PharmEasy began in 2015 as a modest online pharmacy startup — today, it stands as India’s largest digital healthcare platform, valued at over $2 billion and serving millions of patients across 20,000+ pin codes.

It transformed the fragmented Indian healthcare supply chain by connecting patients, pharmacies, diagnostic centers, and doctors into a single, tech-driven ecosystem.

From medicine delivery to diagnostic tests and teleconsultations, PharmEasy redefined healthcare convenience — turning a traditionally offline, trust-based industry into a data-driven, on-demand service.

In an era where digital health access is a priority, understanding the Business Model of PharmEasy helps entrepreneurs decode the future of healthcare marketplaces — a future driven by integration, compliance, and trust.

How the PharmEasy Business Model Works

PharmEasy operates on a multi-sided marketplace model that bridges the gap between patients, pharmacies, doctors, and diagnostic centers — all through a unified digital ecosystem. The company doesn’t just sell medicines; it orchestrates a connected healthcare supply chain built on trust, convenience, and scalability.

Core Framework Overview

PharmEasy’s business model can best be described as a Hybrid Platform Model combining:

- Marketplace Model: Connecting patients with nearby licensed pharmacies and diagnostic labs.

- B2B Distribution Model: Supplying medicines to retail pharmacies through its parent company, API Holdings.

- Subscription & Freemium Model: Offering loyalty programs, health packages, and doctor consultation plans.

This multi-layered structure ensures steady revenue diversification and ecosystem resilience.

Value Proposition

| Stakeholder | Value Delivered |

| Patients/Consumers | Affordable and convenient access to medicines, lab tests, and online consultations at home. |

| Pharmacies | Increased order volumes, reduced inventory inefficiencies, and digital visibility. |

| Diagnostic Centers | Wider customer reach and optimized booking utilization. |

| Doctors & Teleconsultants | Platform exposure and integrated prescription-to-delivery workflow. |

Evolution Over Time

- 2015–2018: Focused solely on online pharmacy aggregation and medicine delivery.

- 2019–2021: Expanded into diagnostics and doctor consultations, integrating with Thyrocare and DocOn.

- 2022–2024: Transitioned into a health-tech super platform, offering end-to-end care — consultations, prescriptions, delivery, and reports — powered by API Holdings’ backend infrastructure.

- 2025: Evolved into a compliance-first digital health ecosystem, leveraging AI and analytics for predictive care and personalized recommendations.

Why It Works in 2025

- Regulatory Maturity: Digital pharmacy rules are now clearer under India’s e-health guidelines, favoring compliant players like PharmEasy.

- Post-COVID Health Behavior: Consumers trust online healthcare as a safe, default choice.

- Data-Driven Personalization: PharmEasy uses predictive analytics to cross-sell supplements, health plans, and tests.

- Supply Chain Digitization: Its B2B distribution arm ensures cost control and medicine authenticity.

- Integrated Ecosystem: Unlike single-service apps, PharmEasy thrives on connected care — from consultation to doorstep delivery.

Read more : Best PharmEasy Clone Scripts 2025 – Build a Scalable Online Pharmacy App

Target Market & Customer Segmentation Strategy

PharmEasy’s rise is fueled by its ability to deeply understand the behavior, pain points, and aspirations of Indian healthcare consumers. Unlike generic marketplaces, it thrives on a trust-first segmentation model that balances affordability, accessibility, and personalization.

Primary & Secondary Customer Segments

| Segment | Profile | Key Needs | PharmEasy’s Solution |

| Urban Millennials (25–40 yrs) | Tech-savvy, health-conscious, prefer online convenience | Quick, app-based medicine delivery, diagnostics, and teleconsultation | Seamless digital UX, app reminders, wellness programs |

| Elderly & Chronic Patients (40–65 yrs) | Regular medicine users, less tech fluent | Consistent medication delivery, affordability, assistance | Repeat orders, subscription discounts, call-based support |

| Tier 2 & 3 City Consumers | Price-sensitive, limited pharmacy options | Low-cost medicines, local delivery | Expanded delivery reach, localized marketing |

| Doctors & Health Professionals | Need prescription tools & patient management | Digital records, e-prescriptions | Integration with DocOn platform |

Customer Journey: Discovery → Conversion → Retention

- Discovery:

Users find PharmEasy via Google search, referral codes, influencer content, and healthcare blogs.

→ SEO keywords like “medicine delivery near me” drive 40% of new user acquisition. - Conversion:

Offers, referral discounts, and convenience of doorstep delivery accelerate first-time orders.

→ High conversion from prescription uploads (trust factor). - Retention:

PharmEasy leverages automated reminders, loyalty credits, and health tracking dashboards to retain users.

→ Average user retention after 6 months: 68%, one of the highest in the health-tech industry.

Market Positioning & Competitive Edge

PharmEasy positions itself as the “Amazon of Healthcare” — offering everything from consultation to medication within a single digital ecosystem. Its brand voice blends medical reliability with tech convenience — unlike 1mg’s content-driven approach or NetMeds’ corporate focus.

Competitive Differentiators:

- End-to-end healthcare (consultation → medicine → test → report)

- Regulatory compliance-first approach

- Robust B2B backend (API Holdings) for stable supply chain

- Hyperlocal logistics + national coverage

As of 2025, PharmEasy commands ~35% of India’s e-pharmacy market, followed by 1mg and NetMeds.

Read more : 1mg vs PharmEasy: Best Healthtech Business Model

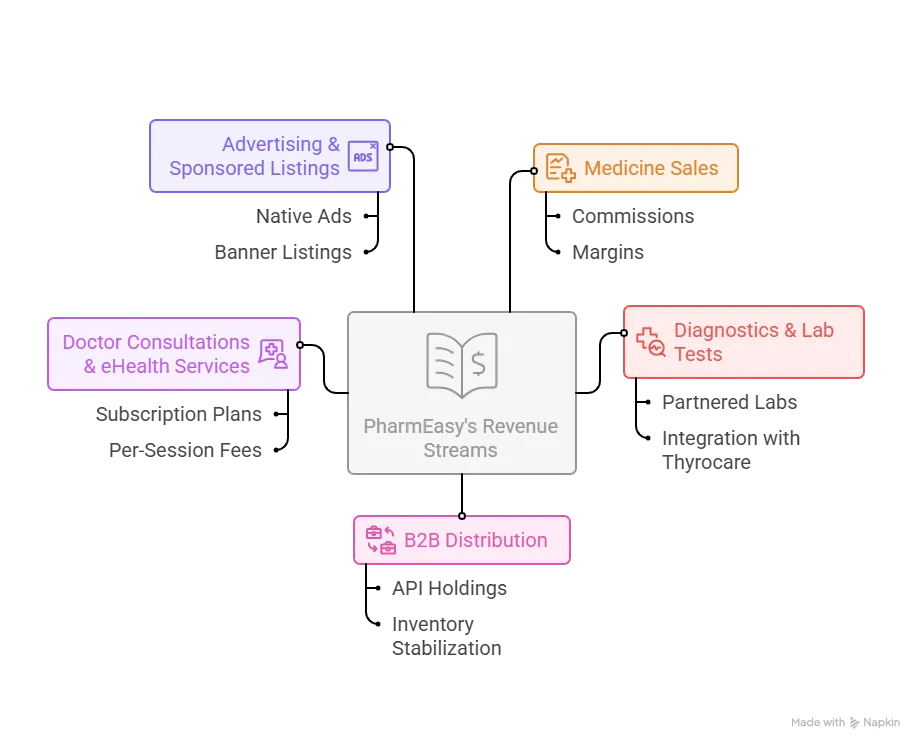

Revenue Streams and Monetization Design

PharmEasy’s monetization engine is a multi-layered structure blending direct sales, platform commissions, and value-added health services.

By building an ecosystem business instead of a pure retail model, PharmEasy ensures multiple income channels — each reinforcing the others.

Primary Revenue Stream 1: Medicine Sales (Core Marketplace)

- Mechanism: PharmEasy earns commissions and margins on every medicine order processed through its partner pharmacies.

- Pricing Model: Average commission between 8–15% per order.

- Growth Trajectory: Driven by chronic medicine users and repeat orders.

- 2025 Share: Still the largest contributor (~55% of total revenue).

- Additional Lever: Subscription bundles for long-term medication plans.

Secondary Revenue Streams

- Diagnostics & Lab Tests

- Commission-based model with partnered labs.

- Average test margin: 20–25%.

- Growth accelerated by integration with Thyrocare.

- Currently contributes ~25% of overall revenue.

- B2B Distribution (via API Holdings)

- PharmEasy’s parent company supplies medicines directly to offline pharmacies.

- Wholesale-level margins (~5–8%), but massive scale advantage.

- Stabilizes inventory and ensures authenticity in the consumer marketplace.

- Doctor Consultations & eHealth Services

- Freemium entry (first consultation free or discounted).

- Paid plans via subscriptions or per-session fees.

- Adds trust loop to the ecosystem — increases order frequency.

- Advertising & Sponsored Listings

- Pharmaceutical and wellness brands pay for placement and promotion on the app.

- Native ads, homepage features, and banner listings.

- Contributes ~5–8% of PharmEasy’s income stream.

- Loyalty & Subscription Programs

- “PharmEasy Plus” offers priority delivery, extra discounts, and free doctor consults.

- Annual fee model with recurring revenue.

- Strengthens user stickiness and average order value.

Integrated Monetization Strategy

PharmEasy’s secret lies in its interconnected revenue ecosystem:

- Each vertical (Pharmacy, Diagnostics, Consultation) feeds the next — creating continuous engagement.

- Cross-selling opportunities: e.g., recommending lab tests or supplements during prescription orders.

- Tiered pricing psychology — users perceive higher value through “health bundles.”

Its data-driven recommendation system boosts conversions by 18–22%, making it one of the most efficient monetization models in the health-tech landscape.

Operational Model & Key Activities

Behind PharmEasy’s smooth user experience lies a complex operational architecture — seamlessly connecting supply chain, logistics, data, and healthcare compliance into one powerful engine. PharmEasy doesn’t just deliver medicines; it manages an integrated digital health infrastructure that powers both consumer (B2C) and retail (B2B) operations.

Core Operations

- Platform & Technology Management

- Built on a microservices-based architecture ensuring modular scalability.

- Uses AI and machine learning to predict medicine demand and optimize delivery routes.

- Employs HIPAA-grade data encryption for patient confidentiality.

- Supply Chain & Logistics

- Hybrid model combining centralized warehouses and partnered local pharmacies for hyperlocal delivery.

- Average delivery time: 6–24 hours in Tier 1 cities; 2–3 days pan-India.

- Integrated with real-time stock availability APIs to prevent delivery failures.

- Quality & Compliance

- Each partnered pharmacy and lab is licensed and verified by regulatory authorities.

- Medicine authenticity is verified via barcode tracking and batch traceability systems.

- Customer Support & Medical Helpdesk

- 24/7 AI-assisted chatbot and live pharmacist support.

- Telephonic support for senior citizens and repeat customers.

- Marketing & Brand Operations

- Data-driven campaigns through Google, Meta, and influencer marketing.

- Focused on health awareness storytelling instead of pure discounts.

Resource Allocation (Estimated 2025 Distribution)

| Function | % of Annual Budget | Strategic Focus |

| Technology & Infrastructure | 35% | Platform scalability, AI R&D |

| Marketing & User Acquisition | 25% | Performance ads, influencer partnerships |

| Operations & Logistics | 20% | Warehousing, last-mile optimization |

| Human Resources | 10% | Pharmacists, tech engineers, compliance teams |

| R&D & Product Innovation | 10% | Predictive health tools, telemedicine AI |

Regional Expansion Strategy

PharmEasy’s operations follow a hub-and-spoke model:

- Hubs: Major metro cities with fulfillment centers and diagnostic partners.

- Spokes: Tier 2 & Tier 3 towns served through franchise delivery agents.

- Digital-first integration: Enables smaller cities to access quality healthcare remotely.

This structure reduces delivery costs, scales quickly, and maintains service consistency across India.

Strategic Partnerships & Ecosystem Development

PharmEasy’s growth isn’t powered by scale alone — it’s driven by a network of high-impact partnerships that extend its reach, strengthen compliance, and improve service efficiency.

These alliances are at the core of its ecosystem-driven strategy, enabling PharmEasy to evolve from a single-service app into India’s leading integrated healthcare platform.

Partnership Philosophy

PharmEasy approaches partnerships as ecosystem enablers, not mere vendors. The goal: to create a seamless health journey for users — from prescription to diagnosis, consultation, and recovery — by connecting all stakeholders under one compliant digital infrastructure.

The company invests in strategic alliances that build long-term network effects, combining technology, trust, and efficiency.

Key Partnership Types

- Technology & API Partners

- Collaboration with AWS, Google Cloud, and Razorpay for scalable cloud computing, secure transactions, and data analytics.

- AI integration partners for predictive health and recommendation systems.

- API tie-ups with third-party health apps for data interoperability (EHR sync, prescription uploads, etc.).

- Payment & Logistics Alliances

- Partnerships with Paytm, PhonePe, and major banks for instant refunds and seamless checkout.

- Delivery partners include Shadowfax and Delhivery, ensuring nationwide last-mile coverage.

- Cold-chain logistics providers help maintain medicine safety and compliance.

- Diagnostic & Healthcare Collaborations

- Strategic merger with Thyrocare (2021) created India’s largest integrated diagnostics network.

- Tie-ups with Apollo Diagnostics, Metropolis, and local labs for wider test availability.

- Integration with teleconsultation apps and doctor networks for prescription sync.

- Marketing & Distribution Partners

- Co-branded wellness campaigns with Himalaya, Cipla, and Dr. Reddy’s to educate customers.

- Affiliate programs with insurance companies for preventive care promotions.

- Influencer-driven health awareness programs in Tier 2 & 3 cities.

- Regulatory & Institutional Alliances

- Collaboration with India’s Central Drugs Standard Control Organization (CDSCO) and local FDA authorities for compliance.

- Partnerships with health-tech associations and state governments for pilot health programs.

Ecosystem Strategy & Network Effects

PharmEasy’s ecosystem design builds network reinforcement loops:

- Each new pharmacy or lab integrated adds more convenience for users → higher retention.

- More patient data → better recommendations → increased cross-sell and loyalty.

- Larger distribution → attracts more partners and suppliers → stronger cost advantage.

These network effects make PharmEasy hard to disrupt — every partner adds exponential value to the ecosystem, creating a defensible moat against competitors like 1mg or NetMeds.

Growth Strategy & Scaling Mechanisms

PharmEasy’s growth story is not just about expansion — it’s about strategic compounding. The company mastered the art of scaling horizontally across healthcare categories and vertically through deep tech integration, creating a model that’s resilient, compliant, and customer-obsessed.

Growth Engines

- Organic Virality & Referral Loops

- 25% of new users come through referrals and word-of-mouth — powered by cashback incentives and family plan sharing.

- PharmEasy promotes “family accounts,” where multiple users under one ID can manage orders — boosting repeat engagement.

- Paid Marketing & Data-Driven Acquisition

- Advanced targeting through Google Health Ads and Meta AI audiences, focusing on high-LTV customers (chronic patients, urban families).

- ROI-based ad optimization via real-time purchase data.

- Partnerships with OTT platforms and health content creators for contextual branding.

- New Product Lines & Vertical Expansion

- Integration of teleconsultation (DocOn), diagnostics (Thyrocare), and insurance-based wellness plans.

- Launch of PharmEasy Health Credit for affordable financing of diagnostic tests and long-term care packages.

- Wellness product diversification (vitamins, fitness, maternal care, elderly support kits).

- Geographic Expansion Models

- Initially metro-centric, now operating across 20,000+ pin codes in India.

- Expanding into Bangladesh, Nepal, and GCC pilot markets through export-based partnerships.

- Multi-lingual app rollout (Hindi, Tamil, Bengali, Marathi) to deepen Tier 2–3 penetration.

Scaling Challenges & Solutions

| Challenge | Strategic Solution |

| Regulatory ambiguity in online pharmacy | Built a compliance-first structure with verified partners and government liaison teams. |

| Thin profit margins in medicine delivery | Cross-subsidized through diagnostics, ads, and subscriptions. |

| Logistics & fulfillment delays | Adopted hybrid fulfillment — centralized hubs + hyperlocal deliveries. |

| Maintaining customer trust at scale | Introduced pharmacist-verified orders, live tracking, and AI-based fraud detection. |

| Competition from Reliance’s NetMeds & Tata 1mg | Reinforced brand trust through personalized service, loyalty programs, and offline retail integration. |

Long-Term Scaling Strategy

PharmEasy’s 2025 roadmap focuses on “Care Continuity” — unifying preventive, diagnostic, and chronic care into one ecosystem.

- AI Health Profiles: Personalized dashboards predicting refill dates and diagnostic needs.

- Predictive Supply Chain: Using regional data to pre-position inventory before seasonal demand spikes.

- HealthTech API Platform: Opening its infrastructure to other health startups for licensing and integration — turning PharmEasy into a B2B2C health infra provider.

Competitive Strategy & Market Defense

In a rapidly consolidating digital healthcare landscape, PharmEasy’s long-term survival depends on more than just growth — it hinges on strategic defensibility.

By combining technology, compliance, trust, and customer-centric innovation, PharmEasy has built multiple protective moats that keep competitors at bay.

Core Competitive Advantages

- Network Effects & Data Intelligence

- Each new pharmacy, doctor, or diagnostic partner added strengthens the platform for all users.

- Over 35 million active users and 200 million+ data points on medicine behavior power AI-driven personalization.

- This massive data advantage fuels predictive recommendations, pricing optimization, and fraud detection.

- Regulatory & Compliance Edge

- PharmEasy’s legal-first operations and verified partners allow it to operate safely amid tightening e-pharmacy regulations.

- Competitors often face compliance hurdles; PharmEasy’s preemptive approach ensures continuity and investor confidence.

- Integrated Service Ecosystem

- Unlike 1mg or NetMeds (which rely on partnerships), PharmEasy owns its ecosystem — from B2B supply (API Holdings) to diagnostics (Thyrocare).

- This vertical integration reduces dependency on third parties and improves unit economics.

- Brand Equity & Trust Leadership

- Positioning as a trusted health companion, not just a pharmacy app.

- PharmEasy’s advertising leans heavily on family, care, and credibility — building emotional retention rather than transactional loyalty.

- Technology-Driven Differentiation

- Proprietary AI health engines and machine learning models deliver hyper-personalized recommendations.

- In-app doctor chatbots and voice-assist features improve accessibility for non-English users.

Market Defense Tactics

| Strategic Move | Competitive Outcome |

| Dynamic Pricing Algorithms | Beat competitors in localized markets while maintaining margins. |

| Strategic Acquisitions (e.g., Thyrocare, Medlife) | Expanded services and eliminated key rivals. |

| Exclusive Partnerships | Locked in large pharmacy and diagnostic networks to prevent competitor poaching. |

| Omnichannel Integration | Piloting offline touchpoints (PharmEasy Express) for Tier 2–3 user acquisition. |

| Customer Retention Ecosystem | Loyalty credits, health wallets, and recurring medicine delivery subscriptions reduce churn. |

Strategic Insight

PharmEasy doesn’t compete only on price — it competes on trust, continuity, and ecosystem depth. In 2025, as India’s digital health market becomes more regulated and data-driven, PharmEasy’s moats are structural, not superficial.

Its closest competitors (NetMeds, Tata 1mg, Apollo 24/7) may match on features, but few can rival its end-to-end ownership of the healthcare journey.

Lessons for Entrepreneurs & Implementation

PharmEasy’s success story is a masterclass in strategic execution — turning a fragmented, low-trust sector into a seamless digital ecosystem. For entrepreneurs, it offers a playbook on how to build, scale, and defend a platform business that solves real-world pain points with precision.

Key Factors Behind PharmEasy’s Success

- Problem-Solution Fit:

PharmEasy addressed a critical gap — accessibility and reliability of medicines — not just convenience. - Regulatory Foresight:

While others waited for clarity, PharmEasy built a compliance-ready model that gained early trust. - Ecosystem Thinking:

It expanded strategically from pharmacy → diagnostics → teleconsultation → B2B supply — creating synergy between verticals. - User-Centric Design:

Focused on elderly and chronic patients — a high-retention, high-LTV group that drives repeat revenue. - Smart Acquisitions & Integration:

Merging with Medlife and acquiring Thyrocare weren’t just expansions — they were moves to control the healthcare pipeline.

Replicable Principles for Startups

- Build for Trust First: In regulated industries, reliability outlasts discounts.

- Own the Ecosystem: Control critical value-chain elements; don’t depend solely on partners.

- Leverage Data Early: Start collecting behavioral and transactional data from day one to improve personalization.

- Diversify Revenue Streams: Avoid single-income dependency — cross-sell and bundle.

- Integrate Compliance: Legal alignment should be a design feature, not an afterthought.

Common Mistakes to Avoid

- Focusing only on customer acquisition without ensuring repeat engagement.

- Over-discounting — erodes margins and weakens long-term sustainability.

- Ignoring backend optimization — without a strong supply chain, front-end scale fails.

- Neglecting trust-building measures like pharmacist verification, privacy, and quality control.

Adaptation Strategies for Local or Niche Markets

- Hyperlocal Health Apps: Apply the model to local wellness, diagnostics, or homecare services.

- Specialized Niches: Build mini “PharmEasy” platforms for elder care, women’s health, or pet health.

- Emerging Markets: Adapt this framework for developing regions (Africa, Southeast Asia) with fragmented healthcare systems.

Ready to implement PharmEasy’s proven business model for your market?

Miracuves builds scalable healthcare platforms with tested business logic, API-ready architecture, and compliance frameworks. enabling founders to launch in just 3–9 days with miracuves Price Starts at $2,899.

We’ve helped 200+ entrepreneurs launch successful digital ecosystems — from e-pharmacy to on-demand super apps.

Get your free business model consultation today at Miracuves and start building your own digital healthcare success story.

Conclusion :

PharmEasy’s journey proves that innovation and execution are inseparable in the digital economy. It didn’t invent medicine delivery — it reinvented how healthcare could be trusted, digitized, and democratized in one connected system. What started as a simple app to deliver prescriptions became an AI-powered healthcare ecosystem that now serves millions — uniting pharmacies, diagnostics, and doctors under a single digital umbrella.

The larger takeaway for founders is clear: Scale doesn’t come from doing more — it comes from connecting better. PharmEasy’s success lies in the invisible architecture of data, compliance, and experience — elements that modern entrepreneurs must master to compete in 2025 and beyond.

As global platform economies evolve, the next wave of billion-dollar startups will emerge from those who understand that the real power lies not in technology alone, but in ecosystem design and customer trust.

FAQs :

1. What type of business model does PharmEasy use?

PharmEasy operates on a hybrid business model combining B2C (medicine delivery, diagnostics, teleconsultation) and B2B (pharmacy distribution via API Holdings). It functions as a multi-sided marketplace connecting patients, pharmacies, and healthcare providers.

2. How does PharmEasy’s model create value?

PharmEasy creates value by simplifying healthcare access. It delivers authentic medicines, lab test bookings, and doctor consultations directly to users while ensuring verified partners and compliance — saving time, reducing costs, and building trust.

3. What are PharmEasy’s key success factors?

PharmEasy succeeds through regulatory compliance, strategic acquisitions like Thyrocare and Medlife, and a strong B2B supply chain via API Holdings. Its data-driven personalization and diversified revenue streams ensure stability and growth.

4. How scalable is PharmEasy business model?

Highly scalable. Its cloud-based infrastructure, AI-driven logistics, and integrated verticals enable rapid expansion into new cities and services while maintaining operational efficiency and regulatory alignment.

5. What are the biggest challenges PharmEasy faces?

PharmEasy faces regulatory ambiguity, thin margins on medicine sales, and the challenge of maintaining partner trust amid fierce competition from NetMeds, Tata 1mg, and Apollo 24/7.

6. How can entrepreneurs adapt PharmEasy’s business model?

Founders can localize this model for regional health delivery, wellness, or teleconsultation niches. The key is to replicate the ecosystem approach — integrating service providers, logistics, and user experience into one seamless platform.

7. What are alternatives to PharmEasy’s business model?

Alternatives include aggregator models (like Practo), direct-to-consumer pharmacies (like Apollo 24/7), or subscription health apps (like Cult.fit), each with simpler operations but limited ecosystem depth.

8. How has PharmEasy’s business model evolved over time?

PharmEasy evolved from an online pharmacy (2015) to a full-stack health-tech ecosystem (2025), expanding through diagnostics, teleconsultations, and strategic mergers that unified India’s healthcare delivery.

Related Articles :