Ripple reshaped global finance by proving that real-time, low-cost international payments are possible without the delays and fees of traditional banking networks. By 2025, RippleNet handled billions in cross-border transaction value across banks, remittance companies, and global enterprises — showing a real demand for fast, blockchain-backed financial infrastructure.

In 2026, the global cross-border payments market crossed $200 trillion in annual volume, and the fastest-growing segment is digital-first, API-driven payment rails powered by automation, tokenization, and compliance engines. For entrepreneurs, creating a Ripple-style platform gives you access to a massive market gap — fast, transparent, low-cost cross-border transfers for SMEs, fintech apps, eCommerce merchants, freelancers, and global ecosystems.

Understanding the Ripple Clone model matters because it blends blockchain settlement, liquidity optimization, FX automation, AML/KYC compliance, and real-time messaging. These capabilities enable founders to launch cutting-edge payment platforms that rival traditional SWIFT networks in speed and efficiency.

A powerful Ripple Clone Script helps startups launch secure, scalable, and compliance-ready payment systems. With Miracuves Clone Solutions, you get the infrastructure, automation, and speed required to compete in global payments in 2026.

What Makes a Great Ripple Clone?

A great Ripple Clone in 2026 must function as a real-time global payment network, not just a crypto transfer app. Ripple’s breakthrough came from combining blockchain settlement with institutional-grade compliance, liquidity management, FX routing, and messaging protocols. Any platform aiming to match that performance must replicate these layers with precision.

Modern cross-border payment users — SMEs, freelancers, exporters, fintech apps, exchanges, and payment aggregators — expect instant transfers, transparent fees, strong compliance, and multi-currency support. They also expect a system that works 24/7, handles peak volumes, and secures their funds using multi-layer encryption. This means your Ripple Clone must deliver predictable performance, enterprise-grade security, and seamless API connectivity for partners.

In 2026, global payment platforms must support blockchain-backed settlement, tokenized liquidity, AI-driven AML checks, and real-time FX optimization. To achieve this, your platform needs microservices architecture, high-throughput nodes, robust KYC layers, and sub-300ms API performance — all core factors that separate great payment platforms from basic crypto tools.

Key Elements of a Great Ripple Clone (2026)

- Real-time cross-border settlement

- On-chain + off-chain transaction routing

- Tokenized liquidity management

- Multi-currency wallet and FX automation

- AI-driven AML/transaction monitoring

- Enterprise-grade encryption and security

- Scalable microservices backend

- Compliance-ready user onboarding

- Smart routing for fast and low-cost transfers

- Seamless partner API integrations

Comparison Table: Modern Ripple Clones and Their Differentiators

| Feature Category | Basic Crypto Transfer App | Advanced 2026 Payment App | Miracuves Ripple Clone Script |

|---|---|---|---|

| Settlement Speed | Minutes | Seconds | Real-time (Ripple-style) |

| Compliance | Limited | Standard KYC | Full AML/KYC + monitoring |

| Liquidity | Manual | Partial | Tokenized liquidity engine |

| FX System | None | Basic | Smart FX routing + automation |

| Throughput | 5K–20K TPS | 50K TPS | High throughput architecture |

| Uptime | 98% | 99.5% | 99.9% enterprise uptime |

| Security | Basic | AES-256 | Multi-layer bank-grade encryption |

| Integrations | Limited | Moderate | Full ecosystem APIs |

| Scalability | Low | Medium | Multi-million user support |

Essential Features Every Ripple Clone Must Have

A Ripple-style platform is fundamentally a global financial infrastructure product. It must operate flawlessly across borders, currencies, institutions, and regulatory environments. This means your Ripple Clone must combine blockchain-level settlement, payment routing intelligence, bank-grade compliance, and enterprise-grade APIs into one seamless system.

Users — whether individuals, SMEs, enterprises, or fintech apps — expect instant transfers, transparent fees, secure wallets, and predictable settlement. Partners expect robust APIs, stable uptime, and compliant transaction flows. Regulators expect airtight KYC, AML, and reporting. A great Ripple Clone must satisfy all three simultaneously.

Below is a breakdown of the essential features your platform must include across the user, admin, and liquidity/settlement layers.

User-Side Features

Users need fast, transparent, and intuitive ways to move money internationally.

- Multi-currency wallet with instant balance updates

- Real-time cross-border payments

- Transparent fee breakdown before transfer

- High-speed QR and link-based transfers

- Transaction receipts and full audit histories

- Integrated KYC onboarding

- Push notifications and live transfer tracking

- Support for fiat, stablecoins, and crypto pairs

Admin Panel Features

Admins must control system integrity, compliance, liquidity, and routing.

- Full KYC/AML/CTF compliance dashboard

- Real-time transaction monitoring

- Smart routing engine configuration

- FX and liquidity management

- Risk scoring and fraud detection

- Dispute management and chargeback tools

- API partner management

- Reporting for regulators and internal auditing

- Treasury management overview

Liquidity & Settlement Engine Features

This is the core that allows a Ripple Clone to function at scale.

- Tokenized liquidity pools

- On-chain and off-chain settlement channels

- Smart FX engine for multi-currency optimization

- Auto-rebalancing liquidity across corridors

- Stablecoin and fiat bridge connectors

- High-speed validator or node integration

- Predictive liquidity forecasting

- Batch and real-time settlement options

Advanced Features for 2026

Modern global payment rails require intelligence, automation, and global readiness.

- AI-driven AML and behavioral transaction monitoring

- Biometric authentication for sensitive transactions

- Tiered user verification and dynamic limits

- Cross-border B2B invoicing and settlement

- Stablecoin rails for instant global remittances

- Blockchain explorer for transparency

- Partner APIs for banks, PSPs, and fintech apps

- Multi-language, multi-region compliance templates

Technical Architecture Requirements

A high-volume global payment system must be robust, secure, fast, and compliant.

- Microservices backend for scaling individual payment components

- Event-driven architecture for instant settlement updates

- High-throughput blockchain or consensus layer

- AES-256 encryption + tokenization for sensitive data

- 99.9% uptime with multi-region failover

- Sub-300ms API response time under load

- Multi-node redundancy for transaction validation

- Secure third-party integrations (banks, PSPs, FX providers)

Feature Comparison Table: Basic vs Professional vs Enterprise

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| Cross-Border Transfers | Yes | Faster routing | Real-time Ripple-style |

| Compliance | Basic KYC | Enhanced | Full AML + behavioral monitoring |

| Wallet | Fiat | Fiat + Crypto | Multi-currency + stablecoins |

| FX Engine | None | Basic | Smart routing FX automation |

| Liquidity | Manual | Partial | Tokenized liquidity pools |

| Transaction Throughput | Medium | High | Very High (enterprise-grade) |

| Integrations | Limited | API support | Full banking & PSP integrations |

| Scalability | Up to 100K users | Up to 1M | Multi-million global |

How Miracuves Implements These Features

Miracuves engineers Ripple-style platforms using:

- A modular settlement engine

- AI-powered compliance monitoring

- Smart routing and FX automation

- Tokenized liquidity architecture

- Full API ecosystem for partners

- Cloud-native scaling

- End-to-end encryption and security

- Delivery timelines within 30–90 days

- Full source-code ownership for long-term independence

Cost Factors & Pricing Breakdown

Ripple-Like Blockchain Payments & Cross-Border Settlement Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Blockchain Payments MVP | Wallet integration, basic ledger interaction, transaction initiation, settlement tracking, and a simple admin panel. | $90,000 |

| 2. Mid-Level Cross-Border Payments Platform | Multi-currency support, liquidity routing logic, real-time settlement tracking, partner integrations, notifications, and analytics dashboards. | $200,000 |

| 3. Advanced Ripple-Level Platform | On-demand liquidity engine, multi-corridor settlement, institutional APIs, compliance automation, monitoring tools, and enterprise-grade scalability. | $380,000+ |

These figures represent the typical global investment required to build a blockchain-based cross-border payments platform similar to Ripple, designed for fast, low-cost international settlements.

Miracuves Pricing for a Ripple-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete blockchain payments foundation with wallet connectivity, transaction and settlement workflows, liquidity-ready architecture, compliance-oriented controls, and a centralized admin dashboard — built for scalable cross-border and institutional payment use cases.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded Ripple-style blockchain payments platform under your own ownership.

Launch Your Ripple-Style Cross-Border Payments Platform — Contact Us Today

Delivery Timeline for a Ripple-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Supported currencies and corridors

- Blockchain network and ledger integrations

- Liquidity and settlement logic complexity

- Compliance, KYC, and regulatory requirements

- Institutional API and reporting depth

- Branding and UI/UX customization

Tech Stack

Built using a JS-based architecture, ideal for blockchain payments and settlement platforms that require secure transaction handling, scalable APIs, real-time settlement tracking, and enterprise-level reliability.

Customization & White-Label Option

Building a Ripple-style blockchain payment and cross-border settlement platform is not just about using crypto rails — it’s about engineering a fast, secure, enterprise-grade financial network capable of real-time global transfers, liquidity management, tokenization, and partner bank integrations. A platform inspired by Ripple must balance blockchain efficiency with compliance, institutional trust, and interoperability across financial systems.

Miracuves delivers a fully white-label Ripple-style solution built for fintech institutions, banks, remittance companies, payment processors, and digital-asset platforms looking to launch their own real-time cross-border payment network. You gain complete control over branding, blockchain logic, liquidity models, corridor setups, and regulatory alignment.

Why Customization Matters

Cross-border payment infrastructure varies significantly by:

- Regulatory frameworks (crypto vs. fiat vs. hybrid models)

- Liquidity requirements

- Partner bank integrations

- Settlement speed and security rules

- Tokenization needs (stablecoins, institutional tokens, asset-backed tokens)

- Corridor-specific constraints (country → country)

Customization ensures your Ripple-style network fits your compliance zone, your currency system, and your partner ecosystem — not a generic blockchain product.

What You Can Customize

1. Blockchain Layer & Settlement Engine

- Permissioned or semi-permissioned blockchain setup

- High-throughput transaction engine

- Real-time settlement capabilities

- Transaction finality timers

- Ledger rules and consensus parameters

- On-chain vs. off-chain logic for speed optimization

2. Tokenization & Digital Asset Models

- Stablecoin issuance (fiat-backed, asset-backed, regional stablecoins)

- Enterprise tokens for liquidity management

- Settlement tokens for financial institutions

- Custom governance logic

- Mint/burn workflows and treasury controls

3. Liquidity & Bridge Mechanisms

- Automated market-making logic

- Liquidity pools for FX conversion

- Institution-to-institution settlement channels

- Multi-pool routing for cost-efficient transactions

- Dynamic fee and slippage rules

4. Cross-Border Corridor Setup

- Country-specific routes

- Bank/operator onboarding

- Compliance checks per corridor

- Local currency pairs and FX logic

- Configurable settlement cycles

5. Compliance, KYC & AML Systems

- User and institution onboarding flows

- Document verification

- AML transaction monitoring

- Sanctions & blacklist screening

- Audit logs & regulatory reporting

6. Payment Gateway & API Integrations

- Bank APIs (ACH, SEPA, UPI, SWIFT alternatives depending on region)

- Remittance partners

- Wallets and custodial systems

- Developer-friendly REST APIs

- Webhooks for transaction events

- SDKs for web, iOS, and Android

7. Wallet & Custody Modules

- Multi-asset wallet

- Retail and institutional wallet dashboards

- Secure key management

- Role-based permissions

- Multi-sig & custodial options

8. Security, Governance & Monitoring

- Node permissioning

- Access control lists

- DDoS protection

- Fraud detection & anomaly scoring

- End-to-end encryption

- Full compliance audit trail

9. Dashboards & Ecosystem Tools

- Real-time transaction monitoring

- Bank/institution partner dashboards

- Liquidity status and utilization panels

- Settlement reports, reconciliation tools

- Fee analytics & route optimization

10. Monetization & Business Models

- Partner integration fees

- Per-transaction settlement fees

- Liquidity provisioning revenue

- White-label licensing for partners

- Institutional membership tiers

How Miracuves Handles Customization

- Requirement Discovery

We analyze your cross-border payment vision, crypto/fiat blend, compliance region, and liquidity model. - Architecture & Blockchain Planning

Core setup: blockchain layer → settlement engine → liquidity pools → compliance → dashboards → APIs. - Design & Development

Token logic, payment flows, consensus rules, dashboards, and integrations implemented per your roadmap. - Testing & Validation

Stress testing, transaction-speed analysis, liquidity simulations, AML compliance testing, and security audits. - Deployment

A fully white-labeled Ripple-style payment network deployed with nodes, dashboards, smart contracts, and bank-ready APIs.

Real Examples from Miracuves Portfolio

Miracuves has delivered 600+ fintech, blockchain, and cross-border payment platforms, including:

- Crypto + fiat hybrid remittance networks

- Institutional settlement engines

- Tokenized liquidity platforms

- High-speed payment solutions for regulated markets

- White-label blockchain financial ecosystems

These implementations show how a Ripple-style concept can be transformed into a secure, compliant, and globally scalable payment infrastructure fully owned and branded by your business.

Read More : What Is Ripple and How Does It Work?

Launch Strategy and Market Entry

Launching a Ripple-style platform is not just a tech deployment, it is the rollout of financial infrastructure. If you launch without the right corridors, partners, and compliance groundwork, you risk delays, blocked transactions, and low trust. A smart launch strategy turns your Ripple Clone into a focused, revenue-generating cross-border payment network instead of a generic crypto app.

The most effective way to go live is in phases: start with limited corridors and user segments, validate flows end to end, then expand liquidity, partners, and coverage.

Pre-launch checklist

Before you move a single live dollar through the system, your payment rails must be stable, secure, and compliant.

- Complete functional testing for wallet, transfers, refunds, and settlement flows

- Run high-volume load tests for peak-time cross-border traffic

- Configure KYC flows and document checks for senders and recipients

- Integrate AML and transaction monitoring rules with alert thresholds

- Set up FX routes and liquidity pools for the first corridors

- Validate fee logic and final settlement amounts in both currencies

- Prepare production-grade cloud infrastructure with monitoring and alerts

- Implement audit logging for all critical actions and transactions

- Align legal documentation: terms, privacy, compliance, and corridor-specific disclosures

Regional and corridor entry strategies

Corridor selection is a strategic decision. Start where demand is high, regulations are clear, and partners are accessible.

Asia–GCC and Asia–US

- Target SME exporters, freelancers, and IT services companies

- Focus on fast settlement and better FX compared to banks

- Partner with local banks, exchange houses, or PSPs for fiat on/off ramps

Europe–US and intra-EU

- Emphasize compliance, traceability, and regulatory reporting

- Offer API-led solutions for fintechs, payroll platforms, and marketplaces

- Integrate open banking where applicable to improve onboarding and risk checks

Africa–Europe and Africa–GCC

- Serve remittance-heavy corridors and SME trade flows

- Provide simple, mobile-friendly interfaces with transparent fees

- Work with mobile money operators, regional PSPs, and banks for last-mile delivery

LatAm–US and LatAm–Europe

- Position as a low-fee, fast alternative to traditional remittance and bank wires

- Focus on freelancers, eCommerce exporters, and SaaS founders receiving global payments

- Offer stablecoin rails where regulations permit, to reduce FX friction

User acquisition frameworks

A Ripple Clone grows through both retail users and B2B partners. You should plan for both.

Retail and SME

- Educational campaigns explaining faster, cheaper cross-border transfers

- Referral programs for SMEs, freelancers, and agencies using your rails

- In-app calculators showing savings vs traditional bank transfers

- Localization of content and UI to match corridor languages and expectations

Partners and platforms

- Offer APIs for fintech apps, wallets, exchanges, and marketplaces to plug into your network

- Create simple partner onboarding kits with sandbox access and technical docs

- Attend and sponsor fintech, payments, and trade events in your target regions

- Provide revenue-share or FX spread share models for integrated partners

Monetization models that work in 2026

Global payment platforms thrive on volume and margin, so your model must be clear from day one.

- FX spread on each cross-currency transaction

- Per-transaction fees for B2B payments and treasury operations

- Subscription or platform fees for API partners and enterprises

- Premium services such as priority settlement, dedicated corridors, or enhanced reporting

- Stablecoin on/off-ramp fees where supported

- White-label network fees for banks, PSPs, and remittance brands using your rails

How Miracuves supports your launch end to end

Miracuves does not just hand over a Ripple-style codebase; it helps you execute a controlled, corridor-focused launch.

- Infrastructure and deployment setup for high-availability environments

- Assistance integrating KYC, AML, FX, liquidity, and bank or PSP APIs

- Configuration of corridors, limits, transaction rules, and fee structures

- Support for staging and pilot phases with limited users or partners

- Monitoring and performance tuning during the first live weeks

- Recommendations on analytics dashboards to track volume, failures, FX margins, and risk signals

With a Miracuves-powered Ripple Clone and a structured 30–90 day launch plan, founders can move from concept to a live, corridor-tested cross-border payment network while keeping risk controlled and growth pathways clear.

Why Choose Miracuves for Your Ripple Clone

When you build a Ripple-style platform, you are not just launching another app. You are building financial infrastructure that businesses, partners, and regulators will rely on. One misrouted payment, one frozen settlement, or one compliance failure can damage trust quickly. That is why your technology partner must understand real-world payments, not just blockchain or generic app development. Miracuves is built for founders who want to operate at that level from day one.

Instead of experimenting with unproven architectures, you get a Ripple Clone foundation that has been shaped through experience across lending, BNPL, neobank, and payment ecosystems. The Miracuves approach focuses on stability, speed, security, and configurability so that your network can handle real corridor traffic, complex compliance rules, and partner integrations without constant firefighting.

Key Strengths of Miracuves for Ripple Clone Development

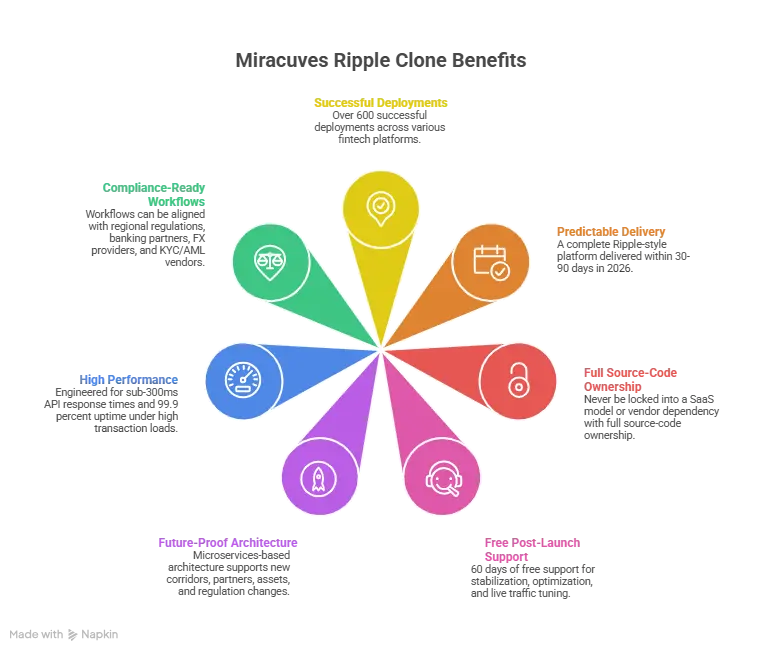

- 600 plus successful deployments across fintech, payments, lending, BNPL, and neobank platforms

- Predictable 30–90 day delivery window for a complete, production-ready Ripple-style platform in 2026

- Full source-code ownership so you are never locked into a SaaS model or vendor dependency

- 60 days of free post-launch support for stabilization, optimization, and live traffic tuning

- Microservices-based, future-proof architecture designed to support new corridors, partners, assets, and regulation changes

- Performance engineered for sub-300ms API response times and 99.9 percent uptime under high transaction loads

- Compliance-ready workflows that can be aligned with your regional regulations, banking partners, FX providers, and KYC/AML vendors

Short Success Stories and Transformations (Style Examples)

A SME-focused Asia–GCC payment corridor

A fintech founder wanted to simplify payments for SMEs exporting goods from Asia to the GCC region. Miracuves deployed a customized Ripple-style engine focused on INR–AED and other key pairs, with corridor-specific KYC tiers and transparent FX routing. Within months, SMEs using the platform reduced settlement times from several days to near real-time and gained clearer visibility on FX costs.

A freelancer payout and marketplace network

A digital marketplace needed a way to pay thousands of freelancers across multiple countries with fewer delays and lower fees. Miracuves tailored its Ripple Clone framework to support mass payouts, local currency delivery, and stablecoin options where allowed. With a single API integration, the marketplace could route global payouts through a unified settlement layer, cutting operational overhead and improving freelancer satisfaction.

A B2B treasury payment platform for exporters

An export-focused business group required a reliable way to manage supplier payments, invoices, and FX exposure across multiple regions. Miracuves adapted its Ripple-style stack to include bulk payment uploads, invoice-linked settlements, and treasury dashboards showing currency exposure and corridor performance. The result was a structured, data-driven payment rail that replaced fragmented bank wires and manual tracking.

Final Thought

Cross-border payments are undergoing the biggest transformation in decades. Traditional bank wires are slow, expensive, and unpredictable — but global businesses, freelancers, exporters, and digital platforms can no longer wait days for settlement. This is why Ripple’s model became so influential: it proved that international money movement can be instant, transparent, and cost-efficient when powered by the right technology.

For entrepreneurs, 2026 presents a rare opportunity. The demand for fast global payouts is exploding — from SMEs exporting internationally, to marketplaces paying global talent, to fintech apps needing unified settlement rails. A Ripple Clone gives you a powerful shortcut into this market, offering the infrastructure required to compete with modern payment networks.

But the real advantage comes from how you execute. A cross-border payment system must be precise, compliant, scalable, and engineered for real-world volume. Miracuves provides all of these capabilities through its production-grade architecture, multi-corridor readiness, liquidity management system, and AI-assisted compliance flows. Instead of spending years building rails from scratch, you can go live within a structured 30–90 day window — with full source-code ownership and long-term scalability.

The future of global payments belongs to platforms that combine speed with trust. With Miracuves as your technology partner, you gain the foundation to launch confidently, expand across corridors, and shape a new generation of frictionless international payment experiences.

Launch your Ripple Clone with a trusted fintech engineering partner that understands global payments end to end. Get a free consultation and a detailed project roadmap from Miracuves, and move from concept to live payment corridors within a predictable 30–90 day window.

FAQs

How quickly can Miracuves deploy my Ripple Clone?

Miracuves can fully deploy a Ripple-style cross-border payment platform within a predictable 30–90 day timeline, including setup, corridor configuration, integrations, and compliance workflows.

What’s included in the Miracuves Ripple Clone package?

You receive a complete multi-currency wallet system, blockchain or hybrid settlement engine, liquidity module, FX automation, compliance dashboards, admin panel, APIs, documentation, and deployment support.

Do I get full source-code ownership?

Yes. Miracuves provides 100% full source-code ownership, giving you complete independence without vendor lock-ins or SaaS-style restrictions.

How does Miracuves ensure scalability for cross-border payment platforms?

Miracuves uses a microservices architecture, high-throughput settlement layer, auto-scaling cloud infrastructure, multi-region redundancy, and sub-300ms API performance to support multi-million user ecosystems.

Does Miracuves assist with regulatory compliance?

Miracuves provides compliance-ready workflows for KYC, AML, transaction monitoring, and reporting. Your legal advisors configure them according to corridor-specific regulations.

Can Miracuves integrate banks, PSPs, FX providers, or stablecoin rails?

Absolutely. Miracuves supports integrations with banks, payment service providers, FX engines, on/off-ramp partners, stablecoin issuers, and blockchain validators.

Is post-launch support included?

Yes. Miracuves offers 60 days of free post-launch support for optimization, performance tuning, monitoring, and addressing early live issues.

What is the upgrade and update policy?

Miracuves provides optional upgrades for new corridors, liquidity modules, compliance enhancements, AI fraud detection, and advanced treasury tools.

How does white-labeling work for the Ripple Clone?

Miracuves fully white-labels the platform with your branding, visual system, domain, mobile apps, emails, notifications, and partner portals — with no external branding visible.

What ongoing support can I expect after launch?

You can opt for extended support plans that include server monitoring, feature upgrades, API management, performance optimization, liquidity model enhancements, and corridor expansion assistance.

Related Articles

- Best Plaid Clone Scripts 2026 – Launch a High-Compliance Open Banking API Platform with Miracuves

- Best Brex Clone Scripts 2026: Launch a Next-Gen & Expense Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Afterpay Clone Scripts 2026: Launch a Powerful BNPL App for Your Fintech Startup

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Groww Clone Scripts 2026: Launch a Powerful Investment & Trading Platform Fast

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast