Crate & Barrel has built a strong global retail identity by blending modern home design with a consistent shopping experience across stores and digital channels. The business model of Crate & Barrel focuses on selling curated furniture, kitchenware, décor, and lifestyle products that appeal to customers looking for premium quality and timeless style.

A key strength in the Crate & Barrel is its omnichannel strategy. Customers can browse online, visit physical showrooms, and use services like in-store pickup, delivery, and personalized design support. This seamless journey improves conversion rates and encourages repeat purchases, especially for high-value categories like furniture and home upgrades.

In 2026, the business model of Crate & Barrel remains competitive through private-label product lines, seasonal collections, and a strong focus on customer experience. By combining brand-led merchandising with efficient supply chain operations, Crate & Barrel continues to scale while protecting margins and building long-term loyalty.

How the Crate & Barrel Business Model Works

Crate & Barrel operates like a premium omnichannel retail ecosystem—where the brand controls product curation, customer experience, and quality perception across both physical stores and digital channels.

Instead of competing only on discounts, it competes on design authority + trust + convenience, which keeps customers coming back for repeat home purchases.

Type of Business Model

Crate & Barrel runs a Hybrid Retail Business Model, combining:

- Direct-to-Consumer (D2C) retail (core engine)

- Omnichannel commerce (store + online + mobile experience)

- Service-driven upsells (design support, delivery, assembly, registry)

Value Proposition (What Each Segment Gains)

1) Consumers (Home Buyers & Lifestyle Shoppers)

They get:

- Curated premium products (less confusion, faster decisions)

- Modern design consistency (matching collections across rooms)

- Trust in durability + returns + delivery service

- Convenience via online browsing + store experience

2) High-Intent Buyers (Furniture & Big-Ticket Customers)

They get:

- Design inspiration + styling guidance

- Coordinated bundles (sofas + tables + décor)

- Reliable shipping, installation, and after-sales support

3) Wedding / New Home Customers (Registry Segment)

They get:

- Gift registry convenience

- A reason to shop early and return often

- Strong emotional brand connection during life milestones

4) Brand Partners & Suppliers

They gain:

- Stable demand through long-term collections

- Predictable volume planning

- Premium positioning through Crate & Barrel brand equity

Stakeholders & Their Roles

Crate & Barrel’s ecosystem stays balanced because each stakeholder supports the experience:

- Merchandising + Design Teams → create “curated collections” that feel premium

- Retail Stores → increase trust, conversions, and high-ticket confidence

- Ecommerce Platform → drives discovery, comparison, and repeat purchases

- Supply Chain + Logistics → ensures delivery reliability (critical for furniture)

- Customer Support → protects brand reputation and reduces friction

- Marketing + Brand Team → keeps positioning premium, modern, lifestyle-led

How the Model Evolved Over Time

Crate & Barrel’s model evolved from traditional retail into a digital-first retail brand by:

- Moving from “store-first” to omnichannel-first

- Increasing focus on private label / exclusive collections

- Expanding into categories like:

- furniture

- modular storage

- kitchen essentials

- seasonal décor

- furniture

- Strengthening services (delivery, design help, registry)

Why It Works in 2026

In 2026, shoppers behave differently:

- They want fewer but better choices

- They trust brands that offer consistent quality + predictable service

- They buy furniture faster when they see:

- lifestyle images

- room setups

- coordinated collections

- lifestyle images

- They prefer retailers that reduce “decision fatigue”

Crate & Barrel wins because it makes buying home products feel easy, premium, and safe—especially for high-value purchases.

Read more : What is Crate & Barrel and How Does It Work?

Target Market & Customer Segmentation Strategy

Crate & Barrel’s growth isn’t driven by “everyone shopping for home products.”

It scales because it targets high-intent lifestyle buyers—people who are ready to upgrade their space, invest in quality, and prefer curated design over endless options.

In 2026, this segmentation strategy matters because furniture and home shopping has become a high-consideration purchase. Customers want fewer decisions, better styling, and a brand they can trust for delivery, returns, and durability.

Primary Customer Segments (Core Users)

1) Urban & Premium Lifestyle Households

These customers value:

- modern aesthetics

- quality materials

- long-term durability

They often buy: - sofas, beds, dining sets

- premium kitchenware

- décor bundles

2) New Home Buyers & Home Upgraders

This segment is high-conversion because they’re already in a “setup mode.”

They buy:

- room-by-room packages (living room, bedroom, dining)

- storage and organization products

- essentials + décor together

3) Wedding & Registry Customers

One of the strongest retention engines.

These users bring:

- repeat browsing

- gifting-driven sales

- long-term loyalty after marriage/new home

Secondary Customer Segments (Growth Drivers)

4) Interior Design-Led Buyers

They want:

- inspiration

- coordinated collections

- styling confidence

They often purchase higher AOV products and bundles.

5) Corporate / Hospitality Buyers (Selective)

Some buyers use Crate & Barrel for:

- office setups

- premium rentals

- hospitality décor upgrades

This segment supports bulk purchases when targeted correctly.

Customer Journey: Discovery → Conversion → Retention

Discovery

Customers find Crate & Barrel through:

- Google search (home décor, furniture collections)

- social media inspiration (Pinterest/Instagram-style discovery)

- seasonal campaigns and trend collections

- word-of-mouth and gifting

Conversion

Crate & Barrel converts buyers using:

- premium product photography + room visuals

- curated collections (reduces decision fatigue)

- store visits for high-ticket confidence

- delivery assurance and support trust

Retention

Retention is driven by:

- repeat home upgrades (seasonal refresh cycles)

- cross-category expansion (kitchen → furniture → décor)

- registry lifecycle (wedding → new home → family)

Acquisition Channels & LTV Optimization

Crate & Barrel optimizes lifetime value by combining:

- content-driven inspiration (style guides, collections)

- high AOV categories (furniture + bundles)

- repeat purchase categories (kitchenware, décor, essentials)

- seasonal triggers (festivals, holidays, home refresh trends)

This creates a loop:

inspiration → purchase → upgrade → repeat purchase

Market Positioning (Competitive Edge)

Crate & Barrel is positioned between:

- mass retail (price-first brands)

and - ultra-luxury design brands (high cost, niche)

Its competitive edge comes from:

- premium design at accessible luxury pricing

- strong brand consistency across categories

- trust in delivery and quality control

collections that feel “designer-approved” without being intimidating

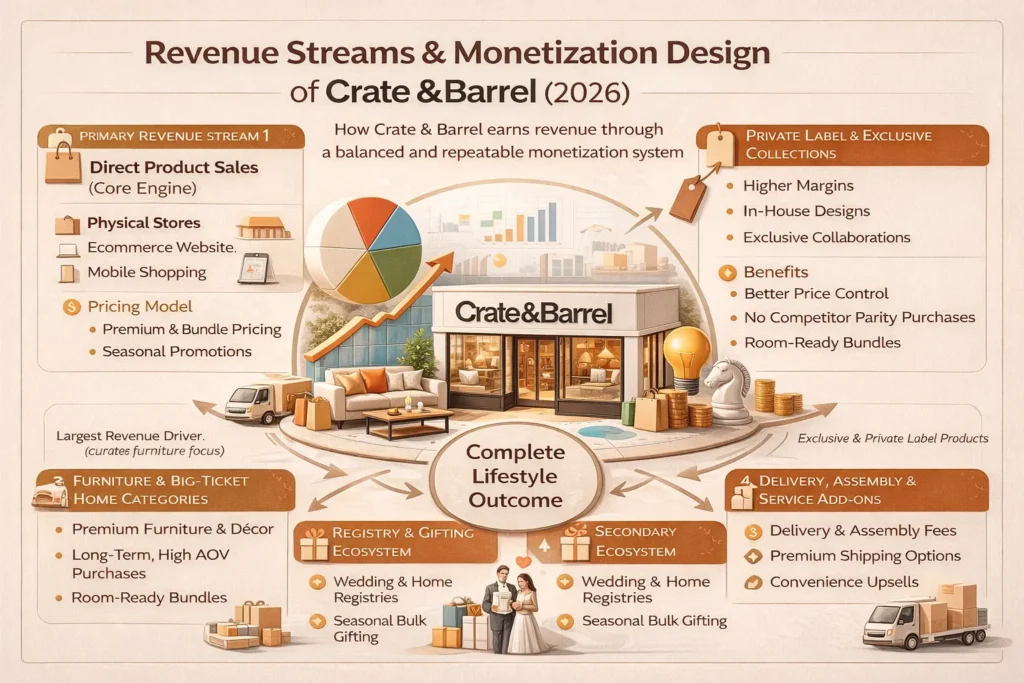

Revenue Streams and Monetization Design

Once you understand who Crate & Barrel serves, the next question becomes obvious:

how does Crate & Barrel actually make money—and why is its revenue model so stable?

The business model of Crate & Barrel is built on high-margin curation + high-ticket categories + repeat purchase behavior.

It doesn’t rely on a single revenue stream. Instead, it captures value across furniture, décor, kitchen essentials, services, and lifecycle-based buying (like weddings and new homes).

Primary Revenue Stream 1: Direct Product Sales (Core Engine)

Mechanism

Crate & Barrel earns most of its revenue by selling products directly to consumers through:

- physical stores

- ecommerce website

- mobile shopping experience

Pricing Model

- Premium pricing (mid-to-high range)

- Collection-based pricing (matching items sold as sets/bundles)

- Seasonal promotions (without becoming discount-dependent)

Revenue Contribution

- Largest revenue driver

- Strong profit stability because many products are exclusive/private label

Growth Trajectory (2026)

- Higher focus on curated furniture collections

- Increased bundling strategy to lift AOV

- Stronger online conversion through improved product discovery

Secondary Revenue Stream 2: Private Label & Exclusive Collections

Mechanism

Crate & Barrel increases margins by selling:

- in-house designed products

- exclusive collaborations

- signature collections not easily comparable elsewhere

Why it matters

- Better control over pricing

- Reduced price wars with competitors

- Higher brand loyalty

Secondary Revenue Stream 3: Furniture & Big-Ticket Home Categories

Mechanism

Furniture creates:

- higher order values

- higher margin opportunities (depending on category)

- long-term repeat cycles (upgrades every few years)

Pricing Strategy

- premium positioning

- “room-ready” collection selling (not single items)

Why it works

Customers buying furniture usually add:

- rugs

- lamps

- side tables

- décor accessories

This naturally increases cart size.

Secondary Revenue Stream 4: Delivery, Assembly & Service Add-ons

Mechanism

Crate & Barrel monetizes convenience through:

- delivery charges (especially for furniture)

- assembly/installation support

- upgraded shipping options

Why it works

In 2026, customers pay more for:

- speed

- safety

- predictable delivery windows

Especially for large purchases.

Secondary Revenue Stream 5: Registry & Gifting Ecosystem

Mechanism

Registry customers bring:

- bulk gifting purchases

- repeat visits

- emotional loyalty to the brand

Value impact

- lower acquisition cost over time

- higher retention after major life events

- predictable seasonal uplift

How the Monetization Strategy Works as a System

Crate & Barrel’s monetization is powerful because each revenue stream supports the others:

- Furniture drives high-ticket revenue

- Décor and kitchen essentials drive repeat purchases

- Private label protects margins

- Delivery + services increase profit per order

- Registry lifecycle creates long-term customer retention

The psychology behind it is simple:

Crate & Barrel doesn’t sell items—it sells a complete lifestyle outcome, which makes customers willing to pay more and buy in bundles.

Read more : Crate & Barrel Clone Revenue Model: How Crate & Barrel Makes Money in 2026

Operational Model & Key Activities

Crate & Barrel looks like a retail brand on the surface—but behind the scenes, it runs like a design-led commerce machine.

The business model of Crate & Barrel works because operations are built to deliver three things consistently:

curation + availability + premium customer experience

In 2026, the operational model matters even more because customers expect fast delivery, accurate product representation online, and smooth service—especially for big-ticket items like furniture.

Core Operations (What Runs Daily)

1) Product Curation & Merchandising

Crate & Barrel’s internal teams manage:

- seasonal collection planning

- category performance tracking

- pricing strategy and product bundling

This is the brand’s core advantage—they sell fewer choices, but better choices.

2) Inventory Planning & Supply Chain

To avoid delays and cancellations, the brand invests in:

- demand forecasting (especially for furniture)

- warehouse distribution planning

- supplier coordination for restocking cycles

This keeps the customer promise strong: what you see is what you can actually buy.

3) Omnichannel Retail Execution

Crate & Barrel ensures a consistent experience across:

- stores (showroom-style layouts)

- ecommerce (high-quality visuals + detailed specs)

- mobile shopping (smooth browsing and checkout)

4) Fulfillment, Delivery & Logistics

Furniture and home goods require strong logistics, including:

- last-mile delivery coordination

- careful packaging and damage control

- delivery scheduling and installation support

This is a key differentiator versus smaller D2C brands.

5) Customer Support & Experience Management

Support operations focus on:

- returns and replacements

- order tracking and delivery issues

- warranty-style trust building

A premium brand survives because customers feel “safe” buying expensive items.

6) Marketing & Brand Storytelling

Crate & Barrel runs marketing like a lifestyle media brand:

- room inspiration campaigns

- seasonal trend pushes

- wedding + registry promotions

The goal is not just traffic—it’s purchase intent + high AOV conversion.

Resource Allocation (Where the Business Invests Most)

Crate & Barrel’s operational priorities typically focus on:

- Technology & Ecommerce Infrastructure

- product discovery and search

- mobile performance

- personalization and recommendations

- product discovery and search

- Supply Chain & Warehousing

- stock reliability

- faster delivery windows

- reduced damage/return costs

- stock reliability

- Retail Store Experience

- showroom layouts

- staff training for premium selling

- showroom layouts

- Brand + Performance Marketing

- seasonal demand capture

- retargeting high-intent users

- seasonal demand capture

- People & Design Teams

- merchandising experts

- product design and sourcing specialists

- merchandising experts

Why This Operational Model Works

Crate & Barrel’s operations support its brand promise:

- curated collections reduce customer confusion

- inventory planning prevents stock frustration

- delivery + service protect trust

- omnichannel consistency improves conversion

That’s why the business model stays stable even when consumer demand shifts.

Strategic Partnerships & Ecosystem Development

Crate & Barrel doesn’t grow only by opening stores or running ads.

It grows by building an ecosystem where design, supply chain, delivery, and digital experience work together smoothly.

In the business model of Crate & Barrel, partnerships act like force multipliers—helping the brand scale faster, reduce operational friction, and strengthen customer trust without losing its premium positioning.

Collaboration Philosophy (How Crate & Barrel Partners)

Crate & Barrel typically partners with companies that help it deliver:

- better product quality and exclusivity

- faster and safer delivery experiences

- stronger digital commerce performance

- brand expansion into new markets and customer segments

The key idea is simple:

partnerships protect the customer experience while enabling growth.

Key Partnership Types

1) Technology & API Partners

To strengthen omnichannel retail performance, Crate & Barrel benefits from:

- ecommerce and performance optimization tools

- analytics and customer behavior tracking

- personalization and recommendation engines

- customer support and CRM integrations

These partnerships help improve:

- conversion rates

- cart value

- repeat purchase frequency

2) Payment & Checkout Ecosystem Partners

A premium brand must make payment feel effortless, so partnerships support:

- multiple payment methods

- installment options (where relevant)

- fraud protection and secure checkout

This improves trust, especially for high-ticket furniture purchases.

3) Logistics, Delivery & Last-Mile Alliances

Furniture delivery is a major make-or-break area.

Crate & Barrel strengthens reliability through partnerships that support:

- scheduled delivery windows

- careful handling for fragile products

- assembly and installation coordination

- reverse logistics for returns

This protects brand reputation and reduces refund-related losses.

4) Product Sourcing & Manufacturing Partners

Crate & Barrel’s private label advantage is powered by:

- long-term supplier relationships

- quality control systems

- exclusive production agreements

- sustainable sourcing alignment (increasingly important in 2026)

These partnerships help maintain:

- consistent design standards

- pricing control

- better margins

5) Marketing, Distribution & Lifestyle Partnerships

Crate & Barrel expands visibility and demand through:

- influencer and lifestyle collaborations

- seasonal campaigns with trend-based positioning

- registry and gifting ecosystem alliances

These partnerships are designed to generate high-intent traffic, not just brand impressions.

Ecosystem Strategy Insight (Why Partnerships Create a Moat)

Crate & Barrel’s ecosystem creates defensibility because:

- network effects happen through trust

(customers return because delivery + quality is reliable) - partners increase value without increasing complexity

(tech improves experience, logistics improves reliability) - monetization improves indirectly

(better delivery + better checkout = higher conversion + fewer cancellations)

In short, partnerships help Crate & Barrel scale without damaging the premium customer experience—this is one reason its model stays strong in competitive retail markets.

Growth Strategy & Scaling Mechanisms

Crate & Barrel scales differently than fast-fashion or discount retailers.

It doesn’t win by adding thousands of random products—it wins by expanding lifestyle relevance, increasing customer lifetime value, and strengthening omnichannel performance.

In 2026, the business model of Crate & Barrel grows through a mix of brand-led demand, high-ticket conversions, and repeat purchase cycles across home categories.

Growth Engines (How Crate & Barrel Expands)

1) Organic Growth Through Brand Trust & Lifestyle Positioning

Crate & Barrel benefits from organic demand because:

- customers trust the quality and design consistency

- shoppers use it as a “default premium home brand”

- word-of-mouth spreads through home upgrades and gifting

This is not viral growth like social apps—but it’s high-intent loyalty growth.

2) Omnichannel Expansion (Store + Online + Mobile)

One of the biggest scaling levers is the seamless journey:

- discover online

- validate in-store (touch, feel, compare)

- purchase digitally or in-store

- deliver reliably

This reduces friction and increases conversions for big-ticket products.

3) Category Expansion & Cross-Selling

Crate & Barrel scales by expanding within the same customer wallet:

- furniture → rugs → lighting → décor

- kitchenware → dining → hosting essentials

- bedroom → storage → seasonal refresh items

This creates higher AOV and repeat purchases without needing entirely new customers.

4) Registry-Led Growth (Lifecycle Marketing)

Registry customers create a powerful flywheel:

- a couple builds a registry

- friends/family purchase gifts

- the couple returns later for upgrades

- loyalty continues through new-home purchases

This lifecycle-based growth is stable and predictable.

5) New Product Drops + Seasonal Collections

Crate & Barrel drives demand spikes using:

- seasonal refresh launches

- limited-time collections

- trend-aligned home aesthetics

This strategy keeps customers browsing even when they’re not actively buying.

Geographic Expansion Models

Crate & Barrel grows across markets using:

- flagship showrooms in high-value locations

- ecommerce-led entry into new regions

- localized delivery and logistics support

- premium positioning (not price-first competition)

Scaling Challenges & How Crate & Barrel Handles Them

Challenge 1: Logistics Complexity (Furniture Delivery Risks)

Big-ticket categories create operational pressure:

- shipping damage risk

- delayed delivery frustration

- return complexity

Solution

- stronger fulfillment systems

- delivery scheduling coordination

- service add-ons and customer support workflows

Challenge 2: Maintaining Premium Experience at Scale

Scaling can dilute brand quality if not controlled.

Solution

- private label consistency

- strict merchandising standards

- curated catalog discipline

Challenge 3: Competing With Price-First Ecommerce Players

Online marketplaces can undercut pricing.

Solution

Crate & Barrel protects value through:

- exclusive products

- brand-led trust

- experience differentiation (design + service + delivery)

Competitive Strategy & Market Defense

Crate & Barrel operates in one of the most competitive spaces in commerce: home, furniture, and lifestyle retail.

In 2026, customers have endless choices—from marketplaces and D2C brands to luxury design labels and discount retailers.

So the real question becomes:

how does Crate & Barrel defend its position and stay ahead without racing to the bottom on price?

The answer lies in how the business model of Crate & Barrel creates defensible advantages through brand trust, curation, and omnichannel strength.

Core Competitive Advantages (Why Crate & Barrel Stays Strong)

1) Curation as a Differentiation Strategy

Crate & Barrel doesn’t try to be everything for everyone.

Its catalog feels:

- intentional

- premium

- coordinated

This reduces decision fatigue and increases conversion because customers can confidently buy matching products across categories.

2) Brand Equity + Customer Trust

For high-ticket products like furniture, trust matters more than discounts.

Crate & Barrel wins because customers believe:

- the product quality will match the photos

- delivery will be reliable

- support will resolve issues

That trust becomes a long-term moat.

3) Omnichannel Strength (Digital + Physical Validation)

Many ecommerce-only brands struggle with furniture because customers want to:

- see it in real life

- test comfort and materials

- confirm size and finish

Crate & Barrel’s stores act like conversion accelerators for online buying.

4) Private Label & Exclusive Collections

Private label is a major defense strategy because it:

- prevents direct price comparison

- protects margins

- strengthens brand identity

- creates product uniqueness

This makes competition harder for marketplaces that sell “similar-looking” alternatives.

5) Premium Experience as a Competitive Weapon

Crate & Barrel competes through experience:

- premium packaging

- professional delivery options

- design inspiration content

- strong customer support systems

In 2026, experience is not optional—it’s the differentiator.

Market Defense Tactics (How It Handles Competition)

1) Avoiding Pricing Wars

Instead of deep discount battles, Crate & Barrel focuses on:

- value-based pricing

- bundles and curated sets

- premium positioning

This keeps the brand protected from “cheap product perception.”

2) Strategic Feature Rollouts

Crate & Barrel defends market share by improving:

- faster delivery windows

- better product discovery online

- more realistic product visuals

- personalized recommendations

These upgrades improve conversion and retention without needing heavy discounting.

3) Strengthening the Ecosystem

Crate & Barrel builds defensive layers through:

- reliable logistics partnerships

- tech improvements for omnichannel experience

- consistent merchandising systems

This reduces operational breakdowns, which is where many competitors lose trust.

4) Timing-Based Collection Strategy

A subtle but powerful defense tactic is seasonal timing:

- launch fresh collections when demand peaks

- push décor refresh during festivals/holidays

- promote registry at peak wedding seasons

This helps the brand capture demand when customers are most ready to buy.

Lessons for Entrepreneurs & Implementation

If you’re a founder planning to build a commerce platform, a niche marketplace, or a D2C-led retail app, Crate & Barrel is a strong reminder of one big truth:

You don’t need to win by being the cheapest.

You win by being the most trusted, most consistent, and easiest to choose.

The business model of Crate & Barrel proves that premium positioning works when you combine curation, customer experience, and operational reliability.

Key Factors Behind Crate & Barrel’s Success

Here’s what really makes the model work:

- Curation beats unlimited choice

Customers want fewer options that feel “right,” not endless listings. - Private label protects margins

Exclusive products reduce direct price comparisons and build uniqueness. - Omnichannel increases conversion

Stores support trust, while online drives scale and convenience. - Big-ticket + repeat purchase mix creates stability

Furniture drives high AOV, while décor/kitchen drive repeat frequency. - Delivery and service are part of the product

For furniture, logistics quality is as important as design quality.

Replicable Principles for Startups

You can apply this model even if you’re not building a huge retail brand.

1) Build a curated catalog first

Start with 30–100 strong SKUs instead of 5,000 average ones.

2) Design collections, not products

Think:

- “Living room setup”

- “Minimal kitchen essentials”

- “Modern bedroom package”

Bundles increase conversion and cart value.

3) Make trust a core product feature

Trust is built through:

- transparent delivery timelines

- clear return policies

- real product visuals

- responsive customer support

4) Use services to increase profit per customer

Even in an app, you can add:

- premium delivery

- installation/assembly support

- design consultation

- extended warranty-style add-ons

Common Mistakes to Avoid

Many founders fail in home/lifestyle commerce because they:

- copy marketplaces and list too many low-quality products

- rely only on discounts to drive sales

- ignore logistics and delivery experience

- don’t invest in product photography and visual storytelling

- build a store, but not a brand identity

How to Adapt This Model for Local or Niche Markets

You can localize Crate & Barrel’s strategy by focusing on:

- a specific design style (minimal, luxury, ethnic-modern, etc.)

- a niche category (kitchenware only, storage only, furniture only)

- a regional fulfillment advantage (fast delivery in one city first)

- a curated premium audience (not mass market)

This is how small brands scale:

own a niche → perfect the experience → expand category-by-category

Implementation & Investment Priorities

Phase 1: Foundation

- choose niche + positioning

- build curated catalog

- define pricing strategy + bundles

Phase 2 : Launch

- launch ecommerce/app

- set delivery workflows

- run high-intent acquisition campaigns

Phase 3 : Scale

- add private label/exclusive SKUs

- improve retention with collections + seasonal drops

- strengthen operations and support

Phase 4 : Expansion

- new categories

- new regions

- stronger partnerships and brand building

Ready to implement Crate & Barrel’s proven business model for your market? Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps. Get your free business model consultation today.

Conclusion

Crate & Barrel’s success proves a powerful 2026 lesson: the best business models don’t just sell products—they sell confidence.

When customers buy furniture or home essentials, they aren’t only paying for wood, fabric, or design. They’re paying for trust that the product will look right, last long, arrive safely, and match the lifestyle they imagine.

That’s why the business model of Crate & Barrel stays resilient. It combines premium curation, omnichannel convenience, private-label strength, and service-driven experience into a system that keeps customers returning over years—not just weeks.

In the future of platform economies, the winners won’t be the brands with the biggest catalogs. They’ll be the ones that make decisions easier, experiences smoother, and loyalty stronger.

FAQs

What type of business model does Crate & Barrel use?

Crate & Barrel uses a hybrid omnichannel retail business model, combining physical stores, ecommerce, curated collections, and service-based selling.

How does Crate & Barrel’s model create value?

It creates value through premium product curation, consistent design collections, trusted delivery, and a seamless online-to-store buying experience.

What are Crate & Barrel’s key success factors?

Its key strengths are brand trust, private-label products, high-ticket furniture categories, strong merchandising, and reliable customer experience.

How scalable is the business model of Crate & Barrel?

It’s highly scalable because it grows through category expansion, omnichannel reach, repeat purchase cycles, and collection-based merchandising.

What are the biggest challenges in this model?

The biggest challenges include logistics complexity, furniture delivery risks, inventory planning, and maintaining premium experience at scale.

How can entrepreneurs adapt this model to their region?

Founders can start with a niche category, build curated collections, offer premium service, and expand city-by-city with strong delivery reliability.

What resources and timeframe are needed to launch a similar model?

A basic version can launch in 30–90 days, but scaling requires investment in inventory planning, fulfillment, ecommerce tech, branding, and customer support.

How has Crate & Barrel evolved over time?

It evolved from store-led retail into a digital-first omnichannel brand, strengthening private label collections, ecommerce convenience, and service-driven buying.

Related Article :

- What is Wayfair and How Does It Work?

- What is Rakuten and How Does It Work?

- Best Faire Clone Scripts 2025: Build a B2B Wholesale Marketplace That Scales

- Best WooCommerce Clone Scripts 2025: Build a Scalable Ecommerce Platform from Day One

- Best BigCommerce Clone Scripts 2025: Build a Scalable SaaS Ecommerce Platform