What began as a simple idea — rewarding users for paying their credit card bills — turned into one of India’s most iconic fintech success stories. CRED now manages millions of high-credit users, processes massive payment volumes, and has become a lifestyle brand with rewards, lending, and exclusive shopping experiences.

In 2026, the global credit management & rewards app market is projected to cross $42B, creating a massive opportunity for founders to replicate CRED’s model in new geographies and niche markets. With increasing adoption of digital payments, credit scoring, and reward-based ecosystems, the demand for CRED Clone Scripts is skyrocketing.

A CRED Clone enables entrepreneurs to enter this high-value market with a proven model — combining credit bill payments, user rewards, gamification, brand partnerships, and premium customer experiences. With Miracuves Clone Solutions, founders get enterprise-grade engineering, secure payment flows, and high-engagement UI experiences designed for long-term customer loyalty.

What Makes a Great CRED Clone?

A successful CRED Clone must go beyond simple credit card bill payments — it must offer premium user experience, reward-driven engagement, and bank-grade security. CRED scaled rapidly because it understood two things:

- Users love frictionless payments.

- Users love rewards even more.

To compete in 2026’s fintech ecosystem, your CRED-style platform must combine effortless bill payments, gamified engagement, brand partnerships, and a trust-driven credit verification system. Performance, UI richness, and user retention strategies are the core pillars of a high-quality CRED Clone.

Core Elements of a Great CRED Clone in 2026

- Ultra-clean premium UI for affluent credit users

- Real-time credit score sync with bureaus (Experian, CRIF, Equifax, CIBIL)

- 99.9% uptime for uninterrupted monthly bill cycles

- Gamified interactions like cashback, badges, coins, and reward drops

- Instant credit bill payments with multi-bank support

- Strong data security using tokenization and AES 256 encryption

- High-performance backend capable of handling heavy traffic during billing cycles

- Automated loyalty engine to strengthen retention

Modern Innovations Every CRED Clone Must Include

- AI-powered reward recommendations

- Personalized credit insights (usage, score growth, utilization alerts)

- Smart EMI conversion on big purchases

- Blockchain-based transaction logs for immutable payment history

- Cross-platform payment integrations

- Integrated lending modules (personal loans, credit lines)

- Brand marketplaces for reward redemption

Comparison Table: Traditional Payment Apps vs Modern CRED Clone (2026)

| Feature | Normal Payment Apps | Modern CRED Clone (2026) |

|---|---|---|

| UI/UX | Basic | Premium, animated, gamified |

| Credit Score | Not available | Real-time bureau sync |

| Rewards | Limited | Coins, cashback, brand deals |

| Security | Standard | AES 256 + tokenization + biometric |

| Engagement | Low | High through gamification |

| Monetization | Minimal | Loans, marketplace, partnerships |

| Performance | Moderate | <300ms response times |

Essential Features Every CRED Clone Scripts Must Have

A CRED-style platform thrives on trust, premium experience, and continuous engagement. Users don’t simply want a bill payment tool — they want a lifestyle ecosystem that rewards responsible financial behavior. Your CRED Clone must combine seamless payments, real-time credit scoring, data security, and gamified experiences that keep users returning every month.

A high-quality CRED Clone is built across three critical layers: User Experience, Admin Intelligence, and the Brand/Partner Ecosystem. Each layer must work together to create a rewards-driven financial environment that feels polished, fast, and reliable.

User-Side Experience

This is where brand loyalty is built.

- Credit card bill payments for multiple banks in seconds

- Real-time CIBIL/Experian credit score updates

- Reward coins & gamification (spin wins, badges, challenges)

- Exclusive partner rewards from brands, travel, lifestyle, dining

- Credit usage insights such as utilization alerts and monthly trends

- Smart reminders for due dates

- Instant EMI conversion

- Secure biometric login (Face ID, fingerprint, device lock)

Admin Panel (Fintech Command Center)

The admin panel powers the intelligence, compliance, and monetization engine.

- User verification with bureau API integration

- Dynamic rewards & coins configuration

- Brand partnership management

- Loan module activation (BNPL, personal loans, credit lines)

- Fraud detection with behavioral insights

- Transaction logs and payment reconciliation

- Push notification and engagement automation

- Multi-role admin access

Partner & Merchant Ecosystem

A CRED-style ecosystem shines when partnered with strong brands.

- Brand onboarding dashboard

- Marketplace setup (products, vouchers, deals)

- Dynamic reward pricing & discount control

- Redemption analytics

- Campaign tools for merchants

Advanced 2026 Features

- AI-driven personal finance coaching (Spend insights, goal tracking)

- Predictive credit score forecasting

- Blockchain-enabled bill history

- Gamified challenge systems (weekly spending challenges, savings streaks)

- AR-based card verification for better onboarding

Technical Architecture Requirements

To match CRED-level performance, the platform must be technically elite.

- Microservices architecture for high concurrent traffic

- AES 256 encryption + tokenization + secure vaults

- Biometric authentication modules

- Credit bureau API integrations (CIBIL, Experian, Equifax, CRIF)

- Auto-scaling cloud infrastructure

- CDN performance optimization for global speed

- <300ms average response time

Feature Comparison: Basic vs Professional vs Enterprise

| Version | User Features | Admin Tools | Partnerships | Best For |

|---|---|---|---|---|

| Basic | Bill payments, basic rewards | Standard admin | Limited partners | Startup MVP |

| Professional | Real-time score sync, gamification, marketplace | Advanced analytics | Multiple partners | Growing fintechs |

| Enterprise | Loans, AI insights, POS rewards, full marketplace | Predictive engine | Global partners | Large BNPL & finance apps |

How Miracuves Implements These Features

Miracuves builds CRED-style apps optimized for:

- Fast credit score syncing

- Real-time payment processing

- Reward engines tailored to user behavior

- Premium class UI/UX with animations

- Scalable microservices designed for peak billing cycles

- Plug-and-play credit bureau & banking APIs

- Fully customizable reward marketplace modules

Cost Factors & Pricing Breakdown

CRED-Like Credit Rewards & Financial Services Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Credit Rewards MVP | User onboarding, credit card linking, bill reminders, reward points logic, basic offers, and a simple admin panel. | $70,000 |

| 2. Mid-Level Rewards & Payments Platform | Mobile-first UI, credit score insights, reward marketplace, partner offers, notifications, and analytics dashboards. | $180,000 |

| 3. Advanced CRED-Level Platform | Credit behavior analytics, personalized rewards engine, lending & BNPL modules, merchant integrations, compliance automation, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a premium, rewards-driven fintech platform similar to CRED, combining credit management, gamification, and financial services.

Miracuves Pricing for a CRED-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete credit-focused fintech foundation with user onboarding, credit card and bill-management workflows, rewards & cashback logic, partner integrations, compliance-ready architecture, and a centralized admin dashboard — built for scalable consumer-finance and loyalty platforms.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded CRED-style platform under your own ownership.

Launch Your CRED-Style Credit & Rewards Platform — Contact Us Today

Delivery Timeline for a CRED-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Credit data and bureau integrations

- Rewards, cashback, and offer logic complexity

- Lending or BNPL feature depth

- Compliance, KYC, and regulatory requirements

- Branding and UI/UX customization

- Reporting and admin control depth

Tech Stack

Built using a JS-based architecture, ideal for modern fintech and rewards platforms that require secure data handling, scalable APIs, real-time user insights, mobile-first performance, and enterprise-level reliability.

Customization & White-Label Option

Building a CRED-style credit-management, rewards, and premium-finance platform is not just about letting users pay credit card bills — it’s about creating an elite, trust-centric financial ecosystem where exceptional UX, smart credit insights, exclusive rewards, and gamified engagement work together. A platform inspired by CRED must balance premium design with deep financial logic, including repayment tracking, credit score insights, reward redemption, offers management, and security at scale.

Miracuves delivers a fully white-label CRED-style solution that can be tailored for fintech brands, digital credit platforms, neobanks, reward ecosystems, or loyalty-driven finance apps. You control every layer — branding, scoring logic, UI/UX, partner ecosystem, and premium user experiences.

Why Customization Matters

CRED-like platforms heavily depend on:

- Credit score data sources

- Bill-fetching/payout integrations

- Rewards/loyalty mechanisms

- Affluent or credit-qualified user targeting

- Merchant partnerships & offers

- Gamification and habit-building psychology

Customization ensures your platform fits your market, your data sources, and your brand positioning, instead of a generic credit-app layout.

What You Can Customize

1. UI/UX & Experience Design

- Ultra-premium UI similar to CRED’s design philosophy

- Animated dashboards, spending insights, reward journeys

- Light/dark minimalist themes, gradients, branded typography

- Animated transitions, card-style layouts, micro-interactions

2. Credit Card Bill Payment Layer

- Card bill fetching (region-dependent)

- Automated reminders for due dates

- Smart repayment suggestions (full/partial/custom)

- Multi-card management with alerts & insights

3. Credit Score Monitoring & Insights

- Credit score fetching (where supported by bureaus)

- Monthly score updates

- Breakdown of factors affecting score

- Tips to improve credit health

- Risk indicators & personalized recommendations

4. Rewards, Cashback & Loyalty Engine

- Reward coins/points for timely bill payment

- Exclusive offers, discounts, partner rewards

- Spin wheel / gamification elements

- Tier-based loyalty system

- Personalized reward feed based on user activity

5. Payments, Wallets & Settlement

- Card, bank, ACH/UPI, or payment-gateway–based bill payments

- Wallet logic for rewards or cashback

- Settlement rules for partners and merchants

- Transaction history with statements

6. User Account & Financial Insights

- Monthly spending analysis

- Card category insights (travel, dining, etc.)

- Budgeting tools, reminders, smart nudges

- Bill history and due-date tracking

7. Partner & Offer Ecosystem

- Merchant onboarding

- Affiliate or partner dashboards

- Dynamic offer placement

- Personalized deal recommendations

- Event-based rewards (festivals, milestones)

8. Security & Compliance

- Biometric login

- Encrypted transaction handling

- Fraud detection and velocity rules

- Audit trails and regulatory compliance

- Role-based access for internal teams

9. Integrations & Backend Systems

- Payment gateways

- Credit bureaus (region-dependent)

- Bank APIs

- Notification services

- CRM, analytics, and support systems

How Miracuves Handles Customization

- Requirement Mapping

We define your target user base (premium, credit-active, retail), your reward model, and your region’s card/payment requirements. - Architecture Planning

Modular setup: onboarding → credit layer → bill-payment engine → rewards → offers → analytics. - Design & Development

Premium UI, smooth interactions, reward logic, partner ecosystem, and financial flows tailored to your vision. - Testing & Quality Assurance

Payment flow testing, score-fetch accuracy, reward systems checks, performance tuning, and security audits. - Deployment

A fully white-labeled credit & reward ecosystem delivered with your branding, domain, and operational setup.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech and loyalty-driven platforms, including:

- Credit score + rewards ecosystems

- Bill payment platforms with gamified engagement

- Loyalty marketplaces with tiered reward systems

- Neobank + credit hybrid products

- Premium financial dashboards inspired by CRED’s UX

These deployments show how a CRED-style concept can evolve into a slick, trusted, and high-engagement financial rewards platform for your brand.

Launch Strategy & Market Entry

Launching a CRED-style platform requires far more than going live on an app store — it demands a carefully crafted fintech launch blueprint. Your app must be compliant, fast, reward-rich, and ready to onboard users who expect a premium financial experience. A strategic launch ensures strong early retention, smooth merchant partnerships, and healthy payment volumes from day one.

Pre-Launch Checklist

Before launching your CRED Clone, ensure these essentials are fully tested:

- Credit bureau integration verification (CIBIL/Experian/CRIF)

- Full security audit + encrypted payment gateway setup

- Load testing for high-traffic billing cycles

- Marketplace partner onboarding

- Gamification logic validation (coins, rewards, jackpots)

- Push notification strategies for due reminders

- App Store & Play Store submission optimization

- Initial user acquisition campaign setup

Market Entry Strategy by Region

India (High credit user density)

- Focus on CIBIL integration

- Partner with D2C brands for rewards

- Introduce EMI + merchant cashback modules

Southeast Asia

- Integrate regional credit scoring APIs

- Build mobile-first reward flows

- Offer cross-border marketplace vouchers

Middle East

- Add wallet integration + Sharia-compliant modules

- Create premium loyalty tiers

Europe

- PSD2-compliant payment flows

- Focus on credit insights + premium rewards

User Acquisition Frameworks

A CRED-style app grows fastest through engagement-first marketing.

- Referral reward loops (coins, jackpots, vouchers)

- Influencer campaigns showing reward drops

- Cashback offers for first bill payment

- Weekly challenges to keep users active

- Smart, predictive reminders to reduce missed payments

Proven Monetization Models for 2026

- Marketplace commissions on brand deals

- Sponsored reward placements

- Premium subscription tiers (exclusive offers, early access)

- Data-driven partner insights

- Credit-line or BNPL integrations

- EMI conversion commissions

- Affiliate partnerships across travel, lifestyle, electronics

Miracuves’ End-to-End Launch Support

Miracuves ensures your CRED Clone is launch-ready, compliant, and optimized for user retention:

- Full server & cloud deployment

- Credit bureau + payment gateway setup

- Marketplace and partner ecosystem integration

- Real-time monitoring for the first 90 days

- Growth optimization with performance insights

This gives founders a powerful, secure, and frictionless launch experience.

Why Choose Miracuves for Your CRED Clone

Building a CRED-style platform is not just about developing another fintech app — it is about building credibility, trust, and long-term engagement. CRED’s success is rooted in premium experience, rewards psychology, and airtight security. Founders need a partner who understands this depth, and that’s why Miracuves stands out.

Miracuves builds production-grade fintech ecosystems using architectures optimized for high traffic, high security, and high retention. With 600+ successful deployments across fintech, lending, rewards, and digital wallets, Miracuves brings the technical maturity required to deliver a CRED-level experience — without the guesswork.

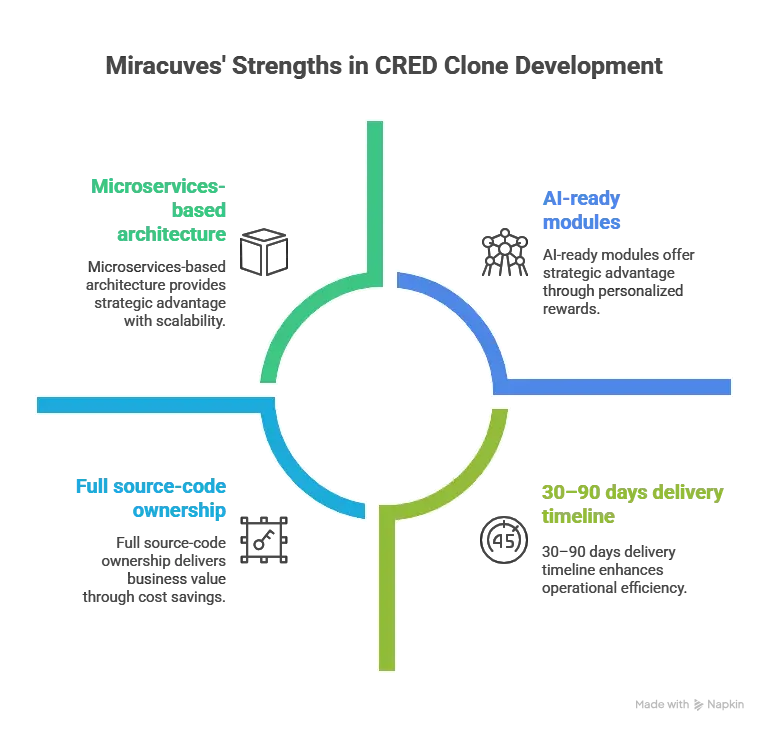

Miracuves’ Core Strengths

- 600+ successful deployments across fintech, banking, lending, and rewards ecosystems

- 30–90 days delivery timeline for complete, production-ready solutions

- Free 60-day post-launch support for optimization and performance stability

- Full source-code ownership — no subscriptions, no lock-in, no recurring licensing

- Microservices-based, future-proof architecture ready for global scaling

- AI-ready modules for personalized rewards, insights, and credit forecasting

- Bank-grade security with AES 256 encryption and tokenization

Founder Success Stories

- A premium credit rewards app grew to 150,000 users within 6 months after launching with Miracuves.

- A Southeast Asian fintech brand built an AI-driven rewards marketplace using Miracuves modules, increasing user retention by 38%.

- A Middle-East credit management app integrated POS-based reward earning, generating 3x merchant engagement within the first quarter.

Miracuves is not just a technology provider — it is a strategic growth partner. By combining engineering excellence with reward-driven UX design and fintech intelligence, Miracuves helps founders build products that users genuinely love.

Final Thought

A CRED-style app is more than a bill payment platform — it is a premium financial ecosystem built around trust, rewards, and user engagement. Entrepreneurs who understand CRED’s model gain a powerful opportunity to reshape how people manage credit, earn rewards, and interact with financial products.

In a rapidly evolving 2026 fintech landscape, the winners will be the brands that combine elegant UI/UX, secure payment flows, and personalized engagement engines. Miracuves empowers founders with advanced clone technology, predictable delivery timelines, and long-term scalability — ensuring your CRED Clone launches faster, grows smarter, and becomes a high-retention fintech asset.

With Miracuves, you’re not just building an app — you’re building a reward-driven financial brand designed to stand out in competitive markets.

Ready to launch your CRED Clone? Get a free consultation and a complete project roadmap from Miracuves — trusted by 200+ global entrepreneurs.

FAQs

How quickly can Miracuves deploy my CRED Clone?

Miracuves can deliver a fully production-ready CRED Clone within 30–90 days, depending on your required features, integrations, and customization level.

What’s included in the Miracuves CRED Clone package?

You receive a complete platform including bill payments, real-time credit score syncing, reward and gamification modules, marketplace setup, admin and partner dashboards, and all banking or bureau API integrations.

Do I get full source-code ownership?

Yes, Miracuves provides complete source-code ownership so you have total control over the platform with no recurring SaaS limitations.

How does Miracuves ensure security for a CRED-style app?

Security is ensured through AES-256 encryption, tokenization, secure payment vaults, biometric authentication, and multi-layered fraud detection systems.

Can Miracuves integrate credit bureau APIs like CIBIL or Experian?

Yes, Miracuves integrates CIBIL, Experian, CRIF, Equifax, and other regional bureaus based on where you plan to operate.

Does Miracuves assist with App Store and Play Store approval?

Yes, full assistance is provided including compliance checks, testing, metadata setup, and final submission to both app stores.

Is post-launch maintenance included?

Miracuves offers 60 days of free post-launch support that covers optimization, fixes, monitoring, and stability enhancements.

Can I customize the rewards and gamification system?

Yes, the entire rewards engine—including coins, jackpots, badges, spins, scratch cards, and partner offers—can be fully customized to match your brand’s engagement strategy.

What is the upgrade and update policy?

Miracuves supports continuous upgrades, adding new features, improving UI/UX, enhancing scoring engines, or scaling the platform whenever needed.

Can Miracuves integrate lending or BNPL modules into my CRED Clone?

Yes, lending products such as personal loans, BNPL, credit lines, and EMI conversion can be seamlessly added to expand your financial ecosystem.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Robinhood Clone Scripts 2026 — Build a Modern Trading App That Scales

- Best Afterpay Clone Scripts 2026: Launch a Powerful BNPL App for Your Fintech Startup

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Groww Clone Scripts 2026: Launch a Powerful Investment & Trading Platform Fast

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast