Let’s be honest—building a crypto exchange isn’t something you do over a weekend. It’s not like throwing together a quick website on Wix and calling it a day. Nope. If you’re an entrepreneur or startup founder dreaming of launching the next big Binance or WazirX, you know the stakes. Crypto is a wild, fast-moving industry where speed, security, and user trust aren’t just buzzwords—they’re make-or-break essentials.

I remember chatting with a founder who thought, “Hey, let’s just hire a couple of developers off Upwork and we’re good.” Well, a few weeks in, their devs bailed, the security was patchy at best, and the project was dead in the water. Brutal? Yeah. But it’s a story I’ve heard too many times. The truth is, building a crypto exchange platform isn’t cheap—and it shouldn’t be. You’re handling people’s money, and in crypto, that means millions of dollars in transactions every day.

So, what actually drives the cost of a crypto exchange build? It’s not just about hiring coders or slapping on a pretty interface. We’re talking tech infrastructure, compliance headaches, liquidity engines, and yes—user experience that doesn’t feel like pulling teeth. At Miracuves, we’ve helped countless startups navigate this maze, so let’s break it down—layer by layer.

Read more: How to Build an App Like GMX: Full-Stack Developer’s Guide

Core Technology Stack: The Engine That Runs the Show

Let’s start with the obvious—your tech stack. This isn’t a WordPress blog or a Shopify store; we’re talking high-performance backend that can handle thousands of concurrent trades, real-time order books, liquidity pools, and multi-crypto wallet management. The deeper you go into blockchain integration—like supporting Ethereum, Solana, or Layer-2 solutions—the more complex (and costly) it gets.

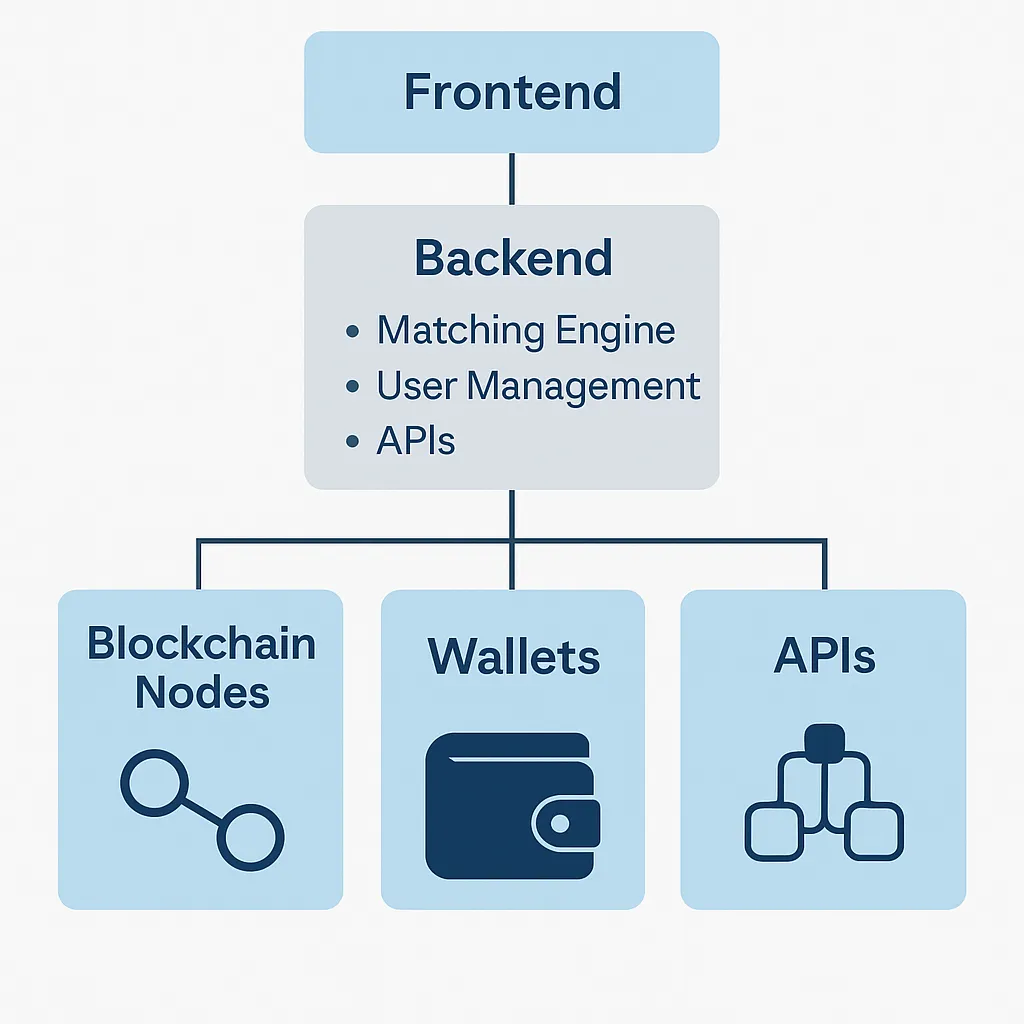

For example, building a centralized exchange (CEX) typically involves:

- Backend server logic for matching engine, user management, and APIs.

- Blockchain nodes to interact with the networks (e.g., Bitcoin, Ethereum).

- Wallet infrastructure (hot, cold, multi-sig).

- Order book and market data feeds for real-time trading.

If you want to go decentralized (DEX), you’re looking at smart contract development, audits, and liquidity pool integration—each of which adds to your budget. And let’s not forget DevOps—setting up scalable cloud infrastructure, CI/CD pipelines, and robust load balancing for global users.

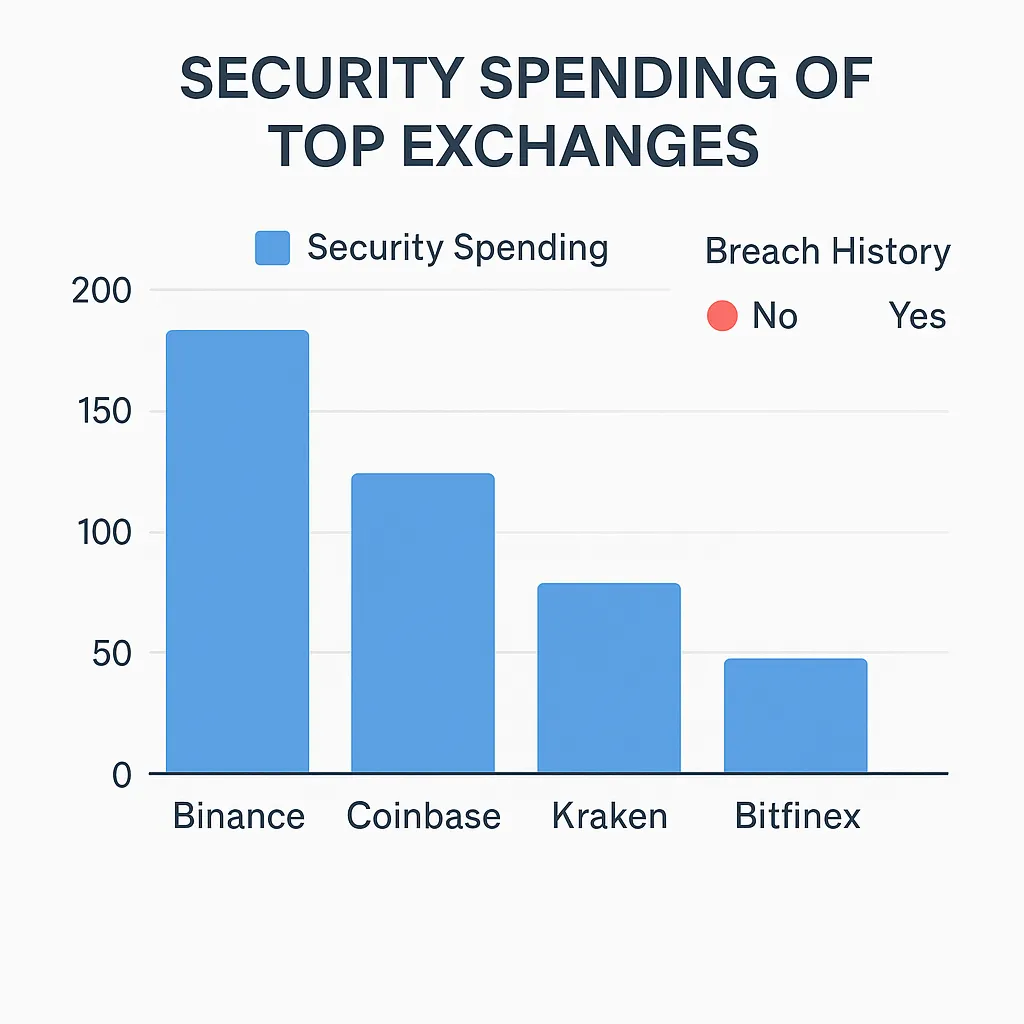

Security: The Non-Negotiable Cost Multiplier

Here’s where a lot of founders try to cut corners—and end up paying the price (literally). Security is the Achilles’ heel of any crypto exchange. One vulnerability, one exploit, and boom—your users’ funds are gone, and so is your reputation.

Security costs include:

- KYC/AML integration (often using APIs like Sumsub or Jumio).

- Multi-factor authentication (MFA) and encryption protocols.

- Penetration testing and bug bounties.

- Regular smart contract audits if you’re on-chain.

A proper security setup can easily chew up 15-25% of your total budget—but it’s non-negotiable. You have to build trust, or users will flee to the next shiny platform.

Regulatory Compliance: The Legal Gauntlet

Crypto isn’t the Wild West anymore (at least, not entirely). Depending on where you operate, you’ll need to tackle:

- Licensing fees (which vary wildly between regions).

- Compliance team hiring or outsourcing.

- Legal consultations for KYC/AML, data privacy (GDPR), and regional laws.

For instance, operating in the US means dealing with the SEC, FinCEN, and state-level regulators—a regulatory minefield. Europe has MiCA, Singapore has MAS, India has its own evolving landscape. Each jurisdiction adds complexity, timelines, and yes—more cost.

Features and User Experience: Where Users Decide to Stay or Leave

Features make or break your app’s success. A bare-bones exchange might get you to market, but will users stick around? Let’s talk must-have features:

- Spot and margin trading.

- Advanced charts and analytics (think TradingView integrations).

- Push notifications for price alerts.

- Mobile apps (iOS and Android) with intuitive UI.

- Staking, lending, and NFT marketplaces for the Web3-savvy crowd.

The more features you pile on, the higher the development cost. But the flip side? The more you offer, the better your chances of retaining users in this competitive market.

Check out how we help startups Build Your Own Crypto Exchange at Miracuves.

Ongoing Maintenance and Scaling: The Hidden Cost Nobody Tells You

Think you’re done after launch? Not a chance. The real work begins after you go live. You’ll need:

- 24/7 monitoring for uptime and trading issues.

- Server scaling to handle user growth.

- Bug fixes, security patches, and feature rollouts.

- Community management (Telegram, Discord, X) for user support.

Remember the FTX meltdown? Part of that was mismanagement and poor tech hygiene. A good exchange is a living organism—you have to feed it (with money and time) or it dies.

Read more: How Much Does It Cost to Develop a GMX-like Platform

Conclusion: The Real Cost of Crypto Exchange Development

Building a crypto exchange platform isn’t just about lines of code; it’s about building trust, scaling fast, and future-proofing your business in a market that never sleeps. Costs stack up because they have to—security, compliance, UX, and reliability are the pillars you can’t skip.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 How much does it typically cost to build a crypto exchange platform?

It depends, but a minimum viable product (MVP) starts around $50,000–$150,000. A fully-featured exchange with liquidity engines, mobile apps, and compliance features can go $250,000 and beyond.

Q:2 Is it cheaper to use a white-label crypto exchange solution?

Yes, white-label solutions can save time and money, but you sacrifice customization and future flexibility. It’s a trade-off: speed to market vs. long-term scalability.

Q:3 What’s the biggest hidden cost in crypto exchange development?

Definitely compliance and security. They’re often underestimated but can account for up to 30% of your budget when done properly.

Q:4 Do I need a license to run a crypto exchange?

In most cases, yes. Regulations vary by country, but KYC/AML compliance and licensing are required to operate legally and avoid fines.

Q:5 How long does it take to build a crypto exchange platform?

A basic version takes around 4-6 months, but a fully featured, secure, and compliant exchange can take 8-12 months or more.

Q:6 Can Miracuves help with post-launch support and scaling?

Absolutely. Miracuves offers end-to-end support—from development to launch to post-launch growth—so your crypto exchange stays ahead of the curve.

Related Articles: