ThredUp has reshaped the secondhand clothing industry by building a scalable, technology-led business model that transforms a fragmented thrift-store experience into an organized digital marketplace. Founded in 2009 with the idea of making used fashion as easy to buy as new, the Business Model of ThredUp centers on centralized operations, allowing the company to process millions of garments annually while partnering with leading fashion brands.

By 2026, the ThredUp has evolved beyond a consumer resale platform into a resale-as-a-service infrastructure. Instead of relying on peer-to-peer listings, ThredUp manages logistics, pricing intelligence, quality control, and fulfillment—solving the operational complexity that limits most secondhand marketplaces and creating a defensible, data-driven ecosystem.

For entrepreneurs exploring marketplace, logistics-heavy, or circular economy platforms, the Business Model of ThredUp offers a practical blueprint for sustainable scale. Its infrastructure-first approach closely aligns with how Miracuves builds scalable platforms—designing systems where technology absorbs complexity, builds trust, and enables long-term growth without increasing user friction.

How the ThredUp Business Model Works

ThredUp operates on a managed marketplace model, fundamentally different from peer-to-peer resale apps. Instead of connecting buyers and sellers directly, ThredUp centralizes supply, logistics, pricing, and fulfillment, acting as both marketplace operator and operational backbone.

This structure allows ThredUp to scale trust and efficiency in a category where quality inconsistency and friction usually limit growth.

Core Framework Overview

At its core, ThredUp’s model removes effort from both sides of the market:

- Sellers send in clothes with minimal involvement

- ThredUp handles inspection, pricing, storage, and fulfillment

- Buyers get a curated, standardized shopping experience similar to traditional eCommerce

Key Business Model Insights

Type of Model

- Managed marketplace

- Asset-light inventory ownership (consignment-based)

- Hybrid B2C + B2B (Resale-as-a-Service for brands)

Value Proposition

- For Sellers:

- Zero listing effort

- Passive income from unused apparel

- Sustainable disposal with brand trust

- For Buyers:

- Affordable, branded fashion

- Quality-checked inventory

- Easy returns and standardized sizing data

- For Brand Partners:

- Turnkey resale infrastructure

- Sustainability credentials without operational burden

Stakeholders & Roles

- Consumers (sellers): Supply generation

- Consumers (buyers): Demand and liquidity

- ThredUp Operations: Authentication, pricing, fulfillment

- Brand Partners: Supply amplification and resale programs

- Logistics & Tech Partners: Scale and efficiency

Model Evolution

- 2010–2015: Peer-assisted resale experiments

- 2016–2020: Shift to full-service managed resale

- 2021–2024: IPO, automation investment, brand resale pilots

- 2025–2026: Resale-as-a-Service expansion and logistics optimization

Why It Works in 2026

- Consumers value convenience over margins when reselling

- Sustainability is now a purchase driver, not a bonus

- Brands outsource resale rather than building in-house

- AI-driven pricing and warehouse automation reduce unit costs

This model works because ThredUp doesn’t compete on speed alone—it competes on operational intelligence and trust.

Read more : What is ThredUp and How Does It Work?

Target Market & Customer Segmentation Strategy

ThredUp’s growth is driven by behavioral segmentation, not just demographics. The company understands that resale adoption depends on lifestyle, convenience preference, and sustainability mindset, and it designs its funnel to meet users at different readiness levels.

Primary & Secondary Customer Segments

Primary Segment: Value-Conscious Fashion Buyers

- Age: 25–45

- Behavior: Online-first shoppers, brand-aware, price-sensitive

- Motivation: Access to premium brands at 50–90% discounts

- Retention Driver: Wide selection + reliable quality standards

Secondary Segment: Convenience-First Sellers

- Profile: Busy professionals, parents, minimalists

- Pain Point: Lack of time to list, ship, and negotiate

- Motivation: Passive decluttering with zero friction

- Retention Driver: One-bag send-in simplicity and trust

Tertiary Segment: Brand & Retail Partners (B2B)

- Mid-to-large fashion brands and retailers

- Motivation: Circular fashion programs, ESG goals, resale monetization

- Retention Driver: White-labeled resale infrastructure and analytics

Customer Journey Mapping

Discovery

- Organic search for discounted brands

- Sustainability-led content and PR

- Brand partner resale programs

Conversion

- AI-personalized product feeds

- Clear quality grading and return policies

- Transparent seller payouts

Retention

- Wishlist alerts and size-based recommendations

- Seasonal clean-out incentives

- Loyalty pricing and resale credits

Lifetime Value Optimization

- Buyers become repeat purchasers due to low risk

- Sellers re-enter cycle through periodic clean-outs

- Brands lock in long-term platform dependence

Market Positioning Analysis

ThredUp positions itself as “resale without the hassle.”

- Competitive Edge: Full-service operations + data-driven pricing

- Brand Voice: Practical, trustworthy, sustainability-forward

- Market Share: One of the largest managed resale platforms in the U.S.

- Differentiation: Solves logistics at scale—something most resale apps avoid

While competitors focus on social selling, ThredUp focuses on infrastructure mastery, creating a defensible position that mirrors Miracuves’ philosophy of building platforms where complexity is hidden from users but optimized behind the scenes.

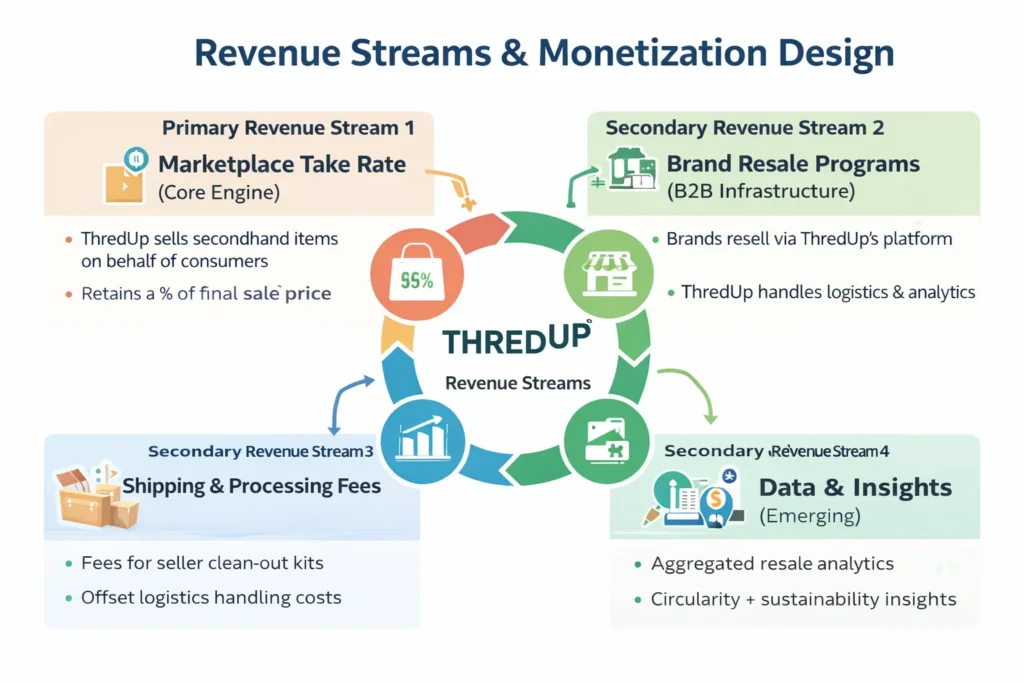

Revenue Streams and Monetization Design

Once ThredUp solved the hardest problem in resale—operations at scale—monetization became a layered system rather than a single income source. Its revenue model is designed to extract value from infrastructure, not from user effort, which keeps participation high on both sides of the marketplace.

Primary Revenue Stream 1: Marketplace Take Rate (Core Engine)

Mechanism

- ThredUp sells secondhand items on behalf of consumers

- Revenue is earned by retaining a percentage of the final sale price

Pricing Model (2025–2026)

- Dynamic commission structure based on item value, category, and brand

- Higher-priced items yield higher seller payouts but also higher platform margins

Revenue Contribution

- Largest share of total revenue

- Directly correlated with Gross Merchandise Value (GMV)

Growth Trajectory

- Increased average order value through premium brand mix

- AI-driven pricing improves sell-through rates

- Automation lowers per-item processing cost, improving margins

Secondary Revenue Stream 2: Brand Resale Programs (B2B Infrastructure)

Mechanism

- Brands use ThredUp’s platform to run their own resale channels

- ThredUp provides logistics, pricing, fulfillment, and analytics

Monetization Model

- Service fees

- Revenue-sharing agreements

- Long-term platform contracts

Why It Matters

- Predictable, contract-based revenue

- Higher margins than pure consumer resale

- Strong switching costs for brands

Secondary Revenue Stream 3: Shipping & Processing Fees

Mechanism

- Sellers may pay upfront or deducted fees for clean-out kits and processing

- Fees offset logistics and handling costs

Psychology

- Small, visible fees reduce frivolous submissions

- Filters low-quality inventory early

Secondary Revenue Stream 4: Data & Insights (Emerging)

Mechanism

- Aggregated resale pricing and demand insights for brands

- Sustainability and circularity analytics

Growth Potential

- High-margin SaaS-style extension

- Deepens brand dependence on ThredUp’s ecosystem

Monetization Strategy Summary

ThredUp’s revenue streams are interconnected:

- Marketplace volume fuels data

- Data strengthens brand partnerships

- Brand programs stabilize revenue cycles

Cross-selling occurs naturally—from consumer resale to enterprise services—while pricing psychology emphasizes convenience over maximized seller payouts.

Read more : ThredUp Clone Revenue Model: How ThredUp Makes Money in 2026

Operational Model & Key Activities

ThredUp’s true competitive advantage lies not in its app interface, but in its industrial-scale resale operations. While most marketplaces avoid inventory complexity, ThredUp built its business around mastering it.

Core Operational Pillars

Platform & Technology Management

- AI-based item recognition and categorization

- Dynamic pricing algorithms trained on millions of past sales

- Personalized recommendation engines for buyers

Supply Chain & Fulfillment

- Large-scale automated distribution centers

- Centralized quality inspection and grading

- SKU-level tracking across millions of unique items

Quality Control & Trust

- Multi-step authentication and condition grading

- Standardized photography and listing formats

- Consistent buyer experience across all categories

Customer Support & Experience

- Managed returns and refunds

- Seller payout transparency

- Dispute resolution handled centrally

Resource Allocation Strategy (2025–2026)

- Technology & Automation: ~35–40% of investment focus

- Operations & Logistics: ~30%

- Marketing & Growth: ~20%

- R&D and Data Science: ~10%

- International Expansion & Partnerships: Selective, capital-efficient

This allocation reflects a long-term bet on unit economics improvement, not short-term growth spikes.

Why This Operational Model Scales

- Centralization improves learning curves and cost efficiency

- Automation reduces per-item processing time year over year

- High fixed costs create barriers for new entrants

- Operational data becomes a competitive moat

For founders, this reinforces a key lesson Miracuves emphasizes: platform success often depends on infrastructure depth, not UI polish.

Strategic Partnerships & Ecosystem Development

ThredUp treats partnerships not as distribution shortcuts, but as ecosystem multipliers. Every alliance is designed to either increase supply quality, stabilize demand, or deepen operational leverage across the resale value chain.

Partnership Philosophy

Instead of building everything in-house, ThredUp focuses on owning the core resale infrastructure while collaborating at the edges—payments, logistics, brands, and sustainability networks. This keeps the platform capital-efficient while still defensible.

Key Partnership Types

Technology & API Partners

- AI and computer vision providers for item recognition

- Cloud infrastructure partners for inventory-scale data processing

- API integrations enabling brand resale storefronts

Payment & Logistics Alliances

- Payment processors for multi-party payouts

- National and regional logistics partners for inbound clean-out kits

- Reverse logistics providers for returns and unsold items

Brand & Retail Partnerships

- Fashion brands outsourcing resale programs

- Retailers embedding resale credits into loyalty programs

- Co-branded sustainability initiatives

Marketing & Distribution Partners

- Influencers and sustainability advocates

- Affiliate networks and cashback platforms

- Content partnerships around circular fashion education

Regulatory & Expansion Alliances

- ESG reporting organizations

- Circular economy consortiums

- Regional compliance and textile recycling partners

Ecosystem Strategy Insights

- Network Effects: More brands → more supply → better buyer selection

- Partner Lock-In: Deep API and data integrations raise switching costs

- Monetization: Service fees layered over volume-based resale economics

- Moat Creation: Operational data shared selectively, not commoditized

This ecosystem-first approach aligns closely with Miracuves’ experience building multi-sided platforms where partner success directly reinforces platform growth.

Growth Strategy & Scaling Mechanisms

ThredUp’s growth strategy is intentionally disciplined rather than explosive. In a capital-intensive category like resale logistics, the company prioritizes unit economics, operational maturity, and repeat behavior over vanity metrics.

Primary Growth Engines

Organic Demand & Repeat Buying

- High inventory turnover creates “treasure hunt” dynamics

- Personalized feeds increase session frequency

- Price anchoring against retail drives conversion

Referral & Circular Loops

- Sellers become buyers and vice versa

- Sustainability narratives encourage repeat clean-outs

- Store credit incentives recycle value within the platform

Paid Acquisition (Selective)

- Performance marketing tied strictly to LTV thresholds

- Brand-led resale partnerships reduce CAC

- Content-driven SEO around value and sustainability

Product & Market Expansion

- Category expansion within apparel (activewear, kids, premium brands)

- Increased penetration of brand-powered resale programs

- Infrastructure built to support future international scaling

Geographic Scaling Model

- Focus on deep density in existing markets before expansion

- Centralized warehouses serving multiple regions

- Avoids fragmented micro-fulfillment that increases cost

Scaling Challenges & How ThredUp Addressed Them

Operational Complexity

- Challenge: Millions of unique SKUs

- Solution: Automation, AI pricing, standardized processes

Margin Pressure

- Challenge: High labor and logistics costs

- Solution: Robotics, pricing intelligence, brand contracts

Regulatory & Sustainability Scrutiny

- Challenge: ESG accountability

- Solution: Transparent reporting and measurable impact metrics

This growth playbook shows that scaling doesn’t always mean faster—it often means smarter, a principle Miracuves applies when designing long-term platform architectures.

Competitive Strategy & Market Defense

ThredUp operates in an increasingly crowded resale landscape, yet its competitive position remains distinct because it defends on infrastructure, data, and trust, not just brand or pricing.

Core Competitive Advantages

1. Operational Scale as a Moat

- Millions of items processed annually create unmatched resale data

- High fixed-cost infrastructure discourages new entrants

- Automation reduces marginal cost over time

2. Network Effects

- More sellers increase inventory breadth

- More buyers improve sell-through and pricing accuracy

- Brand partners amplify both sides simultaneously

3. Brand Trust & Standardization

- Centralized quality control eliminates peer-to-peer risk

- Consistent photography, grading, and returns

- Trust converts first-time buyers into repeat customers

4. Data-Driven Intelligence

- Pricing algorithms trained on years of resale demand

- Inventory insights improve sell-through predictability

- Personalization improves conversion and basket size

Market Defense Tactics

Against New Entrants

- Competes on convenience and reliability, not payout maximization

- Maintains high operational standards that are costly to replicate

Against Pricing Wars

- Uses dynamic pricing instead of blanket discounts

- Anchors value against original retail pricing

Strategic Feature Rollouts

- Improves automation before expanding categories

- Adds brand resale features before competitors can respond

M&A and Partnership Strategy

- Acquisitions focused on capabilities, not market share

- Partnerships used to neutralize potential competitors

ThredUp’s defense strategy reflects a broader 2026 platform truth: the strongest moats are built behind the scenes, not in visible features—a lesson Miracuves applies when helping founders design defensible digital ecosystems.

Lessons for Entrepreneurs & Implementation

ThredUp’s journey offers a playbook for founders building complex, operations-heavy platforms. Its success didn’t come from viral growth or social mechanics, but from absorbing friction that users didn’t want to manage.

Key Factors Behind ThredUp’s Success

- Designed the model around convenience, not maximum seller profit

- Invested early in infrastructure and automation

- Built trust through standardization, not community policing

- Treated sustainability as a business lever, not just branding

Replicable Principles for Startups

1. Hide Complexity From Users

If your model involves logistics, verification, or compliance, centralize it.

2. Build for Unit Economics Before Scale

Growth without margin control creates fragility.

3. Use Data as an Operating System

Pricing, inventory, and demand forecasting should improve automatically.

4. Monetize Infrastructure, Not Just Transactions

B2B layers stabilize revenue and reduce cyclicality.

Common Mistakes to Avoid

- Over-indexing on peer-to-peer simplicity

- Underestimating operational costs

- Expanding categories before optimizing processes

- Treating sustainability as marketing instead of measurement

Adapting the Model for Local or Niche Markets

- Start with high-value, high-repeat categories

- Limit SKU diversity initially

- Partner with logistics providers instead of building early

- Use managed resale selectively to prove economics

Implementation Timeline & Investment Priorities

Phase 1 :

Platform architecture, core workflows, pilot logistics

Phase 2 :

Automation, pricing intelligence, retention loops

Phase 3 :

Brand partnerships, data monetization, regional scaling

Read more : Best ThredUp Clone Scripts 2025 – Launch Your Fashion Resale Marketplace Fast

Ready to implement ThredUp’s proven business model for your market?

Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps. Get your free business model consultation today.

Conclusion :

ThredUp’s business model proves that true innovation often lies in execution, not invention. While resale itself isn’t new, ThredUp reimagined it as a logistics-first, data-powered platform, turning what was once a fragmented thrift experience into a scalable digital ecosystem.

The company’s journey highlights a defining lesson for 2026 and beyond: platforms that win are those willing to solve the hardest problems their users avoid—even when those problems involve warehouses, automation, and thin early margins.

As platform economies mature, the next generation of category leaders won’t be built on hype alone. They’ll be built on operational depth, intelligent monetization, and long-term trust. ThredUp stands as a clear example of how aligning technology with real-world complexity creates sustainable growth.

FAQs :

What type of business model does ThredUp use?

ThredUp uses a managed marketplace model where the platform handles pricing, logistics, quality control, and fulfillment instead of peer-to-peer selling.

How does ThredUp’s business model create value?

It removes friction for sellers, standardizes quality for buyers, and monetizes resale infrastructure at scale.

What are ThredUp’s key success factors?

Operational automation, pricing intelligence, trust through standardization, and strong brand resale partnerships.

How scalable is ThredUp’s business model?

Highly scalable, but capital-intensive. Scale improves margins as automation reduces per-item processing costs.

What are the biggest challenges in this model?

Logistics complexity, inventory variability, labor costs, and maintaining consistent quality at scale.

How can entrepreneurs adapt this model to their region?

By focusing on a narrow category, partnering with logistics providers, and centralizing quality control early..

What are alternatives to ThredUp’s model?

Peer-to-peer resale apps, social commerce platforms, or hybrid consignment marketplaces.

How has ThredUp’s business model evolved over time?

It evolved from experimental resale to a resale-as-a-service infrastructure platform supporting both consumers and brands.

Related Article :