In 2014, Acorns introduced a simple idea that reshaped the investing world: invest spare change automatically. What started as a small experiment in behavioral finance has now grown into a platform with over 7 million active users and billions in assets under management. Acorns proved that investing doesn’t need to be intimidating—small, automated contributions can create long-term financial impact.

In 2026, the demand for micro-investing apps is skyrocketing as younger users seek smooth, automated, low-entry investing tools. With the global micro-investment market expected to reach $14B+ by 2027, entrepreneurs have a massive opportunity to launch their own Acorns-style platform without the costs and delays of building from zero.

A powerful Acorns Clone Script helps founders tap into this booming category by offering round-up automation, recurring investments, smart portfolios, and behavior-driven financial tools—delivered faster, safer, and more affordably.

Miracuves empowers entrepreneurs with industry-leading clone solutions optimized for performance, security, scalability, and long-term control.

What Makes a Great Acorns Clone?

A successful Acorns-style platform goes far beyond simple round-ups. In 2026, users expect a micro-investing app to feel intelligent, invisible in effort, and deeply rewarding. A great Acorns Clone must deliver seamless automation, real-time insights, flawless security, and the kind of intuitive UI that builds lifelong financial habits.

Investors—especially Gen Z and Millennials—prefer platforms that remove complexity and make wealth-building feel effortless. This means your Acorns Clone should combine behavioral finance, AI-powered automation, and secure, scalable infrastructure. The best micro-investing apps operate quietly in the background while users see steady, meaningful progress every week.

To stand out today, an Acorns Clone must deliver: fast onboarding, smart goal-based investing, auto round-ups on every purchase, cash-back partnerships, educational micro-lessons, and high-performance dashboards. Technically, the platform must maintain 99.9% uptime, handle thousands of real-time transactions, and deliver response times under 300ms across devices.

Below is a structured breakdown of what defines a high-quality Acorns Clone in 2026:

Core Traits of a High-Quality Acorns Clone

• Automated Round-Ups: Converts spare change into micro-investments in real time

• Smart Portfolio Allocation: AI-driven selection based on age, goals, and risk appetite

• Recurring Investments: Daily, weekly, or monthly automated contributions

• Cash-Back Rewards & Offers: Partner integrations to boost user savings

• Goal-Based Tracking: Retirement, emergency fund, travel, education, etc.

• High Security: AES-256 encryption, biometric login, MFA, secure bank sync

• Cross-Platform Integration: Web + mobile with instant sync

• Scalability: Cloud infrastructure capable of 10,000+ concurrent users

Must-Have Technologies for 2026

• AI-driven behavior analysis and investment optimization

• Real-time bank API connections

• Blockchain-backed transaction logs

• Microservices architecture for modular scaling

• 300ms API response benchmark

• Cloud-based autoscaling & load balancing

Comparison of Modern Micro-Investing Clones

| Clone Type | Core Strength | Automation Level | Scalability | Ideal For |

|---|---|---|---|---|

| Basic Micro-Invest App | Simple recurring deposits | Low | Medium | Beginners / small startups |

| Acorns-Style Clone | Round-ups + portfolios + rewards | High | High | Growth-oriented startups |

| Advanced AI Investing Clone | Predictive behavior + dynamic portfolios | Very High | Very High | Premium finance apps targeting large scale |

Essential Features Every Acorns Clone Script Must Have

A strong Acorns-style platform is built on the promise of effortless investing. Users shouldn’t feel like they are managing money—they should feel like the app is doing the work silently and intelligently in the background. To achieve this, an Acorns Clone must combine user-centric design, automation, financial intelligence, and administrative control.

A well-built system contains three core layers: the user experience layer, the admin control layer, and the service/investment engine layer. Each plays a critical role in delivering a smooth, trustworthy micro-investing ecosystem.

User Side — Experience, Convenience, Retention

The user-facing app must feel simple, friendly, and motivating. Acorns succeeded because people barely needed to think—your clone must replicate that ease.

• Fast, frictionless onboarding with bank account sync

• Round-Up Automation that invests spare change from every transaction

• Recurring Deposits for habit-building (daily, weekly, monthly)

• Smart ETF Portfolios based on risk and long-term goals

• Real-Time Portfolio Dashboard with clean charts and progress bars

• Found Money Rewards from brand partners

• Biometric Login & Device Security

• Educational Micro-Lessons to improve user literacy

Admin Panel — Control, Analytics, Optimization

For founders, the admin panel is the heart of operations. It must be intelligent, transparent, and automation-ready.

• Central User Management Dashboard

• Portfolio Allocation Engine Controls

• Risk-Level Management & Investment Rules

• Transaction Logs & Audit Trails

• KYC/AML Automated Verification

• Reward Partners & Cash-Back Program Control

• Revenue Analytics (subscriptions, round-up insights)

• Automated Compliance Alerts

Investment / Automation Engine Layer

This forms the backbone of your platform’s intelligence. It must be stable, real-time, and future-ready.

• AI-Based Portfolio Optimization

• Automated Rebalancing depending on market shifts

• Round-Up Calculation Engine syncing with bank APIs

• Real-Time Market Sync (ETFs, index funds, bonds, optional stocks/crypto)

• Predictive Risk Analysis Models

• Goal Calculation & Forecast Engine

Advanced 2025–2026 Features to Stand Out

• AI-personalized saving recommendations

• Gamified saving journeys (badges, milestones)

• AR Goal Visualizer for future planning

• Blockchain-backed transaction transparency

• Smart Cash-Back Triggers based on user behavior

• Micro-savings through smart expense categorization

Technical Architecture Requirements

To compete with modern micro-investing apps, the architecture must support heavy automation and real-time computation:

• Microservices architecture for modular expansion

• Load handling of 25K+ concurrent users

• AES-256 encryption + SSL/TLS 1.3

• Cloud autoscaling (AWS/GCP/Azure)

• Banking & Card Network API Integrations

• Edge caching for sub-300ms response times

• Redundant failover systems for 99.9% uptime

Feature Comparison Table — Basic vs Professional vs Enterprise

| Features | Basic | Professional | Enterprise |

|---|---|---|---|

| Round-Up Savings | Yes | Yes | Advanced smart categorization |

| Recurring Deposits | Yes | Yes | AI-adjusted contributions |

| Portfolio Types | Limited | Standard ETFs | Multi-asset global ETFs |

| Reward Partners | No | Yes | API-based dynamic partner rewards |

| Education Tools | Simple | Personalized | AI-generated lessons |

| White-Label Branding | Partial | Full | Full + custom UX overhaul |

| Admin Analytics | Standard | Advanced | Enterprise-grade insights |

| Blockchain Audit Trail | No | Optional | Yes |

How Miracuves Implements These Features

Miracuves designs every Acorns Clone solution with:

• Modern UI/UX built for conversion and habit formation

• Automation engines optimized for micro-transactions

• AI-ready architecture to grow with your users

• Bank-level security layers

• Flexible modules to scale from a micro-investing MVP to a global enterprise app without rebuilding the core

Read More : What is Acorns and How Does It Work?

Cost Factors & Pricing Breakdown

Acorns-Like Micro-Investing & Robo-Advisory Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Micro-Investing MVP | User onboarding, KYC basics, round-up investing logic, basic portfolios, performance tracking, and a simple admin panel. | $70,000 |

| 2. Mid-Level Digital Investment Platform | Mobile-first UI, automated deposits, diversified ETF portfolios, notifications, goal tracking, and analytics dashboards. | $180,000 |

| 3. Advanced Acorns-Level Platform | Smart round-ups, recurring investments, tax-aware portfolios, rewards & cashback investing, compliance automation, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a micro-investing platform similar to Acorns, designed for automated savings, long-term investing, and beginner-friendly financial growth.

Miracuves Pricing for an Acorns-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete micro-investing foundation with user onboarding, round-up investment logic, automated portfolio management, recurring deposits, performance reporting, compliance-ready controls, and a centralized admin dashboard — built for scalable digital wealth platforms.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard and mobile integration, and deployment assistance — allowing you to launch a fully branded Acorns-style investment app under your own ownership.

Launch Your Acorns-Style Micro-Investing Platform — Contact Us Today

Delivery Timeline for an Acorns-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Round-up and automated investment logic

- Portfolio strategy and asset allocation

- Compliance, KYC, and regulatory requirements

- Market-data and brokerage integrations

- Reporting and admin control depth

- Branding and UI/UX customization

Tech Stack

Built using a JS-based architecture, ideal for micro-investing and robo-advisory platforms that require secure financial processing, scalable APIs, automated portfolio logic, real-time data handling, and enterprise-level reliability.

Customization & White-Label Option

Building an Acorns-style micro-investing and round-up savings platform isn’t just about automating investments — it’s about creating an intelligent wealth-building ecosystem designed for everyday users who want simple, consistent, and stress-free financial growth. A platform inspired by Acorns must combine automated round-ups, portfolio allocation, recurring investments, personalized financial insights, and compliance while keeping everything extremely easy for beginners.

Miracuves delivers a fully white-label Acorns-style solution that can be customized for micro-investing apps, savings-automation products, neobanks adding investment tools, or financial wellness platforms. The system is structured so you can tailor round-up logic, investment strategies, analytics, and user journeys according to your brand vision and regulatory environment.

Why Customization Matters

Micro-investing platforms differ based on:

- Banking & card integrations for round-ups

- Regional fund availability (ETFs, bonds, mutual funds)

- Target users (students, young professionals, first-time investors)

- Regulatory requirements for investment advice

- Monetization model (subscriptions, AUM fees, hybrid)

Customization ensures your platform reflects your financial model, your compliance rules, and your user psychology, rather than copying a generic automation flow.

What You Can Customize

1. UI/UX & User Experience

- Dashboard for savings, round-ups, and investment progress

- Goal-based visualization (education fund, rainy-day savings, retirement, etc.)

- Themes, color systems, typography, micro-animations

- Mobile-first interface for high engagement and retention

2. Round-Up & Savings Automation

- Card transaction connection and round-up accuracy

- Rules for rounding (nearest 1, 5, 10 units, percentage skimming, custom amounts)

- Auto-transfer scheduling

- Smart-detection rules for spending patterns

3. Automated Portfolio Logic

- Portfolio presets (Conservative, Moderate, Aggressive, ESG, etc.)

- Asset allocation rules

- Recurring investment schedules

- Rebalancing thresholds

- Optional dividend reinvestment

4. Financial Wellness & Education Tools

- Bite-sized financial education cards

- Growth projections & calculators

- “Smart tips” based on user behavior

- Savings health score or habit-building nudges

5. KYC, Risk & Compliance

- Digital onboarding with document upload

- Risk questionnaire for suitability scoring

- AML screening and investment-disclosure flows

- Regulatory document logs and audit trails

6. Banking, Cards & Integrations

- Bank account linking

- Card transaction fetching (region-dependent)

- Payment gateways or ACH/UPI/transfer rails

- Third-party custodians or broker integrations

7. Analytics & User Insights

- Savings behaviour analytics

- Round-up history & categorization

- Performance charts and goals tracking

- Spending-to-savings ratio insights

8. Notifications & Engagement

- Round-up confirmations

- Progress alerts for goals

- Market updates

- Auto-invest triggers and reminders

9. Monetization & Revenue

- Subscription tiers

- Premium financial insights

- Partner rewards or brand-based cashback

- Investment management fee model

How Miracuves Handles Customization

- Requirement Discovery

We define your product purpose, compliance region, asset coverage, and monetization model. - Architecture Planning

Modular layering: onboarding → round-up engine → portfolio logic → analytics → reporting → integrations. - Design & Development

Branding, UI customization, automation rules, and investment logic tailored to your roadmap. - Testing & Quality Assurance

Rule accuracy tests, savings simulation, regulatory compliance validation, performance optimization. - Deployment

A fully white-labeled micro-investing app is published with your branding and operational configurations.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech & wealth-tech solutions, including:

- Micro-investing and automated savings apps

- Round-up and drip investing engines

- Digital wealth-building dashboards

- Neobank + investment hybrid platforms

- Fully white-label robo-advisor and financial planning systems

These deployments show how an Acorns-style platform can be transformed into a simple, habit-forming, and trustworthy micro-investing ecosystem under your brand identity.

Launch Strategy & Market Entry

Launching an Acorns-style micro-investing platform requires precision. In fintech, users don’t just download an app—they entrust it with their money. That means your launch must be strategic, compliant, user-focused, and growth-ready from day one.

Pre-Launch Checklist

Product Readiness

• Verify round-up calculations across all bank transactions

• Test recurring deposits and portfolio execution

• Ensure dashboard accuracy for returns, goals, and projections

• Conduct full security validation including MFA, encryption, and API protection

Compliance Preparation

• Complete KYC/AML integration with automated workflows

• Ensure data compliance (GDPR, CCPA, RBI/SEC/FINRA regional requirements)

• Audit-ready reporting for regulators and financial partners

User Experience Setup

• Optimize onboarding flow to reduce friction

• Configure notifications and saving reminders

• Finalize UI details for goals, rewards, and investment summaries

Go-Live Essentials

• Prepare App Store and Play Store listings

• Publish a dedicated SEO landing page

• Set up CRM + support channels

• Integrate analytics tools like GA4, Mixpanel, Amplitude

Regional Market Entry Strategies

Micro-investing works differently across global markets. Your strategy should match local behavior and regulatory expectations.

Asia (India, Singapore, Indonesia)

• Promote low-cost round-ups and daily savings

• Add local languages for higher conversions

• Ideal for subscription model monetization

MENA (UAE, KSA, Bahrain)

• High demand for automated savings tools

• Opportunity to offer Shariah-compliant fund baskets

• Users prefer instant KYC and biometric sign-in

Europe (UK, Germany, France)

• Users expect transparency and fee clarity

• Strong appetite for retirement-focused saving themes

• Great market for goal-based investing tools

United States

• Mature micro-investing ecosystem

• Best to target specific niches (students, freelancers, families)

• High-value users respond well to reward partners and tax-efficient tools

User Acquisition Frameworks

Influencer Collaboration

Partner with finance creators on TikTok, YouTube, and Instagram to explain round-ups and easy investing.

Referral Loop Engine

Reward users for inviting friends—micro-investing apps scale extremely fast with referrals.

Content Authority Strategy

Publish weekly financial tips, saving hacks, and goal-building guides.

Retention Funnels

• Weekly savings summary

• Goal achievements

• Personalized recommendations

• Re-engagement insights

Proven Monetization Models (2026)

• Monthly subscription tiers

• AUM-based fees

• Premium AI-based insights

• Cash-back partner commissions

• Micro-advisory add-ons

How Miracuves Supports Your Launch

Miracuves provides end-to-end launch support to help founders enter the market with stability, compliance, and strong early traction.

• Full deployment and server configuration

• App store submission assistance

• Compliance-ready KYC/AML setup

• Analytics + CRM configuration

• First 90-day growth strategy roadmap

• Continuous optimization and fine-tuning

Miracuves ensures your Acorns-style app goes live fast, secure, optimized, and market-ready, giving you a competitive advantage from day one.

Why Choose Miracuves for Your Acorns Clone

Launching a micro-investing app is not just a technical project—it’s a trust project. Users expect your platform to safeguard their money, automate their savings, and provide accurate long-term financial insights. Choosing the right development partner directly determines whether your product grows or struggles.

Miracuves stands out as the most reliable partner for founders entering the micro-investing space because it blends speed, experience, scalability, and ownership—the four essential pillars for fintech success.

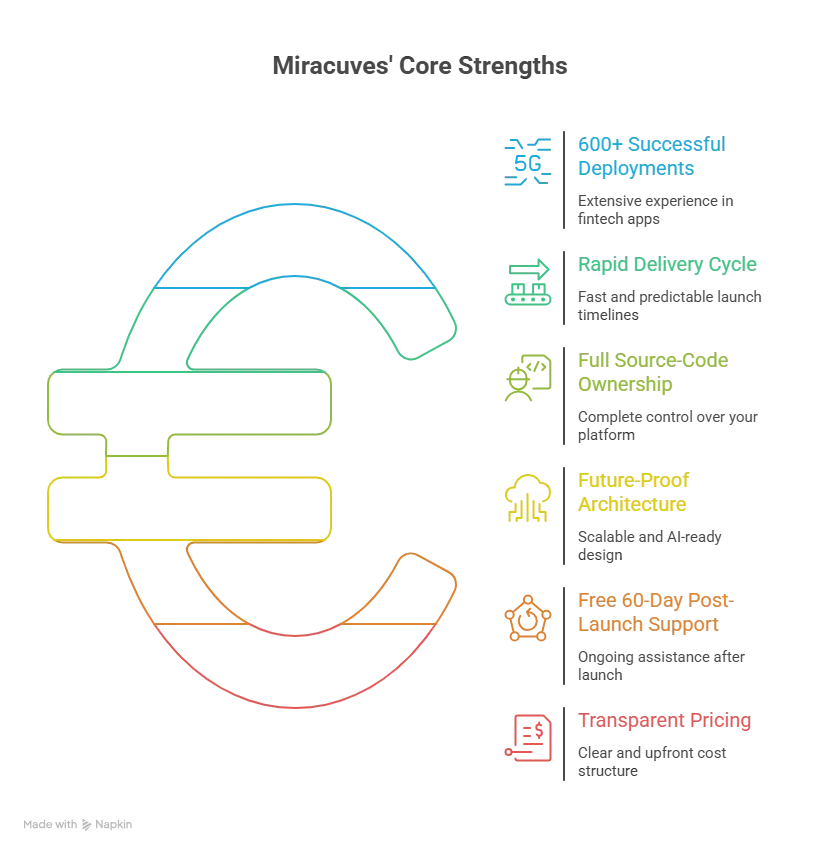

Miracuves’ Core Strengths

600+ Successful Deployments

Miracuves has delivered fintech, neobank, wealth management, and investment apps across the globe. This real-world experience enables highly stable, compliant, and user-friendly product delivery.

Rapid Delivery Cycle

Instead of long, traditional development timelines, Miracuves uses optimized modules and automation engines to launch your Acorns Clone in a fast, predictable timeframe.

Full Source-Code Ownership

You retain complete ownership of your platform. No restrictions, no SaaS lock-ins, no dependency on third-party systems.

Future-Proof Architecture

Designed with microservices, cloud scalability, and AI-ready modules, your app can grow from MVP to enterprise-level without rebuilding the core.

Free 60-Day Post-Launch Support

Most agencies stop at the handover, but Miracuves continues to assist with improvements, fixes, optimization, and stabilization after launch.

Transparent Pricing

Every cost is clear upfront. No hidden fees, no unpredictable add-ons.

Real Success Stories

Case Study 1 — Student Micro-Saving App in the U.S.

A U.S.-based founder built an Acorns-style app targeting students. With round-up automation and gamified rewards, the platform achieved 10,000 installs in the first 45 days.

Case Study 2 — Middle East Automated Saving Platform

A fintech startup launched a Shariah-compliant micro-investing solution, fully customized through Miracuves. The app crossed 4,500 active users in the first month.

Case Study 3 — Europe Micro-Investment Brand

A European founder used Miracuves’ system to build a micro-ETF saving app tailored for young families. The platform reached $5M+ managed savings within 8 months.

Final Thought

Micro-investing is no longer a trend — it’s a behavioral shift. Users want financial growth without complexity, without heavy decision-making, and without large capital commitments. An Acorns-style platform gives them exactly that: effortless investing built into their everyday lives.

For entrepreneurs, this is one of the most powerful opportunities in fintech. With the right Acorns Clone, you can launch quickly, validate real demand, and scale into a trusted financial brand. You don’t need years of development or millions in investment; you need a strong foundation, smart automation, and a technology partner who understands the future of wealth-tech.

Miracuves helps founders transform their ideas into stable, scalable, and revenue-ready micro-investing platforms. When you combine your market vision with Miracuves’ engineering strength, you gain the ability to enter the industry faster, operate with confidence, and innovate beyond what competitors are doing.

The future of automated saving and investing is bright — and with the right technology, it can start with your platform.

Ready to launch your Acorns Clone? Get a free consultation and a personalized project roadmap from Miracuves — trusted by 200+ entrepreneurs worldwide for building successful fintech platforms.

FAQs

How quickly can Miracuves deploy my Acorns Clone?

Miracuves delivers a ready-to-launch micro-investing platform in a rapid timeframe, while deeper customizations, integrations, and enterprise-grade features are completed within 30–90 days, depending on the scope.

What’s included in the Miracuves clone package?

You receive a complete micro-investing ecosystem: user app, admin panel, automated round-up engine, smart portfolio system, bank sync, analytics, and full branding.

Can I get full source-code access?

Yes. Miracuves provides 100% source-code ownership, giving you complete control, flexibility, and freedom to scale without restrictions.

How does Miracuves ensure scalability?

The platform is built using microservices architecture, cloud autoscaling, optimized APIs, and caching systems designed to handle thousands of concurrent users effortlessly.

Does Miracuves assist with app store approval?

Yes. Miracuves guides you through App Store and Google Play submission to ensure your app meets all required guidelines and avoids common rejections.

Is post-launch maintenance included?

Yes. Miracuves offers 60 days of free post-launch support, including optimization, fixes, and performance tuning.

Can Miracuves integrate custom payment gateways or banks?

Absolutely. You can integrate region-specific gateways like Stripe, Razorpay, PayPal, and connect local banking APIs as needed.

What’s the upgrade/update policy?

You can request upgrades anytime. New features, expanded modules, and performance enhancements are supported as your platform grows.

How does white-labeling work?

Miracuves applies your brand colors, logo, app name, dashboard styles, and user experience flows to deliver a fully white-labeled micro-investing platform.

What kind of ongoing support can I expect?

You receive continuous technical assistance, bug fixes, improvements, scalability planning, and long-term enhancement options even after the initial support period.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Robinhood Clone Scripts 2026 — Build a Modern Trading App That Scales

- Best Betterment Clone Scripts 2026 for Automated Investing Platforms

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Starling Bank Clone Scripts 2026 : Build a Digital Bank That Scales in the Real World