In just over a decade, business model of Nubank transformed a two-founder Brazilian startup into one of the largest independent digital banks in the world, serving 80+ million customers across Latin America and Europe by 2025. Its rise redefined what banking could look like — not as a legacy institution weighed down by branches and bureaucracy, but as a customer-first digital platform with minimal friction, transparent pricing, and hyper-efficient tech.

Nubank’s journey from startup to unicorn, and then to global publicly-traded fintech, underscores a powerful trend: financial services can be reinvented when mobile-first design, data-driven engagement, and platform economics converge.

For entrepreneurs building platforms today — whether in fintech, marketplace apps, or SaaS — Nubank’s business model offers a masterclass in customer acquisition at scale, long-term monetization without traditional fees, and ecosystem expansion through embedded finance.

How the Nubank Business Model Works

Nubank operates on a digital-first, low-cost, high-engagement banking platform model designed to acquire users at scale first, then monetize them progressively over time. Unlike traditional banks that lead with fees and products, Nubank leads with trust, simplicity, and experience — and turns that into long-term financial relationships.

At its core, Nubank is not just a “digital bank.” It’s a financial services platform that layers multiple products on top of a single, deeply engaged customer base.

Business Model Overview

Type of Model

- Hybrid Fintech Platform

- Digital banking

- Freemium + product-led growth

- Embedded finance ecosystem

- Cross-selling–driven monetization

- Digital banking

This hybrid approach allows Nubank to behave more like a tech company with a banking license than a traditional financial institution.

Value Proposition (by User Segment)

For Consumers

- Zero or low-fee accounts and credit cards

- Intuitive mobile-first experience

- Transparent pricing with no hidden charges

- Fast onboarding (minutes, not days)

- Humanized, high-NPS customer support

For Nubank (the Platform)

- Extremely low customer acquisition costs (CAC)

- High engagement via daily-use financial products

- Rich first-party financial data

- Long customer lifetime value (LTV)

- Strong brand advocacy and referrals

For Partners & Merchants

- Access to millions of active users

- Embedded credit, payments, and financial tools

- API-driven integrations

- Distribution without building banking infrastructure

Key Stakeholders in the Ecosystem

- Customers → Use core banking, credit, and investment products

- Regulators → Enable trust, compliance, and expansion across regions

- Technology Teams → Build scalable, cloud-native infrastructure

- Partners → Power payments, investments, insurance, and rewards

- Investors → Fuel growth and geographic expansion

Maintaining balance between regulatory rigor and startup agility is one of Nubank’s defining strengths.

Evolution of the Model

Nubank’s model evolved in clear, strategic phases:

- Single Product Focus

- Launched with a no-fee credit card to attack incumbents

- Launched with a no-fee credit card to attack incumbents

- Core Banking Expansion

- Added digital accounts, payments, and transfers

- Added digital accounts, payments, and transfers

- Monetization Layering

- Introduced lending, installments, insurance, and investments

- Introduced lending, installments, insurance, and investments

- Platform & Ecosystem Phase

- Embedded finance, marketplace products, and regional scaling

- Embedded finance, marketplace products, and regional scaling

Each phase was built on existing user trust, not aggressive upselling.

Why Nubank’s Model Works in 2026

Nubank thrives today because it aligns perfectly with current market realities:

- Consumers expect mobile-first, instant financial services

- Trust in traditional banks remains fragile in emerging markets

- AI-driven personalization improves credit and risk models

- Open banking and APIs enable faster ecosystem expansion

- Cost efficiency matters more than physical presence

In 2026, Nubank’s model proves that owning the customer relationship is more valuable than owning branches.

Read more : What is Nubank and How Does It Work?

Target Market & Customer Segmentation Strategy

Nubank’s growth didn’t come from chasing “everyone” at once. It came from deeply understanding underserved segments, winning their trust, and then expanding outward. Its segmentation strategy is behavioral, not just demographic — focusing on financial pain points, digital readiness, and trust gaps.

Primary & Secondary Customer Segments

Primary Segments

1. Mass-Market & Underbanked Consumers

- Age: 18–45

- Middle-income, urban and semi-urban users

- First-time or frustrated bank customers

- High mobile usage, low patience for bureaucracy

Why they stay

- No-fee structure

- Clear communication

- Easy credit access

- Feeling “respected” by a financial institution

2. Digital-Native Professionals

- Salaried employees, freelancers, gig workers

- Regular monthly inflows

- Credit-hungry but risk-aware

Why they stay

- Fast credit approvals

- Installment flexibility

- Smart spend tracking and insights

Secondary Segments

3. SMB Owners & Micro-Entrepreneurs

- Use Nubank accounts for cash flow management

- Require working capital and payment tools

4. Affluent & Premium Users (Emerging Segment)

- Higher balances and investments

- Premium cards and advisory features

- Long-term monetization focus

Customer Journey: From Discovery to Retention

1. Discovery

- Word-of-mouth and referrals (major growth driver)

- App store visibility

- Social proof and influencer credibility

- Anti-bank positioning in marketing

2. Onboarding

- 100% mobile sign-up

- Approval in minutes

- No paperwork, no branch visits

3. Activation

- First transaction (card swipe, transfer, bill pay)

- Personalized nudges and in-app education

4. Retention

- Daily-use features (payments, balances, insights)

- Proactive notifications

- Human-centered customer support

5. Monetization

- Credit products

- Installment plans

- Insurance, investments, and premium services

Acquisition Channels & LTV Optimization

Key Acquisition Channels

- Referral loops (friend invites)

- Organic social buzz

- App store optimization

- Content-driven trust building

Lifetime Value Optimization

- Gradual product layering

- Behavioral-based credit scoring

- Personalized offers instead of blanket promotions

- Long-term relationship mindset (10–20 year customer view)

Market Positioning & Competitive Edge

Nubank positions itself as:

“The financial institution that works for you — not against you.”

Differentiation Strategies

- Radical transparency

- Anti-fee, anti-complexity messaging

- Tech-first execution

- Strong emotional brand connection

Market Standing (2026)

- Category leader in digital banking across Brazil

- Strong growth in Mexico and Colombia

- Expanding footprint beyond core Latin America markets

Its brand voice is friendly, human, and empowering — a stark contrast to traditional banks’ formal tone.

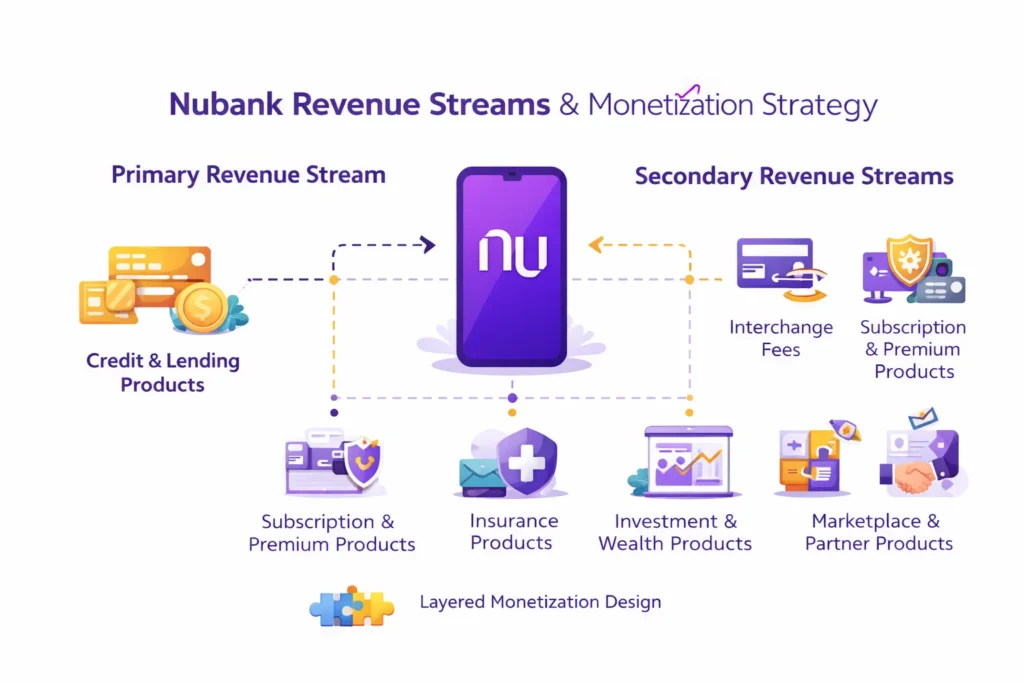

Revenue Streams and Monetization Design

Nubank’s monetization strategy is intentionally subtle, diversified, and long-term. Instead of relying on aggressive fees, it builds revenue gradually by embedding financial products into everyday user behavior. This approach keeps customer satisfaction high while expanding average revenue per user (ARPU) year over year.

Think of Nubank’s revenue model as a layered architecture — each layer activates only when the customer is ready.

Primary Revenue Stream: Credit & Lending Products

This is Nubank’s largest and fastest-growing revenue driver.

How it works

- Credit card interest (revolving balances)

- Installment plans (parcelado)

- Personal loans and overdraft products

- BNPL-style short-term credit offerings

Pricing & Mechanics

- Dynamic interest rates based on risk scoring

- Personalized credit limits

- Flexible repayment schedules

Why it scales

- Rich first-party spending and income data

- AI-driven underwriting models

- Low default rates compared to legacy banks

By 2025, lending-related products accounted for the majority of Nubank’s operating revenue, with Brazil remaining the strongest contributor.

Secondary Revenue Streams

1. Interchange Fees

- Earned on every card transaction

- Paid by merchants’ acquiring banks

- Scales automatically with transaction volume

- Low-margin individually, massive at scale

2. Subscription & Premium Products

- Nubank Ultravioleta and premium tiers

- Monthly or annual fees

- Higher cashback, metal cards, concierge services

- Appeals to affluent and high-frequency users

3. Insurance Products

- Life, device, and micro-insurance

- Commission-based earnings

- Simple, modular coverage inside the app

4. Investment & Wealth Products

- Brokerage and fund distribution

- Custody and advisory fees

- Long-term monetization play for affluent users

5. Marketplace & Partner Products

- Third-party financial services

- Embedded offers inside the Nubank ecosystem

- Revenue-sharing agreements

How the Monetization Strategy Fits Together

Nubank’s revenue streams are designed to reinforce each other:

- Payments data improves credit scoring

- Credit usage increases engagement

- Engagement boosts cross-sell success

- Premium users subsidize free users

- Trust lowers churn and price sensitivity

Pricing Psychology at Work

- “Free” removes friction at entry

- Optional paid upgrades feel earned, not forced

- Transparency builds willingness to pay

- Personalized offers outperform mass pricing

This is a monetization philosophy Miracuves often applies:

Build adoption first → activate value → monetize with precision, not pressure.

Operational Model & Key Activities

Nubank’s operational strength is one of its biggest competitive advantages. While traditional banks struggle with legacy systems and bloated cost structures, Nubank runs a lean, tech-centric operation optimized for scale, speed, and regulatory compliance.

At its core, Nubank operates like a cloud-native software company — with banking layered on top.

Core Operational Activities

1. Platform & Infrastructure Management

- Cloud-first architecture (high availability, elastic scaling)

- Microservices-based systems

- Real-time transaction processing

- Continuous deployment and testing

2. Risk, Compliance & Governance

- In-house compliance teams aligned with regulators

- Automated KYC, AML, and fraud detection

- Country-specific regulatory frameworks

- Real-time risk monitoring

3. Product Development & Innovation

- Rapid feature experimentation

- A/B testing on UX and pricing

- AI-powered credit scoring and personalization

- Continuous product iteration based on user feedback

4. Customer Support & Experience

- Humanized, chat-first support model

- Highly trained support agents (not call-center outsourcing)

- Fast resolution as a brand promise

- Support treated as a loyalty lever, not a cost center

5. Marketing & Growth Operations

- Brand-led growth over performance-heavy ads

- Community-driven storytelling

- Referral system optimization

- Localized messaging per market

Resource Allocation Strategy

Nubank’s spending reflects its long-term platform mindset rather than short-term profit extraction.

Approximate Allocation Focus

- Technology & Engineering: ~35–40%

- Risk, Data & Compliance: ~15–20%

- Marketing & Growth: ~15%

- Customer Support & Operations: ~15%

- R&D & New Products: ~10%

- Geographic Expansion & Legal: ~5%

This structure keeps operational costs per customer extremely low, even as the user base scales into the tens of millions.

Operational Philosophy That Enables Scale

- Automate everything that doesn’t create emotional value

- Invest heavily in systems before demand spikes

- Treat compliance as a product feature, not a constraint

- Build once, localize many times

Strategic Partnerships & Ecosystem Development

Nubank doesn’t try to build everything alone. Its ecosystem strategy is rooted in a clear belief: own the customer experience, but partner for speed, scale, and specialization. This allows Nubank to move fast without bloating operations or diluting focus.

Partnerships are treated as strategic multipliers, not just vendor relationships.

Collaboration Philosophy

Nubank partners where:

- Time-to-market matters more than ownership

- Specialized expertise beats in-house replication

- Ecosystem expansion increases customer stickiness

- Shared incentives create win–win growth

This mindset has helped Nubank evolve from a single-product fintech into a multi-service financial platform.

Key Partnership Types

1. Technology & API Partners

- Cloud infrastructure providers

- Data analytics and AI tooling platforms

- Cybersecurity and fraud prevention services

- Open banking API integrations

These partnerships allow Nubank to:

- Scale globally with reliability

- Continuously enhance product intelligence

- Maintain best-in-class security standards

2. Payment & Financial Infrastructure Alliances

- Card networks (Visa, Mastercard)

- Payment processors and clearing houses

- Local payment rails in each market

Impact:

- Seamless domestic and cross-border transactions

- Faster settlement cycles

- Reduced dependency on legacy banking rails

3. Product & Marketplace Partners

- Insurance providers

- Investment funds and brokers

- Rewards, cashback, and lifestyle services

Value creation:

- Nubank expands product breadth without balance-sheet risk

- Partners gain instant access to millions of users

- Revenue is shared through commissions or usage-based fees

4. Marketing & Distribution Partners

- Co-branded campaigns

- Influencer and creator partnerships

- Retail and e-commerce collaborations

These partnerships reinforce Nubank’s friendly, human brand image while lowering acquisition costs.

5. Regulatory & Expansion Alliances

- Local financial institutions for licensing

- Government and regulatory bodies

- Regional compliance consultants

This enables Nubank to:

- Enter new markets faster

- Reduce regulatory friction

- Build trust with authorities early

Ecosystem Strategy: The Bigger Picture

Nubank’s ecosystem creates powerful network effects:

- More users → more partner interest

- More partners → richer product offerings

- Richer offerings → higher engagement and retention

Competitive Moats Built Through Partnerships

- Hard-to-replicate integrations

- Long-term partner contracts

- Embedded financial workflows

- Data-driven personalization advantages

From Miracuves’ standpoint, this is a textbook example of ecosystem-first platform building:

Read more : Best Nubank Clone Scripts 2026: Build the Future of Digital Banking

Growth Strategy & Scaling Mechanisms

Nubank’s growth story isn’t about blitzscaling at all costs. It’s about controlled, compounding growth — expanding users, products, and geographies without breaking trust, infrastructure, or regulatory alignment.

Its strategy blends product-led growth, data intelligence, and disciplined expansion.

Core Growth Engines

1. Organic Virality & Referral Loops

- High NPS-driven word-of-mouth

- Simple “invite a friend” mechanics

- Social proof fueled by anti-bank storytelling

Why it works:

- Financial trust spreads peer-to-peer

- Referrals outperform paid ads in CAC efficiency

- Customers become brand advocates

2. Product-Led Growth (PLG)

- Free core products lower entry friction

- Value is experienced before monetization

- Feature discovery happens naturally in-app

Examples:

- Credit limit increases over time

- New financial tools unlocked based on behavior

- Personalized nudges instead of hard sells

3. Paid Marketing (Used Strategically)

- Brand campaigns > performance-only ads

- Focus on education, not pressure

- Localized messaging by country

Paid channels are used to amplify momentum, not create artificial demand.

4. New Product Lines

- Lending → insurance → investments → premium tiers

- SMB tools and business accounts

- Embedded finance and marketplace offerings

Each new product increases:

- ARPU

- Retention

- Customer lifetime value

5. Geographic Expansion Model

Nubank follows a playbook-style expansion:

- Enter with a single flagship product

- Build regulatory credibility

- Scale users rapidly

- Layer monetization gradually

This approach has worked particularly well in Mexico and Colombia, where Nubank adapted to local behaviors while reusing core infrastructure.

Scaling Challenges & How Nubank Solved Them

Challenge 1: Operational Complexity

- Millions of users, real-time transactions

Solved with cloud-native systems and automation

Challenge 2: Credit Risk at Scale

- Rapid lending growth increases exposure

Solved through AI-driven risk models and staged credit expansion

Challenge 3: Regulatory Barriers

- Different rules across countries

Solved via early regulator engagement and local partnerships

Challenge 4: Experience Dilution

- Growth often hurts UX

Solved by treating UX and support as strategic assets

This is the same growth logic Miracuves applies when helping founders expand platforms across regions without rebuilding from scratch.

Competitive Strategy & Market Defense

Fintech is one of the most competitive sectors in 2026, with neobanks, super apps, traditional banks, and Big Tech all fighting for user attention. Nubank’s advantage isn’t just innovation — it’s defensibility. The company has built multiple layers of protection that make its position hard to attack.

Core Competitive Advantages

1. Network Effects

- More users → more transaction data

- Better data → better credit decisions

- Better decisions → lower defaults and better pricing

- Better pricing → more users

This self-reinforcing loop strengthens Nubank with every new customer.

2. High Switching Barriers

- Users store balances, cards, loans, and investments in one app

- Financial history improves offers over time

- Emotional trust and habit formation

Switching banks isn’t just inconvenient — it means losing personalized benefits.

3. Brand Equity & Trust

- Positioned as the “anti-bank”

- Transparent communication during crises

- Strong customer advocacy and social proof

Trust is Nubank’s most valuable intangible asset.

4. Technology & Data Advantage

- Proprietary risk and personalization algorithms

- Real-time financial insights

- Continuous learning models across markets

Traditional banks struggle to replicate this due to legacy systems.

5. Regulatory Maturity

- Deep relationships with regulators

- Proven compliance track record

- Faster approvals for new products

Regulatory credibility acts as a hidden moat.

Market Defense Tactics

Handling New Entrants

- Rapid feature rollout based on user feedback

- Preemptive pricing moves

- Faster iteration cycles than competitors

Pricing & Margin Defense

- Cross-subsidization (premium users support free users)

- Dynamic pricing models

- Focus on LTV over short-term margins

Strategic Feature Timing

- Launching features when trust is established

- Avoiding overloading new users

- Rolling out complex products gradually

Acquisitions & Partnerships

- Selective acquisitions to add capabilities

- Partnerships to block competitors’ access to distribution

- Ecosystem lock-in through integrations

Competitive Reality in 2026

While competitors can copy features, they struggle to copy:

- Nubank’s culture

- Its data depth

- Its customer trust

- Its operational efficiency at scale

This reinforces a crucial insight for founders:

Lessons for Entrepreneurs & Implementation

Nubank’s success isn’t magic — it’s the result of clear principles, disciplined execution, and long-term thinking. For entrepreneurs building fintech, marketplaces, or platform-based apps in 2026, Nubank offers a repeatable playbook — if applied thoughtfully.

Let’s break it down like a mentor would.

Key Factors Behind Nubank’s Success

- Customer Trust Before Monetization

- Nubank earned trust first, then introduced revenue layers

- No early pressure to “extract value”

- Nubank earned trust first, then introduced revenue layers

- Extreme Focus at the Start

- One product

- One pain point

- One core market

- One product

- Tech as a Strategic Asset

- Cloud-native from day one

- Data-driven decision-making across products

- Cloud-native from day one

- Regulation as an Advantage

- Early compliance investment

- Strong regulator relationships

- Faster scaling later because of trust

- Early compliance investment

- Brand With a Point of View

- Clear enemy: traditional banking friction

- Emotional connection, not just functionality

- Clear enemy: traditional banking friction

Replicable Principles for Startups

Entrepreneurs can adapt Nubank’s model even without massive funding:

- Start with a free or low-friction core offering

- Design onboarding to feel magical, not bureaucratic

- Build data loops that improve personalization over time

- Monetize gradually through value-based upgrades

- Invest early in scalability and compliance

Miracuves often applies these same principles when helping founders build on-demand platforms, fintech apps, and marketplaces that scale smoothly.

Adapting Nubank’s Model for Local or Niche Markets

Nubank’s framework works best when localized:

- Focus on one underserved segment

- Adapt pricing to local income realities

- Partner instead of building everything

- Respect cultural trust signals

- Build modular products that expand over time

This approach is especially powerful in emerging markets and niche verticals.

Implementation & Investment Priorities

Phase 1 :

- Core product development

- UX-first onboarding

- Compliance groundwork

Phase 2 :

- User growth and engagement

- Data collection and personalization

- Initial monetization layers

Phase 3 :

- Product expansion

- Ecosystem partnerships

- Geographic scaling

Ready to implement Nubank’s proven business model for your market?

Miracuves builds scalable platforms with tested business models and growth mechanisms.

We’ve helped 200+ entrepreneurs launch profitable apps.

Get your free business model consultation today.

Conclusion

Nubank’s business model proves a defining truth of the modern digital economy:

innovation alone doesn’t build empires — execution, trust, and systems do.

By reimagining banking as a platform relationship rather than a transaction, Nubank escaped the gravity of legacy institutions and built a company that scales with its customers, not against them. Its success didn’t come from charging more — it came from removing friction, aligning incentives, and compounding trust over time.

As we move deeper into 2026, Nubank stands as a blueprint for the future of platform businesses.Nubank’s success is built on being customer-first rather than product-first, data-driven instead of assumption-led, and ecosystem-powered rather than siloed.

Platform economies will only grow more competitive, regulated, and trust-sensitive. Nubank shows that when innovation and execution move together, sustainable growth isn’t just possible — it’s inevitable.

FAQs

What type of business model does Nubank use?

Nubank follows a hybrid fintech platform model combining digital banking, freemium user acquisition, lending, subscriptions, and ecosystem partnerships. It monetizes gradually as customer trust grows.

How does Nubank’s business model create value?

It removes banking friction through mobile-first design, transparent pricing, and fast onboarding. Data-driven personalization helps deliver relevant financial products at the right time.

What are Nubank’s key success factors?

Customer trust, low-cost digital infrastructure, AI-powered credit models, and strong regulatory alignment are its biggest strengths. Its brand-first, long-term monetization strategy drives loyalty.

How scalable is Nubank’s business model?

Highly scalable due to cloud-native architecture and automation. Nubank can add millions of users and new products with minimal incremental operational cost.

What are the biggest challenges in Nubank’s model?

Managing credit risk at scale and navigating regulations across countries are key challenges. Maintaining customer experience during rapid growth is another critical focus area.

How can entrepreneurs adapt Nubank’s model to their region?

Start with one underserved segment, offer a low-friction core product, and localize compliance and pricing. Expand features only after building trust and usage.

What are alternatives to Nubank’s business model?

Alternatives include fee-based digital banks, super-app financial platforms, or embedded finance models. Each varies in capital needs, regulation complexity, and scalability.

How has Nubank’s business model evolved over time?

It evolved from a no-fee credit card to a full digital bank and then into a financial ecosystem. Monetization layers were added only after achieving scale and trust.

Related Article :

- What is a Neobank App and How Does It Work?

- What is a Revolut App and How Does It Work?

- Best Remitly Clone Scripts 2025: Launch Your Global Remittance App Faster & Smarter

- Best Stripe Clone Scripts 2025: Build a Scalable Global Payment Infrastructure for Your Startup

- Best PayPal Clone Scripts 2025 Launch a Secure Global Digital Payment Platform