Not too long ago, cryptocurrencies were considered a playground for tech geeks and risk-takers. Fast forward to 2026, and digital assets have become part of the mainstream financial conversation. From first-time investors buying their first satoshis to seasoned traders managing portfolios of altcoins, crypto is no longer just a buzzword — it’s an ecosystem.

And where there’s demand for trading, there’s opportunity for building. Coinbase was one of the first to make crypto trading user-friendly, regulatory-aware, and sleekly designed. But it’s far from the only game in town. Entrepreneurs around the world are launching their own crypto exchanges — many using Coinbase clone scripts to get to market faster.

If you’re considering launching a crypto exchange, you don’t need to build one from scratch. With a powerful Coinbase clone script, you can enter the market with a trading platform that’s secure, scalable, and revenue-generating from day one.

What Is a Coinbase Clone?

A Coinbase clone is a ready-made crypto exchange script designed to replicate the key features and functions of the Coinbase platform — including crypto trading, fiat integration, KYC, wallets, and analytics. It’s your shortcut to launching a branded, high-performance exchange without months of expensive development.

Unlike decentralized exchanges (DEXs), Coinbase-style clones are custodial — meaning the platform holds and manages user funds, offering a streamlined and familiar trading experience.

This makes it ideal for:

- Regulated exchanges in specific regions

- Fiat-to-crypto onramps

- Business models requiring KYC and compliance

- Investor-focused dashboards and data tools

Read More : Reasons startup choose our Coinbase clone over custom development

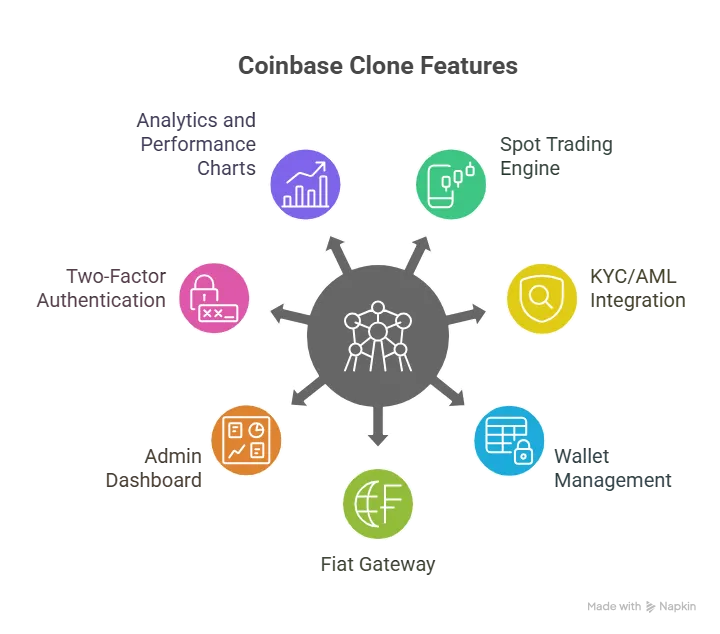

Essential Features of a Coinbase Clone Script

Security and performance aren’t optional in crypto — they’re everything. If your platform stutters, lags, or has vulnerabilities, you’re done before you begin. These are the must-have features of any serious Coinbase clone in 2026:

1. Spot Trading Engine

Enable real-time buy/sell orders for BTC, ETH, and altcoins. A robust order-matching system with live price feeds and tight spreads is crucial.

2. KYC/AML Integration

Know Your Customer (KYC) and Anti-Money Laundering (AML) modules are essential for compliance in most regions. Automate identity verification with third-party tools.

3. Wallet Management

Support hot and cold wallets, address generation, QR code scanning, and balance visibility. For advanced users, consider multi-sig wallets.

4. Fiat Gateway

Allow users to buy crypto with debit cards, bank transfers, or mobile wallets. This opens the door to wider adoption and mass-market appeal.

5. Admin Dashboard

Track users, manage listings, monitor suspicious activity, and generate revenue reports — all from a secure backend panel.

6. Two-Factor Authentication & Encryption

Security features like 2FA, IP whitelisting, and end-to-end encryption are not negotiable. These are table stakes for trust.

7. Analytics and Performance Charts

Give users interactive tools to track price trends, portfolio value, trading volumes, and market news.

Read More : Coinbase Marketing Strategy | Ride the Crypto Wave

Cost Factors & Pricing Breakdown

Coinbase-Like Crypto Exchange Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Crypto Exchange MVP | User signup/login, basic trading pairs, order placement, wallet system, KYC basics, transaction history, simple admin for users & trades. | $70,000 |

| 2. Mid-Level Crypto Trading Platform | Web + mobile UI/UX, spot trading engine, charts, deposits/withdrawals, multi-wallet system, KYC/AML, notifications, promo codes, analytics dashboards. | $150,000 |

| 3. Advanced Coinbase-Level Exchange | High-performance trading engine, liquidity integration, staking modules, advanced KYC/AML automation, multi-chain support, API trading, cold/hot wallet architecture, enterprise-grade security. | $300,000+ |

These figures represent typical global development costs for building a secure, compliant, high-performance crypto exchange like Coinbase — factoring in trading engine complexity, compliance standards, and wallet infrastructure.

Miracuves Pricing for a Coinbase-Like Platform

Miracuves Price: $3,299

This provides a complete cryptocurrency exchange system equipped with user dashboard, wallet management, buy/sell trading engine, admin controls, compliance settings, security enhancements, and liquidity-ready architecture — fully brandable and customizable.

Note:

Includes full non-encrypted source code, backend configuration, exchange setup, admin panel configuration, deployment assistance, and initial launch support — enabling you to operate a professional exchange platform with confidence.

Launch Your Coinbase-Style Crypto Exchange — Contact Us Today

Delivery Timeline for a Coinbase-Like Platform with Miracuves

A typical delivery timeline is 3–9 days, depending on:

- Trading options required (spot, swap, hybrid)

- Wallet integrations and blockchain support

- Security features (2FA, KYC/AML flows, anti-fraud tools)

- UI/UX customization and branding

- Payment gateway or fiat on-ramp integrations

- Liquidity setup and API requirements

Tech Stack

Developed using PHP, optimized for exchange-level performance, secure transactions, modular wallet integration, trading logic, and scalable multi-user operation in the crypto ecosystem.

How Do Coinbase Clone Owners Make Money?

The crypto industry isn’t just growing — it’s lucrative. Here are the most common ways Coinbase-style exchanges make money:

- Trading Fees: Charge a percentage on every transaction, typically 0.1% to 0.25%.

- Listing Fees: Projects pay to get their token listed on your platform.

- Withdrawal Fees: Apply small charges when users withdraw crypto or fiat.

- Spread Earnings: Set a small margin between buy and sell rates.

- Premium Features: Offer portfolio management tools, pro charts, or instant swaps behind a paywall.

- Staking Rewards Cut: Take a commission on staking returns for delegated proof-of-stake tokens.

With the right combination of user trust and efficient execution, the revenue possibilities are significant — especially in regions with growing crypto adoption.

Read More : How Much Does It Cost to Build a Peer-to-Peer Cryptocurrency Marketplace in 2025

Why Crypto Exchanges Are Still a Smart Bet in 2026

Some might think the crypto wave has peaked — but the underlying shift is just beginning. Here’s why launching a Coinbase clone still makes perfect sense:

1. Global Financial Inclusion

Billions of people are still unbanked or underbanked. Crypto provides them access to digital finance with just a smartphone.

2. Regional Regulation = Opportunity

As countries roll out crypto-friendly regulations, there’s space for localized exchanges that serve national currencies and legal frameworks.

3. Institutional Adoption

With banks, ETFs, and payment giants embracing digital assets, retail investors are gaining confidence and participation is growing.

4. Tokenized Assets & Utility Coins

The rise of real-world asset (RWA) tokens means exchanges need to evolve — and fast. Being early gives you leverage.

5. Cultural Normalization

Crypto is no longer fringe. Mainstream influencers, artists, and even governments are involved. Your platform can ride that momentum.

Choosing the Right Tech Partner: What to Ask

Building a crypto exchange isn’t a weekend project. Before picking a clone script or development firm, ask the following:

- Does the script follow best security practices (OWASP, encryption, audits)?

- Is it scalable to handle thousands of concurrent users?

- Can it integrate with compliance tools and local fiat systems?

- Does it include updates and support post-deployment?

- Is the UI/UX optimized for both newbies and pro traders?

A secure, intuitive, and regulation-ready exchange is your ticket to gaining — and keeping — user trust.

Read More : Top Coinbase Features Every Crypto App Needs

Final Thoughts

Crypto may have had its ups and downs, but the long-term momentum is unmistakable. Launching a Coinbase-style exchange in 2026 is more than a tech project — it’s a chance to reshape how people invest, transact, and store value.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

Still have questions about Coinbase clone scripts? Let’s clear them up.

Is a Coinbase clone legal?

Yes, if you follow local regulations. Many countries require licensing, KYC processes, and financial compliance before operating a crypto exchange.

How much capital do I need to start?

It depends on your region and feature set. A basic MVP can start around $3,000–$5,000, while full-scale exchanges may require more for security, liquidity, and compliance.

Do I need liquidity providers?

Yes, especially early on. Integrating with third-party liquidity providers ensures that your users get competitive prices and faster order matching.

Can users buy crypto with their debit card?

Yes, with a fiat gateway integration, users can purchase crypto using debit/credit cards, bank transfers, or mobile wallets.

Will I need a native app?

Absolutely. Mobile-first design is crucial in 2026. Most trading activity now happens on Android and iOS apps.

How do I stand out from other exchanges?

Focus on a niche — regional currency pairs, ease of use, staking options, educational content, or even zero-fee trading to gain traction.

Related Keywords