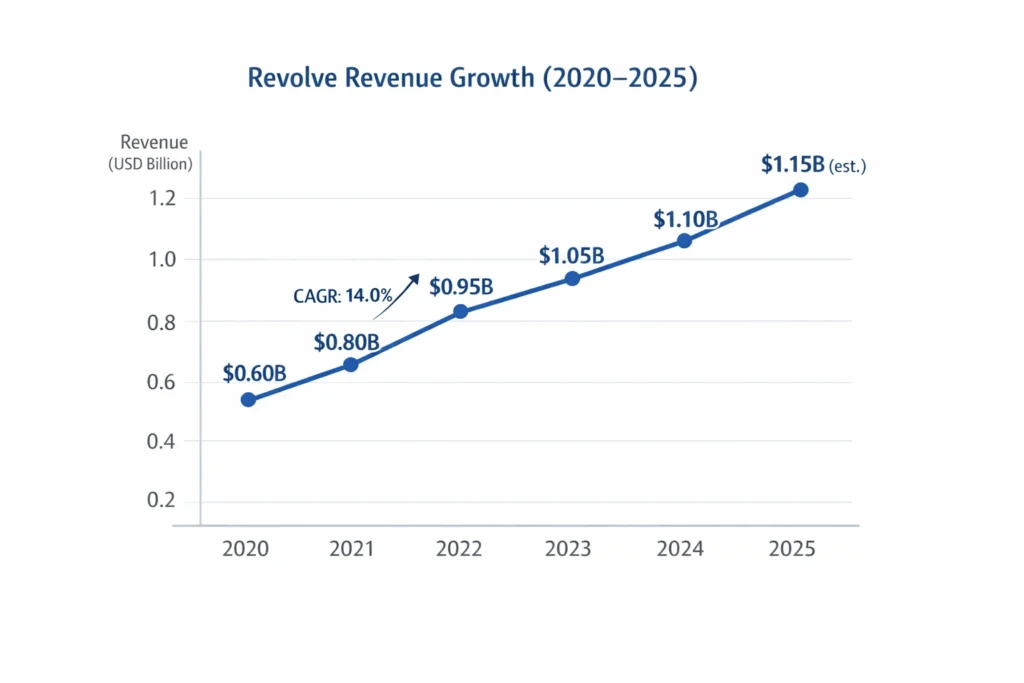

Revolve crossed $1.15 billion in annual revenue in 2025, proving that influencer-first fashion commerce is not a trend—it’s a systemized, repeatable business model. The company didn’t rely on seasonal hype alone; it built structured creator partnerships, data-driven merchandising, and tightly controlled inventory cycles that consistently convert attention into sales at scale.

What makes Revolve fascinating for founders is not just its size, but how efficiently it transforms social influence into predictable revenue. By turning influencers into long-term growth channels rather than one-off promoters, Revolve achieves high repeat purchase rates, lower customer acquisition costs, and strong lifetime value across core customer segments.

If you’re building a fashion marketplace or D2C platform, Revolve’s revenue mechanics offer a clear blueprint for monetization and retention. From drop-based launches and premium pricing psychology to loyalty-driven repeat buying, its model shows how fashion platforms can grow profitably without constant discounting or margin erosion.

Revolve Revenue Overview – The Big Picture

2025 Revenue: ~$1.15 billion

Valuation: ~$2.3–2.6 billion (market-based estimate)

YoY Growth: ~4–6% (stabilized post-pandemic)

Revenue by Region:

- North America: ~78%

- Europe: ~12%

- Asia-Pacific & Others: ~10%

Profit Margins:

- Gross margin: ~52–54%

- Net margin: ~4–6%

Competition Benchmark:

- Higher margins than fast-fashion players

- Lower logistics costs than marketplace-heavy models

- Stronger repeat purchase rate vs generic eCommerce

Read More: What is REVOLVE and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Direct-to-Consumer Fashion Sales

Revolve operates primarily as a curated D2C retailer, purchasing inventory wholesale and selling at premium prices.

- Contribution: ~72%

- Average order value: $220–$260

- Markups: 2.2x–2.6x wholesale cost

- 2025 revenue from this stream: ~$828M

Revenue Stream #2: Influencer-Led Capsule Collections

Influencers collaborate on exclusive drops that sell out fast, reducing inventory risk.

- Contribution: ~12%

- Pricing: 15–30% premium over standard SKUs

- High-margin due to demand predictability

Revenue Stream #3: Revolve Man

Menswear expansion brings higher basket values with lower return rates.

- Contribution: ~8%

- Higher profitability than women’s fast trends

Revenue Stream #4: Private Label Brands

Owned brands improve margin control and reduce dependency on third parties.

- Contribution: ~6%

- Gross margin: 60%+

Revenue Stream #5: International Expansion Sales

Localized pricing and logistics drive incremental growth.

- Contribution: ~2%

- High long-term upside

Revenue Streams Breakdown Table

| Revenue Stream | % Share |

|---|---|

| D2C Fashion Sales | 72% |

| Influencer Collections | 12% |

| Menswear | 8% |

| Private Labels | 6% |

| International | 2% |

The Fee Structure Explained

User-Side Fees

- Product price (all-inclusive)

- Express shipping fees in select regions

- Return restocking fees (limited categories)

Provider-Side Fees

- Wholesale margin absorption

- Influencer revenue share (5–12% per drop)

Hidden Revenue Layers

- Breakage on returns

- Exchange over refunds

- Promotional brand placements

Regional Pricing Variation

- Higher pricing in EU & APAC due to logistics

- Currency-based dynamic pricing

Fee Structure Table

| User Type | Fee Type | Range |

|---|---|---|

| Buyers | Shipping | $0–$25 |

| Buyers | Return Fee | $0–$15 |

| Influencers | Revenue Share | 5–12% |

| Brands | Margin Cut | 40–55% |

How Revolve Maximizes Revenue Per User

Revolve focuses heavily on lifetime value, not one-time sales.

- Segmentation: VIP shoppers get early access

- Upselling: Style bundles & complete looks

- Cross-selling: Accessories added at checkout

- Dynamic pricing: Trend-based elasticity

- Retention monetization: Drops over discounts

- LTV optimization: Email + influencer remarketing

- Psychological pricing: Premium anchoring

Real Data Insight:

Returning customers generate ~65% of total revenue, despite being under 40% of total users.

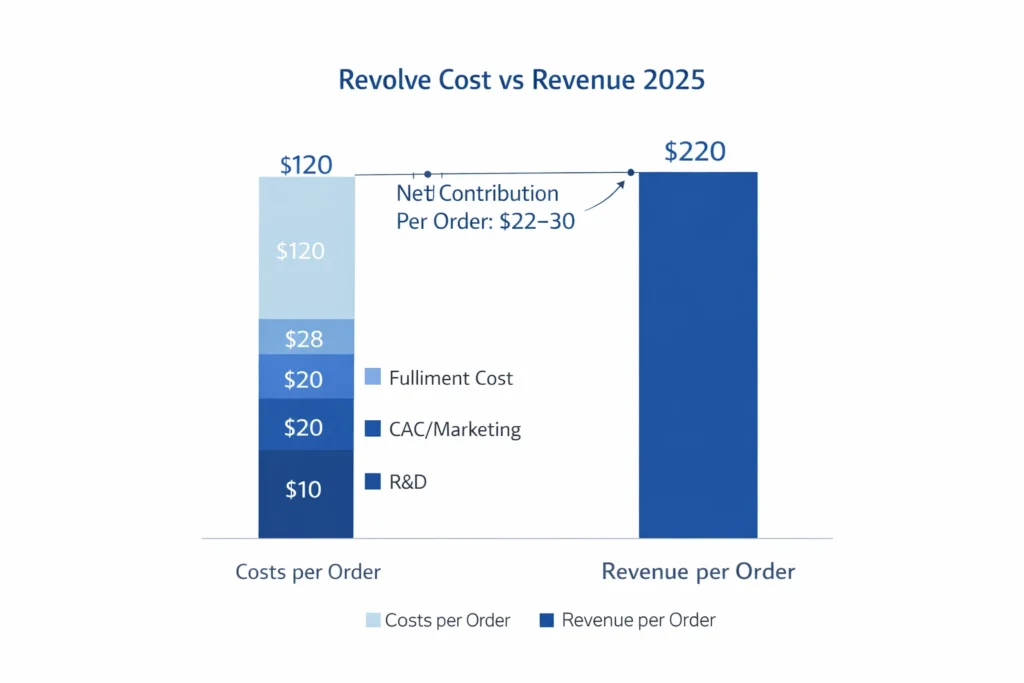

Cost Structure & Profit Margins

Infrastructure Cost

- Cloud commerce systems

- Inventory warehousing

- Fulfillment automation

CAC & Marketing

- Influencer trips & campaigns

- Social-first spend (lower than paid ads)

Operations

- Returns management

- Customer support

R&D

- Data-driven merchandising

- Trend forecasting tools

Unit Economics

- Avg gross profit/order: ~$120

- Avg fulfillment cost: ~$28

- Net contribution/order: ~$22–$30

Profitability Path

- Margin expansion via private labels

- Lower influencer CAC than ads

Read More: Best Revolve Clone Scripts 2025 | Premium Fashion E-Commerce

Future Revenue Opportunities & Innovations

- AI-powered demand forecasting

- Creator storefront monetization

- Live shopping commerce

- Sustainable fashion premium lines

- Expansion into Middle East & Southeast Asia

Predicted Trends (2025–2027):

- Fewer discounts, more exclusivity

- Influencers as equity partners

- Faster drop cycles

Risks & Threats:

- Inventory misreads

- Influencer fatigue

- Fast-fashion pricing wars

Opportunities for Founders:

- Niche-focused Revolve-style platforms

- Regional influencer marketplaces

Lessons for Entrepreneurs & Your Opportunity

What Works

- Influencers as distribution, not ads

- Scarcity-driven merchandising

What to Replicate

- Drop-based inventory model

- Data-led buying decisions

Market Gaps

- Mid-tier fashion creators

- Regional influencer commerce

Founder Improvements

- Lower return friction

- Community-owned fashion labels

Want to build a platform with Revolve’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Revolve-style fashion marketplace clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Revolve proves that fashion eCommerce doesn’t need endless discounts to scale sustainably. Instead of racing to the bottom on price, it focuses on perceived value, limited availability, and brand-led demand, allowing the platform to protect margins while still driving high conversion rates.

What fashion eCommerce truly needs is cultural relevance, controlled supply, and repeat-driven monetization. Revolve stays close to social trends, limits overproduction through data-backed buying, and monetizes customer loyalty through frequent drops, exclusive access, and high-return engagement loops rather than constant promotions.

For founders, the real opportunity lies in localizing this model for untapped creator economies. Regional influencers, niche fashion communities, and culturally specific trends remain under-monetized, creating space for new platforms to replicate Revolve’s playbook at smaller, faster-moving scales with lower competition and higher community trust.

FAQs

1. How much does Revolve make per transaction?

Around $22–$30 in net contribution per order.

2. What’s Revolve’s most profitable revenue stream?

Private labels and influencer-led capsule drops.

3. How does Revolve’s pricing compare to competitors?

Higher than fast fashion, lower than luxury brands.

4. What percentage does Revolve take from providers?

Typically 40–55% margin on wholesale pricing.

5. How has Revolve’s revenue model evolved?

From pure D2C retail to influencer-powered demand creation.

6. Can small platforms use similar models?

Yes, especially with niche influencer communities.

7. What’s the minimum scale for profitability?

Roughly 5,000–10,000 monthly active buyers.

8. How to implement similar revenue models?

Drop-based inventory, influencer partnerships, and data-led pricing.

9. What are alternatives to Revolve’s model?

Marketplace-only fashion platforms or subscription styling services.

10. How quickly can similar platforms monetize?

Many begin generating revenue within 30–60 days post-launch.