From a Stanford student project to a publicly listed fintech powerhouse, Affirm transformed the BNPL industry, helping millions split payments into transparent, interest-free installments. Today Affirm processes billions in annual transactions and is one of the most trusted names in consumer financing.

As we move into 2026, the global BNPL industry is projected to hit $565B+ in transaction volume, creating unprecedented opportunity for entrepreneurs entering the space. Understanding how Affirm’s model works — instant credit checks, transparent fees, merchant partnerships, and frictionless checkout — gives founders a strategic advantage when launching their own financing platform.

An Affirm Clone Script empowers entrepreneurs to tap into this booming sector with lower development risk, faster launch cycles, and built-in user behavior already proven in the market. With Miracuves Clone Solutions, founders get enterprise-grade BNPL technology optimized for trust, compliance, and profitable credit operations.

What Makes a Great Affirm Clone?

A successful Affirm Clone in 2026 must be engineered for trust, speed, and transparent lending. Affirm grew because it simplified consumer financing — no hidden fees, no complex interest structures, and no friction during checkout. For entrepreneurs building a BNPL platform today, replicating this experience requires powerful underwriting, seamless merchant integration, and a reliable repayment engine.

A great Affirm-style clone handles consumer requests in milliseconds, runs soft credit checks without hurting user scores, and automates repayment cycles with absolute accuracy. As the BNPL industry becomes more regulated, high-performance architecture and compliant scoring systems have become mandatory rather than optional.

Key Elements That Define a Great Affirm Clone in 2026

- Ultra-fast responses with sub-300ms decisioning

- Real-time soft credit checks and affordability scoring

- Clear repayment schedules with no hidden charges

- 99.9% uptime for uninterrupted merchant transactions

- Scalable microservices capable of handling peak shopping seasons

- Advanced fraud detection powered by machine learning

- Clean, intuitive UI/UX for fast checkout and high merchant conversions

- Transparent dashboards for both users and merchants

Must-Have Modern BNPL Innovations

- AI-Powered Lending: Auto-adjust credit limits, predict repayment reliability

- Blockchain Transparency: Immutable logs for disputes and settlements

- Embedded Finance Support: Integrations for eCommerce stores, apps, and POS systems

- Cross-Platform Sync: Web, mobile, and merchant portals connected via unified APIs

- Cloud-Native Performance: Auto-scaling resources for global workloads

Comparison Table: Traditional BNPL vs Modern Affirm Clone (2026)

| Feature | Traditional BNPL | Modern Affirm Clone (2026) |

|---|---|---|

| Credit Check | Manual or slow | Instant soft-check AI scoring |

| Performance | 1–2 sec load | <300ms checkout experience |

| Transparency | Basic | Full fee transparency + repayment clarity |

| Security | Standard | AES 256, tokenization, multi-layer security |

| Integrations | Limited | Shopify, WooCommerce, Magento, POS |

| Scalability | Moderate | Cloud-native microservices |

Essential Features Every Affirm Clone Must Have

A powerful Affirm Clone doesn’t just process split payments — it builds a trust-driven, transparent financing system that users depend on and merchants prefer. For entrepreneurs entering the BNPL market in 2026, the winning formula is a combination of seamless user flows, intelligent credit decisioning, automation, and enterprise-grade scalability.

An Affirm-style BNPL platform is structured across three functional layers: the user experience, merchant operations, and the admin intelligence system. Each layer must deliver performance, clarity, and accountability with every transaction.

User-Side Features

This is where trust and convenience determine retention.

- Instant installment approvals with soft credit checks

- Transparent repayment schedules (no hidden charges)

- In-app credit limit overview

- Personalized offers and repayment plans

- Virtual cards for flexible BNPL payments

- Order tracking integrated with merchant systems

- Smart reminders to reduce missed payments

Merchant Dashboard

Merchants choose BNPL partners who make their business smoother and more profitable.

- Fast merchant onboarding with KYC/AML

- Automated payout settlements

- Transaction analytics and customer insights

- Refund and dispute management

- POS and eCommerce integrations (Shopify, WooCommerce, Magento)

- Ability to set custom promotions and financing tiers

Admin Panel (The Brain of the Platform)

Where fintech operations, lending rules, and risk management converge.

- Dynamic AI-driven credit scoring

- Fraud detection alerts

- Automated penalties and interest rules

- User segmentation and lending logic

- Merchant performance dashboard

- API monitoring and transaction logs

- Multi-level admin access

2026 Advanced Features for BNPL Success

- AI-based personal finance insights

- AR-based ID onboarding for secure verification

- Blockchain logs for transparent disputes

- Smart EMI adjustments based on repayment history

- Predictive repayment intelligence

Technical Architecture Requirements

A high-performance Affirm Clone must be built for global scalability and regulatory stability.

- Microservices architecture allowing horizontal scaling

- High-load support for peak seasonal traffic

- AES 256 encryption + tokenization for sensitive data

- Integrated KYC, AML, and payment gateway APIs

- CDN-powered global accessibility

- Auto-scaling cloud infrastructure ensuring 99.9% uptime

Feature Comparison: Basic vs Professional vs Enterprise

| Version | User Tools | Merchant Tools | Admin Control | Best For |

|---|---|---|---|---|

| Basic | Simple BNPL checkout | Basic settlements | Standard admin panel | Early-stage startups |

| Professional | AI scoring, loyalty, analytics | Full merchant dashboard | Automated risk workflows | Growing BNPL startups |

| Enterprise | Multi-region, POS finance, virtual cards | Custom merchant portals | Predictive AI risk engine | Fintech enterprises |

How Miracuves Implements These Features

Miracuves builds BNPL ecosystems designed for heavy traffic and regulatory compliance.

- Smart lending engine optimized for Affirm-like scoring

- Seamless merchant integration for faster onboarding

- Ultra-fast microservices ensuring sub-300ms checkouts

- Secure, scalable fintech architecture

- Fully customizable modules for repayments, lending, and risk scoring

- White-label branding across all apps, portals, and dashboards

Cost Factors & Pricing Breakdown

Affirm-Like Buy Now, Pay Later (BNPL) Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core BNPL MVP | Merchant onboarding, installment checkout flow, loan schedule management, transaction history, and a simple admin panel. | $75,000 |

| 2. Mid-Level BNPL Platform | Web dashboards, multi-merchant support, flexible repayment terms, notifications, refunds, and analytics dashboards. | $180,000 |

| 3. Advanced Affirm-Level Platform | Real-time credit decisioning, transparent APR calculations, dynamic credit limits, merchant financing tools, compliance automation, fraud monitoring, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a transparent, risk-aware BNPL platform similar to Affirm, designed for responsible lending and large-scale merchant adoption.

Miracuves Pricing for an Affirm-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete BNPL foundation with merchant onboarding, installment and deferred-payment logic, checkout APIs, transaction management, risk-ready architecture, compliance-oriented controls, and a centralized admin dashboard — built for scalable consumer-finance operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend checkout & dashboard integration, and deployment assistance — allowing you to launch a fully branded Affirm-style BNPL platform under your own ownership.

Launch Your Affirm-Style BNPL Platform — Contact Us Today

Delivery Timeline for an Affirm-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Repayment structures and loan tenures

- Credit checks and underwriting depth

- Merchant checkout integrations

- Compliance, KYC, and regulatory requirements

- Branding and UI/UX customization

- Reporting and admin control depth

Tech Stack

Built using a JS-based architecture, ideal for BNPL and consumer-credit platforms that require secure transaction handling, scalable APIs, real-time credit decisioning, and enterprise-level reliability.

Customization & White-Label Option

Building an Affirm-style Buy Now, Pay Later (BNPL) & financing platform isn’t just about offering installment plans — it’s about creating a transparent, trust-driven financing ecosystem where users clearly understand payments, merchants enjoy higher conversions, and lending logic runs seamlessly in the background. A platform inspired by Affirm must support flexible EMI plans, real-time underwriting, merchant integrations, repayment automation, and regulatory-safe credit workflows, all while keeping the user experience extremely clean and confidence-building.

Miracuves delivers a fully white-label Affirm-style solution that can be customized for ecommerce platforms, fintech lenders, retail brands, marketplace operators, or financial institutions entering the flexible-finance space. You get complete control over branding, credit rules, repayment terms, merchant onboarding, and long-term product strategy.

Why Customization Matters

Financing differs across:

- Regulatory zones that treat BNPL as lending

- Credit-scoring logic (soft vs. hard checks)

- Ticket sizes (small retail vs. high-value electronics)

- Repayment structures (6, 12, 18, or 24-month plans)

- Marketing positioning (zero-interest, low-interest, or merchant-subsidized)

Customization ensures your Affirm-style platform fits your lending strategy, your compliance system, and your merchant ecosystem — not a fixed template.

What You Can Customize

1. UI/UX & User Journey

- Checkout financing screens

- EMI breakdown pages and total cost disclosures

- User dashboard for upcoming payments, past loans, and interest statements

- Themes, color palettes, typography, and brand styling

- Pre-approval banners shown during product browsing

2. Financing Models & Repayment Plans

- Zero-interest merchant-funded plans

- Interest-bearing plans (APR-based)

- Short-term installments (3–6 months)

- Long-term financing (6–36 months)

- Pay Later models (15/30 days)

- Penalty, grace period, and late-fee rules (region-dependent)

3. Real-Time Underwriting & Risk Engine

- Soft credit checks

- Income & affordability scoring

- Purchase-level risk logic

- Behavioral scoring based on user repayment history

- Device fingerprinting & fraud screening

- Dynamic credit-limit adjustments

4. Merchant Management & Partnerships

- Merchant onboarding flow with KYB checks

- Commission rules & fee structures

- Plug-ins for Shopify, Magento, WooCommerce

- Merchant dashboard for orders, loan statuses, conversions

- Settlement logic for merchants (instant, T+1, weekly)

5. Payments, Billing & Settlement

- Auto-debit rules using cards/banks

- Flexible repayment dates

- Refund & adjustment workflows

- Wallet or stored balance for adjustments

- Merchant reimbursement reports

- Detailed settlement ledger

6. User Account Controls

- Loan history

- Early payoff options

- Breakdown of principal vs. interest

- Alerts for due dates and failed payments

- Spending limits & credit line adjustments

7. Offers, Rewards & Personalization

- Personalized credit offers

- Higher limit rewards

- Partner-based discounts

- Pre-approved promotional financing

8. Backend Integrations

- Payment gateways

- Credit bureaus (optional/region-dependent)

- Banking/ACH/UPI/SEPA rails

- Compliance tools (KYC, AML)

- CRM, marketing, analytics systems

How Miracuves Handles Customization

- Requirement Mapping

Defining your financing model, risk appetite, merchant categories, and regulatory boundaries. - Architecture Planning

Modular setup for: onboarding → credit engine → checkout → repayment → merchant dashboard → settlement. - Design & Development

UI/UX customization, financing rules, underwriting logic, dashboards, and integrations. - Testing & QA

Credit simulations, repayment cycle testing, settlement accuracy checks, security validation. - Deployment

A fully white-labeled financing solution released with your domain, merchant connectors, and branded apps.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech, lending, and ecommerce systems, including:

- BNPL + EMI engines with dynamic credit scoring

- Ecommerce checkout financing solutions

- Merchant settlement dashboards

- Multi-term lending platforms

- White-label digital credit ecosystems

These real-world outcomes demonstrate how an Affirm-style system can be adapted into a transparent, conversion-focused, and regulatory-safe financing platform under your brand.

Launch Strategy & Market Entry

Launching an Affirm-style BNPL platform requires a blend of technical readiness, compliance alignment, merchant partnerships, and strategic user acquisition. A smooth launch ensures the system handles real financial traffic from day one — including credit approvals, merchant checkouts, disputes, and repayments.

Founders who launch BNPL apps without a clear market-entry plan often face low adoption, high defaults, or poor merchant trust. With the right strategy, your Affirm Clone can scale quickly and build credibility in competitive markets.

Pre-Launch Checklist

Before going live, ensure every part of the system is tested end-to-end.

- Complete regulatory compliance review (KYC/AML/credit rules)

- Load testing for peak-season traffic

- Merchant pilot testing with real checkout flows

- Integrated risk scoring simulations

- UI/UX polishing for higher conversions

- App Store & Play Store submission preparation

- Pre-launch marketing & awareness campaign setup

Market Entry Strategy by Region

Asia (High BNPL adoption growth)

- Mobile-first optimization

- Local KYC integration (e.g., Aadhaar, SingPass)

- Merchant partnerships with regional eCommerce platforms

MENA (Interest-free financing demand)

- Sharia-compliant installment plans

- Merchant settlements optimized for SMEs

Europe (Highly regulated but high spending power)

- Strong compliance & consumer protection features

- Multi-currency & PSD2 compliance tools

United States (Competitive but high volume)

- Strong merchant onboarding workflows

- Cashback, loyalty & reward mechanisms to increase adoption

User Acquisition Frameworks

A BNPL platform grows fastest when both users and merchants benefit.

- Influencer campaigns demonstrating “Pay Later” simplicity

- Merchant referral incentives for onboarding new stores

- Cashback or reward-based referral loops

- Personalized reminders & repayment nudges

- First-purchase zero-interest campaigns

- Data-driven retention funnels

Proven Monetization Models for 2026

- Merchant transaction fees

- Instant settlement fees

- Subscription tools for merchants (analytics, POS modules)

- Smart interest-based repayment plans

- White-label BNPL partnerships

- Cross-selling financial products

Miracuves’ End-to-End Launch Support

Miracuves provides comprehensive launch support that covers the entire rollout and early growth phase:

- Full server setup and cloud optimization

- App Store & Play Store submission

- Merchant onboarding setup

- 90-day real-time monitoring & optimization

- Scalability planning for regional or global expansion

This ensures that your Affirm Clone launches strong, stable, and ready to scale from day one.

Why Choose Miracuves for Your Affirm Clone Script

Building a BNPL platform like Affirm is not simply an engineering task — it is a trust-building mission. Consumers expect transparency. Merchants expect dependability. Investors expect scalability. Achieving all this requires a technology partner who understands the depth and complexity of fintech systems. This is exactly where Miracuves stands out.

Miracuves doesn’t build “just another app.” It builds production-grade financial systems capable of handling real credit operations, risk scoring, merchant settlements, and regional compliance — all within predictable timelines. Founders rely on Miracuves because they want proven infrastructure, not experiments.

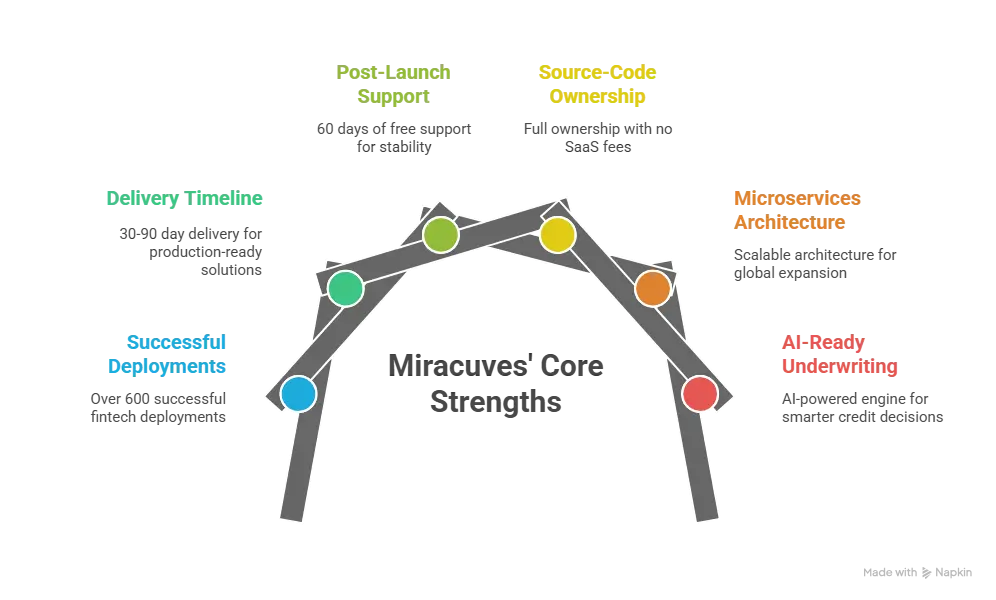

Miracuves’ Core Strengths

- 600+ successful deployments across fintech, digital wallets, lending, and neobanking

- 30–90 days delivery timeline for complete production-ready solutions

- Free 60-day post-launch support to ensure stability and performance tuning

- Full source-code ownership — no SaaS fees, no vendor lock-in, total independence

- Future-proof microservices architecture for scaling across multiple regions

- AI-ready underwriting engine for smarter credit decisions

Founder Success Stories

- A US-based installment financing startup launched in 42 days, securing 9,000+ users within the first quarter.

- A European BNPL platform built on Miracuves architecture achieved a 37% increase in checkout conversion.

- A Southeast Asian pay-later app reduced default rates by 25% using Miracuves’ predictive risk scoring model.

Miracuves brings speed, reliability, and fintech intelligence together, giving founders a powerful foundation for their BNPL journey.

Final Thought

An Affirm-style BNPL platform goes far beyond split payments — it shapes consumer trust, merchant loyalty, and long-term financial behavior. Entrepreneurs who understand Affirm’s transparent, user-centric model can use it as a blueprint to build a high-growth BNPL brand of their own.

With Miracuves’ advanced clone technology, founders gain a significant head start: faster development, proven architecture, AI-ready underwriting, and full ownership without limitations. In a competitive 2026 fintech landscape, the ability to launch quickly, scale intelligently, and maintain absolute control is what separates winning BNPL platforms from the rest.

Your Affirm Clone can become the foundation of a powerful financial ecosystem — and Miracuves ensures you build it with confidence, precision, and long-term scalability.

Ready to launch your Affirm Clone? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200+ global entrepreneurs.

FAQs

How quickly can Miracuves deploy my Affirm Clone?

Miracuves can deliver a fully production-ready Affirm Clone within 30–90 days, depending on your chosen features, integrations, and customization level.

What’s included in the Miracuves Affirm Clone package?

You receive the complete BNPL ecosystem — user app, merchant dashboard, admin panel, repayment engine, risk scoring modules, APIs, and full documentation.

Do I get full source-code ownership?

Yes. Miracuves provides 100% source-code ownership, giving you complete independence and no SaaS lock-ins.

How does Miracuves ensure scalability?

Through a microservices architecture, horizontal scaling, load balancing, global CDNs, and secure transaction pipelines designed for millions of users.

Can Miracuves help with App Store and Play Store approval?

Yes, Miracuves assists with complete publishing, including testing, bundle preparation, screenshots, metadata, and listing compliance.

Is post-launch support included?

Yes. You get 60 days of free post-launch support, covering optimization, bug fixes, monitoring, and stability improvements.

Can Miracuves integrate custom payment gateways?

Absolutely. Local, global, bank-level, and custom API-based payment gateways can be integrated based on your region and compliance needs.

What is the upgrade and update policy?

Miracuves offers ongoing upgrades — new features, risk models, modules, regional scaling enhancements, and tech stack updates.

How does white-labeling work?

Your brand replaces everything: logos, colors, UI elements, merchant panels, domain branding, transactional emails, and in-app identity.

What kind of long-term support can I expect?

Miracuves provides extended maintenance plans covering security updates, performance tuning, AI scoring improvements, new features, scaling, and continuous fintech optimization.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Robinhood Clone Scripts 2026 — Build a Modern Trading App That Scales

- Best Betterment Clone Scripts 2026 for Automated Investing Platforms

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Groww Clone Scripts 2026: Launch a Powerful Investment & Trading Platform Fast

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast