag. In 2026, robo-advisors are also expected to integrate AI-powered risk modeling, behavioral finance insights, ESG investment options, and long-term wealth planning tools.

Security factors are equally important. A proper clone must include bank-grade encryption, multi-factor authentication, fraud analytics, and secure API handling. Add that with a polished UI/UX, and you have a foundation that can rival the original Betterment experience while reflecting your own brand’s vision.

Key Attributes of a Great Betterment Clone

- AI-Driven Portfolio Management: Automated rebalancing, risk assessment, tax-loss harvesting

- Scalable Infrastructure: Capable of handling 10,000+ concurrent requests

- Real-Time Market Data Sync: Instant portfolio updates and pricing

- Cross-Platform Integration: Web + Android + iOS

- Regulatory-Ready Compliance: KYC, AML, transaction logs, reporting

- Investor-Friendly UX: Clean dashboards, goal-based investing, easy navigation

- Advanced Security: 256-bit encryption, secure APIs, multi-factor authentication

- Modular Architecture: Easier customization and future upgrades

Comparison Table — Modern Betterment Clones & Their Differentiators

| Feature | Standard Robo-Advisors | Modern Betterment Clone (2026) |

|---|---|---|

| Automation Level | Basic rebalancing | Full AI automation + behavior-driven insights |

| Performance | 500–700ms | Under 300ms response time |

| User Experience | Generic dashboards | Personalized goal-based investing |

| Security | Standard encryption | Bank-grade + behavioral fraud analytics |

| Scalability | Limited concurrency | 10k–50k concurrent users |

| Integrations | Few APIs | Multi-API support (banks, brokers, exchanges) |

Essential Features Every Betterment Clone Must Have

A successful Betterment Clone goes beyond simple investing tools—it must deliver a complete wealth-building ecosystem. To win user trust in 2026, your platform must combine ease of use, automation, real-time intelligence, and institutional-grade security. This section breaks down each functional layer and explains what makes a modern robo-advisory platform truly competitive.

A powerful Betterment Clone starts with a user journey that feels effortless. Investors need an interface where they can set goals, analyze performance, deposit funds, and view recommendations without friction. On the backend, your admin team must have advanced tools for compliance, reporting, user management, algorithm controls, and automated workflows. Meanwhile, portfolio managers—or AI agents—must handle rebalancing, allocation shifts, market changes, and risk analytics in real time.

Modern users also expect next-generation features: AI models that predict user risk tolerance, AR-based onboarding for better understanding of financial planning, blockchain verification for transparent investing, and intelligent nudges that increase engagement and retention. These innovations separate old-fashioned platforms from 2026-ready fintech products.

On the technical side, your Betterment Clone must be built on a scalable architecture capable of handling high-frequency operations. Cloud auto-scaling, microservices, multi-layer caching, secure third-party API integrations, and data encryption create the reliability users expect from a real investment platform. Miracuves integrates all these requirements into every Betterment Clone it delivers.

User Side Features

- Goal-Based Investing Tools

- AI Risk Profiling & Personalized Portfolios

- Real-Time Performance Tracking

- Automated Rebalancing & Tax-Loss Harvesting

- Easy Deposits/Withdrawals via Secure Payment Gateways

- Smart Notifications & Behavior Nudges

- Multi-Asset Support (stocks, ETFs, bonds, crypto—optional)

Admin Panel Features

- Complete User Management System

- Portfolio Algorithm Controls & Risk Settings

- KYC/AML Compliance Tools

- Automated Reporting & Ledger Records

- Third-Party API Management Console

- Real-Time Monitoring of Market Events & Server Load

- Role-Based Access Controls

Advisor/AI Engine Features

- Automatic Portfolio Allocation Adjustments

- AI-Triggered Alerts for Market Movement

- Fraud & Anomaly Detection Engine

- Earnings Dashboard for Advisors (if hybrid model)

- Algorithm Performance Analytics

Advanced 2026-Level Capabilities

- AI-Based Personalization Engine for micro-investing behaviors

- AR Onboarding to explain asset classes visually

- Blockchain Verification for secure investment logs

- Multi-Layer Security System including biometric login

- Real-Time Data Processing using cloud and microservices

Technical Architecture Requirements

- Scalability: Auto-scale for 50k+ active users

- Speed: Sub-300ms response time

- Load Handling: 1000+ transactions per minute

- Security Layers: SSL, 256-bit encryption, DDoS protection

- APIs: Payment gateways, brokerage APIs, KYC/AML tools

- Cloud/Server Setup: AWS, GCP, Azure with CI/CD pipelines

Feature Comparison Table — Basic vs Professional vs Enterprise

| Feature | Basic | Professional | Enterprise |

|---|---|---|---|

| Automated Rebalancing | ✔ | ✔ | ✔ |

| AI Risk Profiling | ✖ | ✔ | ✔ |

| Tax-Loss Harvesting | ✖ | ✔ | ✔ |

| Multi-Asset Support | Limited | Medium | Full Suite |

| Blockchain Verifications | ✖ | Optional | ✔ |

| AR Onboarding | ✖ | Optional | ✔ |

| Custom Analytics | Basic | Advanced | Enterprise-Grade |

| White-Label Branding | ✔ | ✔ | ✔ |

How Miracuves Implements These Features

Miracuves builds Betterment Clone solutions with a future-proof, modular architecture that allows:

- Flexible customization of workflows and algorithms

- Real-time data updates using optimized caching

- AI-powered suggestions to boost user retention

- Bank-level security for compliance and long-term reliability

- Smooth scaling as your user base grows

Cost Factors & Pricing Breakdown

Betterment-Like Robo-Advisory & Wealth Management Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Robo-Advisor MVP | User onboarding, KYC basics, goal-based portfolios, automated rebalancing logic, performance tracking, and a simple admin panel. | $80,000 |

| 2. Mid-Level Digital Wealth Platform | Mobile-first UI, ETF portfolio management, tax-loss harvesting basics, automated deposits, notifications, and analytics dashboards. | $190,000 |

| 3. Advanced Betterment-Level Platform | Advanced portfolio optimization, tax-efficient strategies, personalized advice tiers, retirement planning modules, compliance automation, and enterprise-grade scalability. | $360,000+ |

These figures represent the typical global investment required to build a modern robo-advisory platform similar to Betterment, focused on automated investing, long-term wealth growth, and regulatory compliance.

Miracuves Pricing for a Betterment-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete robo-advisory foundation with user onboarding, goal-based portfolio management, automated rebalancing workflows, performance reporting, compliance-ready controls, and a centralized admin dashboard — built for scalable digital wealth management.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded Betterment-style robo-advisor under your own ownership.

Launch Your Betterment-Style Robo-Advisory Platform — Contact Us Today

Delivery Timeline for a Betterment-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Portfolio strategy complexity

- Tax-optimization and rebalancing logic

- Compliance, KYC, and regulatory requirements

- Market-data and brokerage integrations

- Reporting and admin control depth

- Branding and UI/UX customization

Tech Stack

Built using a JS-based architecture, ideal for robo-advisory platforms that require secure financial processing, scalable APIs, real-time market data integration, automated portfolio logic, and enterprise-level reliability.

Customization & White-Label Option

Building a Betterment-style automated investing and wealth-management platform isn’t just about offering portfolios — it’s about delivering a guided financial experience where automation, transparency, and long-term optimization work together. A platform inspired by Betterment must provide goal-based investing, intelligent allocations, automated rebalancing, tax optimization (region-dependent), and a seamless user journey backed by compliance and security.

Miracuves delivers a fully white-label Betterment-style solution that can be customized for robo-advisor startups, digital wealth platforms, personal finance apps, or neobanks looking to add investment automation. The architecture allows you to shape rules, goals, investment products, and user journeys according to your financial philosophy and regulatory region.

Why Customization Matters

Automated investing varies by:

- Regional licensing & regulatory restrictions

- Asset availability (ETFs, mutual funds, bonds, crypto)

- Risk scoring frameworks

- Target customer segments (beginners, professionals, retirees)

- Business monetization model

Customization ensures your platform is aligned with your market, your compliance standards, and your investment strategy — not a generic robo-advisor template.

What You Can Customize

1. UI/UX & User Experience

- Dashboard layouts for portfolio overview, growth projection, and risk insights

- Goal creation flows (retirement, education, wealth building, emergency fund, custom goals)

- Themes, color palettes, typography, and visual identity

- Mobile-first design for higher engagement

2. Automated Portfolio Management

- Portfolio structures (Aggressive, Conservative, Moderate, Thematic, ESG, etc.)

- Risk-based allocation logic

- Automated rebalancing frequency and thresholds

- Dividend reinvestment automation

- Tax-aware logic (where applicable by region)

3. Financial Planning & Goal Tracking

- Smart calculators for retirement, savings, and long-term planning

- Goal forecasts via projections and simulations

- Personalized milestones and progress insights

- Adjustable timelines and savings recommendations

4. Risk & Compliance Controls

- Risk profiling questionnaires

- Suitability scoring & required disclosures

- KYC/KYB onboarding

- Regulatory document acknowledgments

- Audit logs and reporting layers

5. Portfolio & Asset Integrations

- Stock/ETF data feeds

- Third-party custodians, brokers, and clearing partners

- Alternative asset modules (if permitted)

- Transaction & settlement handling

6. Notifications & User Engagement

- Portfolio updates, rebalancing alerts, dividend notifications

- Goal progress reminders

- Market movement insights

- Educational nudges for new/inactive investors

7. Backend Systems & Extensions

- Integration with analytics platforms, CRM systems, compliance tools

- API layer for partner access

- Transaction tracking & settlement visibility

- Advisor dashboards (if hybrid advisory model)

8. Monetization & Revenue Models

- Subscription tiers for financial coaching

- AUM-based fees

- Premium portfolio tiers

- Partner investment products

- Add-on financial planning services

How Miracuves Handles Customization

- Requirement Understanding

We define your asset strategy, regulatory boundaries, monetization model, and target user segments. - Architecture & Planning

Modular structuring of onboarding, risk scoring, portfolio engine, analytics, payments, and reporting. - Design & Development

UI/UX customizations, logic implementation, portfolio automation, and ecosystem integrations. - Testing & Quality Assurance

Simulation testing, risk logic checks, compliance validation, performance monitoring, and security audits. - Deployment

A fully white-label investing platform launched with branded apps, dashboards, and operational setup.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech, wealth-tech, and financial platforms, including:

- Automated investment and portfolio-tracking tools

- Digital wealth-building platforms with risk scoring

- Multi-goal financial planning apps

- Hybrid advisory platforms with advisor dashboards

- White-label long-term investing ecosystems

These real-world deployments showcase how a Betterment-style system can be transformed into a smart, automated, and user-centric wealth-management platform operating fully under your brand.

Read More : What is Betterment App and How Does It Work?

Launch Strategy & Market Entry

Launching a Betterment-style robo-advisory platform in 2026 isn’t just about building software—it’s about entering a competitive fintech landscape with clarity, compliance, and a growth-ready plan. The right launch strategy determines whether your platform becomes a niche challenger or a category leader. Miracuves guides founders through every stage, ensuring your investment app enters the market with stability and momentum.

A strong launch begins with a meticulous pre-launch checklist. This includes validating all financial workflows, running compliance reviews, testing payment gateways, simulating real-user investment journeys, integrating KYC/AML systems, and preparing your app store assets. Quality assurance is essential in fintech because even a minor bug can damage user trust. The goal is to deliver a platform that feels polished from day one.

Your initial market-entry strategy can greatly influence adoption. Regions like Asia and MENA see rapid adoption of automated investing due to rising incomes and digital trust. Europe values regulation-heavy, transparent wealth tools. The U.S. rewards platforms that offer tax-optimized investing and hybrid advisor models. Localizing asset baskets, tax strategies, and user experience can dramatically increase engagement and credibility.

User acquisition is where founders must think creatively. Influencer-led financial education campaigns, referral loops, content funnels, and community-driven growth work exceptionally well in the investment niche. Retention matters too—AI-powered nudges, performance alerts, and personalized goals help users stay loyal and invested for the long term.

Miracuves supports every stage of this journey—from server deployment and security hardening to app store approvals and the first 90-day growth roadmap. With a focus on automation, data accuracy, and compliance, Miracuves empowers founders to launch their Betterment Clone confidently and competitively.

Pre-Launch Checklist

- Complete KYC/AML integration

- Verify investment algorithms and risk scoring

- Stress-test portfolio rebalancing engine

- Ensure secure payment & bank transfer modules

- Prepare app store assets (screenshots, descriptions, branding)

- Run device/browser compatibility tests

- Set up server monitoring, backups, and error logs

Regional Market Entry Approaches

Asia: Offer micro-investment features & low-entry portfolios

MENA: Provide Sharia-compliant investment baskets

Europe: Emphasize transparency & compliance

United States: Highlight tax-saving strategies & hybrid advisory options

User Acquisition Playbook

- Influencer campaigns with finance creators

- Referral bonuses to accelerate early user growth

- Educational content funnels explaining long-term investing

- AI-led nudges to improve activation & deposits

- Goal-based achievements to boost habit formation

Proven Monetization Models for 2026

- Subscription-based premium tools

- Assets Under Management (AUM) fees

- One-time advisory add-ons

- Brokerage commissions

- Robo-advisor + human advisor hybrid plans

Miracuves’ Role in Your Launch Success

- End-to-end deployment support

- Secure hosting & server setup

- Compliance-ready app store preparation

- Growth coaching for the first 90 days

- Scalable architecture for future expansion

Why Choose Miracuves for Your Betterment Clone

Building a robo-advisory platform is not just a technical project—it’s a trust project. Users are investing their hard-earned money, so every screen, every calculation, every security layer must work perfectly. This is where Miracuves becomes more than just a development partner; it becomes a strategic advantage.

Miracuves blends fintech engineering expertise, AI-driven automation, and enterprise-grade security to help founders launch a Betterment-style platform that feels premium from day one. With over 600+ successful deployments across banking, investing, lending, and digital wallet ecosystems, Miracuves has seen every real-world challenge—from extreme market volatility to compliance pressures—and knows exactly how to build systems that withstand them.

Founders also value speed. Traditional fintech development can take 6–12 months, but Miracuves’ optimized architecture delivers a production-ready Betterment Clone in 30–90 days, depending on customizations. The combination of rapid delivery, full-source code ownership, and future-proof design gives entrepreneurs what they need most: control and momentum.

Miracuves’ platforms are built to evolve. You can expand to new regions, add new asset classes, integrate new risk models, or introduce AI-powered recommendations without needing to rebuild the core system. This flexibility ensures your wealth-tech brand grows without technical blockers.

And even after launch, you’re not alone. With 60 days of free post-launch support, Miracuves helps stabilize performance, monitor early user behavior, optimize flows, and prepare for the scale-up phase.

Miracuves’ Core Strengths

- 600+ fintech deployments globally

- 30–90 days delivery with guaranteed quality

- Full-source code ownership for lifetime independence

- Future-proof modular architecture

- Enterprise-grade security and compliance readiness

- Free 60-day post-launch support

- Expert guidance on scaling + monetization

Real Client Success Stories

- A U.S.-based investment startup launched a niche robo-advisor targeting millennials and achieved 12,000+ users in its first 5 months using a customized Miracuves clone.

- A European wealth-tech founder integrated AI-powered predictive alerts, reducing portfolio-risk spikes by 30% during volatile market periods.

- A MENA-fintech client used a white-labeled Betterment-style clone to introduce Sharia-compliant portfolios, growing retention by 42% in the first 90 days.

Final Thought

Building a Betterment-style robo-advisory platform in 2026 is not just a smart business opportunity—it’s a chance to reshape how people invest, save, and secure their financial futures. Understanding Betterment’s business logic gives founders a clear blueprint: automation, simplicity, trust, and long-term value creation. But combining this understanding with the right technology partner is what truly determines success.

With Miracuves, entrepreneurs gain more than a clone script—they gain a future-ready wealth-tech foundation designed for rapid scaling, high performance, and deep customization. Whether you’re targeting a niche region, offering unique investment baskets, or aiming to build a global financial brand, Miracuves equips you with the systems, support, and engineering excellence needed to move fast and stay competitive.

Your vision, paired with Miracuves’ proven fintech expertise, can help you launch faster, scale smarter, and build a platform capable of disrupting the next wave of digital investing.

Ready to launch your Betterment Clone? Get a free consultation and a detailed project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Betterment Clone?

Miracuves delivers fully functional Betterment Clone platforms within 30–90 days, depending on customization, integrations, and compliance requirements.

What’s included in the Miracuves Betterment Clone package?

You receive the complete user app, admin panel, AI-driven advisory engine, automated rebalancing tools, secure payment modules, portfolio dashboards, and all core wealth-management features.

Can I get full source-code access?

Yes. Miracuves provides 100% source-code ownership, giving you long-term control, flexibility, and independence from third-party vendors.

How does Miracuves ensure scalability?

The platform is built on a modular, cloud-ready architecture with auto-scaling, microservices, multi-layer caching, and high-speed API handling.

Does Miracuves assist with app store approval?

Yes. Miracuves helps prepare your app for Google Play and Apple App Store approvals, handling guidelines, documentation, and technical compliance.

Is post-launch maintenance included?

You receive 60 days of free post-launch support, covering performance optimization, bug fixes, security audits, and early growth adjustments.

Can Miracuves integrate custom payment gateways or financial APIs?

Absolutely. Miracuves integrates any required APIs—payment gateways, brokerage APIs, market-data providers, KYC/AML tools, or banking connections.

What’s the upgrade or update policy?

You can request new modules, redesigns, or feature upgrades anytime. Miracuves’ modular architecture ensures updates don’t disrupt the core system.

How does white-labeling work?

Your platform receives full branding: logo, app icon, UI theme, color palette, typography, dashboard layout, and marketing materials—all aligned to your identity.

What kind of ongoing support can I expect after launch?

Beyond the initial 60 days, Miracuves offers long-term maintenance, scalable hosting solutions, feature expansions, security upgrades, and growth consulting.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best SoFi Clone Scripts 2026: Build a Next-Gen Digital Banking & Lending Platform

- Best Remitly Clone Scripts 2025: Launch Your Global Remittance App Faster & Smarter

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best N26 Clone Scripts 2026 for Digital Banking Startups

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Starling Bank Clone Scripts 2026 : Build a Digital Bank That Scales in the Real World