You’re envisioning the next big thing in crypto—a token launch system that actually puts control back into the hands of the community. But then, reality bites. How the heck do you even start building a decentralized IDO launchpad?

You’re not alone. Thousands of indie devs, startup hustlers, and vision-driven entrepreneurs are on the same path. They’ve seen the chaos (and money) surrounding centralized token sales, the pump-and-dumps, the opaque processes. Everyone wants transparency. Autonomy. And yep—real decentralization. The IDO model promises all that, but building it? That’s a wild ride of tech decisions, security hurdles, smart contract headaches, and a splash of market psychology.

But here’s the good news—you don’t need to reinvent the wheel. At Miracuves, we’ve helped visionaries like you bring decentralized platforms to life with scalable, monetizable, and lightning-fast app clones. Let’s break this down into something real-world doable.’

What Is an IDO Launchpad and Why Decentralize It?

Initial DEX Offerings (IDOs) are the lovechild of ICOs and DEXs—public token sales directly on decentralized exchanges. But most current launchpads? Still centralized behind the scenes. Gatekeeping, hefty fees, and opaque selection processes plague the ecosystem.

By developing a decentralized IDO launchpad, you’re not just building tech—you’re championing fairness. This approach empowers projects to raise funds transparently, while investors gain instant access without needing to go through a middleman.

Core Features Your Decentralized IDO Launchpad Needs

Smart Contract Infrastructure

Every IDO is governed by smart contracts. These should automate whitelisting, fund collection, token distribution, and refund mechanisms if the project fails to meet funding goals.

- Language: Solidity (for Ethereum or BSC)

- Must-haves: upgradeability patterns (proxy contracts), multi-sig governance, and verifiability.

Multi-Chain Compatibility

Ethereum might be the OG, but it’s pricey. Support EVM-compatible chains like:

- Binance Smart Chain

- Polygon

- Avalanche

Pro tip: Use Chainlink oracles for real-time pricing and randomness.

Decentralized KYC (Without Sacrificing UX)

Yes, KYC and decentralization can co-exist. Use decentralized identity (DID) solutions and zero-knowledge proofs to validate user eligibility without compromising privacy.

Token Allocation Logic

Gone are the days of “first come, first served”. Your platform should support:

- Tiered allocation based on staked tokens

- Randomized lotteries

- Anti-whale mechanisms

The Tech Stack Breakdown

| Layer | Tech | Purpose |

|---|---|---|

| Frontend | React, Web3.js | Wallet connect, dashboards |

| Backend | Node.js, Firebase | User management, event triggers |

| Blockchain | Solidity, Hardhat | Smart contracts |

| Storage | IPFS, Arweave | Decentralized asset storage |

| Analytics | Mixpanel, Dune Analytics | User tracking and campaign performance |

Monetization Models That Actually Work

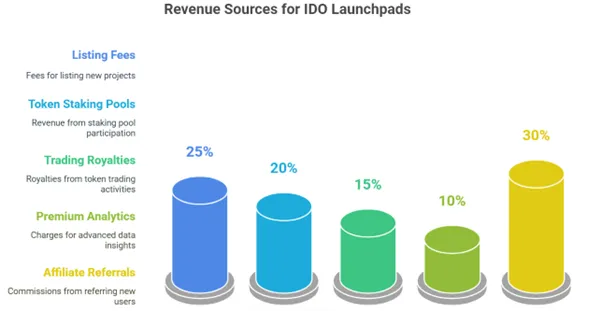

Most people think launchpads are only about raising money for others. Nope. You can monetize smartly too:

- Token Listing Fees — crypto projects pay to launch

- Staking Tiers — boost revenue through locked assets

- Secondary Market Royalties — earn from post-sale token trades

- Premium Analytics — offer whales deep-dive insights

Legal Landmines and How to Avoid Them

Crypto laws = moving targets. But here’s your survival kit:

- Avoid promising investment returns (no “moon” guarantees!)

- KYC/AML where local laws require it

- Use disclaimers for non-custodial services

- Open-source your contracts for legal transparency

UX Tips from Top Launchpads

- Pre-sale countdowns increase hype

- Use progress bars for funding goals

- Offer Telegram/Discord integrations for trust

- Embed wallet-based notifications for user updates

Conclusion & Final Thoughts

The future of fundraising is rapidly shifting towards decentralization—and for good reason. In a digital economy that values transparency, autonomy, and trust, decentralized IDO launchpads represent more than just a tool; they embody a philosophy. They strip away centralized bureaucracy and empower both creators and communities to participate in fair, smart, and efficient funding rounds.

But let’s be real—it’s not just about writing smart contracts and calling it a day. If you’re building an IDO platform, you need to think holistically. That means obsessing over multi-chain compatibility, ensuring your UI doesn’t look like it’s from the early 2000s, and creating a seamless experience for both token issuers and investors. It’s not just tech—it’s psychology, design, and community building rolled into one.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1. What is a decentralized IDO launchpad?

It’s a platform where crypto projects can raise funds via token sales without relying on centralized gatekeepers. Everything runs on smart contracts.

2. How do I make my IDO launchpad multi-chain?

Integrate with EVM-compatible networks like BSC or Polygon and use APIs/oracles that support chain-specific data.

3. Is it legal to run an IDO platform?

Yes, but compliance is key. Add KYC/AML features and disclaimers based on your local jurisdiction.

4. Can I make money running a launchpad?

Totally. You can charge listing fees, offer staking tiers, and monetize insights from user data—just be transparent.

5. What’s the hardest part of development?

Security. Smart contract bugs = potential millions lost. Always audit and open-source critical parts.