LendingClub began as a small peer-to-peer lending idea and quickly evolved into one of the United States’ largest digital lending platforms, processing billions in loans annually. Its success reshaped how consumers borrow and how investors earn — proving that online lending can outperform traditional banks when engineered with transparency and user trust.

By 2025, the global digital lending market crossed $450 billion, with P2P lending alone contributing over $110 billion. This makes the LendingClub model one of the most attractive fintech opportunities for entrepreneurs in 2026 — combining predictable revenue, high loan demand, and strong investor returns.

Understanding the LendingClub Clone model is crucial because modern users expect instant approvals, risk-based interest rates, automated repayment cycles, and transparent borrower-lender matching. For founders, a LendingClub-style platform offers an entry into a high-growth fintech segment supported by data, AI-driven scoring, and compliance frameworks.

A robust LendingClub Clone Script helps entrepreneurs launch quickly with lending workflows, risk engines, investor dashboards, and borrower journeys ready to scale. With Miracuves Clone Solutions, founders gain speed, security, and future-proof architecture tailored for real lending environments.

What Makes a Great LendingClub Clone?

A great LendingClub Clone in 2026 goes far beyond matching borrowers and lenders. It must operate as a high-precision lending ecosystem capable of handling risk scoring, automated repayments, investor portfolio management, underwriting logic, and compliance workflows — all while maintaining speed, accuracy, and user trust.

Modern lending platforms are expected to deliver instant decisioning, transparent interest rates, automated documentation, and seamless EMI journeys. At the same time, investors demand real-time returns, credit risk insights, and diversification tools. This means your LendingClub Clone must balance both sides of the marketplace through a stable, compliant, and scalable architecture.

A high-quality clone also requires performance benchmarks like sub-300ms API response time, 99.9 percent uptime, multi-layer security, encrypted loan documents, fraud checks, and AI-powered credit decisioning. In 2026, lending platforms must integrate with open banking, KYC APIs, bureau scoring systems, and alternative data sources to stay competitive.

To deliver success, your platform must excel in performance, scalability, security, and monetization — not just UI.

Key Elements of a Great LendingClub Clone (2026)

- Advanced AI-driven loan underwriting

- Borrower and investor dashboards with real-time insights

- Transparent EMI schedules and repayment automation

- Multi-layer security with encryption and fraud detection

- Cloud-native architecture for high-volume loan processing

- Smart portfolio recommendations for investors

- Automated KYC/AML workflows

- Integration with credit bureaus and open banking

- Scalable microservices-based backend

Comparison Table: Modern LendingClub Clones and Their Differentiators

| Feature Category | Basic P2P Clone | 2026 Advanced P2P Clone | Miracuves LendingClub Clone Script |

|---|---|---|---|

| Credit Scoring | Rule-based | AI-driven | AI + alternative data scoring |

| Performance | 500–700ms | 350–450ms | Under 300ms optimized |

| Repayment Engine | Basic | Automated | Smart automation with reminders |

| Investor Tools | Limited | Moderate | Full analytics + auto-invest |

| Scalability | Up to 50K users | Up to 500K users | Multi-million user support |

| Security | Basic encryption | AES-256 | Multi-layer security + fraud engine |

| Uptime | 98 percent | 99.5 percent | 99.9 percent |

| Compliance | Partial | Standard KYC | Compliance-ready + API integrations |

Essential Features Every LendingClub Clone Must Have

A LendingClub-style lending platform runs on multiple moving parts: borrower journeys, investor tools, admin monitoring, risk engines, and automated repayment systems. Each component must work in harmony to ensure trust, reduce defaults, and deliver a smooth experience from loan request to loan closure.

Borrowers expect fast approvals, transparent loan terms, and simple EMI management. Investors expect predictable returns, low-risk diversification, and real-time performance analytics. Admin teams need full visibility into risk, compliance, loan performance, and fraud signals. A great LendingClub Clone must deliver on all three fronts.

Borrower-Side Features

Borrowers are the core engine of lending platforms. Their user experience defines trust and repayment behavior.

- Quick digital onboarding with KYC/AML verification

- Instant loan eligibility checks

- AI-based interest rate calculation

- Transparent EMI schedule and amortization breakdown

- Auto-debit repayment with reminders

- Digital loan agreements with e-sign

- Real-time loan tracking dashboard

- Credit score insights and tips

Investor-Side Features

Investors need clarity, risk awareness, and predictable returns.

- Portfolio dashboard with real-time returns

- Risk category filters (A+, A, B, C, etc.)

- Automated investment (auto-invest feature)

- Diversification recommendations

- Detailed borrower profiles and risk scoring

- EMI income tracker

- Analytics-based performance graphs

- Withdrawal and settlement options

Admin Panel Features

The admin backend controls the entire lending ecosystem.

- AI-powered loan approval management

- Automated underwriting and risk matrix

- User onboarding with compliance flows

- Loan book performance dashboards

- Delinquency tracking and default prediction

- Fraud detection and behavior analysis

- Investor return reconciliation

- API management for bureaus, KYC, and payments

- Dispute management and arbitration tools

Advanced Features for 2026

Modern lending requires more intelligence and more compliance.

- AI-based alternative data scoring (banking patterns, transaction insights)

- Open banking API integrations

- Blockchain-backed loan agreements

- Multi-currency lending support

- Dynamic risk-based pricing models

- Predictive default analytics

- Biometric authentication for high-value loans

Technical Architecture Requirements

A high-volume lending system must remain stable under pressure.

- Microservices architecture for scaling loan workflows

- Auto-scaling cloud infrastructure

- Multi-layer security with AES-256 and tokenization

- Real-time data pipelines for underwriting

- Payment gateway integrations for EMI collection

- 99.9 percent uptime with redundancy and failover

- High-speed API performance under 300ms

Feature Comparison Table: Basic vs Professional vs Enterprise

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| KYC + Loan Request | Yes | Yes | Yes |

| AI Credit Scoring | No | Basic | Advanced models |

| Investor Tools | Basic | Standard | Full analytics + auto-invest |

| EMI Automation | Standard | Enhanced | Smart automation + alerts |

| Fraud Detection | Limited | Moderate | AI-powered engine |

| White-Label | Yes | Full branding | Multi-brand deployment |

| Integrations | Limited | API support | Full ecosystem integrations |

| Scalability | Up to 100K users | Up to 500K users | Multi-million users |

How Miracuves Implements These Features

Miracuves builds LendingClub Clones with:

- AI underwriting engines

- Optimized cloud-native architecture

- Secure loan and EMI automation frameworks

- Fast API execution under heavy load

- Compliance-ready workflows

- Full customization flexibility

- Delivery timelines between 30–90 days

Cost Factors & Pricing Breakdown

LendingClub-Like Digital Lending & Credit Marketplace — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Lending MVP | Borrower & lender onboarding, KYC basics, loan listing & application flow, repayment schedules, and a simple admin panel. | $80,000 |

| 2. Mid-Level Digital Lending Platform | Web dashboards, credit scoring integration, automated loan matching, payment collections, notifications, and analytics dashboards. | $180,000 |

| 3. Advanced LendingClub-Level Platform | Marketplace lending engine, dynamic interest rate models, investor dashboards, compliance automation, fraud monitoring, reporting, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a regulated, data-driven digital lending platform similar to LendingClub, focused on efficient borrower-lender matching and scalable credit operations.

Miracuves Pricing for a LendingClub-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete digital lending foundation with borrower & lender onboarding, loan origination workflows, repayment and collection logic, credit-ready architecture, compliance-oriented controls, and a centralized admin dashboard — built for scalable peer-to-peer and institutional lending models.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded LendingClub-style lending platform under your own ownership.

Launch Your LendingClub-Style Digital Lending Platform — Contact Us Today

Delivery Timeline for a LendingClub-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Loan products and repayment structures

- Credit scoring and underwriting depth

- Payment gateway and collection integrations

- Compliance, KYC, and regulatory requirements

- Risk management and reporting features

- Branding and UI/UX customization

Tech Stack

Built using a JS-based architecture, ideal for digital lending platforms that require secure financial processing, scalable APIs, automated loan workflows, real-time data handling, and enterprise-level reliability.

Customization & White-Label Option

Building a LendingClub-style peer-to-peer (P2P) lending and credit marketplace is not just about matching borrowers and lenders — it’s about creating a compliant, risk-managed financial ecosystem where credit scoring, loan underwriting, investor dashboards, repayment workflows, and regulatory reporting work together seamlessly. A platform inspired by LendingClub must balance lending efficiency with trust, transparency, and operational discipline.

Miracuves delivers a fully white-label LendingClub-style solution that can be customized for P2P lending platforms, digital lending marketplaces, SME financing products, community lending apps, or hybrid lending ecosystems. You get full control over branding, underwriting rules, investor workflows, risk layers, and repayment logic.

Why Customization Matters

P2P lending platforms vary significantly based on:

- Regulatory restrictions (in some countries P2P lending requires special licenses)

- Borrower categories (salaried, self-employed, SME owners)

- Risk scoring logic

- Interest & repayment structures

- Investor expectations (returns, transparency, protection)

- Loan sizes & ticket ranges

Customization ensures your platform matches your lending philosophy, your compliance zone, and your credit-risk appetite, instead of copying a generic loan marketplace flow.

What You Can Customize

1. UI/UX & Borrower Journey

- Loan application forms

- KYC, income proof, document upload flows

- Eligibility checks & instant loan-estimate screens

- Branded colors, visuals, typography, and dashboards

2. Underwriting & Risk Engine

- Rule-based credit scoring

- Income verification logic

- Risk categories (A, B, C, D grade loans like LendingClub)

- Approval or rejection automation

- Fraud detection & identity checks

- AI-assisted scoring (optional)

3. Investor Marketplace & Dashboard

- Browse loans by risk grade, returns, tenure

- Auto-invest rules

- Portfolio insights, earnings, repayments

- Diversification recommendations

- Tax statements & performance metrics

4. Loan Products & Repayment Structures

- Personal loans

- Business/SME loans

- Education or medical loans

- Repayment cycles (monthly, bi-weekly, weekly)

- Interest-based or flat-fee models

- Pre-closure rules & late-fee logic

5. Payments & Settlement

- Auto-debit using card/bank rails

- Split repayments to multiple investors

- Wallet system for earnings, withdrawals, and reinvestments

- Automated reconciliation & ledger systems

6. Compliance, KYC & AML

- Borrower verification workflows

- Blacklist / fraud-risk flags

- Lending documentation

- Investor regulatory disclosures

- Full audit logs

7. Notifications & Engagement

- Reminder alerts for repayments

- Investor updates for earnings or portfolio events

- Borrower status updates

- Personalized investment suggestions

8. Integrations & Extensions

- Credit bureaus (where allowed)

- Payment gateways

- Bank statement analyzers

- CRM systems

- Analytics dashboards

- Customer support systems

9. Monetization Models

- Platform fee for borrowers

- Commission on disbursed loans

- Investor management fee

- Premium tools for investors

- Late-fee revenue (region-dependent)

How Miracuves Handles Customization

- Requirement Mapping

We define your loan categories, repayment structures, investor model, and regulatory boundaries. - Architecture Planning

Modular setup: onboarding → underwriting engine → marketplace → repayment engine → investor dashboards → reporting. - Design & Development

Loan flows, investor dashboards, risk models, branding, and scalability enhancements per your roadmap. - Testing & Quality Assurance

Repayment simulations, risk model accuracy, document verification testing, and security audits. - Deployment

Your fully white-labeled loan marketplace is deployed with operational dashboards, branded apps, and domain setup.

Real Examples from Miracuves Portfolio

Miracuves has delivered 600+ fintech, lending, and marketplace systems, including:

- Peer-to-peer lending engines

- SME financing platforms

- Automated underwriting systems

- Loan management systems with investor dashboards

- End-to-end digital credit ecosystems

These implementations show how a LendingClub-style concept can be transformed into a scalable, compliant, and yield-generating lending ecosystem under your brand.

Launch Strategy and Market Entry

Launching a LendingClub-style platform is not just about going live with the code. It is about orchestrating technology, compliance, operations, and growth in a synchronized way. In 2026, digital lending is closely watched by regulators and highly scrutinized by users. A thoughtful launch plan helps you build trust from day one, avoid compliance setbacks, and create early traction with the right borrowers and investors.

Your launch roadmap should move in phases: pre-launch readiness, controlled beta, public launch, and scale-up. Each phase has a clear objective: validate risk models, test underwriting logic, refine UX, align marketing, and stabilize EMI flows.

Pre-Launch Checklist

Before you onboard your first real borrower, your platform must be stable and compliant.

- Complete end-to-end functional testing for borrower, investor, and admin flows

- Run load tests on loan requests, underwriting, and EMI processing

- Configure KYC, AML, and credit bureau integrations

- Confirm legal documentation: loan agreements, policies, terms, and disclosures

- Validate EMI schedules, interest calculations, and penalty rules with finance and legal teams

- Set up analytics tools for funnel tracking and cohort monitoring

- Prepare App Store and Play Store builds (if mobile apps are included)

- Train internal teams on admin portal usage and escalation workflows

Regional Entry Strategies

Different geographies have different lending cultures and regulatory expectations.

Asia (India, Southeast Asia)

- Focus on smaller-ticket, short-tenure loans or salary advances initially

- Educate users about responsible borrowing through content and in-app tips

- Partner with payroll platforms, MSME associations, or gig platforms for sourcing borrowers

- Use strong KYC and alternative data to support thin-file borrowers

MENA - Collaborate with licensed entities where required

- Target SMEs, professionals, and specific verticals like healthcare or retail

- Highlight transparency and Sharia-compliant models where relevant

Europe and UK - Begin with clearly regulated segments (SME, business lending, or specific consumer products)

- Prioritize documentation, credit transparency, and data protection compliance

- Integrate open banking early to strengthen risk models

United States and similar markets - Start in clearly defined niches such as debt consolidation, student loans, or small business lending

- Use strict underwriting, clear APR disclosure, and strong compliance alignment

User Acquisition and Growth Frameworks

Digital lending growth depends on acquiring quality borrowers and trustworthy investors.

- Launch with a closed beta group (employees, partners, selected borrowers and investors)

- Use referral programs with capped, responsible incentives

- Partner with businesses, payroll companies, or marketplaces for embedded lending

- Build educational content around credit behavior, EMI discipline, and risk

- Use email and in-app flows to guide borrowers through onboarding and repayment

- Offer investor education on risk grades, diversification, and expected returns

- Monitor early cohorts closely to refine underwriting and approval criteria

Monetization Models That Work in 2026

A LendingClub Clone can monetize in multiple ways if structured correctly.

- Origination fees on approved loans

- Spread-based income between borrower interest and investor return

- Platform or servicing fees for investors

- Late payment charges (aligned with local regulations)

- Subscription-style plans for investors with advanced analytics and tools

- White-label lending partnerships where third parties use your platform stack

Miracuves End-to-End Launch Support

Miracuves does not stop at delivering the platform. It supports you through launch and early growth.

- Infrastructure setup and optimization for production

- Assistance with API configuration for KYC, payments, bureaus, and open banking

- Guidance on structuring workflows to align with local regulations (in coordination with your legal team)

- Help with App Store and Play Store submissions if mobile apps are included

- Monitoring and optimization support for the first live cohorts

- Performance tuning for underwriting, EMI runs, and investor dashboards

- Recommendations on analytics dashboards to track portfolio health and cohort behavior

With a Miracuves-powered LendingClub Clone and a clear launch strategy, founders can move from prototype to live, regulated lending platform within a structured 30–90 day window while keeping risk, experience, and growth in balance.

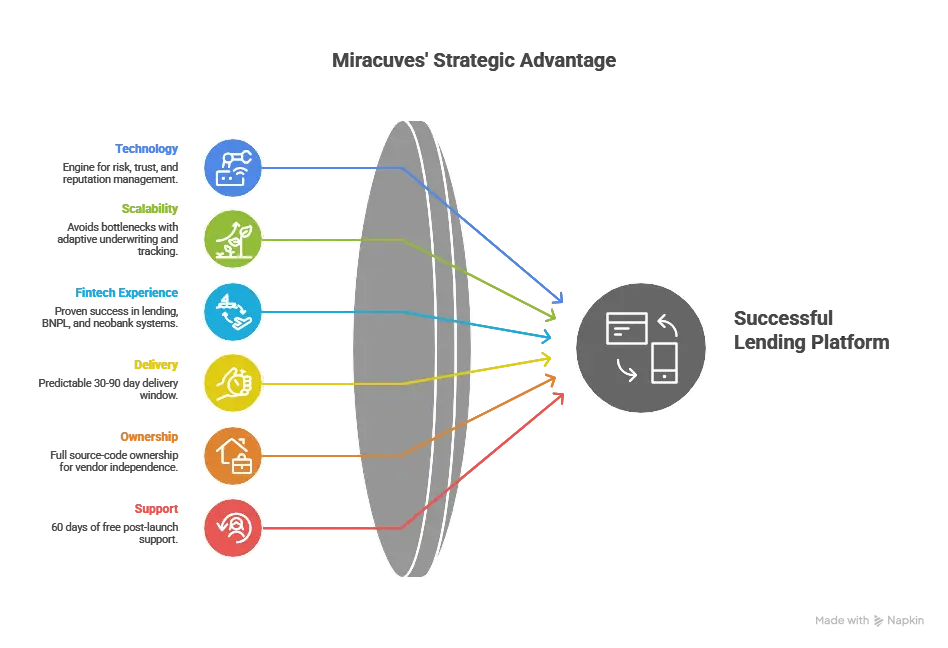

Why Choose Miracuves for Your LendingClub Clone

In lending, technology is not just the system behind the scenes — it is the engine that controls risk, trust, and reputation. One miscalculated EMI, one failed disbursement, or one broken repayment flow can damage your brand, attract regulatory attention, and erode investor confidence. That is why choosing your technology partner for a LendingClub-style platform is a strategic decision, not a purely technical one. Miracuves is built for founders who want to enter the digital lending space in 2026 with a platform that can handle real-world pressure from day one.

Most lending platforms fail not because the idea is weak, but because the execution breaks at scale. Underwriting rules do not adapt, default tracking is manual, investor reporting is inconsistent, or the system slows down as loan volumes grow. Miracuves has worked across lending, neobank, BNPL, and credit-backed products, so its LendingClub Clone framework is engineered specifically to avoid these operational bottlenecks.

Key Strengths of Miracuves for LendingClub Clone Development

- 600 plus successful fintech deployments, including lending, BNPL, and neobank systems

- Predictable 30–90 day delivery window for launching a complete lending platform in 2026

- Full source-code ownership so you are never locked into a vendor or SaaS model

- 60 days of free post-launch support to stabilize performance and fine-tune flows

- Future-proof modular architecture ready for AI underwriting, open banking, and new loan products

- Performance engineered for sub-300ms response times and 99.9 percent uptime under real loan traffic

- Compliance-ready workflows that can be aligned with your regional regulations through configuration

Short Success Stories and Transformations

A regional SME lending marketplace

A founder wanted to build a marketplace where local businesses could access working capital while local investors could fund them directly. Using the Miracuves LendingClub-style engine, the platform went live in under 60 days with SME-specific scoring rules and invoice-based underwriting. Within the first year, the marketplace processed thousands of SME loans with a healthy repayment track record and strong investor retention.

A salary advance lending app for employees

An HR-tech company wanted to offer salary advances and short-term credit to employees through employers. Miracuves customized its LendingClub Clone to support employer-linked risk checks, payroll-integrated repayments, and employer dashboards. The result was a low-default product that improved employee satisfaction while keeping risk controlled and predictable.

A niche education lending platform

An education-focused startup needed staged disbursement for tuition, strong documentation flows, and parent–student profile mapping. Miracuves extended the lending engine with academic verification, milestone-based disbursements, and transparent repayment structures. The platform now supports recurring enrollment cycles and long-tenure education loans with clear visibility for both investors and borrowers.

Final Thought

The digital lending landscape is evolving faster than ever. Borrowers want faster access to funds, investors want predictable returns, and regulators want transparency. The LendingClub model has proven that when technology, trust, and data come together, lending can scale into a powerful ecosystem — one that outperforms traditional financial institutions.

For entrepreneurs, the opportunity in 2026 is immense. Whether you want to build a P2P marketplace, an SME credit platform, an education lending solution, or a community-based micro-lending system, the foundations remain the same: strong underwriting, secure workflows, intuitive user journeys, and a scalable technology backbone.

A LendingClub Clone is not just a shortcut — it is a strategic accelerator. Paired with the Miracuves fintech engine, you gain speed, ownership, and a future-ready architecture built to withstand real-world loan volumes and operational challenges. Instead of spending years building risk engines and lending workflows from scratch, you can enter the market confidently within 30–90 days and focus on growth, partnerships, and product innovation.

With Miracuves as your development partner, you are not just launching an app — you are building a lending business backed by proven systems, global experience, and scalable infrastructure. The next generation of lending leaders will be those who understand the model deeply and execute it with precision — and Miracuves equips you to do exactly that.

Ready to launch your LendingClub Clone and build a serious digital lending business in 2026? Get a free consultation and a detailed project roadmap from Miracuves — trusted by 200 plus entrepreneurs worldwide for secure, scalable lending and fintech platforms.

FAQs

How quickly can Miracuves deploy my LendingClub Clone?

Miracuves delivers a fully functional LendingClub Clone within a predictable 30–90 day timeline, covering setup, customization, risk configuration, integrations, and launch readiness.

What’s included in the Miracuves LendingClub Clone package?

You receive borrower and investor modules, admin dashboard, underwriting engine, EMI automation, risk scoring workflows, backend system, APIs, documentation, and deployment support.

Do I get full source-code ownership?

Yes. Miracuves provides 100% full source-code ownership, giving you complete control with no dependency on third-party platforms or SaaS models.

How does Miracuves ensure scalability for lending platforms?

Miracuves uses microservices architecture, auto-scaling cloud servers, high-speed APIs, encrypted data pipelines, and lending-optimized databases capable of handling multi-million user ecosystems.

Does Miracuves provide app store approval assistance?

Yes. Miracuves helps with Play Store / App Store submissions, guideline checks, compliance considerations, and deployment support.

Is post-launch support included?

Yes. Miracuves provides 60 days of free post-launch support to help with optimization, stability, and early-stage operational adjustments.

Can Miracuves integrate my preferred payment gateways?

Absolutely. Miracuves supports Razorpay, Stripe, PayPal, Paytm, custom banking APIs, and region-specific payment gateways.

What is the upgrade and update policy?

Miracuves offers optional upgrades for new features, security enhancements, compliance updates, AI-based underwriting modules, and additional lending products.

How does white-labeling work for the LendingClub Clone?

The entire platform — borrower app, investor portal, admin dashboard, notifications, and domain — is branded fully under your identity with no vendor traces.

What ongoing support can I expect after the initial launch?

You get access to ongoing maintenance options, security patches, feature enhancements, risk model updates, performance monitoring, and dedicated developer support based on your needs.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Afterpay Clone Scripts 2026: Launch a Powerful BNPL App for Your Fintech Startup

- Best Betterment Clone Scripts 2026 for Automated Investing Platforms

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Groww Clone Scripts 2026: Launch a Powerful Investment & Trading Platform Fast

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast