What began as a simple solution to help startups manage cap tables has grown Carta into a global equity management platform trusted by over 40,000 companies and millions of shareholders worldwide. In 2026 equity management is no longer a back-office task it is a strategic growth function powering fundraising ESOP compliance and investor trust. Startups scale faster when ownership data is accurate transparent and real time.

For entrepreneurs and SaaS founders the Carta clone model represents a massive opportunity. The global equity management and corporate governance software market crossed $6.5 billion in 2025 driven by startup formation ESOP adoption and increasing regulatory complexity. Investors now expect clean cap tables automated equity workflows and compliance-ready reporting before committing capital. With Carta Clone Development, founders can build platforms that serve startups VC firms accelerators and enterprises with precision and confidence. Miracuves helps entrepreneurs turn this proven model into a market-ready SaaS product using the Best Carta Clone Script 2026, engineered for security scalability and rapid deployment in 2026.

What Makes a Great Carta Clone?

A great Carta Clone in 2026 is not just a digital cap table it is a trusted source of truth for ownership compliance and investor confidence. Entrepreneurs building equity management platforms must focus on accuracy automation and audit readiness from day one. Startups investors and employees rely on these systems to make high-stakes decisions so performance security and data integrity are non-negotiable. A strong Carta Clone Development strategy combines legal-grade precision with SaaS-level usability.

Modern equity platforms are expected to operate with near-zero data errors, sub-300ms system response time, and 99.9 percent uptime to support fundraising rounds audits and real-time reporting without disruption. Security and compliance are core differentiators with encryption access controls and regulatory readiness built into the platform architecture. At Miracuves every Carta Clone Script is engineered to handle complex equity events while remaining scalable and easy to use for non-technical founders.

Core Qualities of a High-Performing Carta Clone in 2026

• Accurate real-time cap table management

• Automated equity issuance vesting and dilution tracking

• Compliance-ready ESOP and regulatory reporting

• Secure role-based access for founders investors and employees

• Scalable SaaS architecture for multi-company management

• Flexible subscription-based monetization

Must-Have 2026 Technologies in Carta Clone Development

AI automation reduces manual equity calculations flags compliance risks and simplifies audit preparation. Blockchain-backed record verification can be used to create immutable equity logs increasing transparency and trust. Cloud-native SaaS frameworks enable multi-tenant environments allowing accelerators VC firms and enterprises to manage thousands of entities efficiently.

Comparison Table: Modern Carta Clones vs Traditional Equity Tools

| Feature Area | Traditional Equity Tools | Modern Carta Clone by Miracuves |

|---|---|---|

| Cap Table Updates | Manual spreadsheets | Real-time automated updates |

| Compliance | Error-prone | Audit-ready and compliant |

| Performance | Inconsistent | Under 300ms response time |

| Security | Basic access | Role-based secure access |

| Scalability | Limited | Multi-tenant SaaS ready |

| Monetization | One-time licenses | Subscription SaaS model |

Essential Features Every Carta Clone Must Have

A modern Carta Clone in 2026 must function as a comprehensive equity intelligence platform rather than a static ownership ledger. Entrepreneurs and SaaS founders expect automated workflows investor-ready reporting and compliance assurance built into the system. Effective Carta Clone Development focuses on layered functionality that serves founders administrators investors and employees with equal precision while maintaining enterprise-grade security and scalability.

Founder and Company User Layer

For founders and finance teams the platform should simplify complex equity structures into clear actionable views. Real-time cap table visibility automated dilution modeling and scenario planning tools help leadership make informed decisions before fundraising or ESOP issuance. Ease of use is critical because equity management often involves non-technical users handling high-stakes data.

Key Founder Features

• Real-time cap table updates and ownership visualization

• Automated share issuance vesting and option tracking

• Fundraising scenario modeling and dilution forecasts

• ESOP plan creation and compliance monitoring

• Export-ready reports for investors and auditors

Admin and Platform Control Layer

The admin panel acts as the operational backbone of a Carta Clone. It enables system administrators and SaaS operators to manage multiple companies subscriptions permissions and compliance workflows efficiently. Miracuves builds admin dashboards that support automation analytics and scalability across thousands of client accounts.

Admin Capabilities

• Multi-tenant company management

• Role-based access control and permissions

• Subscription billing and plan management

• Compliance tracking and audit logs

• Platform-wide analytics and performance monitoring

Investor and Employee Access Layer

Investors and employees require transparency without complexity. Secure dashboards allow stakeholders to view holdings vesting schedules and equity value without exposing sensitive company controls. This transparency improves trust and reduces administrative overhead for founders.

Advanced 2026 Features

• AI-driven equity insights and compliance alerts

• Blockchain-backed immutable equity records

• Automated regulatory reporting and filings

• Multi-currency and jurisdiction support

• Secure API integrations with payroll legal and accounting systems

Technical Architecture Requirements

A production-ready Carta Clone must support sensitive financial data at scale. Miracuves uses cloud-native microservices encrypted databases secure APIs and automated backups to ensure sub-300ms response times and 99.9 percent uptime. The architecture is designed to scale across regions while maintaining strict data integrity and security controls.

Feature Comparison Table: Carta Clone Editions

| Feature Scope | Basic | Professional | Enterprise |

|---|---|---|---|

| Cap Table Management | Core features | Advanced modeling | Enterprise-grade controls |

| ESOP Management | Limited | Full ESOP workflows | Multi-jurisdiction ESOP |

| Reporting | Standard exports | Investor-ready reports | Audit and compliance reports |

| Security | Standard encryption | Advanced access control | Compliance and blockchain |

| Customization | Minimal | Moderate | Full white-label |

Miracuves integrates all these capabilities into its Best Carta Clone Script 2026, allowing entrepreneurs to launch quickly customize confidently and scale their equity management platform without rebuilding the core system.

Cost Factors & Pricing Breakdown

Carta-Like Platform Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Cap Table MVP | Company onboarding, shareholder records, equity issuance tracking, basic cap table views, admin dashboard | $40,000 – $60,000 |

| 2. Mid-Level Equity Management Platform | Advanced cap tables, vesting schedules, ESOP management, document storage, audit logs, reporting & analytics | $90,000 – $140,000 |

| 3. Advanced Carta-Level Platform | Compliance-ready equity workflows, 409A valuation support, investor portals, automation, enterprise security & scalability | $180,000+ |

Carta-Style Equity & Cap Table Management Platform Development

The above estimates reflect the global market cost of building an equity management and cap table platform like Carta.

Such platforms require high data accuracy, compliance-readiness, legal-grade security, auditability, and enterprise workflows, often resulting in 6–12 months of development with senior fintech and SaaS engineers.

Miracuves Pricing for a Carta-Like Custom Platform

Miracuves Price: Starts at $15,999

This pricing is ideal for a feature-rich, enterprise-ready equity management ecosystem, including cap table management, shareholder records, vesting logic, reporting dashboards, admin controls, and secure user roles—built for startups, enterprises, and investors alike.

Note:

This includes full non-encrypted source code (complete ownership), end-to-end deployment support, backend & API setup, admin panel configuration, and publishing support for the Google Play Store and Apple App Store (if required)—ensuring you receive a fully operational equity management platform ready for launch and long-term scale.

Planning to build a Carta-style cap table and equity management platform with full ownership and enterprise-grade foundations? Book a consultation today to get a clear, step-by-step roadmap tailored to your SaaS vision.

Delivery Timeline for a Carta-Like Platform with Miracuves

For a Carta-style, JavaScript-based custom build, the typical delivery timeline is 30–90 days, depending on:

- Complexity of cap table and vesting logic

- Compliance, audit, and reporting requirements

- Role-based access & investor portals

- Security, data integrity, and scalability needs

- UI/UX customization level

Tech Stack

We preferably use JavaScript for building the entire solution—leveraging Node.js / Next.js for backend & frontend, PostgreSQL for structured equity and compliance data, and Flutter or React Native for mobile access if required.

This ensures high performance, scalability, and a single unified codebase across platforms.

Other tech stacks or region-specific compliance customizations can be discussed during the consultation phase.

Customization & White-Label Options

Building a Carta-style equity management platform requires more than cap table tracking. Companies expect accuracy, compliance, transparency, and secure handling of highly sensitive ownership data. The platform must support the full equity lifecycle—from incorporation to fundraising, employee ownership, and exits—while remaining easy to use for founders, employees, and investors.

A fully white-label Carta-style solution can be customized to match your brand, target market, jurisdiction, and compliance requirements—whether you’re serving startups, law firms, venture funds, or enterprise equity programs.

Why Customization Matters

Equity management platforms operate at the intersection of legal, financial, and regulatory complexity. Businesses typically require:

- Accurate, real-time cap table management

- Support for multiple share classes and instruments

- Employee equity plans (ESOPs, RSUs, options)

- Investor and stakeholder access controls

- Compliance-ready reporting and audit trails

- Secure document storage and e-sign workflows

- Jurisdiction-specific legal and tax handling

- Admin tools for support, compliance, and reporting

Customization ensures the platform aligns with legal frameworks, company structures, and growth stages.

What You Can Customize

UI/UX & Branding

Custom dashboards for founders, employees, and investors, role-based views, and branded communications.

Cap Table & Equity Logic

Support for common and preferred shares, options, warrants, SAFEs, convertible notes, vesting schedules, and dilution modeling.

Employee Equity Management

Grant issuance, vesting tracking, exercise workflows, employee portals, and tax-related documentation.

Fundraising & Valuation Tools

Round modeling, scenario analysis, ownership dilution views, and valuation tracking.

Compliance & Reporting

409A support, jurisdiction-specific reports, audit trails, disclosures, and regulatory filings.

Document Management

Secure storage for legal documents, board approvals, shareholder agreements, and e-sign integrations.

Security & Access Control

Role-based permissions, encryption, activity logs, and data isolation.

Backend Integrations

Payroll systems, HR platforms, accounting tools, legal software, identity providers, and analytics.

Monetization Add-Ons

Subscription plans, per-entity pricing, premium compliance tools, fund administration features, and advisory services.

How We Handle Customization

- Requirement Analysis

Identify target users, jurisdictions, equity structures, and compliance obligations. - Sprint Planning

Break delivery into phases—from core cap table management to advanced compliance and fund tools. - Design & Development

Build equity logic, workflows, dashboards, reporting engines, and admin controls. - Testing & QA

Validate calculations, legal edge cases, access controls, and security. - Deployment

Launch a fully branded equity management platform with user portals, admin dashboards, compliance reporting, and support workflows.

Real Examples for a Carta-Style Platform

- Startup equity and cap table management platforms

- Employee stock ownership and option management tools

- Venture fund portfolio and LP reporting systems

- Law-firm-focused equity and compliance platforms

- Enterprise equity administration solutions

Launch Strategy & Market Entry for a Carta Clone

Launching a Carta Clone in 2026 requires a trust-first go-to-market strategy. Equity management platforms deal with sensitive ownership data legal compliance and investor confidence so a rushed or poorly planned launch can damage credibility. Entrepreneurs who approach launch as a structured rollout phase rather than a one-day release typically gain early enterprise traction within 30 to 90 days. Miracuves supports founders with both technical readiness and strategic market entry planning.

Pre-Launch Readiness Checklist

Before going live the platform must be validated for accuracy security and compliance. Equity calculations vesting logic and reporting must be thoroughly tested to avoid errors. Legal documentation data privacy policies and regulatory alignment should be finalized to ensure smooth onboarding for startups and investors.

Critical Pre-Launch Actions

• End-to-end testing of cap table and ESOP logic

• Security audits and data encryption verification

• Compliance alignment with regional regulations

• SaaS billing and subscription setup

• App hosting monitoring and backup systems

Target Market Entry Strategies

Market entry varies depending on the customer segment. Startups and early-stage founders respond well to simple pricing transparent workflows and education-led onboarding. VC firms and accelerators prioritize portfolio-level visibility reporting automation and data accuracy. Enterprise clients focus on compliance audit readiness and integrations with legal and payroll systems. Miracuves builds Carta Clone Scripts that support all these segments without code rewrites.

Customer Acquisition Frameworks That Work in 2026

Thought leadership and trust-based marketing are key for equity platforms. Content explaining ESOP compliance fundraising readiness and cap table best practices builds credibility. Partnerships with startup communities incubators and legal firms accelerate adoption. Referral-driven onboarding through VCs and accelerators often leads to high-value long-term clients.

Monetization Models Proven for Carta Clones

Subscription-based SaaS pricing remains the most effective model. Tiered plans for startups scale-ups and enterprises allow predictable recurring revenue. Add-on services such as ESOP consulting compliance reporting and advanced analytics increase ARPU and retention.

Miracuves End-to-End Launch Support

Miracuves assists founders with infrastructure deployment security validation compliance readiness and onboarding workflows. Each client receives a structured 30 to 90 days launch and growth roadmap covering customer acquisition onboarding optimization and platform scaling. This ensures founders can focus on partnerships and sales while Miracuves manages the technical foundation.

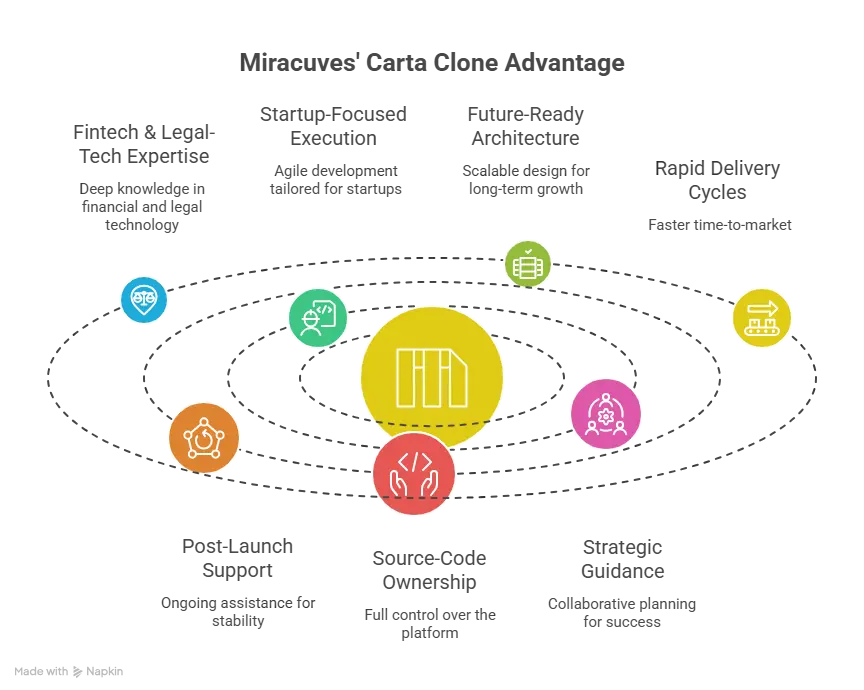

Why Choose Miracuves for Your Carta Clone

Choosing the right technology partner is one of the most important decisions when building a Carta Clone. In 2026 equity management software demands absolute accuracy regulatory awareness and enterprise-grade reliability. Miracuves stands out because it goes beyond development delivery and acts as a long-term product partner helping founders build trust-driven SaaS platforms that scale and generate recurring revenue within 30 to 90 days.

Miracuves combines deep fintech and legal-tech expertise with startup-focused execution. Every Carta Clone Development project is built on a future-ready architecture designed to handle complex equity events compliance workflows and multi-tenant SaaS scaling. This approach has helped entrepreneurs move from concept to live equity management platforms faster and with greater confidence than traditional development routes.

What Makes Miracuves a Trusted Partner for Entrepreneurs

• 600+ successful deployments across fintech SaaS and compliance-driven platforms

• Rapid delivery cycles enabling faster market entry

• Free 60 days post-launch support for stability and optimization

• Complete source-code ownership with no licensing restrictions

• Secure scalable architecture built for long-term SaaS growth

Entrepreneurs working with Miracuves often gain early momentum because the platform is engineered with monetization compliance and enterprise trust in mind. One founder launched a Carta-style SaaS for startups and accelerators and secured paying clients within 30 to 90 days. Another built a region-specific equity compliance platform for enterprises and achieved operational breakeven in the first quarter after launch.

Miracuves believes in partnership not one-time delivery. Founders receive strategic guidance on feature prioritization pricing models compliance planning and scaling decisions throughout the journey. This collaborative approach ensures your Carta Clone evolves with regulatory changes market demands and customer expectations while remaining competitive in the equity management space.

Final Thought

Building a successful Carta Clone in 2026 is about far more than recreating cap table software it is about enabling trust transparency and confidence at every stage of a company’s growth. Equity management sits at the intersection of fundraising compliance and stakeholder relationships, and platforms that get this right become deeply embedded in their customers’ operations. Entrepreneurs who understand Carta’s core business logic gain a powerful advantage in creating SaaS products with high retention and long-term value.

With Miracuves Clone Solutions, founders can transform this complex equity management model into a scalable compliant and market-ready platform without the usual technical and regulatory hurdles. By combining robust architecture automation and expert execution, Miracuves empowers entrepreneurs to launch faster adapt to regulatory change and scale smarter achieving meaningful traction and recurring revenue within 30 to 90 days.

Ready to launch your Carta clone ? Get a free consultation and a detailed project roadmap from Miracuves trusted by 200+ entrepreneurs worldwide.

FAQs

How quickly can Miracuves deploy my Carta clone

Miracuves delivers a production-ready Carta Clone built for accuracy compliance and scalability, with founders typically achieving customer onboarding and revenue traction within 30 to 90 days depending on customization and launch strategy.

What’s included in the Miracuves Carta clone package

The package includes real-time cap table management ESOP workflows investor dashboards compliance-ready reporting admin controls subscription billing and secure SaaS infrastructure.

Do I get full source-code ownership

Yes Miracuves provides complete source-code ownership allowing full control customization and future expansion without vendor lock-ins.

How does Miracuves ensure data accuracy and scalability

Miracuves uses automated equity calculations validation checks cloud-native microservices encrypted databases and load balancing to maintain performance and data integrity at scale.

Does Miracuves support regulatory compliance and audits

Yes Miracuves builds compliance-ready systems and supports audit trails ESOP regulations and regional reporting requirements.

Is post-launch support included

Yes every Carta Clone project includes 60 days of free post-launch support covering monitoring optimization and issue resolution.

Can Miracuves integrate legal payroll or accounting systems

Miracuves supports API integrations with legal payroll accounting and HR platforms to streamline equity operations.

What is the upgrade and update policy

The platform supports modular upgrades allowing new features compliance updates and performance improvements without downtime.

How does white-labeling work

White-labeling removes all Miracuves branding enabling founders to launch under their own SaaS brand domain and identity.

What ongoing support options are available

After the initial support period Miracuves offers flexible maintenance and growth plans including compliance updates scaling support and feature evolution.

Related Articles