From a small Charleston-based startup in 1993, Greystar Real Estate Partners has evolved into the world’s largest residential property management and multifamily housing company — over $75 billion in assets under management across 200+ markets by 2025.

In an industry historically driven by local players and asset-heavy models, Greystar disrupted conventions by combining property development, investment management, and operational excellence under one scalable global ecosystem.Understanding Greystar’s business model of Greystar is crucial for entrepreneurs and investors navigating today’s real estate-tech and property management landscape.

The company’s hybrid model — blending real estate ownership, third-party management, and institutional investment partnerships — demonstrates how operational efficiency, capital access, and data intelligence can coexist in one sustainable structure.

For founders building property-tech (PropTech), rental, or co-living platforms, Greystar’s strategy is a masterclass in scaling real-world assets through digital ecosystems — a domain Miracuves helps automate and scale through its white-label, platform-based infrastructure.

How the Greystar Business Model Works

Greystar operates at the intersection of real estate development, investment management, and property operations, forming a vertically integrated ecosystem that delivers both financial and operational scalability.

At its core, Greystar’s business model revolves around three synergistic pillars:

- Investment Management – pooling capital from institutional investors to acquire, build, and reposition residential assets.

- Development & Construction – creating high-value multifamily, student housing, and senior living communities.

- Property Management & Operations – overseeing day-to-day management for owned and third-party properties, ensuring stable cash flows and resident satisfaction.

This multi-vertical setup gives Greystar a powerful “own, operate, and optimize” framework, where data insights from operations feed back into investment decisions and future developments.

Business Model Type:

Hybrid Real Estate Platform — combining asset-heavy (ownership) and asset-light (management & service) models.

Value Proposition

| Stakeholder | Value Delivered |

| Investors | Access to global real estate portfolios with professional management and risk-adjusted returns. |

| Property Owners | Professional property operations, marketing, and tenant management at scale. |

| Residents | Quality, tech-enabled living experiences and consistent service standards. |

| Partners (Developers, Lenders) | Co-development and co-investment opportunities backed by Greystar’s expertise and data systems. |

Ecosystem Stakeholders

- Institutional Investors: Pension funds, sovereign wealth funds, and REITs.

- Property Owners: Individual and institutional landlords seeking management.

- Developers & Builders: Collaborators on new or restructured projects.

- Residents: End-users and key experience drivers.

Evolution of the Model

- 1990s: Started as a U.S.-centric property management firm.

- 2000s: Expanded into real estate investment via partnerships with institutional capital.

- 2010s: Global expansion (Europe, Asia-Pacific) + entry into student & senior housing.

- 2020s: Tech integration — AI-based pricing, smart leasing systems, and PropTech collaborations.

Why It Works in 2025

- Data-Driven Decision Making: Predictive analytics enhance occupancy rates and rent pricing.

- Vertical Integration: In-house control reduces inefficiencies.

- Diversification: Multiple asset classes mitigate risk.

- Global Standardization: Uniform service delivery builds trust among investors and residents.

Read more : What Is Greystar App and How Does It Work?

Target Market & Customer Segmentation Strategy

Greystar’s growth is anchored in its multi-segment targeting — serving different layers of the real estate value chain, from investors and property owners to tenants across lifestyle and income tiers.

Its customer strategy focuses on building long-term relationships through service consistency, digital experience, and investment-grade credibility.

Primary Customer Segments

| Segment | Description | Needs & Value Drivers |

| Institutional Investors | Pension funds, insurance firms, sovereign funds investing in real estate assets. | Reliable returns, transparency, risk diversification, ESG-aligned investments. |

| Property Owners & Developers | Owners seeking operational management for multifamily or student housing assets. | Operational efficiency, tenant satisfaction, cost reduction, brand trust. |

| Residents / Renters | Individuals and families renting apartments or student housing. | Quality living spaces, tech convenience, affordability, community engagement. |

Secondary Customer Segments

| Segment | Description | Key Focus |

| Corporate Tenants | Long-term housing for employees or business clients. | Flexible leasing terms, service reliability, premium amenities. |

| Strategic Partners | Builders, suppliers, PropTech startups, and local governments. | Co-development, technology integration, and smart city collaboration. |

Customer Journey Mapping

- Discovery:

Through online listings, social media, and corporate leasing programs.

(Digital-first lead generation and PropTech integrations.) - Conversion:

Smart leasing portals and virtual tours simplify onboarding. - Retention:

Loyalty through consistent service, maintenance responsiveness, and community events. - Expansion:

Cross-selling opportunities like furnished living, co-living, or premium amenities.

Market Positioning & Brand Voice

- Positioning: “The global leader in rental housing management and investment.”

- Brand Voice: Professional, trustworthy, future-focused, and lifestyle-driven.

- Differentiation: Full-stack real estate platform spanning ownership, operations, and technology integration — few global rivals match this breadth.

By 2025, Greystar commands a leading market share in multifamily rental housing across the U.S., U.K., and key European and Asia-Pacific cities — driven by strong brand equity and institutional partnerships.

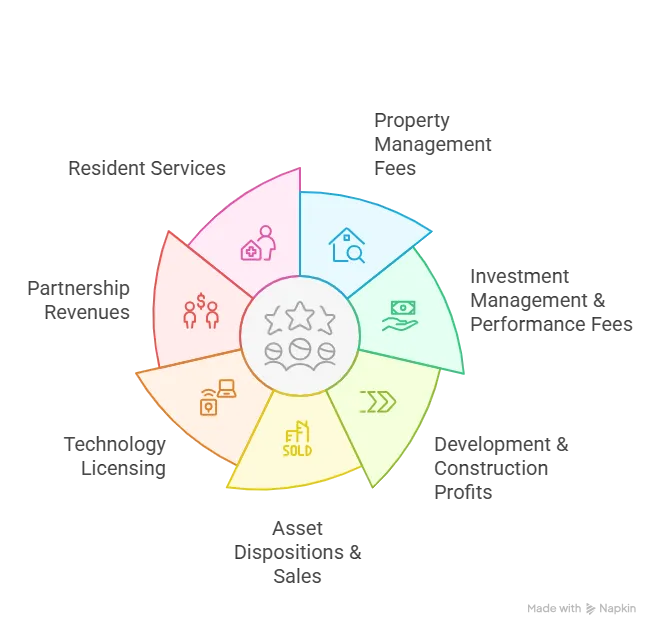

Revenue Streams and Monetization Design

Greystar’s revenue model is a multi-source architecture balancing steady operational income with high-margin investment gains.

This blend of recurring management fees and capital appreciation makes it resilient to economic cycles — a hallmark of its scalability.

Primary Revenue Streams

- Property Management Fees

- Collected from both Greystar-owned and third-party managed properties.

- Typically 3–6% of gross rents.

- Provides steady recurring revenue from 857,000+ units under management globally (as of 2025).

- Reinforced by digital management tools and automation (reducing per-unit operational cost).

- Investment Management & Performance Fees

- Greystar raises institutional funds and earns management fees (1–2%) plus performance incentives when fund returns exceed benchmarks.

- Assets under management exceed $75B (2025), with growing allocations toward ESG-certified assets.

- Development & Construction Profits

- Revenue from in-house development of new multifamily, student housing, and senior living projects.

- Includes margins on design, build, and asset sale phases.

- Expansion into build-to-rent and co-living sectors adds new vertical revenue.

Secondary Revenue Streams

- Asset Dispositions & Sales: Realizing capital gains from property sales or fund exits.

- Technology Licensing: Internal PropTech tools potentially white-labeled to partners.

- Partnership Revenues: Revenue-sharing with co-developers and local partners.

- Resident Services: Add-ons like parking, furnishings, pet services, and community memberships

.

Monetization Strategy

Greystar’s approach blends recurring cash flow (from management) with cyclical capital gains (from investments).

Key strategic principles:

- Cross-leverage operations data to improve asset performance → higher investor fees.

- Use development profits to reinvest into new markets.

- Build resident-centric digital experiences that increase lifetime value per unit.

- Layer optional revenue through service extensions and partnerships.

In short, Greystar’s Revenue Architecture acts as a closed ecosystem — investments fund developments, developments create assets, and management generates recurring yield.

Read more : Best Greystar Clone Scripts 2025 — Build Your Real Estate Empire Fast

Operational Model & Key Activities

Greystar’s operations function like a high-performance real estate engine, balancing capital management, construction, and day-to-day service operations — all powered by data intelligence and global process standardization.

Its success lies in integration — every department feeds insights back into the value chain, ensuring scalability without losing local agility.

Core Operational Activities

- Property Management Operations

- Daily operations for owned and third-party buildings.

- Rent collection, maintenance, tenant relations, and occupancy optimization.

- Supported by Greystar’s proprietary digital management suite (smart leasing, predictive maintenance).

- Investment Management

- Sourcing and structuring investment deals with institutional capital partners.

- Ongoing fund management and performance reporting.

- ESG integration and compliance auditing to attract sustainable capital.

- Development & Construction Management

- End-to-end project oversight: land acquisition → design → construction → lease-up.

- Regional development teams maintain local regulatory expertise.

- Partnerships with architects, contractors, and governments for fast-track projects.

- Technology & Data Infrastructure

- Real-time analytics for rent pricing, energy efficiency, and occupancy trends.

- AI-driven predictive systems for property lifecycle management.

- Centralized CRM linking investors, tenants, and staff.

- Marketing & Brand Management

- Digital-first strategy: paid search, SEO, 3D virtual tours, and influencer partnerships.

- Unified brand identity across 200+ markets, creating trust in new territories.

Resource Allocation (2025 Snapshot)

| Category | Approx. Allocation | Focus Area |

| Technology & Data Infrastructure | 25% | AI, analytics, PropTech integration |

| Development & Acquisitions | 30% | Global project pipeline |

| Marketing & Brand Growth | 15% | Market expansion, digital campaigns |

| Operations & HR | 20% | Staff training, service quality |

| R&D / Sustainability | 10% | ESG innovation, smart housing initiatives |

Operational Edge

- Global standardization with local flexibility.

- AI-enabled efficiency reduces downtime and cost per unit.

- Vertically integrated feedback loops improve asset ROI.

In essence, Greystar’s operational model ensures financial stability, operational agility, and technological foresight — a blueprint for modern asset-backed platform businesses.

Strategic Partnerships & Ecosystem Development

Greystar’s success isn’t built in isolation — it thrives on a deep network of global partnerships spanning finance, technology, construction, and urban development.

These collaborations form a self-reinforcing ecosystem where every stakeholder benefits from Greystar’s scale, credibility, and integrated platform.

Partnership Philosophy

Greystar views partnerships not as transactions but as ecosystem alliances — designed to amplify market access, innovation, and risk mitigation.

Its model promotes mutual value creation, where partners leverage Greystar’s operational capabilities while contributing capital, technology, or local market expertise.

Key Partnership Types

- Technology & PropTech Partnerships

- Collaborations with smart home tech providers (Nest, Honeywell, Latch) for connected living.

- Data analytics and AI integrations with real estate software partners.

- Piloting automation tools for maintenance, leasing, and tenant communication.

- Financial & Investment Alliances

- Strategic joint ventures with institutional investors such as Blackstone, PGGM, and APG.

- Long-term capital relationships for multi-billion-dollar residential portfolios.

- ESG-focused green finance programs promoting sustainable construction.

- Construction & Development Partners

- Local and regional contractors for high-volume build-to-rent developments.

- Partnerships with architecture firms and design consultants to meet localized preferences.

- Integration of prefabrication and modular building technologies to cut costs and timelines.

- Marketing & Distribution Collaborations

- Digital partnerships with rental marketplaces and listing platforms.

- Community-building with universities and corporate leasing programs.

- Regulatory & Government Engagements

- Working with urban development authorities for housing projects in high-demand metros.

- Policy collaboration for affordable housing initiatives and ESG compliance.

Ecosystem Strategy Insights

- Network Effects: Each new asset or investor enhances ecosystem value by feeding data and brand visibility.

- Partner Monetization: Shared equity, co-development fees, and recurring management contracts.

- Defensive Moat: Long-term capital partnerships make market entry difficult for new competitors.

Greystar’s ecosystem is now global — seamlessly blending institutional finance, PropTech innovation, and local execution — setting a benchmark for asset-based platform scalability.

Growth Strategy & Scaling Mechanisms

Greystar’s rise to global dominance is no accident — it’s the result of strategic scaling, where market entry, product diversification, and technology adoption are orchestrated like a global chessboard.

Its 2025 growth playbook blends organic expansion, acquisitions, and digital transformation, creating compounding momentum.

Core Growth Engines

- Geographic Expansion

- From a U.S.-centric player to a presence in 200+ cities across 20+ countries.

- Targeting emerging markets in India, Southeast Asia, and Latin America through joint ventures.

- Follows a “cluster strategy” — entering new markets via major cities, then expanding to secondary hubs.

- Vertical Diversification

- Expansion from multifamily apartments into student housing, senior living, and build-to-rent communities.

- Launch of Greystar Global Partners Fund to finance emerging housing models.

- ESG-focused housing and co-living formats to capture Gen Z and millennial renters.

- Digital Transformation

- AI-powered pricing, chatbots, and smart leasing automation enhance resident experience.

- Use of PropTech analytics for real-time portfolio optimization.

- Data centralization enables faster market decision-making and asset lifecycle forecasting.

- Brand Extension & Service Innovation

- “Greystar Living” — a global residential lifestyle brand focused on customer experience.

- Cross-selling new services (furnished rentals, corporate housing, digital concierge).

- Launch of mobile-first resident platforms to foster loyalty and referrals.

Scaling Challenges & Solutions

| Challenge | Greystar’s Solution |

| Operational complexity across regions | Regionalized management structures and technology-driven standardization. |

| Regulatory barriers in new countries | Partnering with local developers and compliance experts. |

| Rising construction costs | Prefabrication, modular builds, and supply chain partnerships. |

| Sustainability pressure | Carbon-neutral projects, LEED certifications, and ESG investment funds. |

| Talent scalability | Leadership academies, global training, and AI-assisted HR planning. |

Growth Strategy Insights

- Greystar’s model thrives on controlled scaling — expanding only where operations and brand can sustain.

- Data-driven replication: Lessons from one market are codified and digitally replicated elsewhere.

- Capital recycling: Profits from matured assets fund entry into new geographies.

By 2025, Greystar’s compounding growth model positions it as both a real estate operator and a global asset management tech powerhouse — redefining what a property company can be.

Competitive Strategy & Market Defense

In an increasingly crowded real estate investment and property management landscape, Greystar’s long-term success depends on a defensible competitive strategy — one built on brand trust, vertical integration, and digital innovation.

By 2025, Greystar competes not just with property developers, but also with institutional investors, PropTech startups, and REITs, making its competitive playbook both sophisticated and dynamic.

Key Competitive Advantages

- Network Effects & Scale Efficiency

- Managing 850,000+ residential units globally provides vast data on rent trends, occupancy, and consumer behavior.

- Each property managed strengthens the feedback loop that improves pricing and investment decisions.

- Vertical Integration

- Few competitors own, develop, and manage assets under one roof.

- This integration eliminates inefficiencies between investment, construction, and operations — a powerful moat.

- Brand Equity & Institutional Credibility

- Long-standing trust among pension funds, sovereign wealth funds, and global investors.

- Reputation as a “safe pair of hands” for multi-billion-dollar mandates ensures consistent capital inflow.

- Technology & Data-Driven Personalization

- Predictive analytics for rent pricing, tenant churn, and ESG scoring.

- Smart leasing platforms offering one-click rentals and 24/7 service support.

- AI-led maintenance scheduling reduces downtime and cost — unmatched operational ROI.

- Sustainability Leadership

- Carbon-neutral development commitments and energy-optimized buildings appeal to ESG-conscious investors.

- Sustainability becomes both a compliance advantage and a market differentiator.

Market Defense Tactics

| Threat | Greystar’s Defensive Strategy |

| New market entrants | Maintains brand moat through scale, reputation, and exclusive partnerships. |

| Price competition | Leverages technology to reduce per-unit cost and sustain margins. |

| PropTech disruptors | Invests or partners early with emerging tech startups to integrate innovation. |

| Economic downturns | Diversified portfolio (student, senior, multifamily) cushions volatility. |

| Regulatory shifts | In-house legal and compliance teams ensure preemptive adaptation. |

Strategic Positioning Summary

Greystar’s defensive strength lies in being both a capital allocator and service operator, turning fixed real estate assets into a flexible digital ecosystem.

While competitors rely on one-dimensional revenue (either ownership or management), Greystar operates on a three-dimensional moat — capital, data, and operations.

This makes it not just resilient but anti-fragile, strengthening under market stress.

Lessons for Entrepreneurs & Implementation

Greystar’s story is more than a corporate success — it’s a masterclass in business model architecture.

Its formula can be decoded into a blueprint for entrepreneurs who aim to build scalable, asset-backed, or platform-based businesses — even beyond real estate.

Key Factors Behind Greystar’s Success

- Vertical Integration = Efficiency & Control

- Combining investment, development, and management created a self-sustaining growth loop.

- Lesson: Don’t rely solely on one stage of the value chain — integrate upstream and downstream activities when feasible.

- Data as the Strategic Engine

- Greystar’s global dataset on rent, occupancy, and demographics drives every decision.

- Lesson: In platform businesses, data isn’t just analytics — it’s the foundation for product, pricing, and strategy.

- Long-Term Capital Partnerships

- Instead of chasing fast growth, Greystar built deep, recurring investor relationships.

- Lesson: Sustainable funding models (retainers, partnerships, recurring revenue) beat one-time spikes.

- Global Standardization with Local Adaptation

- Greystar blends global brand standards with local customization — vital for international scale.

- Lesson: Create modular business processes that can localize without breaking global efficiency.

- Sustainability as Strategy, Not Obligation

- By leading in ESG and green housing, Greystar turned compliance into competitive advantage.

- Lesson: The next generation of growth lies in responsible, future-proof business practices.

Replicable Principles for Founders

- Build ecosystems, not just products.

- Create feedback loops between user experience, data, and operations.

- Leverage technology for scale — automation, analytics, and AI are key to operational edge.

- Seek partnerships that compound — finance, distribution, or co-innovation.

Common Mistakes to Avoid

- Relying on fragmented value chains.

- Scaling too early without operational standardization

- Ignoring compliance or sustainability early in development.

- Over-customizing across markets — destroying global cohesion.

Adaptation Strategies for Entrepreneurs

| Sector | Adaptation Insight |

| PropTech / Real Estate | Adopt Greystar’s “own + operate + optimize” model digitally — use AI to replicate their efficiency. |

| Marketplace Apps | Treat each participant (buyer, seller, partner) as part of a long-term ecosystem, not a transaction. |

| SaaS / Subscription Platforms | Integrate feedback loops between usage data and product improvement — like Greystar does with resident analytics. |

| On-Demand Platforms | Create trust loops through brand consistency, compliance, and customer service. |

Miracuves’ Role in Implementation

Miracuves helps founders translate complex models like Greystar’s into scalable digital ecosystems.

From real estate SaaS to marketplace automation, our white-label and custom solutions empower entrepreneurs to launch platform-driven businesses — fast, secure, and sustainable.

Ready to implement Greystar’s proven business model for your market?

Miracuves builds scalable platforms with tested growth frameworks.

We’ve helped 200+ entrepreneurs launch profitable, platform-based ventures.

Get your free business model consultation today.

Conclusion :

Greystar’s journey shows that the future of business isn’t about owning more — it’s about integrating better.

Its rise from a local U.S. operator to a $75+ billion global powerhouse underscores how vision, structure, and discipline can turn a traditional industry into a scalable digital-era ecosystem.

At its heart, Greystar proves that innovation in operations — not just in product or marketing — can unlock exponential growth. Its success teaches entrepreneurs that the path to dominance lies in building closed-loop systems, And with Miracuves’ expertise in white-label digital infrastructure, replicating such models has never been faster, safer, or more achievable.

FAQs :

1. What type of business model does Greystar use?

Greystar operates a hybrid business model that combines real estate investment, development, and property management under one vertically integrated system. This allows it to generate both recurring income and long-term capital gains.

2. How does Greystar’s model create value?

Greystar creates value by managing the entire housing lifecycle — from funding and construction to tenant operations and asset sales. Its integration of investment and management ensures high returns for investors and exceptional experiences for residents.

3. What are Greystar’s key success factors?

Greystar’s success stems from its vertically integrated model, seamlessly combining investment, construction, and management under one roof. Its global scale, backed by data intelligence, institutional partnerships

4. How scalable is Greystar’s business model?

Highly scalable. Its standardized global processes, tech-enabled operations, and partnership-driven expansion allow rapid replication across markets. In 2025, Greystar manages over 850,000 units in 20+ countries.

5. What are the biggest challenges Greystar faces?

Greystar’s main hurdles include navigating complex regional regulations and managing rising construction and financing costs. Maintaining consistent service quality across global markets while competing with agile, digital-first PropTech startups adds further operational and strategic pressure.

6. How can entrepreneurs adapt this model to their region?

Founders can replicate Greystar’s model digitally — by launching tech-enabled property management, co-living, or investment platforms that automate processes and localize services. Miracuves’ white-label platforms make this adaptation seamless.

7. What resources and timeframe are needed to launch a similar platform?

With Miracuves’ white-label infrastructure, a Greystar-inspired real estate or property management platform can be launched in 3–9 days with full branding, core modules, and admin setup Price Starts at $12,999, depending on scale, integrations, and customization requirements.

8. What are alternatives to Greystar’s model?

Alternatives include asset-light PropTech platforms (like Airbnb or CoHo) and property listing SaaS models. However, Greystar’s integrated investment-management framework delivers deeper, more sustainable value over time.

9. How has Greystar’s business model evolved over time?

From a U.S.-based management company (1990s) → to an investment fund manager (2000s) → to a global property development and PropTech-integrated ecosystem (2020s). Its journey mirrors the evolution from analog real estate to digital asset ecosystems.

10. Why is Greystar’s business model relevant in 2025?

Because it bridges physical assets and digital infrastructure, balancing stability with innovation — a model increasingly sought after by institutional investors, PropTech founders, and platform-driven entrepreneurs alike.

Related Article :